Top 10 Best Financial Planning Software for Individuals in 2025

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

Managing your money effectively requires more than just good intentions; it demands the right tools. Navigating the world of personal finance can feel like coordinating a complex operation, with income streams, expenses, investments, and long-term goals all vying for attention. The best financial planning software for individuals acts as your central command center, consolidating this disparate information into a clear, actionable picture of your financial health. These platforms automate the tedious tasks of tracking spending, categorizing transactions, and monitoring budgets, freeing you to focus on strategic decisions.

This guide is designed to help you cut through the noise and find the perfect financial copilot for your specific needs. We’ve done the heavy lifting by meticulously reviewing the top contenders in the market, from comprehensive desktop applications to sleek, mobile-first budget trackers. Whether you are a meticulous budgeter, a hands-off investor, or someone just starting to take control of their finances, the right solution is on this list.

Inside, you will find in-depth analysis of each platform, including:

- Honest pros and cons based on real-world use.

- Detailed pricing breakdowns to avoid any surprises.

- Specific use cases to match software to your financial style.

- Screenshots and direct links for a closer look.

While many of these tools offer robust investment tracking, their primary focus is on budgeting and cash flow management. For comprehensive management of your investments, exploring dedicated platforms for portfolio tracking can provide advanced tools to monitor and analyze your entire financial holdings. You can find detailed reviews of the best portfolio tracking software to complement your financial planning toolkit. Let's dive in and find the software that will help you achieve your financial goals.

1. Quicken Classic

Quicken Classic has been a cornerstone of personal finance management for decades, evolving from simple checkbook software into a comprehensive desktop application. Its primary strength lies in its depth, offering granular control over every facet of your financial life, making it one of the best financial planning software for individuals who prioritize detail and local data control. Unlike many modern web-based apps, Quicken operates from a file stored directly on your Windows or Mac computer, a significant draw for privacy-conscious users.

This platform excels at transaction-level management. Users can meticulously track spending, reconcile bank accounts to the penny, and manage complex debt-reduction plans for loans and mortgages. Its investment tracking is particularly robust, allowing you to monitor performance, analyze asset allocation, and generate detailed tax-related reports, including capital gains and Schedule B/D information.

Key Features & User Experience

Quicken's interface, while powerful, presents a steeper learning curve than simpler apps. It is built around a register-style view that will feel familiar to long-time users but may seem dated to newcomers. However, this structure enables its powerful reporting capabilities, which are unmatched for generating custom cash-flow statements, net worth reports, and budget variance analyses.

- Best For: Detailed-oriented users, small business owners, and individuals managing rental properties.

- Unique Offering: Dedicated versions for "Business & Personal" and "Home & Business" provide tools for P&L statements, invoicing, and rental income tracking.

- Practical Tip: Take time to explore the reporting section. Customizing and scheduling regular reports can provide deep insights that are difficult to replicate with other tools.

Pricing and Access

Quicken Classic is available via an annual subscription, with different tiers offering escalating features. The "Deluxe" plan covers most individual needs, while "Premier" adds advanced investment and tax tools.

| Plan | Key Features |

|---|---|

| Deluxe | Budgeting, Debt Tracking, Investment Monitoring |

| Premier | Advanced Investment Tools, Tax Reports |

| Home & Business | Business & Rental Property Management |

While bank connectivity is generally reliable, it can sometimes require manual intervention or troubleshooting, a common pain point noted by users. However, for those seeking a powerful, all-in-one financial hub with offline capabilities, Quicken Classic remains a top contender.

Website: https://www.quicken.com/products/pricing-comparison-classic/

2. Quicken Simplifi

Quicken Simplifi is the modern, cloud-based counterpart to its desktop predecessor, designed for a new generation of users prioritizing simplicity and real-time cash flow management. It distills complex financial planning into an intuitive app that focuses on what you can actually spend today. As one of the best financial planning software for individuals seeking clarity without a steep learning curve, Simplifi excels at providing an immediate, actionable snapshot of your finances, connecting exclusively to U.S. and Canadian bank accounts.

The platform’s core strength is its forward-looking approach. Instead of just logging past transactions, it projects your income and bills to calculate a "spendable" balance, helping prevent overspending before it happens. Its goal-tracking and real-time spending watchlists are particularly effective, offering instant alerts that empower users to make smarter daily financial decisions. Unlike more complex tools, Simplifi is built for quick, on-the-go checks via its highly-rated mobile app.

Key Features & User Experience

Simplifi offers a clean, visually appealing interface that makes it easy to get started. The dashboard immediately presents key metrics like your projected cash flow and top spending categories, removing the need to dig through reports. This focus on ease of use makes onboarding fast, and features like subscription management help you quickly identify and cut recurring costs you may have forgotten.

- Best For: Individuals and couples wanting a clear view of their day-to-day cash flow and progress toward savings goals.

- Unique Offering: The "Space Sharing" feature allows you to securely share your financial picture with a partner or financial advisor without sharing login credentials.

- Practical Tip: Use the "Spending Watchlists" for categories where you tend to overspend, like dining out or shopping. Setting a monthly target provides real-time alerts that can curb impulse buys.

Pricing and Access

Simplifi operates on an annual subscription model, offering a single tier that includes all its features. This straightforward pricing avoids the confusion of multiple plans, ensuring every user gets the full experience. A 30-day trial is typically available for new users.

| Plan | Key Features |

|---|---|

| Simplifi Annual Plan | Real-time Spendable Balance, Goal Tracking, Spending Watchlists, Space Sharing |

A common point of feedback from users involves the annual-only subscription model and occasional price increases at renewal. Additionally, its limitation to U.S. and Canadian banks and single-currency use makes it unsuitable for those with international financial needs. However, for its target audience, Simplifi provides a powerful yet uncomplicated tool for mastering daily finances.

Website: https://www.simplifimoney.com/

3. Empower Personal Dashboard

Empower Personal Dashboard (formerly Personal Capital) stands out by offering a powerful suite of financial aggregation and analysis tools completely free of charge. It excels at providing a high-level, 360-degree view of your entire financial life, making it one of the best financial planning software for individuals focused on long-term wealth building and retirement planning. The platform links all your accounts-from banking and credit cards to loans and complex investments-into a single, intuitive dashboard.

