8 Powerful LEAPS Option Strategies for Long-Term Gains

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

Unlocking Long-Term Growth: Your Guide to LEAPS Option Strategies

Welcome to the world of LEAPS, which stands for Long-Term Equity AnticiPation Securities. Here, strategic patience meets leveraged potential. Unlike short-term options that thrive on quick, volatile moves, LEAPS are designed for the long-haul investor. With expirations stretching a year or more into the future, they offer a unique way to participate in a stock's potential growth without the full capital commitment of owning shares outright. This extended timeframe significantly slows the pace of time decay, or theta, giving your investment thesis ample time to mature.

This guide moves directly into actionable strategies. We will explore a curated list of powerful LEAPS option strategies, each tailored for different market outlooks and risk appetites. You will learn specific techniques for everything from bullish growth plays and income generation to sophisticated portfolio protection. Whether you're aiming to supercharge your returns, create a steady income stream with less capital, or insure your portfolio against downturns, understanding these approaches is critical. Let's dive into how LEAPS can become a cornerstone of your investment framework.

1. The Foundation: Buy and Hold LEAPS Calls for Leveraged Growth

At its core, the simplest and most direct of all LEAPS option strategies is buying and holding a long-term call option. This approach functions as a stock replacement, allowing you to control 100 shares of a company for an extended period, often one to three years, at a fraction of the cost of an outright stock purchase. It's the quintessential strategy for expressing a long-term bullish conviction on a stock while precisely defining your maximum risk.

The mechanics are straightforward. Instead of deploying $15,000 to buy 100 shares of a $150 stock, you might purchase a two-year LEAPS call with a $150 strike price for a premium of $2,500. Your risk is capped at this $2,500 premium, but your potential profit is theoretically unlimited, mirroring the stock's upward movement. This capital efficiency frees up the remaining $12,500 for diversification or other investments. For those new to options, understanding the fundamentals of calls and puts is essential before deploying this strategy; for a deeper dive, you can explore this helpful guide to options trading for beginners.

When and Why to Use This Strategy

This strategy is ideal for investors with a strong, directional belief in a company's growth over a multi-year horizon. It's particularly effective for high-quality, but often high-priced, growth stocks where a full share position is capital-intensive.

- Best Use Case: You are highly confident that a stock like Apple (AAPL) or Tesla (TSLA) will appreciate significantly over the next two years but want to limit your initial cash outlay and define your risk. For instance, buying TSLA LEAPS calls in early 2019 would have provided massive, leveraged returns through its historic rally into 2021.

Actionable Implementation Tips

- Strike Selection: Choose an in-the-money (ITM) or at-the-money (ATM) strike price. An ITM LEAPS call with a delta of .70 or higher will move more closely in line with the underlying stock, providing a better stock-like performance while still offering leverage.

- Company Quality: Focus exclusively on fundamentally strong companies with clear growth catalysts, durable competitive advantages, and a history of stable growth. This is not a strategy for speculative, high-volatility meme stocks.

- Time Horizon: Always buy more time than you think you will need. If your investment thesis is based on a two-year outlook, purchase a LEAPS option with at least 2.5 years until expiration to mitigate the impact of time decay (theta).

- Volatility Check: Monitor the implied volatility (IV) of the options. The best time to enter a long LEAPS call position is when IV is relatively low, as this makes the option premium cheaper.

2. LEAPS Covered Calls (Poor Man's Covered Call)

The LEAPS Covered Call, often called the "Poor Man's Covered Call" (PMCC), is a sophisticated strategy that mimics the income-generating power of a traditional covered call without the substantial capital requirement of owning 100 shares. This diagonal spread involves buying a deep in-the-money (ITM) LEAPS call as a stock surrogate and then systematically selling shorter-term, out-of-the-money (OTM) calls against it. The goal is to collect premium from the short calls, lowering the cost basis of your long LEAPS position over time.

