Define Covered Calls A Guide to Generating Consistent Income

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

A covered call is a simple but powerful options strategy where you sell someone the right to buy a stock you already own, at a price you choose, in exchange for getting paid cash upfront.

Think of it this way: you’re collecting an immediate payment for agreeing to potentially sell your shares later. It's one of the most popular ways investors generate a consistent income stream from their existing stock portfolio.

Understanding Covered Calls With a Simple Analogy

To really get what a covered call is, let's step away from the stock market for a minute.

Imagine you own a rental house. You bought it, you believe in its long-term value, and you collect rent every month. That rent is your steady, reliable income.

Now, your tenant comes to you with an interesting offer. "I love this house," they say. "I'll pay you an extra, non-refundable fee today if you agree to sell me the house for $400,000 anytime in the next six months."

If you take the deal, you pocket that extra cash right away. You still own the house, and you keep collecting rent. The only catch? You’ve agreed to cap your potential profit at $400,000, even if the housing market goes crazy and the home's value shoots up to $500,000.

This is exactly how a covered call works.

- Your 100 Shares of Stock: This is your rental property. You own it and you're happy to hold it.

- The Premium You Collect: This is the extra fee your tenant paid you. It's guaranteed cash in your pocket, and you keep it no matter what.

- The Agreement to Sell (The Call Option): This is your promise to sell the house at the agreed-upon price. It's a short-term contract that either gets triggered or simply expires.

By selling a call option, you're essentially renting out your stock's potential upside for a fee. The "covered" part just means you already own the 100 shares needed to make the sale if it happens. This makes it a defined-risk strategy, unlike a naked short call option, which carries massive, unlimited risk.

To help put it all together, here’s a quick summary table that breaks down the components of the strategy and continues our real estate analogy.

Covered Call At a Glance

| Component | Description | Real Estate Analogy |

|---|---|---|

| The Asset | 100 shares of a stock you already own. | Your rental property. |

| The Agreement | You sell a call option contract against those shares. | You agree to a potential future sale of your property. |

| The Income | You receive an immediate cash payment, called a premium. | The non-refundable fee your tenant pays you upfront. |

| The Obligation | You must sell your shares if the stock price rises above the strike price. | You must sell the house at the agreed price if the buyer wants it. |

| The Risk | You miss out on any gains above the agreed-upon sale price. | You don't profit if the house's value soars past the sale price. |

This table neatly lays out the moving parts. You're giving up some potential future upside for a definite, immediate cash payment.

The core trade-off is clear: you are exchanging the possibility of unlimited future gains for a smaller, guaranteed profit today.

This strategy is so effective because it lets you generate cash flow from stocks that might just be sitting there, moving sideways, or only climbing slowly. Instead of just waiting for appreciation, you’re actively putting your assets to work to create an extra paycheck—just like a landlord collecting rent.

The Nuts and Bolts of a Covered Call

Analogies are great, but to really get a feel for covered calls, we need to walk through an actual trade. The good news is that once you understand the moving parts, putting one on is surprisingly simple.

Let’s break down the entire process, from setting up the trade to seeing how it can play out.

First things first, you need the "covered" part of the covered call. That means you have to own at least 100 shares of a stock for every single call option you plan to sell. Your shares are the collateral that "covers" your end of the deal if the option buyer decides they want to buy them from you.

Once you have the shares, you're ready to start generating some income.

