A Practical Guide to the Option Short Put Strategy

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

Selling a put option is a bit like being an insurance company for stocks. You're telling another investor, "Hey, I'm willing to buy 100 shares of this company from you at a set price, even if the market price tanks."

For taking on that promise, you get paid an upfront cash premium. That premium is yours to keep, no matter what happens. This is a go-to strategy for investors who are neutral-to-bullish on a stock—meaning they think the price will hold steady or climb.

What Is an Option Short Put and How Does It Work?

At its core, selling a short put means you’re collecting a premium in exchange for the obligation to buy a stock at a specific price (the strike price) if it drops to that level by a certain date (the expiration date).

It's a way to generate income from stocks you're already willing to own, but at a price that's lower than where it's trading today. Think of it as getting paid to set a "buy-low" order.

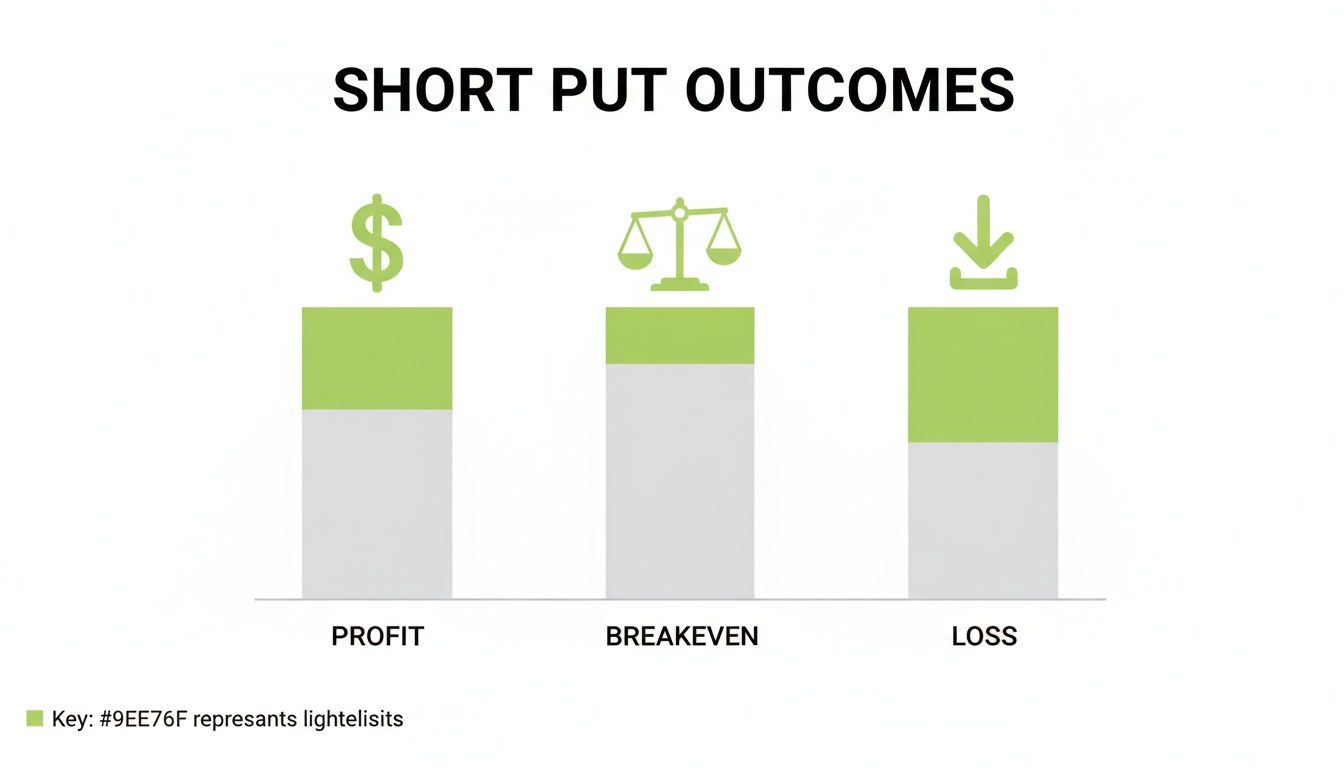

The Three Potential Outcomes at Expiration

Every short put trade wraps up in one of three ways once the option expires. Knowing these scenarios is the key to understanding how this strategy really works and how to manage your trades. It all comes down to where the stock price lands in relation to your strike price.

Let's walk through each possibility:

- Stock Price Finishes Above the Strike Price: This is the best-case scenario. The option expires worthless because the buyer has no reason to sell you their shares for less than the market is offering. You simply pocket the entire premium as pure profit.

