Earn Passive Income from Stocks: Proven Strategies for Success

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

Generating passive income from stocks is one of the most reliable ways to build wealth by making your money work for you. It all boils down to two main paths: collecting regular cash payouts from companies (dividends) or benefiting from the long-term growth of diversified funds like ETFs.

This isn't about getting rich quick. It's about building a sustainable financial engine that runs on its own.

Your Blueprint for a Lasting Income Stream

Think of it like planting a "money tree." It takes some upfront effort—you have to choose the right spot, plant the seed, and water it—but eventually, it grows into something that produces fruit year after year with minimal work.

That's exactly what we're doing here. This blueprint will walk you through creating a system that generates income without your constant attention.

The first step is understanding your own financial landscape. Before you start building, you need to know what you're building and why. This means setting clear, measurable goals. Are you trying to supplement your salary, save for a down payment, or fund your retirement? Your "why" determines your "how."

Define Your Income Goals and Timeline

First things first: get specific. A vague goal like "I want to make more money" isn't going to cut it.

Try something like this instead: "I want to generate $500 per month in passive income within the next five years." Now you have a clear target and a deadline, which makes it much easier to track your progress.

Next, figure out your starting capital. How much can you realistically set aside to invest? Don't worry if it's not a huge amount. Starting small and contributing consistently is often more powerful than waiting to invest a big lump sum, thanks to the magic of compounding.

Building a passive income portfolio is a marathon, not a sprint. Consistency, patience, and a clear strategy are your most valuable assets on this journey toward financial independence.

Assess Your Comfort with Risk

Every investment comes with risk. The stock market goes up, and it goes down. The key is understanding how much of that volatility you can stomach without panicking and making emotional decisions.

A well-built portfolio should match your personal risk tolerance. If you're not sure where you stand, tools like a risk tolerance questionnaire can give you a much clearer picture of your comfort level.

