Options Trading Journal: Transform Your Trading in 90 Days

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

Why Your Options Trading Journal Changes Everything

Look, here's the deal with options trading journals: they're not just about keeping records. They're your secret weapon. Seriously. I've seen so many traders go from mediocre to consistently profitable just by tracking the right things. It's not about logging every tiny detail or building some crazy spreadsheet. It’s about understanding your trading patterns, seeing your blind spots, and making decisions based on evidence, not on gut feelings (which, let’s be honest, are often wrong).

Think of your trading journal as a flight recorder. It captures not just what happened, but why. And understanding the "why" is what separates the consistently profitable traders from everyone else.

For example, I worked with one trader who discovered, through their journal, that they absolutely nailed covered calls when implied volatility was high. But in low-volatility environments? Forget about it. That single insight allowed them to focus on high-IV setups and avoid situations where they just didn't have an edge.

Uncovering Hidden Opportunities

Here’s another example: a trader I mentored meticulously logged every trade. After a while, a clear pattern emerged. Their win rate on puts was way higher during market downtrends. The flip side? They consistently lost on puts during uptrends. This wasn't some magical revelation – it was just the data talking. And they could only see it after carefully analyzing their entries and exits alongside the broader market context. This allowed them to refine their approach, focusing on puts during bearish times and looking for other strategies when things were bullish.

We all tend to remember the big wins, right? And conveniently forget the string of losses that came before. A journal removes that bias. It gives you a clear, unbiased view of your strengths and weaknesses.

This data-driven approach reveals opportunities you’d otherwise miss completely. You might find a specific setup, a particular time of day, or a certain market condition that consistently leads to winning trades. These are your hidden edges, just waiting to be discovered.

Historical options data is a huge part of this process, too. It lets you backtest your strategies and understand how the market behaves. Resources like Cboe Global Markets offer tons of historical options volume data. This data provides context for your own trading. Explore Cboe's historical data resources.

By combining your personal trading data with the bigger picture, you make smarter decisions. An options journal isn’t just about tracking; it’s about turning raw data into actionable intelligence. It gives you a real advantage. This constant feedback loop is how you evolve from hoping for wins to consistently making them.

Building Your Perfect Journal Framework

Look, most traders either barely track anything, or they get bogged down in useless data. Neither helps you improve. After years of working with real trading accounts, I’ve realized what actually matters in an options trading journal. It boils down to capturing three things: the trade's nuts and bolts, the market context, and – most importantly – your why.

Sure, the basic facts matter: the date, the strike price, whether you bought or sold. But the real magic is understanding the story behind each trade. Why that particular strike? What was the implied volatility rank at entry? How did the trade actually do, not just in dollars, but compared to the probability you gave it at the start?

