6 Covered Call Example Strategies for Income in 2025

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

The covered call strategy stands as a cornerstone for investors seeking to generate consistent income from their stock holdings. While the concept is straightforward - selling call options against shares you already own - mastering its application requires a deeper understanding of real-world scenarios. It’s one thing to know the theory, but another to see how it performs with different asset types, market conditions, and strategic goals. This playbook moves beyond basic definitions to provide a tactical breakdown of how the strategy works in practice.

This article provides a detailed analysis of six distinct covered call example trades. We will dissect each one, from selecting the right underlying stock to choosing the optimal strike price and expiration date. You won't find generic success stories here. Instead, you'll get a granular look at the numbers, potential outcomes, and the strategic thinking behind each decision.

We will explore everything from a conservative, dividend-focused blue-chip trade to a more aggressive earnings play on a volatile tech stock. Each example is designed to equip you with replicable methods and actionable takeaways. By examining these diverse scenarios, you'll learn how to manage risk, maximize premium collection, and adapt the covered call strategy to fit your own portfolio and financial objectives. Let's dive into the examples.

1. High Dividend Blue Chip Covered Call

For investors seeking a conservative, income-generating strategy, the high-dividend blue-chip covered call is an excellent starting point. This approach involves buying shares of stable, well-established companies (blue chips) that also pay a consistent dividend, then selling out-of-the-money (OTM) call options against those shares. The goal is to generate two streams of income: the regular dividend payments and the premium received from selling the call option.

This strategy is particularly effective for investors who already own or plan to own these stocks for the long term. It allows them to enhance their total return during periods of low volatility or sideways price movement, which are common for mature blue-chip companies.

Strategic Breakdown: A KO Example

Let's break down a classic covered call example using The Coca-Cola Company (KO), a quintessential blue-chip stock.

- Position Setup: An investor owns 100 shares of KO, purchased at an average cost basis of $58 per share.

- Option Sale: The investor sells one KO call option contract with a strike price of $62, expiring in 45 days. They receive a premium of $1.50 per share, or $150 total for the contract ($1.50 x 100 shares).

- Income Generated: The immediate income is $150. If KO's ex-dividend date falls within this period, the investor also collects the dividend, provided they still own the shares.

Key Insight: The primary goal here isn't a massive capital gain from the stock appreciating. It's about consistently harvesting premium while collecting dividends, effectively lowering the cost basis of the original stock position over time.

Potential Outcomes

- Stock Stays Below $62: The option expires worthless. The investor keeps the $150 premium and their 100 shares of KO. They can then sell another call option for the next expiration cycle. This is the ideal outcome.

- Stock Rises Above $62: The shares are "called away" (sold) at the $62 strike price. The investor realizes a capital gain of $4 per share ($62 sale price - $58 cost basis), totaling $400, in addition to keeping the $150 premium. The total profit is $550.

