Credit Spreads vs Debit Spreads A Trader's Guide

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

The real difference between credit spreads and debit spreads boils down to a simple question: How are you trying to make money?

Credit spreads pay you an upfront premium to bet a stock will stay within a certain price range. Think of it as an income-focused, high-probability strategy. On the other hand, debit spreads cost you money to open and are built to profit from a big directional move, offering a higher potential reward for a lower chance of success.

Choosing Your Strategy: Credit vs Debit Spreads

Deciding between a credit or debit spread is one of the most fundamental choices an options trader can make. It sets the entire tone for the trade. The right call depends on your primary goal, your read on the stock's next move, and the current market volatility.

Credit spreads are the go-to for traders looking to generate consistent income. You win as time passes (theta decay) and the stock stays relatively quiet or drifts in your favor. It’s a lot like selling insurance; you collect a premium and hope nothing dramatic happens.

Debit spreads are for traders hunting for capital appreciation from a specific price swing. You're essentially buying a directional bet at a discount, but time decay is your enemy here. This strategy only works if you’re right about where the stock is headed.

The core trade-off is simple: Credit spreads offer a high win rate for smaller, defined profits, while debit spreads provide a lower win rate for larger, defined profits.

Let's make this practical. Imagine you’re bullish on a stock. Your choice isn’t just about being bullish; it’s about how bullish you are and what the market is doing. This quick decision matrix breaks down the key factors to consider.

Credit Spreads vs Debit Spreads Quick Decision Matrix

This table breaks down the core differences in strategy when choosing between a credit spread and a debit spread for a bullish outlook.

| Decision Factor | Bull Put Credit Spread | Bull Call Debit Spread |

|---|---|---|

| Primary Goal | Generate Income | Capital Appreciation |

| How You Profit | Time decay & stock staying above a price | Stock price moving significantly higher |

| Initial Cash Flow | Net Credit (Receive Money) | Net Debit (Pay Money) |

| Probability of Profit | High (Often >60%) | Low (Often <50%) |

| Best Volatility Environment | High (Sell expensive options) | Low (Buy cheap options) |

Ultimately, choosing a bull put credit spread means you're confident the stock won't go down. In contrast, choosing a bull call debit spread means you need the stock to go up significantly to turn a profit. It’s a subtle but critical distinction that shapes your entire approach.

How Each Spread Is Built

To really get the difference between credit and debit spreads, you have to start with how they're put together. Both strategies involve buying one option and selling another at the same time, but the relationship between the two creates completely different results for your portfolio.

Let's walk through the nuts and bolts of each one.

Constructing a Credit Spread

A credit spread is all about generating income right away. The main idea is to sell an option that has a higher premium while buying a cheaper one to act as a safety net. The difference between the money you collect and the money you pay out is your net credit.

This structure sets the tone for the entire trade. Your maximum profit is locked in from the start—it's the credit you received. You get to keep all of it if the options expire worthless. The option you buy is your insurance policy, capping your potential loss if the trade goes sideways.

Example: A Bull Put Spread

Let's say stock XYZ is trading at $105, and you think it’s going to stay above $100 for the next month. You could build a bull put spread like this:

- Sell a put option: You sell the $100 strike put and collect a premium of $2.00 per share.

- Buy a put option: At the same time, you buy the $95 strike put for protection, paying a premium of $0.50 per share.

Your net credit is $1.50 ($2.00 received - $0.50 paid), which comes out to $150 per contract. If XYZ closes above $100 when the options expire, both become worthless, and you pocket the full $150. This risk-defined approach is what makes spreads so powerful. You can dive deeper into the core concepts in our guide on what is an option spread.

A credit spread pays you to be right in a general sense. You don't need a big move; you just need the underlying asset to avoid moving significantly against your short strike.

Assembling a Debit Spread

On the flip side, a debit spread is built to profit from a directional move in the stock. It always results in a net debit, meaning you pay to open the position. You buy a more expensive option you think will gain value and sell a cheaper one to lower your entry cost.

Your maximum loss is limited to the initial debit you paid. Even though you're paying to get in, the profit potential is usually much higher than what you put down, creating a compelling risk-reward profile if you nail the direction. This makes it a strategy for growing your capital, not generating upfront income.

Example: A Bull Call Spread

Using the same XYZ stock at $105, let's say this time you expect it to rally toward $110. You could construct a bull call spread:

- Buy a call option: You buy the $105 strike call, paying a premium of $3.00.

- Sell a call option: You then sell the $110 strike call, receiving a premium of $1.00 to offset the cost.

Your net debit is $2.00 ($3.00 paid - $1.00 received), or $200 per contract. If XYZ rallies past $110, you hit your maximum profit. This just goes to show how both strategies define risk from the start but go after profits in completely different ways.

