Explain the Greeks for Options: A Complete Trader's Guide

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

If you’ve ever felt like you’re just guessing with options, the Greeks are what will shift your trading from speculation to strategy. Think of them as the instrument panel for your trades.

These metrics—all named after Greek letters—give you a clear readout on how sensitive your option's price is to things like a stock's movement, the simple passage of time, and overall market jitters.

What Are the Options Greeks and Why Do They Matter?

Imagine you’re flying a plane. You wouldn't just stare out the window and hope for the best, right? You'd keep a close eye on your altitude, speed, and fuel. The Greeks give you that same kind of critical feedback for your portfolio, translating complex market forces into data you can actually use.

Instead of just buying a call and hoping the stock rips higher, the Greeks tell you how much your option’s price is likely to change and why. They were born from the need to quantify an option's risk, a concept at the heart of the famous Black-Scholes pricing model.

This is what turns a black box of risk into a measurable science.

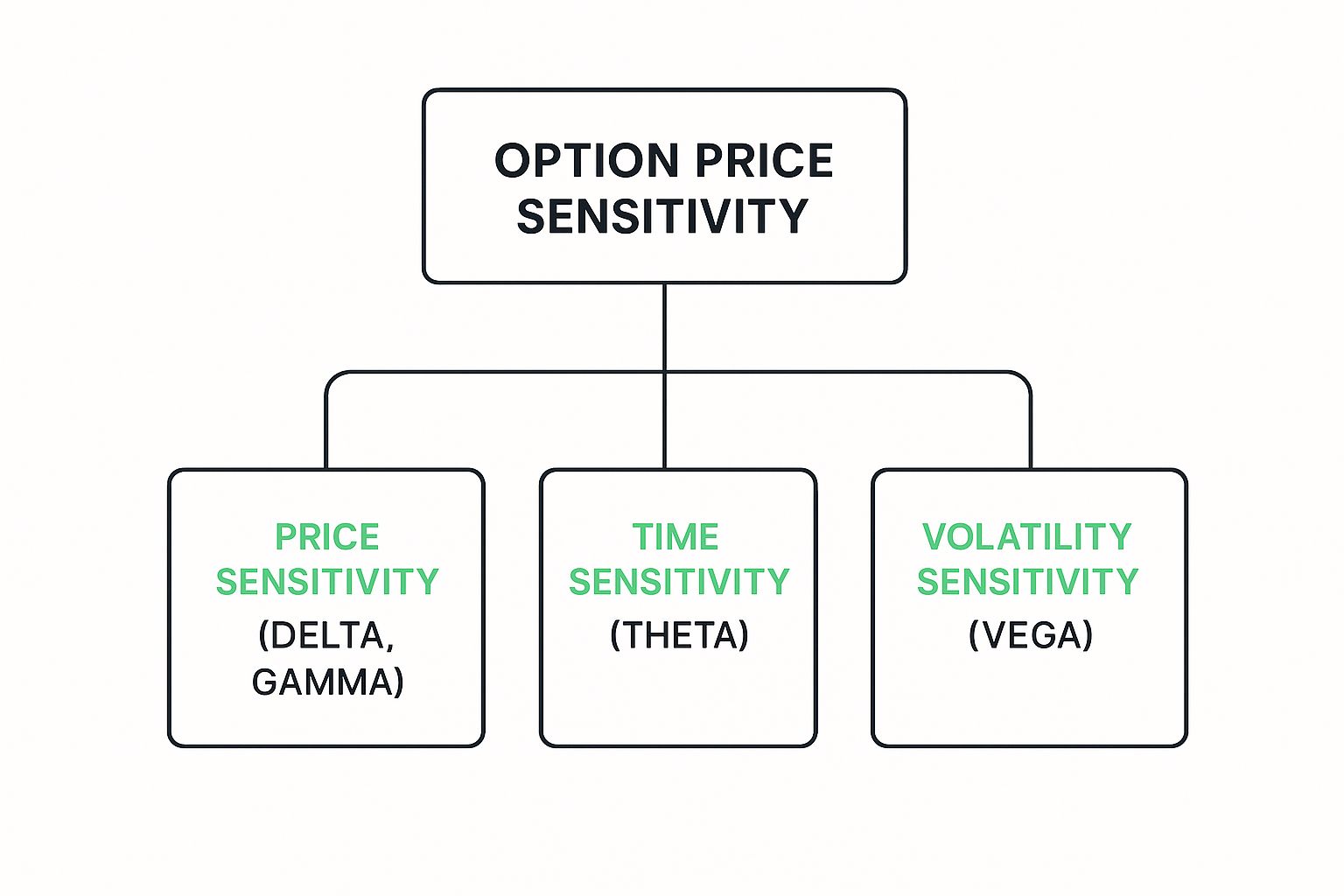

As you can see, an option’s price isn't just one thing. It's a blend of its sensitivity to the stock's price (Delta and Gamma), the ticking clock (Theta), and changes in market fear or uncertainty (Vega).

The Five Core Greeks You Need to Know

Each Greek offers a specific piece of the puzzle, telling you about the risks and potential rewards of your position. Understanding them one by one is the first step, but the real power comes from seeing how they work together.

To get you started, here's a quick reference guide to the five Greeks you'll encounter most often.

A Quick Reference Guide to the Five Options Greeks

This table breaks down each Greek, what it measures, and how it directly impacts your options position. It's a great cheat sheet to keep handy as you get more comfortable.

| Greek | What It Measures | Primary Impact |

|---|---|---|

| Delta (Δ) | Sensitivity to the underlying stock's price | How much your option's premium changes for a $1 move in the stock. |

| Gamma (Γ) | The rate of change in Delta | How quickly your directional exposure (Delta) changes as the stock moves. |

| Theta (Θ) | The rate of time decay | How much value your option loses each day just from time passing. |

| Vega (ν) | Sensitivity to implied volatility | How much your option's price changes when market fear or uncertainty goes up or down. |

| Rho (ρ) | Sensitivity to interest rates | How much your option's price changes when risk-free interest rates change. |

By learning to read these "gauges," you're no longer flying blind. You can see the risks building up or the opportunities taking shape right in front of you.