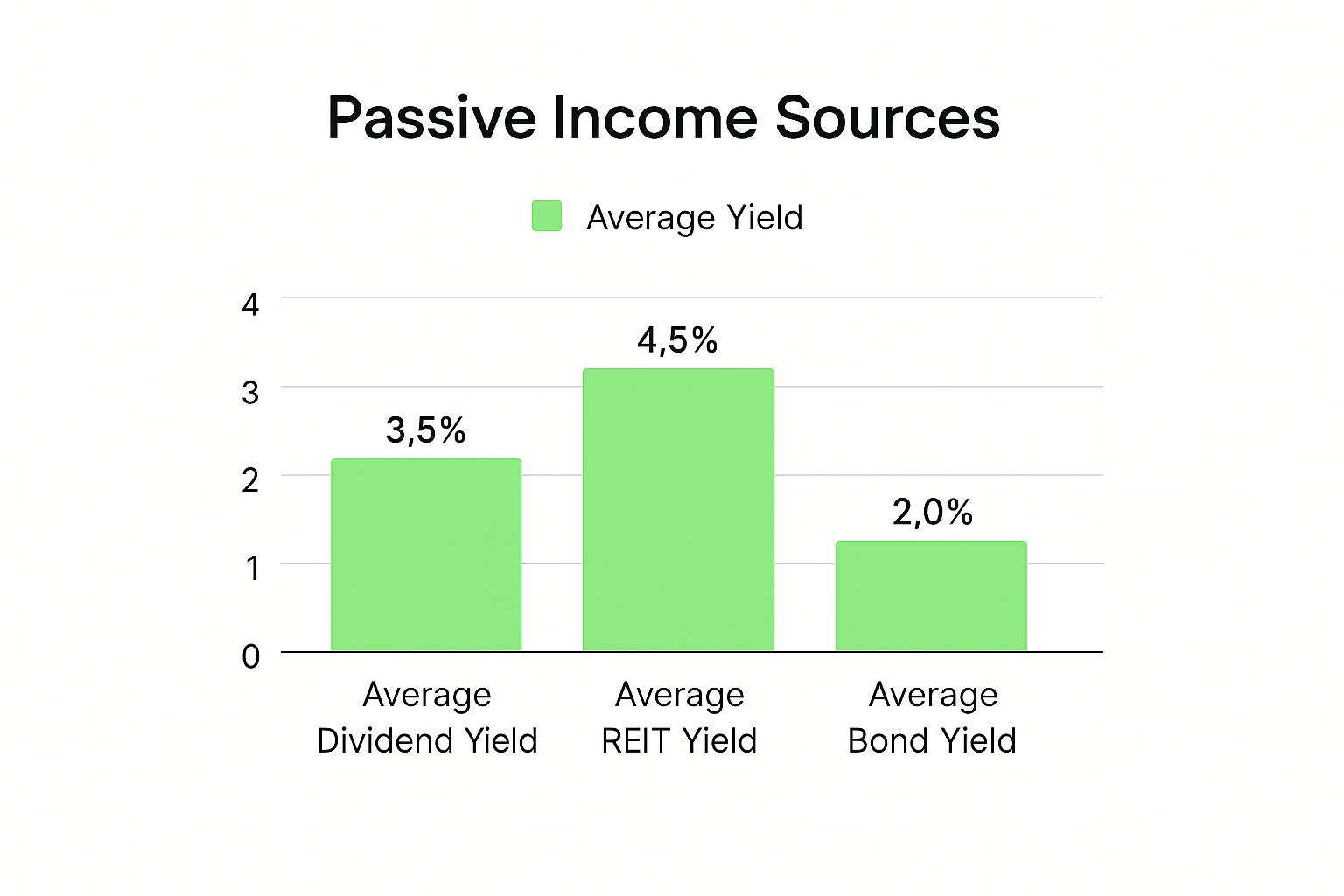

This chart gives you a sense of the typical yields you can expect from different passive income sources, including stocks.

As you can see, different assets offer different income potential, which is why a diversified approach is so important.

Crafting a blueprint for a lasting income stream often benefits from a comprehensive financial strategy. For more tailored guidance on how passive income fits into the bigger picture, you might want to explore resources that offer expert retirement planning advice.

How Stocks Actually Generate Passive Income

So, how does money from stocks actually end up in your pocket? To get a real grip on passive income from stocks, you have to see it for what it is. Owning a stock means you own a tiny slice of a real business. That little piece gives you a claim on the company's assets and, more importantly, its profits.

Think of it like being a silent partner in a local coffee shop. When the shop has a great quarter and turns a profit, you're entitled to your share of the winnings. The stock market works on the exact same principle, just on a much, much bigger scale.

This ownership funnels cash to you in two main ways. Both are critical for building a steady income stream, but they work very differently.

Dividends: The Direct Payout

The most straightforward way stocks put money in your account is through dividends. A dividend is simply a cash payment a company sends to its shareholders, usually every quarter. It’s the company’s way of sharing the profits directly with you, the owner.

Why would they do this? Many established, profitable companies make more cash than they need to reinvest in the business. Instead of just letting that money pile up, they return it to shareholders as a reward for their investment. It’s also a powerful signal of the company's financial stability.

A consistent dividend isn't just income; it's a vote of confidence from the company's leadership. Businesses that can afford to regularly share profits typically have strong, predictable cash flow.

Take a big, stable company like a major food brand. They’ve already built their factories and captured their market share. While they still spend on growth, they often have plenty of extra profit to hand back to investors. This is the bedrock of any dividend-focused income strategy.

Capital Appreciation: The Value Growth

The second way you profit is through capital appreciation—the increase in a stock's price over time. This isn’t a direct cash deposit like a dividend, but it's a huge part of building wealth that you can turn into income down the road.