Its primary strength lies in its investment and retirement planning tools. The platform's free "Investment Checkup" analyzes your portfolio for hidden fees, historical performance, and risk-adjusted returns, offering actionable insights. The Retirement Planner is another standout feature, using Monte Carlo simulations to project your financial future and assess your readiness for retirement based on your current savings and spending habits.

Key Features & User Experience

Empower's user interface is clean, modern, and highly visual, emphasizing charts and graphs to display net worth, cash flow, and asset allocation over time. This makes complex financial data easy to understand at a glance. While its budgeting tools are less granular than dedicated apps, they are sufficient for tracking overall spending trends.

- Best For: Long-term investors, retirement planners, and anyone wanting a holistic view of their net worth.

- Unique Offering: The Fee Analyzer tool exposes hidden fees in your 401(k), mutual funds, and other investments, a feature rarely found in free platforms.

- Practical Tip: Regularly use the Retirement Planner's "Recalculate" feature to see how life events, like a salary increase or a large purchase, impact your long-term goals.

Pricing and Access

The core dashboard, including all tracking and analysis tools, is entirely free and ad-free. Empower's business model involves offering its paid wealth management services to users with significant assets, which may lead to occasional marketing outreach from their advisors.

| Plan | Key Features |

|---|---|

| Free Dashboard | Net Worth Tracking, Retirement Planner, Fee Analyzer, Budgeting |

| Wealth Management | All free features plus dedicated financial advisors and managed portfolios |

Although the budgeting features are not as robust as some competitors, Empower Personal Dashboard's sophisticated, free investment and retirement analysis tools make it an indispensable platform for serious long-term financial planning.

Website: https://www.empower.com/track-your-portfolio

4. YNAB (You Need A Budget)

YNAB, which stands for "You Need A Budget," operates on a simple yet powerful philosophy: give every dollar a job. This zero-based budgeting method forces users to be intentional with their money, making it one of the best financial planning software for individuals focused on gaining control over spending and breaking the paycheck-to-paycheck cycle. It is a proactive tool designed to change financial habits, rather than just passively tracking past expenses.

The platform is less about complex investment analysis and more about conscious cash flow management. It excels at helping you plan for future expenses, pay down debt strategically, and align your spending with your priorities. The educational resources, including live workshops and an active user community, provide exceptional support for users new to budgeting. For those looking to optimize their finances, mastering net worth tracking with YNAB, Google Sheets, and Excel can provide a more comprehensive view of your financial health.

Key Features & User Experience

YNAB's interface is modern, clean, and accessible across desktop and mobile devices with real-time syncing. The initial setup requires connecting accounts and assigning all your current money to various budget categories, which can take time but is crucial to the method's success. This process is instrumental in learning how to set financial goals and breaking them down into manageable monthly targets. The software's focus on future planning, rather than just past reporting, is a key differentiator.

- Best For: Individuals and couples determined to eliminate debt, stop living paycheck-to-paycheck, and build a strong saving habit.

- Unique Offering: A proven four-rule methodology that acts as a financial education course built directly into the software.

- Practical Tip: Embrace the "Roll with the Punches" rule. If you overspend in one category, move money from another to cover it instead of feeling like you've failed.

Pricing and Access

YNAB is offered as a single-tier subscription, available either monthly or annually, with the annual plan providing a significant discount. A 34-day free trial is available, giving users ample time to test the methodology.

| Plan | Key Features |

|---|---|

| YNAB Annual Plan | Full access to budgeting software, goal tracking, debt planner, real-time sync, and all educational resources |

While its subscription cost is higher than many free apps, users often find the financial control and savings it enables far outweigh the price. The primary drawback is its limited focus on investment and retirement tracking, as it is first and foremost a budgeting tool.

Website: https://www.ynab.com/pricing

5. Monarch Money

Monarch Money positions itself as a modern, premium alternative in the personal finance space, designed for collaborative household management. It provides a clean, ad-free interface and robust connectivity, making it one of the best financial planning software for individuals and partners looking to manage finances together. Its strength lies in its reliable bank connections, which leverage multiple data providers to ensure your accounts stay synced and up-to-date with minimal manual intervention.

The platform offers a holistic view of your finances by tracking everything from bank and investment accounts to crypto holdings via Coinbase and even property values through Zillow integration. This comprehensive approach allows users to set and monitor progress towards specific financial goals, analyze cash flow, and maintain a clear budget without the clutter of advertisements. The unlimited collaborator feature is a standout, allowing you to invite a partner or financial advisor to view and manage finances within a single subscription.

Key Features & User Experience

Monarch Money’s user experience is a major selling point. The web and mobile apps are intuitive, well-designed, and easy to navigate, avoiding the steep learning curve associated with more traditional desktop software. Its dashboard presents a clear, customizable overview of your net worth, recent transactions, and goal progress, making it easy to get a quick financial snapshot. While it lacks a permanent free version after the trial, its premium-only model ensures user data privacy and an ad-free experience.

- Best For: Couples, families, and individuals seeking a modern, collaborative budgeting and net worth tracking tool.

- Unique Offering: The ability to add unlimited collaborators (partners, financial advisors) to a single account at no extra cost.

- Practical Tip: Use the "Goals" feature to create specific savings targets, like a down payment or vacation fund. Monarch will track your progress and show you how your spending habits are impacting your timeline.

Pricing and Access

Monarch Money operates on a straightforward subscription model after a free trial period. There are no complicated tiers; one plan gives you access to all features.

| Plan | Key Features |

|---|---|

| Premium | Unlimited Accounts, Goals, Budgeting, Investment Tracking, Unlimited Collaborators |

The platform's primary drawback for some may be the lack of a permanent free tier and a smaller third-party app ecosystem compared to established players like Quicken. However, for those who value a clean interface, superior connectivity, and strong collaborative tools, Monarch Money presents a compelling and modern solution.

Website: https://www.monarchmoney.com/

6. Tiller

Tiller offers a unique approach for spreadsheet enthusiasts, bridging the gap between manual entry and fully automated apps. Instead of locking your data into a proprietary interface, it automatically feeds all your financial transactions directly into Google Sheets or Microsoft Excel. This makes it one of the best financial planning software for individuals who crave complete control and customization over their financial data without the tedious task of manual data entry.

