How to Do Covered Calls a Modern Investor's Guide

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

At its core, a covered call is pretty simple: you sell someone the right to buy 100 shares of a stock you already own at a set price, and in return, you get paid a cash premium right away. The real magic happens when you repeat this process over and over, turning your stocks from passive holdings into a steady source of income.

A Modern Approach to Generating Income with Covered Calls

Forget the old "set-it-and-forget-it" mindset. Today’s traders are taking a much more active, data-driven approach, transforming their portfolios into reliable cash-flow engines. You own the stock, and you're essentially renting it out by selling someone the right to purchase it at a higher price by a certain date.

For providing this service, you collect an immediate cash premium. That money is yours to keep, no matter which way the stock moves. This guide will demystify the key components you can control, turning what often feels like guesswork into a calculated process for building dependable income.

Shifting Your Investment Mindset

The goal here is to stop just waiting for your stocks to appreciate and start making them work for you—right now. Each week or month presents a new opportunity to generate income from the assets you already own.

This isn’t about chasing random premiums. It's about systematically managing risk and reward using the three main levers at your disposal:

- Strike Price: The price you agree to sell your shares for.

- Expiration Date: The deadline for the option contract.

- Premium: The cash you get paid upfront for selling the option.

By mastering how these three elements work together, you can dial in your strategy to fit your own financial goals and comfort level with risk. While covered calls are a fantastic tool, you can see how they stack up against other methods in our guide to the best income-generating investments.

The real power of a modern covered call strategy lies in its repeatability. It's not a one-time trade but a continuous cycle of selling options, collecting premiums, and managing your positions to create a predictable income stream.

This process lets you slowly lower your stock's cost basis over time or simply use the cash flow to cover everyday expenses. Instead of just hoping for the market to deliver gains, you're actively creating your own returns.

Laying the Groundwork for Successful Covered Call Trades

Before you sell your first covered call, you need to get your house in order. Think of it as a pre-flight check. Getting these foundational pieces right is what separates consistent income from costly mistakes. It all starts with the number one rule of this game.

First thing’s first: you must own at least 100 shares of a stock for every single call contract you want to sell. A standard options contract always controls 100 shares. This is non-negotiable. Owning the stock is what puts the "covered" in covered call, saving you from the unlimited risk of selling a naked call.

If you sold a call without owning the shares, you'd be on the hook for potentially catastrophic losses if the stock rips higher. When you own the stock, your obligation to sell is backed by shares you already have, defining your risk and reward right from the start.

Choosing the Right Stock for Covered Calls

Not every stock is a good fit for selling calls. It’s easy to get lured in by stocks offering massive premiums, but those often come with wild volatility that can blow up in your face. The real goal is finding a sweet spot between a healthy premium and a quality company.

The perfect stock for a covered call is one you’d be happy to own for the long haul, even if it takes a temporary hit. If you wouldn't buy the stock on its own, don't sell calls against it. You're a shareholder first; the covered call is just a tool to boost your returns on that position.

It's a classic rookie mistake: picking a stock just because the options premium is high. A much smarter way is to start with a list of quality companies you already believe in, then see which ones have a good options market. You're building an income stream on top of a solid investment, not the other way around.

Look for companies with a track record of stability or at least predictable growth. You need some volatility to generate decent premiums, but jumping on erratic, news-driven stocks is a recipe for disaster. You'll end up getting your shares called away at the worst possible time.

Essential Characteristics of a Good Candidate Stock

To really sharpen your stock-picking process, you need a filter. This helps you move from just picking stocks to strategically selecting assets that are built for generating income.

A strong candidate usually checks these boxes:

- Liquid Options: You want to see high open interest and a tight bid-ask spread on the options chain. Liquidity is crucial. It means you can get in and out of your trades easily at a fair price without getting ripped off by slippage. Trying to manage a position in an illiquid market is a nightmare.

- Moderate Implied Volatility (IV): Yes, higher IV means higher premiums—and that's what we're after. But extremely high IV is a warning sign. It often signals a huge risk on the horizon, like an earnings report or some big company announcement that could send the stock price on a rollercoaster. You're looking for that goldilocks zone: enough IV for a good premium, but not so much that the risk is out of control.

- Long-Term Conviction: Ask yourself this simple question: "If this stock drops 20%, will I still be comfortable holding it and selling calls?" If the answer is no, walk away. This isn't a get-rich-quick scheme. The goal is to generate steady income, and that means sticking with your assets through the market's normal ups and downs.

