How Options Work A Simple Guide for Beginners

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

So, what are options, really?

At their core, options are financial contracts that give you the right, but not the obligation, to buy or sell a stock at a set price by a certain date. Think of it like putting a refundable deposit on a house. You pay a small fee to lock in today's price, which gives you the flexibility to walk away later if you change your mind. You aren't forced to buy.

What Exactly Are Stock Options?

Unlike buying a stock, where you own a small piece of a company, buying an option gives you temporary control over 100 shares of that stock for a fraction of the cost. This small shift in perspective—from ownership to control—is what makes options so powerful and versatile.

Before we dive deeper, let's clear up one of the biggest points of confusion for new traders by comparing options directly to stocks.

Key Differences Between Buying a Stock and Buying an Option

This table breaks down the fundamental differences between owning a stock and owning an option contract.

| Attribute | Buying a Stock | Buying an Option |

|---|---|---|

| Ownership | You own a piece of the company. | You own a contract, not the underlying stock. |

| Rights | You have voting rights and can receive dividends. | You have the right to buy or sell the stock, but no ownership perks. |

| Cost | You pay the full market price per share. | You pay a smaller "premium" for the contract. |

| Risk | Your risk is the entire amount invested. | Your risk is limited to the premium paid for the contract. |

| Lifespan | You can hold the stock indefinitely. | The contract has a set expiration date and will expire worthless if not used. |

As you can see, they are two completely different instruments designed for different goals. A stock is about long-term ownership, while an option is a strategic tool with a ticking clock.

Why Do Investors Use Options, Anyway?

So, why bother with this complexity? Because options open up a whole new world of strategic possibilities that you just can't get with traditional stock ownership. Their flexibility allows you to craft a trade for nearly any market condition—up, down, or sideways.

Here are the three main reasons people turn to options:

- Speculation: This is the most common use case. You can make a bet on a stock’s future direction—up or down—with way less capital than buying the shares outright. This gives you leverage, which can amplify your potential gains (and losses).

- Hedging: Think of this as buying insurance for your portfolio. If you own shares and are worried about a price drop, you can buy an option that profits if the stock falls, helping to offset some of your losses.

- Income Generation: Instead of buying options, you can sell them to other investors. By doing this, you collect an immediate cash payment, known as a premium, which is yours to keep no matter what.

This dynamic marketplace has exploded since the Chicago Board Options Exchange (CBOE) introduced standardized contracts back in 1973. Today, millions of contracts are traded daily across thousands of stocks, creating a massive ecosystem of strategic opportunities. If you're curious about the history and scale, Databento offers great context on the evolution of options trading.

Options transform investing from a simple buy-and-hold game into a strategic exercise in managing probabilities, time, and risk. They let you clearly define your potential profit and loss before you even enter a trade.

Ultimately, getting comfortable with options starts with grasping that core idea of controlling shares without actually owning them. Once that clicks, you'll start to see just how powerful they can be.

Understanding Calls and Puts

At the heart of every options strategy, you’ll find two fundamental building blocks: call options and put options. Getting a real feel for how these two contracts work is the key to unlocking everything else. They represent opposite views on a stock's future direction, which is what lets you tailor a trade for almost any market you can imagine.

Think of them as two sides of the same coin. One is built to profit when a stock climbs, and the other is designed to profit when it falls.

Let’s break them down.

Call Options: The Bullish Bet

A call option gives the buyer the right, but not the obligation, to buy 100 shares of a stock at a set price (the strike price) on or before a certain date. You buy a call when you think a stock's price is headed up.

It’s like getting a coupon to buy a hot new gadget at today’s price, but the coupon is good for the next three months. If that gadget’s price suddenly skyrockets, your coupon becomes incredibly valuable because you can still buy it at the old, cheaper price. A call option works the same way, gaining value as the stock rises above your strike price.

A call option is a bet on optimism. The buyer is speculating that the stock will perform well, while the seller is betting that it won't rise above a certain level before the contract expires.