It stands out by placing the user's spreadsheet at the center of the experience. Your financial information, from over 20,000 supported institutions, populates a sheet that you own and control, ensuring privacy and endless flexibility.

Key Features & User Experience

The platform is built for users comfortable navigating spreadsheets. Tiller provides a robust "Foundation Template" to get you started with dashboards for budgeting, net worth, and expense tracking. Its real power comes from customization, including the "AutoCat" feature that lets you build powerful rules to automatically categorize transactions exactly how you want. The active user community constantly develops and shares new templates for everything from debt reduction to investment tracking.

- Best For: Spreadsheet power users, DIY-financiers, and anyone wanting ultimate data ownership and flexibility.

- Unique Offering: The platform is entirely spreadsheet-native; all your data and analysis live in your Google or Microsoft account, not on Tiller’s servers.

- Practical Tip: Leverage the Tiller Community Solutions gallery. You can find pre-built templates for complex tasks, like tracking portfolio performance, which can also help you learn how to rebalance your portfolio using spreadsheet data.

Pricing and Access

Tiller operates on a simple, single-tier subscription model, offering a 30-day free trial to test the service fully. After the trial, it requires an annual subscription.

| Plan | Key Features |

|---|---|

| Annual Subscription | Automated bank feeds, Foundation Template, AutoCat, Community support, Google Sheets & Excel integration |

The primary challenge for new users is the initial setup and learning curve associated with spreadsheet functions. It provides less hand-holding than traditional apps, but for those who master it, the level of insight and control is unparalleled.

Website: https://www.tillerhq.com/

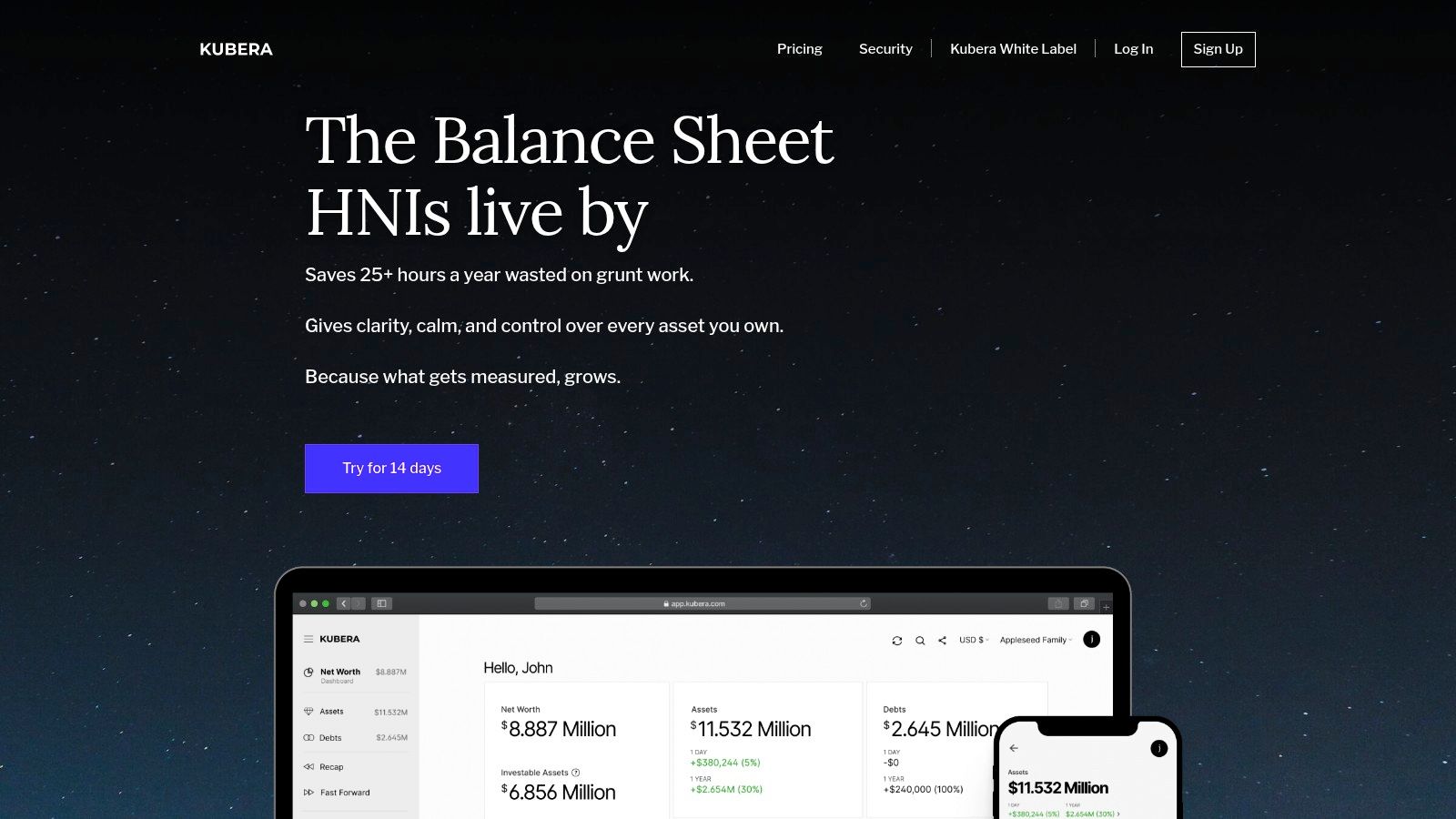

7. Kubera

Kubera is a modern, high-end wealth tracker designed for individuals with diverse and complex portfolios. It positions itself not as a budgeting tool, but as a holistic dashboard for your entire net worth, unifying traditional investments, cryptocurrency, real estate, and alternative assets in one clean interface. This makes it one of the best financial planning software for individuals who prioritize a high-level, real-time view of their wealth and value data privacy above all else. Its core philosophy is providing a clear picture of what you own without upselling financial advice.