Here’s a snapshot of the main players you’ll be working with:

- Delta (Δ): This is your option's speed. It tells you how much its price should change for every $1 move in the stock.

- Gamma (Γ): This is your acceleration. It measures how fast your Delta changes, showing how quickly your directional risk can ramp up or down.

- Theta (Θ): Think of this as a melting ice cube. Theta measures time decay, showing you how much value your option loses every single day.

- Vega (ν): This tracks sensitivity to implied volatility. When the market gets nervous or "fearful," Vega shows how much that will inflate or deflate your option's price.

- Rho (ρ): This one measures sensitivity to interest rates. It's less of a concern for most short-term retail traders, but it’s still part of the complete risk picture.

When you start analyzing these metrics together, you gain a massive advantage. You can see these numbers in action by checking out our guide on using an options greeks calculator. In the sections ahead, we’re going to dive deep into each one.

Delta and Gamma: Gauging Price and Acceleration Risk

Imagine you’re driving. Your speedometer tells you how fast you're going—that’s your Delta. The accelerator pedal dictates how quickly you can speed up or slow down—that’s your Gamma.

When we talk about the Greeks in options trading, we have to start with these two. Why? Because they directly measure the risk and reward tied to a stock’s price movements.

Delta is the first and most important Greek to get a handle on. It tells you how much an option's price is expected to change for every $1 move in the underlying stock. It's a straightforward measure of your directional risk.

- Call options have a positive Delta (between 0 and 1.0).

- Put options have a negative Delta (between 0 and -1.0).

So, if you buy a call option with a 0.60 Delta, its premium should jump by about $0.60 if the stock pops $1. If the stock drops by $1, you can expect the premium to fall by roughly $0.60. This makes Delta an incredible tool for quickly sizing up a position's sensitivity to price.

Delta's Dual Role as a Probability Gauge

Here's where it gets really interesting. Delta isn't just about price sensitivity; it also doubles as a rough estimate of an option's probability of expiring in-the-money (ITM).

A call option with a 0.30 Delta has roughly a 30% chance of finishing ITM at expiration. This is a game-changer for strategies like selling covered calls or cash-secured puts, where you're specifically targeting probabilities.

For instance, a conservative covered call seller might pick a strike with a very low Delta, say 0.20, to collect premium with a high probability (80%) that the option expires worthless and they keep their shares.

