Covered Call Option Strategies for Steady Income

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

Covered call option strategies are a fantastic way to put the stocks you already own to work, generating extra income from your portfolio. Think of it like renting out a room in a house you own; you hold onto the asset (your stock) and collect regular 'rent' (the option premium) by giving someone the right—but not the obligation—to buy it from you at a set price down the road. It's a straightforward approach to creating consistent cash flow while you hang on to your long-term investments.

What Are Covered Call Option Strategies

The covered call is one of the most popular and easiest-to-understand options strategies out there, often a go-to for investors looking to boost their portfolio's returns. At its heart, the strategy has just two simple parts: owning at least 100 shares of a stock and selling (or "writing") one call option contract against those shares.

When you sell that call option, you're essentially selling a contract. This contract gives the buyer the right to purchase your 100 shares at a specific price, which we call the strike price, on or before a set expiration date. For selling this right, you get paid an immediate cash payment known as a premium. The best part? That premium is yours to keep, no matter what the stock does next.

This creates an instant income stream from the stocks you're already holding. The strategy gets its "covered" name because you already own the underlying shares needed to make good on the contract if the buyer decides to exercise their option. This ownership dramatically cuts down the risk compared to "naked" call selling, where you'd be forced to buy the shares on the open market—potentially at a very high price—if the option was exercised.

To really get the hang of it, it helps to break the strategy down into its key pieces. For a deeper look at the basic mechanics, you can learn more about what are covered call options and see how they work in different market scenarios.

The Three Core Components

Every covered call strategy is built on three simple pillars. Once you master these, you'll have a clear framework for putting them into action.

- Owning the Underlying Shares: You must own at least 100 shares of a stock or ETF for every single call option contract you plan to sell. This is the "covered" part of the equation.

- Writing the Call Option: You pick a strike price and an expiration date, then sell the call option through your brokerage account. The premium hits your account instantly.

- Managing the Outcome: From there, one of two things happens. You either keep the premium and your shares if the stock price stays below the strike, or you sell your shares at the strike price if it climbs above it—and you still keep the premium either way.

To give you a quick cheat sheet, the table below sums up the key parts of a standard covered call strategy.

Covered Call Strategy at a Glance

This table provides a quick summary of the core components and characteristics of a basic covered call strategy.

| Component | Description | Objective |

|---|---|---|

| Primary Goal | Generate consistent income from existing stock holdings. | To create an additional return stream beyond dividends and capital appreciation. |

| Ideal Market | Neutral, slightly bullish, or slightly bearish markets. | The strategy performs best when the stock price remains relatively stable or rises slowly. |

| Risk Profile | Limited profit potential in exchange for immediate income. | The main risk is missing out on significant upside gains if the stock price soars past the strike price. |

Ultimately, the goal is to find a sweet spot where you're earning good premium income without giving up too much potential profit if the stock takes off.

How a Covered Call Works in Practice

Theory is one thing, but seeing how a covered call plays out with a real stock makes the concept click. Let's walk through a concrete example to show you exactly how this works from start to finish. It’s a lot like renting out a room in a house you already own.

Imagine you're a long-term investor holding 100 shares of Apple (AAPL). Instead of just letting them sit there, you decide to put them to work generating some extra cash. The market feels pretty stable, and you think AAPL will either trade sideways or inch up slowly over the next month—a perfect setup for this strategy.

You already own the shares, so step one is done. Now it's time to set up the "rental" agreement.

Picking Your Option and Getting Paid

Your next move is to head over to the "option chain" in your brokerage account. This is just a big list of all the available call options for AAPL. Here, you need to make two key decisions.

The Strike Price: This is the price where you agree to sell your shares. Let’s say AAPL is currently trading at $190. You pick a strike price of $200, which is "out-of-the-money" since it's above the current market price.

The Expiration Date: This is when the contract ends. You choose an expiration date one month from now.

For agreeing to sell your shares at $200 anytime in the next month, a buyer offers you a premium of $2.50 per share. Since one option contract covers 100 shares, you immediately get $250 deposited into your account ($2.50 x 100). This cash is yours to keep, no matter what happens next.

Key Takeaway: You just got paid $250 for making a simple promise: to potentially sell your 100 AAPL shares at $200 each within the next month. You’ve officially written a covered call.

How It All Plays Out: The Two Possible Outcomes

Once you sell the call, the trade is on. From here, only one of two things can happen. Where AAPL’s stock price lands on the expiration date will determine the final outcome.

Let's break down both scenarios.

Scenario 1: The Stock Stays Below Your Strike Price

This is the outcome most income-focused investors are hoping for. On the expiration date, AAPL's stock price closes at $198.