- Stock Price Finishes Below the Strike Price: Here, the option buyer will almost certainly exercise their right to sell you their shares at the higher, agreed-upon strike price. This is called assignment. You are now obligated to buy 100 shares of the stock at a price that's above its current market value.

- Stock Price Finishes Exactly at the Strike Price: It’s rare, but if the stock closes exactly at your strike, the option also expires worthless. The buyer has no financial incentive to exercise, and you keep the full premium.

The real beauty of the short put is that you can make money even if the stock price goes down a little, as long as it stays above your strike price when the contract expires. This built-in margin for error makes it a really flexible income strategy.

Ultimately, the goal is usually for the option to expire worthless, letting you collect the premium without ever having to buy the stock. But here’s a core principle of selling puts responsibly: only use this strategy on high-quality companies you wouldn’t mind owning anyway. That way, even if you get assigned, it's still a win—you just bought a great stock at a discount.

Before we dive deeper, here's a quick cheat sheet summarizing the key aspects of the short put strategy.

Short Put Strategy at a Glance

| Characteristic | Description |

|---|---|

| Strategy Goal | Generate income by collecting a premium. |

| Market Outlook | Neutral to Bullish (you believe the stock will stay flat or rise). |

| Maximum Profit | The premium you receive when you sell the put option. |

| Maximum Risk | Substantial; it's the strike price minus the premium, per share. |

| Breakeven Point | Strike Price - Premium Received. |

| Assignment | You are obligated to buy 100 shares at the strike price if the stock is below it. |

This table provides a high-level view, but understanding the nuances is what separates successful traders from the rest. Let's move on to the mechanics of risk, reward, and margin.

Understanding the Risk and Reward of Selling Puts

Every trade has a trade-off, and selling puts is no exception. That upfront cash from the premium is mighty appealing, but it’s balanced by a clear risk profile. Getting a handle on this dynamic is non-negotiable before you sell your first contract.

Your maximum profit is always capped at the initial premium you collect. That’s your best-case scenario. It happens when the stock price stays above your strike price through expiration. You just keep the cash, and the trade is done. Simple.

The risk, on the other hand, is much bigger. If the stock price tanks and falls well below your strike, your losses can add up fast. Your potential loss is the difference between the strike price and wherever the stock is when you’re assigned, minus the premium you collected (which helps soften the blow a little).

Calculating Your Breakeven Point

To get a grip on this risk, the first thing you need to know is your breakeven point. This is the exact price the stock needs to stay above for you to avoid a loss.

Luckily, the math is simple.

Breakeven Price = Strike Price – Premium Received

Let’s say you sell a put with a $100 strike and collect a $2.00 premium per share (or $200 total). Your breakeven is $98. As long as the stock closes above $98 at expiration, you won’t lose a dime on the trade.

This chart breaks down the three possible outcomes for any short put.

As you can see, the profit is fixed, but the loss keeps growing as the stock price drops below your breakeven.

The Cash-Secured Put as a Safety Net

While the downside risk looks scary, it's not infinite—a stock can’t go below zero. The most responsible way to handle this risk is by selling what’s called a cash-secured put.

This just means you have enough cash set aside to buy 100 shares at the strike price if you get assigned. It’s a simple practice that ensures you’re prepared for the worst-case outcome, turning a potentially stressful situation into a planned stock purchase at a price you already liked.

For traders looking to go deeper into advanced principles like comprehensive risk management, an elite trading guide can provide some powerful insights.

A core rule for this strategy is to only sell puts on stocks you genuinely wouldn't mind owning. If you get assigned, you're not stuck with a falling asset you hate; you're just buying a company you wanted anyway, at your chosen price.

Of course, other factors like time decay and volatility are constantly affecting your position’s value. To learn more about these moving parts, check out our guide on the primary option trading Greeks and see how they pull the strings behind every trade.

How to Select the Right Strike Price and Expiration

Alright, this is where the rubber meets the road. Picking the right strike price and expiration date is the moment your strategy turns into an actual trade. It’s always a balancing act: you’re weighing the premium you want to collect against the risk you’re willing to take.

There's no magic formula here. The "best" choice is always the one that aligns with your personal risk tolerance and what you’re trying to achieve with your portfolio.

Generally, the closer your strike price is to the current stock price, the juicier the premium. Why? Because there's a higher statistical chance the stock could dip below that price, meaning you'd be on the hook to buy the shares. On the flip side, picking a strike price way below the current price is much safer, but the premium you collect will be significantly smaller.

The same logic applies to expiration dates. Contracts further out in time pay more. That extra cash is your compensation for taking on risk over a longer period. But it also gives the stock more time to make a move against you.

Using Delta to Gauge Probability

So, how do you stop guessing and start making calculated decisions? One of the handiest tools in an option seller's toolbox is Delta.

