How to Calculate Intrinsic Value Like a Pro

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

Before we get into the nitty-gritty of the math, let's get one thing straight. To figure out a company's intrinsic value, you're essentially forecasting its future cash flows and then bringing those future dollars back to what they're worth today.

It's a process that cuts through the market noise to reveal what a business is actually worth, completely separate from its day-to-day stock price swings. This is the secret weapon for spotting genuinely undervalued companies.

Why Intrinsic Value Is Your Investing Superpower

Let's start with a foundational idea, one that legends like Warren Buffett built their fortunes on: price is what you pay, value is what you get.

Those two things are almost never the same. A stock's market price is a chaotic mix of headlines, herd mentality, and whatever mood Wall Street is in that day. Intrinsic value couldn't be more different. It's a sober assessment of a business's long-term ability to churn out cold, hard cash.

Think about it like buying a house. The seller's asking price might be sky-high because it's a seller's market. But a professional appraisal—which looks at the home's real condition, its location, and what it could realistically earn in rent—tells you its true, intrinsic value. Your job as an investor is to find great businesses when the market is having a sale, offering them for way less than that "appraised" value.

Setting the Stage for Calculation

The go-to method for this kind of "appraisal" is the Discounted Cash Flow (DCF) model. It’s the same technique the pros on Wall Street use, and we're going to break it down step-by-step.

Getting a handle on this isn't just learning a formula; it's like gaining a new sense. It lets you:

- Tune out the noise: Market freak-outs? Hype trains? You can ignore them and focus purely on the business fundamentals.

- Spot true bargains: It gives you the conviction to buy when everyone else is selling, because you know you're getting a great asset on the cheap.

- Own your decisions: Your investment thesis will be built on your own research, not some talking head's hot tip.

The whole point of a DCF model is to arrive at a logical, defensible estimate of a company's worth. This number becomes your anchor, a benchmark you can use to judge the market's often-wild price swings. The gap between your calculated value and the market price? That’s where opportunity lives.

Now, let's get ready to roll up our sleeves and actually calculate this thing.

Diving Into the Discounted Cash Flow Model

When serious investors talk about finding a company's "real" value, the Discounted Cash Flow (DCF) model is usually what they're talking about. It’s considered the gold standard for a reason, and it’s a lot less complicated than it sounds.

The whole thing boils down to one powerful idea: a company's true worth is the sum of all the cash it's going to generate in the future. But there’s a catch. You have to adjust that future cash for what it's worth today.

A dollar in your pocket right now is worth more than a dollar you’ll get ten years from now. That's because you could invest today's dollar and watch it grow. The DCF model simply applies this "time value of money" concept to an entire business.

The Three Pillars of DCF Analysis

To build a solid DCF model, you have to get three key pieces right. Nailing these inputs is what separates a good valuation from a wild guess.

- Forecasting Future Cash Flows: This is where you put on your analyst hat. You need to project how much cash the company will churn out over the next 5 or 10 years. Getting this right is everything, and learning how to improve cash flow is a great way to understand what drives these numbers.

- Picking a Discount Rate: Think of this as your "risk penalty." It’s a percentage that reflects how risky the investment is. A shaky, unproven company gets a higher discount rate, which pushes the present value of its future cash down. A stable blue-chip gets a lower one.

- Calculating a Terminal Value: A business doesn't just fall off a cliff after ten years. This number is your best estimate of the company's value from the end of your forecast period into eternity.

To help you keep these components straight, I've put together a quick cheat sheet.

Your DCF Model Cheat Sheet

This table breaks down the essential inputs for a DCF calculation and, more importantly, what they actually mean for your valuation.

| Component | What It Represents | Where to Find It |

|---|---|---|

| Free Cash Flow (FCF) | The actual cash a company generates after covering all its operating expenses and capital expenditures. | Company's financial statements (Cash Flow Statement). |

| Discount Rate (WACC) | The required rate of return or the riskiness of the investment. Often the Weighted Average Cost of Capital. | Calculated using market data, beta, and company debt information. |

| Terminal Value | The estimated value of the business beyond the initial forecast period (e.g., beyond Year 10). | Calculated using a perpetuity growth model or an exit multiple. |

Getting a feel for these inputs is what allows you to move from theory to practical application.

For instance, if you project a company's cash flows and apply an 8% discount rate, you might find its future earnings are worth $830 million today. If that company has 100 million shares out there, the intrinsic value comes out to $8.30 per share.