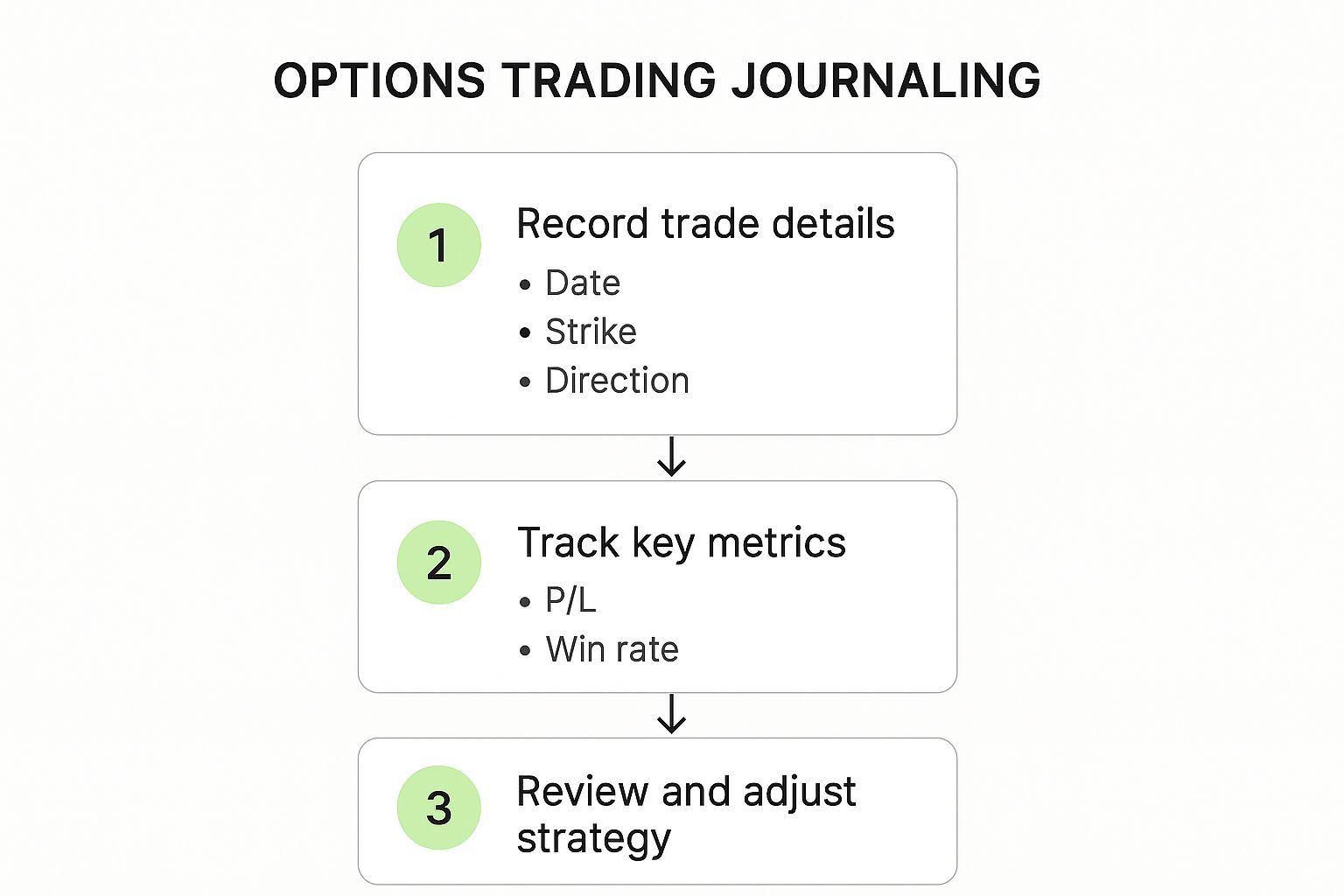

This simple infographic shows the core process:

Like the infographic shows, consistently logging details, tracking key metrics, and regularly reviewing creates a powerful feedback loop. This ongoing process of reflection and adjustment is the key to refining your strategies over time.

Setting Up Effective Entry Templates

Think of your journal entries like pre- and post-trade briefings. Before you jump in, capture your thinking. What's your rationale? What market conditions are you expecting? What’s your profit target, and where will you cut losses? This sets you up for later analysis. After the trade closes, compare the actual outcome to your initial plan. Were you right for the right reasons, or did you just get lucky?

Here’s a real-world example. Say you’re selling a covered call on Apple. Instead of just jotting down the strike and expiry, write why you picked that strike. A technical level? A specific probability of profit? Did you factor in the implied volatility rank? These details help you later analyze if your logic was solid, or if the market just happened to move your way.

Structuring Your Journal for Meaningful Review

Your trading journal isn't just a record; it's a tool for improvement. Organize it so it's easy and helpful to review. Try using categories or tags to group similar trades. For example, tag by strategy (covered calls, puts, spreads), underlying asset (Apple, Tesla, SPY), or even market conditions (high volatility, earnings season). This lets you filter and analyze specific groups of trades to see patterns and refine your approach.

