A Practical Guide to Generating Income with Covered Call Options

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

Think of a covered call like this: you own a stock, and you sell someone the right to buy it from you at a specific price, by a certain date. For that right, they pay you cash upfront. It’s a bit like renting out a house you own; you still have the asset, but you’re collecting regular income from it.

Getting a Feel for Covered Calls

If you own a rental property, you collect monthly rent from a tenant. This creates a steady income stream, all while you continue to own the house. A covered call strategy works in a strikingly similar way for your stock portfolio—it turns your shares into little income-producing assets.

This isn’t about high-risk gambling. It's a more conservative play used by investors to squeeze consistent returns from stocks they already have in their account. The whole idea is to get paid from your existing holdings without having to sell them, which makes it a fantastic tool for anyone focused on generating income.

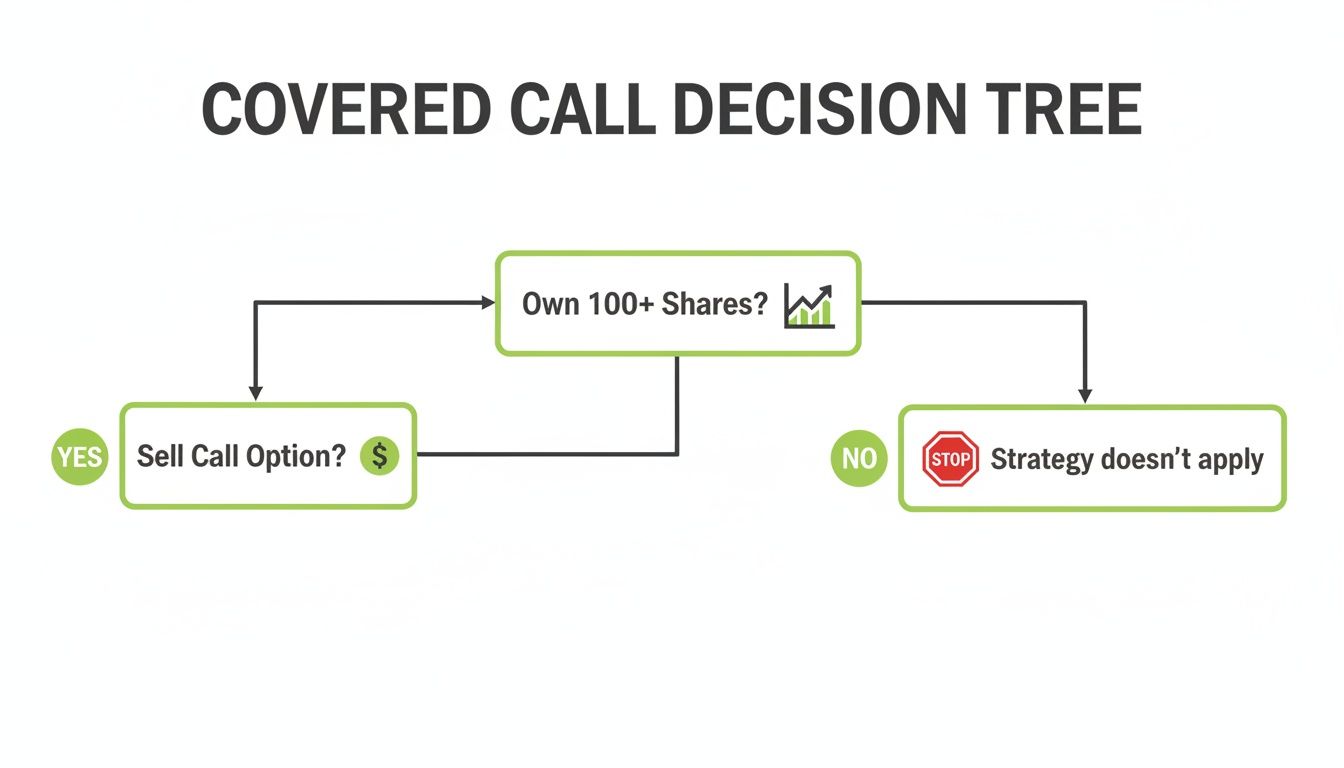

The Two Must-Haves for This Strategy

To pull this off, you need two things. First, you must own at least 100 shares of a stock or ETF. This is non-negotiable. Owning the shares is what makes the call option "covered," meaning you have the goods ready to deliver if the buyer decides they want them. Without the shares, you’d be selling a "naked call," which is a whole different (and much riskier) ballgame.