While we're talking about stocks here, the core idea of present value is universal in finance. It’s the same logic that helps you understand the difference when you https://strikeprice.app/blog/intrinsic-vs-extrinsic-option-value.

Calculating Intrinsic Value: A Practical Walkthrough

Alright, theory is great, but let's get our hands dirty. This is where we stop talking about concepts and start crunching real numbers on a real company. My goal here is to show you that this isn't some dark art reserved for Wall Street analysts—it’s a skill you can absolutely learn.

The first move is always to gather your materials. For a publicly traded company, that means diving into its financial statements, specifically the annual 10-K report. Think of this as your treasure map. It contains everything you need, from historical free cash flow to what management thinks about the future. This data keeps our valuation grounded in reality, not wishful thinking.

Projecting Future Cash Flows

First up, we need to forecast the company's free cash flows (FCF) for a certain period—usually the next five or ten years. Start by pulling the FCF from the last few years to get a feel for the baseline. Then, you'll apply a realistic growth rate based on its past performance, industry tailwinds, and common sense.

Pro Tip: The biggest mistake I see people make is getting way too optimistic with growth rates. A company that ripped 20% growth last year isn't going to hold that pace for a decade. It just doesn't happen. A more conservative, sober estimate will almost always give you a more reliable valuation.

The whole idea is to map out what the company's cash generation will look like over time.

