6 Best Covered Call Strategy Options for 2025

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

Covered calls are a cornerstone of income-focused investing, but not all approaches are created equal. A generic strategy often leads to mediocre results, leaving potential gains on the table or exposing your portfolio to unnecessary risk. The key to unlocking consistent, superior returns is to match the right technique to your specific financial goals, risk tolerance, and the current market outlook. A truly effective plan requires more than just selling a call against shares you own; it demands a nuanced approach tailored to your objectives.

This guide moves beyond the textbook definition to explore six distinct, actionable strategies that can transform your results. We will dissect each method, providing clear implementation steps, real-world examples, and the critical pros and cons you need to decide which approach is the best covered call strategy for you. Whether you're seeking to amplify dividend income, generate consistent cash flow with the Wheel, or use LEAPS for long-term premium harvesting, this article has you covered.

Forget one-size-fits-all advice. Here, you'll find the practical details needed to elevate your portfolio. Let's transform your options trading from a simple tactic into a powerful, data-driven income engine designed for today's market conditions.

1. High-Dividend Covered Calls

The high-dividend covered call strategy is a powerful method for generating two distinct income streams from a single stock position. This approach targets stable, dividend-paying companies and layers an options strategy on top to significantly boost total returns. By combining consistent dividend payments with the premium collected from selling call options, investors can create a reliable cash flow engine.

This strategy is particularly effective for income-focused investors who are comfortable holding quality stocks for the long term but want to enhance their yield. The core idea is to select stocks with a healthy dividend yield, typically in the 4-7% range, and then sell out-of-the-money (OTM) call options against the shares. This is often considered one of the best covered call strategy variations for those prioritizing income over aggressive capital appreciation.

How It Works: A Dual-Income Approach

The process is straightforward. First, you identify and purchase at least 100 shares of a high-quality, dividend-paying stock. For example, a well-established company like Verizon (VZ) often has a dividend yield exceeding 6%. Once you own the shares, you sell a call option with a strike price set above the current market price, collecting an immediate premium.

The goal is to have the option expire worthless, allowing you to keep both the premium and your shares, ready to repeat the process. If the stock price rises above the strike price and your shares are "called away," you still profit from the capital gain, the collected premium, and any dividends paid before the assignment.

Actionable Implementation Tips

To maximize success with this strategy, consider the following:

- Avoid Ex-Dividend Week: Do not sell a call option with an expiration date that falls during the week the stock goes ex-dividend. This helps ensure you capture the dividend payment, as early assignment is more likely when a dividend is pending.

- Focus on Quality Yield: Prioritize stocks with a history of stable or growing dividends. A high yield from a struggling company is a red flag. Aim for established names with strong financials.

- Compound with DRIP: If your shares are not called away, use a Dividend Reinvestment Plan (DRIP) to automatically buy more shares with your dividend payments. This compounds your position over time, allowing you to eventually sell more covered call contracts.

Key Insight: The true power of this strategy lies in its ability to generate income in three different market scenarios: when the stock goes up (moderately), sideways, or even slightly down. The dividend provides a buffer, while the premium adds a consistent cash inflow.