This approach offers a powerful combination of leveraged upside and consistent income generation, making it a favorite among income-focused options traders. Instead of tying up tens of thousands of dollars in stock, you can control the same 100 shares with a LEAPS call for a fraction of the cost, using the premium from the short calls to pay for the long-term option. It's one of the most capital-efficient leaps option strategies available.

When and Why to Use This Strategy

The PMCC is ideal for investors who are moderately to very bullish on a stock over the long term but also want to generate regular cash flow. It thrives in stable, upward-trending markets where you can consistently sell OTM calls that expire worthless, allowing you to keep the full premium.

- Best Use Case: You believe an index ETF like QQQ will gradually appreciate over the next 18 months. You could buy a deep ITM LEAPS call with a 0.80 delta and then sell monthly calls against it that are 5-10% out-of-the-money. The premium collected each month reduces your risk and can eventually pay for the entire LEAPS position, creating a "risk-free" trade with continued upside potential.

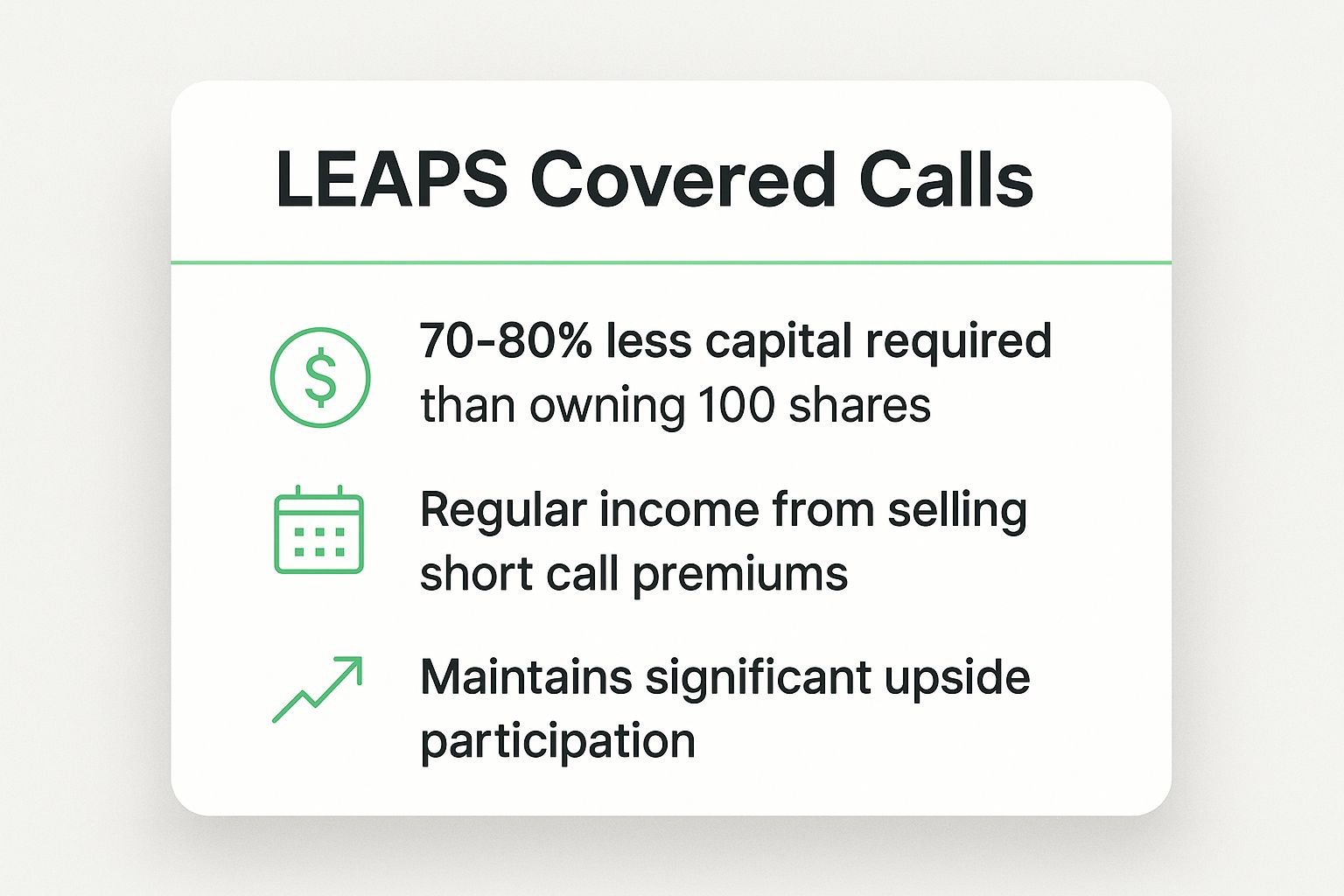

The following infographic highlights the core benefits of this capital-efficient strategy.

This visual summary underscores how the strategy dramatically lowers the barrier to entry for income generation while preserving significant growth potential. The platform Tastytrade and its founder, Tom Sosnoff, have been instrumental in popularizing this approach, emphasizing its mechanical, probability-based advantages for retail traders. For a deeper, visual explanation of the setup and management, the video below provides an excellent walkthrough.

Actionable Implementation Tips

- LEAPS Selection: Buy a deep ITM LEAPS call with a delta of at least .75 to .85. This ensures the option behaves very much like the underlying stock, minimizing risk from stock price declines.

- Time Horizon Ratio: Ensure the expiration of your long LEAPS call is at least twice as far out as the short calls you plan to sell. If you are selling monthly calls, your LEAPS should have at least six to twelve months until expiration to mitigate time decay.

- Short Call Management: Sell short calls with 30-45 days to expiration (DTE) to maximize premium from time decay. Actively manage these positions by closing them out for a 25-50% profit to lock in gains and avoid the risk of the stock moving against you and having your LEAPS called away.