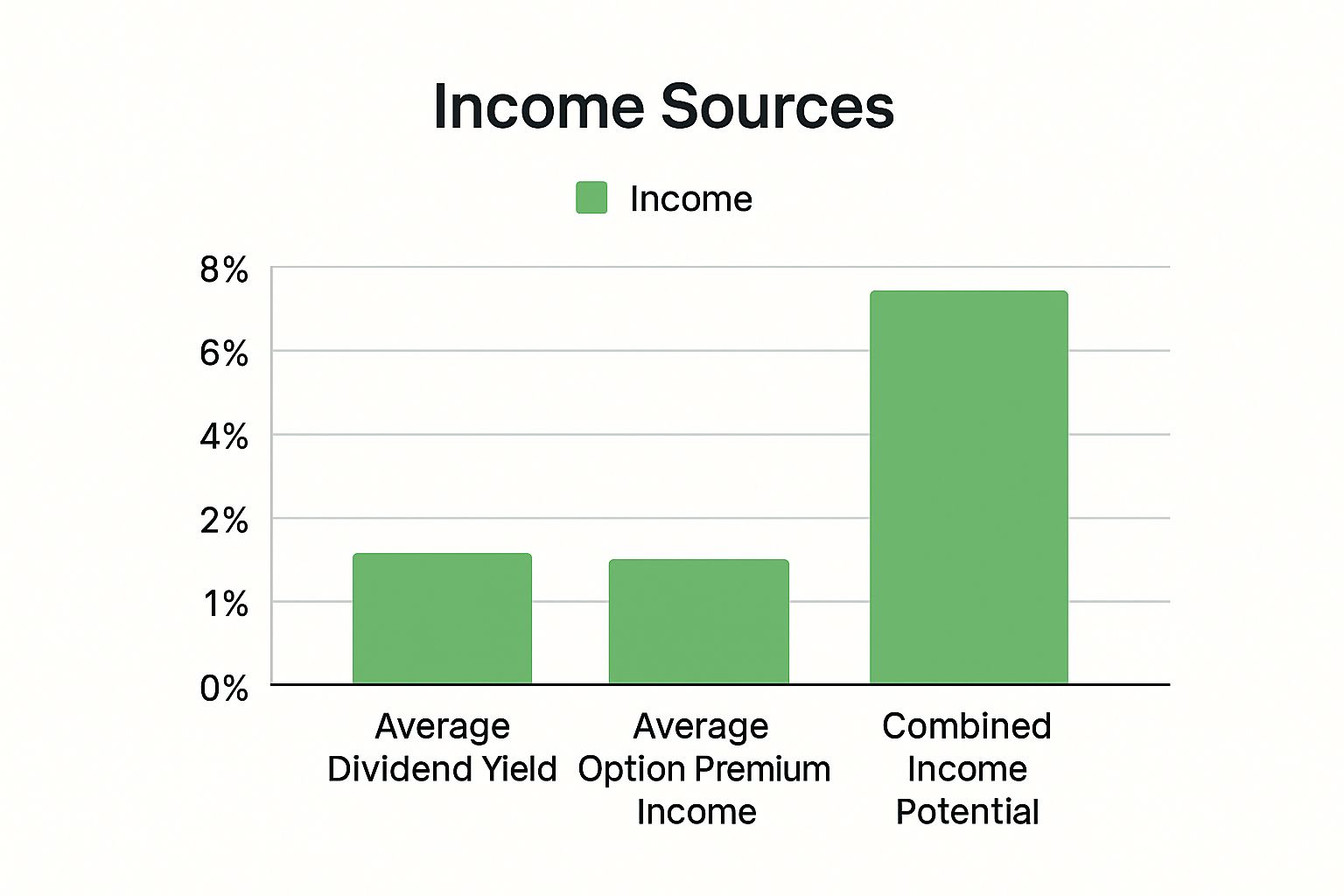

The following bar chart illustrates the combined income potential from integrating both dividend yield and option premium.

The chart highlights how combining a typical blue-chip dividend with a conservative option premium can significantly boost an investor's annual income potential.

Actionable Takeaways

- Prioritize Dividend Capture: When possible, sell call options with expiration dates after the stock's ex-dividend date to ensure you collect the dividend payment.

- Strike Price Selection: Always choose a strike price above your cost basis. This guarantees a profit even if your shares are called away.

- Focus on Stability: This strategy works best with companies that have predictable price movements and a long history of paying dividends, like Microsoft (MSFT), AT&T (T), or Johnson & Johnson (JNJ).

2. Tech Stock Growth Covered Call

For investors with a higher risk tolerance, the tech stock growth covered call offers a way to generate significant income while maintaining exposure to high-growth companies. This strategy involves buying shares of dynamic, often volatile, technology stocks and then selling call options against them. The higher implied volatility (IV) associated with these stocks translates into much larger option premiums compared to blue-chip counterparts.

This approach is best suited for traders who are comfortable with wider price swings and are looking to capitalize on periods of market consolidation or sideways movement in otherwise trending stocks. It turns a growth-oriented asset into a potent income-generating machine.

Strategic Breakdown: A TSLA Example

Let's explore an aggressive covered call example using Tesla, Inc. (TSLA), a stock known for its volatility and substantial option premiums.

- Position Setup: A trader purchases 100 shares of TSLA during a consolidation phase at a cost basis of $180 per share.

- Option Sale: Sensing a period of range-bound trading, the trader sells one TSLA call option with a strike price of $195, expiring in 30 days. Due to high IV, they collect a hefty premium of $7.50 per share, or $750 total for the contract ($7.50 x 100 shares).