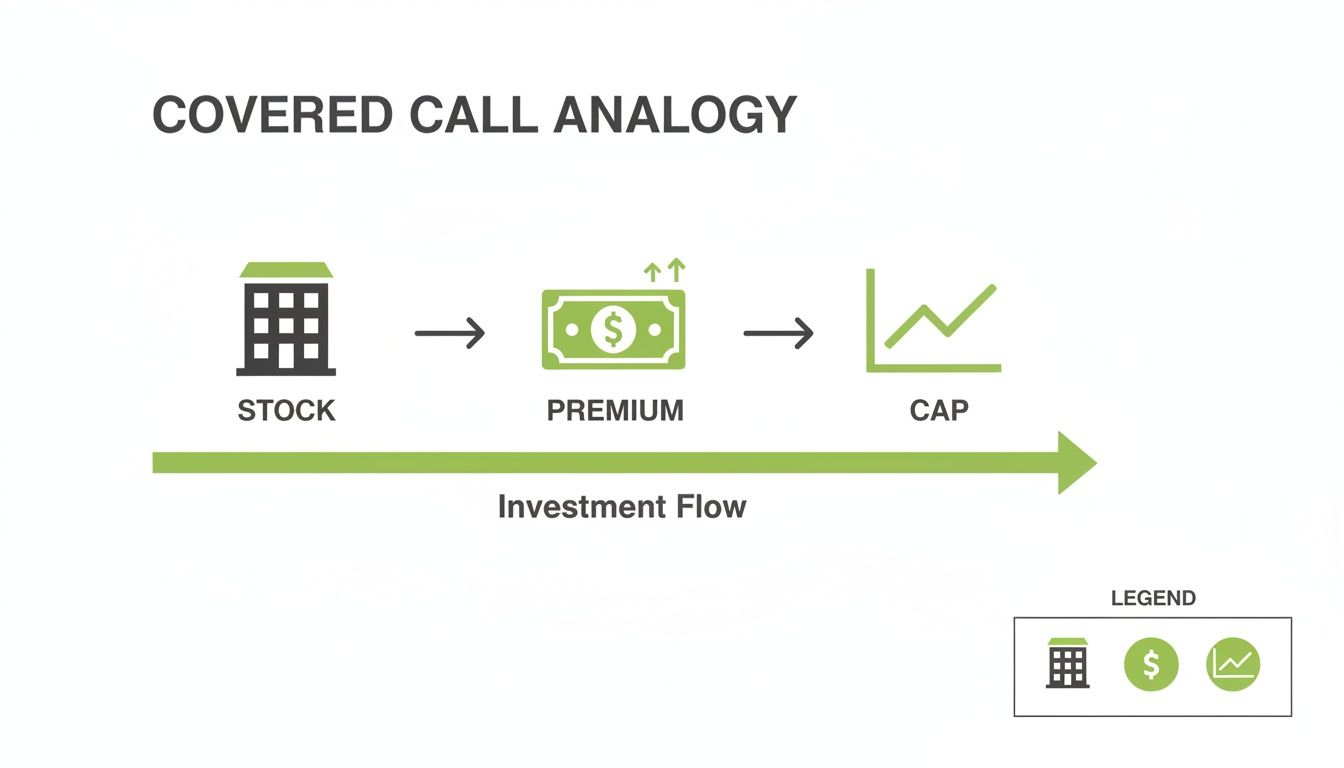

This flow is pretty straightforward: you use the stock you already own to collect an immediate cash payment (the premium), but in exchange, you agree to a ceiling on your potential profit.

As you can see, the stock is the key that unlocks the premium. That income, however, comes with a trade-off: a capped upside.

A Real-World Example, Step by Step

Let's make this real. Imagine you own 100 shares of Company XYZ. You bought them a while back for $45 a share, and today, the stock is trading at $50. You think the stock will probably hang out around this price or maybe creep up a little over the next month, which makes it a perfect candidate for a covered call.

Here’s how you’d place the trade:

- Pick Your Option: You pull up the options chain for XYZ and decide to sell one call option with a $55 strike price that expires in 30 days. The strike price is simply the price you're agreeing to sell your shares for if the buyer wants them.

- Sell to Open: You’ll place a "sell to open" order for that specific contract. If you want a deeper dive into what that order type means, check out our guide on how to sell to open an options position.

- Collect Your Cash: The market is paying $2.00 per share for this option. Since one contract controls 100 shares, you immediately get $200 ($2.00 x 100) deposited into your brokerage account. That cash is yours, no matter what happens next.

Just like that, you've created an income stream from stocks you already owned. You were paid $200 today for making a promise: to sell your 100 shares of XYZ for $55 each if the stock price is above that level at expiration.