- Net Credit Focus: The premium you receive from selling the short call should be a meaningful percentage of the time value (extrinsic value) in your long LEAPS. This ensures you are effectively "financing" your long-term position.

3. The LEAPS Put Spread: Defined-Risk for a Downward Trend

While many LEAPS option strategies focus on bullish outlooks, the LEAPS put spread offers a powerful, defined-risk way to capitalize on a long-term bearish thesis. This strategy involves buying a higher-strike LEAPS put and simultaneously selling a lower-strike LEAPS put with the same distant expiration date. The premium received from selling the lower-strike put reduces the net cost of the position, making it a capital-efficient way to bet against a stock.

This vertical spread creates a clear profit and loss scenario. Your maximum loss is capped at the net debit paid to enter the trade, while your maximum profit is the difference between the strike prices minus the net debit. It's a strategic choice for an investor who believes a stock will decline over the next one to two years but wants to avoid the higher cost and theta decay of an outright long put. This approach isolates a specific price range for potential profit, making it a more targeted bearish instrument.

When and Why to Use This Strategy

The LEAPS put spread is ideal for investors anticipating a moderate to significant, multi-year decline in a stock's value due to fundamental headwinds. It is particularly useful when you believe a stock is overvalued but want to strictly limit your potential loss and reduce the upfront capital required.

- Best Use Case: You foresee sustained challenges for a company, such as a real estate investment trust (REIT) facing a prolonged period of rising interest rates, which typically pressures property values. Another example would be establishing a LEAPS put spread on a company like Netflix during a period of intensifying streaming competition, anticipating a slow erosion of its market dominance over the coming years.

Actionable Implementation Tips

- Strike Selection: Target strike prices that represent a realistic, plausible downside scenario. The long put should be at-the-money (ATM) or slightly out-of-the-money (OTM), while the short put defines the lower boundary of your expected price decline. Spreads of 10 to 20 points are common for higher-priced stocks.

- Risk Management: Aim to close the position when it has achieved 50% to 75% of its maximum potential profit. Waiting for full profit exposes you to unfavorable price swings and gamma risk as expiration nears, which can quickly erase gains.