- Income Generated: The immediate income is $750, representing a 4.1% return on the stock cost in just 30 days.

Key Insight: The goal here is aggressive premium harvesting. Traders often aren't married to the stock long-term. They use technical analysis to identify periods where the stock is likely to stagnate, allowing them to collect large premiums without the shares being called away.

Potential Outcomes

- Stock Stays Below $195: The option expires worthless. The trader keeps the entire $750 premium and their 100 shares of TSLA. They can immediately sell another call option, potentially generating similar income for the next month. This is the ideal outcome for pure income generation.

- Stock Rises Above $195: The shares are called away at the $195 strike price. The trader realizes a capital gain of $15 per share ($195 sale price - $180 cost basis), or $1,500. Adding the $750 premium, the total profit for the 30-day period is an impressive $2,250.

Actionable Takeaways

- Leverage Technical Analysis: Use indicators like support and resistance levels or moving averages to time your option sales, ideally when the stock is at the top of a trading range.

- Avoid Earnings Roulette: Tech stocks can make massive moves around earnings reports. It's often prudent to close your covered call position before an earnings announcement to avoid unpredictable, outsized price swings that could lead to losses or missed upside.

- Set Profit Targets: Don't feel obligated to hold the option to expiration. If you can buy back the call for 50% of the premium you collected well before the expiration date, do it. This locks in a profit and frees up your shares to sell another call.

3. REITs and Utilities Covered Call Income Strategy

For investors whose primary goal is maximizing consistent income, the REIT and utilities covered call strategy is a powerful tool. This approach targets sectors known for high dividend yields and relatively low price volatility, such as Real Estate Investment Trusts (REITs) and utility companies. The strategy involves combining their substantial dividend payouts with the premium from selling call options.

These sectors are often less sensitive to economic cycles than high-growth tech stocks, providing a more stable underlying asset for income generation. This stability makes them ideal candidates for repeatedly selling covered calls, as large, unexpected price surges that would get the shares called away are less common.

Strategic Breakdown: A Realty Income (O) Example

Let's explore a covered call example using Realty Income Corp. (O), a popular REIT famous for its monthly dividend payments.

- Position Setup: An investor holds 100 shares of O, with a cost basis of $53 per share.

- Option Sale: The investor sells one O call option contract with a $55 strike price, set to expire in 35 days. For selling this option, they collect a premium of $0.85 per share, totaling $85 for the contract ($0.85 x 100 shares).

- Income Generated: The investor secures an immediate $85 in premium income. Because O pays a monthly dividend, there's a high probability the ex-dividend date falls within the 35-day option period, allowing the investor to also capture the dividend payment.

Key Insight: This strategy prioritizes a high-frequency, dual-income stream. The goal is to collect monthly (or quarterly) dividends while simultaneously harvesting option premium, creating a reliable and predictable cash flow machine from a single stock position.

Potential Outcomes

- Stock Stays Below $55: The option expires worthless. The investor keeps the $85 premium and their 100 shares of O. They retain the dividend and are free to sell a new call for the following month, repeating the income cycle. This is the ideal scenario.

- Stock Rises Above $55: The shares are called away at the $55 strike price. The investor locks in a capital gain of $2 per share ($55 sale price - $53 cost basis), for a total of $200. They also keep the $85 premium, for a total profit of $285.

Actionable Takeaways

- Monitor Interest Rates: REITs and utilities are interest-rate sensitive. Rising rates can put downward pressure on these stocks, so adjust your strike prices or premiums accordingly.

- Diversify Your Holdings: Instead of concentrating on a single company, consider spreading your capital across several REITs or utilities, or use a sector ETF like the Utilities Select Sector SPDR Fund (XLU) for built-in diversification.

- Time Sales Around Dividends: Always be aware of ex-dividend dates. Selling a call option that expires just after the ex-dividend date allows you to capture both the premium and the dividend, maximizing your income for the period.

4. ETF Covered Call Strategy

For investors who prioritize diversification and want to reduce single-stock risk, the ETF covered call strategy is a powerful alternative. This approach involves buying shares of a broad-market or sector-specific Exchange-Traded Fund (ETF) and then selling call options against that position. It allows you to generate income from options premiums while maintaining exposure to an entire market index or industry.