While it has a more technical definition, you can think of Delta as a quick-and-dirty estimate of the probability that your put option will expire in-the-money (and get assigned).

For instance, a put option with a Delta of 0.30 has a rough 30% chance of expiring in-the-money. A more conservative trade with a 0.15 Delta? Only about a 15% chance. Just by glancing at the Delta, you can immediately see if a trade fits your comfort zone.

- Aggressive traders chasing higher income might sell puts with Deltas around 0.30 to 0.40.

- Conservative traders who prioritize safety will likely stick to Deltas of 0.20 or lower.

This simple metric helps you move beyond gut feelings. Instead of just hoping for the best, you can use Delta to systematically pick trades that fit a predefined risk profile. It makes your strategy consistent and repeatable.

Before you make a decision, it's helpful to see the trade-offs side-by-side. Your choice of strike price directly impacts how much you earn and how much risk you take.

Strike Price Selection Trade-Offs

| Strike Choice | Premium Level | Probability of Assignment | Best For |

|---|---|---|---|

| Out-of-the-Money (OTM) | Lower | Low | Conservative traders who want to prioritize safety and avoid buying the stock. |

| At-the-Money (ATM) | Moderate | Medium | Traders looking for a balance between generating solid income and taking on moderate risk. |

| In-the-Money (ITM) | Highest | High | Aggressive traders or those who are genuinely happy to buy the stock at the strike price. |

This table lays it out clearly: the more you want to get paid, the more risk you have to accept. Finding your sweet spot is the key to a sustainable strategy.

From Guesswork to Data-Driven Decisions

While Delta is a great starting point, modern tools give you an even clearer picture without the guesswork. Platforms built for option sellers, like Strike Price, crunch the market data for you and present real-time probability metrics in a simple, visual way.

Here’s a look at the Strike Price dashboard. It gives you a clean overview of potential trades, framed in terms of risk and reward.

Instead of sorting through confusing option chains, you can filter for trades that meet your exact criteria for safety and income. This makes the selection process incredibly efficient. With a data-driven approach, you can set a target income goal and let the platform show you the short put trades that get you there.

Walking Through a Real-World Short Put Trade

Theory is great, but let's put some skin in the game with a concrete example. Seeing how a trade plays out from start to finish is the best way to make these concepts click.

Imagine you've been watching Microsoft (MSFT). You like the company, believe in its future, and see it as a solid long-term hold. The stock is currently trading around $430 per share. Your view is neutral to bullish—you don't see it tanking anytime soon, and honestly, you wouldn't mind owning it if you could get it at a discount.

This is the perfect setup for selling a short put. The goal is simple: generate some income now, while setting a lower price where you'd be happy to step in and buy the stock.

Setting Up the Trade

With MSFT at $430, you decide you'd be a comfortable buyer of 100 shares down at $410. You pull up the option chain and find a put contract that expires in 45 days with a $410 strike price. The premium for selling this put is $5.00 per share.

Let’s break down the key numbers of the trade:

- Total Premium Collected: $5.00 per share x 100 shares = $500. This cash hits your account right away.

- Maximum Profit: Your profit is capped at the $500 premium you just collected. That’s your best-case scenario.

- Capital Required: To secure this put, you need the cash on hand to buy the shares if you're assigned: $410 strike price x 100 shares = $41,000.

- Breakeven Price: This is your true line in the sand. It’s the Strike Price minus the Premium: $410 - $5.00 = $405.

As long as MSFT stays above $405 per share by expiration, you can’t lose money on this trade. To run these numbers for your own trades, our free cash-secured put calculator makes it quick and easy.

Following the Trade to Expiration

Now, we fast-forward 45 days. As the expiration date rolls around, one of three things is going to happen, and each one dictates your next move.

Scenario 1: MSFT Closes Above $410

This is the ideal outcome. Let's say MSFT finishes the day at $435. The put option you sold is worthless. Your obligation vanishes, and you keep the entire $500 premium as pure profit. You’re now free to sell another put and repeat the process.

Scenario 2: MSFT Closes Between $405 and $410

Imagine MSFT closes at $408. The option is in-the-money, so you’ll be assigned. This means you have to buy 100 shares at your $410 strike price, for a total of $41,000. But remember that $500 premium? It lowers your effective cost basis. Your real purchase price is your breakeven of $405 per share. You now own a great company at a discount from where it was trading 45 days ago.

Scenario 3: MSFT Closes Below $405

If MSFT takes a dive and closes at $400, you are still assigned and must buy the 100 shares at $410. With the stock now at $400, your position has an unrealized loss of $5 per share ($405 breakeven - $400 current price). This is exactly why you should only sell puts on stocks you genuinely want to own for the long haul. This isn't just theory; it's a systematic approach with a proven track record for generating competitive, risk-adjusted returns. Studies have shown how disciplined put-selling strategies have historically performed.