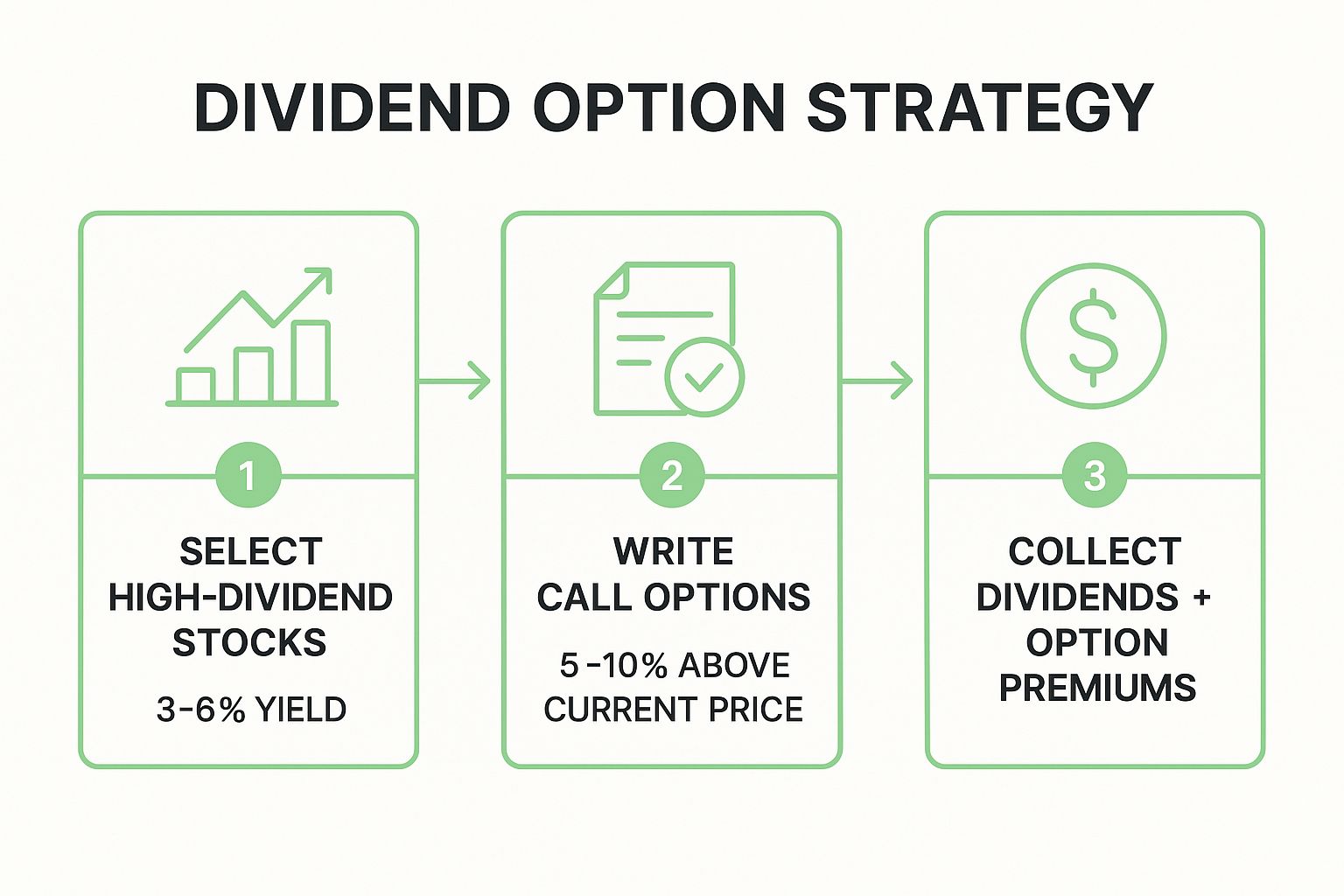

The following infographic illustrates the simple, three-step process for setting up a high-dividend covered call position.

This visual process flow highlights how an investor can systematically combine stock ownership with option selling to create a reliable income-generating machine.

2. The Wheel Strategy

The Wheel Strategy is a systematic and cyclical options trading method designed to generate consistent income. It begins with selling cash-secured puts and, if the shares are assigned, transitions into selling covered calls. This approach essentially allows an investor to get paid to wait to buy a stock at their desired price and then get paid again to hold it.

Popularized by platforms like Tastytrade, this strategy is ideal for patient investors who want to acquire shares of quality companies at a discount and generate cash flow in the process. By combining two distinct income-generating options strategies, it creates a powerful wheel of returns, making it a contender for the best covered call strategy for systematic traders. For a deeper dive into its mechanics, you can learn more about the Wheel Strategy.

How It Works: A Cyclical Income Generator

The strategy operates in two main phases. First, you identify a high-quality stock you wouldn't mind owning and sell a cash-secured put option below its current price. If the option expires worthless, you keep the premium and repeat the process. If the stock price drops below your strike and the shares are assigned to you, you purchase 100 shares at your chosen lower price.

Once you own the shares, the strategy shifts to the covered call phase. You begin selling call options above your cost basis to generate more income. The goal is for the calls to expire worthless, but if the stock price rises and the shares are called away, you lock in a profit and can restart the cycle by selling puts again.

Actionable Implementation Tips

To effectively implement the Wheel Strategy, consider these key actions:

- Wheel Quality Stocks Only: The most critical rule is to only use this strategy on stocks you are comfortable owning for the long term. This prevents panic if you are assigned shares during a market downturn.