This method is ideal for investors who want to participate in overall market movements but are concerned about the volatility or specific business risks of individual companies. It's a systematic way to produce income on a diversified basket of assets, making it a cornerstone for many conservative options traders.

Strategic Breakdown: A SPY Example

Let's illustrate this with a covered call example using the SPDR S&P 500 ETF Trust (SPY), which tracks the S&P 500 index. This provides a clear look at how to apply the strategy to the broader U.S. market.

- Position Setup: An investor owns 100 shares of SPY, with a cost basis of $440 per share.

- Option Sale: The investor sells one SPY call option contract with a strike price of $450, expiring in 30 days. For this, they collect a premium of $3.50 per share, totaling $350 for the contract ($3.50 x 100 shares).

- Income Generated: The immediate income is $350. SPY also pays dividends, which the investor will collect if they hold the shares through the ex-dividend date.

Key Insight: The main advantage here is diversification. A negative earnings report from a single company won't derail the strategy, as SPY's value is based on 500 different stocks. This makes the income stream potentially more stable and predictable.

Potential Outcomes

- SPY Stays Below $450: The option expires worthless. The investor keeps the entire $350 premium and their 100 shares of SPY. They are now free to sell another call for the next expiration cycle, repeating the income-generating process. This is the desired scenario.

- SPY Rises Above $450: The shares are called away at the $450 strike price. The investor locks in a capital gain of $10 per share ($450 sale price - $440 cost basis), which is $1,000, plus they keep the $350 premium. The total profit is $1,350. While they no longer own the shares, they have realized a significant return.

Actionable Takeaways

- Choose the Right Delta: A good starting point is selling calls with a delta between 0.20 and 0.30. This offers a healthy balance between collecting a decent premium and having a lower probability (20-30%) of the shares being called away.

- Systematize Your Approach: ETFs are well-suited for a mechanical, rules-based strategy. Consistently sell calls at a specific delta or a set percentage above the current price each month to remove emotion from the decision-making process. For help finding opportunities that fit your rules, you can learn more about how a covered call screener can automate this search.

- Mind the Correlation: If you run covered calls on multiple ETFs (e.g., SPY and QQQ), be aware of how correlated they are. During a broad market downturn, both positions will likely fall, so ensure your overall portfolio remains diversified.

5. Earnings Play Covered Call

For traders with a higher risk tolerance, the earnings play covered call is a tactical strategy designed to capitalize on heightened uncertainty. This approach involves selling a covered call just before a company's earnings announcement to take advantage of the spike in implied volatility (IV). Higher IV inflates option premiums, offering a significantly larger potential return than during normal market conditions.

This strategy is best suited for investors who are comfortable holding the underlying stock through a potentially volatile earnings event. The goal is to collect a super-sized premium while correctly predicting that the stock's post-earnings move will not dramatically exceed the option's strike price.

Strategic Breakdown: A NFLX Example

Let's explore a tactical covered call example using Netflix (NFLX), a stock known for its significant price swings after earnings reports.

- Position Setup: An investor holds 100 shares of NFLX, acquired at a cost basis of $590 per share, a few days before its scheduled quarterly earnings release.

- Option Sale: Due to high pre-earnings IV, the investor sells one NFLX call option with a strike price of $640, expiring the Friday of that same week. They collect a hefty premium of $12.00 per share, or $1,200 total for the contract ($12.00 x 100 shares).

- Income Generated: The immediate premium collected is $1,200. This provides a substantial cushion against a potential drop in the stock price following the earnings announcement.

Key Insight: The core of this strategy is "selling volatility." You are betting that the actual price move will be less dramatic than the market's fear (implied volatility) suggests, allowing you to keep the inflated premium. Understanding when to sell covered calls, especially around such events, is critical. For a deeper dive, you can explore the timing of selling covered calls on strikeprice.app.

Potential Outcomes

- Stock Stays Below $640: The earnings report is neutral or mildly positive, and the stock closes the week below the $640 strike. The option expires worthless. The investor keeps the entire $1,200 premium and their 100 shares, having successfully navigated the earnings volatility.

