A Trader's Guide to Options Margin Requirements

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

When you sell options, you'll often hear the term margin requirement. This isn't a fee you pay; think of it more like a security deposit. It's the minimum amount of cash your broker requires you to keep in your account as collateral to cover any potential losses on the trade.

Unpacking Your Broker's Safety Net

Buying an option is pretty straightforward. Your maximum risk is the premium you pay to own the contract, so that's all the capital you need.

Selling options, however, is a completely different ballgame. When you sell, you’re taking on an obligation—and with it, potentially significant (sometimes unlimited) risk. This is exactly where margin requirements come into play.

Your broker needs to know you can make good on your end of the bargain if the market turns against you. Margin is that guarantee. It's a pool of your capital set aside just in case, and this system is what helps keep the market stable.

The Core Purpose of Margin

At its heart, margin protects everyone involved: you, your broker, and the broader market. By ensuring traders have enough capital to absorb losses, these rules prevent a single bad trade from creating a domino effect of defaults. For a simple long call or put, the margin is easy—you have to pay the full premium, which means a 100% margin requirement on the cost.

But this collateral isn't a fixed number. It's constantly changing based on a few key factors:

- The price of the underlying stock

- Overall market volatility

- How much time is left until the option expires

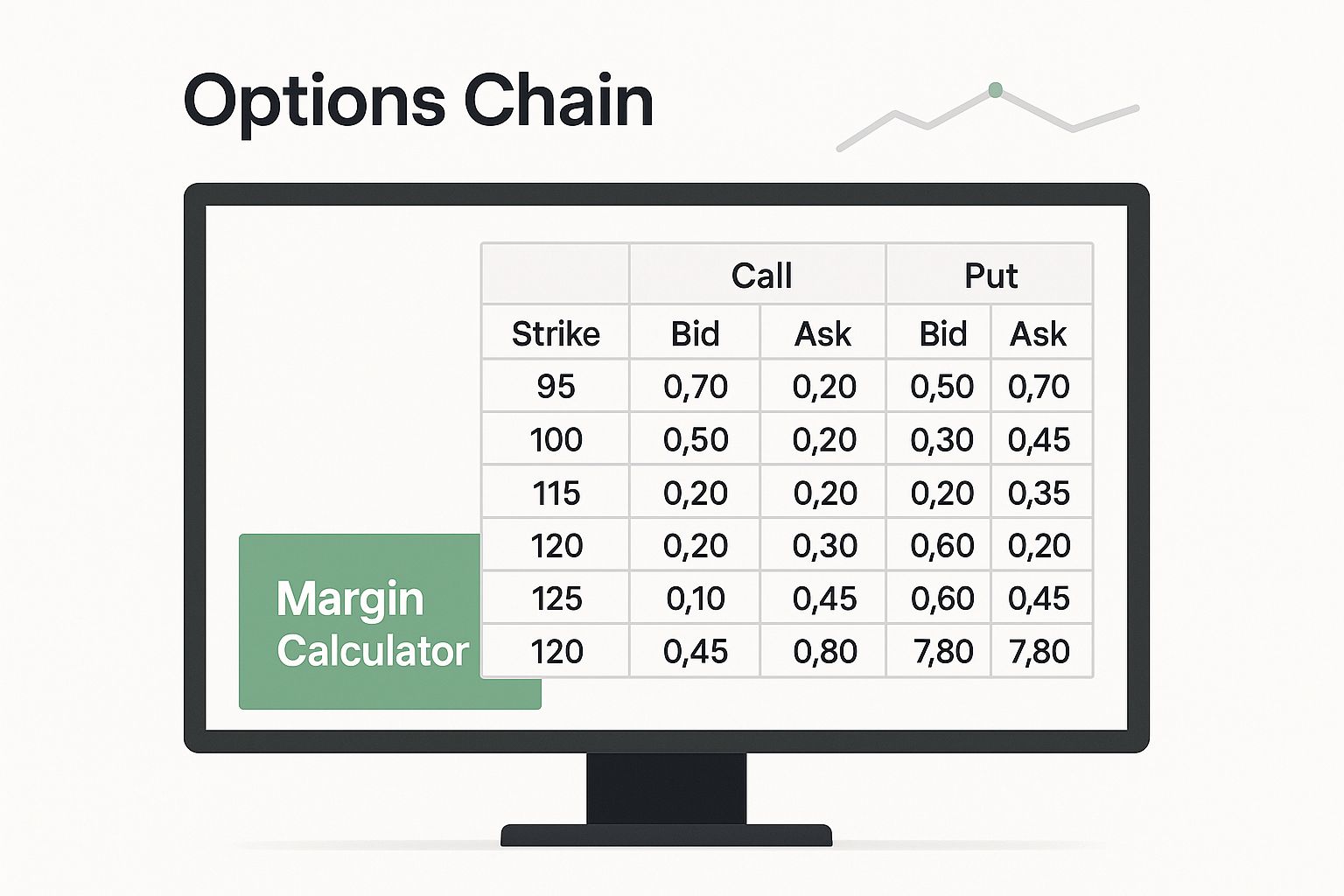

Getting a handle on these moving parts is critical. Before you even think about complex strategies, you have to master the basics of how to read an option chain to see how these variables play out in real-time.

