Options Strategy Backtesting: Transform Your Trading Success

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

Mastering The Fundamentals That Actually Matter

Options strategy backtesting is much more than simply running a simulation. It's a structured process used to validate trading ideas before risking your capital. Think of it as the critical link between theoretical strategies and practical application, allowing traders to refine their approaches and gain confidence. Unfortunately, many traders fall into common traps, making their backtesting efforts ineffective. This section explores the core principles of effective options strategy backtesting.

Why Backtesting Matters

Backtesting provides a way to objectively assess a strategy's potential for profit and its inherent risks. Let's say you're interested in testing a covered call strategy on AAPL. Backtesting reveals its historical performance under various market conditions. This helps you understand its potential return and the likelihood of assignment, empowering you to make informed trading decisions.

Backtesting vs. Paper Trading: A Critical Distinction

While both involve simulated trading, backtesting and paper trading have different purposes. Backtesting analyzes historical data to evaluate a strategy's past performance. Paper trading, conversely, tests a strategy in current market conditions without risking real money. So, backtesting shows how a strategy would have performed, while paper trading reveals how it might perform now.

Essential Components of Reliable Backtesting

Effective options strategy backtesting depends on several key factors:

High-Quality Data: Accurate and comprehensive historical data forms the bedrock of reliable backtesting. Bad data leads to bad results.

Realistic Assumptions: Incorporating transaction costs, slippage, and realistic fill prices is vital for accurate projections. Ignoring these can significantly inflate backtested returns.

Robust Testing Methodology: A robust methodology includes selecting appropriate time periods, avoiding look-ahead bias (using future information), and accounting for survivorship bias (overlooking failed strategies).

Options strategy backtesting has evolved, with platforms like tastytrade offering extensive historical data. Traders can backtest strategies using over a decade of data, refining their approach without risking real capital. This process involves simulating past trades, using historical prices and market conditions, to evaluate performance over time. This historical data provides valuable insights into the potential risks and rewards, allowing traders to make more informed investment decisions. It's equally important to understand backtesting's limitations. No backtest perfectly predicts future performance, as markets are constantly changing.

The Massive Scale Behind Professional Strategy Testing

Professional options strategy backtesting happens on a scale most individual traders can't fathom. It's not about testing a few variations. It's about analyzing millions of potential strategies across countless market scenarios. Understanding this massive scale offers valuable insights for individual traders looking to improve their own backtesting.

The Power of Extensive Analysis

Firms invest heavily in sophisticated algorithms and powerful computing for options strategy backtesting. They might, for instance, test how factors like days to expiration or strike price deltas impact a strategy's profitability. They also explore how adjusting position sizing affects returns and risk.

The sheer volume of data processed is immense. The scale of options backtesting is vast, with firms like ORATS having conducted over 50 million backtests. These extensive analyses help pinpoint the most effective strategies.

These analyses help traders identify effective strategies by evaluating historical performance under various market conditions. For instance, they can show the impact of entry and exit criteria, such as days to expiration and strike price deltas. They also provide insights into how market conditions, like volatility, affect outcomes.

While past performance doesn't guarantee future results, backtesting offers critical guidance. Find more detailed statistics here. This helps identify statistically robust patterns and filter out the noise that can mislead traders using smaller datasets.

Simulating Diverse Market Conditions

Professional backtesting goes beyond simple historical data. It includes a broad spectrum of market conditions to see how strategies perform in different environments. This includes testing against various market cycles, from bull to bear markets and everything in between.

Professionals also evaluate strategy resilience under different volatility levels. They assess how strategies perform during periods of both low and high volatility. This ensures the strategies can withstand real-world market fluctuations. This comprehensive approach provides a realistic assessment of long-term viability. It also helps traders identify potential weaknesses and adjust accordingly. The goal is to find strategies that consistently perform, regardless of market conditions.

Advanced Tools That Give You The Real Edge

Effective options strategy backtesting requires more than just basic tools. To truly refine your approach, you need platforms capable of in-depth analysis, handling granular data, and offering helpful automation features. Let's explore the tools changing how traders approach backtesting.

Minute-By-Minute Data: The Power of Precision

Many basic backtesting tools rely on daily or less frequent data. This can obscure important intraday price movements, which are especially critical for short-term options strategies. Advanced tools use minute-by-minute data, providing a higher-resolution view of your strategy's performance. This allows for the identification of subtle patterns and more accurate optimization of entry and exit points.