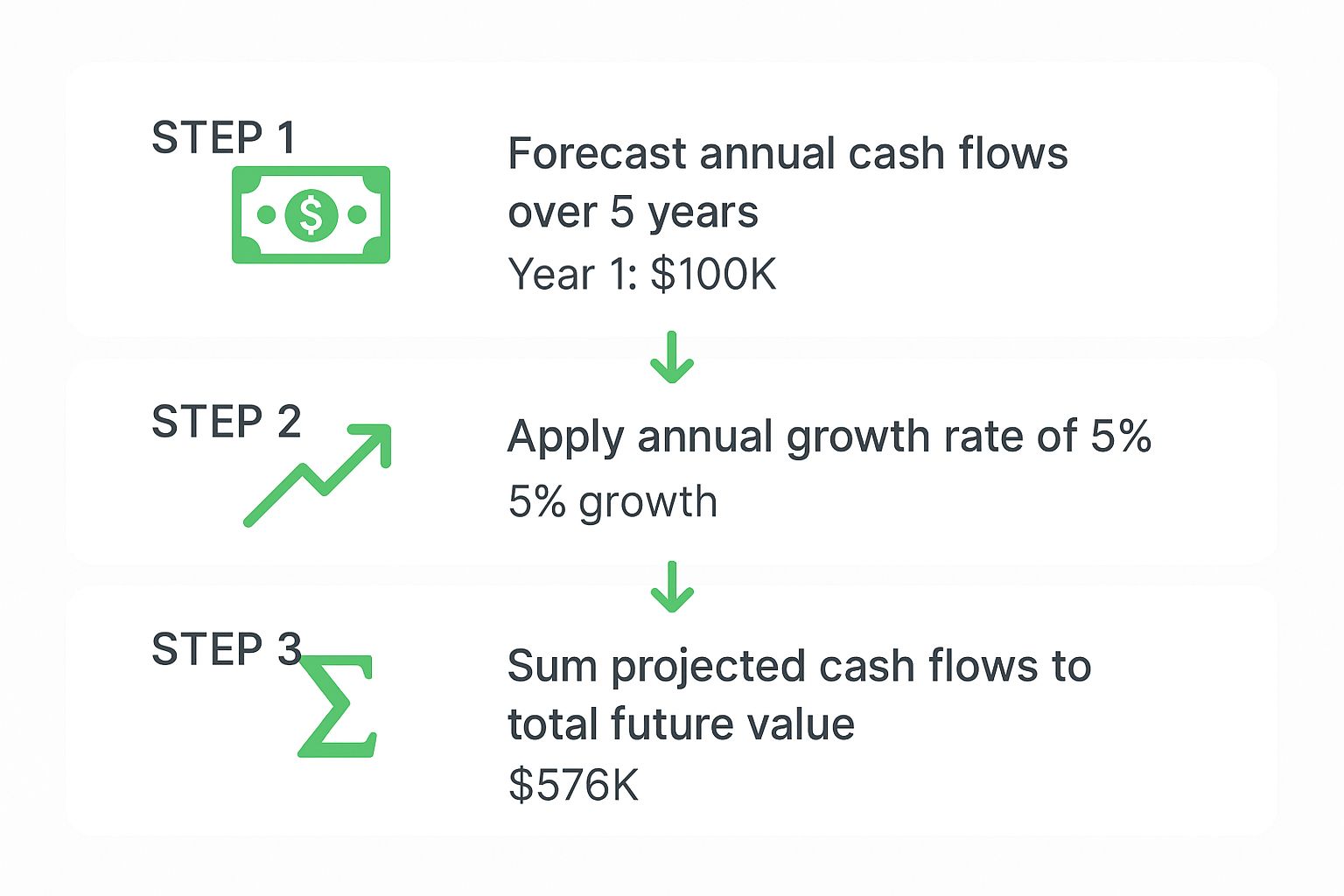

This visual shows how even small, steady growth starts to stack up, building the foundation of the company’s future value. From there, we just need to bring it all back to today's dollars.

Choosing a Discount Rate

Next, you need a discount rate. This is your "reality check" number. It represents the return you could reasonably expect from other investments with a similar level of risk. You could get formal and calculate the Weighted Average Cost of Capital (WACC), but you don't have to. Many investors just use a rate that reflects their personal required return—something in the 8% to 12% range is a common starting point.

This is where the magic happens. We use this rate to discount each year's projected FCF back to what it's worth today. After all, a dollar tomorrow is worth less than a dollar in your hand right now. This process is the core of intrinsic value—assessing the present value of all expected future cash by factoring in growth, margins, and risk.

While the fundamental concept is the same for stocks and options, the mechanics differ. It's crucial to understand how to calculate option premium separately, since it involves unique variables like volatility and time decay.

And it’s not just for public stocks. The same principles apply in the private world, where a 409A valuation is used to determine the Fair Market Value of a private company’s stock.

Once you’ve discounted all your future cash flows (and the terminal value), you just add them all up. That final number? That's your estimate of the company's intrinsic value.

The Art of Assumptions and Margin of Safety

A Discounted Cash Flow (DCF) model is an incredible tool, but it's only as smart as the numbers you feed it. Let’s be clear: it’s not a magic eight ball spitting out the perfect price. It’s a mirror, simply reflecting your own judgments and predictions about a company's future.

This is where valuation becomes more art than science. The final intrinsic value your model produces is completely at the mercy of your inputs.

A tiny tweak to your projected growth rate or your chosen discount rate can send the final value swinging wildly. Slap an overly optimistic growth forecast on a struggling company, and you can make it look like a diamond in the rough. Conversely, an excessively high discount rate can make even a market darling seem overpriced.

Why a Single Number Is a Trap

This extreme sensitivity is precisely why chasing a single, perfect intrinsic value is a fool's errand. You'll never get it exactly right.

The real goal isn't to find the number, but to define a probable range of what the business is actually worth. The best way I’ve found to do this is by running a sensitivity analysis. It's less complicated than it sounds—you just run your DCF model a few times with different assumptions to see how the value shifts.

- Best-Case: What happens if growth is a little stronger than you expect?

- Worst-Case: What if a recession hits and cash flows take a nosedive?

- Base-Case: This is your most realistic, most probable scenario.

By creating this range, you shift your mindset from seeking pinpoint accuracy to embracing probability. This is what separates novice investors from the pros. You stop asking, "What is this company worth?" and start asking, "What is the most likely range of its worth, and can I buy it at a price that still works out even if my pessimistic scenario plays out?"

How Assumptions Change Everything A Sensitivity Analysis

See how small adjustments in key inputs dramatically alter the intrinsic value per share for our example company.

| Scenario | Discount Rate Change | Growth Rate Change | New Intrinsic Value |

|---|---|---|---|

| Pessimistic | Increase by 1% | Decrease by 1% | $78.50 |

| Base Case | No Change | No Change | $95.00 |

| Optimistic | Decrease by 1% | Increase by 1% | $114.20 |

Even a single percentage point change in our assumptions creates a massive $35.70 swing in the final valuation. This really drives home why you can't just trust one number.

Embracing the Margin of Safety

This brings us to one of the most powerful ideas in all of investing: the margin of safety. Championed by none other than Warren Buffett, it’s the all-important buffer between what your analysis says a stock is worth and the price you actually pay.