As a company gets bigger, innovates, and boosts its earnings, its overall value goes up. That means your ownership stake—your shares—becomes more valuable, too. You only get that value in cash when you decide to sell your shares, making it a more indirect way to generate income.

The Power of Funds For Simplified Income

Let's be honest: picking individual dividend stocks one by one can be a ton of work. That’s where passive funds, like Exchange-Traded Funds (ETFs), have completely changed the game for income investors. Think of an ETF as a basket that holds hundreds or even thousands of different stocks.

When you buy a single share of a dividend-focused ETF, you instantly own tiny pieces of every company in that basket. This approach comes with some major perks:

- Instant Diversification: Your risk isn't tied to the fate of one or two companies; it's spread out across a whole portfolio.

- Blended Income Stream: The ETF collects all the dividends from every company it holds and pays them out to you in one simple, consolidated distribution.

- Lower Effort: Forget researching hundreds of individual stocks. The fund’s manager does all the heavy lifting for you.

This move toward passive investing has become a massive trend. After the 2007–2008 financial crisis, investors started shifting from actively managed funds to these simpler passive options in droves. In fact, by 2017, passive funds already held over one-third of all assets in U.S. domestic equity funds. You can learn more about this shift in institutional investment trends and see why it’s so popular.

Choosing Your Dividend Investing Strategy

Jumping into dividend investing is a bit like picking a hiking trail. Some trails offer a slow, steady climb with beautiful scenery, while others are steep, direct, and get you to the top faster—but with more risk. Both paths can lead you to your financial goals, but the journey looks very different.

Your choice of trail really boils down to what you want to achieve with your passive income from stocks.

Two main approaches dominate the conversation: dividend growth investing and high-yield dividend investing. While both are designed to put cash in your pocket, they prioritize different outcomes. Getting a handle on the trade-offs is key to building a portfolio that actually works for you. Let's break them down.

Dividend Growth Investing: The Slow and Steady Approach

Dividend growth investing is the marathon runner's strategy. The goal isn’t to grab the biggest payout today. Instead, you're hunting for high-quality, stable companies with a long, proven history of increasing their dividend payments year after year.

Think of it like planting a small orchard. The first harvest might not be much, but every year those trees get bigger, stronger, and produce way more fruit. This is all about harnessing the incredible power of compounding, where your income stream doesn't just show up—it actively grows over time.

Investors who love this strategy often gravitate toward companies known as Dividend Aristocrats (S&P 500 members that have hiked dividends for 25+ consecutive years) and Dividend Kings. These are the elite of the elite, known for their rock-solid reliability. For example, companies like American States Water and Procter & Gamble have been raising their dividends for an amazing 70 and 68 years, respectively. You can discover more insights on the stability of Dividend Kings to see just how dependable they've been.

This strategy is less about immediate cash flow and more about building a reliable, ever-increasing income stream for the future. It's a testament to patience and the power of quality over quantity.

High-Yield Dividend Investing: The Immediate Income Approach

If dividend growth is the marathon, high-yield investing is the sprint. This approach is all about maximizing your current income by focusing on companies offering a much higher-than-average dividend yield right now. It's a go-to for retirees or anyone needing to supplement their income immediately.

The appeal is obvious: more cash in your pocket today. But be careful. A super-high yield can sometimes be a red flag. It might mean the company is in a struggling industry, or that investors are dumping the stock, which pushes the price down and artificially inflates the yield. It's critical to ask why the yield is so high.

A high-yield strategy demands a lot more homework to avoid "yield traps." These are companies that tempt you with big payouts they can't actually afford, leading to a surprise dividend cut and a painful drop in the stock price.

- Pro: Generates significant income right away, which you can use for expenses or to reinvest.

- Con: Comes with higher risk, as those juicy yields can signal underlying business problems.

- Best For: Investors who need immediate cash flow and are comfortable taking on more risk.

