Options Probability Calculator: Master Risk-Smart Trading

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

Understanding What Options Probability Calculators Really Do

Options trading can be challenging. Predicting price movements is difficult, and even experienced traders can find consistent profits elusive. This is where options probability calculators become valuable tools. They offer a data-driven way to assess potential outcomes, moving beyond intuition and emotion.

So, what do these calculators actually do? They analyze market data, including the current price, volatility, and time to expiration, to estimate the likelihood of an option expiring in the money (ITM). This helps determine the chances of the underlying asset's price reaching a specific level, allowing for more informed trading decisions. For example, a calculator might show a 60% probability of a call option expiring ITM, suggesting a reasonable chance of profit.

This differs significantly from traditional stock screeners, which often focus on surface-level metrics. Options probability calculators provide a deeper, more nuanced perspective on potential price action. Understanding the likelihood of success is crucial for managing risk in options trading.

These calculators also offer an advantage by helping traders size their positions. Knowing the probability of an option expiring ITM enables strategic capital allocation, maximizing potential gains while minimizing potential losses. This calculated approach can prevent costly mistakes that can damage a trading account.

How Probability Calculators Transform Raw Data into Actionable Insights

Probability calculators empower traders by converting complex market data into easily digestible probabilities. This facilitates better risk assessment and improved decision-making. Traders can use data-backed insights to guide their strategies, rather than relying solely on intuition.

Real-World Scenarios and Practical Application

Imagine a trader using a probability calculator for a covered call strategy. The calculator might indicate a 90% chance of the underlying stock remaining below the strike price. This suggests a high probability of keeping both the premium and the stock. This insight allows for more strategic choices, aligning positions with risk tolerance and profit goals.

However, market context remains crucial. While probability calculators offer valuable data, they should be used alongside fundamental and technical analysis. Tools like McMillan's Probability Calculator offer further analysis, using methods like Monte Carlo simulations to predict price movements. You can explore more about options probability calculators here.

Integrating probability analysis doesn't have to be complicated. Platforms like Strike Price simplify the process, providing real-time probability metrics. By understanding these calculators and using them strategically, traders can gain a significant edge in the dynamic world of options trading.

Getting Started With Free Probability Calculator Tools

Free options probability calculators offer an accessible starting point for traders looking to integrate probability-based decisions into their options strategies. These tools provide a practical way to begin exploring probability analysis without a large financial investment. However, understanding their capabilities and limitations is crucial for effective use.

Key Inputs and Their Importance

Using these calculators effectively hinges on understanding the key inputs. Essential inputs typically include the underlying asset's current price, the option's strike price, the time to expiration, and the implied volatility. While some calculators may incorporate additional inputs, these core elements drive the probability calculations. For example, a longer time to expiration generally increases the likelihood of an option hitting its target price.

Interpreting Results and Avoiding Common Traps

Simply getting a probability percentage isn't enough; understanding what it means is crucial. A common mistake is thinking of the probability as a guaranteed outcome. Instead, it represents the likelihood of a price move based on current market conditions. Additionally, these calculators often rely on historical data, which might not accurately predict future market behavior. You might be interested in: How to master options selling strategies.

Setting Realistic Price Targets and Timeframes

Success with probability-based trading involves setting realistic price targets and timeframes. Aligning these parameters with current market conditions and individual trading styles maximizes the effectiveness of the calculations. For example, setting overly ambitious price targets in a stable market can lead to unrealistic probability estimates.

The free stock options probability calculator available on platforms like Optionistics computes the theoretical probability of future stock prices based on option prices. This calculator is particularly useful for understanding market sentiment towards a stock's potential price movements. For example, if a stock's current price is $50 and there's a call option with a $60 strike price expiring in two months, the calculator can estimate the probability of the stock exceeding $60 by expiration. This could be around 20% based on historical volatility and current market conditions. Such statistics help traders assess the risk and potential rewards associated with options trading. Find more detailed statistics here.