- Stock Rises Above $640: The earnings are a blowout, and the stock rallies past $640. The shares are called away at the $640 strike price. The investor realizes a capital gain of $50 per share ($640 sale price - $590 cost basis), or $5,000, plus keeps the $1,200 premium. The total profit is a substantial $6,200.

Actionable Takeaways

- Analyze Historical Moves: Before placing the trade, research how the stock has historically reacted to earnings. Does it typically move +/- 5% or +/- 15%? This helps in setting a realistic strike price.

- Set Strike Beyond the Expected Move: Use the options chain to see the market's "expected move." Sell a call with a strike price outside of this range to increase your probability of the option expiring worthless.

- Avoid Binary Events: This strategy is extremely risky with biotech or clinical trial stocks, where the outcome is truly binary (huge gain or massive loss). Stick to more predictable companies.

6. Poor Man's Covered Call (PMCC)

For investors looking for a more capital-efficient way to generate income, the Poor Man's Covered Call (PMCC) offers a powerful alternative to the traditional covered call. This strategy involves buying a long-term, in-the-money call option, known as a LEAPS (Long-term Equity Anticipation Security), and then selling a short-term, out-of-the-money call option against it. This "synthetic" covered call simulates owning 100 shares of stock but requires significantly less upfront capital.

The PMCC is ideal for traders who want to gain exposure to high-priced stocks like Amazon (AMZN) or Alphabet (GOOGL) without the massive capital outlay of purchasing 100 shares. It allows them to generate consistent income from selling short-term calls while benefiting from the potential upside of the underlying stock.

Strategic Breakdown: An SPY Example

Let's illustrate this advanced covered call example using the SPDR S&P 500 ETF Trust (SPY), a popular and liquid underlying for options traders.

- Position Setup: An investor buys one SPY LEAPS call option with a strike price of $450, expiring in 18 months. They choose a high delta (e.g., 0.85) to closely mimic the stock's movement, paying a premium of $100 per share, or $10,000 total for the contract. This is the "stock replacement" part of the strategy.

- Option Sale: The investor then sells one SPY call option with a strike price of $550, expiring in 30 days. They receive a premium of $2.50 per share, or $250 total. This is the income-generating component.

- Income Generated: The immediate income is $250, which directly reduces the net cost of their long LEAPS position.

Key Insight: The PMCC is a diagonal spread designed to profit from the difference in time decay (theta) between the long and short options. The short-term option decays much faster than the long-term LEAPS, allowing the trader to repeatedly sell new calls each month and lower the cost basis of their LEAPS.

Potential Outcomes

- SPY Stays Below $550: The short call expires worthless. The investor keeps the $250 premium and their LEAPS call. They can then sell another short-term call for the next cycle, continuing to generate income. This is the ideal scenario.

- SPY Rises Above $550: The short call is in-the-money. The investor can either close both legs of the spread for a net profit or roll the short call up and out to a higher strike price and later expiration date to collect more premium and avoid assignment.

Actionable Takeaways

- Choose High Delta LEAPS: Select a LEAPS call with a delta of at least 0.80. This ensures your long option behaves similarly to owning 100 shares of the stock, providing a stable foundation for the strategy.

- Maintain Expiration Spread: Always ensure there is a significant time gap (at least 30-45 days) between your short call's expiration and your long LEAPS's expiration. This gives you flexibility to manage the position.

- Manage Your Position Actively: The PMCC is not a set-it-and-forget-it strategy. Monitor the position regularly and plan to close out the entire spread about 30-60 days before the LEAPS option expires to avoid accelerated time decay. You can get more insights on how to choose option strike prices on Strikeprice.app to optimize this strategy.