Comparing the Two Strategies

Deciding between these two isn't always a black-and-white choice. In fact, many savvy investors blend both. But knowing their core differences helps you put your money to work in a way that makes sense for you.

| Feature | Dividend Growth Investing | High-Yield Dividend Investing |

|---|---|---|

| Primary Goal | Long-term, compounding income growth | Maximum immediate cash flow |

| Typical Companies | Stable, established leaders (e.g., blue-chips) | Often in sectors like REITs, utilities, or energy |

| Risk Profile | Generally lower risk and volatility | Generally higher risk and volatility |

| Investor Mindset | "The tortoise"—patience and long-term focus | "The hare"—focus on current income |

Ultimately, your strategy should be a mirror of your personal financial situation, goals, and timeline. By picking the right path—or even creating a hybrid of both—you can build a powerful engine for passive income that truly serves your needs.

Using ETFs for Diversified Passive Income

Picking individual stocks to build an income stream is a lot of work. You have to research companies, monitor their performance, and understand every little detail. It's like trying to cook a five-course meal from scratch every single day.

But what if you could just buy a professionally prepared meal instead? That's the idea behind Exchange-Traded Funds (ETFs).

Think of a dividend ETF as a basket holding dozens, sometimes hundreds, of different dividend-paying stocks. You buy one share of the ETF, and you instantly own a small piece of every company in that basket. It’s a game-changer for anyone who wants passive income from stocks without becoming a full-time analyst.

This is the fastest way to get instant diversification, spreading your money across different companies and industries. Diversification is your best friend when it comes to managing risk. If one company in the ETF has a rough quarter and cuts its dividend, the impact on your income is minimal because all the others are still paying out.

Index Funds: The Original Passive Income Machine

The easiest place to start is with broad-market index ETFs. These funds are built to simply mirror major stock market indexes, like the S&P 500. When you buy a share of an S&P 500 ETF, you’re essentially buying a tiny slice of the 500 largest public companies in the U.S.

Many of these are blue-chip giants that have paid dividends for decades. The ETF does all the work for you—it collects the dividends from all 500 companies and bundles them into a single, regular payment that hits your account. You get a steady, blended income stream without the headache of buying 500 individual stocks.

ETFs make investing accessible. They offer a low-cost, low-effort way to build a diversified portfolio. For income investors, they cut out the guesswork and deliver an immediate, multi-source income stream.

This hands-off approach is catching on globally. In Europe, investors are flocking to passive funds. Long-term index funds there pulled in €13.41 billion in net inflows in April 2024 alone, while actively managed funds saw money flow out. You can discover more about the rise of passive investing to see how this trend is reshaping how people invest.

This chart from Morningstar shows just how much market share passive funds have gained over the years.

That steady climb says it all. Investors increasingly prefer the simplicity and reliability of passive funds to build their wealth.

Specialized Dividend ETFs for Targeted Income

Want to get more specific? Beyond broad index funds, you'll find specialized ETFs designed purely for generating income. These funds use a set of rules to pick stocks based on their dividend history, giving you a more focused way to build your passive income.

They generally fall into a few key types:

- High-Yield Dividend ETFs: These funds hunt for companies with the highest current dividend yields. They're great if you want to maximize your cash flow right now, but they can sometimes be a bit riskier.

- Dividend Growth ETFs: The focus here is on companies with a long track record of increasing their dividends year after year. This strategy is all about building a reliable and growing income stream for the long haul.

- Dividend Aristocrat ETFs: These are the gold standard of dividend growth. They only hold companies that have raised their dividends for at least 25 consecutive years, a clear sign of incredible financial strength.

By choosing an ETF that matches your goals—whether that's maximum income today or steady growth tomorrow—you can put your strategy on autopilot. You're basically hiring the fund to do the heavy lifting for a tiny fee, letting you focus on the big picture.

How to Build Your Passive Income Portfolio

Okay, let's move from theory to action. This is where your journey to generating passive income from stocks really gets going. Building a portfolio isn’t about just grabbing a few high-yield stocks and hoping for the best. It's about designing a personalized income engine built to fit your financial life.