Key Insight: Delta isn’t just about how much your option’s price will move; it's also a powerful shorthand for estimating the likelihood of your trade succeeding, a core metric for platforms like Strike Price.

This dual function makes Delta indispensable. You get a single, clean number that quantifies both potential profit and risk exposure. But Delta doesn't tell the whole story, because it's not a static value. And that's where Gamma comes into play.

Introducing Gamma: The Acceleration Metric

If Delta is your speed, Gamma is your acceleration. It measures the rate of change in Delta for every $1 move in the stock.

Put simply, Gamma tells you how quickly your directional risk (Delta) will ramp up or down as the stock price fluctuates.

Let’s go back to that 0.60 Delta call. If the stock rallies $1, the Delta won’t stay at 0.60. It might tick up to 0.65. That +0.05 change is all thanks to Gamma. This effect is most powerful for at-the-money options, especially as they get closer to expiration.

High Gamma means your option's Delta is extremely sensitive and can change dramatically with even small price moves. This can be fantastic if the stock moves your way but downright dangerous if it goes against you, as your losses can accelerate just as fast. Low Gamma, on the other hand, means your Delta is more stable.

Understanding Gamma is what separates beginners from seasoned traders. It shows you not just where your position is headed (Delta), but also how fast it’s getting there. This helps you stay ahead of the curve, preventing you from getting blindsided by a sudden acceleration in gains or, more importantly, losses.

Mastering Theta and Vega: Time Decay and Volatility

Beyond the simple up and down movements of a stock, two powerful, invisible forces are always at play with your option contracts: the steady tick of the clock and the wild swings of market fear.

To really get a handle on options trading, you have to understand these two forces, which we measure with Theta and Vega. Getting this right is what separates guessing from strategy.

Theta (Θ): The Melting Ice Cube

Think of Theta as a melting ice cube. Every option contract has a limited lifespan, and with each passing day, a little bit of its value—specifically, its extrinsic value—melts away. This erosion of premium is constant, predictable, and for an option buyer, completely unavoidable.

This daily loss is exactly what Theta measures.

For an option buyer, Theta is a relentless headwind. It’s the daily price you pay just to hold the contract and hope for a big move. But for an option seller? Theta is your best friend. It’s the primary engine that drives income for strategies like covered calls and secured puts, as you collect premium that is designed to decay over time.

The Inevitable Cost of Time

Theta is always shown as a negative number because it represents value leaving the option. So, a Theta of -0.05 means the option is expected to lose about $0.05 in value overnight, assuming the stock price and volatility don’t change.

While that might seem tiny, the effect of Theta isn't linear. It accelerates dramatically as an option gets closer to its expiration date. This is a crucial concept every trader needs to burn into their memory.

At-the-money options are notorious for experiencing the most aggressive time decay. In fact, some research shows that during the final week before expiration, Theta can wipe out 2% to 5% of an option's value every single day. You can dive deeper into the data on how this acceleration works at OptionMetrics.com.

This rapid decay is precisely why selling weekly or monthly options is such a popular income strategy. You’re essentially positioning yourself to profit from the period where the "ice cube" melts the fastest.

Vega (ν): The Fear Gauge

While Theta is slow and predictable, Vega (ν) is all about sudden, unpredictable shifts in the market’s mood. Think of Vega as the "fear gauge."

Vega measures how much an option's price will change for every 1% change in implied volatility.

When uncertainty skyrockets—maybe right before an earnings report or a big Fed announcement—investor fear goes up. This fear drives up demand for options, which inflates their prices. This inflation is what Vega captures. An option with a Vega of 0.15 will gain $0.15 in value if implied volatility ticks up from 30% to 31%, even if the stock itself doesn’t move a penny.

This leads to a simple but critical dynamic:

- Buying options: When you buy an option, you are "long Vega." This means you profit if implied volatility rises.

- Selling options: When you sell an option, you are "short Vega." This means you profit if implied volatility falls.

Understanding Vega is all about timing. Buying options when volatility is already sky-high (meaning Vega has already pumped up the price) is like buying a plane ticket the day before a holiday—you're paying a massive premium.