Second, you sell a call option contract against those shares. This contract gives another investor the right—but not the obligation—to buy your 100 shares at a set price, called the strike price, before a specific expiration date.

The real magic here is the premium. The second you sell that call option, you get an immediate cash payment. That money is yours to keep, no matter what the stock does next.

Why the Rental Analogy Clicks

The rental property analogy really holds up because it nails the key benefits and the trade-offs:

- The Stock is Your Property: Owning 100 shares is just like owning the house. It's your asset, and you still care about its long-term value.

- The Option is the Lease: Selling the call option is like signing a lease. You’re just giving someone else temporary rights related to your asset for a fixed amount of time.

- The Premium is Your Rent: The cash you collect from selling the option? That's your rental income. It’s a reliable payment you get upfront for letting someone else potentially buy your "property" at a price you already agreed on.

Just like a landlord gives up the chance for a massive windfall if the housing market suddenly explodes, a covered call writer caps their stock's potential profit at the strike price. But in return, they get a steady, predictable income stream. That trade-off is the absolute core of understanding when and why to use covered call options.

Breaking Down a Covered Call Trade, Step-by-Step

Theory is great, but let's get our hands dirty and walk through a real-world trading scenario. Seeing the numbers move is what really makes the concept click. We’ll follow a complete trade from the moment you place it until it expires, so you can see exactly how the money is made and what the different outcomes look like.

Let's say you own 100 shares of a fictional company, "XYZ Corp." It’s currently trading at $50 per share, making your total position worth $5,000 ($50 x 100 shares). You're bullish on the company long-term but don't see it rocketing up in the next 30 days. That makes it a perfect candidate for this strategy.

Setting Up the Trade

Your goal is simple: make a little extra cash from the shares you're already holding. You decide to sell one call option contract, which corresponds to your 100 shares. Looking at the option chain on your brokerage platform, you’ll need to make two key decisions:

- Pick a Strike Price: You choose a strike price of $55. This is "out-of-the-money" since it's above the current $50 stock price. By picking $55, you're essentially saying, "I'd be happy to sell my shares for a $5 profit each."

- Choose an Expiration Date: You select an expiration date 30 days out. This gives the trade a clear timeframe to play out.

For selling this specific option, the market pays you a premium of $2.00 per share. Since one contract covers 100 shares, you immediately collect $200 ($2.00 x 100) in your brokerage account. That cash is yours to keep, no matter what happens next.

This decision-making flow is the foundation of the strategy. You have to own the shares first before you can "rent them out" by selling a call.

Analyzing the Three Potential Outcomes

Once the trade is live, one of three things will happen by the expiration date. Let's break down each possibility and see how the math works out.

Covered Call Scenario Outcomes for XYZ Stock

To make it crystal clear, this table lays out what happens to your investment in each of the three scenarios we're about to cover. We started by buying 100 shares of XYZ at $50 each and sold a call option with a $55 strike, collecting a $200 premium.

| Scenario at Expiration | Stock Price Action | Option Outcome | Total Profit/Loss Calculation | Final Result |

|---|---|---|---|---|

| Ideal Outcome | Stock closes at $54 (below $55 strike) | Option expires worthless | You keep the $200 premium + retain your shares. | $200 profit and you still own your 100 shares. |

| Maximum Profit | Stock closes at $58 (above $55 strike) | Option is exercised; shares are sold at $55. | $500 capital gain ($5/share) + $200 premium. | $700 total profit. Your shares are sold. |

| Downside Scenario | Stock closes at $45 (well below $55 strike) | Option expires worthless. | $200 premium - $500 unrealized loss on shares. | Net unrealized loss of $300. The premium cushioned the fall. |

As you can see, the premium income improves your final result in every single case, whether the stock goes up, down, or sideways.