For example, one-minute bars can reveal how quickly a price reacts after a news event. This granular data is also essential for navigating fast-moving markets and trading short-term options like 0DTE (zero days to expiration) contracts. You might be interested in learning more about covered call strategies: How to Master Covered Call Strategies.

Specialized Tools for High-Frequency Trading

The increasing popularity of 0DTE options has driven the development of specialized backtesting tools. Optimized for high-frequency strategies, these tools allow for rapid analysis of multiple trades executed within a single day. Tools like the 0DTE Backtester from Option Alpha demonstrate these advanced capabilities.

This tool uses 1-minute historical data to backtest 0DTE and next-day options strategies. Traders can set up a strategy with specific parameters, like entry and exit criteria, and then analyze the results. Comparing multiple backtests allows traders to visualize how different strategies perform concurrently. This detail and automation helps refine strategies and make data-driven decisions. Learn more about 0DTE backtesting: here.

Automation for Enhanced Efficiency

Advanced backtesting platforms often include automation features, allowing you to run multiple tests concurrently and explore various parameter combinations. Instead of manually adjusting variables and re-running tests, you can set up a series of backtests with different parameters and let the platform do the work.

This saves considerable time and allows for broader strategy exploration. It also helps identify optimal parameters to maximize profitability. Many of these platforms also integrate with brokerage accounts for a smooth transition from backtesting to live trading.

Reading The Numbers That Reveal Strategy Truth

Options strategy backtesting produces a lot of data. But focusing on the wrong metrics can lead to expensive mistakes based on an incomplete picture. This section breaks down the essential performance indicators that truly predict real-world options trading success. We'll cover how to analyze key metrics, find statistically significant results, and spot the warning signs of flawed backtesting.

Key Performance Indicators (KPIs) for Options Strategies

Looking beyond simple profit and loss, several KPIs offer a deeper understanding of a strategy's strengths and weaknesses. Let's break them down:

Win Rate: This is the percentage of winning trades. While a high win rate is good, it's not the only factor determining profitability.

Average Win/Loss: This compares the average profit of winning trades against the average loss of losing trades. It reveals the strategy's risk/reward profile.

Maximum Drawdown: This shows the largest peak-to-trough decline during the backtesting period. A smaller maximum drawdown usually suggests lower risk.

Sharpe Ratio: This metric measures risk-adjusted return. A higher Sharpe ratio typically indicates stronger performance compared to the risk involved.

Statistical Significance: Separating Luck From Skill

In options strategy backtesting, identifying statistically significant results is crucial. Testing a strategy over a longer period, with a higher number of trades, makes the results more reliable. For instance, 50 trades provide less confidence than 500 or more. This larger sample size filters out random market fluctuations and reveals more consistent patterns.