Think of it as your built-in protection against being wrong.

"The three most important words in investing are margin of safety." - Warren Buffett

So, if your analysis points to a stock being worth somewhere between $80 and $100, you don't jump in and buy it at $79. You wait. You wait until the market, in its infinite and often irrational wisdom, offers it to you at a significant discount—maybe $60.

That $20 to $40 gap is your margin of safety. It's the cushion that protects your portfolio from flawed assumptions, unexpected bad news, or just plain old bad luck. This same logic is a cornerstone of solid options risk management, where protecting your downside is everything.

A margin of safety is what turns a good analysis into a great investment.

Turning Your Numbers Into Action

Alright, you've done the hard part. The cash flows are projected, you’ve settled on a discount rate, and you even have a range of potential values from your sensitivity analysis. So, what now? This is where the rubber meets the road.

The final step is beautifully simple: you compare your calculated intrinsic value range to the stock's current price on the market. That’s it. This single comparison is what separates disciplined investors from speculators. It’s your framework for making a call.

The Moment of Truth: Buy, Hold, or Sell?

This isn’t about finding a single magic number; it’s about creating a repeatable process you can trust. Your analysis will point you toward one of three clear paths.

- Buy: The market price is trading well below even your most pessimistic intrinsic value. This is what value investors live for—a significant margin of safety. It's a strong signal to start building a position.

- Hold: The stock’s price is floating somewhere inside your calculated range. This tells you the company is likely fairly valued. No need to rush for the exits, but it’s probably not the screaming bargain you’re looking for.

- Sell: The current market price has rocketed far past your most optimistic projection. This is a classic sign of an overvalued stock. It might be a good time to cash in your chips and lock in those gains.

The real goal here is building the discipline to trust your own analysis. The market will swing wildly based on news, hype, and fear. Your intrinsic value calculation is your anchor in that storm, keeping your decisions grounded in fundamentals, not feelings.

When you get to this stage, you've moved beyond just picking tickers on a screen. You're starting to think like an owner, making deliberate, informed decisions. You’ve built the skills to figure out what a business is actually worth—and the patience to act only when the price makes sense.

A Few Lingering Questions on Intrinsic Value

Even after you get the hang of building a Discounted Cash Flow (DCF) model, a few questions always seem to hang in the air. Let's clear them up so you can feel more confident in your own valuation work.

Are There Any Shorter, Faster Ways to Estimate Intrinsic Value?

You bet. While a DCF is the gold standard for a deep, fundamental analysis, sometimes you just need a quick read on a company. That's where valuation multiples come in handy.

- Price-to-Earnings (P/E) Ratio: This classic ratio pits the stock price against the company's earnings per share. It's a quick gut check on how expensive a stock is relative to its current profits.

- Price-to-Book (P/B) Ratio: This one compares the market price to the company’s net asset value on its books. It’s particularly useful for asset-heavy businesses like banks or industrial companies.

Think of these as useful shortcuts for initial screening. They give you a ballpark idea, but they lack the forward-looking detail that a proper DCF analysis provides. They’re a great supplement, but not a replacement.

How Often Should I Recalculate This Stuff?

I get this question a lot. My personal rule of thumb is to refresh my valuations at least once a year, right after a company drops its annual 10-K report. That’s when you get the most comprehensive, audited financial data.

Beyond that, you absolutely need to revisit your model any time something significant happens. We're talking about events that could fundamentally alter the company's future cash flows—a huge acquisition, a revolutionary new product launch, or even a major regulatory change that shakes up the entire industry.

What's the Biggest Mistake People Make When Calculating Intrinsic Value?

Hands down, the most common pitfall is getting way too optimistic with growth assumptions. It is so easy to get swept up in a company's narrative and project sky-high growth rates far into the future. That's a recipe for overpaying.

Another classic blunder is completely overlooking the balance sheet. A company can look like a cash-printing machine, but if it's drowning in debt, the whole thing can come crashing down. Always, always ground your forecasts in reality and stress-test them with a few different scenarios.

Ready to stop guessing and start making data-driven decisions? Strike Price gives you the real-time probability metrics you need to sell options with confidence. Our smart alerts and custom strategies help you maximize premium income while managing risk. Transform your options selling from a gamble into a strategic process at https://strikeprice.app.