Limitations of Free Tools and Cross-Referencing Techniques

Free options probability calculators are a valuable starting point, but it's essential to recognize their limitations. They often lack the advanced modeling of professional tools and may not account for complex factors influencing option pricing. This is where strategies like using a decision tree, discussed in this article on expected monetary value, could be helpful. This highlights the importance of cross-referencing results with other analytical methods.

Practical Examples With Real Market Scenarios

Consider this real-market example: a trader using a free calculator sees a 70% probability of a put option expiring in the money (ITM). However, by analyzing news about the underlying company and observing a bullish trend, the trader might adjust their position size or avoid the trade entirely. Integrating probability with other analysis forms is crucial for informed decision-making.

Free tools empower traders with valuable insights into options trading probabilities. By understanding their inputs, interpreting results carefully, and setting realistic parameters, traders can leverage these tools effectively. However, acknowledging the limitations of free calculators and combining them with other analytical techniques is crucial for mitigating risks and making sound trading decisions. This combined approach helps traders navigate market complexities and improve their chances of success.

Professional Platform Tools That Actually Move The Needle

Free options probability calculators offer a helpful introduction to probability-based trading. However, to truly excel, professional-grade platforms offer advanced features that significantly boost trading results. These tools often justify their cost with functionalities far beyond basic calculations, giving traders a real edge in the market.

Advanced Features of Professional Options Probability Calculators

Professional platforms stand out in key areas. They handle complex multi-leg strategies effortlessly, allowing analysis of sophisticated options combinations. They also provide real-time probability updates during market volatility, ensuring traders have the most current data. These platforms integrate seamlessly with existing trading workflows, boosting efficiency.

- Advanced Modeling Capabilities: Professional tools utilize advanced models, incorporating implied volatility curves and complex pricing algorithms for more precise probability assessments.

- Backtesting: This essential feature lets traders test strategies against historical data. This reveals potential weaknesses before impacting real capital, refining strategies, and optimizing performance.

- Sophisticated Risk Analysis Tools: These platforms offer advanced risk analysis, allowing traders to manage position sizing across their entire portfolio. This holistic view minimizes potential losses and maximizes returns.

Justifying the Cost: Premium Features vs. Bells and Whistles

While some premium features enhance trading, it's important to distinguish valuable tools from unnecessary add-ons. Focus on features that directly improve decision-making and risk management. Visually appealing charts are nice, but they don't add value without actionable insights.

Fidelity's Options Analytics tool is a prime example of a valuable premium feature. Its Probability Calculator models various option strategies, determining the probability of an underlying asset trading above, below, or between specific price targets by a certain date. This helps investors hedge positions or speculate on market movements. For example, it can calculate the probability of the S&P 500 being above a certain level by the next expiration date, based on historical data and market conditions. This empowers investors to make informed decisions, leading to better risk management and returns. Explore this topic further here.

Real Trader Experiences and Platform Comparisons

Seeing how professional traders use these tools provides valuable insights. Detailed platform comparisons help identify the best fit for individual trading styles and needs. By studying successful traders, aspiring professionals learn how to maximize the effectiveness of these platforms. This is especially important for strategies like covered calls or cash-secured puts. Strike Price offers real-time probability metrics, allowing active risk management. These platforms help transform options selling from a gamble into a strategic income-generating process, offering features like Target Mode to customize income goals and safety thresholds.

Integrating Professional Tools into Your Workflow

Successful integration requires understanding how these tools fit into your overall strategy. Avoid relying solely on probability calculations; combine them with other forms of analysis. This balanced approach leads to well-informed decisions based on a complete market picture.

By carefully selecting and implementing professional platform tools, traders can significantly improve their options trading. Choose the right tools, focus on valuable features, and integrate them seamlessly into a comprehensive trading workflow.

Building Bulletproof Risk Management With Probability Data

An options probability calculator offers traders valuable information, but real success comes from incorporating this data into a solid risk management strategy. Seasoned traders know probability isn't a crystal ball, but a tool for managing potential outcomes. This section explains how to use this data to create a trading approach that both protects capital and seizes opportunities.