By running potential stocks through this checklist, you start building a portfolio of assets that are perfectly suited for a long-term covered call strategy. That's how you set yourself up for consistent, repeatable income.

Using Data to Select Your Strike Price and Expiration

Once you’ve nailed down a solid stock for your covered call strategy, the next step is where the real art and science begin. Choosing the right strike price and expiration date isn't just a shot in the dark; it's a calculated decision you make with data. This is how you shift from simply selling calls to strategically engineering an income stream that fits your comfort zone.

The Weekly vs. Monthly Debate

A lot of traders get hung up on whether to sell short-term weekly options or longer-term monthlies. While monthlies can sometimes feel a bit safer, weekly options often give you a serious edge. Why? Because of something called accelerated time decay.

An option's value bleeds away fastest in the last few days before it expires. This is called theta decay, and it's the covered call seller's best friend. By selling weekly options, you're constantly putting your capital right in that sweet spot of rapid decay. This can lead to higher annualized returns and also gives you the nimbleness to adjust your strategy every seven days as the market shifts.

If you really want to get under the hood, it's worth understanding how option time decay works because it’s the engine that drives your premium income.

Let Probability Be Your Guide

For a covered call seller, the single most important metric is the probability of the option expiring worthless. Most decent brokerage platforms will show you this number. It’s the market’s best guess—in percentage terms—that the stock will stay below your strike price by expiration. Think of it as your secret weapon for balancing risk and reward.

It’s pretty straightforward:

- A high probability of expiring worthless (say, 85% or more) means the strike is a good distance from the current stock price. This is a much safer trade, but the premium you’ll collect will be smaller.

- A lower probability (maybe 60-70%) means your strike is closer to the money. This trade is riskier because your shares are more likely to get called away, but the premium you get paid will be a lot tastier.

