How to Sell Covered Puts for Reliable Income

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

Selling a covered put boils down to this: you short a stock and simultaneously sell a put option against it. It's a fantastic income strategy for traders who believe a stock's price will stay flat or, more ideally, drift lower.

The "covered" part is key. It means your obligation to buy the stock (if the put is exercised) is protected by the short stock position you're already holding.

Getting to Know the Covered Put Strategy

The covered put is a more advanced play that mixes a bearish market view with steady income generation. It's often confused with its much more common cousin, the cash-secured put, but they are polar opposites. While a cash-secured put is a bullish trade, the covered put profits when a stock's price falls, chops sideways, or even rises just a little.

At its core, the strategy involves two moves you make at the same time:

- Shorting a Stock: You borrow and sell 100 shares of a stock, making a bet that its price will drop.

- Selling a Put Option: You sell one put option contract (which represents 100 shares) on that same stock, pocketing the premium right away.

Your goal is to make money from two places: the upfront cash from selling the put option and any interest you might earn on the proceeds from your short sale.

How the Trade Works in Practice

This strategy really shines when you have a moderately bearish outlook. If you're convinced a stock is about to plummet, you might be better off just shorting the stock or buying a put. The covered put is perfect for those scenarios where you expect a slow grind down or sideways price action, as this allows time decay to eat away at the value of the put you sold.

A key part of the setup is choosing the right option. Many traders who use this strategy go for a deep in-the-money (ITM) put. This just means the strike price is a good bit higher than where the stock is currently trading. Selling an ITM put gives you a much larger premium, which acts as a nice cushion if the stock decides to move against you and rally a bit.

But let's be crystal clear about the risk. The primary danger here is straightforward but severe: unlimited loss. Because you're holding a short stock position, a powerful and unexpected rally can cause losses that quickly dwarf the premium you collected.

Covered Puts vs. Cash-Secured Puts

It's easy to get these two put-selling strategies mixed up, but they're designed for completely different market views. A covered put is bearish, while a cash-secured put is bullish. Here’s a quick breakdown to keep them straight.

Covered Put vs Cash-Secured Put At a Glance

| Feature | Covered Put | Cash-Secured Put |

|---|---|---|

| Market Outlook | Bearish to Neutral | Bullish to Neutral |

| Goal | Get paid to short a stock | Get paid to buy a stock |

| How It's "Covered" | By a short stock position | By cash set aside to buy the stock |

| Max Profit | Premium received + (Stock price - Strike price) | Premium received |

| Max Risk | Unlimited (if stock rallies) | Substantial (if stock drops to zero) |

| Ideal Outcome | Stock drops, put is exercised | Stock stays above strike, put expires worthless |

This table makes the core differences obvious. With a covered put, you want the stock to fall so you can close your short position at a profit. With a cash-secured put, you want the stock to rise so you can just keep the premium.

Is It a Form of Arbitrage?

Some experienced traders view this strategy as a type of arbitrage, especially when they spot overvalued puts trading close to their intrinsic value. The thinking goes that by shorting the stock and selling a deep ITM put at the same time, the cash you get from both trades can be invested to earn interest. If the put gets exercised, the whole position basically closes out at breakeven, but you get to walk away with the interest you earned.

This approach requires a margin account and a rock-solid understanding of risk. Before you even think about placing your first trade, it's critical to have the fundamentals down cold. To build that foundation, feel free to dive into our comprehensive option trading tutorials, which cover a huge range of strategies from beginner to advanced.

Alright, theory's out of the way. Let's get our hands dirty and execute your first covered put. This is where the rubber meets the road, but you need to make sure your brokerage account is set up correctly first. You'll need approval for the right options trading level and a solid understanding of the margin requirements for shorting stock.

Your first step isn’t just finding a stock you’re bearish on; it’s finding the right kind of stock. I can't stress this enough. Chasing highly volatile or low-float stocks is a recipe for disaster. A sudden price spike can blow up your short position, leading to catastrophic losses. Stick with established, liquid companies, not speculative flyers.

