8 Powerful Put Option Selling Strategies for 2025

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

Welcome to your definitive guide on generating consistent income through options trading. While many focus on buying options for explosive gains, a powerful secret for many successful traders lies in selling them. Selling puts is a high-probability approach that allows you to collect regular premiums, effectively getting paid to wait to buy stocks you already want at a discount.

However, not all put option selling strategies are created equal. They range from conservative methods ideal for beginners to complex structures designed for experienced professionals. Understanding the nuances of each is critical to managing risk and maximizing returns.

This in-depth guide breaks down 8 distinct approaches, from the foundational Cash-Secured Put to more advanced spreads. We will explore the mechanics, ideal market conditions, pros, cons, and actionable tips for each one. By the end, you'll have a clear roadmap to select the right strategy for your risk tolerance and financial goals, turning market volatility into a reliable income stream.

1. The Foundation: Cash-Secured Put

The Cash-Secured Put (CSP) is the cornerstone of conservative put option selling strategies and the perfect entry point for income-focused traders. This strategy involves selling a put option while simultaneously setting aside enough cash to purchase 100 shares of the underlying stock at the strike price. By securing the position with cash, you eliminate margin risk, making it a popular choice for retirement accounts and risk-averse investors.

The approach transforms put selling from pure speculation into a disciplined plan for generating income or acquiring stock at a discount. If the stock price stays above your strike price by expiration, the option expires worthless, and you keep the entire premium as profit. If the stock price drops below the strike, you are assigned the shares at your chosen price, effectively buying a stock you wanted at a lower cost basis.

How It Works: A Real-World Example

Imagine a dividend-paying blue-chip stock, XYZ Corp, is trading at $105 per share. You believe it's a solid long-term investment but would prefer to buy it closer to $100. Instead of waiting, you can sell a cash-secured put.

- Action: You sell one XYZ $100 put option with 30 days until expiration and collect a $2.00 premium per share, or $200 total.

- Cash Secured: You set aside $10,000 ($100 strike price x 100 shares) in your account to cover the potential purchase.

- Outcome 1 (Stock stays above $100): The option expires worthless. You keep the $200 premium, generating a 2% return on your secured cash in just 30 days.

- Outcome 2 (Stock drops to $98): You are assigned the shares and buy 100 shares of XYZ at $100 each. Your effective cost basis is $98 per share ($100 strike - $2 premium), a price you were comfortable with from the start.

Actionable Tips for Success

To maximize this strategy, target stocks you genuinely want to own for the long term. This ensures that even if you are assigned, you are happy with the outcome. Consider focusing on dividend-paying stocks, as this provides an additional income stream if you end up owning the shares. For optimal time decay (theta), sell puts with 15 to 45 days until expiration, as this is where the rate of decay accelerates most favorably.

2. Naked Put Selling

For traders with a higher risk tolerance and a deep understanding of market dynamics, Naked Put Selling offers a way to amplify returns through leverage. This strategy involves selling a put option without setting aside the full cash amount required to purchase the shares upon assignment. Instead, the position is secured by the available margin in a brokerage account, making it far more capital-efficient than its cash-secured counterpart.

This approach is one of the more advanced put option selling strategies, as it carries the potential for significant, undefined risk if the underlying stock price falls dramatically. However, when managed correctly, it allows experienced traders to generate substantial income from a smaller capital base. Success hinges on disciplined risk management, position sizing, and a solid understanding of portfolio margin.

How It Works: A Real-World Example

Let's revisit XYZ Corp, trading at $105 per share. An experienced trader believes the stock will remain stable or rise, and they want to use their capital more efficiently than a cash-secured put would allow.

- Action: The trader sells one XYZ $100 put option with 30 days until expiration, collecting a $200 premium.

- Margin Secured: Instead of setting aside $10,000, their broker requires only a fraction of that, perhaps $1,500, as a margin requirement to secure the trade.

- Outcome 1 (Stock stays above $100): The option expires worthless. The trader keeps the $200 premium, achieving a 13.3% return on their margined capital in 30 days.

- Outcome 2 (Stock drops to $98): The trader is assigned the shares. They must either purchase the 100 shares at $100 each using available cash/margin or close the position for a loss before assignment. Unlike the CSP, they did not have the full amount pre-allocated.

Actionable Tips for Success

Strict risk management is non-negotiable with this strategy. Never risk more than 2-3% of your portfolio on a single trade and maintain strict position sizing rules. Monitor your margin requirements closely, as they can change based on market volatility. Always have a clear exit plan before entering the trade, such as a stop-loss order or a pre-defined point to roll the position. To learn more about the mechanics, explore this detailed guide on the short put on strikeprice.app.