- Monitor Assignment Risk: If the stock price drops significantly and your short put moves deep in-the-money (ITM), be aware of the risk of early assignment. While uncommon for long-dated options, it's a possibility you should be prepared to manage.

- Cost vs. Probability: A wider spread between the strikes offers a higher potential reward but also comes with a higher net debit (cost). A narrower spread is cheaper but has a lower maximum profit. Balance this trade-off based on your conviction and risk tolerance.

4. The LEAPS Straddle: Betting on Long-Term Volatility

While most LEAPS option strategies focus on a directional bias, the LEAPS straddle is a pure volatility play. It involves simultaneously buying a long-term call and a long-term put with the same strike price and expiration date. This strategy profits from a significant price move in the underlying stock, regardless of whether it's up or down, making it ideal for situations where you anticipate major disruption but are uncertain of the outcome.

The core principle is that the profit from the winning leg of the trade must eventually overcome the total premium paid for both the call and the put. The extended timeframe of LEAPS provides a wide runway for a significant catalyst to unfold and drive the stock price far from the strike. Your maximum loss is limited to the total debit paid for the two options, which occurs if the stock price remains pinned at the strike price at expiration.

When and Why to Use This Strategy

This strategy is built for high-conviction, high-uncertainty events with a multi-year horizon. It’s a powerful tool when you believe a company is at a critical inflection point that will fundamentally revalue it, but the direction of that revaluation is unclear.

- Best Use Case: Consider a biotechnology firm with a blockbuster drug awaiting a final FDA decision two years from now. A positive outcome could cause the stock to double, while a rejection could cut it in half. A LEAPS straddle allows you to profit immensely from either binary event, capturing the explosive move without needing to predict its direction. It's also applicable to companies facing major antitrust litigation or potential M&A activity where the outcome is years away.

Actionable Implementation Tips

- Volatility Analysis: The ideal entry point is when current implied volatility (IV) is relatively low, or at least below the expected future historical volatility. High initial IV makes the straddle expensive and raises your break-even points.

- Catalyst Timeline: Ensure the LEAPS expiration date extends well beyond the expected date of the major catalyst. This gives your thesis ample time to play out and avoids rapid theta decay as the event approaches.

- Strike Placement: Purchase the straddle at-the-money (ATM), with the strike price as close as possible to the current stock price. This maximizes the position's sensitivity to price changes (gamma).

- Managing the Trade: After a significant price move, consider closing the profitable leg to lock in gains. You could then hold the losing leg as a cheap, long-shot bet on a sharp reversal or close the entire position to realize the net profit.

5. LEAPS Calendar Spreads: Profiting from Time's Passage

The LEAPS calendar spread, also known as a time spread, is a sophisticated strategy designed to profit from the passage of time. This approach involves buying a long-term LEAPS option and simultaneously selling a shorter-term option with the same strike price. The core principle is to capitalize on the accelerated time decay (theta) of the short-term option, which loses value much faster than the long-term LEAPS option. It's a nuanced way to maintain long-term exposure while generating income from near-term price stability.

This strategy establishes a net debit position, as the LEAPS option will always be more expensive than the shorter-dated option you sell. Your maximum profit is realized if the underlying stock price is exactly at the strike price when the short option expires worthless. This allows you to retain the full premium from the sold option while your long LEAPS option retains most of its value. This strategy is one of many that can be fine-tuned; understanding how to evaluate historical performance can be a significant advantage, and you can delve into the power of options strategy backtesting to refine your approach.

When and Why to Use This Strategy

This is an ideal strategy for a neutral to slightly bullish outlook on a stock over the short term, but a more bullish view over the long term. It excels in low-to-moderate implied volatility environments where you expect the stock to trade within a relatively predictable range in the coming weeks or months, but appreciate significantly in the long run.

- Best Use Case: You believe an index ETF like SPY will consolidate and trade sideways for the next 30-45 days before resuming its long-term uptrend. You could buy a two-year ATM LEAPS call on SPY and sell a 30-day ATM call against it. The premium from the short call offsets the cost of the LEAPS and profits if SPY remains near the strike.