Choosing the Right Stock and Option

Once you've zeroed in on a suitable company, the real craft begins: picking the perfect put option. This single decision is what shapes your potential profit, your risk, and your breakeven point. It's a big deal.

Here’s what I look for from experience:

- Strike Price: I almost always aim for a deep in-the-money (ITM) put. This means picking a strike price that's significantly higher than where the stock is currently trading. Why? A higher strike gives you a much larger upfront premium, which creates a nice, wide buffer against small upward moves in the stock.

- Expiration Date: You want an expiration that lines up with your forecast for the stock. A common sweet spot is choosing options that expire in 30 to 45 days. This window offers a great balance—you capture a meaningful premium, but you also get the benefit of noticeable time decay (theta) working in your favor.

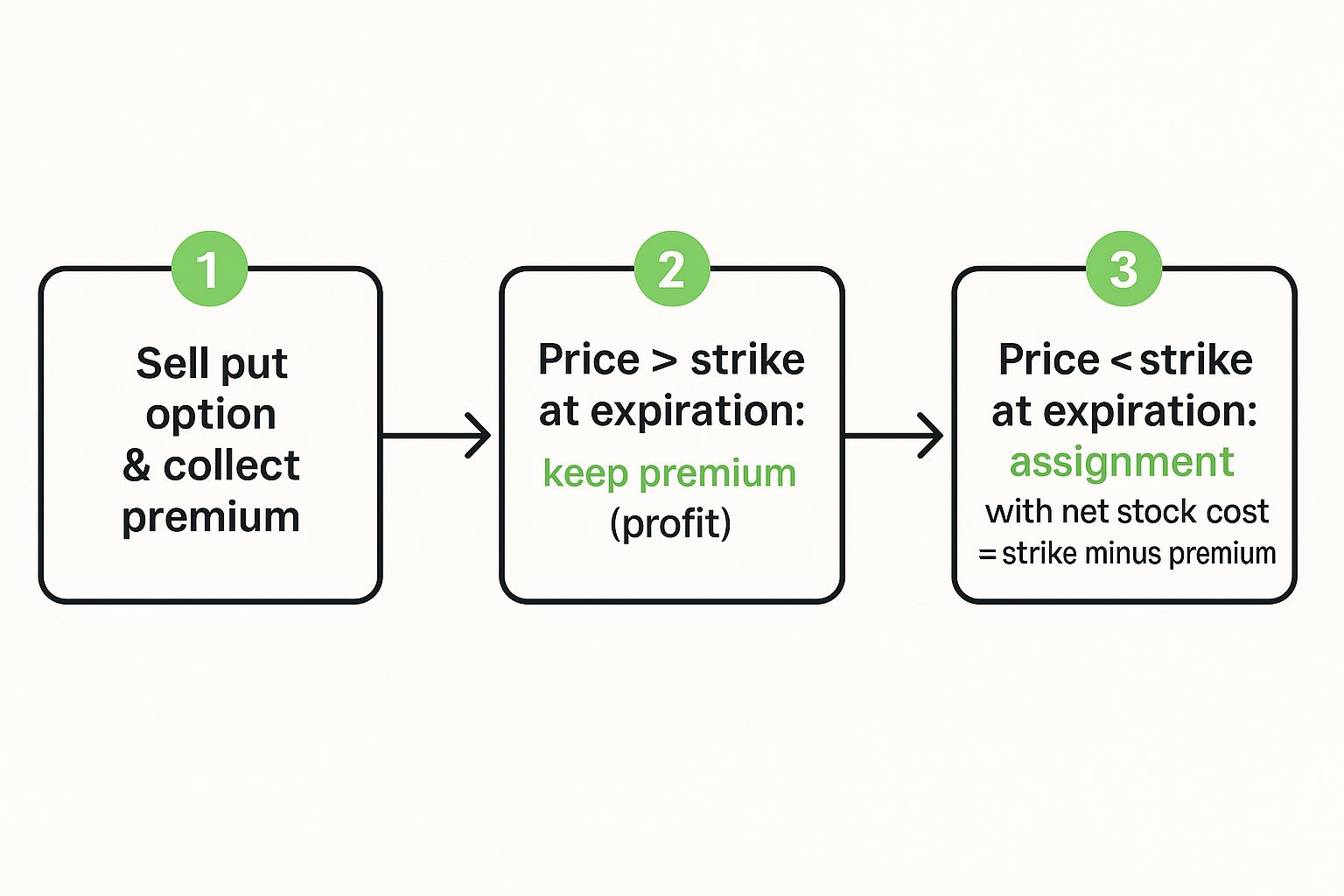

This image really helps visualize the profit and loss flow of the strategy, depending on where the stock price ends up at expiration.

