Cash secured put calculator: Analyze risk and trade wins

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

A cash secured put calculator is one of those tools that can instantly turn a sea of market data into clear, actionable trading ideas. It does the heavy lifting for you, calculating your maximum profit, breakeven price, and potential return on investment before you ever put a dime at risk.

This lets you stop guessing and start making decisions based on solid numbers.

Why a Calculator Is Your Most Important Trading Tool

Honestly, selling cash secured puts without a calculator is like trying to drive across the country without a map. You might know which way is west, but you’re missing the critical details that help you avoid roadblocks and find the best route.

A good calculator automates all the tedious math, freeing you up to focus on what really matters: your strategy.

Instead of just hoping a trade works out, you can see the entire financial picture in seconds. Think of it as your co-pilot, designed to spell out both the potential reward and the risk you’re taking on.

Quantifying Your Trade's Potential

A cash secured put calculator cuts through the noise and shows you the numbers that actually drive your success. You plug in the stock price, your chosen strike, and the option premium, and it spits out the metrics you need to build a confident, repeatable trading plan.

To really understand a potential trade, you need a few key outputs. The table below breaks down what a calculator shows you and why each piece of information is so important for your strategy.

Key Metrics from a Cash Secured Put Calculator

| Metric | What It Means for Your Trade | Why It's Important |

|---|---|---|

| Maximum Profit | The total premium you collect upfront. This is your best-case scenario. | This is your reward. It defines the income potential of the trade. |

| Required Cash | The capital you must set aside to secure the trade (strike price x 100). | Knowing this ensures you have the funds to buy the shares if assigned. |

| Breakeven Point | The exact stock price where you start losing money (strike price - premium). | This number defines your margin of safety and shows how far the stock can drop before you're in the red. |

| Annualized Return | Your potential profit projected over a full year. | This is huge. It lets you compare a short-term options trade to other investments, like holding a stock or a bond. |

These metrics give you a complete risk/reward profile at a glance. You're no longer just looking at a premium; you're seeing the full story.

I see new traders make this mistake all the time: they get fixated on a high premium. But a juicy premium often signals higher risk. A calculator helps you see that risk clearly, preventing you from chasing yield and getting burned.

Here's a great real-world example. This calculation for Pinterest (PINS) shows the initial return and, more importantly, the annualized return.

The output makes it crystal clear: you're looking at a 1.49% return for the life of the trade. That might not sound like much, but when you annualize it, it comes out to an impressive 18.11%.

Suddenly, you have a solid benchmark to judge the trade's performance.

When you start digging into the details of the probability of profit in options trading, you can refine how you interpret these numbers even further. This data-first approach takes emotion out of the equation, which is the key to building a systematic and successful income strategy over the long haul.

Finding the Right Numbers for an Accurate Analysis

Any calculator is only as good as the numbers you plug into it. Garbage in, garbage out, right? The good news is that pulling the right inputs from your trading platform’s options chain is pretty simple once you know what you’re looking for.

These data points are the foundation of your analysis. Each one tells a small part of the story, shaping the risk and reward of the trade you're considering.

Sourcing Your Key Data Inputs

Before you can crunch any numbers, you’ll need to grab four specific pieces of information from the options chain. Think of it like gathering ingredients before you start cooking.

- Current Stock Price: This one’s easy. It’s what the stock is trading for right now and acts as your main reference point for everything else.

- Expiration Date: Options have a shelf life. You need to pick an expiration that fits your timeline, whether that’s just a few weeks or several months from now.

- Strike Price: This is the price you're agreeing to buy the stock at if you get assigned. Your choice of strike price is a direct reflection of your personal comfort level with risk.

- The Bid Price: An options chain will always show a "bid" and an "ask." As the seller, the bid price is the premium you’ll actually collect, so this is the number you have to use for your calculations to be accurate.