Actionable Implementation Tips

- Strike Selection: Use at-the-money (ATM) or slightly out-of-the-money (OTM) strikes. An ATM strike maximizes the time value of the short option you are selling, leading to the highest potential income from theta decay.

- Active Management: Plan to manage the short leg actively. Close the short option when it reaches 50-75% of its maximum profit. You can then "roll" the position by selling another short-term option for the next expiration cycle, continuously generating income against your long LEAPS.

- Assignment Risk: Be vigilant about assignment risk. If the short call goes deep in-the-money (ITM), you may be assigned and forced to sell 100 shares. To avoid this, close or roll the position before it gets too deep ITM.

- Underlying Choice: Focus on stocks or ETFs, like those tracking high-dividend sectors or broad market indexes, that exhibit periods of consolidation or predictable range-bound trading. This stability is crucial for the short-term leg of the trade to succeed.

6. LEAPS Protective Puts: Long-Term Portfolio Insurance

The LEAPS Protective Put serves as a powerful form of long-term portfolio insurance. This strategy involves buying a long-term put option on a stock you already own, effectively setting a floor price below which your position cannot lose value. It's a strategic move for investors who want to protect their hard-earned gains from a significant market downturn while retaining all of the stock's future upside potential. This is one of the most direct and effective leaps option strategies for risk mitigation.

Unlike buying short-term puts for temporary protection, this approach provides a safety net that can last for years. If you own 100 shares of a stock trading at $200, you could buy a two-year LEAPS put with a $180 strike. This guarantees you the right to sell your shares for at least $180 anytime in the next two years, regardless of how far the stock might fall. This provides peace of mind for concentrated positions or during periods of high economic uncertainty. For a more comprehensive look at managing risk, you can explore detailed guides on options trading risk management.

When and Why to Use This Strategy

This strategy is perfect for long-term investors who hold a concentrated stock position and are concerned about a potential bear market or a company-specific downturn but do not want to sell their shares and trigger a taxable event. It allows you to "have your cake and eat it too" by participating in all future growth while capping your maximum loss.

- Best Use Case: You hold a large, appreciated position in a tech stock after a multi-year bull run. Fearing a correction due to rising interest rates, you buy a two-year LEAPS put to lock in the majority of your gains. This protects your capital from a 2022-style tech wreck while allowing you to hold the shares for a potential rebound.

Actionable Implementation Tips

- Strike Selection: Choose an out-of-the-money (OTM) strike price, typically 10-20% below the current stock price. This makes the put premium significantly cheaper, acting as a true "insurance" policy that only pays out in a substantial decline.

- Portfolio Hedging: For broad market protection, consider buying LEAPS puts on a highly correlated ETF like SPY (for the S&P 500) or QQQ (for the Nasdaq 100) instead of individual stocks. This can be a more cost-effective way to hedge a diversified portfolio.

- Volatility Check: The ideal time to buy a LEAPS protective put is during periods of low market volatility. When implied volatility (IV) is low, option premiums are cheaper, allowing you to purchase long-term protection at a discount.

- Rolling for Continued Protection: As your LEAPS put approaches expiration, if you still want protection, you can "roll" the position by selling the expiring put and buying a new one with a later expiration date.

7. LEAPS Ratio Spreads

For the more advanced trader, LEAPS ratio spreads offer a nuanced way to structure a position with a specific directional bias and income generation component. This strategy involves buying a certain number of LEAPS options and simultaneously selling a larger number of further out-of-the-money (OTM) options, typically in a 1x2 or 1x3 ratio. The goal is to create a position that can often be established for a net credit or very low debit, profiting most if the underlying stock moves moderately in the desired direction.

A LEAPS call ratio spread, for instance, involves buying one long-term ATM or ITM call and selling two further OTM calls with the same expiration. This creates a position that benefits from a slow, steady rise in the stock price up to the short strike. If the stock soars past the short strikes, the position's unlimited profit potential is capped, and it can even turn into a losing trade. This makes it one of the more complex LEAPS option strategies, requiring diligent management.