3. Put Credit Spread

The Put Credit Spread, also known as a bull put spread, is one of the most popular defined-risk put option selling strategies. It allows traders to generate income with significantly less capital and a capped maximum loss compared to a cash-secured put. This strategy involves selling a higher-strike put option while simultaneously buying a lower-strike put option, both with the same expiration date.

The premium received from selling the higher-strike put is partially offset by the cost of buying the lower-strike put, resulting in a net credit. This long put acts as insurance, limiting your potential loss if the trade moves against you. Your goal is for the underlying stock to stay above the higher strike price, allowing both options to expire worthless so you can keep the entire net credit as profit.

How It Works: A Real-World Example

Let's say the SPDR S&P 500 ETF (SPY) is trading at $410. You are bullish to neutral and believe it will remain above $400 for the next month. You can use a put credit spread to capitalize on this outlook.

- Action: You sell one SPY $400 put and simultaneously buy one SPY $395 put with 30 days to expiration. This creates a $5-wide spread. You collect a net credit of $1.50 per share, or $150 total.

- Maximum Profit: Your maximum profit is the $150 credit you received. This is achieved if SPY closes at or above $400 at expiration.

- Maximum Loss: Your maximum loss is the width of the spread minus the credit received: ($5.00 - $1.50) x 100 = $350. This occurs if SPY closes at or below $395 at expiration.

- Outcome (SPY closes at $405): Both options expire worthless. You keep the full $150 premium as profit.

Actionable Tips for Success

For consistent results, focus on high-probability trades by selling spreads far out of the money. A good rule of thumb is to seek a credit that is at least one-third of the spread's width, creating a favorable risk-to-reward profile. Many traders close the position early once they have captured 25% to 50% of the maximum potential profit to reduce risk. Mastering this strategy requires a solid understanding of how to interpret strike prices and premiums, so it's wise to learn more about how to read an option chain before placing trades.