To make it super practical, here’s a table I use to organize my journal entries. It might give you some ideas for your own:

Essential Options Trading Journal Fields A comprehensive breakdown of must-have data fields for tracking options trades effectively

| Field Category | Specific Data | Why It Matters | Frequency of Use |

|---|---|---|---|

| Trade Details | Date, Time, Ticker, Strategy (e.g., Covered Call, Put) | Basic record-keeping | Every Trade |

| Entry Metrics | Entry Price, Strike Price, Expiration Date, Implied Volatility Rank, Premium Received | Understanding trade setup | Every Trade |

| Market Context | Overall Market Trend (Bullish, Bearish, Neutral), Volatility Level (High, Low), News/Events | Evaluating external influences | Every Trade |

| Rationale | Reasons for Entering Trade, Expected Price Action, Probability of Profit (based on IV Rank) | Capturing decision-making process | Every Trade |

| Exit Metrics | Exit Price, Profit/Loss (Dollar and Percentage), Days Held | Measuring trade performance | Every Trade |

| Post-Trade Analysis | What went well? What could be improved? Did the trade perform as expected? | Learning from each trade | Every Trade |

This table keeps everything organized, making reviews much more efficient. I can quickly see which factors are contributing to my wins and losses.

Remember, the goal isn’t to create more work. It’s about feedback. Make it a system that works for you and gives valuable insights. If your current journaling method feels like a chore, it probably isn't structured effectively. Experiment! Find what works and stick with it. This constant refinement, based on real data and honest self-assessment, turns journaling into a real edge.

Tracking Metrics That Actually Improve Performance

Simply tracking profit and loss? That's just scratching the surface. Real growth in options trading comes from digging deeper. Think about it – successful traders focus on probability-based metrics that reveal insights you’d miss with casual observation. They're analyzing things like implied volatility (IV) percentiles at entry and exit, and really dissecting how time decay affected their positions (compared to their initial guesses). They also keep a close eye on how delta changes over the life of the trade.

Let me give you an example. Imagine you’re always selling covered calls. Your trading journal might show that chasing premium alone leads to frequent early assignment and lower overall returns. Ouch. But what if you used probability metrics, like those from Strike Price, to pick strikes with a slightly lower premium but a much higher chance of expiring out-of-the-money? You might actually boost your long-term profit. That's the power of thinking in probabilities.

Using IV Percentiles and Time Decay to Your Advantage

Tracking IV percentiles adds a whole other dimension. Say you’re selling a put on a stock. A high IV percentile means the market expects bigger price swings. If your journal shows your put strategies consistently crush it when IV is in the top 20% of its range, boom – you’ve found an edge. Now you can be more selective, waiting for those high-IV setups. You can also use helpful tools like the options risk-reward calculator discussed in this post: Check out our guide on Options Risk-Reward Calculator.

Time decay is another key piece of the puzzle. Did your position decay faster or slower than you predicted? Were you overly optimistic about theta? Analyzing this data helps refine your estimates for future trades, leading to more accurate profit targets and better risk management. For digging into historical trends (going all the way back to 1996!), check out OptionMetrics: Discover more insights on option metrics. They have great data on implied volatility, option prices, and Greeks across different markets.

The Power of "Why" in Your Journal Entries

Your journal should always answer the question why. Why did you enter this trade? What was your thesis? What market conditions were at play? What did you learn, win or lose? This is way more than just logging the basic details.

Picture this: two profitable trades, same strategy. In the first, your analysis was perfect, the market moved as expected, and you nailed your profit target. In the second, the market went against you, but surprise! An unexpected news event flipped things in your favor. Lucky win. Without notes, both trades look identical in your journal. But the why tells a different story. Trade one reinforces a valid strategy; trade two highlights the need for risk management and avoiding overconfidence from unpredictable events.