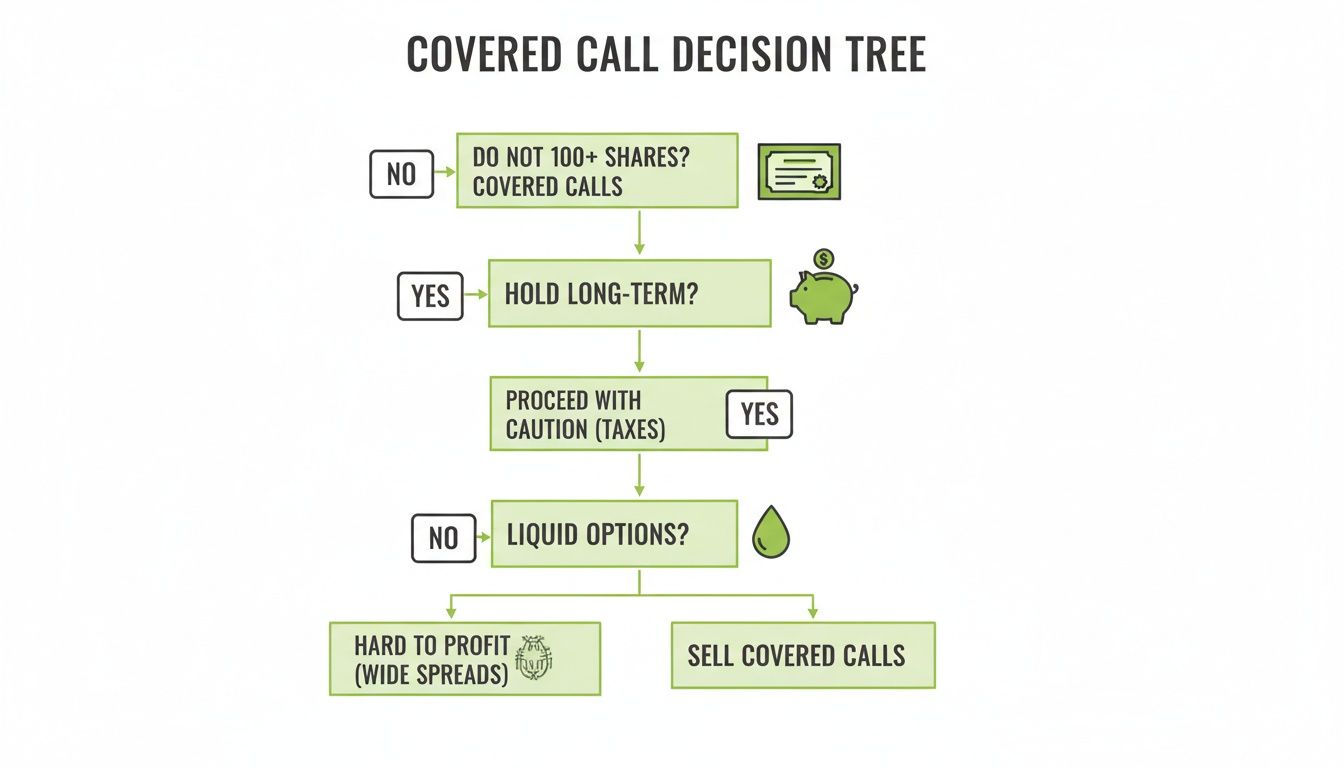

This simple flowchart is a great way to visualize the sanity checks you should run before you even start looking at strike prices.

This decision tree helps you confirm you're starting with a solid foundation before you dive into the numbers.

Ultimately, your own risk tolerance decides which path to take. Are you playing for small, consistent wins where you almost never lose your shares? Or are you okay with a higher chance of selling those shares in exchange for more cash in your pocket today? There's no right answer—only what works for your goals.

For many income-focused investors, the sweet spot is a strike price with a 70% to 85% probability of expiring worthless. This range usually offers a healthy premium while keeping the odds stacked firmly in your favor.

A Practical Strike Selection Framework

Let’s bring this down to earth. Imagine you own 100 shares of XYZ stock, which is trading at $100 a share. You open up the options chain for next week's expiration and see a bunch of different strike prices, each with its own probability and premium.

Your goal is to turn that raw data into a smart decision. This simple framework can help you categorize your choices based on your primary objective.

Strike Price Selection Framework: Safety vs. Yield

This table breaks down the classic trade-off: Do you want maximum safety, or do you want maximum yield?

| Strike Price Type | Description | Probability of Profit (POP) | Typical Premium Yield | Best For |

|---|---|---|---|---|

| Conservative | Strike is far above the current stock price | 85%+ | 0.5% - 1.0% Weekly | Investors who prioritize keeping their shares |

| Balanced | Strike is moderately above the current stock price | 70% - 85% | 1.0% - 2.0% Weekly | Generating consistent income with managed risk |

| Aggressive | Strike is very close to the current stock price | 50% - 70% | 2.0%+ Weekly | Maximizing premium, willing to sell shares |

If your main goal is to just hang onto your XYZ shares and skim a little extra cash off the top, that conservative strike is your play. You won’t get rich off the premium, but the odds of your shares getting called away are tiny.

On the flip side, if you're perfectly happy to sell your shares at a nice profit and want the biggest upfront payment, the aggressive strike is where the action is. The balanced approach, as you’d expect, is the happy medium that most covered call writers find themselves gravitating towards.

Using this data-first approach takes the guesswork out of picking a strike. It transforms a gamble into a calculated business decision—and that’s the core of any successful covered call strategy.

How to Execute and Manage Your Covered Call

You’ve done the homework—you’ve picked your stock, your strike price, and your expiration date. Now it's time to put your plan into action and officially put those shares to work. This is the moment you move from analysis to execution, and knowing the ropes here is what separates a confident investor from a nervous one.

The core of the transaction is a "Sell to Open" order. This specific command tells your broker you’re creating a brand-new short option position. You aren't selling an option you already own; you're writing a new contract from scratch and collecting the cash for it.

To do this, you’ll head to the options chain for your chosen stock and expiration date. You'll see two sides: calls and puts. On the call side, you want to focus on the "Bid" price for the strike you selected. The bid is the highest price a buyer is currently willing to pay, and it's the price you can expect to receive when you sell.

Placing the Trade: A Real-World Example

Let's walk through it with a real example. Say you own 100 shares of Microsoft (MSFT), and the stock is trading around $445. You've decided to sell a weekly covered call with a $460 strike price that expires this Friday.

Here's how it plays out in your brokerage account:

- Find the Options Chain: Pull up the MSFT options chain for the upcoming Friday expiration.

- Pick Your Strike: Zero in on the $460 strike price on the call side of the chain.

- Start the Order: Click on the bid price, which might be something like $1.20. This will usually pop up a pre-filled trade ticket.

- Check the Details: The ticket should auto-populate everything for you. Confirm you are Selling to Open, the quantity is 1 contract (for your 100 shares), the order type is a Limit Order, and your price is $1.20.