And that process starts with you, not the market.

Before you put a single dollar to work, you have to know what you’re aiming for. A vague goal like "I want to make money" is basically useless. Get specific. "I want to generate $500 per month in passive income to cover my car payment" — now that's a target you can build a plan around.

Just as important is being honest about your risk tolerance. What's your gut reaction if your portfolio value drops 20% in a month? Knowing how you'll handle the market's inevitable mood swings helps you build a portfolio you can actually stick with when things get choppy.

Crafting Your Asset Allocation

Asset allocation is just a fancy term for deciding how to slice up your investment pie. For an income portfolio, it’s all about finding the right balance between dividend-paying stocks, dividend ETFs, and maybe some growth funds to make sure your nest egg keeps getting bigger.

There's no magic formula here. A younger investor can stomach more risk for higher growth, while someone nearing retirement is probably going to focus on protecting their capital and locking in that steady income.

The key is finding the right mix for your situation.

Sample Passive Income Portfolio Allocations

To give you an idea of what this looks like in practice, here are a few sample allocations based on different investor profiles. Think of these as starting points, not rigid rules.

| Investor Profile | Dividend Stocks % | Dividend ETFs % | Growth/Index ETFs % | Potential Focus |

|---|---|---|---|---|

| Conservative | 40% | 30% | 30% | Stable income and capital preservation. |

| Balanced | 30% | 40% | 30% | A mix of immediate income and long-term growth. |

| Aggressive | 20% | 30% | 50% | Prioritizing total return with some income. |

The real power isn't in copying these numbers, but in using them as a guide to create an allocation that feels right for you and your goals.

Putting Your Portfolio on Autopilot

Want to know the real secret to successful passive income investing? Make it automatic. The less you have to actively do, the more likely you are to stay the course and let your money work for you. Automation is your best friend here.

You can get your portfolio running almost on its own with two simple, powerful moves.

Automatic Investments: Set up a recurring transfer from your bank to your brokerage account. Investing the same amount every week or month—a strategy called dollar-cost averaging—takes the emotion out of buying and ensures you’re consistently building your positions.

Dividend Reinvestment Plans (DRIPs): This is where the magic of compounding comes to life. A DRIP automatically uses the dividends you earn to buy more shares of that same stock or ETF, usually with no commission. Every new share then starts earning its own dividends, creating a snowball effect that can seriously accelerate your growth over the years.

Automation is the bridge between good intentions and consistent results. Setting up DRIPs and automatic investments transforms your portfolio from a passive collection of assets into an active, self-fueling income machine.

Finally, make a habit of rebalancing your portfolio every so often—maybe once a year. Some of your investments will grow faster than others, which can throw your target allocation out of whack. Rebalancing is just selling a bit of your winners and buying more of your underperformers to get back to your ideal mix.

It’s a simple, disciplined way to manage risk and keep your strategy on track. And for those looking to add another income stream, you can also explore how to generate regular income from covered calls on the stocks you already own.

Managing Risks to Protect Your Income

The dream of passive income from stocks is powerful, but it's not a set-it-and-forget-it journey. Think of your portfolio as a garden. You can’t just plant the seeds and walk away; you have to protect your harvest from pests and bad weather. Ignoring risk is like setting sail without a life raft—you might be fine for a while, but you’re completely unprepared for a storm.

Let's be real about the threats. First, there's market volatility. Stock prices bounce around daily, and watching your portfolio value dip can test anyone's nerves.

For income investors, an even bigger worry is a dividend cut. When a company suddenly reduces or eliminates its payout, your cash flow takes a direct hit. And finally, there's the silent killer: inflation. The $100 in dividends you earn today simply won't buy as much ten years from now. A smart strategy has to plan for all of this.