This deep dive – focusing on the reasoning and how it matches market reality – is what sets apart consistently profitable traders from those relying on luck. By understanding not just what happened, but why, you can repeat wins, avoid past mistakes, and build a solid trading system. Your journal becomes your secret weapon for constant improvement, driving you towards consistent profits.

Journal Templates That Work in Real Trading

Let's ditch those generic spreadsheets and dive into options trading journals that actually work. I'm talking about templates that have been tested in the real world, by traders managing their own capital. We'll explore three approaches, from simple to sophisticated, and how you can adapt them as your trading style evolves.

The Streamlined Template: Income Strategies

This is your bread-and-butter template for conservative strategies like covered calls and cash-secured puts. Think clean, efficient, and focused on probability and risk management. Here's what it looks like:

- Underlying Asset: (e.g., AAPL, MSFT)

- Strategy: (e.g., Covered Call, Cash-Secured Put)

- Expiration Date: (e.g., 2024-12-20)

- Strike Price: (e.g., $150)

- Premium Received: (e.g., $2.50 per share)

- Probability of Profit (POP): (e.g., 85%) - This is crucial! Tools like Strike Price can calculate this for you. Think about automating data extraction using tools like Documind to pull key performance indicators for easy analysis.

- Max Profit: (e.g., $250)

- Max Loss: (e.g., $14,750 – for a covered call, this is your cost basis minus the premium)

- IV Rank at Entry: (e.g., 70th percentile)

- Notes: (e.g., "Entered based on high IV rank and technical support at $145")

This streamlined approach emphasizes rapid data entry, highlighting the core metrics for income-focused strategies. It prioritizes probability and risk/reward – because knowing your potential upside and downside is everything.

The Detailed Template: Directional Plays

When you're dealing with more complex strategies like spreads and condors, you need more granular data. This template adds extra layers for technical analysis and precise timing:

- All fields from the Streamlined Template

- Entry Date/Time: (e.g., 2024-11-20 10:30 AM)

- Exit Date/Time: (e.g., 2024-12-15 2:00 PM)

- Technical Indicators: (e.g., "RSI overbought, MACD crossover")

- Catalyst (if applicable): (e.g., "Earnings announcement expected")

- Delta at Entry/Exit: (e.g., 0.30/0.60)

- Theta at Entry/Exit: (e.g., -0.05/-0.10)

- Detailed Trade Review: (e.g., "Entry signal was accurate, but exited too early based on fear. Need to stick to the plan next time.")

This provides a deeper look into market context and your decision-making process. These details help you refine your entries and exits – and importantly, manage your emotional responses. Backtesting your options strategies can also be invaluable, giving you insights into how your trades might perform under various scenarios. Check out this article on options strategy backtesting for more.

The Hybrid Approach: Adapting to the Market

Let's be real, many traders use a blend of strategies based on market conditions. A hybrid template gives you that flexibility. Start with the streamlined version, then add fields from the detailed template only when necessary. This keeps things from getting overwhelming but ensures you’re capturing the important stuff for more complex trades.

The key is to treat your template as a living document. As your trading evolves, so should your journal. Add metrics that gain importance and remove those that no longer provide value. This keeps your journal a powerful tool, not just a graveyard of data.

To help illustrate the different template types, let's look at a comparison table:

Journal Template Comparison: Side-by-side comparison of different journal templates for various options trading approaches

| Template Type | Best For | Key Features | Complexity Level |

|---|---|---|---|

| Streamlined | Income Strategies (Covered Calls, Cash-Secured Puts) | Focus on probability, risk management, quick data entry | Simple |

| Detailed | Directional Plays (Spreads, Condors) | Granular data on technicals, timing, Greeks, trade review | Complex |

| Hybrid | Adaptable to market conditions and evolving strategies | Combines elements of streamlined and detailed as needed | Moderate |

This table highlights the core differences between the templates, allowing you to choose the one that best suits your trading style or even create your own personalized hybrid. Remember, the goal is to create a journal that works for you.