- Set Puts at Support Levels: Sell your cash-secured puts with a strike price at or near a strong technical support level. This increases the probability that the stock will bounce, allowing you to keep the premium without taking ownership.

- Manage Your Cash Reserves: Keep at least 30-50% of your capital in cash. This ensures you have enough liquidity to handle multiple put assignments if several of your positions are exercised simultaneously during a broad market correction.

Key Insight: The Wheel Strategy transforms you from a passive stock buyer into an active income generator. Instead of just waiting for a stock to hit your target price, you are paid a premium while you wait, effectively lowering your cost basis if you are assigned.

3. ATM/ITM Covered Calls

The at-the-money (ATM) or in-the-money (ITM) covered call strategy is an aggressive approach designed to maximize immediate income generation. Unlike more conservative methods that aim for capital appreciation, this strategy prioritizes collecting the highest possible option premium. It involves selling call options with a strike price at or below the current stock price.

This strategy is highly effective for investors who believe a stock will trade sideways, decline slightly, or who are willing to part with their shares for a guaranteed, high-premium return. For example, during the 2022 bear market, selling ITM calls on ETFs like QQQ allowed some investors to generate returns exceeding 20% from premiums alone, even as the underlying asset fell. This is often considered the best covered call strategy for bearish or neutral market outlooks where income is the primary goal.

How It Works: A Premium-Maximization Approach

The process begins when you own at least 100 shares of a stock. Instead of selling an out-of-the-money call, you sell a call option with a strike price equal to (ATM) or lower than (ITM) the stock’s current trading price. Because these options have more intrinsic value, they command a significantly higher premium than OTM options.

The trade-off is a very high probability that your shares will be "called away" at expiration if the stock price remains above the strike. The profit is locked in from the large premium collected, which can offset a small decline in the stock's price. This makes it a powerful tool for generating cash flow from stagnant or volatile stocks, such as in the energy sector during periods of commodity price swings.

Actionable Implementation Tips

To execute this strategy effectively, focus on these key points:

- Set Buy-Back Rules: Establish a rule to buy back the call option if its value drops by 50-80%. This allows you to lock in a large portion of the premium early and potentially sell another call.

- Prioritize Liquidity: Only use this strategy on stocks with highly liquid options. Look for tight bid-ask spreads to ensure you can enter and exit the position efficiently without significant slippage.

- Understand Tax Implications: Since assignment is frequent, be mindful of the tax consequences. Each time your shares are called away, it creates a taxable event (short-term or long-term capital gains), which can impact your overall net return.

Key Insight: This strategy transforms the covered call from a tool of modest income enhancement into a powerful engine for aggressive premium harvesting. It shines in flat or down-trending markets where capital gains are unlikely, allowing you to generate substantial returns from the option premium alone.

4. Buy-Write Strategy

The buy-write strategy is an efficient, institutional-grade method where an investor simultaneously buys stock and sells a call option against it in a single transaction. This integrated approach, often favored by professional money managers and institutional funds, is designed to generate immediate income from option premiums while establishing a new stock position with a lower effective cost basis. It systematizes the covered call process from the very beginning of the investment.

This strategy is ideal for investors looking to immediately reduce the risk of a new stock purchase and generate upfront cash flow. Instead of buying shares first and then deciding to sell a call later, the buy-write combines both actions into one order. This makes it a contender for the best covered call strategy for those who value efficiency and have a clear income objective from the outset. Well-known examples include the CBOE's BuyWrite Index (BXM) and popular ETFs like the JPMorgan Equity Premium Income ETF (JEPI), which systematically deploy this tactic.

How It Works: A Single-Transaction Approach

The execution is streamlined. An investor places a combination order to buy 100 shares of a stock and, at the same time, sell one call option contract against those shares. The premium received from selling the call option immediately subsidizes the purchase price of the stock, lowering the position's break-even point.

For instance, if you buy 100 shares of XYZ at $50 and simultaneously sell a call option for a $2 premium, your net cost for the position is reduced to $48 per share. Your maximum profit is capped at the strike price plus the premium, but your risk on the downside is immediately cushioned by the premium collected.

Actionable Implementation Tips

To effectively implement the buy-write strategy, consider the following:

- Use Limit Orders: Execute the buy-write as a single "combo" or "net debit" limit order. This ensures you get a favorable execution price for both the stock purchase and the option sale, preventing unfavorable price slippage on either leg of the trade.