Comparing Risk Reward and Win Rates

The real heart of the credit spreads vs. debit spreads debate comes down to their completely different risk-reward profiles. This is where you decide your style: are you playing for consistent income with a high probability of success, or are you swinging for the fences on a directional bet? Each one has its own mathematical edge built for specific market setups.

Credit spreads are built for a high probability of profit. Since you collect a premium upfront, you win if the stock moves in your favor, stays flat, or even drifts slightly against you. That built-in cushion often pushes the win rate above 60-70%, which is why they're such powerful tools for generating steady income.

But that high win rate has a catch: a skewed risk-reward profile. With a credit spread, your maximum potential loss is always bigger than your maximum potential profit. You're basically risking more to make less, banking on the fact that you'll win far more often than you lose.

The Debit Spread Trade-Off

Debit spreads flip that dynamic on its head. They are naturally lower-probability trades because the stock has to make a real directional move just for you to break even. Win rates for debit spreads often hang out below 50%, since you have to be right about both the direction and the size of the move.

The reward for being right, though, is a much healthier risk-reward ratio. Your max profit is usually greater than your max loss (the debit you paid). It's common to find debit spreads where you might risk $100 for a shot at making $400. This makes them a great fit for traders trying to grow capital, not just collect income.

The core trade-off is this: Credit spreads offer a high probability of a small win, while debit spreads offer a low probability of a large win. Your choice depends on whether you prefer frequent small gains or infrequent big ones.

A Concrete Example

Let's look at how this plays out with two bullish strategies on a stock trading at $50.

- Bull Put Credit Spread: You sell the $48 put and buy the $46 put, collecting a $0.50 credit ($50). Your max profit is $50, and your max loss is $150. The stock just needs to stay above $47.50 for you to make money, giving you a high probability of winning.

- Bull Call Debit Spread: You buy the $50 call and sell the $52 call, paying a $1.00 debit ($100). Your max loss is $100, while your max profit is also $100. The stock has to climb all the way to $51 just to break even—a much lower probability event.

The different profiles become clear in practice. Take a put credit spread on a stock like XYZ at $30: you could sell the $30 put for $0.65 and buy the $29 put for $0.32. That nets you a $0.33 credit, or $33 per contract. Your max profit is that $33 as long as the stock stays above $30, while your max risk is $67. That's a risk-reward of about 1:2, but your breakeven is down at $29.67—only 1.1% below the current price. In a neutral or high IV environment, that gives you a 70-80% chance of success. For more on these differences, check out the analysis on etftrends.com.

How Implied Volatility Dictates Your Choice

If you only master one concept, make it this one: implied volatility (IV) will completely change how you approach the credit spread vs. debit spread decision. For spread traders, the most critical rule of thumb is simple but incredibly powerful: sell credit spreads when implied volatility is high, and buy debit spreads when it's low.

This isn't just a suggestion; it's a core principle rooted in the very nature of how options are priced.

When IV is high, option premiums get expensive. This is the perfect environment for a credit spread seller. You're essentially selling "rich" premium and collecting a healthy credit upfront for taking on the risk. Your goal is for that inflated volatility to come back down to earth over the life of the trade.

This drop in IV is often called a "volatility crush." Credit spreads have negative Vega, which means they profit as implied volatility falls. A classic example is selling premium right before a known event like an earnings report. You collect a high premium because of all the uncertainty, and once the news is out, IV typically plummets—helping your trade become profitable even if the stock barely moves.

Vega The Volatility Greek

Every options trader needs to get comfortable with Vega. It's the Greek that measures an option's sensitivity to changes in implied volatility, telling you exactly how much an option's price should change for every 1% move in IV. For a deeper dive, check out our complete guide explaining what Vega is in options.

By design, credit spreads have negative Vega. This means your position’s value goes up as IV drops. On the flip side, debit spreads have positive Vega, so they benefit when IV rises after you've entered the trade.

The core idea is to align your strategy with where you think volatility is headed. Sell volatility when it's expensive (high IV) and buy it when it's cheap (low IV).

When to Deploy Each Strategy

This brings us to a practical, data-driven way of thinking. A stock’s volatility level points you to the optimal strategy. Credit spreads thrive in high-IV environments where you can sell expensive premium, while debit spreads are built for low-IV setups where you want directional leverage without overpaying for it.

A common rule of thumb is to buy debit spreads when a stock's IV percentile is in the 0-50% range of its 52-week history (options are cheap). When it’s above 50%, premiums are getting rich, and it’s time to start looking at selling credit spreads.