Outcome 1: The Stock Price Stays Below the $55 Strike Price

This is the most common and, for many income-focused investors, the ideal outcome. Let's imagine XYZ stock closes at $54 per share on expiration day.

Because the stock price is below the $55 strike price, the call option you sold expires worthless. The buyer has zero incentive to pay $55 for shares they could buy on the open market for just $54.

You simply keep your original 100 shares of XYZ, and you also keep the entire $200 premium you collected upfront. You just made a 4% return ($200 / $5,000) in about a month without having to sell your stock. Perfect.

Outcome 2: The Stock Price Rises Above the $55 Strike Price

Now, let's say XYZ has a great month and rallies to $58 per share by expiration.

The stock price is now above your $55 strike price, so the option is "in-the-money." The buyer will exercise their right to buy your shares from you at the agreed-upon price of $55. This is called assignment. Your broker handles it automatically, and your 100 shares are sold.

Your profit is a combination of the share appreciation and the option premium:

- Capital Gain: You made $5 per share ($55 sale price - $50 cost basis). That's a $500 gain.

- Premium Income: You also keep the $200 you were paid for the option.

- Total Profit: $500 + $200 = $700

This is your maximum possible gain. Sure, you missed out on the extra $3 per share of upside between $55 and $58, but you still locked in a fantastic, predefined profit.

Outcome 3: The Stock Price Falls Significantly

What happens if the news turns sour and XYZ stock drops to $45 per share?

The option expires worthless, just like in the first outcome. The stock is way below the $55 strike price, so the contract has no value.

You keep the $200 premium, which now acts as a small cushion against the falling stock price. Your shares have an unrealized loss of $500 (a $5 drop per share x 100 shares).

But that $200 in premium income softens the blow. Instead of being down the full $500, your net unrealized loss is only $300. The covered call provided a valuable, albeit small, buffer on the downside.

Balancing Risk and Reward: The Covered Call Tradeoff

There’s no such thing as a free lunch in investing, and covered calls are a perfect example. The entire strategy is a calculated trade: you swap unlimited upside for immediate, consistent income.

Getting your head around this fundamental balance is the key to figuring out if this strategy actually fits your goals and how much risk you’re comfortable taking.

The biggest draw, of course, is the steady stream of income you get from selling the options. Every premium you collect is like an extra dividend, putting cash directly into your account. This income also chips away at your average cost per share, giving you a nice cushion when the market is flat or drifting down. It basically turns a stock that's just sitting there into an active, income-producing asset.

The Upside: A Capped Opportunity

The main risk you take on with a covered call is opportunity cost. Plain and simple. When you sell a call, you’re agreeing to sell your shares at the strike price—no matter how high the stock might fly. If the stock price blasts past your strike, you miss out on those huge gains.

Say you sell a call with a $55 strike, and the stock unexpectedly rallies to $70. You still only get to sell your shares for $55. Sure, you made a profit you knew you were getting, but you left a lot of money on the table.

This tradeoff is the very heart of the strategy. You are consciously picking a higher chance of a smaller, more reliable profit over a lower chance of a much bigger one. It’s a strategic choice to harvest premiums instead of chasing runaway rallies.

This is a critical concept. You aren't losing money in the traditional sense, but you are putting a ceiling on your maximum profit. For investors focused on generating income rather than pure growth, it's often a worthwhile exchange.

Downside Protection: A Limited Buffer

While the premium income does provide a buffer against losses, let's keep it in perspective. The covered call strategy does not get rid of downside risk. If your stock takes a nosedive, the premium you pocketed will only soften the blow a little.