Strategies for a Resilient Income Stream

Building a resilient income portfolio isn't about complex financial wizardry. It’s about sticking to time-tested principles that create a portfolio that can bend, not break, when the market gets choppy.

Your single most powerful tool is diversification. Seriously, don't put all your eggs in one basket. By spreading your investments across different companies, industries, and even countries, you ensure that a problem in one area doesn’t sink your entire ship.

"A well-diversified portfolio is your first line of defense against market shocks. It smooths out the ride by ensuring that the poor performance of a single investment doesn't derail your entire income strategy."

Next, focus on quality. Invest in companies with rock-solid balance sheets, a history of consistent earnings, and a proven ability to navigate recessions. These are the businesses least likely to cut their dividends when things get tough.

And remember, keep a long-term perspective. Don't let short-term market noise push you into emotional decisions. To build a truly robust plan, it helps to dig into the best practices for risk management and make them part of your core strategy.

Maximizing Returns Through Tax Efficiency

Here's an angle many investors overlook: taxes. Your tax bill can take a huge bite out of your returns, dramatically slowing down the growth of your passive income stream. The good news is, there are smart, legal ways to keep more of your money.

Using tax-advantaged accounts is a total game-changer. By holding your dividend stocks inside accounts like these, you can shield your income from the taxman.

- Roth IRA: You contribute with after-tax dollars, which means qualified withdrawals in retirement are 100% tax-free. Every dollar of dividend income and every penny of capital gains can grow without ever being taxed again.

- Traditional IRA: Your contributions might be tax-deductible now, which lowers your current income tax. You'll just pay taxes on the money when you withdraw it in retirement.

Strategically using these accounts is one of the simplest ways to let your passive income compound faster, securing more of your hard-earned cash for the future.

Common Questions About Passive Income from Stocks

When you first dive into building a dividend portfolio, a few practical questions always pop up. It's totally normal. Getting clear, straightforward answers is the best way to move forward with confidence.

Here are a few of the most common things investors ask when they’re just getting started.

How Much Money Do I Need to Start?

This is easily the number one question, and the answer is better than you think: you don't need a fortune to get in the game. Thanks to the rise of fractional shares and zero-commission trading platforms, you can literally start with $5 or $10.

The real key isn't the amount you start with, but your consistency. Investing a little bit on a regular basis is how you build momentum, especially when you start reinvesting those dividends and let compounding do its thing.

How Often Will I Get Paid?

The payment schedule is completely up to the stocks or funds you choose to own. Here in the U.S., the vast majority of companies that pay dividends do it quarterly. That means four paydays a year from that single stock.

But not everything follows that schedule. You’ll find a few different rhythms:

- Monthly: Some ETFs and REITs are specifically built to pay out every month. These are fantastic for anyone trying to match their income stream to their regular monthly bills.

- Semi-Annually: A number of international stocks pay out twice a year.

- Annually: It’s less common, but a few companies cut a check just once a year.

Your brokerage account automatically collects all these payments for you, giving you a clean look at the cash flowing into your account.

The goal is to eventually build a portfolio where payments from different stocks land at different times, creating a smoother, more continuous stream of income all year round.

Can Dividend Income Really Replace My Salary?

Yes, it's absolutely possible—but it takes a ton of capital, time, and a disciplined game plan. Let's be clear: replacing a full-time salary with stock income isn't an overnight trick. It's a long-term mission.

It means consistently investing over many years, putting every single dividend back to work, and letting the magic of compounding build on itself. For most people, it’s a slow and steady journey that starts small. First, your dividends cover a coffee, then a utility bill, and eventually grow into a powerful stream of income that gives you real financial freedom.

Ready to turn your stock portfolio into a consistent income engine? Strike Price provides the data-driven tools you need to sell options strategically. Use our real-time probability metrics to find high-reward opportunities and manage risk, transforming guesswork into informed action. Start optimizing your income at https://strikeprice.app.