Put Options: The Bearish Protection

A put option, on the other hand, gives the buyer the right, but not the obligation, to sell 100 shares of a stock at a locked-in price. You buy a put when you believe a stock's price is going to fall. It’s like buying an insurance policy for your investments.

Imagine you own a car valued at $20,000 and buy a policy that lets you sell it for $19,000, no matter what happens to its market value. If the car gets in an accident and its value drops to $12,000, that policy is a lifesaver. A put option does the same thing for your stocks, protecting you from downside risk by guaranteeing a sale price.

Buyer vs. Seller Motivations

For both calls and puts, the motivations of the buyer and seller are mirror images of each other. Understanding this dynamic is crucial for seeing how options work in the real world.

The Buyer: The option buyer pays a premium for control and potential. They’re either speculating on a big price move or trying to hedge an existing position to limit their risk. Their maximum loss is always capped at the premium they paid for the contract.

The Seller (or Writer): The option seller collects the premium as immediate income. They are essentially betting that the buyer's predicted price move won't happen. Their goal is for the option to expire worthless so they can keep the entire premium as profit. This income-focused approach is popular, but it comes with a completely different set of risks than buying.

This tug-of-war between buyers and sellers creates a dynamic market where an option's value is always changing. It’s influenced not just by the stock's price, but also by the relentless passage of time. To really get a handle on this, you can learn more about how time decay in options eats away at a contract's premium.

The Anatomy of an Option Contract

To really get how options work, you have to learn to read the contract like a blueprint. Each one has a few standard parts that spell out its exact purpose, value, and lifespan. Once you know what you're looking for, that confusing chain of numbers on a trading screen starts to make a lot more sense.

Think of an option as a super-specific agreement with three critical pieces. Nail these down, and you’ve cracked the code on an option's potential.

The Strike Price

The strike price is the heart of the contract. It’s the fixed price where you get the right to either buy (with a call) or sell (with a put) the stock. This price is locked in for the entire life of the contract, no matter how wild the stock's ride gets on the open market.

Let’s say you buy an Apple (AAPL) call option with a $190 strike price. You've just secured the right to buy 100 shares of AAPL for exactly $190 a pop. If AAPL’s market price skyrockets to $210, your right to buy at $190 is still intact, making your contract more and more valuable. The strike price is your anchor for the whole trade.

The Expiration Date

Every option has a ticking clock. The expiration date is the last day the contract is valid. After that day, it simply ceases to exist, and your right to buy or sell at the strike price vanishes. If you haven't sold or exercised it by then, it expires worthless, and the money you paid is gone.

This built-in deadline creates urgency and introduces a killer factor called time decay. As the expiration date inches closer, an option's value tends to shrink, even if nothing else changes. Why? Because there's less time for the stock to make the big move you’re betting on.

An option is a decaying asset. Its value is a mix of the stock’s current price and the time left on the clock. Time is a resource that’s always working against the option buyer.

The Premium

Finally, we have the premium. This is the price you pay to buy the option contract in the first place. It's the cost of getting the right to control 100 shares without having to shell out the cash to buy them outright. As an option buyer, this is the only money you can lose; your maximum risk is always capped at the premium you paid.

So, what decides the premium? It's a blend of a few key things:

- Stock Price vs. Strike Price: The closer the stock is to a profitable strike, the higher the premium.

- Time to Expiration: More time means more chances for the stock to move, so options with later expiration dates cost more.

- Volatility: If a stock is known for big, dramatic price swings, its options will be pricier to account for that uncertainty.

These three elements—strike price, expiration, and premium—are the DNA of every option. They're the essential dials you’ll be turning to build and manage every trade you make.

Visualizing Potential Profit and Loss

Reading about options is one thing, but to really get it, you need to see it. That's where payoff diagrams come in. They're simple graphs that map out your potential profit or loss as the underlying stock price moves, making abstract ideas like risk and reward feel tangible.