The platform excels at aggregating a wide range of asset classes that many competitors ignore. It connects directly to bank accounts, brokerages, and crypto wallets (including DeFi protocols and NFTs). Furthermore, it integrates with services like Zillow to provide live estimates for real estate and can track the value of vehicles and domain names, presenting everything in your chosen currency.

Key Features & User Experience

Kubera’s interface is minimalist and elegant, focusing on a clean, visual representation of your asset allocation and net worth over time. It deliberately avoids the complexity of transaction-level budgeting, making it incredibly user-friendly for its intended purpose: wealth tracking. The platform's powerful IRR (Internal Rate of Return) calculator provides true performance metrics for any individual asset or your entire portfolio.

- Best For: High-net-worth individuals, cryptocurrency investors, and anyone with a diverse portfolio of traditional and alternative assets.

- Unique Offering: A "Life Beat Check" feature acts as a dead man's switch, securely sharing your financial portfolio with a designated beneficiary if you become inactive.

- Practical Tip: Use the document vault to store important files like deeds, wills, and insurance policies alongside their corresponding assets for a truly consolidated legacy plan.

Pricing and Access

Kubera operates on a straightforward annual subscription model, eschewing a "freemium" approach to align its business model with user privacy. There is one simple plan that provides access to all features.

| Plan | Key Features |

|---|---|

| All-in-One | Multi-currency support, Crypto/DeFi/NFT tracking, Zillow & vehicle valuation, IRR for assets, Beneficiary management |

While its focus on wealth tracking means it lacks the deep budgeting and spending analysis of other tools, Kubera's strength lies in its specialized purpose. For those who need an elegant, private, and comprehensive view of a complex financial picture, it is an unparalleled solution.

Website: https://www.kubera.com/

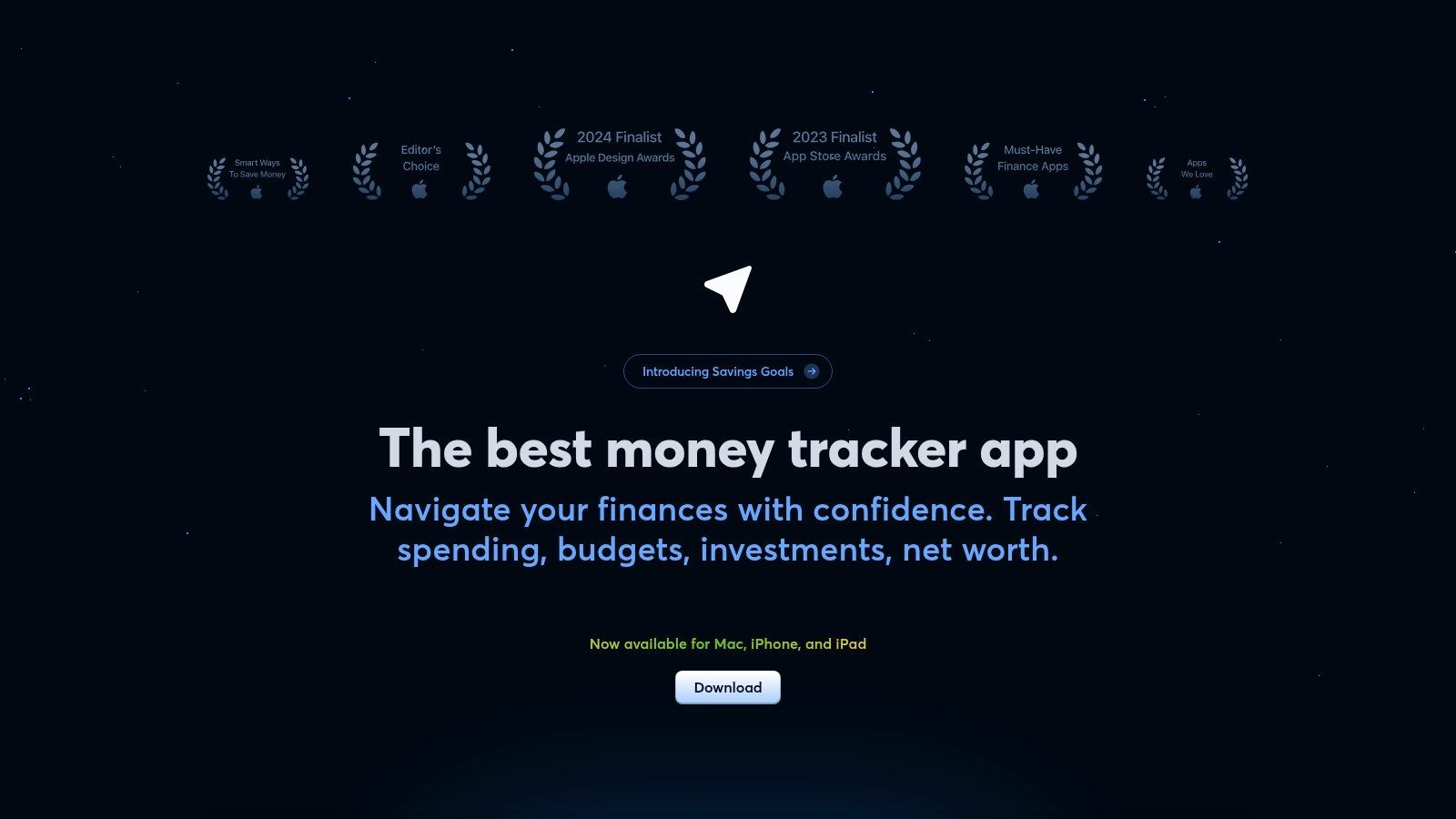

8. Copilot Money

Copilot Money is a modern, design-forward personal finance app built exclusively for the Apple ecosystem. It distinguishes itself with an intuitive interface and AI-powered features, making it one of the best financial planning software for individuals who live on their iPhone, iPad, or Mac. Designed for U.S. users, its core strength lies in providing a smart, proactive overview of your daily finances rather than deep, long-term retirement planning.

The platform shines with its "Copilot Intelligence," which uses AI for predictive transaction categorization, saving users significant manual effort. It excels at tracking recurring bills and subscriptions, sending smart alerts about upcoming charges and changes in cash flow. Its investment tracking provides a clean dashboard to monitor portfolio performance across multiple accounts, helping you understand your asset allocation and overall net worth. For those looking to see how their portfolio aligns with their goals, it can be useful to understand your investment risk profile.