History shows this works. During the wild volatility of 2022, S&P 500 bull put credit spreads saw average returns of 18% as IV got crushed after Fed hikes. Conversely, the extremely low IV environment of 2017 heavily favored debit spreads. Nasdaq debit calls returned over 250% on tech surges because the cheap premiums minimized entry costs and supercharged the gains. You can explore more historical scenarios in the full analysis about using both spreads on bigtrends.com.

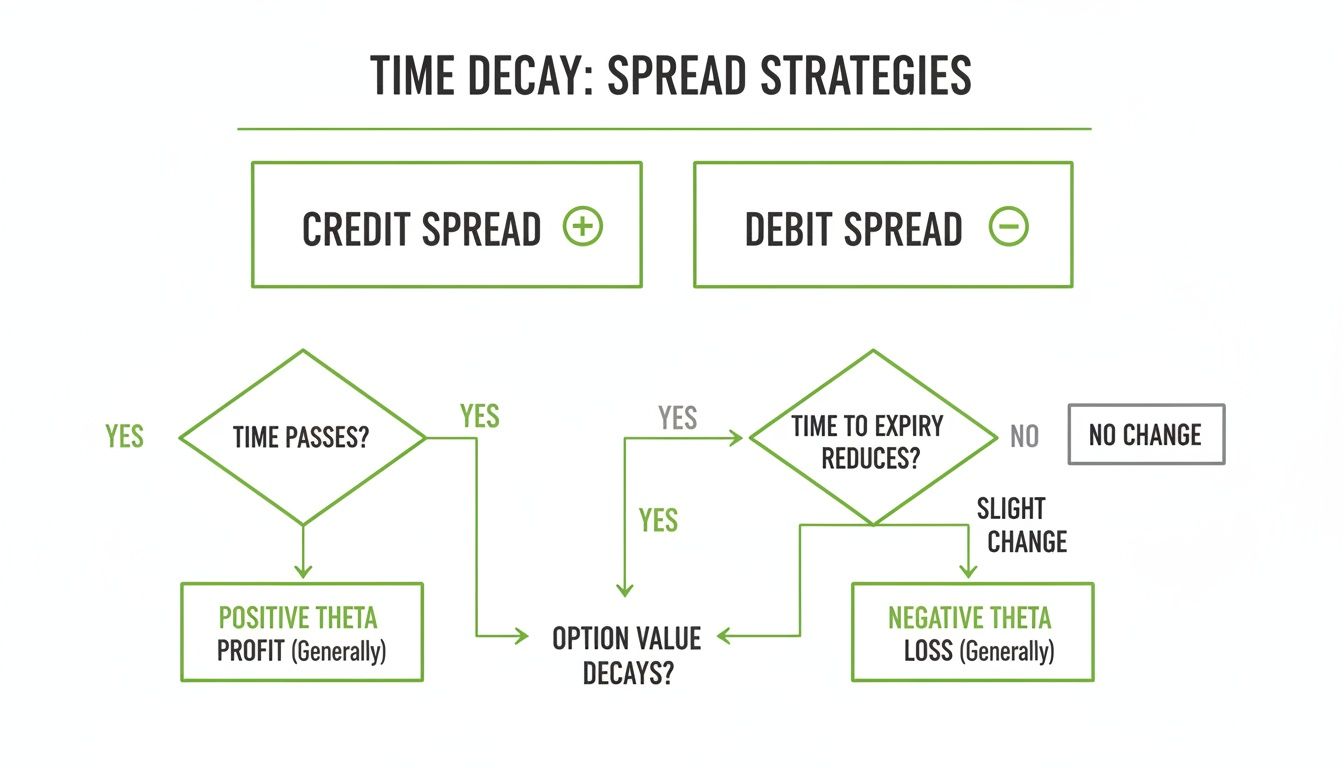

Using Time Decay To Your Advantage

In the world of options, time is an asset you can either spend or earn. When you’re weighing credit spreads against debit spreads, the role of time decay—measured by the option Greek Theta—is a huge deciding factor. One strategy puts time on your side, while the other makes it your enemy.

Credit spreads are positive Theta positions. This means they’re built to profit from the simple passage of time. Because you sell a more expensive option and buy a cheaper one, your position naturally gains value each day as the options you sold decay. It's like collecting rent; as long as the market behaves, time is working for you, adding to your profit day by day.

Debit spreads, on the other hand, are negative Theta positions. Here, time decay is actively working against you. The more expensive option you bought is losing a little bit of value every single day, eating away at your position if the underlying stock doesn't move in your favor, and fast. This makes them a much better fit for short-term, catalyst-driven trades where you expect a big move and have a good idea of when it'll happen.

The fundamental difference is this: credit spreads pay you to wait, making them ideal income strategies. Debit spreads cost you money to wait, requiring a directional move to overcome the daily decay.