By visualizing a trade before you even place it, you can instantly spot your breakeven point, your maximum possible profit, and—just as importantly—your maximum potential loss. It's an incredibly powerful way to understand the very different risk profiles between buying and selling options.

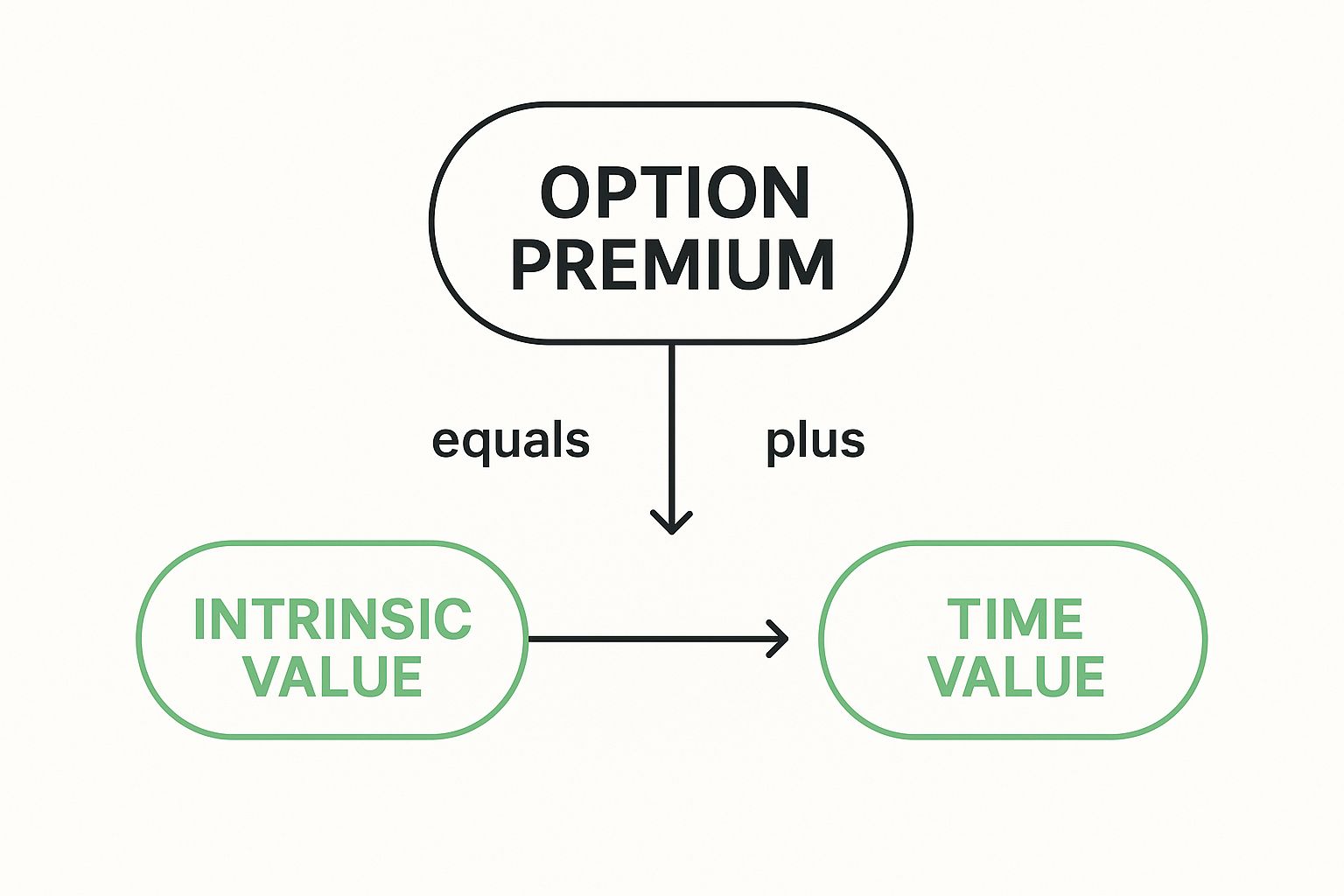

This visual breaks down the two key pieces that make up the premium you either pay or receive for an option.