What Happens Next? Calculating the Outcomes

When the option's expiration date arrives, one of two things will happen.

Scenario 1: The Stock Stays Below $55

If XYZ closes at or below the $55 strike price, the option expires worthless. The buyer isn't going to buy your shares for $55 when they can get them cheaper on the open market. In this outcome, you keep the $200 premium and your 100 shares of XYZ. You're now free to sell another covered call for the next month and do it all over again. This is usually the ideal outcome.Scenario 2: The Stock Rises Above $55

If XYZ closes above $55—let's say it hits $58—the option is "in-the-money." The buyer will almost certainly exercise their right to buy your shares. You are now obligated to sell your 100 shares at the agreed-upon $55 price. Your shares get "called away."

Here’s how the profit breaks down:

- Capital Gain: You make $10 per share ($55 sale price - $45 cost basis), which comes out to $1,000.

- Premium Received: You also keep the $200 premium.

- Your Maximum Profit: $1,000 + $200 = $1,200

You still walk away with a nice profit. The only catch is that you missed out on the extra gains the stock made between $55 and its $58 market price. This capped upside is the fundamental trade-off you make for that guaranteed premium income upfront.

Understanding the Real Risk and Reward

A covered call offers a pretty sweet deal on the surface: get paid for stocks you already own. And while that income is very real, it's critical to understand this strategy isn't a free lunch. It’s a calculated trade-off, and you need to see both sides of the coin before you jump in.

The primary reward is obvious and immediate: income generation. The premium you collect from selling the call option is cash in your account, plain and simple. It's yours to keep, no matter what. This cash can lower your stock's cost basis, be reinvested, or just pad your bank account. If you’re trading dividend stocks, you'll also want to factor in other income sources like understanding fully franked dividends.

That premium also gives you a small but real cushion against minor price dips, which makes the whole thing feel a bit safer than just holding the stock.

The Unavoidable Trade-Off: Capped Upside

The biggest risk here isn't that you'll lose your shirt overnight. It's the opportunity cost you’re signing up for.

When you sell a covered call, you’re agreeing to sell your shares at the strike price. If the stock suddenly has a monster rally and blasts past that price, your profit is capped. All those juicy gains above your strike price? You miss out on them completely.

Think of it this way:

- Your Reward: A guaranteed, immediate cash payment (the premium).

- Your Risk: Giving up unlimited growth potential for a limited time.

You are swapping the possibility of a home-run gain for the certainty of a smaller, upfront profit. This is the fundamental bargain you're making, and you have to be okay with it.

The Myth of Perfect Downside Protection

Another common misconception is that covered calls are a perfect hedge against losses. They aren't. Not even close.

The premium you collect only provides downside protection equal to the amount you received. If the stock price takes a nosedive, your position is still going to lose a lot of value. The premium just softens the blow a tiny bit.

Historically, this strategy shines brightest in down or sideways markets. Take 2022, for example. The S&P 500 fell a brutal 17%, but the CBOE S&P 500 BuyWrite Index (BXM), which tracks a covered call strategy, limited its losses to 11%. The premiums helped, but they absolutely did not prevent losses. You can read more about how covered calls performed during that bear market on Atlas Capital's website.

The key takeaway is this: A covered call doesn’t eliminate the risk of owning a stock. It only reduces it by the premium you collect, which is made up of both intrinsic and extrinsic option value. You should only ever sell covered calls on high-quality stocks you are comfortable holding for the long haul.

When to Use the Covered Call Strategy

Figuring out the mechanics of a covered call is the easy part. The real skill is knowing when to actually use it. This isn't a strategy you can just set and forget; its success rides on picking the right moments and the right market conditions.

Use it at the wrong time, and you'll either cap your gains in a monster bull run or watch your premium disappear in a market crash.

The Sweet Spot for Covered Calls

The absolute best time to sell a covered call is when you have a neutral to moderately bullish outlook on a stock you already own.

What does that mean? It means you expect the stock to trade sideways, climb a little, or maybe even dip slightly over the next month or so. In these low-volatility scenarios, the premium you collect is basically free money, since the stock is unlikely to blast past your strike price.