When and Why to Use This Strategy

This strategy is best suited for experienced investors who have a strong opinion on a stock's range of movement, not just its direction. It's for situations where you anticipate moderate appreciation but believe a massive, runaway rally is unlikely. The income from the extra short option provides a buffer and a defined profit zone.

- Best Use Case: You believe a stable, blue-chip stock like Johnson & Johnson (JNJ) will grind higher over the next 18 months but is unlikely to double in price. A 1x2 LEAPS call ratio spread lets you participate in that expected upside while collecting a premium that enhances returns if the stock stays within a predictable channel.

Actionable Implementation Tips

- Strike Selection: The distance between your long and short strikes defines your maximum profit zone. A wider spread increases the potential profit but may require a debit to enter. A narrower spread is easier to establish for a credit but has a smaller profit range.

- Manage Your Greeks: Pay close attention to the position's net delta and gamma. As the stock price approaches your short strikes, gamma risk increases significantly, meaning price changes will have a much larger impact on your P&L.

- Early Assignment Risk: Be aware that the short calls in your spread are subject to early assignment, especially if they become deep in-the-money or a dividend is approaching. This is a critical risk to manage with American-style options.

- Profit Target: Because of the defined profit zone, it's wise to have a clear exit plan. Consider closing the position when you've captured 50-70% of the maximum potential profit rather than holding it to expiration and risking a price reversal.

8. LEAPS Iron Condors for Long-Term Range-Bound Income

For the patient, market-neutral investor, the LEAPS Iron Condor offers a unique way to generate income over an extended timeframe. This advanced strategy involves simultaneously selling an out-of-the-money (OTM) LEAPS put spread and an OTM LEAPS call spread on the same underlying asset. This combination creates a wide "profit window," allowing the trader to collect a premium upfront and realize maximum profit if the underlying stock price remains between the two short strikes at expiration.

The core idea is to capitalize on significant time decay (theta) over many months or years, coupled with the assumption that a stock will trade within a predictable, albeit broad, range. By using long-dated options, you give the underlying asset ample time to meander without breaching your break-even points. This is one of the more complex LEAPS option strategies, designed for traders who believe significant price appreciation or depreciation is unlikely.

When and Why to Use This Strategy

This strategy is ideal for investors who forecast a long period of consolidation or sideways movement for an otherwise stable, low-volatility asset. It's a bet against a major breakout in either direction, making it suitable for mature companies or broad-market ETFs in stable economic environments.

- Best Use Case: You believe a large-cap, stable stock like Johnson & Johnson (JNJ) or a utility sector ETF (XLU) will remain range-bound for the next 18-24 months due to predictable earnings and a stable interest rate environment. An iron condor allows you to collect income while waiting for a new catalyst to emerge.

Actionable Implementation Tips

- Strike Selection: Aim for a wide range between your short strikes. A common practice is to place the short put and short call strikes around one to two standard deviations away from the current stock price to increase the probability of success.

- Credit Target: When initiating the position, target a premium received (credit) that is approximately 20-30% of the width of the spreads. For example, on a 10-point wide condor, you might aim to collect $2.00 to $3.00.

- Profit Taking: Be disciplined and don't hold out for the maximum profit. It is a common best practice to close the position when you have captured 25-50% of the maximum potential gain, as this reduces long-term risk exposure.

- Managing the Position: Monitor the position relative to the stock's price movements. If the stock price trends aggressively toward either your short put or short call strike, be prepared to adjust the untested side or close the entire position to manage risk.