Key Features & User Experience

Copilot’s user experience is its primary selling point. The interface is clean, fast, and visually appealing, a stark contrast to more traditional, data-heavy desktop software. It presents financial data through beautiful charts and summaries that are easy to digest at a glance. The app is proactive, using notifications to keep you informed about your spending, budget status, and large transactions, which helps prevent financial surprises.

- Best For: Apple users in the U.S. who want a visually intuitive app for daily budget and spending management.

- Unique Offering: AI-powered smart categorization and proactive alerts for subscriptions and recurring bills.

- Practical Tip: Leverage the custom categories and transaction rules. Spending a few minutes teaching the AI how you categorize unique purchases will make your budget tracking nearly automatic over time.

Pricing and Access

Copilot Money operates on a single subscription model, emphasizing its privacy-first, ad-free approach. Unlike free apps that may sell user data, Copilot's revenue comes directly from its users, aligning its interests with theirs. It is available exclusively on the Apple App Store for iPhone, iPad, and Mac.

| Plan | Key Features |

|---|---|

| Annual Subscription | AI-Powered Categorization, Smart Alerts, Budget & Subscription Tracking, Net Worth & Investment Monitoring |

The main limitations are its U.S.-only availability and the complete absence of an Android or web version, making it a non-starter for anyone outside the Apple ecosystem. While excellent for day-to-day finances, users needing complex, multi-decade retirement forecasting may find it less comprehensive than dedicated desktop planners.

Website: https://copilot.money/

9. CountAbout

CountAbout positions itself as a direct, no-nonsense alternative for users migrating from legacy software like Quicken or Mint. Its core value is providing a clean, ad-free, and lightweight platform for essential budgeting and transaction management. This makes it one of the best financial planning software for individuals seeking a simple, privacy-focused online solution without the overwhelming features of more complex systems. It operates entirely in your browser, with companion mobile apps for on-the-go access.

The platform's standout feature is its ability to import data directly from Quicken (QIF files) and Mint, allowing users to preserve years of financial history seamlessly. It excels at core financial tasks such as transaction tracking, custom spending categorization, and basic reporting. While it lacks the deep investment analysis or advanced forecasting of its competitors, its straightforward approach is perfect for users who need a reliable digital checkbook register and a clear view of their day-to-day cash flow.

Key Features & User Experience

CountAbout offers a refreshingly simple and uncluttered interface that prioritizes function over form. Navigation is intuitive, focusing on registers, budgets, and reports. While the visuals are more basic than modern fintech apps, this simplicity contributes to a fast and responsive user experience. The setup is quick, especially for those importing existing financial data.

- Best For: Former Mint or Quicken users, budgeters who prioritize simplicity, and anyone wanting a low-cost, ad-free experience.

- Unique Offering: Direct data import from Quicken and Mint, making it a leading choice for users transitioning from those platforms.

- Practical Tip: Use the recurring transactions feature to automate entries for regular bills and income. This keeps your registers accurate with minimal manual effort.

Pricing and Access

CountAbout's affordability is a major draw. It uses a low-cost annual subscription model with two simple tiers, ensuring it remains accessible.

| Plan | Key Features |

|---|---|

| Basic | Manual Transaction Entry, Budgeting, Reporting |

| Premium | Automatic Bank Transaction Downloads |

The primary difference between plans is automatic transaction syncing, a feature most users will find essential for convenience. Its transparent, ad-free pricing model is a welcome change from platforms that rely on selling user data or upselling financial products.