As you can see, an option's premium is a mix of its real, tangible intrinsic value and its potential time value. This is exactly why a contract’s price is always on the move.

The Four Basic Payoff Profiles

Each of the four basic option positions—buying a call, selling a call, buying a put, and selling a put—has its own unique visual signature. Getting familiar with these shapes is fundamental to understanding how options actually work in the wild.

Here’s a quick tour of what you’d see on a payoff diagram for each position:

- Buying a Call (Long Call): The graph starts as a flat line showing a small loss (the premium you paid) until the stock price climbs past the strike price. From there, the profit line shoots up at a sharp angle, showing unlimited potential profit. Your risk is strictly limited to the premium you paid to get in.

- Buying a Put (Long Put): This one is the mirror image. You see a small loss until the stock price drops below the strike. Then, the profit line angles down, showing substantial profit potential as the stock price falls. Again, your risk is capped at the premium.

For an option buyer, the worst-case scenario is always known upfront. Your maximum loss is the premium you paid for the contract, period. This defined risk is a key reason traders are drawn to buying options.

- Selling a Call (Short Call): The seller's chart is just the buyer's flipped upside down. It shows a flat line of maximum profit (the premium you collected) as long as the stock stays below the strike price. But if the stock rises above it, the loss line angles sharply downward, pointing to unlimited potential risk.

- Selling a Put (Short Put): Similarly, this graph shows a flat profit line until the stock price drops below the strike. If it goes lower, the loss line angles downward, showing significant risk—though it is capped, since a stock's price can’t fall below zero.

These simple visuals cut right through the jargon. They show that option buyers pay a premium for a shot at huge profits with strictly defined risk. On the flip side, sellers collect that premium in exchange for taking on much greater, and often uncapped, risk.

Putting It All Together with a Covered Call

Alright, we’ve covered the basic building blocks of options. Now, let’s see how they work in the real world with a practical strategy. One of the most common ways investors generate extra cash from stocks they already own is through the covered call.

Imagine you own 100 shares of XYZ Company, which is currently trading at $50 per share. You’re bullish on the company long-term, but you don't see it making any huge jumps in the next month. Instead of letting those shares just sit there, you can put them to work.

Selling the Call Option

This is where you decide to sell one call option contract against your 100 shares. You look at the option chain and pick a contract with a $55 strike price that expires in 30 days. For selling this contract, another investor pays you a premium—let's say it's $2 per share.

That comes out to $200 total ($2 x 100 shares), and it goes straight into your account. This money is yours to keep, no matter what happens next. You’ve just generated immediate income from your stock.

The term "covered" simply means you already own the 100 shares needed to make good on the deal if the buyer decides to exercise their right.

By the expiration date, one of two things will happen.

A covered call allows you to get paid for agreeing to sell your stock at a higher price in the future. It turns a static holding into an active, income-generating asset.

Potential Outcome One: The Stock Stays Below the Strike Price

If XYZ stock is trading below the $55 strike price when the option expires, the contract is worthless to the buyer. Why would they exercise their right to buy your shares for $55 when they could get them cheaper on the open market? They won't.

In this scenario:

- The option simply expires.

- You keep the $200 premium.

- You keep your original 100 shares of XYZ.

The best part? You can repeat this process month after month, collecting more premiums and effectively lowering the cost basis of your investment over time.

Potential Outcome Two: The Stock Rises Above the Strike Price

Now, what if XYZ stock rallies and is trading above $55 at expiration—say, it hits $58? The buyer will definitely exercise their option. You are now obligated to sell them your 100 shares at the agreed-upon $55 strike price.

In this scenario:

- You sell your 100 shares for $5,500 ($55 x 100).

- You also get to keep the $200 premium you collected upfront.

