Delta in option trading: Master the Key Concept for Smarter Trades

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

When you're trading options, think of delta as the speedometer for your position. It tells you exactly how much your option's price should change for every $1 move in the underlying stock. It’s that simple.

For instance, if you have a call option with a delta of 0.65, its value will climb by about $0.65 for every $1 the stock price goes up. If the stock falls by $1, you can expect your option to lose around that same $0.65.

What Is Delta in Option Trading and Why It Matters

Imagine you’re driving a car. Your speedometer doesn't just tell you if you're moving; it tells you precisely how fast. Delta brings that same level of clarity to your options trades. It’s the first and most important of the option trading greeks—a set of metrics traders use to measure how sensitive an option is to different market changes.

Delta is your direct link between the stock’s price movement and your option's premium. It turns abstract market predictions into concrete, actionable numbers.

This relationship is fundamental for every options trader, whether you're just selling your first covered call or managing a complex portfolio. Understanding it is what separates strategic trading from simple guesswork.

Key Takeaway: Delta measures how closely your option's price will track the stock's movement. A higher delta means the two will move more in sync, dollar for dollar.

Positive vs. Negative Delta

The direction of this relationship—whether your option gains or loses value as the stock rises—depends on if you're trading a call or a put. This is a crucial distinction that defines the entire directional bet of your trade.

- Calls have a positive delta, ranging from 0 to +1.0. This means they have a direct relationship with the stock. When the stock price goes up, the call option's value goes up, too.

- Puts have a negative delta, ranging from -1.0 to 0. This signifies an inverse relationship. As the stock price rises, the put option's value falls.

This simple positive/negative framework is how you build bullish or bearish trades. If you think a stock is about to climb, you want a position with positive delta. If you're expecting a drop, a negative delta position is your tool of choice.

Quick Guide to Delta Characteristics

To keep it simple, here’s a quick summary of how delta behaves for calls and puts.

| Option Type | Delta Range | Price Relationship with Underlying |

|---|---|---|

| Call Option | 0 to +1.0 | Increases as the stock price rises |

| Put Option | -1.0 to 0 | Decreases as the stock price rises |

By mastering this one metric, you gain instant insight into how your position will react to market moves. It's the key to selecting the right strikes, managing your risk, and making sure your strategy truly aligns with what you expect the market to do.

What Delta Actually Tells You (It’s Two Things)

