Your Guide to the Covered Put Strategy

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

A covered put is a straightforward strategy that involves two key moves: shorting a stock while simultaneously selling a put option on that very same stock.

If you have a moderately bearish outlook on a stock, this approach can be a smart way to generate immediate income from the option premium. That premium acts as a small cushion, giving you a bit of breathing room if the stock's price unexpectedly moves against you and starts to rise.

What Is the Covered Put Strategy?

Think of it like this: Imagine you're a real estate investor who thinks a particular property's value might dip a little. Instead of just betting on its decline, you decide to rent it out. This way, you collect guaranteed income (rent) right away, which helps offset a small price drop or even makes a tiny gain if the value stays flat.

The covered put works on the same principle in the stock market. You're bearish on the stock, but you're also collecting "rent" upfront in the form of an option premium.

This strategy is built on two distinct actions happening at the same time:

- Short Selling the Stock: First, you borrow 100 shares of a stock and sell them on the market. The goal is to buy them back later at a lower price for a profit.

- Selling a Put Option: At the same time, you sell one put option contract on that stock. This contract gives the buyer the right (but not the obligation) to sell 100 shares of that stock to you at a set price (the strike price) before it expires.

The short stock position is what "covers" the put option you sold. If the put option buyer decides to exercise their right, they'll sell you the shares. This purchase simply closes out your initial short position, neatly tying everything together.

To give you a quick reference, here's a breakdown of the covered put strategy's key features.

Covered Put Strategy at a Glance

| Characteristic | Description |

|---|---|

| Market Outlook | Neutral to moderately bearish |

| Strategy Components | Short 100 shares of stock + Sell 1 cash-secured put option |

| Maximum Profit | (Stock's Short Sale Price - Strike Price) + Premium Received |

| Maximum Loss | Unlimited (if the stock price rises significantly) |

| Breakeven Point | Short Sale Price + Premium Received Per Share |

| Primary Goal | Generate income from a short stock position and lower the breakeven point. |

This table neatly summarizes the mechanics and objectives, but understanding when to use it is just as important.

When This Strategy Makes Sense

A covered put isn't the right tool if you're convinced a stock is about to crash. In that scenario, a simple short sale offers much more profit potential. This strategy shines in more nuanced situations.

A covered put is best suited for traders who are neutral to moderately bearish. It thrives when you expect a stock's price to stay flat, decline slightly, or even rise a little—but not rally significantly.

The real advantage here is generating income from a stock you're already shorting. The premium you collect from selling the put immediately gets added to your bottom line, which effectively raises your breakeven point compared to just shorting the stock alone. It gives you a wider margin of error.

However—and this is critical—you have to respect the risk. While that premium provides a buffer, your potential loss is theoretically unlimited if the stock price skyrockets. Your gains are capped, but your losses aren't, which makes disciplined risk management an absolute must for anyone using this strategy.

How to Execute a Covered Put Strategy

So, you're ready to put the covered put strategy into action. It's a precise two-part move that starts with a short sale and is immediately followed by selling an option. The whole trade is built around a moderately bearish view—you think a stock might drift down or trade sideways, but you aren't expecting a total freefall.

Getting the mechanics right is everything. Let's walk through how to set up the trade from start to finish.

Initiating the Trade

To kick things off, you need to perform two actions, ideally at the same time. You'll establish a short stock position and then sell a put option against it.

Short the Underlying Stock: First, you'll borrow and sell 100 shares of your chosen stock. This short position is the "cover" for the put you're about to sell, hedging your risk if the stock price moves unexpectedly.

Sell a Put Option: With your short position in place, you then sell one put option contract for every 100 shares you shorted. The cash premium you collect from selling the put lands in your account right away. This instantly generates income and lowers the breakeven point of your entire position.