If your stock drops by $10 per share, that $2 premium you collected only offsets 20% of the loss. You’re still on the hook for the rest of the decline. But over time, especially in choppy markets, that buffer can really add up.

- Bear Market Performance: History shows that covered call strategies provide some real downside protection. During the sharp downturn in 2022, the S&P 500 fell 17%, but an index tracking a covered call strategy was down only 11%. That 6% buffer came directly from collecting premiums on calls that expired worthless as stocks fell—a pattern we also saw in the 2000 and 2008 bear markets.

- Cost Basis Reduction: Every premium you collect and keep lowers the effective price you paid for your stock. This makes it easier to get back to break-even or into profit territory.

Ultimately, this strategy really shines in stable, slightly bullish, or even slightly bearish markets. It’s in these environments that the steady premium income can outperform the stock's modest price moves. It’s far less effective when stocks are either rocketing up or crashing down.

A deeper look into the inherent covered call risks can help you decide if this tradeoff is right for your portfolio.

Go Beyond the Basics with Advanced Covered Call Strategies

Once you’re comfortable with the bread-and-butter covered call, it’s time to explore a more active approach to managing your positions and boosting your income. These techniques take you beyond the simple "set it and forget it" mindset.

Instead of passively waiting for expiration day, you can get in the driver's seat. Two of the most powerful tools in an active trader’s kit are rolling an option and executing a buy-write. Each has a different purpose, but they both aim to maximize your returns while adapting to what the market is doing right now.

Rolling Your Covered Call for More Time or More Premium

Imagine your covered call is getting close to expiration. The stock has rallied, and it’s now flirting with your strike price. You still think the stock has room to run and you'd rather not sell your shares just yet. This is the perfect scenario to "roll" the position.

Rolling is a simple two-part move you do all at once:

- Buy to close your current short call.

- Sell to open a new call with a later expiration date, a different strike price, or both.

This lets you extend the life of your trade, and you can often do it for a net credit, meaning you pocket even more premium. For instance, you could roll "up and out" by picking a higher strike price and a later expiration. This gives your stock more upside potential while you continue to generate income. It’s a game-changer for long-term investors who want to keep their shares.

The Buy-Write: A One-Step Approach to Income

A buy-write is exactly what it sounds like: you buy the stock and sell a covered call against it in a single, simultaneous transaction. Think of it as an efficient way to start a covered call position from the ground up, and it often saves you a bit on commissions compared to placing two separate orders.

This strategy is perfect when you've already decided you want to own a stock and want to immediately lower your cost basis or start generating income from day one. By combining the stock purchase and the option sale, you lock in your maximum profit and your initial downside cushion right from the start.

The real magic of these strategies is their adaptability. You’re no longer a passive bystander. You're actively managing your risk, your income goals, and your stock position, turning a basic income play into a dynamic part of your portfolio.

The Shift Toward Daily Options

While monthly options have long been the standard, a newer approach using daily options is gaining serious traction. Why? Because it offers the potential to ramp up both your yield and your ability to capture stock gains.

Recent data really brings this to life. Some strategies that reset daily have shown impressive performance by collecting smaller premiums far more frequently. This allows for daily upside right up to the strike, which is a huge advantage over monthly options that cap your gains for a full 30 days.

One index tracking this daily method showed an annualized yield of 10.80%, with total returns for a related ETF hitting 18.55% over a specific period. It’s a powerful example of how rapid resets can help you navigate market volatility.

The biggest benefit is that you aren't locked into one strike price for a whole month. You can adjust your outlook every single day—a massive edge in fast-moving markets.

This screenshot shows how a tool can help you make these kinds of data-driven decisions on the fly. It visualizes the trade-off between the premium you can earn and the probability of having your shares called away, making it much easier to pick a strike that truly fits your goals.

To see how different strike prices change the dynamics of a trade, check out our detailed guide on in-the-money covered calls.