Position Sizing and Stop-Loss Strategies

Probability data is key to determining position size. A higher probability of profit doesn't automatically mean a larger position. Instead, think about the potential loss if the trade goes against you. This means balancing the probability of winning with the size of potential gains and losses. For instance, a trade with a 70% probability of a 5% gain but a 30% probability of a 20% loss might need a smaller position than its probability alone would suggest.

Stop-loss orders are another vital element. Probability data can help determine where to set these orders, minimizing losses while letting winning trades continue. For example, if an options probability calculator shows a 20% chance of the price dropping below a specific point, setting a stop-loss just below that point might be a wise move. You might be interested in: Learn more about cash-secured puts in our article.

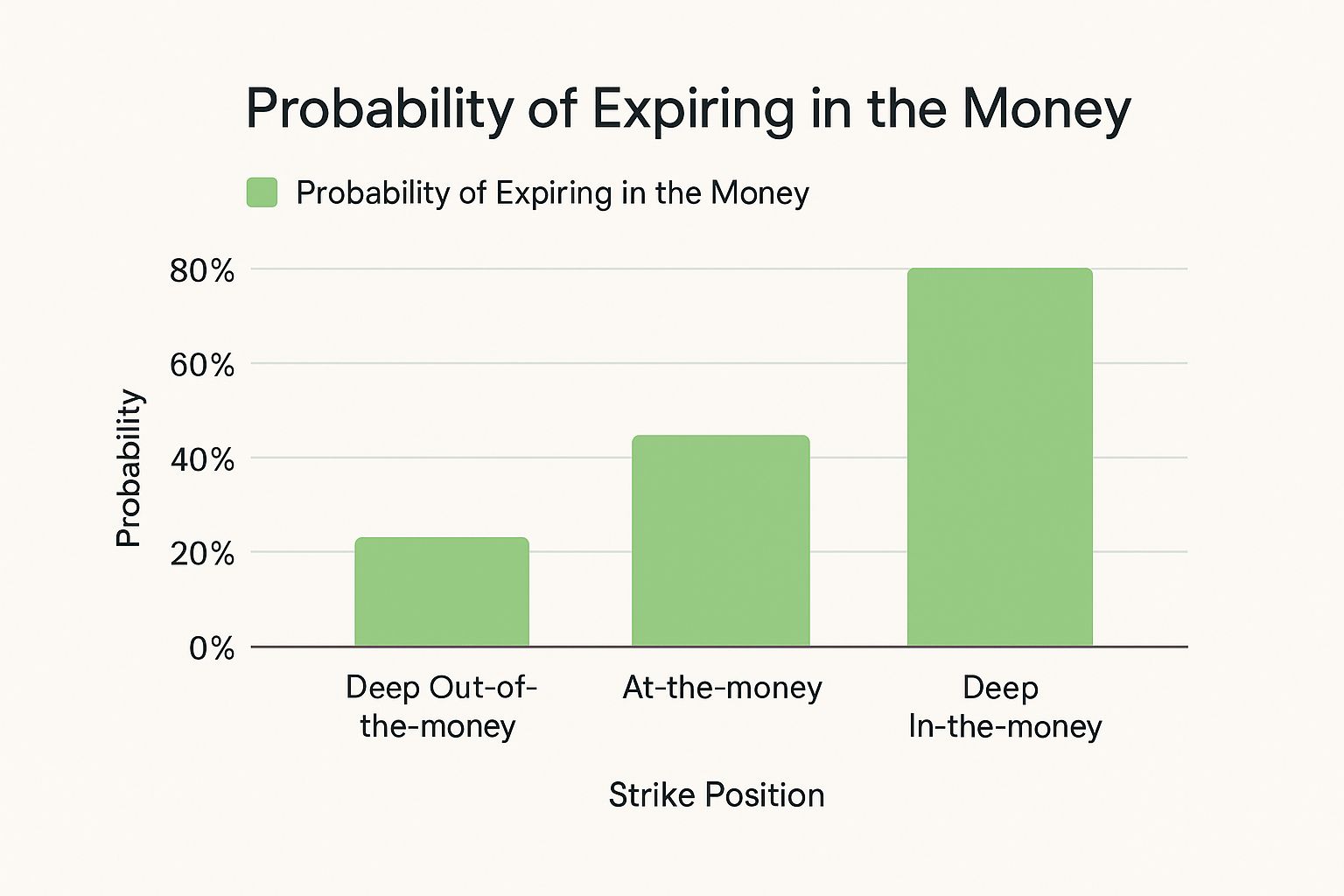

This infographic shows the probability of expiring in the money for three different strike positions. Deep in-the-money options have a much higher probability (80%) of expiring ITM than at-the-money (50%) and deep out-of-the-money (20%) options. This illustrates the connection between choosing a strike price and probability.

Practical Frameworks for Combining Probability with Traditional Risk Management

Probability analysis strengthens traditional risk management methods. Consider the risk-reward ratio. While a 3:1 ratio is often seen as desirable, probability data allows for a more refined strategy. A trade with a higher probability of success might justify a lower risk-reward ratio, whereas a lower probability might demand a higher potential reward.

The following table summarizes risk management strategies based on different probability ranges. It highlights how position sizing and stop-loss orders can be adjusted based on the likelihood of a successful trade.

Risk Management Strategies Based on Probability Ranges

| Probability Range | Suggested Position Size | Stop-Loss Strategy | Risk Level |

|---|---|---|---|

| > 70% | Moderate | Wider stop-loss | Lower |

| 50% - 70% | Smaller | Moderate stop-loss | Medium |

| < 50% | Smallest | Tighter stop-loss | Higher |

This table demonstrates how understanding probability can lead to a more nuanced approach to risk management. Higher probability trades can accommodate larger positions and wider stop-losses, while lower probability trades require smaller positions and tighter stop-losses to manage potential downside.

Determining Entry and Exit Points Using Probability Thresholds

Probability thresholds can establish clear entry and exit points. For example, a trader might enter a trade when the probability of profit goes above 60% and exit when it drops below 40%. These thresholds offer objective rules, minimizing emotional decision-making.