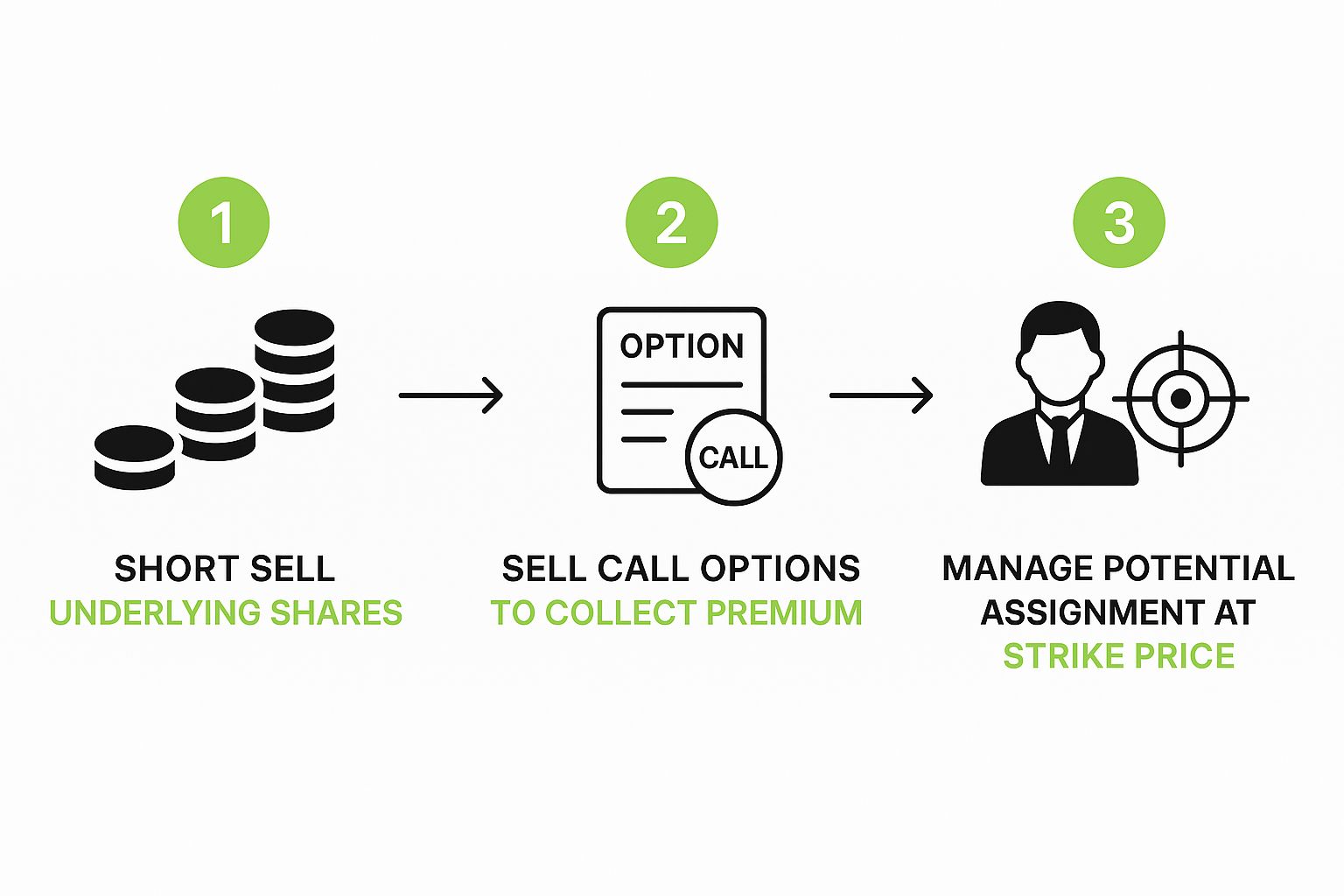

This infographic breaks down the flow of setting up a covered put.

As the visual lays out, the trade begins with shorting the stock, which is then paired with selling a put. This creates a position where if you get assigned on the put, your short stock position has you covered.

Selecting the Right Option

Picking the right put option is just as critical as choosing the right stock. The strike price and expiration date you select will directly shape your potential profit, your risk, and the trade's overall odds of success.

An out-of-the-money (OTM) put will net you a smaller premium, but it has a better chance of expiring worthless (which is what you want). On the flip side, an in-the-money (ITM) put brings in a much larger premium but also comes with a higher probability of being assigned.

The real art is finding that sweet spot. You're looking for a strike price that pays you a decent premium for the risk you're taking, matched with an expiration date that aligns with your forecast for the stock's movement.

Let's say you short a stock at $50. Selling a put with a $48 strike price gives you a $2 cushion before your short stock position starts to lose money (not counting the premium you pocketed). A more aggressive trader might sell the $50 strike put to collect a fatter premium, but this also dials up the chances of getting assigned the shares.

A more detailed guide on how to sell covered puts can walk you through more in-depth examples to help you really sharpen your selection process. In the end, it all comes down to your personal risk tolerance and what you think the market is about to do.

Calculating Your Potential Profit and Loss

To trade covered puts well, you have to get comfortable with the numbers. Knowing how to map out your potential outcomes isn't just a "nice-to-have"—it's the only way to manage risk and make smart decisions. This strategy has a unique financial DNA: your profit is capped, there's a clear breakeven point, and the risk, at least in theory, is unlimited.

Let's break down the math behind each piece. When we're done, you'll have a solid framework for sizing up any covered put trade that comes your way.

Determining Your Maximum Profit

First things first: the profit on a covered put is capped. This is a critical feature of the trade. You hit your maximum gain if the stock drops to or below the strike price you sold, triggering an assignment. That's your best-case scenario for this specific trade.