As you can see, there are really only two main outcomes. Either the option gets exercised and you lock in a planned profit, or it expires worthless and you walk away with the premium you collected. Simple as that.

Placing the Multi-Leg Order

Here’s a critical point: you can't just place a covered put as two separate trades. You absolutely must use a multi-leg or "combo" order on your trading platform. This lets you short the stock and sell the put at the exact same time for a single net price, which is essential to making the strategy work.

Let's walk through a typical order entry. Imagine you're bearish on Apple (AAPL) and want to open a covered put:

- Action: Sell

- Strategy: Custom / Multi-leg

- Leg 1: Sell 100 Shares of AAPL (This is your short stock position)

- Leg 2: Sell 1 AAPL Put Contract (Choose your ITM strike and expiration)

- Order Type: Limit

- Price: Net Credit (This is the total cash you’ll receive upfront)

This setup is almost a mirror image of a cash-secured put, but you're using a short stock position as collateral instead of cash. If you want to see a direct comparison, check out our detailed cash-secured put example to see the key differences in how they're built and what they're for.

Ultimately, this strategy is all about generating income from a bearish or neutral view. Your order has to reflect that. The net credit you receive is your initial profit, locked in the second your trade gets filled.

Calculating Your Potential Profit and Loss

Before you ever put a single dollar on the line with a covered put, you absolutely have to understand the numbers. Let's walk through a real-world scenario to see how your profit and loss (P&L) can shift as the stock price moves. This kind of hands-on analysis is how you build an intuitive feel for the strategy's risk and reward.

Imagine you’re feeling bearish on stock XYZ, which is currently trading at $50 per share. You decide to open a covered put position.

- You short 100 shares of XYZ right at $50.

- At the same time, you sell one XYZ put option with a $55 strike price that expires in 45 days. For this, you collect a $6 premium per share, which is $600 in your pocket.

Right away, you've got a $600 cash credit. The goal here is for the stock to drop below your put's strike price by expiration. If that happens, you’ll be assigned the shares, which neatly closes out your short position for a planned profit.

Breaking Down the Numbers

Your breakeven point is critical—it’s the price where you don't make or lose a dime. For a covered put, you just add the premium you received to the price where you shorted the stock.

Breakeven Price = Short Stock Price + Premium Received In our XYZ example: $50 + $6 = $56

If XYZ is trading exactly at $56 per share when your option expires, you'll break even on the trade (not counting commissions). Any price above $56 means you're in the red.

Your maximum profit is also capped. You'll hit your max gain if the stock price falls to or anywhere below your put's $55 strike price by expiration. If it does, the put gets exercised, and you’ll have to buy 100 shares at $55. This action closes out your initial short position.

So, how much did you make? It’s the difference between your short sale price and the strike price, plus the premium you pocketed.

- Maximum Profit = (Short Stock Price - Strike Price) + Premium Received

- Here's the math: ($50 - $55) + $6 = $1 per share, for a total profit of $100.

The Uncapped Risk Factor

Now for the scary part. The biggest risk is painfully straightforward: if the stock rallies hard against you, your losses are theoretically unlimited. That $600 premium you collected offers a small cushion, but it won't do much if the stock decides to double. If XYZ rocketed up to $70, your $56 breakeven would be a distant memory, and you'd be staring at a major loss on your short stock position.

As you calculate your potential outcomes, don't forget about taxes. For some general insights into the taxation of investment profits, it's worth exploring external resources. This kind of strategic thinking isn't unique to covered puts. An investor selling a cash-secured put on a stable $100 stock, for example, might sell a $95 strike put for a $3 premium. That's a quick 3% return on their secured cash over just a couple of months.