A classic rookie mistake is using the "mid" or "last" price for the premium. Always, always use the bid. It’s what a buyer is willing to pay right now, so it’s the only number that reflects the real cash you’ll pocket.

Let’s look at a real-world example. A quick analysis of Pinterest Inc. (PINS) shows how these inputs paint a clear picture. For a 30-day cash-secured put on PINS when it was trading around $31.61, the calculator revealed an initial return of 1.49% if held to expiration. That annualizes to a pretty impressive 18.11%.

Beyond the Trade Numbers

While the immediate trade details are critical, a smart analysis always looks at the bigger picture. The numbers from your calculator tell you about the trade's potential, but that trade doesn't exist in a bubble. It's part of your broader financial strategy.

You need to think beyond the trade itself and consider things like tax implications. For example, knowing how the income you generate will be taxed is just as important as the premium you collect. Investors in some regions might need to be aware of things like understanding the UK dividend allowance for investors to get a true sense of their financial standing.

Pulling the right data is the foundational skill for using a cash secured put calculator. Once you get the hang of this simple process, you can turn a confusing wall of numbers into a clear, actionable set of inputs, ready for analysis.

How to Calculate Your Profit and Breakeven Point

Once you've plugged in the numbers, a cash secured put calculator does the heavy lifting, turning abstract data into real, actionable intelligence. This is where you see the mechanics of the trade laid bare—the potential reward, the cash you need to set aside, and your exact margin for error.

Getting a handle on these numbers is what separates casual put sellers from traders who strategically generate income month after month.

The first, and most exciting, number is your maximum profit. It's simply the premium you collect for selling the put. That's it. No matter how high the stock price flies, your profit is capped at that initial credit you received. It's your absolute best-case scenario.

Tallying Up Your Financial Commitment

Before you can even think about profit, you need to know exactly how much cash this trade will tie up. The calculator handles this instantly, but the math is straightforward: it’s the strike price multiplied by 100 (since every options contract represents 100 shares).

Let's look at an example:

- Strike Price: $95.00

- Multiplier: 100 shares

- Total Cash Secured: $95.00 x 100 = $9,500

This $9,500 isn't a fee or a loss. It's the cash your broker makes you set aside to prove you can actually buy the shares if you're assigned. Managing this capital effectively is the backbone of any successful put-selling strategy.

Finding Your Breakeven Price

While max profit is what gets your attention, the breakeven price is arguably more important for managing your risk. It’s the precise stock price where you stop making money and start losing it. Knowing this number gives you a clear line in the sand.

The calculation is dead simple:

Breakeven Price = Strike Price - Premium Per Share

This little formula is the foundation of risk assessment for any short put options strategy. If the stock price stays above your breakeven at expiration, you walk away profitable.

Your breakeven point is your true cost basis if you get assigned the shares. Thinking of it this way reframes the entire trade: you're not just selling a put; you're setting yourself up to potentially buy a stock you like at a nice discount.

Let's walk through a quick, real-world scenario. Imagine ABC Corporation is trading at $100 per share. You decide to sell a put with a $95 strike price and collect a $3.00 premium per share, which comes out to $300 total ($3 x 100).

Your breakeven price would be $92 ($95 strike - $3 premium).

This means that even if the stock tumbles from its current $100 price, your trade stays in the green as long as it closes above $92 on expiration day. And if you do get assigned at $95, your actual purchase price is just $92, giving you an immediate 3% discount from where the stock was trading when you opened the position. This is the power a cash secured put calculator puts at your fingertips—it turns numbers on a screen into a concrete financial advantage.

Turning Your Calculations into a Cohesive Strategy

Figuring out your max profit and breakeven point is a great start, but that’s just a snapshot of a single trade. To build a repeatable, successful strategy, you have to look at the bigger picture. This is where a cash secured put calculator really shines—it helps you compare the efficiency of different trades.

Knowing a trade could pocket you $200 in premium is one thing. But understanding how hard your cash is working to generate that $200 is what separates the pros from the hobbyists. That’s where return on investment (ROI) comes in.