- Focus on Liquid Assets: Stick to stocks or ETFs with high trading volume and a liquid options market. This ensures tight bid-ask spreads, making it easier to enter and exit the position at a fair price.

- Maintain Consistency: Develop a consistent methodology for selecting your strike prices and expiration dates. For example, always selling 30-45 days out at a 0.30 delta strike helps create predictable returns and simplifies decision-making over time. For more information, you can learn more about the fundamentals of covered call options.

Key Insight: The buy-write's primary advantage is its efficiency and discipline. By executing both parts of the trade simultaneously, it forces a defined risk-reward profile from the start and turns a standard stock purchase into an immediate income-producing asset.

5. LEAPS Covered Calls

The LEAPS covered call strategy is a long-term approach that maximizes both income generation and capital appreciation potential. It involves purchasing Long-term Equity Anticipation Securities (LEAPS), which are call options with expiration dates more than a year away, and then selling short-term call options against that long position. This method, often called the "poor man's covered call," provides a capital-efficient way to control a stock-like position for a fraction of the cost of buying 100 shares.

This strategy is ideal for investors who are bullish on a stock over the long term but want to generate consistent income along the way without a massive upfront capital outlay. By using a long-dated in-the-money (ITM) call option as a proxy for stock ownership, you can still collect premiums from selling monthly or weekly calls. This makes it one of the best covered call strategy variations for leveraging capital on high-priced growth stocks.

How It Works: A Capital-Efficient Approach

The process begins by buying a deep in-the-money LEAPS call option, typically with a delta of .80 or higher and an expiration date 12 to 24 months in the future. This high delta ensures the option behaves very similarly to the underlying stock. Once you own the LEAPS call, you then sell a shorter-term, out-of-the-money call option against it, collecting a premium.

For example, you could buy a 2-year LEAPS call on Amazon (AMZN) and then sell 30-45 DTE call options against it month after month. The goal is to collect enough premium over time to significantly reduce or even eliminate the initial cost of your LEAPS call, creating a high-return, low-cost position.

Actionable Implementation Tips

To effectively implement this strategy, consider the following points:

- Focus on Long-Term Growth: Select LEAPS on stocks with strong, stable, long-term growth prospects. This strategy underperforms if the underlying stock stagnates or declines significantly.

- Mind the Spread: When buying your LEAPS and selling your short call, be mindful of the bid-ask spread. A wide spread can eat into your potential profits, so use limit orders to get favorable pricing.

- Plan Your Exit: Consider rolling or closing your entire position when the LEAPS contract has about 6 to 9 months of life remaining. This helps you avoid the accelerated time decay (theta) that occurs closer to expiration. You can learn more about LEAPS option strategies to refine your approach.

Key Insight: The primary advantage of the LEAPS covered call is leverage. You can control a position equivalent to 100 shares for a much lower cost, which can dramatically increase your return on capital if the underlying stock performs as expected.

6. Covered Call Ladders

The covered call ladder is a sophisticated strategy that diversifies a single stock position across multiple options with different expiration dates and strike prices. Instead of writing one large covered call position, an investor "ladders" their contracts, creating a more consistent income stream and spreading out risk. This approach smooths out returns and reduces the impact of any single option's outcome.

This strategy is ideal for investors holding a large position in a single stock (e.g., 500+ shares) who want to generate regular cash flow while maintaining flexibility. By staggering expirations, you avoid having your entire position tied to one specific date, providing more opportunities to adjust to market movements. This method is often considered a more advanced but powerful version of the best covered call strategy for managing larger portfolios.

How It Works: A Diversified Income Approach

The core concept involves breaking a large stock holding into smaller, 100-share lots and selling covered calls against each lot with unique parameters. For an investor holding 500 shares of Apple (AAPL), instead of selling five identical contracts, they might sell one weekly, two monthly, and two quarterly contracts, each with a different strike price.

This diversification means you are collecting premium at different times throughout the month and quarter. If one short-term option results in an assignment, the longer-dated positions remain active, continuing to generate income and allowing you to manage the overall position more dynamically.

Actionable Implementation Tips

To effectively build a covered call ladder, consider these specific actions:

- Start with 2-3 Cycles: Begin with a simple ladder using just two or three different expiration cycles (e.g., weekly, monthly, and quarterly) before adding more complexity. This makes it easier to manage and track.