On the flip side, selling options when volatility is high can be incredibly profitable. You benefit from both Theta decay and a potential drop in volatility after the event passes. This one-two punch is a phenomenon traders call a "volatility crush." As you'd expect, options with more time until they expire will have a higher Vega, simply because there's more time for uncertainty to rear its head.

Understanding Rho: The Forgotten Greek

While Delta, Theta, and Vega get all the glory, there's one more Greek that often works quietly in the background: Rho (ρ). Rho measures how sensitive an option's price is to a change in interest rates. For most of us trading short-term contracts, its impact is usually so tiny it’s easy to ignore.

But to really master the Greeks, you have to understand the whole family. Think of it like this: when interest rates go up, the "cost of carry"—or the cost to tie up your money in stocks—also rises.

This has a small but direct effect on option premiums.

- Call options have a positive Rho. As rates climb, buying a call (which takes less capital) becomes a slightly more attractive alternative to buying the stock itself. This can give the call's value a tiny boost.

- Put options have a negative Rho. When rates are higher, holding cash from a stock sale earns more interest. This makes the protection a put offers slightly less valuable, which can drag its premium down a bit.

When Does Rho Actually Matter?

For the average trader selling covered calls or secured puts that expire in a few weeks or months, Rho’s impact is minimal. A quarter-point rate hike from the Fed might only shift your option's value by a penny or two.

So, when should you actually pay attention to it?

Rho’s importance spikes when the Federal Reserve gets aggressive. It became a much bigger deal during the post-2021 inflationary cycle, for example, when the Fed hiked rates by over 4% in just two years. When rates move that fast, even small Rho values can add up. You can find more historical data on how economic cycles affect the Greeks by exploring resources from OptionMetrics.

The other time Rho steps into the spotlight is with long-dated options (LEAPS), which have expirations a year or more in the future. With such a long time horizon, the cumulative effect of interest rate changes becomes much more significant.

For large institutional funds managing millions in long-term option positions, a small shift measured by Rho can have a very real financial impact across their entire portfolio.

Putting the Greeks into Action with Trading Strategies

Knowing what the Greeks measure is one thing. Actually using them to make smarter trading decisions? That's where the real value is. Let's move from theory to practice and see how you can deploy the Greeks to execute two of the most popular income strategies: the covered call and the cash-secured put.

These strategies aren't about just picking a strike price and crossing your fingers. They are calculated moves where the Greeks become your guide, helping you balance risk, reward, and probability to hit your specific goals.

Example 1: The Covered Call Strategy

A covered call is a fantastic strategy for generating income from stocks you already own. The idea is to sell a call option against your shares, collect a premium, and—ideally—have the option expire worthless so you can do it all over again.

The Greeks are absolutely essential for picking the right strike price.

Let's say you own 100 shares of stock XYZ, which is currently trading at $50. You want to generate some income, but you don't think the stock will make a huge upward move in the next 30 days.

- Your Goal: Collect a premium with a high probability of keeping your shares.

- Your Tool: Delta. Remember, Delta isn't just about price sensitivity; it's also a rough guide to the probability of an option expiring in-the-money.

- Your Action: You pull up the option chain and decide to sell a call with a 0.20 Delta. This tells you the strike has only a ~20% chance of being in-the-money at expiration, which gives you an ~80% probability of success.

You’ve just put the Greeks to work for you. By choosing a low-Delta option, you've deliberately tilted the odds in your favor. You're also benefiting from Theta (time decay), as the option's value will erode each day, pulling it closer to zero and solidifying your profit. You can dive deeper into these approaches in our guide on options income strategies.

Example 2: The Cash-Secured Put Strategy

A cash-secured put involves selling a put option while setting aside enough cash to buy the stock if it drops below your chosen strike price. With this strategy, your goal can be one of two things, and Delta is the key to executing either one perfectly.

Scenario A: You just want to collect premium. If your main goal is income, you’ll act just like the covered call seller. You’d sell a low-Delta put (like a -0.20 Delta) to maximize the probability that the option expires worthless, letting you pocket the full premium.

Scenario B: You want to buy the stock at a discount. What if you actually want to own the stock, but at a better price? This is where you can use a put with a higher Delta.

By selling an at-the-money put with a -0.50 Delta, you’re essentially accepting a ~50% chance of assignment. This gives you a coin-flip probability of either acquiring the stock at your desired price or simply keeping the premium if the stock price stays flat or moves up.