Aligning Strategy With Time Horizon

This dynamic directly shapes the ideal holding period for each strategy. Since credit spreads benefit from Theta decay, they are often more effective for longer-duration trades. You’re giving the strategy more time to be right, allowing all that daily decay to pile up and contribute to your profit. For a deeper look at this process, check out this guide on how option time decay works.

Conversely, debit spreads demand precision. The clock is always ticking against you, so these trades are best used when you have a strong conviction about an upcoming move. Holding a debit spread for too long without the price action you need can turn a winning idea into a losing trade, even if your directional call was eventually right.

Data-Driven Duration Choices

Backtesting data often shows that credit spreads can deliver better win rates and profitability over longer timeframes, mainly because of how much they benefit from time decay. A comprehensive study on SPY data from 2005 to 2023 tested credit spreads at 15, 45, and 75 days-to-expiration (DTE).

While all durations had high win rates of 88% or more, the average profit and loss jumped significantly with more time. The 75 DTE spreads massively outperformed the shorter-duration ones, proving just how much giving time decay more room to work can improve your bottom line. You can see the full analysis of duration's impact on credit spreads for yourself. It really reinforces the idea that with credit spreads, more time can often mean more profit.

Your Decision-Making Framework

Alright, let's pull all this together into a simple, actionable framework. Choosing the right spread doesn’t have to feel like guesswork. By asking yourself just four questions, you can confidently pick the best strategy for whatever the market is doing, making sure the trade aligns perfectly with your thesis.

This isn't about complicated formulas; it's about clarity. Each question helps you zero in on whether a credit or debit spread makes more sense right now.

Four Key Questions for Every Trade

Before you place your next spread, run through this quick mental checklist:

- What's my market outlook? Are you bullish, bearish, or neutral on the underlying stock? This is your starting point and determines whether you're using puts or calls. A slightly bullish view might lead you to a bull put credit spread, while a strong bearish conviction could point toward a bear put debit spread.

- Is volatility high or low? High implied volatility (IV) means option premiums are expensive. That's a great environment for credit spreads, where you get to sell that inflated premium. Low IV makes options cheap, which is the ideal setup for debit spreads, where you're a buyer of that cheap premium.

- What's my primary goal? Are you looking to generate consistent income, or are you aiming for capital growth from a directional bet? For income, credit spreads are your go-to tool. For growth, debit spreads are the better choice.

- Is time on my side? Time decay, or Theta, is a huge factor. It actively helps credit spreads, as you profit from the simple passage of time. On the other hand, it eats away at debit spreads, making them better suited for short-term, catalyst-driven trades where you expect a move to happen soon.

This decision tree gives you a great visual of how time decay acts as a tailwind for credit spreads but a headwind for debit spreads.

The takeaway is clear: time is an asset for anyone selling a credit spread but a liability for anyone buying a debit spread.

Common Questions from Traders

Getting into options spreads always brings up a few practical questions. Let's tackle the most common ones traders ask when weighing credit spreads against debit spreads.

Are Credit or Debit Spreads Better for New Traders?

While both are great risk-defined strategies, many beginners find credit spreads a bit more forgiving. Their high probability of profit means you can still make money even if the stock goes nowhere or even slightly against you. That helps build confidence.

Debit spreads, on the other hand, demand you be right about the market's direction. That can be a tall order for someone just starting out. A great way to begin is by selling wide, out-of-the-money credit spreads to get a feel for the mechanics with a bigger cushion for error.

Key Takeaway: Credit spreads let beginners earn a profit without needing a crystal ball to predict a stock's next move. They're a fantastic tool for learning risk management and getting a feel for the market's rhythm.

What's the Best Way to Handle a Losing Credit Spread?

Active management is everything if you want to succeed with credit spreads long-term. The most straightforward approach is to just close the trade for a small, manageable loss before it gets anywhere near its maximum loss.

A more advanced move is "rolling" the position. This means closing your current spread and opening a new one further out in time, often with different strike prices. Rolling buys your trade more time to work out and can sometimes be done for another credit, which lowers your total risk. Always, always have a management plan before you even think about placing the trade.

Should I Actually Use Both Strategies?

Absolutely. The most versatile traders have both in their toolkit so they can adapt to whatever the market throws at them. They might use credit spreads as their core income strategy when volatility is high, then switch to tactical debit spreads when they spot a low-volatility directional opportunity.

Being good at both means you can find profitable trades in almost any market instead of just sitting on your hands waiting for that one perfect setup. Your strategy should fit the market, not the other way around.

Mastering options selling requires having the right data at the right time. Strike Price delivers real-time probability metrics for every single strike, helping you shift from guesswork to a strategic, data-driven income process. Explore your advantage with Strike Price today.