Psychological Traps and How to Avoid Them

Even with probability data, psychological biases can hinder risk management. Overconfidence can result in oversized positions, while fear of missing out (FOMO) can push traders to disregard their own rules. Building discipline and sticking to a pre-determined plan is vital for long-term success. This means regularly reviewing and adjusting your strategy based on market behavior and performance.

Probability-Based Risk Management for Consistency and Profitability

Ultimately, probability-based risk management encourages consistency by providing a structured trading approach. This doesn't guarantee profits on every trade, but it improves the chances of long-term success through effective risk management. This approach is beneficial in both turbulent and calm market conditions, giving a framework for navigating varying circumstances. By using probability, traders shift their approach from reactive to proactive, basing decisions on data and analysis rather than emotion and speculation. This change in mindset is crucial for a lasting and profitable trading career.

Avoiding The Mistakes That Kill Trading Accounts

Even with sophisticated tools like options probability calculators, traders can still fall prey to critical errors that can decimate their accounts. This section explores some of these common pitfalls and how to steer clear of them. It's about moving beyond simply inputting data and cultivating a deeper understanding of how the market truly works.

The Danger of Blind Faith in High Probability

One of the biggest mistakes is placing blind faith in high-probability setups without considering the bigger picture. An options probability calculator might suggest a 90% chance of a specific outcome. However, unexpected news or a sudden market shift can quickly turn the tables.

This is precisely why relying solely on the calculator's output can be a recipe for disaster. For example, a seemingly secure covered call position could quickly become precarious due to unforeseen circumstances. You might be interested in: Learn more in our article about how to write covered calls.

Overconfidence and Position Sizing Disasters

Overconfidence fueled by probability calculations often leads to another common trap: excessive position sizing. Even with a high probability of winning, a large position can wipe out an account if the trade moves against you.

A 75% probability of a 10% gain is undoubtedly enticing. But a 25% chance of a 50% loss can be catastrophic with an oversized position. This underscores the importance of carefully balancing potential profits with acceptable risk.