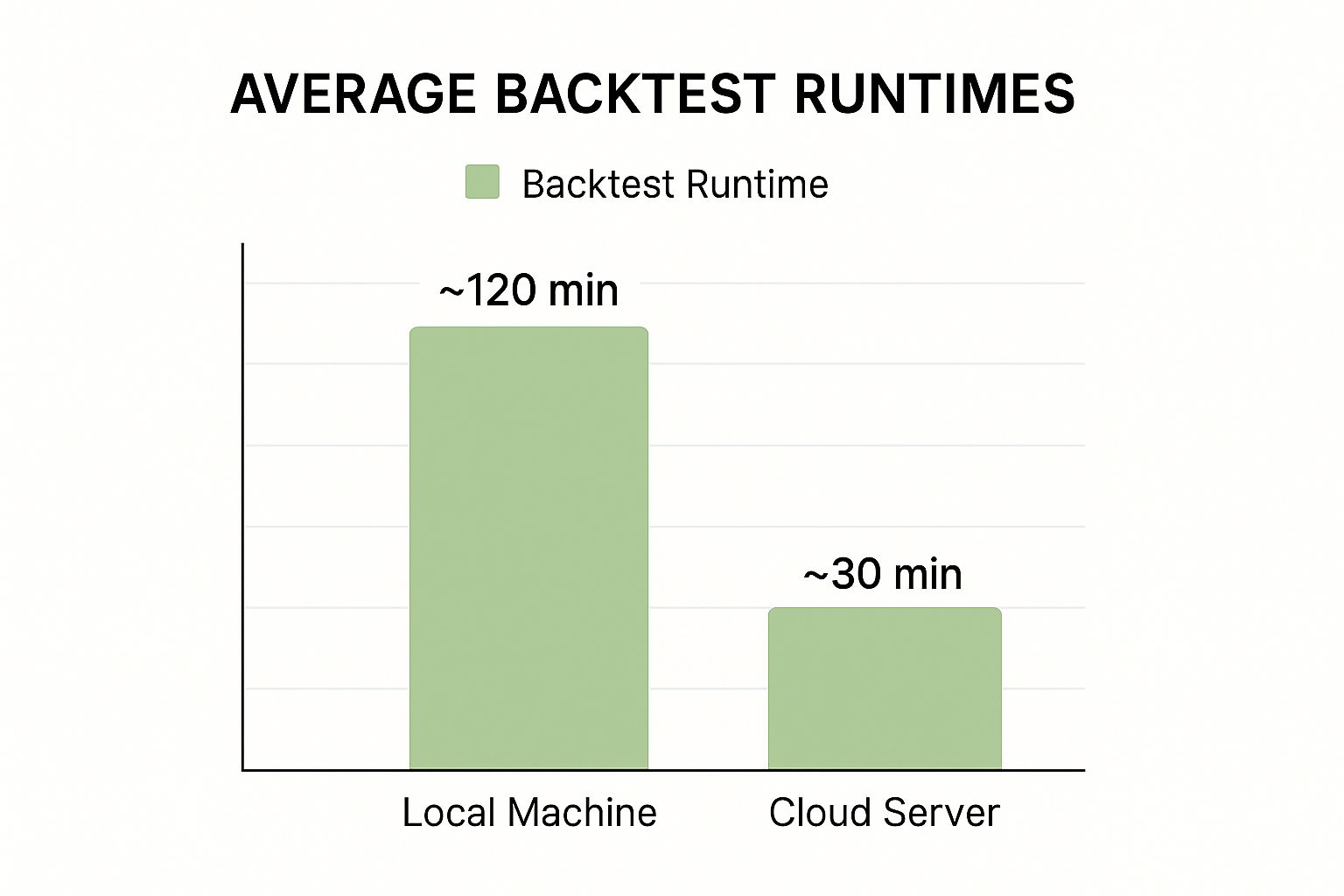

To demonstrate how much faster cloud-based backtesting is, we've included an infographic. It compares the average runtime on a local machine (about 120 minutes) versus a cloud server (around 30 minutes).

As the infographic shows, using cloud computing for your backtests dramatically reduces the processing time. This means you can analyze data and make adjustments to your strategies much faster. This speed empowers individual traders to perform the type of in-depth analysis that used to be accessible only to large institutions.

Absolute vs. Risk-Adjusted Returns: Which Matters More?

While absolute returns matter, they don't tell the whole story. Risk-adjusted returns, like the Sharpe Ratio, provide a more complete view of performance. A strategy with lower absolute returns but a higher Sharpe Ratio might be preferable. This is because it could achieve similar returns with less risk, resulting in consistent profits without exposing your capital to significant potential losses.

Avoiding Backtesting Pitfalls: Curve-Fitting and Other Dangers

Curve-fitting is a major backtesting pitfall. This happens when a strategy is overly optimized for historical data, leading to impressive backtested results but poor real-world performance. To avoid curve-fitting, test your strategies on out-of-sample data – data not used in the optimization process. This confirms that the strategy's success isn't just a fluke or due to over-optimization. Look-ahead bias is another critical consideration. This occurs when the backtest uses information that wouldn't have been available at the time of the actual trade.

Before we delve deeper, let's look at a comparison of key metrics.

To understand how these metrics interact, let's examine the following table:

Essential Options Backtesting Metrics Comparison

A comprehensive comparison of key performance metrics used in options strategy backtesting, including their significance and interpretation guidelines

| Metric | Description | Good Range | Warning Signs |

|---|---|---|---|

| Win Rate | Percentage of winning trades | > 50% (but consider other metrics) | High win rate with low overall profit |

| Average Win/Loss | Ratio of average winning trade to average losing trade | > 1.5 (ideally higher) | Large losses offsetting frequent small wins |

| Maximum Drawdown | Largest peak-to-trough decline | As low as possible, depends on strategy | Drawdowns exceeding risk tolerance |

| Sharpe Ratio | Measures risk-adjusted return | > 1 (higher is better) | High returns with excessive volatility |

This table provides a quick reference for evaluating your backtesting results. Keep in mind that these ranges are general guidelines. The ideal values will vary depending on the specific strategy and market conditions.