The formula for your max profit is pretty simple:

Maximum Profit = (Short Sale Price – Strike Price) + Premium Received

Think of it as two separate wins adding up. You make money from the stock's price drop (the difference between where you shorted it and the strike where you're forced to buy it back). Then, you tack on the premium you were paid for selling the put, which is yours to keep no matter what happens.

Finding Your Breakeven Point

Every trade has a tipping point—that price where you go from red to black. For a covered put, we call this the breakeven point. It’s the exact stock price where, if you closed out your entire position, you'd walk away with no profit and no loss.

Here's how to find it:

- Breakeven Price = Short Sale Price + Premium Received Per Share

That premium you pocketed acts as a buffer. It nudges the breakeven price higher, giving you more room for error than if you had just shorted the stock outright. If the stock drifts up but stays below this breakeven level at expiration, you can still come out ahead.

Understanding the Risk Profile

This is where discipline is everything. While the premium gives you a small cushion, the biggest risk in a covered put strategy is its unlimited loss potential. Because you're short 100 shares of the stock, your losses keep growing for as long as the stock price climbs.

There’s no ceiling on how high a stock can go, which means your potential loss is, theoretically, infinite. This is the single biggest risk of the trade and exactly why it’s not for the faint of heart.

To make this all click, let's walk through a real-world example. A covered put involves shorting a stock and selling a put option against it at the same time.

Imagine a trader shorts a stock at $114.88 a share and sells a $112 strike put that expires in 46 days, collecting a $5.02 premium.

- The breakeven price becomes $119.90 ($114.88 short price + $5.02 premium).

- The maximum profit on this trade would be $790, calculated from the difference between the short sale price and the strike price, plus the premium collected for 100 shares.

You can dive into more detailed examples and get additional insights into the mechanics of covered puts from Project Finance. Seeing the numbers work together really helps define the trade's true risk and reward.

The Benefits and Risks of Covered Puts

Every options strategy is a balancing act, a trade-off between reward and risk. The covered put is no different. Before you even think about placing a trade, you need to get a feel for both sides of the coin to see if this moderately bearish approach actually fits your goals.

It comes with some unique perks, but it also carries serious risks that demand your full attention and a solid management plan.

The single biggest draw, and the main reason traders even look at this strategy, is immediate income generation. The moment you sell that put option, cash from the premium hits your account. That payment is yours to keep, no matter what happens next, giving you a head start on profits or a small buffer if the trade goes slightly against you.

The Upside Advantages

That premium you collect does more than just pad your account balance; it fundamentally improves the math of your short position. Think of it as a built-in advantage.

Here's how the benefits break down:

- Improved Breakeven Point: The cash you receive from the premium effectively raises your breakeven price on the short stock. This gives you more room for error. The stock can actually tick up a little bit, and you can still get out of the trade without a loss.

- Enhanced Profit on Minor Dips: If the stock's price falls just a little, or even trades flat, the covered put will be more profitable than just shorting the stock. Why? Because you pocketed that extra premium income. It's a great way to make money from a neutral-to-slightly-bearish view.

This ability to generate income is what makes strategies like this so appealing. While it's not a perfect comparison, research on its cousin strategy, the covered call, has shown that generating premiums can be a smart way to manage risk. For instance, studies on SSRN suggest that while simply buying puts for protection can lag, strategies that produce income are often a better fit for investors who are more concerned with avoiding losses.

The Downside Risks

Now for the other side. The risks that come with a covered put strategy are significant, and you absolutely cannot afford to ignore them. The word "covered" can lull you into a false sense of security. It doesn't mean you're safe—it just redefines the risk.

The most significant risk of a covered put is its unlimited loss potential. Because you are short 100 shares of the underlying stock, your losses will continue to mount for as long as the stock price rallies upward.

On top of that, your potential profit is capped. A straight short sale lets your profits run as long as the stock keeps falling. With a covered put, you trade away that unlimited gain potential in exchange for the certainty of that upfront premium. Your maximum profit is locked in at the option's strike price.

For a complete breakdown of the mechanics, check out our guide where we have covered puts explained in much greater detail.

When to Use the Covered Put Strategy

Timing is everything in trading, and the covered put is no different. It's not a strategy you pull out for every market; think of it as a specialized tool for a very specific outlook on a stock.

You should consider a covered put when you’re neutral to moderately bearish on a stock’s future. It’s the right play when you think the price will likely chop around sideways, dip a little, or maybe even inch up slightly—but you're pretty sure it isn't going to take off. This strategy is all about monetizing that stagnation or minor decline, not betting on a total collapse.

The Ideal Market Conditions

So, when does the covered put really shine? It’s perfect when your analysis suggests a stock is heading for a period of consolidation or a slow grind down. You're basically saying, "I don't see this stock doing anything special, and it might even lose a little ground."