- Submit the Trade: Hit submit. If your order fills, you'll immediately see a $120 credit hit your account ($1.20 premium x 100 shares).

Using a limit order here is non-negotiable. It ensures you get the price you want (or better) and protects you from a bad fill if the market suddenly shifts.

The Three Outcomes: What Happens Next?

Once the call is sold and the premium is in your pocket, your job shifts from execution to management. From now until expiration day, one of three things will happen. Knowing each scenario helps you act decisively, no matter where the stock goes.

The best-case scenario for most income investors is for the option to simply expire worthless. This happens if MSFT stays below your $460 strike price when the market closes on expiration day.

Ideal Outcome: The Option Expires Worthless

Your $460 call option just fades away into nothing. You keep the entire $120 premium, and you keep your 100 shares of MSFT, ready to sell another call against them next week. This is the rinse-and-repeat cycle that builds a steady income stream.

Another possibility is the stock price falls. If MSFT drops to $435, your call is even further out-of-the-money and will definitely expire worthless. You still made $120 from the premium, but your underlying stock position has an unrealized loss. The premium acts as a small cushion—effectively lowering your cost basis—but it won't save you from a major stock decline.

The third outcome is assignment. This is triggered if MSFT rallies and closes above your $460 strike on expiration. The buyer of your call exercises their right to buy your shares, and your broker will automatically sell your 100 shares of MSFT for $460 each. You get to keep the $46,000 from the sale plus the original $120 premium. Assignment isn't a failure; it’s a planned, profitable exit at a price you agreed to beforehand.

The Art of Rolling Your Position

But what if expiration is getting close, MSFT is rallying, and you'd rather not sell your shares? This is where the powerful technique of "rolling" comes in. Rolling is just the act of closing your current option and opening a new one in a single move.

Imagine it's Thursday and MSFT is trading at $461. Your $460 call is now in-the-money, and assignment is looking like a sure thing. If you want to hold onto your shares, you can roll the position. It’s a two-part combo order:

- Buy to Close: You buy back your current $460 weekly call.

- Sell to Open: You sell a new call for the following week, maybe at a higher $465 strike price.

Often, you can do this for a net credit, meaning you collect even more cash after buying back the old option. This move lets you bank more premium, raise your potential sale price, and give the trade more time to work out. For a deeper dive into this essential skill, you might be interested in our complete guide on rolling over options effectively.

The Rise of Daily Options

The covered call landscape has changed dramatically with the introduction of daily, or 0DTE (zero-days-to-expiration), options. This innovation allows for an even faster income cycle.

The S&P 500 Daily Covered Call Index, which launched in October 2023, is a perfect example of this shift. Back-tested data from mid-2022 to the end of 2023 suggested this daily strategy could have yielded a cumulative gross premium of 23.03%. The big advantage is the ability to adjust your strike prices every single day and collect premiums far more frequently, cutting down on the opportunity cost of having your gains capped by a longer-dated option. You can learn more about these innovative covered call strategies and their performance.

Balancing the Risks and Rewards of Covered Calls

There’s no magic bullet in investing, and covered calls are no different. The people who succeed with them are the ones who truly understand the trade-offs. The reward is clear and compelling, but it comes with a risk you have to fully accept before you even think about placing a trade.

The main reward is obvious: income. The second you sell a call option, that premium hits your account. You can use that cash to lower your cost basis on the stock over time, generate a steady cash flow, or just reinvest it to let your returns compound. It also acts as a small buffer if your stock dips a little, offering a bit of a defensive cushion.

The True Cost of Capping Your Upside

The biggest risk, and the one you really need to wrap your head around, is opportunity cost. When you sell a call, you’re agreeing to sell your shares at a set price. You are capping your potential profit.

If the stock you own suddenly launches into orbit and blows past your strike price, you’ll miss out on all those extra gains. You'll still make a profit, sure, but it will be just a fraction of what you could have made by simply holding the stock.

This isn’t some theoretical risk. It’s a well-documented trade-off, especially in a roaring bull market. Data shows that while the S&P 500 delivered an average annual return of 10.46% from 1926 to 2021, a standard monthly covered call strategy on the index returned only 6.6% per year between 1996 and 2022.

Think about the historic bull run from March 2009 to December 2021. An investor just holding the S&P 500 saw a cumulative return of nearly 700%. The covered call investor? Just 200%. That’s a massive difference. You can dig into this performance comparison on ftportfolios.com.