Ignoring Volatility and Market Events

Many traders fail to appreciate the impact of volatility, particularly during earnings announcements or significant market events. Volatility can drastically alter option pricing and probabilities. Ignoring these fluctuations can derail even the most well-thought-out strategies.

A strategy that performed admirably during calm market conditions might fail spectacularly when the market becomes turbulent.

Real-World Examples of Costly Mistakes

Consider a trader who relied heavily on an options probability calculator indicating a high probability of success for a specific iron condor strategy. This trader overlooked an impending earnings announcement for the underlying stock and maintained a large position. The resulting volatility triggered a significant price swing, wiping out the entire trade and a considerable chunk of the account.

This example highlights the vital importance of factoring in external influences into probability-based trading.

Developing Judgment and Overriding the Numbers

While probability calculators offer valuable data, traders must develop the judgment to know when to override the numbers. This involves constantly monitoring market conditions, news, and other pertinent information.

Sometimes, market sentiment contradicts the calculator's projections. In such instances, trusting your experience and adapting your strategy becomes paramount. This doesn't mean discarding probability calculations altogether, but rather understanding their inherent limitations.

Recognizing Misleading Signals and Developing Adaptive Strategies

By reviewing past trades, both wins and losses, traders can identify situations where probability calculations might be misleading. This continuous learning process involves analyzing market behavior, recognizing patterns, and refining trading strategies accordingly.

Developing this adaptable approach is essential for effectively navigating the constantly shifting market landscape. Continuously refining your approach based on experience and market feedback will enhance your trading effectiveness over time. This means embracing lifelong learning and perpetually striving to improve your grasp of market dynamics and probability-based trading.

Advanced Integration With Technical and Fundamental Analysis

Seasoned traders know that options probability calculators, while valuable tools, reach their full potential when combined with other analytical methods. This exploration delves into how integrating probability data with technical and fundamental analysis helps create more robust trading strategies. It's about making informed decisions, no matter the market conditions.

Validating Technical Setups With Probability

Technical analysis uses chart patterns and indicators like those found on TradingView to pinpoint potential trading opportunities. An options probability calculator adds a crucial layer of analysis: quantifying the likelihood of those setups working.

Imagine a trader spots a bullish breakout on a chart. Using a probability calculator helps confirm the breakout's potential by estimating the chance of the price hitting the target. This adds a data-driven perspective to chart insights, strengthening trading decisions.

Identifying High-Confidence Trades

The real strength of this integrated approach lies in finding trades supported by multiple analyses. A trade backed by technical indicators, fundamental analysis, and a favorable probability calculation offers a high degree of confidence. This convergence suggests the trade has solid support from different angles.

For instance, consider a stock with a positive earnings surprise. It’s breaking out from resistance on the chart, and the options probability calculator shows a high chance of reaching the target price. This presents a very compelling trading opportunity.

Adapting to Market Environments

Markets are constantly in flux, shifting between periods of stability and volatility. Options probability calculations need to reflect these shifts. During earnings season, implied volatility often increases. This must be considered in probability calculations. Similarly, understanding overall market sentiment helps interpret probability data. Knowing market dynamics is key for adapting probability-based strategies.

To help you compare different platforms, here’s a quick look at some popular options probability calculators:

Popular Options Probability Calculator Platforms Comparison

| Platform | Key Features | Cost | Best For | Limitations |

|---|---|---|---|---|

| OptionStrat | Options strategy backtesting and analysis | Free and paid versions | Options strategy development and testing | Limited real-time data in free version |

| Thinkorswim | Comprehensive trading platform with probability analysis | Varies based on brokerage account | Active traders | Requires TD Ameritrade account |

| Tastyworks | Options-focused trading platform with probability tools | Commission-based pricing | Options traders | May not be suitable for all investors |

This table highlights the key features, costs, and ideal user profiles for several options probability calculator platforms, helping you choose the best fit for your needs. Each platform offers a unique blend of tools and resources, so understanding their strengths and limitations is crucial.