How to Manage Your Position and Avoid Assignment

A good trade isn’t just about the entry—it’s about how you manage it when things get messy. Even the best-laid plans can come under pressure if the market zigs when you expect it to zag. The key is having a game plan before a position moves against you, so you aren't forced into a stressful, reactive decision.

The main risk we're trying to manage is assignment, which is just the fancy term for having to make good on your end of the contract. This happens when the stock price drops below your strike price, making it profitable for the option buyer to "put" their shares to you. While early assignment is pretty rare, it becomes a near certainty if your option is in-the-money as expiration day gets closer.

The Proactive Strategy of Rolling

When a stock starts creeping down toward your strike, you don't have to just sit there and hope for the best. One of the most powerful tools in an options seller's toolbox is rolling the position. It’s a single transaction that does two things at once:

- Buy to Close: You exit your current short put, likely for a small loss.

- Sell to Open: You open a new short put on the same stock.

Typically, you’ll roll to a contract with a later expiration date, a lower strike price, or a combination of both. This move accomplishes two things: it buys you more time for the stock to recover and gives your position more breathing room by lowering the strike. We break down the mechanics in our deep-dive guide on rolling over options.

The goal of rolling is to dodge assignment while often collecting another credit. Over time, this can turn a losing trade into a breakeven or even profitable one—as long as your original belief in the stock hasn't changed.

Using Alerts for Early Warnings

In today's fast-moving market, trying to track everything by hand is a recipe for disaster. The difference between a well-managed trade and a surprise assignment often comes down to getting the right information at the right time. You need to know the second your risk profile changes.

Here’s an example of a real-time alert that gives you an early heads-up when your assignment risk is climbing.

Think of automated notifications like these as your personal risk manager, giving you the signal you need to roll your position or take other defensive action. But tools are only half the battle; discipline is the other. A backtest of over 41,000 short put trades showed that using systematic stop-loss rules dramatically improved the worst-case outcomes. It’s a powerful reminder of how important disciplined exit plans are. Discover more insights about these findings.

By combining strategic adjustments like rolling with data-driven alerts, you can manage your short put positions with a lot more confidence and a lot less stress.

Common Questions About Selling Puts

As you start selling puts, a few questions almost always come up. Getting straight answers to these is the key to building real confidence in your trading. Let's walk through the most common ones.

Is a Short Put the Same as a Cash-Secured Put?

This is a great question. While people often use the terms interchangeably, they’re not quite the same thing.

Selling a short put is the action itself—opening the trade. A cash-secured put describes how you’re managing the risk of that trade. It means you have enough cash set aside in your account to buy 100 shares of the stock at the strike price if you’re assigned.

Some very advanced (and high-risk) traders might sell "naked" puts without that cash backing, but that’s a whole different ballgame. For our purposes, and for any sound income strategy, every short put you sell should be a cash-secured put.

What Happens if My Short Put Is Assigned?

First off, assignment isn't a failure—it's one of the planned outcomes. When you get assigned, you're just holding up your end of the contract you sold.

The cash you set aside is automatically used to buy 100 shares of the stock at the strike price you picked. Those shares will then show up in your brokerage account. From there, you're a shareholder. You can hold the stock, sell it, or move on to the next step of a popular strategy called "The Wheel" by selling covered calls against your new shares to generate even more income.

Think of assignment as a successful "buy-low" order that you got paid to place. You decided you wanted the stock at that price, and now you own it. This is why you should only ever sell puts on companies you’d be happy to own.

Can I Lose More Than the Premium I Received?

Yes, absolutely. This is probably the most important risk to understand with a short put strategy. Your maximum profit is always capped at the premium you collected when you opened the trade.

Your potential loss, on the other hand, can be substantial. If the stock price drops hard, your loss is the difference between your strike price and the stock's current price, minus the premium you received. The "cash-secured" part ensures you can afford to buy the shares, but it doesn't stop you from having an unrealized loss if the stock keeps falling after you own it.

How Does Volatility Affect Short Put Premiums?

Implied volatility (IV) is a massive factor for anyone selling options. To put it simply, higher IV means higher option premiums. As a seller, that's exactly what you want to see.

When IV is high, it means the market is expecting bigger price swings. Option buyers are willing to pay more for protection (or speculation) during those times, and that translates directly into richer premiums for you. Many traders specifically hunt for opportunities to sell puts when IV is high to get the most income for the risk they're taking. Just remember, high IV often goes hand-in-hand with falling stock prices, so you still need to do your homework.

Ready to move from theory to action? Strike Price provides the real-time probability data and smart alerts you need to sell puts with confidence. Stop guessing and start making data-driven decisions to generate consistent income. Explore how Strike Price can help you achieve your trading goals today.