You’ve locked in a solid profit on your stock and pocketed the premium. Sure, you missed out on the gains above $55, but you met your goal of a profitable exit at a price you were happy with.

For a deeper dive into the mechanics and benefits, check out our guide on what covered call options are and how they can fit into your portfolio.

An option's price isn't set in stone. It's constantly moving, reacting to forces in the market. You have to understand these drivers to get a feel for how your contract's value might shift over time—even when the stock price itself doesn't budge.

Two of the biggest forces are implied volatility and time decay. You can think of them as the wind and tide of the options market. You can't control them, but you absolutely have to respect them.

Implied Volatility: The Market's Fear Gauge

Implied volatility (IV) is a huge concept in options trading. In simple terms, it's the market's collective guess on how much a stock's price is going to swing around in the future. Higher IV means the market is expecting bigger, more dramatic price moves, which makes options more expensive for everyone.

A spike in IV can pump up an option's premium in a hurry, even if the underlying stock hasn't moved an inch. This gives you a great read on market sentiment and risk. For example, during big market shake-ups like the 2008 financial crisis or the COVID-19 pandemic, implied volatility for S&P 500 options went through the roof, sometimes hitting over 80%. That's a world away from the typical 15-20% average. You can discover more insights about market volatility on optionmetrics.com.

The Greeks: Delta and Theta

To measure these constantly shifting risks, traders use a set of calculations called "the Greeks." There are a few of them, but you really only need to know two to get started:

Delta: This tells you how much an option's price should change for every $1 move in the stock. A Delta of 0.50 means the option's premium will move up or down by $0.50 for every dollar the stock moves.

Theta: This is the measure of time decay. It shows you how much value an option loses each day as it gets closer to expiring. For an option buyer, Theta is the silent killer.

Think of the Greeks as the vital signs of your trade. Delta shows you how sensitive it is to price, while Theta reveals the slow, steady cost of time.

These forces are always in play, shaping the value of every single contract. Time decay, especially, has a massive impact on whether a trade ends up profitable, which is why figuring out what happens when options expire is such a critical next step.

Got Questions? Let's Get Them Answered.

As you start wrapping your head around how options work, it's totally normal for a few practical questions to bubble up. Think of this as the part where we connect the dots, clearing up the common "what ifs" that new traders run into.

Let's tackle the big ones.

What Happens if My Option Expires?

If your option hits its expiration date and isn't profitable—meaning the stock is below your strike for a call, or above it for a put—it simply expires worthless. The contract vanishes, and the premium you paid is gone. This is actually the most common outcome; a huge percentage of options expire without ever being exercised.

Now, if an option is even one penny "in-the-money" when it expires, most brokers will automatically exercise it for you. This is a big deal. You need to be sure you have enough cash in your account to either buy or sell the 100 shares per contract.

Do I Have to Hold an Option Until Expiration?

Absolutely not. In fact, most people who trade options don't.

You can sell an option you've bought at any point before the expiration date. This is how you lock in a profit or cut your losses short. It's often the smarter move, as it lets you cash in on the option's remaining time value before it inevitably decays to zero.

It's like a concert ticket. You don't have to wait until the night of the show to sell it. If demand for the band suddenly spikes, you can sell that ticket to someone else for a profit days or even weeks before the event.

Can Anyone Trade Options?

To trade options, you’ll need a brokerage account that's been specifically approved for it. This isn't just a box you check.

The approval process usually involves filling out a form about your investment experience, your financial standing, and how much risk you're comfortable with. Brokers have different approval levels, from basic strategies like covered calls all the way up to complex, multi-leg trades. For beginners just looking to buy and sell simple calls and puts, getting approved is usually pretty straightforward. It’s a necessary safety step brokers take to make sure you understand the risks you're taking on.

Ready to turn theory into action? Strike Price provides the real-time data and probability metrics you need to sell options with confidence. Stop guessing and start making informed, income-generating trades. Discover your strategy at https://strikeprice.app.