Choosing Your Journaling Tools and Systems

The age-old question for options traders: Which journaling method is best? Handwritten notes? A custom spreadsheet? Fancy software? I've explored countless options (pun intended!), and the truth is, there's no single "best" way. It's all about finding what clicks for you. So, let's dive into the pros and cons of different approaches, from free tools like Google Sheets to premium platforms.

From Handwritten Notes to Automated Data Feeds

Believe it or not, some wildly successful traders still prefer the old-school method: pen and paper. They find that physically writing down each trade helps them connect with the emotional side of things—the fear, the greed, the thrill of a winning trade. Others swear by automated data feeds, which eliminate manual entry (goodbye typos!) and save tons of time, especially for high-volume traders.

The key is finding a system that matches your trading style, technical skills, and review habits. If you're only making a few trades each week, a simple spreadsheet might be perfect. Trading multiple times a day? Automated data entry becomes a lifesaver. Your comfort level with technology matters too. If you're a spreadsheet wizard, building a custom journal can be incredibly powerful. But if spreadsheets make you want to run for the hills, a user-friendly platform might be a better fit.

The Hidden Downsides of Fancy Platforms

Here’s a hard truth: some expensive journaling platforms can actually make analysis harder. They’re often packed with bells and whistles you don’t need, making it tough to find the insights that truly matter. Think of it like a kitchen with every gadget imaginable, but you can’t even find a spatula to flip your eggs!

Another trap is the "set it and forget it" mindset. Some platforms promise automation for everything, but real improvement comes from actively engaging with your data. A journal isn't a magic bullet—it's a tool. You have to use it, analyze your trades, and look for patterns. This brings us to another crucial point: your review habits. Even the most sophisticated journal is useless if you’re not regularly reviewing it.

Matching Your Journal to Your Trading Style

Different trading styles demand different features. If you’re focused on income strategies like covered calls and cash-secured puts, you'll want a journal that tracks probability metrics and risk management tools. For more aggressive directional plays, tracking technical indicators and timing becomes key. And for traders who switch between strategies, a flexible, hybrid approach often works best.

For example, as a covered call seller, you'll want to track not just profit and loss, but also metrics like implied volatility rank and probability of profit. This helps you choose strikes that balance premium with the likelihood of keeping your shares. If you're trading complex spreads, you'll need a journal that can handle multiple legs and calculate Greeks like delta and theta. Comprehensive market data can also significantly enhance your journal analysis. IVolatility.com, for instance, provides a treasure trove of historical option prices, bid-ask spreads, and volume data for US and global markets. This data is invaluable for understanding market trends and volatility.

Don't overcomplicate things! Start simple and add complexity as needed. A basic spreadsheet can be surprisingly effective, especially when you’re starting out. As your trading volume and experience grow, you can then consider upgrading to a more sophisticated tool. The most important thing is to choose a system that fits your workflow and lets you easily track, analyze, and learn from your trades.

Review Habits That Drive Real Results

The truth is, simply keeping an options trading journal isn't enough. Plenty of traders meticulously record every detail, but never unlock the insights buried within that data. The real value lies in the review process. Profitable traders know this. They use targeted reviews to transform raw journal entries into actionable trading wisdom.

I've witnessed firsthand how powerful effective review habits can be. I once worked with a trader who'd kept a detailed journal for months, yet his performance was flat. We overhauled his review process, shifting from a surface-level P/L check to a deep dive into his decision-making. Within weeks, he'd spotted a recurring pattern: entering trades based on gut feelings during volatile markets. His journal showed these emotional trades consistently underperformed. Recognizing this, he implemented stricter entry rules and significantly boosted his win rate.

Weekly Reviews: Fine-Tuning Your Approach

Think of weekly reviews as tactical adjustments, like a coach reviewing game film. The goal is to identify immediate patterns. Are your covered calls performing better on certain weekdays? Are your puts underperforming on Fridays? Look for those short-term trends to inform next week's decisions.