LEAPS Option Strategies Comparison Table

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Buy and Hold LEAPS Calls | Low 🔄 | Low ⚡ | Leveraged upside with limited loss 📊 | Bullish outlook, long-term growth stocks | High returns with defined risk ⭐, capital efficient |

| LEAPS Covered Calls | Medium 🔄 | Medium ⚡ | Income generation + upside capped 📊 | Moderately bullish, income-focused | Capital efficient income, lower breakeven ⭐ |

| LEAPS Put Spreads | Medium 🔄 | Medium ⚡ | Defined risk-reward, profits from declines 📊 | Bearish outlook, risk-defined hedging | Lower cost bearish bets, defined risk ⭐ |

| LEAPS Straddles | High 🔄 | High ⚡ | Profits large moves both ways 📊 | High volatility expected, uncertain direction | Unlimited directional profits, volatility gains ⭐ |

| LEAPS Calendar Spreads | High 🔄 | Low-Medium ⚡ | Time decay profits, limited upside 📊 | Sideways markets, low volatility | Low cost with positive time decay ⭐ |

| LEAPS Protective Puts | Low 🔄 | Medium ⚡ | Downside protection with upside retained 📊 | Portfolio insurance, uncertain markets | Limits downside risk while keeping upside ⭐ |

| LEAPS Ratio Spreads | High 🔄 | Medium ⚡ | Income with defined profit zones 📊 | Moderate volatility, active management | Income plus defined profit areas ⭐ |

| LEAPS Iron Condors | High 🔄 | Medium ⚡ | Income from range-bound movement 📊 | Range-bound, low volatility markets | Income with defined risk, benefits time decay ⭐ |

Integrating LEAPS Into Your Long-Term Trading Arsenal

Navigating the world of options can feel overwhelming, but as we've explored, LEAPS option strategies offer a distinct and powerful advantage for the long-term investor. These aren't tools for chasing fleeting, high-risk daily gains. Instead, they represent a sophisticated way to construct positions that align with a multi-year market outlook, granting you the invaluable gift of time to let your thesis play out. We've journeyed through a diverse set of these strategies, each with a unique purpose in a well-rounded portfolio.

From the straightforward leverage of buying a LEAPS call on a high-conviction stock to the steady income generation of a Poor Man's Covered Call, you have access to capital-efficient methods for expressing a bullish view. For more nuanced or defensive outlooks, LEAPS put spreads, protective puts, and even complex structures like LEAPS iron condors provide defined-risk ways to capitalize on bearish sentiment, sideways markets, or simply to insure your core holdings against unforeseen downturns. The common thread is patience. Success with LEAPS is less about timing the market perfectly and more about correctly identifying long-term fundamental trends.

Key Takeaways and Your Next Steps

The true power of these strategies emerges when you move from theory to practice. To effectively integrate LEAPS into your trading, consider these critical next steps:

- Match Strategy to Thesis: Don't choose a strategy and then look for a stock. First, develop a clear, long-term thesis for a specific security or the market as a whole. Is it slow and steady growth? A potential for a major breakout? Range-bound action? Your answer will point directly to the most appropriate LEAPS strategy.

- Prioritize Liquidity: LEAPS are less liquid than their short-dated counterparts. Always trade LEAPS on highly liquid underlyings (large-cap stocks and major ETFs) to ensure you can enter and exit your positions at fair prices without significant bid-ask spread costs.

- Manage the Short Leg Actively: For income-focused strategies like the Poor Man's Covered Call, the short-term call you sell is your engine. Managing this leg effectively, by rolling it up and out or closing it at key moments, is paramount to maximizing your returns and managing risk.

- Understand the Tax Implications: As you build a portfolio and generate profits using these long-term instruments, it is crucial to plan for the financial responsibilities that follow. Taking time for understanding capital gains taxes will ensure you are prepared and can manage your earnings effectively, avoiding any surprises come tax season.

Mastering LEAPS option strategies is a journey, not a destination. It requires a commitment to continuous learning and a disciplined, data-driven approach. By starting with small, manageable positions and focusing on high-quality underlying assets, you can methodically build the skills and confidence needed to make these powerful tools a cornerstone of your long-term financial success.

Ready to apply these concepts with precision? For income strategies like the Poor Man's Covered Call, Strike Price provides the real-time probability data you need to select the optimal short-term strikes. Stop guessing and start making data-driven decisions to consistently generate premium.