Website: https://countabout.com/pricing/

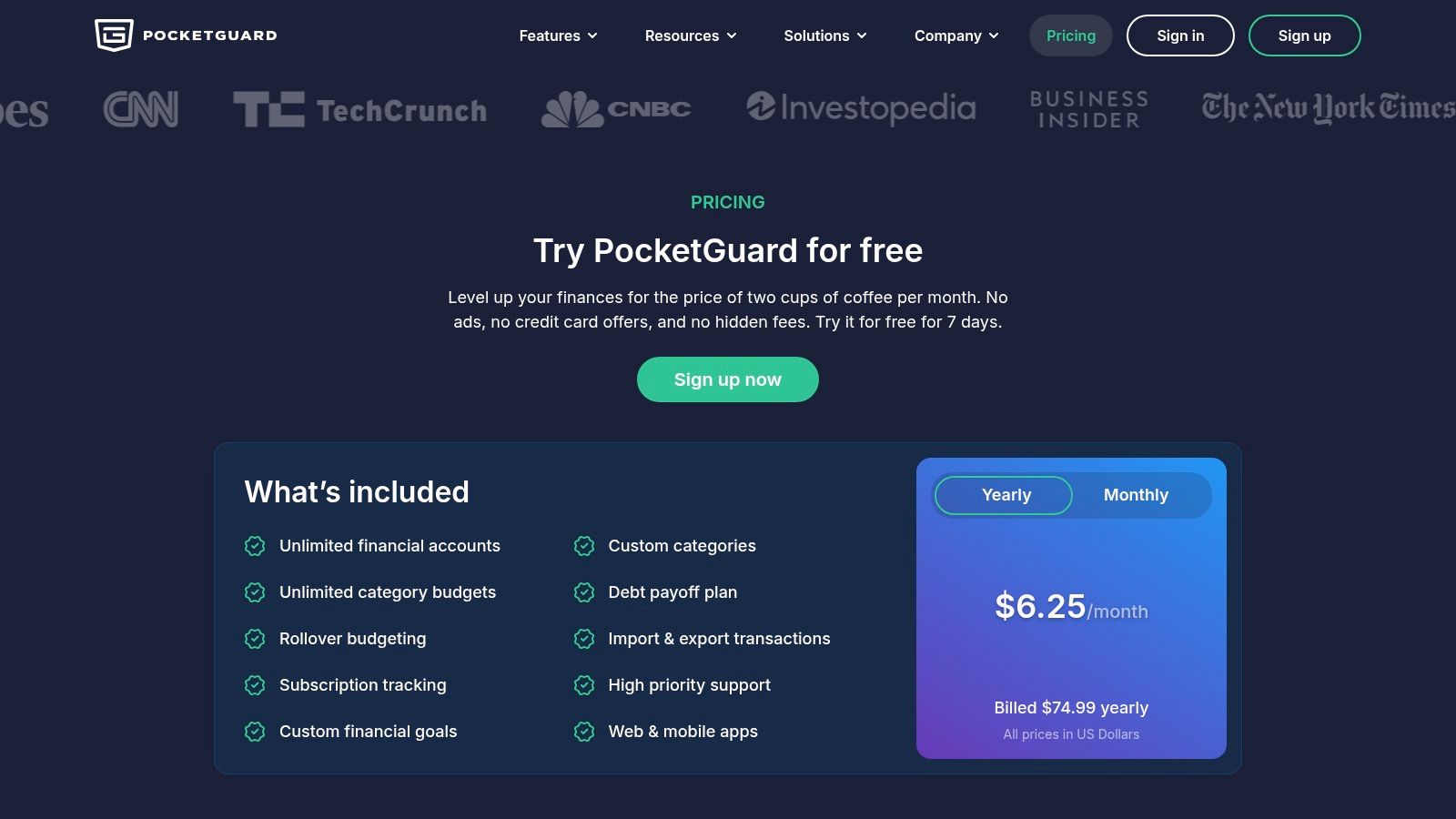

10. PocketGuard

PocketGuard is designed to answer one simple but crucial question: "How much is in my pocket for spending?" This app simplifies budgeting by focusing on your actual spendable cash after bills, savings goals, and recurring expenses are accounted for. It excels at providing a clear, immediate snapshot of your financial health, making it one of the best financial planning software for individuals who feel overwhelmed by complex spreadsheets and detailed tracking. Its intuitive approach is built for on-the-go management via its robust iOS and Android apps.

The platform automatically categorizes your transactions and identifies recurring subscriptions and bills, helping you spot potential savings by canceling services you no longer use. PocketGuard also includes tools to create savings goals and build a personalized debt payoff plan, providing actionable steps to improve your financial situation based on your real-time cash flow.

Key Features & User Experience

PocketGuard’s user interface is clean, modern, and built for simplicity, making it accessible for budgeting newcomers. The "In My Pocket" feature is the centerpiece, offering an at-a-glance number that guides daily spending decisions without needing to dig through complex reports. Its focus is on cash flow management rather than long-term investment analysis.

- Best For: Beginners to budgeting, users focused on controlling daily spending, and individuals wanting to identify and cut recurring expenses.

- Unique Offering: The "In My Pocket" calculation provides a highly practical, real-time figure for discretionary spending, simplifying financial decision-making.

- Practical Tip: Regularly review the "Recurring Bills" and "Subscriptions" section. PocketGuard often finds forgotten charges that can be easily eliminated to free up cash.

Pricing and Access

PocketGuard offers a functional free version, but the "PocketGuard Plus" subscription unlocks its most powerful features, such as unlimited accounts, rollover budgeting, and the ability to export transaction data.

| Plan | Key Features |

|---|---|

| Free | Basic budgeting, Limited accounts, Subscription tracking |

| Plus | Unlimited accounts & categories, Rollover budgeting, Debt payoff plan, Data export |

While its investment and retirement planning tools are minimal compared to more comprehensive platforms, PocketGuard’s strength lies in its excellent cash flow management and user-friendly design, making it a top choice for gaining control over your everyday finances.

Website: https://pocketguard.com/pricing/

11. EveryDollar (Ramsey Solutions)

EveryDollar, developed by Ramsey Solutions, is a budgeting tool built entirely around Dave Ramsey's popular zero-based budgeting method. Its core philosophy is simple: give every dollar a job before the month begins. This approach makes it one of the best financial planning software for individuals focused on gaining control over their spending, eliminating debt, and building a solid financial foundation according to a proven, step-by-step plan.

The platform strips away the complexity of comprehensive financial management to focus intently on cash flow and conscious spending. Unlike tools that emphasize wealth and investment tracking, EveryDollar excels at helping users align their daily financial habits with long-term goals like paying off debt and building an emergency fund. Its integration with the broader Ramsey ecosystem provides a clear roadmap for financial wellness.

Key Features & User Experience

EveryDollar offers a clean, intuitive interface on both web and mobile, making it easy to create and stick to a monthly budget. The free version requires manual transaction entry, which forces users to be mindful of every purchase. The premium version adds bank syncing, which automates transaction importing while still requiring users to drag and drop each expense into its correct budget category.

- Best For: Individuals and families new to budgeting, anyone following the Ramsey Baby Steps, and users seeking a simple, goal-oriented cash flow tool.

- Unique Offering: Direct alignment with Ramsey’s 7 Baby Steps, providing a structured, motivational path from debt to wealth-building.

- Practical Tip: Use the "fund" feature for irregular expenses like holidays or car repairs. This helps you save a small amount each month, preventing these costs from breaking your budget when they occur.

Pricing and Access

EveryDollar offers a functional free version and a premium subscription that unlocks key automation and reporting features. The premium plan is required for connecting bank accounts.

| Plan | Key Features |

|---|---|

| Free Version | Manual transaction entry, create monthly budgets |

| Ramsey+ (Premium) | Bank account syncing, paycheck planning, custom reports, financial coaching resources |

While the lack of bank connectivity in the free version is a limitation for some, many users find the manual process reinforces discipline. For those committed to the Ramsey method, EveryDollar provides an unparalleled, focused tool for financial transformation.