Managing Your Position and Controlling Risk

Once your covered put trade is live, the real work begins. Successful options trading isn't a "set and forget" activity; it's a game of active management. Your primary job now is to watch how the underlying stock behaves, especially in relation to your breakeven point.After you sell a covered put, you need to track two things: the stock's price and the option's time decay (theta). Every day that passes, theta nibbles away at the value of the put you sold, which is exactly what you want. But a sharp, unexpected rally can wipe out those gains in a hurry and put your trade in a dangerous spot.

Defending Against a Rally

The single biggest threat to a covered put is a strong upward move in the stock. Since you're short the shares, your potential loss is, in theory, unlimited. This is where having a proactive risk plan is absolutely non-negotiable.

You should seriously consider setting a stop-loss order on your short stock position. For instance, if your breakeven point is $56, you might place a buy-to-cover stop order at $58. This acts as a hard ceiling on your potential loss, preventing one bad trade from turning into a portfolio-killer. Don't let hope be your strategy; let a pre-defined plan protect your capital.

Knowing when to cut the whole thing loose is just as important. If the stock rallies and trips your stop-loss on the shares, you should immediately buy back the put option you sold to close out the entire position. Taking a small, controlled loss is always the smarter move.

A disciplined exit strategy is the most important tool you have. The premium you collected is your cushion, but it will not save you from a runaway stock. Your stop-loss is your ultimate safety net.

To help you react quickly, here’s a breakdown of how to think about managing your trade as the market moves.

Risk Management Actions Based on Market Moves

This table outlines common scenarios you'll face and the actions you can take to stay in control of your covered put position.

| Market Scenario (Stock Price) | Potential Risk | Recommended Action |

|---|---|---|

| Stock price rallies toward breakeven | Unlimited loss potential on short stock | Monitor closely. Prepare to execute stop-loss. |

| Stop-loss on short stock is triggered | Position is bleeding significant money | Immediately buy back the short put to close the entire trade. |

| Stock price drops or moves sideways | Time decay erodes option value (good) | Let the position work. Consider taking profits early. |

| Stock nears expiration, profit at 80-90% | A sudden reversal erases gains | Close the entire position (buy back put, cover stock). |

By having a clear plan for each scenario, you remove emotion from the equation and can trade more systematically and safely.

Taking Profits and Redeploying Capital

What about when things go your way? If the stock has fallen and your option is getting close to expiration, you have a choice. While you could just let the position get assigned to capture your maximum profit, it’s often smarter to close the trade out manually.

When you've captured 80-90% of your potential profit, think about buying back the short put and covering your short stock. This locks in your gains and frees up your capital to hunt for the next opportunity. Holding on for that last 10% of profit usually isn't worth the risk of a last-minute market reversal.

Effective options trading risk management is all about balancing offense with defense. Know your exit points—for both wins and losses—before you even put the trade on.

Common Mistakes and How to Avoid Them

Knowing the mechanics of selling covered puts is one thing. Knowing how to avoid the pitfalls that can drain your account is another. Trust me, it’s much cheaper to learn about these mistakes here than from your own P&L statement.

The Siren Song of High Volatility

The single biggest mistake I see traders make is chasing volatility. It's so tempting. You see a high-flying "meme stock" with options offering absurdly juicy premiums, and you think you've found a goldmine.

This is a classic trap. A sudden rally, often fueled by nothing more than social media hype, can lead to devastating losses on your short stock position. Those losses can easily wipe out the premium you collected—and then some.

Stick to liquid, stable, large-cap stocks or broad-market ETFs. The premiums won't be as flashy, but surviving to trade another day is far more valuable.

Ignoring the Calendar and Your Margin

Another frequent blunder is completely overlooking assignment risk around ex-dividend dates. When you're short a stock, you are on the hook to pay the dividend to the shareholder you borrowed the stock from. This comes directly out of your pocket and eats into your profits.

What's more, the owner of the put you sold has a huge incentive to exercise their option early—right before the ex-dividend date—to capture that dividend themselves. This can force you out of your position early and at a potential loss.