- What happens? The option expires "worthless." Because the stock price ($198) is below your $200 strike price, the buyer has no reason to use their right to buy your shares for $200. They could just buy them for less on the open market.

- Your result: The contract simply vanishes. You keep your original 100 shares of AAPL, and you also keep the $250 premium you were paid. Now you're free to do it all over again next month.

Scenario 2: The Stock Rises Above Your Strike Price

Now for the other possibility. Let's say Apple releases great news, and the stock takes off. On the expiration date, AAPL is trading at $205.

- What happens? Since the stock price ($205) is above your $200 strike price, the buyer of your option will absolutely exercise their right to buy your shares at that cheaper, agreed-upon price. This is called getting assigned.

- Your result: Your broker automatically sells your 100 AAPL shares for $200 each, netting you $20,000. You also keep the $250 premium you collected upfront. Your total take is $20,250.

Sure, you missed out on the extra gains above $200, but you still profited from the stock's move from $190 to $200 and pocketed the option income.

This example really highlights the core trade-off of a covered call. You collect guaranteed income today in exchange for capping your potential upside if the stock makes a huge run-up.

How Covered Calls Perform in Different Markets

So, how does a covered call strategy actually hold up in the real world? It’s one of the most common questions I hear, and the honest answer is: it depends entirely on the market.

Think of covered calls less as an all-weather vehicle and more as a specialized tool. It's not a magic bullet, but it absolutely excels in certain environments. To set the right expectations, you need to understand how it behaves when the market is climbing, going nowhere, or heading down. The income is a great perk, but your total return can swing wildly depending on which way the winds are blowing.

Performance in a Bull Market

When stocks are on a tear, covered call writers face a classic good news/bad news situation. The good news? Your underlying stock is gaining value. The bad news? This is where the strategy’s biggest risk comes into play: capped upside potential.

- The Outcome: If your stock shoots past the strike price, your shares will probably get called away. You'll pocket the profit up to the strike price and keep the premium, but you'll wave goodbye to any gains beyond that point.

- Total Return: In a raging bull market, a simple buy-and-hold approach will almost always come out on top. The premium you earn just isn't enough to make up for the massive upside you give up.

This is why it's so critical to only write calls on stocks you'd be happy to sell at a specific price. You have to be okay with letting it go.

Thriving in Flat or Sideways Markets

This is the covered call's home turf. When the market is chopping sideways—stuck in a narrow range with no real direction—buy-and-hold investors get frustrated. Their portfolios just sit there, going nowhere.

But for a covered call writer, this is the perfect setup for generating income. You can sell call options against your shares over and over, collecting premium month after month. Because the stock isn't making any big moves up, the options usually expire worthless. You keep your shares, you keep the premium, and you get to do it all again.

This is the sweet spot: In a market that's stuck in neutral, covered calls create an income stream out of thin air. Those accumulated premiums can seriously boost your total return, often pushing you ahead of a static buy-and-hold portfolio.

Providing a Cushion in a Bear Market

When the market turns sour, no stock strategy is going to be completely safe. But covered calls offer a nice cushion that can soften the blow of falling prices. The premium you collect from selling the call acts as a small buffer against your losses.

Let's say your stock drops by $5 per share, but you collected a $2 per share premium. Your net loss is only $3. That income helps offset the paper losses on your stock, effectively lowering your cost basis and providing a defensive stream of cash flow when you need it most.

The data backs this up. In a volatile period from June 1, 2022, to December 29, 2023, the S&P 500 Daily Covered Call Index delivered a total return of 19.38%, beating the S&P 500’s 16.66% gain. More recently, since January 2023, the index returned 25.92%, just nosing out the S&P 500's 24.23%. It proves the strategy can be incredibly competitive. You can dig into these covered call index findings and see the numbers for yourself.

Making the Right Strategic Choices

Getting covered calls right isn't about luck; it's about making smart choices upfront. The income you make and the risk you take come down to the decisions you make before you ever hit the "trade" button.

Think of it like this: every trade needs a flight plan. Your success depends on three key variables: the stock you pick, the strike price you set, and the expiration date you choose. Each one forces you to make a trade-off between earning more cash now versus leaving room for your stock to grow. Getting this balance right is what separates a good strategy from a bad one.