Website: https://www.everydollar.com/

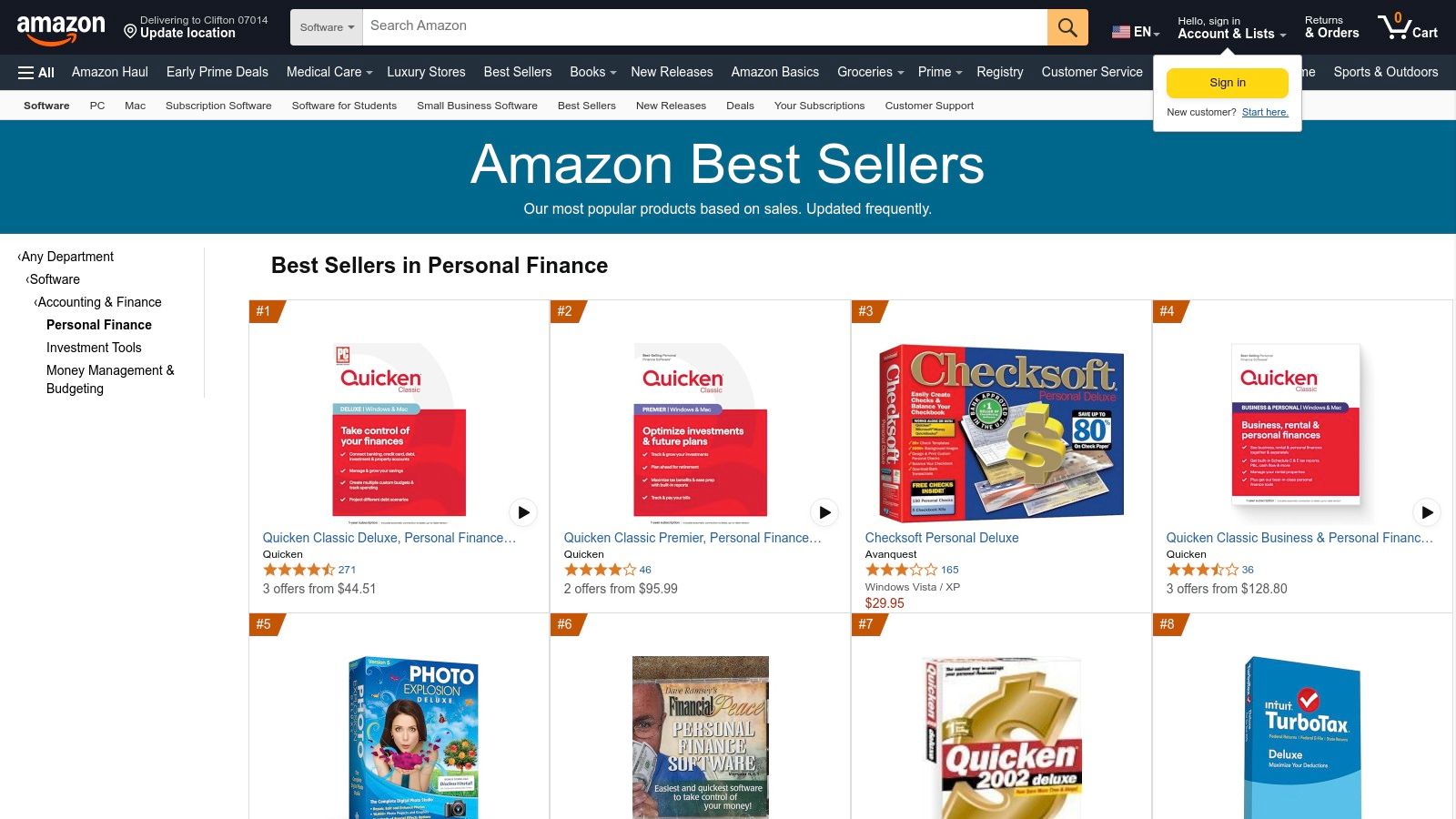

12. Amazon - Personal Finance Software Marketplace

While not a software application itself, Amazon’s marketplace serves as a critical purchasing hub for many desktop-based financial tools. It offers a unique value proposition by aggregating listings for boxed and downloadable software, often providing competitive pricing and user reviews that are essential for making an informed decision. For individuals seeking traditional, locally installed programs like Quicken or H&R Block, Amazon is often the first and last stop for comparing editions and finding potential discounts.

This platform's primary strength is price comparison and consumer feedback. Instead of buying directly from a publisher, you can browse offers from multiple sellers, read thousands of unfiltered buyer reviews, and often take advantage of fast Prime shipping for physical key cards. This makes it an excellent resource for those who have already decided on a specific program and are now looking for the best financial planning software for individuals at the best possible price.

Key Features & User Experience

Amazon's familiar interface makes it simple to search for, compare, and purchase software. The user reviews section is particularly valuable, offering real-world insights into installation issues, feature limitations, and customer support experiences that you might not find on the publisher's site. However, the experience is purely transactional; there is no software trial or direct product support.

- Best For: Price-conscious buyers, users purchasing physical software copies, and those who value extensive peer reviews before buying.

- Unique Offering: Access to multiple third-party sellers, which can lead to lower prices on annual subscriptions or one-time purchases compared to buying direct.

- Practical Tip: Always verify the seller's reputation and ensure you are purchasing the correct version (e.g., Windows vs. Mac, correct subscription year) for your needs.

Pricing and Access

Pricing on Amazon is dynamic and varies by seller and software edition. It is a marketplace, so costs for the same product can differ. Be sure to check if you are buying a digital download code, a physical key card, or a disc.

| Purchase Type | Key Considerations |

|---|---|

| Digital Download | Instant access, code delivered via email. |

| Physical Key Card | Requires shipping, may be eligible for Prime. |

| Third-Party Seller | Verify seller ratings and return policies. |

A key drawback is that support and returns are handled by Amazon or the specific seller, not the software publisher. This can add a layer of complexity if you encounter issues. Nonetheless, for savvy shoppers, it is an indispensable resource for securing a deal on top-tier financial software.