Pro-Tip: Always, always check the ex-dividend calendar for any stock you’re about to short. If an ex-dividend date falls within your option's life, it's often smarter to just pick a different stock and avoid the headache.

Miscalculating your margin is another classic. Shorting stock ties up a good chunk of capital, and a sudden price spike can trigger that dreaded margin call from your broker. This forces you to close your position at the absolute worst time. Make sure you have more than enough capital to ride out any rough patches.

The Psychological Game

Perhaps the toughest mistakes to avoid are psychological. It's human nature to cling to a losing trade. When a stock rallies hard against your short position, it's easy to fall into the "hope" trap, praying for a reversal. This is exactly how small, manageable losses turn into account-crippling disasters.

Your best defense is to define your exit plan before you even enter the trade. Set a firm stop-loss on your short stock position and stick to it religiously. In trading, decisiveness beats emotion every time.

Don't just take my word for it. The data on put option performance highlights why discipline is so critical. A historical study of in-the-money puts from 1986-1989 showed a mean 12-week holding period return of -24.7% with a staggering standard deviation of 104.3%. That kind of extreme volatility is not something you want to mess with without a solid plan. You can dig into the full analysis of put option return variability yourself, but the takeaway is clear: this strategy demands discipline.

Covered Put FAQs: Your Questions Answered

Even when you've got a handle on the mechanics, it's totally normal to have a few questions about selling covered puts. This strategy has its own unique risks and quirks, setting it apart from more common options plays. Let's walk through some of the most common questions to clear things up.

What’s the Real Difference Between a Covered Put and a Cash-Secured Put?

The main difference comes down to your view of the market and how you set up the trade.

You sell a cash-secured put when you're bullish or neutral on a stock and you'd be happy to buy shares at a lower price. You're basically getting paid to wait for a discount.

On the other hand, you sell a covered put when you're bearish or neutral. You "cover" the put by shorting the stock, which is a bet that the price will either fall or stay flat. A cash-secured put makes money if the stock goes up, while a covered put makes money if the stock goes down.

What Happens If the Stock I Shorted Pays a Dividend?

This is a huge risk you absolutely can't afford to ignore. When you short a stock, you are on the hook for paying any dividends it issues. That payment gets pulled right out of your brokerage account, cutting directly into your trade's profit.

It gets trickier. The owner of the put you sold has a big incentive to exercise their option early—specifically, right before the ex-dividend date—so they can grab that dividend. This can force your entire position to close unexpectedly, often at the worst possible time. Always, always check the ex-dividend calendar before you short a stock.

What's the Best Type of Stock for Selling Covered Puts?

The sweet spot for covered puts is stable, large-cap companies with really liquid options markets. Think big, established businesses, not high-flying, volatile growth stocks.

The logic here is simple:

- Lower Volatility: The biggest enemy of this strategy is a sharp, sudden rally. Stable stocks are much less likely to have the kind of explosive upward moves that can rack up massive losses on your short position.

- High Liquidity: You need to be able to get in and out of the trade at a fair price. Liquid options have tight bid-ask spreads, which is essential for protecting your profit margin.

Another great approach is to use a broad-market ETF like SPY (tracking the S&P 500) or QQQ (for the Nasdaq 100). This helps you sidestep the single-stock risk that comes from a surprise earnings report or bad company news.

Can I Lose More Than My Initial Investment?

Yes. Absolutely. This is the single most critical risk to wrap your head around with covered puts. Because you are shorting the underlying stock, your potential loss is, in theory, unlimited.

If the stock price takes off and skyrockets, the loss on your short shares can balloon far beyond the small premium you collected. That initial cash is a nice cushion, but it provides almost no real protection against a powerful rally. This is exactly why disciplined risk management, especially using a mandatory stop-loss order on your short stock position, is non-negotiable for survival.

Ready to stop guessing and start making data-driven options trades? Strike Price provides real-time probability metrics for every strike, helping you balance safety and premium. Get smart alerts, track your contracts, and find tailored strategies that match your income goals. Transform your options selling from a gamble into a strategic process.

Explore how Strike Price can boost your income at strikeprice.app