Getting Paid to Wait

Think of the premium as getting paid for your patience. The real magic here is time decay (theta), which becomes your best friend. Every single day that ticks by, the value of the option you sold melts away a little bit more. As the seller, that's exactly what you want. This decay speeds up as you get closer to the expiration date, especially if the stock isn't making any big moves.

This strategy really shines in a few specific situations:

- Neutral or Sideways Markets: If you think a stock is just going to bounce around in a range, selling calls lets you squeeze some income out of an asset that isn't really going anywhere.

- Slightly Bullish Markets: Expecting slow, steady growth? You can set a strike price just above the current price. This lets you pocket a premium while still giving you some room to profit if the stock climbs.

- Slightly Bearish Markets: If you think the stock might dip a bit, the premium you collect acts as a small cushion, offsetting a portion of the losses on your shares.

To put it into perspective, here’s a quick comparison of how covered calls stack up against just holding the stock.

Covered Call Performance by Market Condition

This table breaks down how a covered call might perform versus a simple buy-and-hold strategy in different market scenarios.

| Market Condition | Holding Stock Outcome | Covered Call Outcome | Which Strategy Is Better? |

|---|---|---|---|

| Strong Bull Market | Significant gains | Capped gains (premium + strike price) | Holding Stock |

| Slightly Bullish Market | Modest gains | Modest gains + premium | Covered Call |

| Neutral/Sideways Market | Breakeven | Premium is pure profit | Covered Call |

| Slightly Bearish Market | Small losses | Losses are cushioned by the premium | Covered Call |

| Strong Bear Market | Significant losses | Significant losses, slightly reduced by premium | Neither (both lose money) |

As you can see, the covered call strategy really pulls ahead in markets that aren't making dramatic upward moves. It’s designed for income and modest growth, not for home runs.

When to Keep This Strategy on the Sidelines

On the flip side, there are two environments where selling covered calls is usually a bad idea.

The first is a roaring bull market. When a stock is taking off like a rocket, the profit you leave on the table by having your shares called away at a lower strike price—what traders call opportunity cost—can easily dwarf the small premium you collected.

But it's not always a losing game. A fascinating analysis of a covered call strategy on the Russell 2000 index found that selling calls 2% out-of-the-money actually beat the index over 15 years, and with lower volatility. It shows that collecting premium can still boost returns without completely killing your growth. You can read more about that analysis here.

The second no-go scenario is a market crash. That premium you collected offers almost no real protection against a steep drop in your stock's value. A $2 premium doesn't do you much good when your stock plummets by $20.

As you get comfortable with covered calls, it’s always a good idea to keep learning. To build a solid foundation, check out these effective strategies for learning stock trading. The more you know, the better your decisions will be.

How to Choose the Right Strike Price and Expiration

Once you’ve got the mechanics down, making money with covered calls really boils down to two key decisions: picking the right strike price and the right expiration date. These two choices are the dials that control how much you get paid, your odds of keeping your shares, and the overall risk you're taking on.

This isn't about guesswork. It’s about figuring out what you want from the trade. Are you trying to squeeze out every last drop of income right now? Or is your main goal to hang on to your shares for the long haul? Your answer changes everything.

Selecting the Right Strike Price

The strike price is simply the price you agree to sell your shares for. It’s the heart of the trade-off between the cash you collect upfront (the premium) and the probability of your stock being "called away." Think of it in three flavors.

Out-of-the-Money (OTM): These strikes are above the current stock price. They pay less premium but give your stock some breathing room to climb before you have to sell. This is the go-to for investors who want a little extra income but really want to keep their shares.

At-the-Money (ATM): These are strikes sitting right near the current stock price. They offer a nice middle ground—solid premiums with roughly a 50/50 shot of your shares being sold. It’s a balanced approach.

In-the-Money (ITM): These strikes are below the current stock price. They pay the highest premiums, but they also come with the highest chance of your shares being sold. This is for investors laser-focused on maximizing today's income, who are perfectly happy to part with their stock at the strike price.