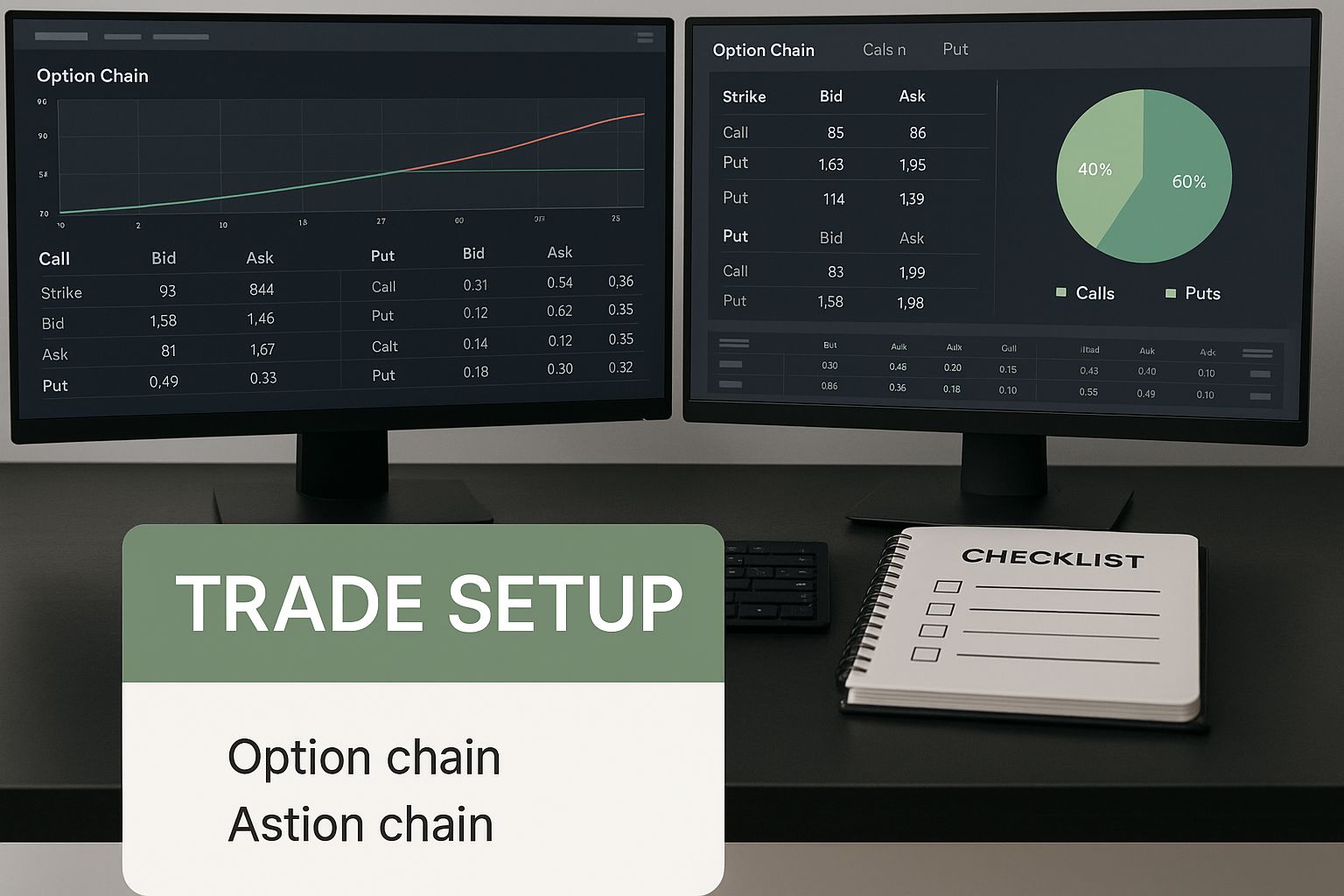

This image lays out the essential parts of a solid trade setup, putting these critical decisions in the spotlight.

Use this as your checklist. A methodical approach, where you tick off each of these boxes, is the secret to consistent performance. Now, let’s dig into how to tackle each one.

Selecting the Right Strike Price

Choosing a strike price is probably the most important call you'll make. It directly controls the core trade-off between income today and potential gains tomorrow. You've got two main paths to choose from.

Go Aggressive for Income: Selling a call option with a strike price closer to the current stock price (at-the-money) always pays a higher premium. This is perfect if your main goal is to maximize immediate cash flow. The catch? The chance of your shares getting "called away" is much higher, since even a small bump in the stock price can push it over your strike.

Play it Conservative for Growth: On the flip side, picking a strike price way above the current stock price (out-of-the-money) gives your stock plenty of room to run. This is the better route if you want some income but you’re really holding the stock for long-term growth. The downside is that the premium you collect will be much smaller, reflecting that lower risk.