Website: https://www.amazon.com/Best-Sellers-Software/zgbs/software/229540

Feature Comparison of Top 12 Financial Planning Tools

| Product | Core Features/Characteristics | User Experience/Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Quicken Classic | Desktop app, local data, investment & tax reports | ★★★★☆ Robust, mature, detailed | 💰 Subscription; offline & privacy | Privacy-conscious pros, biz users | 🏆 Business & rental property modules |

| Quicken Simplifi | Cash-flow focus, goal tracking, multi-user sharing | ★★★☆☆ Easy, clear spendable view | 💰 Annual subscription only | Casual users, households (US/CA) | ✨ Real-time alerts, subscription mgmt |

| Empower Personal Dashboard | Account aggregation, retirement planning tools | ★★★★☆ Clean, intuitive dashboards | ★ Free core tools; optional advisory 💰 | Long-term planners, investors | ✨ Fee analyzer, portfolio checkup |

| YNAB | Zero-based budgeting, goal targeting, multi-user | ★★★★☆ Educational, community-driven | 💰 Higher subscription price | Budgeters wanting habit-building | 🏆 Strong education, live classes |

| Monarch Money | Unlimited accounts, goal-based planning, collaboration | ★★★★☆ Clean UI, reliable | 💰 Paid only, no free tier | US/Canada households, advisors | ✨ Zillow, crypto tracking, advisor tools |

| Tiller | Spreadsheet automation, customizable transactions | ★★★☆☆ Flexible, spreadsheet-savvy | 💰 Subscription; high customization | Spreadsheet power users | ✨ AutoCat rules, daily financial feeds |

| Kubera | Multi-asset wealth tracker, multi-currency support | ★★★★☆ Privacy-focused, complex | 💰 Premium pricing, wealth focus | High net-worth, multi-asset holders | ✨ DeFi, NFTs, IRR analytics, vault |

| Copilot Money | AI categorization, Apple ecosystem exclusive | ★★★★☆ Smooth UX on Apple devices | 💰 Subscription; US only | Apple users, US only | ✨ Predictive alerts, privacy-first |

| CountAbout | Web/mobile budgeting, imports from Quicken/Mint | ★★★☆☆ Simple, affordable | 💰 Very affordable annual pricing | Budgeters seeking simplicity | ✨ QIF imports, basic reporting |

| PocketGuard | Rollover budgets, debt payoff, subscription tracking | ★★★☆☆ Clear cash-flow snapshots | 💰 Competitive pricing | Budgeters, debt payers | ✨ Helps identify unwanted charges |

| EveryDollar (Ramsey) | Zero-based budgeting, paycheck planning, coaching | ★★★☆☆ Simple, goal-oriented | 💰 Premium for bank sync | Ramsey Method followers | ✨ Coaching, Ramsey ecosystem access |

| Amazon Marketplace | Aggregated software listings & reviews | ★★★☆☆ Varied by seller | 💰 Potential discounts on boxed/software | All buyers | ✨ Centralized price & edition comparison |

Making Your Final Choice: Which Financial Software Is Right for You?

Navigating the crowded market of personal finance tools can feel overwhelming, but making an informed decision is the first crucial step toward mastering your financial destiny. We've journeyed through a comprehensive list, from the robust desktop power of Quicken Classic to the spreadsheet-centric flexibility of Tiller and the sleek, mobile-first design of Copilot Money. The key takeaway is that the best financial planning software for individuals is not a one-size-fits-all solution; it is the one that aligns perfectly with your unique financial personality, goals, and habits.

Your ideal tool depends entirely on what you want to achieve. Are you a meticulous budgeter dedicated to the zero-based method? YNAB or EveryDollar is likely your best fit. Are you a high-net-worth individual or a data-driven investor needing to track complex assets and get a 30,000-foot view of your portfolio? Empower Personal Dashboard and Kubera excel in this area. For those simply seeking to understand their spending habits and automate savings, apps like Quicken Simplifi or PocketGuard offer simplicity and clarity.

How to Select Your Perfect Financial Co-Pilot

Choosing the right software is a commitment, so it’s essential to approach the decision with a clear strategy. Before you sign up for a free trial or commit to a subscription, take a moment to reflect on your specific needs. This self-assessment will be your most valuable guide.

Here are the critical factors to weigh as you make your final choice:

- Define Your Primary Goal: Are you trying to aggressively pay down debt, build a detailed budget, track investments, or simply monitor your cash flow? Your main objective will immediately narrow the field. For instance, a debt-focused user has very different needs than an options trader monitoring their portfolio.

- Assess Your Tech Comfort Level: Be honest about your technical skills. Do you love the infinite customization of a spreadsheet like Tiller offers, or do you prefer an intuitive, plug-and-play app that requires minimal setup? Choosing a tool that matches your comfort level is critical for long-term adoption.

- Consider Your Financial Complexity: Do you have a simple financial life with one or two bank accounts and a 401(k)? Or are you managing multiple investment properties, cryptocurrency, and various brokerage accounts? Tools like Kubera are built for complexity, while others are designed for streamlined simplicity.

- Evaluate the Cost vs. Value: While many powerful free tools exist, such as Empower Personal Dashboard, paid subscriptions often unlock advanced features, dedicated support, and an ad-free experience. Determine your budget and ask yourself if the features of a paid tool like Monarch Money or YNAB will provide a return on investment through better financial outcomes.

Your Actionable Next Steps

Information without action is just noise. To turn this guide into a tangible improvement in your financial life, follow these implementation steps:

- Shortlist Your Top 2-3 Candidates: Based on the reviews and your self-assessment, pick two or three platforms that seem like the best fit.

- Utilize Free Trials: Nearly every paid software on our list offers a free trial period. This is your opportunity to test-drive the platform. Connect your real accounts, categorize some transactions, and explore the reporting features.

- Test for Your "Must-Haves": During the trial, actively check if the software meets your non-negotiable requirements. Does it connect reliably to your primary bank? Is the mobile app easy to use on the go? Is the reporting feature insightful for your specific needs?

- Commit and Be Consistent: Once you've made your choice, commit to using it consistently for at least one full month. The initial setup and learning curve can be challenging, but consistency is where you will start to see real, lasting benefits.

Ultimately, the right financial planning software is a powerful ally, transforming abstract financial goals into a clear, actionable plan. It provides the clarity to make smarter decisions, the discipline to stick to your budget, and the insight to grow your wealth effectively. By choosing a tool that resonates with your personal style and empowers your financial journey, you are not just organizing your finances; you are building a more secure and prosperous future.

For investors focused on generating steady income through options strategies like covered calls and secured puts, layering a specialized tool on top of your financial planning software can be a game-changer. Strike Price provides probability-based decision tools and real-time monitoring specifically for income-focused options traders. Enhance your financial toolkit by exploring how you can optimize your premium generation at Strike Price.