- Focus on Liquid Underlyings: This strategy works best with highly liquid stocks like SPY or MSFT that have active options markets across many expiration dates. This ensures tight bid-ask spreads and easy entry/exit.

- Maintain a Tracking Spreadsheet: Use a spreadsheet to meticulously track each "rung" of your ladder. Record the underlying stock, number of shares, strike price, expiration date, premium received, and cost basis to monitor performance accurately.

Key Insight: The main advantage of a ladder is risk mitigation through diversification. By spreading expirations, you reduce "timing risk," where a single, poorly timed market move could force an assignment of your entire position at an undesirable price.

The following infographic illustrates the concept of building a covered call ladder with multiple expiration dates against a single stock holding.

This visual representation clarifies how laddering creates a continuous cycle of premium collection and position management, transforming a static holding into a dynamic income-generating asset.

Top 6 Covered Call Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| High-Dividend Covered Calls | Moderate | Moderate (focus on dividend stocks) | 8-15% annual yield (dividends + premiums) | Income-focused investors seeking dual income streams | Dual income, lower volatility, regular dividends |

| The Wheel Strategy | High | High capital ($50,000+) | 12-20% annual returns | Investors wanting systematic income & discounted stock acquisition | Generates income in all markets, systematic cycle |

| ATM/ITM Covered Calls | Moderate to High | Moderate to High (active management) | 15-25% annual returns | Aggressive income in sideways or declining markets | Highest premiums, downside protection |

| Buy-Write Strategy | Moderate | Moderate to High (large portfolios) | Consistent option income, risk-adjusted returns | Professional managers, large portfolios | Immediate premium income, lower volatility |

| LEAPS Covered Calls | Moderate | Moderate (long-term capital commitment) | Moderate premiums with long-term appreciation | Long-term investors seeking growth & income balance | High upfront premiums, less management intensive |

| Covered Call Ladders | Advanced | Very High ($75,000-$150,000+) | More consistent income flow | Experienced traders managing large positions | Smooth income, timing risk reduction, flexibility |

Choosing and Executing Your Winning Strategy

Throughout this guide, we have explored a diverse range of powerful covered call strategies, from the dual-income stream of High-Dividend Covered Calls to the long-term premium generation of LEAPS Covered Calls. We’ve dissected the active, systematic approach of The Wheel and the precision of Covered Call Ladders. Each method offers a unique pathway to generating consistent income and managing portfolio risk.

The core lesson is clear: the best covered call strategy is not a universal formula. Instead, it is the one that aligns seamlessly with your unique financial landscape, including your investment timeline, risk tolerance, and income objectives. A retiree seeking stable monthly cash flow will have different needs than a growth-oriented investor aiming to enhance long-term returns.

From Theory to Profitable Action

Understanding the mechanics of each strategy is only the first step. True success in options trading is built on a foundation of disciplined execution and data-driven decision-making. Simply knowing what to do is not enough; you must know when and why to do it. This is where many investors falter, letting emotion or guesswork dictate their trades.

To elevate your execution, consider these critical action items:

- Define Your Goals: Are you aiming for maximum monthly income, minimizing assignment risk, or a balanced blend of both? Your primary objective will immediately narrow down which strategy is most suitable for your portfolio.

- Master Risk Management: Never sell a covered call on a stock you are not willing to own long-term or sell at the strike price. Define your exit plan before entering a trade, whether that involves rolling the option or accepting assignment.

- Embrace Data Over Intuition: Successful traders replace "I think" with "the data shows." Key metrics like probability of profit (PoP), delta, and the premium’s return on risk are not just numbers; they are your guideposts for making informed, high-probability trades.

The transition from a theoretical understanding to consistent, real-world application is the most critical hurdle to overcome. This is where leveraging the right tools becomes a game-changer, transforming a good strategy into your best covered call strategy. By focusing on precise execution and a disciplined approach, you can harness the full potential of covered calls to build a reliable and growing income stream from your investments.

Ready to move beyond theory and execute your chosen strategy with data-driven precision? Strike Price provides real-time probability metrics and an intuitive Target Mode to help you identify the optimal covered call trades that align perfectly with your income goals and risk tolerance. Take the guesswork out of your trading and start making smarter, more profitable decisions today at Strike Price.