Here's the bottom line: Margin isn’t a trading fee. It’s the cost of securing the risk you’ve decided to take on. It’s the buffer that allows the options market to run smoothly, even when things get choppy.

Effectively navigating the world of options means having solid risk management. Applying sound contract management best practices helps you keep your obligations clear and under control.

Why Margin Protects the Entire Market

Think of options margin requirements as more than just a hurdle for your personal account. They’re actually a foundational pillar that keeps the entire market from collapsing. The whole financial system is really just an intricate web of promises. When you sell an option, you’re promising to either buy or sell a stock at a certain price. Margin is the collateral that proves you can make good on that promise, even if the trade blows up in your face.

This system is what prevents one trader’s catastrophic loss from setting off a dangerous chain reaction. Without margin, a single major default could cascade through the system, taking down brokerages and rattling confidence across the entire financial world.

The Regulatory Backbone of Market Safety

This isn’t some informal gentleman's agreement; it's a highly regulated process. Organizations like the CBOE (Chicago Board Options Exchange) set airtight rules that every brokerage must follow to manage their risk. Their job is to protect the integrity of the market by stopping defaults before they can happen. This oversight is a critical backstop, especially during wild market swings.

These rules force every brokerage to stress-test their clients' positions every single day. This constant monitoring is what keeps the gears of the market turning smoothly. It’s a proactive defense designed to contain risk at the individual account level, so it never becomes a systemic problem.

A key part of this is the daily "mark-to-market" calculation. Every day, regulators and clearinghouses assess all the positions across the market. The CBOE, for instance, runs a tight ship: it calculates margin deficiencies and issues calls by 7:00 a.m. the next trading day. Those calls have to be settled with cash or equivalents (like U.S. Treasury securities) by 9:00 a.m. If you want to dive deeper into how these processes safeguard the market, the Federal Reserve has a great paper on clearinghouse risk.

The Dreaded Margin Call Explained

So, what happens when your account’s available collateral drops below the required minimum? You get a margin call. This isn't a polite request—it's an urgent demand from your broker to get your account back in good standing.

A margin call isn't just a friendly reminder. It's a non-negotiable demand to deposit more funds or securities immediately. Failure to meet it has serious and swift consequences.

If you can’t meet the call, your broker has the right—and the obligation—to start liquidating your positions. They can sell your stocks or close out your options contracts without your permission to cover the shortfall.

This forced liquidation is the ultimate safety valve. It stops your losses from spiraling out of control and harming the brokerage or its other clients. While it’s a painful experience for any trader, it's a necessary evil that ensures the stability of the entire financial ecosystem. Margin protects the market, the broker, and ultimately, it protects you from total financial ruin.

How Your Strategy Impacts Margin Requirements

Not all options trades are created equal, and your broker knows it. The specific strategy you choose is the single biggest factor in determining how much cash they'll ask you to set aside as a security deposit.

Think of it as a risk spectrum. The more potential danger your trade has, the bigger the deposit your broker will demand. This reality splits the options world into two clear categories: defined-risk and undefined-risk trades. Getting a handle on this difference is key to managing your margin and avoiding any nasty surprises.

Defined-Risk Strategies and Fixed Margin

Defined-risk strategies are exactly what they sound like—trades where your maximum possible loss is locked in the moment you open the position. Because the worst-case scenario is already known and capped, the margin calculation is refreshingly simple and fixed.

A perfect example is a vertical spread, where you buy one option and sell another of the same type and expiration date. That long option acts as a built-in safety net, putting a hard ceiling on your potential loss.

For defined-risk trades like vertical spreads, the margin requirement is typically just the maximum possible loss. It’s a fixed, predictable amount that doesn't change, no matter how wild the market gets.

This predictability is a huge advantage. You know exactly how much of your capital is tied up, which makes planning your next move much, much easier.

Undefined-Risk Strategies and Dynamic Margin

On the other end of the spectrum, you have undefined-risk strategies, like selling a naked put or a naked call. With these trades, your potential loss is theoretically unlimited, which understandably makes brokers a bit nervous.

The margin required for these positions is much higher and way more complex.