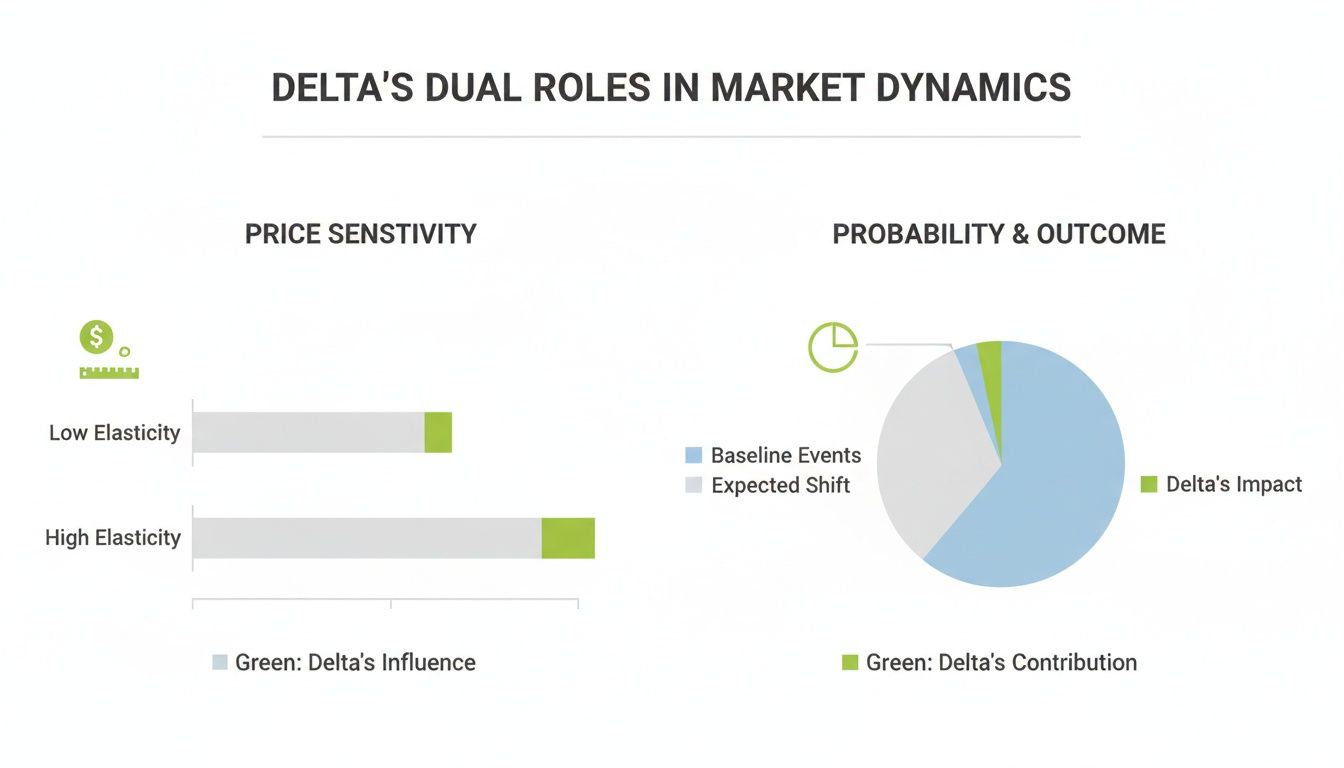

To really get a handle on delta, you need to think of it as a tool with two distinct, super-important jobs. It's not just a speedometer for an option's price. Understanding this duality is what separates traders who are just guessing from those who can clearly see both the reward and the risk in any trade.

First, delta is your direct measure of price sensitivity. It gives you a clean, simple answer to the question, "If the stock moves, how much does my option's price change?"

The second job is less obvious but is a total game-changer for strategy. Delta also acts as a quick-and-dirty probability calculator, giving you a snapshot of the market's odds that your option will finish in-the-money (ITM) when it expires.

Job #1: Delta as Price Sensitivity

Let's make this real. Imagine a stock, XYZ, is trading at $100 a share. You're looking at two different call options on it.

- Option A: A call option with a delta of 0.70.

- Option B: A call option with a delta of 0.30.

Now, let's say some good news hits, and XYZ stock jumps $2 to $102. Here's how delta plays out in the real world:

- Option A's Change: The $2 stock move is multiplied by its 0.70 delta, so the option's price increases by $1.40 per share. Since one contract is 100 shares, that's a $140 jump in the contract's value.

- Option B's Change: The same $2 stock move is multiplied by its 0.30 delta, so its price only goes up by $0.60 per share. That contract's value increases by just $60.

This shows it perfectly: the higher delta option acts more like the stock itself, giving you a much bigger bang for the same buck move in the underlying stock.

Delta as Sensitivity: Think of it this way: Delta tells you exactly how many cents an option's premium will change for every $1 the stock moves.

Job #2: Delta as a Probability Gauge

This is where delta gets really powerful for building a strategy. Beyond telling you how much an option's price will move, it gives you a rough idea of its chances of expiring with any real value.

Just think of the delta value as a percentage. A delta of 0.30 doesn’t just mean a $0.30 price change per dollar—it also implies there’s roughly a 30% chance of that option finishing in-the-money. A 0.70 delta option? You guessed it—about a 70% probability of being ITM at expiration.

This insight completely changes how you pick your trades.

- Selling Options: Someone selling options might pick a low delta, like 0.20, because it has a high probability (~80%) of expiring worthless. That means they're likely to keep the entire premium they collected.

- Buying Options: On the other hand, a trader who is confident in a stock's direction might buy a higher delta option, like 0.60, because it has a better shot at paying off and will deliver bigger gains if they're right.

This is a powerful rule of thumb for any trader. At-the-money options usually have a delta right around 0.50, which tells you the market sees it as a coin flip—a 50/50 shot of finishing in or out of the money. You can learn more about how pros use this with options risk analytics on Schwab.com.

Delta as Probability: A 0.40 delta call has about a 40% chance of being profitable at expiration. It’s an instant gut check on your odds.

Once you start seeing delta through both these lenses, you can make smarter decisions on every single trade, balancing the potential profit with the real probability of success.

How Delta Changes with Price and Time

An option's delta isn't a "set it and forget it" number. Think of it as a living metric, constantly reacting to every tick in the stock price and every minute that passes. If you want to manage your positions effectively, you have to understand how delta shifts—it's key to anticipating changes in your risk and potential rewards.

Delta's behavior is tied directly to an option's "moneyness," which is just a fancy way of saying how close its strike price is to the current stock price. The logic is simple: the more certain an option is to finish in the money, the more it will act like the underlying stock.

This is where delta's dual personality comes into play. It's both a measure of price sensitivity and a rough estimate of probability, giving you two critical pieces of information in one number.