Making Data-Driven Decisions to Select the Right Strike Price

Successful options traders don't guess. They don't trade on gut feelings. They replace emotion with a repeatable, data-driven process that guides every decision they make. This is especially true for one of the most critical parts of any covered call strategy: picking the right strike price.

Your choice of strike directly impacts your potential income and the odds of having your shares sold. It's the central trade-off of the whole strategy. Making a smart choice here means looking beyond just the premium you see on the screen.

Introducing Delta: The Trader's Probability Gauge

One of the most practical metrics for this is delta. It has a technical definition, but for our purposes, you can think of it as a simple, real-time estimate of the probability that your option will expire in-the-money. It gives you an instant, data-backed snapshot of a trade's risk profile.

A call option with a delta of 0.30, for example, has roughly a 30% chance of finishing in-the-money by expiration. That also means there’s a corresponding 70% chance it will expire worthless, letting you keep both your shares and the full premium.

Using this number moves you from, "I think this is a good strike," to, "This strike aligns with my exact risk tolerance."

- Higher Delta (e.g., 0.40 - 0.50): This means a higher probability of assignment but also a fatter premium. You're getting paid more because you're taking on more risk of having your shares called away.

- Lower Delta (e.g., 0.15 - 0.25): This signals a lower chance of assignment and, as you'd expect, a smaller premium. This is the more conservative play for investors who really want to hang on to their shares.

By focusing on probability instead of just the premium's dollar amount, you can build a far more consistent and predictable income stream. This is how you take the emotional rollercoaster out of trading.

Finding Your Sweet Spot Between Income and Risk

The "best" strike price is different for everyone because it all comes down to your primary goal for that specific stock. Are you trying to squeeze out every possible dollar of income, or is your main priority holding onto those shares for the long haul?

Think about it in terms of these two mindsets:

- Income Focus: If your goal is to maximize cash flow, you might pick a strike closer to the current stock price, maybe with a delta between 0.30 and 0.40. The premiums will be higher, but so will the chance of assignment. This works great for stocks you wouldn't mind selling at a profit anyway.

- Share Retention Focus: If you're long-term bullish on a stock and want to avoid selling it, you’d look for a strike price further out-of-the-money. A delta of 0.20 or lower would be more your speed, offering a smaller premium in exchange for a much higher probability of keeping your shares.

This is where modern trading tools are essential. They scan the entire options chain in seconds, instantly showing you the delta, premium, and potential return for every single strike price. You can see the risk/reward trade-off laid out clearly, no complex math required. These platforms let you filter for exactly what you want, like "show me all options with a delta under 0.25 and an annualized return over 15%."

Why Extrinsic Value Is Key to Your Decision

This whole process of picking a strike is really about one thing: capturing extrinsic value. This is the part of an option's premium that comes from factors like time until expiration and implied volatility—it’s the "time and risk" component you're getting paid to take on. Grasping this is a huge step toward making smarter trades, and you can learn more about how extrinsic option value works in our guide.

When you sell an out-of-the-money covered call, the entire premium you pocket is pure extrinsic value. Your goal is for this value to decay to zero by expiration day. That's what lets you keep the full premium. Using a metric like delta helps you put a number on the probability of that decay happening in your favor, turning a complex decision into a simple, data-driven choice.

Common Covered Call Mistakes and How to Avoid Them

While selling covered calls is a pretty straightforward way to generate income, a few common stumbles can quickly turn a reliable strategy into a source of major frustration. Getting ahead of these pitfalls is the real key to building a consistent process that actually works.

One of the first traps new investors fall into is chasing the highest premiums they can find, without really thinking about the risk involved. Huge premiums are almost always tied to stocks with wild volatility. That volatility is a double-edged sword, increasing the odds of a sudden price swing that leaves you with a result you didn't want.

Ignoring Company and Market Events

Probably the most frequent—and easily avoidable—mistake is selling a covered call without a quick glance at the calendar. An upcoming earnings report can be a landmine for an options seller, often causing a stock’s price to either gap up or crater overnight.