By analyzing these metrics and avoiding common pitfalls, options backtesting becomes a powerful tool. This helps determine which strategies are worth pursuing and which ones to discard. It moves you away from guesswork and towards building a sustainable edge in options trading.

Avoiding The Traps That Destroy Trading Accounts

Even the most carefully planned options strategy backtesting can sometimes fall short of expectations in live trading. Often, this disconnect stems from hidden traps that invalidate the testing process and create a false sense of security. This section explores some of these pitfalls and offers strategies to help you avoid them.

Survivorship Bias: Not All Strategies Survive

Survivorship bias occurs when backtests only consider currently available options, neglecting those that have failed or been delisted. This creates a skewed perspective of potential performance. For instance, a backtest focused on a specific industry sector might only include companies that are still operating today. This ignores the potential losses from companies that went bankrupt or were acquired. To mitigate survivorship bias, incorporate broader market data, including historical constituents of indexes like the S&P 500 and information on delisted options.

Look-Ahead Bias: Peeking Into The Future

Look-ahead bias is another common pitfall. This happens when your backtesting incorporates information that wouldn't have been available at the time of the simulated trade. A simple example is using the closing price of a stock to enter a trade. In reality, you would only have access to the bid/ask spread at that moment. This seemingly small difference can dramatically overstate potential profits. Always ensure your backtests use only the information that would have been accessible at the time of each trade.

Overfitting: Tailoring To The Past

Overfitting occurs when a strategy is excessively optimized for historical data. While it might perform exceptionally well in backtests, it often fails in live trading. Think of it like tailoring a suit perfectly to a mannequin. It looks flawless on the mannequin but may not fit a real person. To avoid overfitting, use out-of-sample testing. Set aside a portion of your data specifically for validating your strategy after the optimization process. This helps evaluate how it performs on data it hasn't “seen” before. Check out our guide on Cash Secured Put Examples for practical application of these principles.

The Impact of Transaction Costs and Slippage

Even small transaction costs and slippage – the difference between the expected price and the actual execution price – can significantly impact profits. This is particularly true for high-frequency options strategies. Many backtests underestimate these costs, leading to inflated profit projections. To get a more accurate picture, incorporate realistic transaction fees and slippage models into your testing process. This will help determine if a seemingly profitable strategy remains viable after accounting for these expenses.

Building Robust Backtests: Best Practices

Creating robust options strategy backtests requires careful planning and execution. Here are a few key principles to keep in mind:

Data Integrity: Use clean, accurate, and comprehensive historical data. Include delisted options and historical index constituents.

Realistic Assumptions: Incorporate transaction costs, slippage, and realistic fill prices based on actual market conditions.

Avoiding Bias: Carefully avoid look-ahead bias and survivorship bias.

Out-of-Sample Testing: Validate optimized strategies with unseen data to confirm robustness and avoid overfitting.

By understanding and avoiding these common pitfalls, your backtests become a more reliable tool for evaluating potential strategies. This allows you to move from speculation to informed decision-making based on sound methodology and data-driven insights.

Making The Leap From Testing To Profitable Trading

So, you've backtested an options strategy, and the results look great. Now comes the real challenge: transitioning from simulated trading to the actual market. This is where many promising options traders falter. This section provides a guide for implementing your strategies without risking too much capital.

The Psychology of Live Trading

Trading with real money brings psychological pressures that don't exist in backtesting. Fear and greed can affect your judgment, causing impulsive decisions. A small loss might make you panic and exit a trade too early. On the other hand, a winning streak can lead to overconfidence and excessive risk. Sticking to your plan is essential.

Position Sizing: Balancing Risk and Reward

Use your backtesting results to determine your position size. Don't start with large positions. Begin with smaller allocations and gradually increase them as you gain confidence and experience. Metrics like maximum drawdown, from your backtesting data, can help you figure out appropriate position sizes. This ensures you can handle market swings without devastating your account.

Monitoring and Comparing Live Performance

Regularly check your live trades against your backtested results. Keep detailed trading records. Track metrics like win rate, average win/loss, and Sharpe ratio. Compare these to your backtesting data. This helps you spot any major differences and diagnose problems early. You might be interested in: How to master options selling strategies.

Recognizing Variance vs. Strategy Failure

Even the best strategies have periods of poor performance. It's important to tell the difference between normal market variance and a strategy failure. A short-term loss doesn't mean your strategy is bad. Your backtesting data shows you the expected ups and downs. Use this to decide if a losing streak is normal or a bigger problem.