As the chart shows, this single metric gives you a powerful perspective, letting you gauge potential profit from price moves while also assessing your odds of success.

How Strike Price Influences Delta

The distance between your option's strike price and the stock's current price is the biggest factor determining its delta. This creates a whole spectrum of sensitivity, from highly reactive to almost completely indifferent.

Deep In-the-Money (ITM) Options: Imagine a call option with a $50 strike when the stock is trading at $80. It's deep in-the-money, and its delta will be very close to 1.0. For every $1 the stock moves, the option's price will move almost exactly $1. It's basically mirroring the stock's performance.

At-the-Money (ATM) Options: An option with a strike price right around the current stock price will have a delta near 0.50 (or -0.50 for puts). The market sees it as a coin flip—roughly a 50% chance of expiring with any value. These options offer a balance of risk and reward.

Far Out-of-the-Money (OTM) Options: Now consider a call with a $120 strike when the stock is still at $80. It's far out-of-the-money, and its delta might be near zero, say 0.05. A $1 move in the stock will only change the option's price by about five cents, making it far less sensitive to small price swings.

The Unrelenting Impact of Time Decay

Time is the second major force acting on an option's delta, and its effect is relentless. As an option gets closer to its expiration date, the certainty of its outcome shoots up, forcing its delta toward one of two extremes: 1.0 or 0. This process is driven by theta, the Greek that measures the rate of option time decay.

Let's look at how this plays out as expiration gets closer:

For an In-the-Money (ITM) Option: As time runs out, the probability of it finishing ITM becomes a near certainty. As a result, its delta will climb towards 1.0 for calls (or -1.0 for puts). The option sheds its speculative value and begins to trade purely on its intrinsic value, moving in lockstep with the stock.

For an Out-of-the-Money (OTM) Option: The opposite happens here. With less time for the stock to make a big move in your favor, the probability of the option expiring worthless skyrockets. Its delta will decay rapidly, collapsing towards 0. The option becomes less and less responsive to the stock price because its fate is all but sealed.

This acceleration of delta change near expiration is a critical concept for any trader to grasp.

A Trader’s Rule of Thumb: As expiration nears, winners (ITM options) get more sensitive to the stock's price, while losers (OTM options) become less sensitive.

The table below breaks down how delta typically behaves based on both moneyness and the march of time.

Delta Behavior Based on Moneyness and Time

| Moneyness | Typical Delta (Calls) | Typical Delta (Puts) | Impact of Approaching Expiration |

|---|---|---|---|

| In-the-Money (ITM) | 0.51 to 1.00 | -0.51 to -1.00 | Delta moves toward 1.0 (Calls) or -1.0 (Puts) as certainty increases. |

| At-the-Money (ATM) | Around 0.50 | Around -0.50 | Remains sensitive; will quickly move toward 1.0 or 0 based on stock movement. |

| Out-of-the-Money (OTM) | 0.00 to 0.49 | 0.00 to -0.49 | Delta decays rapidly toward 0 as the chance of expiring worthless grows. |

Understanding this dynamic allows you to see how your position's risk profile will evolve. A profitable ITM option will become more stock-like and carry more directional risk, while a losing OTM option will see its premium evaporate ever faster.

Putting Delta to Work in Your Trading Strategies

Knowing the theory is one thing, but actually using delta to make money is what really matters. Delta isn't just a number on your screen—it's a practical tool that helps you pick smarter strikes and manage your risk like a pro.

Let's get practical and see how delta in option trading can sharpen two of the most popular income strategies out there: the covered call and the cash-secured put. By applying delta, you can stop guessing and start making data-driven moves.

Using Delta for Smarter Covered Calls

The covered call strategy is straightforward: you sell a call option against shares of a stock you already own. It's a fantastic way to generate income, but there's always a trade-off. You have to balance the premium you pocket against the risk of having your shares "called away" if the stock price soars past your strike.

This is exactly where delta becomes your best friend.

A popular rule of thumb for covered call writers is to look for options with a delta around 0.30. Here’s why this number is often the sweet spot:

- Premium vs. Risk: A 0.30 delta option usually pays a decent premium. It’s far enough out-of-the-money to give your stock some breathing room to grow without getting assigned right away.

- Probability at a Glance: Remember, delta is your shortcut to probability. A 0.30 delta means there’s roughly a 30% chance the option will expire in-the-money. Flip that around, and you've got about a 70% probability of keeping your shares and the full premium.