This is the fundamental contract you make when selling a covered call: you are trading the potential for unlimited upside for the certainty of immediate income. Accepting this trade-off is the key to using the strategy without regret.

Understanding Downside Stock Risk

Here’s another critical point: selling a covered call does not protect you from a stock taking a nosedive.

Let's say you own 100 shares of a stock at $50 (a $5,000 position) and sell a call for a $100 premium. That premium is nice, but if the stock price plummets to $30 (now a $3,000 position), you’re still sitting on a $1,900 unrealized loss. The premium helps a little, but it won’t save you from a major drop.

This is exactly why the first rule of covered calls is to only use them on high-quality stocks you’re perfectly happy owning for the long haul. The real risk is always tied to the stock itself.

Taxes and Other Important Considerations

Finally, you can’t ignore the paperwork. Managing your positions means being aware of the tax implications. Any time you buy back options or your shares get sold, there are tax consequences.

Be especially mindful of the IRS wash sale rule if you’re actively managing positions, as it can affect your ability to deduct losses.

Brokerage fees, while usually small, can also add up over dozens of trades and chip away at your profits. Getting a firm grip on this complete risk-reward profile is essential. If you understand both the benefits and the limitations, you can use covered calls as an effective tool to hit your goals without getting blindsided.

Your Covered Call Questions, Answered

Even when you've got the mechanics down, new questions always seem to pop up. Let's tackle some of the most common ones that traders have when they first start writing covered calls. Getting these straight is the key to trading with confidence.

What Happens If My Shares Get Called Away?

First off, "assignment" sounds a lot scarier than it is. It's just a normal, and often profitable, part of the process.

Assignment simply means the option buyer exercised their right to buy your shares at the strike price you agreed to. This almost always happens when your stock is trading above your strike price as the expiration date hits.

Your brokerage handles the whole thing automatically. Exactly 100 shares per contract will be sold from your account at the strike price, and the cash shows up in your account. You keep 100% of the premium you originally pocketed, plus you get the full proceeds from the stock sale.

Don't think of assignment as a failure. Think of it as a planned and successful exit. You sold your stock at a target price you set in advance, all while collecting an extra cash bonus from the option premium.

How Are Covered Call Premiums Taxed?

This is a big one, because taxes directly impact your real returns. The way your premium gets taxed depends entirely on how the trade ends.

- If the option expires worthless: The premium you collected is usually treated as a short-term capital gain. That means it's taxed at your ordinary income tax rate.

- If your shares get assigned: The premium gets added to your sale proceeds from the stock. This effectively bumps up your stock's selling price, which is then used to figure out the capital gain or loss on the shares themselves.

Whether that final gain is short-term or long-term depends on how long you held the stock, not the option. Tax rules can get tricky, so it’s always a good idea to run things by a qualified tax professional to see how it all applies to your situation.

Can I Actually Lose Money Doing This?

Yes, you can absolutely lose money. It's critical to understand where that loss comes from, though. The loss isn't from selling the call option—that part always generates instant income. The real risk is the stock itself declining in value.

That premium you collect only provides a small cushion. For example, if you own $10,000 worth of a stock and sell a call for a $200 premium, but the stock’s value drops to $8,000, you’ve still got an unrealized loss of $1,800. The premium softened the blow, but it didn't stop the loss.

This brings us to the golden rule of covered calls: only use them on stocks you’re comfortable owning for the long haul anyway. The strategy is there to lower your cost basis and generate income, but it never removes the fundamental risk of owning stock.

Do Covered Calls Work in a Bear Market?

This is where the strategy can really pull its weight, at least on a relative basis. Covered calls might lag in a roaring bull market because your upside is capped, but they've historically provided a defensive buffer when things turn south. The steady stream of income from premiums can help offset some of the paper losses from falling share prices.

Take the 2022 bear market, for instance. The CBOE BuyWrite Index, which tracks a systematic covered call strategy, fell by about 11%. That's a lot better than the S&P 500's 17% drop over the same time. You can see similar patterns in past downturns, like 2008 and the 2000-2002 dot-com bust, where that premium income helped cushion the portfolio's fall. You can read more about this historical performance on atlasca.com.

Just remember, while they can reduce risk, they aren't a true hedge against a market crash.

Ready to stop guessing and start making data-driven decisions? Strike Price gives you the real-time probability metrics and smart alerts you need to confidently sell covered calls. Turn your portfolio into a consistent income engine by finding the perfect balance between premium and safety. Join thousands of successful income investors on Strike Price today!