This isn't about self-criticism. It's about asking, "What can I tweak right now to improve?" Maybe your journal reveals you consistently misjudge Implied Volatility Rank. This week, focus on accurately assessing IVR before entering any positions. Small, targeted adjustments based on recent data can lead to big improvements over time.

Monthly Deep Dives: Unearthing Hidden Edges

Your monthly review provides a strategic overview. Zoom out and look for bigger-picture patterns. Are there seasonal trends impacting your covered-call returns? Does your journal show better performance during specific volatility regimes? These deeper dives often uncover hidden edges and areas for long-term optimization.

You might discover, for example, that your iron condors thrive in low volatility but struggle during periods of market uncertainty. This could lead you to adjust your strategy, deploying iron condors more aggressively in quiet markets and shifting to other strategies when volatility spikes. This is how a journal becomes a powerful performance-enhancing tool, not just a record-keeping chore. Cboe's historical data can be helpful in validating these long-term trends:

This data shows historical options volume trends, which you can correlate with your journal to identify broader market influences on your performance.

Analyzing Emotional Decision-Making

Perhaps the most valuable aspect of a thorough journal review is analyzing your emotional decision-making. Did fear cause you to exit a winning trade too early? Did greed make you hold a loser too long? Honestly reviewing your emotional state during each trade helps you recognize these patterns and develop strategies to mitigate their impact. When selecting your journaling tools, consider a dedicated dashboard to track key metrics. You can learn how to build an effective dashboard with an Excel KPI Dashboard.

This is about building a feedback loop. Each review session should make you a slightly better trader. The goal isn’t perfect record-keeping, it’s consistent learning and improvement. By turning your options trading journal into a source of actionable insights, you move from hoping for wins to systematically creating them.

Building Your Consistent Trading Success System

We've talked a lot about options trading journals—the why and the how. But the real magic happens when you move from simply recording trades to actively using that data to level up your game. It's about creating a system that fits you, not just ticking boxes.

Think of it like any new habit: it takes time and effort. Don't expect to become a journaling pro overnight. There will be bumps in the road. You might miss entries during a hectic week, or realize your initial template isn't quite right. That's perfectly normal! Adapt, adjust, and keep at it. You might even want to explore different options strategies for income: best options strategies for income.

Warning Signs and Adapting Your System

How do you know if your journaling approach needs a refresh? If reviewing your journal feels like a chore, or you're not getting any useful information from it, it's time for a change. Maybe your template is too complicated, or the metrics you're tracking don't align with your trading style. Don't be afraid to experiment. Simplify your template, maybe focusing on just a few key metrics. Or try a different journaling tool entirely. The right system should feel intuitive and give you valuable feedback.

As your trading evolves, so should your journal. When you start exploring new strategies, like spreads or condors, you'll need to track more information. This is where a flexible system really shines. You might start tracking delta and theta, or dive deeper into analyzing your entries and exits. Your journal should be a dynamic tool that grows with you.

Overcoming Common Obstacles

Let's be real, consistency is hard. Life happens. Work, family, even just being tired can derail the best-laid plans. One trick I use is tying my journaling to a specific time or event. I review my journal every Sunday evening, or right after I'm done trading for the day. This helps create a routine.

Staying motivated during a losing streak is tough. It’s tempting to ignore the journal when things aren't going well. But this is exactly when it's most valuable! Reviewing losses gives you crucial insight into what’s going wrong. It helps you spot patterns, refine your strategies, and avoid making the same mistakes again.

Finally, use your journal to build real confidence, not false hope. Your journal isn't a magic eight ball. It can't predict the future. But it can give you a clear, objective view of your past performance, helping you make smarter decisions going forward. This data-driven approach builds true confidence based on facts, not wishful thinking.

Ready to transform your trading journal into a powerful tool for success? Check out Strike Price (https://strikeprice.app) and start making data-driven decisions today.