Analyzing Your Return on Investment

The ROI formula is straightforward: (Premium Received / Cash Secured) x 100. This percentage tells you the raw return on the capital you’re setting aside. For instance, earning a $200 premium on $10,000 of secured cash gives you a 2.0% ROI.

But a 2.0% return over 30 days is a completely different animal than a 2.0% return over 90 days. To make fair comparisons between trades—and against other investments in your portfolio—you need to annualize that return.

The annualized return simply projects what your short-term ROI would look like over a full year. A good calculator does this for you instantly, showing you how a 30-day options trade stacks up against holding a stock or a bond for 12 months. This metric is the great equalizer for judging your strategy's true performance.

Seeing an annualized return of 18% or 25% can be a real eye-opener. It reframes a small premium into a powerful income engine when you do it consistently. That’s how you start to appreciate the compounding potential of selling puts.

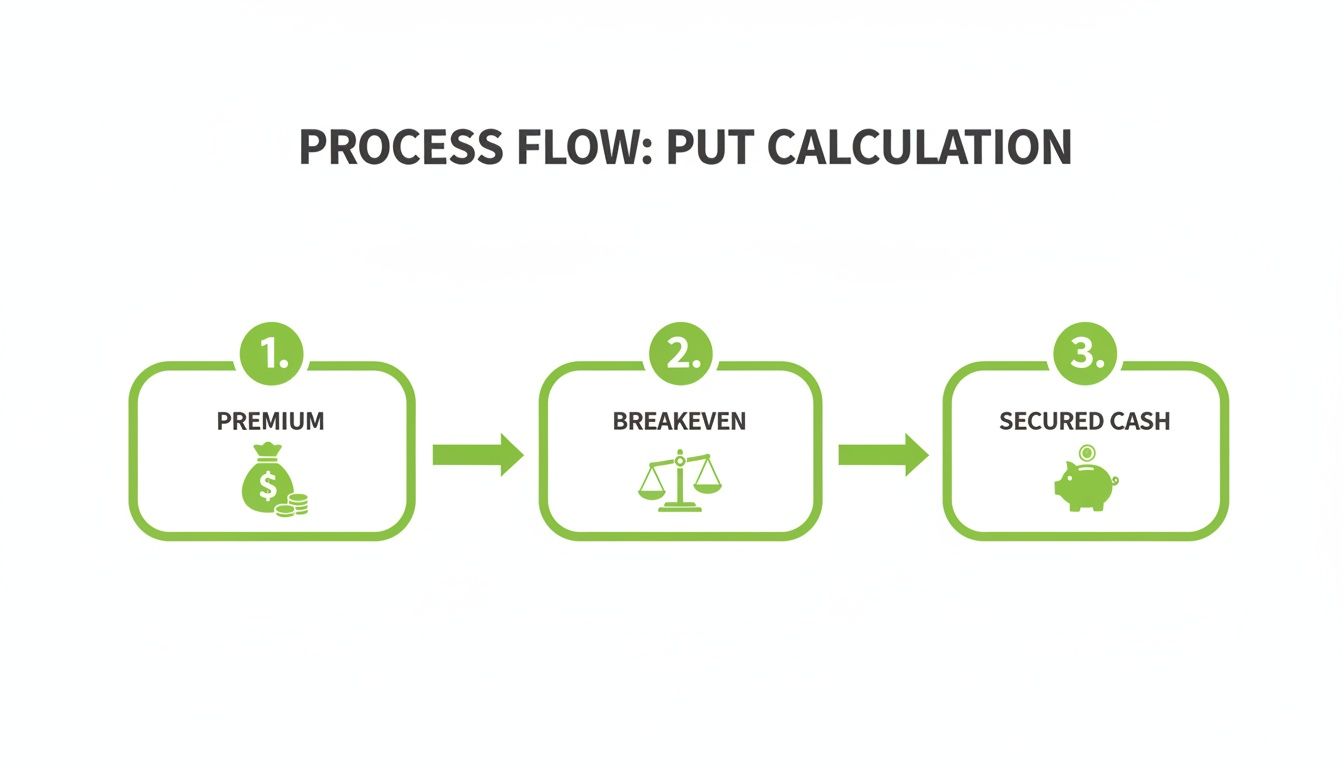

This flow shows how each calculation builds on the last, from the premium you collect to the cash you need to back the trade.