This quick check lets you instantly size up the risk versus the reward. You're no longer just picking a strike price that "feels" right; you're choosing one based on a specific, calculated probability that fits your goal of earning income while holding onto your stock.

Example: A Covered Call in Action

Let's say you own 100 shares of ABC, currently trading at $150. You want to sell a covered call to make some extra cash. You pull up the option chain and see a few choices:

- The $155 strike call has a 0.50 delta. (Juicy premium, but a ~50% risk of assignment)

- The $160 strike call has a 0.30 delta. (Good premium, ~30% risk of assignment)

- The $165 strike call has a 0.15 delta. (Smaller premium, only ~15% risk of assignment)

Choosing the $160 strike with its 0.30 delta is a strategic move. You collect a solid premium while taking on a calculated 30% risk that your shares get sold for $160 each—which is still a $10 gain from where the stock is trading now.

Choosing Cash-Secured Puts with Delta

With a cash-secured put, you sell a put option and keep enough cash on hand to buy the stock at the strike price if you're assigned. Traders do this for two main reasons: to earn income or to buy a stock they like at a lower price.

Delta is the key to making sure the trade lines up with what you really want to happen.

If your main goal is to actually buy the stock, you might sell a put with a higher delta, like 0.50 or 0.60, since it has a better shot at being assigned. But if you're just in it for the income and would rather not buy the stock, a lower delta is your go-to.

For traders focused purely on income, that 0.30 delta is a popular target once again. It signals there's only about a 30% chance you'll have to buy the shares, giving you a 70% probability of just keeping the premium and moving on. Knowing your probability of profit in options is a huge step toward building a strategy that lasts.

Example: A Cash-Secured Put in Action

Imagine you're eyeing company XYZ, which is trading at $50. You'd be happy to own it, but you think you can get it for a better price.

You check the option chain and find a put with a $47.50 strike price and a delta of -0.30.

By selling this put, you get paid a premium right away. From there, two things can happen:

- XYZ stays above $47.50: The option expires worthless. You keep the entire premium and don't have to buy the stock. A successful income trade.

- XYZ drops below $47.50: You're assigned and must buy 100 shares at $47.50. But because you already collected the premium, your actual cost is even lower. You just bought the stock you wanted at a discount.

In both of these popular strategies, delta cuts through the noise and gives you the clarity to make a smart decision. And it's not just for retail traders; institutional investors use delta as a cornerstone of their risk management. It’s also foundational for more complex positions, like in understanding credit spread vs debit spread strategies. Delta gives you the confidence to pick a strike that perfectly matches what you’re trying to achieve, whether that’s steady income, buying shares, or a little of both.

Using Delta to Hedge and Manage Risk

Beyond just picking strikes, delta’s real power lies in professional-grade risk management. It's the tool that lets you move from making simple directional bets to building finely tuned positions, giving you precise control over your portfolio's exposure to the market.

Advanced traders and market makers often aim for what's called delta neutrality. The goal is to build a position where the positive and negative deltas from different assets perfectly cancel each other out, bringing the net delta to zero.

Why would they do this? A delta-neutral position is initially immune to small moves in the underlying stock. Instead of betting on direction, these traders are isolating other factors, like time decay (theta) or changes in implied volatility (vega), to turn a profit while keeping directional risk off the table.

Achieving Delta Neutrality

Getting to a delta-neutral state is a balancing act. It’s all about pairing positions with positive delta (like owning stock or long calls) with positions that have negative delta (like long puts or short calls).

For instance, owning 100 shares of a stock gives you a delta of +100. Your position’s value moves dollar-for-dollar with the stock. It's a pure bullish bet. To hedge this, you need to add something with a delta of -100.

Example: Building a Delta-Neutral Position

Let's say you own 100 shares of XYZ stock. Your position delta is +100, and you're worried about a small dip but don't want to sell.

- Your Position: +100 delta from owning the stock.

- The Hedge: You check the option chain and find an at-the-money put option with a delta of -0.50.

- The Math: To get to a -100 delta, you need to buy two of these put contracts (2 contracts x -0.50 delta x 100 shares/contract = -100 delta).

- The Result: Your total position delta is now +100 (stock) + (-100) (puts) = 0.

Just like that, your position is delta-neutral. A small move up or down in XYZ won't really change the total value of your combined holdings.

This technique is a cornerstone of sophisticated delta in option trading, letting traders isolate and bet on other market variables. But remember, this balance is temporary. As the stock moves and time ticks by, the option's delta will shift (this is called gamma), and you'll need to make adjustments to stay neutral.