This outlook is key because your maximum profit is capped from the start. If you were convinced the stock was about to crash and burn, a simple short sale would give you far more upside. On the flip side, using this strategy in a raging bull market is a bad idea because of its unlimited risk if the stock rallies hard against you.

Key Insight: The covered put is an income strategy. You're using it to generate cash from an asset you expect to underperform, capturing premium while the price action is muted or slightly negative.

The Role of Implied Volatility

Another huge piece of the puzzle is implied volatility (IV). Selling options is always more attractive when IV is high because it pumps up the premiums you collect. High IV is a sign of market uncertainty, and you get paid a bigger premium for stepping in and taking on that perceived risk.

When volatility is cranked up, selling the put in your covered put setup means you pocket a richer premium. This does two important things for your trade:

- It boosts your potential maximum profit right away.

- It pushes your breakeven point even higher, giving you a bigger cushion in case the stock rallies unexpectedly.

This is a different mindset from a strategy like the cash-secured put, which is more of a bullish-to-neutral trade. You can see how that works by checking out this cash secured put example to compare the mechanics.

Ultimately, using the covered put well means finding that sweet spot: a moderately bearish outlook combined with juicy, elevated volatility.

Common Mistakes to Avoid with Covered Puts

The covered put is a sharp tool for traders with a bearish outlook, but like any tool, it can be dangerous if mishandled. A few common slip-ups can easily flip a well-planned trade into a painful loss. Getting these right is the key to using this strategy successfully over the long haul.

The single biggest mistake? Getting the stock's trend completely wrong. This strategy is built for stocks you expect to be neutral or drift slightly lower. If you short a stock right before it rips higher, you're in for a world of hurt. The premium you collected will feel like a drop in the bucket as losses on your short stock position pile up fast.

Key Takeaway: Don't let the word "covered" lull you into a false sense of security. It doesn't mean you're safe. It just means the risk is defined—and in this case, the risk is the unlimited loss potential from your short stock position if the price takes off.

This is exactly why having a non-negotiable risk management plan is so critical. Before you even think about placing the trade, you must have a stop-loss order ready for your short stock position. Know your exit point before you ever enter.

Poor Option Selection

Another trap many traders fall into is picking the wrong option. It’s a delicate balance.

Choosing a put that’s way out-of-the-money might feel safe, but the tiny premium you'll get for it probably isn't worth the risk you're taking on by shorting the stock. On the other hand, an in-the-money put will hand you a fat premium, but it also comes with a very high chance of being assigned.

Sloppy option selection can completely wreck your trade’s risk-to-reward ratio. The goal is to find that sweet spot that lines up with your forecast and what you're willing to risk. Ignoring the math is a classic rookie error. Historically, the numbers don't lie. Data from the late 1980s showed that put options over 12-week periods had incredibly high standard deviations (104.3%) and negative average returns. This just hammers home the point: you have to pick your strikes carefully and manage your risk like a hawk. You can dig deeper into these findings on put option returns yourself.

Covered Put Strategy FAQs

Even after you've got the basics down, a few questions always seem to pop up about covered puts. Let's tackle the most common ones to clear up any lingering confusion and help you trade with more confidence.

What’s the Difference Between a Covered Put and a Naked Put?

The real difference comes down to how the trade is secured. With a covered put, you are already short 100 shares of the stock. That short stock position acts as your "cover" or hedge if the stock price rips higher against you.

A naked put, on the other hand, is sold without that short stock position. This leaves the trader exposed to a significant—though not unlimited—loss if the stock price tanks and the put option goes deep in-the-money.

The covered put's main risk is your short stock position (theoretically unlimited loss if the price rallies). The naked put's main risk is the put option itself (loss is limited to the stock price falling to zero).

Can I Get Assigned on My Short Put Option?

Absolutely. Assignment is always a possibility when you sell any option. With a covered put, you're most likely to be assigned if your put is in-the-money as the expiration date gets closer.

If the option buyer decides to exercise, you'll be forced to buy 100 shares of the stock at the strike price you agreed to. The good news? This purchase of shares automatically closes out the short stock position you started with. Your profit or loss is then whatever's left after you factor in the difference between your short sale price and this new purchase price, plus the original premium you collected.

Is This Strategy Good for Beginners?

Definitely not. The covered put strategy is an advanced move. It combines two pretty complex actions—short selling and selling options—and both come with their own serious risks. Just the unlimited loss potential from shorting a stock makes this a poor choice for anyone new to trading.

Before you even think about trying a covered put, you should be completely comfortable with basic options and understand exactly what can go wrong when you short a stock. We can't stress this enough: paper trade this strategy until you know it inside and out before putting any real money on the line.

Ready to turn guesswork into informed action? Strike Price provides real-time probability metrics for every strike price, helping you balance safety and premium income. Get smart alerts and track your contracts at a glance. Transform your options selling with Strike Price today!