It really is that simple: a more aggressive, income-first approach means picking strikes closer to the current price (ATM or ITM). A more conservative, "I want to keep my stock" approach means choosing strikes further away (OTM).

Choosing the Expiration Date

The expiration date sets the clock on your contract. Shorter dates can mean faster profits from time decay, while longer dates offer bigger premium payments upfront.

Short-Term Expirations (Weekly or Monthly): These are the bread and butter for income seekers. Time decay works its magic fastest here, eroding the option's value—which is great for you as the seller. This lets you collect premiums more often.

Long-Term Expirations (Quarterly or Longer): These will hand you a larger chunk of cash right away. The catch? You're locked into that price for a lot longer, giving the stock more time and opportunity to make a big move against you.

The income from covered calls can help soften the blow in a down market and add a nice yield when things are flat. But let's be real—the downside protection from a traditional setup is limited. Research on the CBOE S&P 500 BuyWrite Index, for instance, found it only captured 61% of the S&P 500's returns in down quarters over a decade—not a massive improvement over its performance in up markets.

This is exactly why guessing just doesn't cut it anymore. Modern tools that give you real, probability-driven data are essential for making smarter decisions. If you want to dive deeper, you can read more research on S&P 500 BuyWrite performance to see the numbers for yourself.

Common Questions About Covered Calls

As you move from theory to actually trading covered calls in your own account, a few practical questions always pop up. It can feel like a big leap, but the most common scenarios are surprisingly easy to navigate.

Think of this as your quick-start FAQ. We’ll walk through what happens when a trade goes right, what happens when it goes wrong, and how to handle the logistics. Getting a handle on these situations is the key to trading with confidence.

What Happens if My Stock Gets Called Away?

This is the best-case scenario if your goal was to sell the stock and lock in a specific profit. If the stock’s price closes above your strike price on expiration day, your shares are automatically sold at that strike price. You don't have to do anything.

This outcome represents your maximum possible profit for that trade. You keep 100% of the premium you collected upfront, plus you lock in any capital gains from what you originally paid for the stock up to the strike price. The cash from the sale just shows up in your brokerage account, ready for your next move.

Just remember, this sale is a taxable event and will generate a capital gain or loss on your shares.

Can I Lose Money With a Covered Call?

Yes, you absolutely can. Selling a covered call is an income strategy, not a magic shield against risk. It will not protect you if the underlying stock price takes a nosedive.

The premium you collect is just a small cushion against a downturn. For example, say you own a stock at $100 and sell a call for a $2 premium. This lowers your effective cost basis to $98. If that stock then plummets to $80, you're still looking at an unrealized loss of $18 per share on your position.

A covered call only reduces your risk by the exact amount of premium you collect. You should only use this strategy on quality stocks you’re comfortable holding for the long haul, even if they dip.

What Are the Tax Implications?

The tax rules for covered calls can feel a little tricky, but they really boil down to two events.

First, the premium you get for selling the option is almost always taxed as a short-term capital gain in the year you close the position.

Second, if your shares get called away, the stock sale itself is a separate taxable event. Your gain or loss is calculated based on the difference between the strike price and what you originally paid for the shares. The holding period of your stock can also get complicated, which might affect whether your gains are taxed at the short-term or long-term rate. Since everyone's situation is different, it’s always smart to check with a qualified tax professional.

Can I Close a Covered Call Position Early?

Yes, and this is a core technique for actively managing your trades. You are never locked into a position until it expires. You can exit the trade anytime by placing a "buy to close" order on the same option you sold.

If the option's price has dropped since you sold it—either from time decay or the stock price falling—you can buy it back for less than you were paid, locking in a profit on the option itself. This is a great way to take profits off the table, cut potential losses, or free up your shares to roll the position to a new strike price or a later date.

Ready to stop guessing and start making data-driven decisions? Strike Price gives you the probability metrics and real-time alerts you need to sell covered calls with confidence. Find high-yield opportunities that match your risk tolerance and track your income goals with a powerful, easy-to-use platform. Join thousands of investors who are turning their portfolios into consistent income streams.

Start your free trial at Strike Price today!