Adjusting vs. Abandoning a Strategy

Sometimes, you need to adjust a strategy. Market conditions might have changed, or your backtesting assumptions might have been wrong. But avoid making frequent, impulsive reactions to short-term market moves. If your live performance consistently differs from your backtesting results, then a thorough review and potential adjustments are needed. Sometimes, abandoning a strategy is the best choice.

Bridging the Gap: Backtesting to Live Trading

The table below explains the key differences between backtesting and live trading. It also suggests ways to manage these challenges.

To effectively use backtested strategies in live trading, it's crucial to understand and address the inherent differences between these two environments. The following table highlights these differences and offers mitigation strategies to help bridge the gap and improve your trading outcomes.

Backtesting vs Live Trading: Key Differences

A detailed comparison highlighting the main differences between backtested results and live trading performance, with strategies to bridge the gap

| Factor | Backtesting | Live Trading | Mitigation Strategy |

|---|---|---|---|

| Emotions | Absent | Present | Develop a trading plan and stick to it. Practice emotional control techniques. |

| Slippage/Commissions | Simulated | Real | Incorporate realistic costs in your backtesting and consider them in your live trading decisions. |

| Market Conditions | Historical | Dynamic | Continuously monitor market conditions and adjust your strategy as needed. |

| Execution | Instantaneous | Subject to delays | Use limit orders and be prepared for potential slippage. |

Understanding these differences and using the right mitigation strategies can significantly improve your chances of turning successful backtested results into consistent live trading profits. Remember, discipline, patience, and continuous learning are essential for success in options trading.

Key Takeaways

Options strategy backtesting is crucial for any serious options trader. It validates trading ideas, identifies potential risks, and builds confidence before risking real capital. This section summarizes the key takeaways from this guide on transforming options strategy backtesting from guesswork into a systematic process.

Systematic Strategy Generation

Generating strategy ideas shouldn't be random. Develop a system to identify potential opportunities. This might involve studying market trends, analyzing historical data, or even researching option pricing models. For example, focus on specific market sectors or volatility patterns. Document your ideas and build a database of potential strategies for future backtesting.

Backtesting Protocol Design

Your backtesting protocol is the foundation of reliable results. Use quality data and realistic assumptions. Account for transaction costs, slippage, and potential fill prices based on market conditions. Avoid biases like survivorship bias (ignoring past failures) and look-ahead bias (using future information in past decisions). Implement out-of-sample testing to validate your strategies with unseen data, ensuring robustness and preventing overfitting.

Continuous Improvement Through Feedback Loops

Backtesting is a continuous process of refinement. After implementing a strategy, monitor live performance against backtested expectations. Keep detailed trading records and compare key metrics like win rate, average win/loss, maximum drawdown, and Sharpe ratio. This feedback loop provides valuable insights and helps you adapt to changing market conditions.

Building Your Personal Backtesting Database

Organize your backtesting results in a structured way. This lets you track progress, compare strategies, and identify promising approaches. Use a spreadsheet or dedicated software. Include details like strategy parameters, backtesting period, key performance indicators, and observations about market conditions. This database becomes an invaluable resource over time.

Developing Criteria for Strategy Selection

Not all strategies perform equally. Establish criteria to determine which ones deserve real money. Your criteria might include a minimum Sharpe Ratio, a maximum drawdown limit, or a target win rate. Tailor these criteria to your risk tolerance and return expectations. This structured approach ensures you select the most robust strategies for your portfolio.

Constructing Diversified Strategy Portfolios

Diversification is crucial. Backtest a range of strategies targeting different market scenarios and volatility levels. A portfolio of uncorrelated strategies mitigates the impact of market volatility, allowing for consistent returns regardless of short-term fluctuations.

Measurable Actions and Progress Tracking

Focus on actionable steps. Monitor specific indicators to validate your approach and identify areas for improvement. For example, if implementing a new options selling strategy, track its win rate, average premium per trade, and maximum drawdown. Compare these results with your backtested expectations to fine-tune your strategy and assess its long-term viability.

By implementing these takeaways, you can transform your approach to options strategy backtesting. Make informed decisions and improve your trading performance.

Ready to transform your options trading? Explore Strike Price and unlock the power of informed options selling. See how their real-time probability metrics, smart alerts, and intuitive dashboard can help your income generation.