Unlike the set-it-and-forget-it margin of a spread, the collateral for a naked option is dynamic. It breathes with the market, constantly fluctuating based on a few key factors.

Here’s what’s driving the numbers behind the scenes:

- Implied Volatility (IV): Higher volatility means there's a greater chance of a huge price swing, which cranks up your risk. As IV rises, expect your broker to demand more margin.

- Stock Price: The underlying stock price is directly tied to your potential loss. A more expensive stock generally means a higher margin requirement.

- Time to Expiration: An option with a lot of time left on the clock has more opportunities to move against you. This means your initial margin will be higher.

These variables, often called "the Greeks," are always pushing and pulling on an option's value and risk profile. To get a better feel for how these forces work, you can explain the Greeks for options in our detailed guide.

When you choose an undefined-risk strategy, you're accepting that your margin requirements can—and will—change. It's a style of trading that demands you keep a much closer eye on your account.

Margin Requirements for Common Option Strategies

To give you a clearer picture, let's break down how margin works across a few common strategies. Notice how the risk level directly influences the amount of capital you need to have on hand.

| Strategy | Risk Level | Typical Margin Requirement |

|---|---|---|

| Buying Calls/Puts | Defined | The premium paid for the option |

| Covered Call | Defined | None (shares are the collateral) |

| Cash-Secured Put | Defined | The cash needed to buy the shares |

| Vertical Spreads | Defined | The difference between the strike prices (max loss) |

| Naked Call/Put | Undefined | A complex formula based on volatility, price, & time |

As you can see, the path of least resistance from a margin perspective is to stick with defined-risk trades. They're simpler to manage and won't give you a surprise margin call if volatility suddenly spikes.

How Brokers Actually Calculate Your Margin

While the exact formulas your broker uses can feel like a secret recipe locked in a vault, the thinking behind them is surprisingly straightforward. You don't need a math degree to get a gut feeling for what drives your options margin requirements.

At the end of the day, your broker is just trying to answer one question for a risky trade like a naked put: "If the market goes wild tomorrow, what's the most we could reasonably expect this position to lose in a single day?" The margin they ask for is their answer to that question.

This isn't like the fixed collateral you put up for a defined-risk spread. The margin for a naked option is a living, breathing number. It shifts and changes right along with the market's mood.

The Three Main Ingredients in the Margin "Recipe"

Think of the margin formula as having three core ingredients. Brokers might add their own special sauce, but these three elements are almost always in the mix. The calculation usually kicks off with a simple percentage of the stock's value and then gets tweaked from there.

Here’s what usually goes into the calculation:

- A slice of the stock's value: This is typically the biggest piece of the puzzle. A broker might start by taking 20% of the underlying stock's total value (that's 100 shares times the current stock price).

- The premium you pocketed: The cash you get from selling the option lands in your account right away. Your broker sees this as a small safety cushion, so they subtract it from the total margin you need to post. Every little bit helps.

- The "out-of-the-money" buffer: This part of the calculation looks at how far away your strike price is from the current stock price. If you sold an option that's way out-of-the-money, it’s less risky, and this can actually lower your margin. But if your option is in-the-money, it adds to the risk and increases it.

In simple terms, the formula often boils down to: (A % of Stock Value) - (Out-of-the-Money Buffer) + (Premium Received). This gives the broker a solid baseline for the risk you're taking on.

Behind the curtain, major clearinghouses like the CME Group are running sophisticated risk models. They don't just look at what a stock did in the past; they blend historical data with real-time volatility metrics from the options market to get a much smarter, forward-looking picture of risk. You can get a peek into how these advanced margin models work on their site.

Let's Calculate Margin for a Naked Put

Okay, let's make this real. Imagine XYZ stock is trading at $100 per share. You decide to sell one naked put with a $95 strike price. For taking on this obligation, you collect a $2.00 premium, which is $200 total.

Here's how a broker might run the numbers using a common industry formula:

- Part 1: The Stock Value Slice: They start with 20% of the underlying value. That's 20% of ($100 x 100 shares), which equals $2,000.

- Part 2: The OTM Buffer: Your put is $5 out-of-the-money ($100 stock price - $95 strike). This buffer reduces your requirement. ($5 x 100 shares) = $500.

- Part 3: The Premium You Received: You were paid $200 for the option.

Now, here's where it gets a little tricky. Brokers usually run a few different calculations and are required to use the one that results in the highest margin requirement. It's all about ensuring there's enough collateral.

One common formula is: ($2,000 - $500) + $200 = $1,700.

But another standard calculation they might run is just 10% of the strike price, plus the premium. That would be (10% of $95 x 100) + $200 = $1,150.