Case Studies and Systematic Approaches

Reviewing case studies of successful traders reveals how they blend probability data with other analyses. These real-world examples offer practical insights into applying these concepts. Developing a systematic approach to analysis ensures consistency and helps remove emotional bias from decision-making.

Leveraging Quantitative and Qualitative Data

Integrating probability with fundamental research brings a quantitative lens to qualitative assessments. Fundamental analysis evaluates a company's financial health and potential for growth. Adding options probability calculations allows traders to estimate how likely a stock price is to reflect its intrinsic value within a timeframe. This combines numerical data with a fundamental understanding of the business, bolstering the trading process.

Adapting to Dynamic Markets and Emerging Opportunities

Markets are dynamic and complex, with new opportunities constantly appearing. Combining probability analysis with other approaches builds adaptable trading methodologies. This means treating the options probability calculator as a supplemental tool, not a standalone trading signal. This allows traders to adjust to changing conditions and seize new opportunities more effectively.

Finally, using an options probability calculator enhances trading by validating setups and uncovering high-confidence opportunities. It also offers a framework for navigating various market conditions and emerging trends, leading to more informed, robust, and ultimately, more profitable trading strategies.

Key Takeaways

This section offers practical guidance for incorporating probability-based options trading into your strategy. It provides actionable advice, sets realistic expectations, and outlines a clear progression from beginner techniques to more advanced methods. You'll also learn key performance indicators (KPIs) to track for long-term success and how to adapt your approach as your account grows.

Building Your Probability-Based Trading Workflow

Getting started with probability-based trading requires a structured approach. Here's a step-by-step guide to help you begin:

Start with Free Tools: Become familiar with free online options probability calculators. Understand their inputs, how to interpret the results, and any limitations they might have. This hands-on experience allows you to grasp the fundamental concepts before considering premium tools.

Focus on Key Inputs: Pay close attention to the underlying asset's current price, the option's strike price, the time to expiration, and implied volatility. These are the core drivers behind probability calculations.

Set Realistic Expectations: Probability represents a likelihood based on current market conditions, not a guaranteed prediction. Avoid the trap of viewing high probability as a certainty of profit.

Evaluating Trades and Refining Your Approach

Successful probability-based trading involves continuous evaluation and refinement. Consider these best practices:

Develop Checklists: Create checklists to assess potential trades systematically. This helps ensure you consider all relevant factors before entering a position.

Track Your Performance: Monitor essential metrics such as your win rate, average profit/loss per trade, and maximum drawdown. This data will help you identify areas for improvement and refine your strategy.

Seek Feedback: Discuss your trades with other traders or mentors to gain valuable perspectives and uncover potential blind spots in your analysis.

Managing Intuition vs. Data

Your intuition might sometimes conflict with the probability data. Here's how to handle that tension:

Maintain Discipline: Adhere to your probability-based strategy even when your gut feeling suggests otherwise. This disciplined approach prevents emotional decisions that can disrupt your trading plan.

Build Confidence in Data: Trust the probability calculations, particularly when supported by other forms of analysis. This data-driven approach helps minimize emotional biases.

Recognize Limitations: Probability calculations are not foolproof. They are tools to guide your decisions, not dictate them. Be prepared to adjust your strategy based on changing market conditions and your own judgment.

Scaling Your Approach as You Grow

As your account and experience grow, adapt your probability-based trading accordingly:

Explore Advanced Tools: Consider professional-grade platforms like Strike Price offering sophisticated probability models, backtesting capabilities, and in-depth risk analysis tools.

Integrate Other Analyses: Combine probability data with technical and fundamental analysis to create more robust and well-rounded trading strategies. This multi-faceted approach offers a more comprehensive view of the market.

Manage Portfolio Risk: Utilize probability data to optimize position sizing and manage risk effectively across your entire portfolio. This holistic approach helps minimize potential losses while maximizing long-term returns.

By following this roadmap, you can effectively integrate probability-based trading into your existing workflow. Remember to start with a structured approach, continually refine your strategy based on market feedback, and maintain discipline even when faced with conflicting information. As you gain experience, scale your approach with advanced tools and broader market analysis to cultivate a sustainable and profitable trading experience.