Each piece of the puzzle gives you a more complete picture of the trade's financial DNA.

Modeling Scenarios to Find Your Sweet Spot

This is where a cash secured put calculator goes from a simple tool to an essential part of your strategic playbook. Instead of just plugging in numbers for one trade, you can model dozens of scenarios in minutes to find the perfect balance of risk and reward for you.

You can finally get instant answers to those critical "what if" questions:

- What if I choose a closer strike price? Your premium and ROI jump up, but your breakeven point gets higher, shrinking your margin of safety.

- What if I select a further expiration date? You'll collect more premium upfront, but your cash is tied up longer, which might actually lower your annualized return.

- How does a spike in implied volatility affect my return? When volatility is high, you can sell puts further out-of-the-money and still collect a decent premium, giving you a much higher probability of success.

By tweaking these variables—strike price, expiration, and premium—you can quickly see how each one impacts your bottom line. You might decide you're happier with a safer 12% annualized return than a riskier 25% opportunity. A calculator makes comparing those choices effortless, giving you the power to build an income strategy that’s truly your own.

Using Advanced Metrics to Refine Your Trade Selection

Once you're solid on the basics of profit and breakeven, it’s time to graduate to a more nuanced, probability-driven approach.

The best cash secured put calculator tools go beyond simple return on investment. They arm you with advanced metrics—often called the "Greeks"—that help you actually quantify risk and make much smarter trade-offs.

Two of the most important metrics for any put seller are Delta and Theta. They might sound a bit intimidating at first, but they are incredibly practical for fine-tuning which trades you take.

Using Delta to Gauge Probability

Think of Delta as your quick-and-dirty probability gauge.

An option's Delta, which runs from 0 to -1 for puts, gives you a rough estimate of the chances that the option will expire in-the-money. For instance, a put with a Delta of -0.20 has approximately a 20% chance of finishing in-the-money (and getting assigned to you).

This simple number lets you filter trades based on your personal comfort zone.

- A Conservative Trader might stick to selling puts with a Delta of -0.15 or less. This gives you roughly an 85% probability of the option expiring worthless.

- An Aggressive Trader might be fine selling puts with a Delta of -0.30, accepting a higher chance of assignment in exchange for a much beefier premium.

Using Delta completely changes your decision-making. Instead of just asking, "How much can I make?" you start asking, "What are my odds of success?" A calculator that displays Delta lets you see this risk profile instantly, helping you sidestep trades that don't align with your strategy.

Benefiting from Theta Time Decay

As an options seller, time is your best friend. Theta is the metric that proves it.

Theta measures how much value an option loses each day just from the passage of time—a process we call time decay. The beautiful part? This decay works directly in your favor.

Every morning you wake up, your short put position has likely lost a little bit of value (which is a gain for you), assuming the stock price and volatility held steady. This is the power of positive Theta—you literally get paid to wait.

A cash secured put calculator that shows Theta helps you understand the engine driving your profit. Options with higher Theta decay faster, which is fantastic for short-term trades. This is especially true for options with around 30-45 days until expiration, where Theta decay really starts to accelerate.

By paying attention to both Delta and Theta, you move from a one-dimensional analysis to a multi-faceted strategy that balances probability, time, and return. To see how all the Greeks work together, you can dig deeper with this guide on the basics of option trading greeks.