Since they have to take the highest number, your initial options margin requirement in this case would be $1,700. Think of it as the security deposit they hold just in case XYZ stock takes a nosedive.

Using Portfolio Margin for Capital Efficiency

For traders who have been in the game for a while, the standard way of calculating margin can feel incredibly restrictive. It’s like a security guard watching every single person in a crowd instead of seeing how the group moves together. Each trade is walled off and assessed on its own, which often misses the bigger picture.

This is where Portfolio Margin completely changes the game.

Instead of just looking at individual trades, Portfolio Margin analyzes the total risk across your entire collection of positions. It’s smart. It knows that some positions actually offset the risk of others. For instance, it understands that a long put can act as a safety net for a short call, which dramatically lowers your overall risk.

By looking at the whole picture, this system can slash your options margin requirements—sometimes by 30-50% or even more compared to a standard margin account. That frees up a massive amount of capital, giving you way more flexibility and efficiency in your trading.

Who Qualifies for Portfolio Margin

Now, this isn't a tool for everyone. Brokers typically keep Portfolio Margin accounts for seasoned traders who can check a few specific boxes.

Usually, you'll need to meet criteria like these:

- A minimum account balance, often starting at $100,000.

- Passing an options knowledge test to prove you know your way around complex strategies.

- A solid track record of trading multi-leg option strategies.

Portfolio Margin is a game-changer for capital efficiency, but it demands a deep understanding of risk. It rewards sophisticated traders who build balanced, hedged portfolios by requiring less collateral for the same level of market exposure.

This approach is a massive advantage for traders who use complex, multi-leg strategies with built-in hedges. Think iron condors, butterflies, or calendar spreads. In a normal margin account, the collateral needed for these can be frustratingly high because each leg is calculated on its own. Portfolio Margin sees the built-in risk controls and adjusts the requirements down to a much more reasonable level.

Is Portfolio Margin Right for You?

Making the jump is a big decision and should be part of a disciplined approach to risk. Before you even consider it, having a solid grasp of core portfolio management best practices is non-negotiable.

On top of that, a critical part of running a complex portfolio is knowing what could happen with every position you open. Before you start building strategies designed for Portfolio Margin, it's a smart move to use an options risk reward calculator to model your trades. This lets you see the potential profits and losses upfront, making sure the risk fits your comfort zone.

When you combine a sophisticated margin system with sharp analytical tools, you can truly optimize your capital and get one step closer to your financial goals.

Got Questions About Options Margin?

Even after you've got the basics down, a few questions always pop up when it comes to options margin requirements. Let's tackle some of the most common ones so you can trade with a bit more confidence.

What Happens if I Get a Margin Call I Can't Meet?

This is the one situation every trader wants to avoid. If you get a margin call and can't add more cash or eligible securities to your account, your broker has the right to step in immediately.

They can start selling off positions in your account—and they don't need your permission to do it. They get to choose what gets liquidated to cover the shortfall, and any losses from those forced sales are on you. This is exactly why keeping a close eye on your margin balance is an absolute must.

Do Cash-Secured Puts Need Margin?

Technically, no. A true cash-secured put doesn't really use "margin" in the way we usually think about it. The whole point of the strategy is that it's "cash-secured"—you've already set aside the full amount of cash needed to buy the stock if it gets assigned to you.

For example, if you sell one put on a $50 stock, you need to have $5,000 sitting in your account, earmarked for that trade. That cash is the collateral, so your broker doesn't have to hold extra margin. The risk is already covered.

Remember: A cash-secured put is fully backed by cash. A naked put, which has a similar risk profile, is not fully backed and comes with some hefty margin requirements.

How Does Market Volatility Affect My Margin?

Volatility is a huge factor, especially if you're selling naked options or other strategies with undefined risk. When implied volatility (IV) shoots up, it's the market's way of saying it expects bigger, faster price swings ahead.

That increased potential for movement makes your short positions riskier. To protect themselves, your broker will raise your margin requirements to make sure you have enough collateral to cover those potentially larger losses. Your margin isn't a "set it and forget it" number; it can and will change with the market's mood.

Can I Use My Long Options as Margin Collateral?

Generally, the answer here is no. You can't use the value of your long calls or puts to meet margin requirements for other trades in your account. Brokers typically require you to meet margin with either cash or other eligible securities, like Treasury bills.

However, a long option is a key part of what makes a defined-risk spread work. In a vertical spread, for instance, the long option you buy is what caps your maximum loss. This directly lowers the margin required for that specific spread, but it doesn't add to your account's overall buying power for other trades.

Ready to trade options with more confidence? Strike Price provides real-time probability metrics for every strike price, helping you balance risk and reward. Turn guesswork into a data-driven strategy and start maximizing your premium income. Learn more and get started today.