Calculating Your Portfolio Delta

You don't need to build complex neutral spreads to make this concept useful. You can apply the same logic to get a quick snapshot of your entire portfolio's directional bias. Just add up the deltas of all your stock and options positions to get one number: your portfolio delta.

This single metric tells you, in terms of "share equivalents," how much your portfolio value will change for every $1 move in the underlying stock.

- A portfolio delta of +350 means your holdings will act like you own 350 shares of the stock. You'll make about $350 for every $1 it goes up.

- A portfolio delta of -200 means you have a bearish tilt. Your portfolio will behave like a short position of 200 shares, gaining roughly $200 for every $1 the stock drops.

Knowing your total delta is a game-changer for risk management. It lets you quantify your exposure and make surgical adjustments. Too bullish ahead of an earnings report? You can sell some stock or buy puts to dial back your positive delta. Want to get more aggressive? Add long calls or sell puts to ramp it up.

For the most accurate numbers, traders lean on real-time data from their brokers. Major platforms are constantly calculating these risk metrics to keep you informed. You can learn more about how professionals use options risk analytics on Schwab.com.

Common Questions About Trading with Delta

As you get more comfortable using delta in your trading, you'll naturally start running into real-world questions. Let's tackle some of the most common ones that come up. Think of this as a quick-reference guide to clear up any lingering confusion and sharpen your practical skills.

Can an Option's Delta Change After I Buy It?

Yes, absolutely. An option's delta isn't static—it's always moving as the market breathes. The Greek that measures this rate of change is called gamma.

So, when the underlying stock price moves, the delta of your option will either climb or fall. Let's say you buy a call option with a delta of 0.50. If the stock rallies, pushing your option deeper in-the-money, its delta will start to climb, maybe to 0.70 or higher. This means its price is now even more sensitive to every dollar the stock moves.

Key Insight: Understanding that delta is a moving target is crucial for managing your risk. A winning trade can start acting more and more like stock, ramping up your directional exposure without you even realizing it.

Is a High Delta or a Low Delta Better?

Neither one is inherently "better" than the other. It all comes down to what you're trying to accomplish with a specific trade. The right delta is simply the one that aligns with your strategy and risk tolerance.

Here’s a simple way to think about it:

- High Delta (e.g., 0.80): This option is going to act a lot like owning the stock. It gives you a bigger bang for your buck if the stock moves your way, but it also costs more and carries more risk. A high delta is also the market's way of telling you there's a high probability of the option expiring in-the-money.

- Low Delta (e.g., 0.20): This option is less sensitive to the stock's price, making it cheaper and less risky. The trade-off is that it has a lower probability of finishing in-the-money.

For income-focused traders selling covered calls, a lower delta is often preferred because the goal is for the option to expire worthless. On the flip side, if you're making a strong directional bet, you might want a higher delta to get the most leverage on your prediction.

How Does Implied Volatility Affect Delta?

Implied volatility (IV) has a big say in an option's delta, especially for out-of-the-money (OTM) contracts. At its core, IV is just the market's forecast for how much a stock might swing around in the future.

When IV is high, it means the market is bracing for a potentially large move. This has the effect of inflating the delta of OTM options, because it gives them a better shot at becoming profitable before they expire. For instance, an OTM call that has a 0.20 delta in a calm market might see its delta jump to 0.30 or more if IV suddenly spikes.

Conversely, when IV is low, the delta of OTM options tends to shrink. For at-the-money (ATM) options, IV has less of a direct impact on delta, which tends to stay hovered around the 0.50 mark.

What Does My Total Portfolio Delta Tell Me?

Think of your portfolio delta as your dashboard's speedometer for directional risk. It boils down all your positions—stocks, calls, and puts—into a single number that tells you how much your portfolio's value will change for a $1 move in the underlying stock. It's often expressed in "share equivalents."

For example:

- If your portfolio has a total delta of +250, it will theoretically gain $250 for every $1 the stock price rises. You effectively have the same bullish exposure as owning 250 shares.

- A negative delta, like -100, means you have a bearish tilt. Your portfolio would gain about $100 for every $1 the stock falls.

Keeping an eye on your portfolio delta is one of the most powerful risk management tools you have. It allows you to see your overall exposure at a glance and make precise adjustments. If you feel you're too bullish heading into an earnings report, you can sell some stock or buy a few puts to bring that positive delta down. It’s a cornerstone of professional delta in option trading because it lets you quantify and control your risk with confidence.

Ready to stop guessing and start making data-driven decisions? Strike Price provides real-time probability metrics for every strike, empowering you to find the perfect balance between premium income and risk. Get smart alerts, track your performance, and build strategies based on real odds, not just gut feelings. https://strikeprice.app