There's no magic "best" strike price. It all comes down to what you care about more for that specific trade: income or appreciation.

Choosing an Optimal Expiration Date

Your next big decision is the expiration date. This determines how long you're locked into the trade and directly impacts both your premium and your flexibility.

Shorter-term options, like weeklies, bring in less cash per trade but let you compound your returns more often. They also give you more freedom, allowing you to adjust your game plan every seven days as the market shifts. Of course, this means you have to be more hands-on.

Longer-term options, like monthlies, pay a bigger premium upfront for a single trade, which can be great if you prefer a set-it-and-forget-it approach. The downside is you're stuck with that strike price for a whole month, making it tough to react if the stock suddenly takes off or news breaks.

The core principle at work here is time decay, or "theta." An option loses value faster and faster as it nears its expiration date. This is exactly why selling shorter-term options can be a powerful income engine if you're actively managing your positions.

To help you see how these choices play out, the table below breaks down the trade-offs.

Strike Price and Expiration Date Trade-Offs

This table compares how different strike prices and expiration dates affect your premium income, risk, and upside potential.

| Strategy Choice | Premium Income | Probability of Assignment | Upside Potential | Best For |

|---|---|---|---|---|

| At-the-Money Strike | High | High | Low (Capped early) | Maximizing immediate income |

| Out-of-the-Money Strike | Low | Low | High (More room to run) | Prioritizing capital gains |

| Weekly Expiration | Lower per trade | Varies | More flexible | Active traders seeking to compound returns |

| Monthly Expiration | Higher per trade | Varies | Less flexible | Passive investors wanting less management |

Ultimately, a good covered call strategy is all about finding the right balance between these variables. Once you understand how each decision shapes your outcome, you can stop guessing and start trading with a clear, deliberate plan.

Advanced Covered Call Techniques

Once you've got the basics down, it's time to explore more dynamic ways to use covered calls. These aren't your set-it-and-forget-it strategies. Instead, they’re about actively adapting to the market, tweaking your risk, and even putting the whole process on autopilot.

A super-efficient way to start a covered call trade is with a buy-write order. Instead of buying 100 shares and then selling the call, a buy-write does both in one shot. This locks in your maximum profit, maximum loss, and breakeven point right from the get-go.

For example, you could place one order to buy 100 shares of a stock at $48 while simultaneously selling a call with a $50 strike for a $1 premium. Your net cost instantly drops to $47 per share ($48 stock price - $1 premium). You know your entire trade's landscape from day one.

The Art of Rolling Your Position

The market is always moving, which means your initial trade might need a tune-up. That's where "rolling" comes in. Think of it as your primary tool for managing a position that isn't quite going to plan. It just means closing your current short call and opening a new one with a different strike price, a later expiration date, or both.

There are three main ways to roll a position:

- Rolling Up: The stock is rallying and pushing up against your strike price, but you don't want to sell your shares just yet. You can "roll up" by buying back your current call and selling a new one with a higher strike price and a later expiration. This lets you capture more of the stock's upside.

- Rolling Out: Your option is about to expire, and the stock price has gone nowhere. To keep the income train rolling, you can "roll out" by closing the current option and selling another one at the same strike price but for a later expiration date. It's a simple way to extend the trade.

- Rolling Down: The stock price took a dive. Your original call premium is shrinking, but you're also looking at a paper loss on your shares. You can "roll down" by closing your call and selling a new one with a lower strike price. This brings in a bigger chunk of premium to help offset the drop in the stock's value.

Key Insight: Rolling isn't about magically erasing a loss. It's a strategic move to adjust your risk and potential reward. A good roll often results in a net credit—meaning you pocket more cash from the new option than it cost to close the old one—adding a little extra to your total income.

Automating with Covered Call ETFs

What if you love the idea of covered call income but don't want to manage the trades yourself? Enter covered call ETFs (Exchange-Traded Funds). These funds are a popular, hands-off solution. They hold a basket of stocks—often tracking an index like the S&P 500—and systematically sell call options against them for you.

The benefits are pretty clear:

- Diversification: You're instantly spread across dozens or hundreds of stocks, so one bad apple won't spoil the bunch.

- Simplicity: The fund manager does all the heavy lifting. They pick the stocks, sell the options, and just send you the income, usually as a monthly dividend.

But that convenience has its trade-offs. You give up all control over the individual stocks, strike prices, and timing. These funds also charge management fees that will nibble away at your returns over time. It's also critical to know exactly what the fund's strategy is. Some are very aggressive in chasing high yields, which can severely cap your upside when the market rallies.