In the global options markets, professional traders have made the Greeks the centerpiece of their risk management. They use sophisticated techniques like Delta hedging, where they constantly balance their portfolio's exposure by offsetting positive and negative Delta positions. They make dynamic adjustments all day long to stay neutral. You can find out more about these historical risk control methods at Orats.com.

How the Greeks Work Together in Your Portfolio

The options Greeks never move in isolation. Think of them less like individual gauges and more like an interconnected dashboard on an airplane. When one reading changes, it can trigger a ripple effect across all your other risk exposures.

A sudden, sharp rally in a stock's price, for instance, doesn't just send your Delta soaring. That kind of rapid move can also crank up implied volatility, which directly impacts Vega. In a single market event, both your directional risk and volatility risk can shift, creating a powerful compounding effect.

This is exactly why looking at a single trade is a rookie mistake. Pro traders think bigger. They look at the net Greeks of their entire portfolio.

Your Portfolio's Net Risk Exposure

Your net Greeks cut through the noise and show you the bottom line: your total sensitivity to the big market forces. By adding up the individual Delta, Gamma, Theta, and Vega values from every single option you hold, you can answer the questions that really matter:

- Net Delta: How much does my entire portfolio stand to make or lose from a $1 move in the S&P 500?

- Net Vega: What’s my total exposure if market-wide volatility suddenly evaporates?

- Net Theta: How much total premium am I collecting (or paying for) from time decay, every single day?

Calculating your net exposure is the leap from just managing individual trades to strategically steering your entire portfolio. This perspective is the bedrock of a solid risk management plan.

This bird's-eye view lets you see how a new trade might balance out—or dangerously amplify—your existing risks. For example, selling a call (which has a negative Delta) can be a smart way to neutralize the positive Delta from a stock you own.

This is a deep topic, and our detailed guide to advanced options risk management dives much further into these portfolio-level strategies. Mastering this way of thinking is what separates a tactical trader from a strategic portfolio manager.

A Few Final Questions About the Greeks

Even after you get the hang of the concepts, it’s totally normal to have questions about putting them to work in the real world. Let's tackle a few of the most common ones traders ask. Getting these down will help you trade with a lot more confidence.

What Are Good Values for the Greeks?

This is a great question, but the answer is always, "It depends on your strategy." "High" or "low" is always relative. That said, there are some general benchmarks to keep in mind.

A Delta above 0.70 is definitely considered high. At that point, the option is behaving a lot like the stock itself. On the flip side, a Delta below 0.30 is low, which tells you there's a lower probability of the option finishing in-the-money.

- High Gamma and Theta are the hallmarks of at-the-money options that are getting close to expiration. This is the danger zone where both price risk and time decay are hitting their absolute peak.

- High Vega usually shows up in two places: longer-dated options (like LEAPS) or right before a big, uncertain event like an earnings announcement.

How Often Should I Check My Greeks?

The answer to this one comes down to your timeline. If you're running active, short-term trades—especially anything expiring in the next week or two—you should be looking at your Greeks every single day. Things can change incredibly fast as you near that expiration date.

For much longer-term positions, like options with a year or more to go, a weekly check-in is probably fine. The big exception is if there's a major market swing or if the stock price starts getting dangerously close to your strike.

The real takeaway here is this: the closer you get to expiration or a key price level, the more often you need to check in. The risks accelerate dramatically in those final days and weeks.

Do I Really Need to Master All Five Greeks?

Honestly, for most retail traders who are focused on income strategies like covered calls and secured puts, you can get by just fine by mastering four of them. Delta, Gamma, Theta, and Vega will cover over 95% of the risk you'll ever need to think about.

Rho, which tracks interest rate risk, is usually so small for short-term trades that its impact is almost zero unless the Fed is making some drastic, unexpected moves.

Focus on the big four first. If you get a solid feel for how they measure risk from price, time, and volatility, you'll already have a massive edge.

Ready to stop guessing and start trading with data-driven confidence? Strike Price gives you real-time probability metrics for every strike, smart alerts, and a consolidated dashboard to turn your options selling into a strategic, income-generating process. Join thousands of traders earning consistent returns today!