Covered Call Strategy Comparison Overview

| Strategy | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| High Dividend Blue Chip Covered Call | Low to moderate; uses stable, dividend stocks | Moderate capital; requires stock ownership | Moderate steady income from dividends + premiums | Conservative investors seeking steady income | Dual income streams, lower volatility, stability |

| Tech Stock Growth Covered Call | High; needs active management and timing | Higher capital; frequent adjustments needed | Higher option premiums with growth exposure | Experienced traders comfortable with active management | High premiums, growth exposure, adjustable strikes |

| REITs and Utilities Covered Call | Low to moderate; focuses on stable, high yield | Moderate capital; dividend-focused stocks | High total yield (8-15% annually) | Income-focused investors seeking high yield | High yield, stable models, downside dividend cushion |

| ETF Covered Call Strategy | Low; uses diversified ETFs with liquid options | Moderate capital; lower individual risk | Consistent option income, reduced single-stock risk | Investors seeking diversified covered call exposure | Diversification, high liquidity, ease of management |

| Earnings Play Covered Call | High; requires precise timing around earnings | Variable; depends on stock price and timing | Elevated premiums due to implied volatility spikes | Advanced traders with strong market analysis skills | Captures max premiums, upside exposure, tactical |

| Poor Man's Covered Call (PMCC) | High; complex multi-leg options strategy | Low capital; synthetic covered call | Similar income potential with less capital | Traders with limited capital understanding advanced options | Capital efficiency, leverage, diversification |

From Examples to Execution: Your Path to Covered Call Mastery

Navigating the world of options trading can feel complex, but as we've explored through a series of detailed covered call examples, the path to consistent income generation is paved with strategy, not just speculation. We've dissected scenarios ranging from stable, dividend-paying blue chips to high-growth tech stocks and even capital-efficient Poor Man's Covered Calls. The common thread woven through each successful trade is a disciplined, analytical approach.

The power of the covered call lies not in a single "magic formula" but in its adaptability. Your strategy for a low-volatility utility stock will, and should, look vastly different from how you approach a tech stock heading into an earnings announcement. This flexibility is your greatest asset.

Core Strategic Takeaways

The examples in this article illuminated several critical principles that separate novice traders from seasoned practitioners. These are the cornerstones of a durable covered call strategy:

- Stock Selection is Paramount: The quality of the underlying asset dictates your risk and potential reward. Choosing stocks you are comfortable holding long-term is non-negotiable, as assignment is always a possible outcome.

- Strike Price Determines Your Goal: Are you aiming for pure income, or are you hoping for assignment to lock in capital gains? Your strike price selection, whether at-the-money, out-of-the-money, or in-the-money, directly reflects this primary objective.

- Volatility is Your Engine for Premium: Understanding Implied Volatility (IV) is crucial. Higher IV means higher premiums but also indicates greater uncertainty and risk. A savvy trader learns to balance this relationship to their advantage, such as selling into strength or during periods of heightened market fear.

- Trade Management is Key: A "set it and forget it" mindset is a recipe for missed opportunities and unnecessary risk. Knowing when to roll a position, close a trade early to lock in profits, or accept assignment is a skill honed through practice and analysis. Each covered call example demonstrated a different management trigger.

Your Actionable Next Steps to Mastery

Moving from theory to practice requires a clear, methodical plan. Here's how you can begin applying these concepts today:

- Define Your "Why": Start by clarifying your personal investment goals. Are you seeking to supplement your income, reduce the cost basis of your existing holdings, or generate a specific monthly return? Your objective will guide every decision you make.

- Build a Watchlist: Based on your goals, create a curated list of high-quality stocks and ETFs that you would be happy to own. Analyze their historical volatility, dividend schedules, and overall market sentiment.

- Paper Trade First: Before risking real capital, use a trading simulator or a simple spreadsheet to track hypothetical trades. Practice selecting strike prices, calculating potential returns, and making management decisions based on real market movements. This is a risk-free way to build confidence.

- Integrate Broader Risk Protocols: Successful covered call writing doesn't exist in a vacuum. It's a component of a larger investment portfolio. As you advance, it's crucial to understand the Top Financial Risk Management Strategies for Investments to ensure your entire portfolio is protected against unforeseen market events.

Mastering the covered call is a journey of continuous learning and refinement. By internalizing the lessons from each covered call example and committing to a disciplined, goal-oriented approach, you can transform this versatile option strategy from a concept into a powerful tool for building wealth and generating consistent cash flow.

Ready to move from theory to execution? The Strike Price app provides the tools you need to find, analyze, and manage your covered call trades with confidence. Get real-time data and powerful scanning features to identify the perfect covered call example for your portfolio today at Strike Price.