While they are a fantastic tool for passive income, they just don't offer the same flexibility as running your own positions. Understanding these nuances is key to getting the most out of your strategy, as we cover in our guide on maximizing income from covered calls.

Understanding the Risks and Downsides

No strategy is a free lunch, and covered calls are no exception. While the income is tempting, it's crucial to go in with your eyes wide open to the potential downsides. Knowing the risks beforehand helps you make decisions that actually fit your financial goals and stomach for surprises.

The biggest trade-off, by far, is the capped upside potential. Think of it as putting a self-imposed ceiling on your profits. If you sell a covered call on a stock you own and it suddenly rockets higher, your gains are locked in at the strike price. You get to pocket the premium, sure, but you'll be watching from the sidelines as the rest of the gains fly by.

The Capped Gains Scenario

Let's walk through a classic example. Imagine you own 100 shares of a hot tech stock trading at $50. You decide to sell a covered call with a $55 strike price and collect a neat $150 premium. A few weeks later, the company drops some game-changing news, and the stock blasts off to $70.

Here’s how that plays out:

- Your Outcome: Your shares get called away at $55. You made a $5 gain per share ($500) and kept the $150 premium. Your total profit is $650.

- The Missed Opportunity: If you had just held onto the stock, your profit would have been $2,000 ($20 gain per share). You left $1,350 on the table.

This isn't a "loss" in the traditional sense, but it’s a massive opportunity cost. You have to be genuinely okay with selling your shares at the price you choose.

The Downside of a Stock Decline

The other major risk is what happens when the underlying stock takes a nosedive. That premium you collected offers a small cushion, but it won’t protect you from a serious drop. If your $50 stock falls to $40, the $150 premium only softens your on-paper loss from $1,000 to $850.

The strategy simply doesn't shield you from a bear market or bad news hitting your specific company.

A Crucial Reality: While covered calls can generate yield, long-term studies suggest this income doesn't always lead to superior total returns. The cost of selling options can sometimes outweigh the premiums collected.

In fact, one analysis of S&P 500 covered calls sold monthly from 1999 to 2023 found the average round-trip profit and loss was a slight monthly loss of 0.05%, or about 0.60% annually. This shows that systematically selling calls, especially just for yield, can sometimes fall short of expectations. You can dig into the long-term performance of covered calls yourself.

Finally, don't forget about Uncle Sam. Both the premium you collect and any capital gains from having your shares called away have tax implications. We break it all down in our guide on the taxes on covered calls. A balanced view of both the rewards and the risks is the true foundation of a successful strategy.

Common Questions About Covered Call Strategies

Once you get the hang of writing covered calls, the real-world questions start popping up. What happens if this happens? What about taxes? Can I do this in my IRA?

Getting comfortable with these details is what separates theory from practice. Think of this as the practical FAQ for situations you’re almost certain to run into.

What Happens if My Option Is Exercised Early?

Early exercise is just what it sounds like: the option buyer decides to buy your shares before the expiration date. It's pretty rare for most options, but it happens.

If your call gets exercised early, the process is straightforward. You sell your 100 shares at the strike price, and you still keep 100% of the premium you collected upfront. The most common reason this happens is right before an ex-dividend date, especially if your option is deep in-the-money. The buyer exercises to snag the upcoming dividend payment, which they wouldn't get by just holding the call.

How Are Profits from Covered Calls Taxed?

This is a big one. You have to know how Uncle Sam views your profits to understand your real return. The IRS splits covered call income into two buckets.

- The Option Premium: The cash you get for selling the call is typically taxed as a short-term capital gain after the option expires or you buy it back to close it.

- The Stock Sale: If your shares get called away (assigned), it’s treated just like any other stock sale. The profit or loss is calculated based on what you originally paid for the shares.

Important Note: Tax rules can get complicated and are always subject to change. It's always a smart move to chat with a qualified tax pro to get advice that fits your specific situation. We break this down further in our guide covering the essentials of taxes on covered calls.

Can I Use Covered Calls in a Retirement Account?

Yes, you absolutely can. In fact, writing covered calls is one of the most common and widely approved options strategies for retirement accounts like an IRA or 401(k). Since you already own the stock, brokers see it as a conservative strategy with a clearly defined risk.

The best part? Any income or gains you make inside these accounts grow tax-deferred. That lets your earnings compound much faster over the long haul. Just be sure to double-check the specific options trading permissions with your brokerage firm first, as their rules can differ.

Ready to turn guesswork into a data-driven strategy? Strike Price provides real-time probability metrics and smart alerts to help you find the best covered call opportunities. Stop guessing and start earning consistent income with confidence. Explore Strike Price today.