Interpreting Advanced Calculator Metrics

Understanding these metrics is one thing, but applying them is what separates the pros from the amateurs. Here’s a quick guide to help you translate these numbers into actionable trading decisions.

| Metric | What It Tells You | How to Use It Strategically |

|---|---|---|

| Delta | The approximate probability of the option expiring in-the-money. | Choose lower Deltas (e.g., -0.15) for conservative, high-probability trades. Select higher Deltas (e.g., -0.30) for more aggressive trades that offer larger premiums but come with greater risk of assignment. |

| Theta | The amount of value the option loses per day due to time decay. This is your daily "profit" if the stock price doesn't move. | Target options with higher Theta, especially in the 30-45 DTE (days to expiration) window, to maximize the benefit of time decay. Higher Theta means your trade becomes profitable faster. |

| POP (Probability of Profit) | The overall statistical likelihood that the trade will make at least $0.01 at expiration. | Use this as a final check. A high POP (often 70%+) confirms that the odds are in your favor, aligning with your goal of collecting premium without getting assigned. |

Think of these metrics as the dashboard in your car. You wouldn't drive just by looking at the speedometer. You also need to know your fuel level and engine temperature. Delta, Theta, and POP give you that complete picture for your trades.

Answering Your Top Questions About Cash Secured Puts

Even with a great cash secured put calculator, translating theory into real-world trades is where the real learning happens. Let’s tackle some of the most common questions I hear from traders so you can start selling puts with confidence.

How Long Should I Hold the Position?

This is a big one. Do you let the option expire worthless to collect every last penny, or do you close it out early?

While it’s tempting to hold on for that full 100% premium, most experienced sellers I know prefer to close their positions early.

Here’s why: the risk-reward profile gets pretty skewed in that last week before expiration. You might be holding on for that last 5-10% of profit, but you’re still exposed to the full downside risk if the stock makes a sudden, sharp move against you.

A solid rule of thumb is to take your profits off the table once you've captured 80-90% of the maximum premium. Banking a consistent win is almost always better than squeezing out the last few dollars at maximum risk.

What Happens If I Get Assigned?

First off, getting assigned isn't a failure—it's one of the two planned outcomes. It simply means the stock price dipped below your strike at expiration, and you’re now obligated to buy 100 shares per contract at that price.

Because you already secured the cash for this exact scenario, the purchase happens automatically.

Now, you own the shares. But think about your actual cost. It isn't just the strike price; it's your breakeven point (Strike Price - Premium). You essentially just bought a stock you already wanted at a nice discount from where it was trading when you sold the put.

From here, you’ve got a couple of great options:

- Hold the shares as a core part of your long-term portfolio.

- Immediately start selling covered calls against your new position to kickstart another income stream.

Just How Successful is This Strategy?

When you follow a clear set of rules and use the right tools, the success rate can be incredibly high. It’s not about luck; it’s about process.

One trader I know meticulously logged 74 real-world cash secured put trades. The final tally? 67 of them were profitable, giving him a 90.5% win rate. What’s even more impressive is that 41 of those trades were closed out in under a week.

If you want to dive into the details, you can see the full breakdown and learn how custom calculators contributed to this high success rate. The takeaway is that success comes from a repeatable system: sell puts on great companies you wouldn’t mind owning, at strike prices that give you a solid margin of safety.

Can I Lose More Than The Cash I Set Aside?

Nope. And this is the most critical safety feature of this strategy.

With a true cash secured put, your maximum financial risk is locked in from the start: the total cost to buy the shares (strike price x 100), minus the premium you already pocketed. Even if the stock somehow went to zero, that’s your ceiling for loss.

The real danger—the kind you hear horror stories about—comes from selling "naked puts." That's when a trader sells a put without having the cash to back it up, exposing them to margin calls and theoretically infinite risk. By sticking to the cash-secured method, your risk is always clearly defined and manageable.

Ready to stop guessing and start making data-driven decisions? The Strike Price platform gives you the real-time probability metrics you need to find the safest, most profitable trades.