If the stock blasts past your strike price after a killer earnings report, your shares are almost certainly getting called away. You'll be forced to sell, missing out on all that extra upside.

Key Takeaway: Always, always check for earnings dates, product launches, or big economic reports before you sell a call. A five-second calendar check can save you from locking in a low sale price right before a stock is about to pop.

Learning to spot and handle these kinds of risks is a critical skill for any investor. Just as there are specific slip-ups in covered calls, understanding broader strategies for avoiding common financial errors can make you a much smarter investor overall.

Selecting the Wrong Strike Price

Another classic blunder is picking a strike price that doesn't actually match what you want to achieve with the stock. If you sell a call that’s too close to the current price, you'll collect a bigger premium—no doubt about it. But you also crank up the probability of having your shares assigned.

This is a massive mistake if you truly believe in the company long-term and want to keep your shares. Sure, you get a nice one-time payment, but you might be sacrificing years of future growth for it.

Here’s a quick-hitter list on how to dodge these common covered call traps:

- Don't Chase Yield: Focus on high-quality, stable stocks instead of volatile names offering fat premiums. A string of smaller, consistent wins is way better than one big, risky gamble.

- Know Your Stock's Story: Keep up with the companies you own. Never sell an option that expires right after a major catalyst like an earnings report. It's just not worth the risk.

- Define Your Goal First: Before you even look at the option chain, decide what you want more: income now or keeping the shares for later. Let that goal drive your strike selection, not the other way around.

- Have an Exit Plan: Know exactly what you'll do if the stock moves against you. Are you going to roll the option to a later date? Or are you okay with letting the shares go? Making a plan before the trade removes all the emotion when things get dicey.

Frequently Asked Questions

When you're getting started with a new strategy, the "what ifs" can feel a little overwhelming. Let's tackle some of the most common questions that pop up for new covered call writers. Think of this as the final check-in before you place your first trade.

What Happens If My Stock Gets Called Away?

This is the big one, and it's a core part of the strategy. If your stock closes above the strike price you chose when the option expires, the buyer is going to exercise their right. You're now obligated to sell them your 100 shares at that price.

Your broker handles all the behind-the-scenes work automatically—it's a process called assignment. When it's all done, you'll see the cash from the sale in your account. You get to keep the full premium you collected when you first sold the call, plus you lock in any profit between what you paid for the shares and the strike price you sold them at. From there, the cash is yours to find a new opportunity or even buy the same stock back if you want to.

Can I Lose Money with Covered Calls?

Yes, absolutely. A covered call does not protect you if the stock itself takes a nosedive. The premium you collect offers a small cushion, but your main risk is still tied to owning the shares.

If the stock's price falls hard, that premium you pocketed won't do much to offset the larger paper loss on your stock position. This strategy limits your upside, but your downside risk is nearly identical to just holding the stock.

The goal here is generating income and creating a small buffer, not hedging against a market crash. Your real risk is that the stock you own drops significantly, and the premium is only a tiny consolation.

How Do I Choose the Right Expiration Date?

Picking an expiration date is a classic trade-off: do you want smaller, more frequent paydays or larger, less frequent ones? There's no single "best" answer—it comes down to what you're trying to accomplish.

Here’s a quick way to think about it:

- Shorter-Dated Options (like weeklys): These expire quickly, which means their value decays faster—that's good for you as the seller. This can set you up for more frequent income opportunities. The catch? The premium you collect for each trade is smaller.

- Longer-Dated Options (30-45 days out): These almost always offer a bigger upfront premium because there's more time for the stock to make a move. The downside is your shares are tied up for longer, and the option's price won't react as quickly to changes in the stock price.

For a lot of traders, that 30 to 45-day window hits the sweet spot. It offers a meaningful premium without locking you into a position for too long.

Ready to stop guessing and start making data-driven decisions? Strike Price provides real-time probability metrics for every strike price, helping you balance income and risk with precision. Get started with Strike Price today!