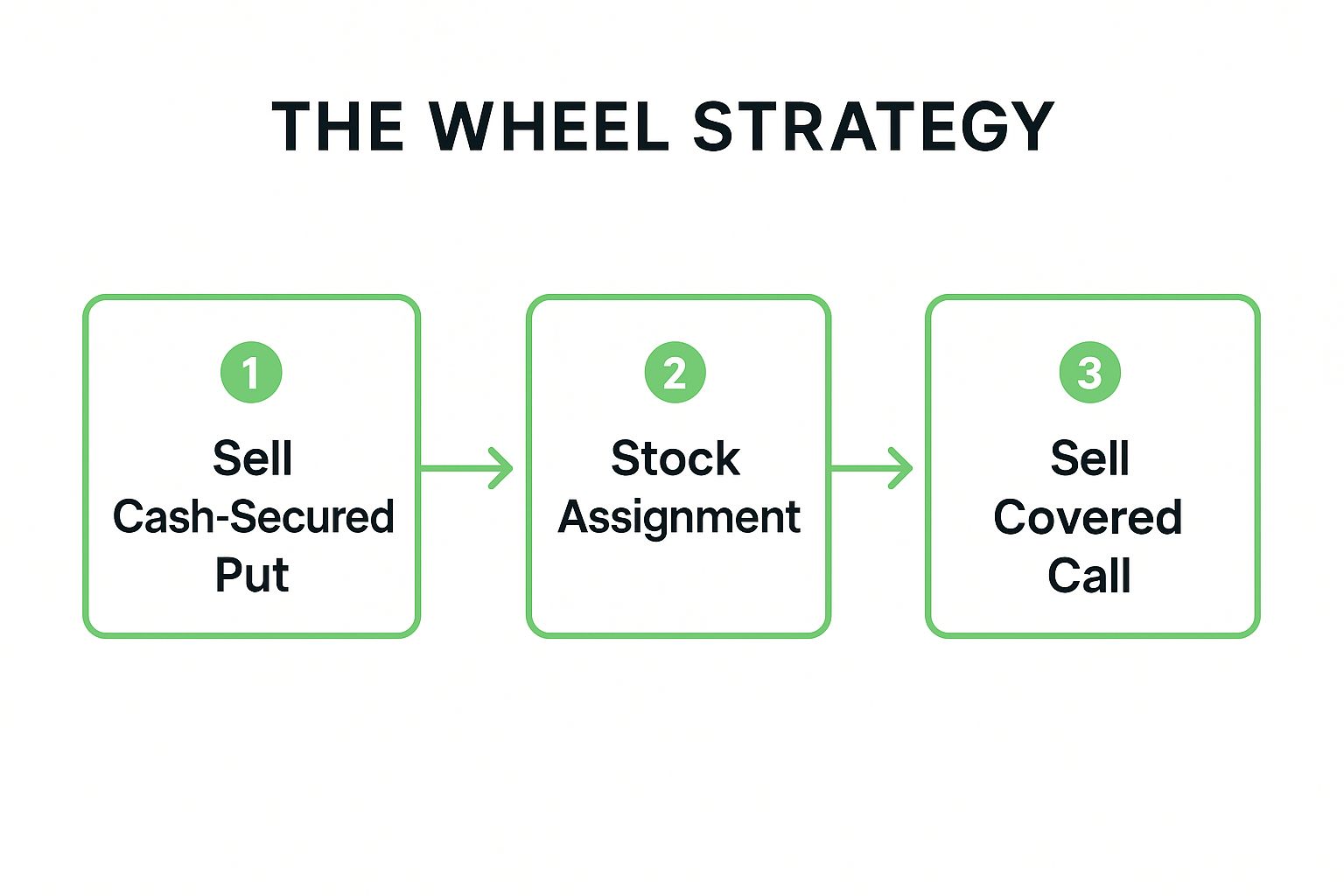

4. The Wheel Strategy

The Wheel Strategy is a systematic, long-term approach that combines two foundational put option selling strategies: the Cash-Secured Put and the Covered Call. It creates a continuous cycle of income generation by first selling puts to acquire a stock at a discount, and then selling calls against that stock to generate more premium until the shares are eventually sold. This method turns options trading into a repeatable, income-focused process, making it incredibly popular among retail investors.

The strategy's appeal lies in its disciplined, two-part system. You begin by collecting premium from cash-secured puts on a stock you want to own. If assigned, you transition to the second phase, collecting premium from covered calls. If the shares are called away, you simply restart the process, creating a "wheel" that consistently generates income from either cash or stock holdings.

How It Works: A Real-World Example

Let's say you want to run the wheel on a stable ETF like the SPDR S&P 500 ETF (SPY), currently trading at $450. You feel comfortable owning it for the long term, especially at a lower price.

- Step 1 (Sell CSP): You sell a SPY $445 put with 30 days to expiration and collect a $5.00 premium, or $500. You secure this with $44,500 in cash.

- Step 2 (Assignment): SPY drops to $443 at expiration. You are assigned 100 shares at $445 each. Your effective cost basis is $440 per share ($445 strike - $5 premium).

- Step 3 (Sell Covered Call): Now owning 100 shares of SPY, you sell a $455 call option with 30 days to expiration and collect another $4.00 premium, or $400. If SPY stays below $455, you keep the premium and repeat. If it goes above $455, your shares are sold for a profit, and you restart the wheel at Step 1.

The following infographic illustrates this simple, yet powerful, three-step cycle.

This process flow visualizes the strategy's circular nature, transitioning seamlessly from selling puts to selling calls and back again.

Actionable Tips for Success

To effectively run the wheel, choose highly liquid stocks or ETFs you are genuinely happy to own, as you may hold them for extended periods. Patience is critical; avoid closing positions at a loss during downturns and instead continue collecting covered call premium. When selling puts, targeting a delta around 0.30 provides a good balance between premium collected and the probability of assignment. Finally, be mindful of dividend dates, as they can influence early assignment on your covered calls.

5. Short Put Ladder

The Short Put Ladder is an advanced strategy that elevates put option selling by creating a position with defined risk and the potential to profit from multiple market scenarios. It involves selling multiple put options at different strike prices, typically with the same expiration date, to construct a position that can benefit from the underlying stock staying stable, rising slightly, or even falling to a certain point.

This strategy is constructed by buying one in-the-money or at-the-money put, selling one at-the-money put, and selling another out-of-the-money put. This combination creates a "ladder" of strike prices. The goal is often to generate a net credit, allowing you to profit if the stock price remains stable or moves within a specific range, while also capping your risk on the downside compared to selling a naked put.

How It Works: A Real-World Example

Imagine a tech stock, BETA Inc., is trading at $150. You expect a moderate price movement or stability around earnings. You decide to implement a short put ladder to generate income while managing risk.

- Action: You execute a 1x1x1 put ladder by buying one $155 put, selling one $150 put, and selling one $145 put, all with the same expiration. You collect a net credit of $1.50 per share, or $150 total.

- Outcome 1 (Stock closes at $150): All options expire worthless. You keep the entire $150 premium as your profit. Your maximum profit is achieved if the stock closes between $145 and $150.

- Outcome 2 (Stock drops to $140): The position now has a defined loss. Your breakeven point is the lowest strike price minus the net credit and the spread between the top two strikes. In this case, your maximum loss is capped below the lowest strike price.

Actionable Tips for Success

To effectively use this put option selling strategy, always use consistent position sizing across all three legs of the ladder to maintain the intended risk profile. It is crucial to monitor your overall portfolio delta, as this complex position's directional exposure can change with the stock price. Consider closing the entire ladder or individual profitable legs systematically as the trade moves in your favor to lock in gains before expiration.

6. The Sophisticated Volatility Play: Put Ratio Spread

The Put Ratio Spread is an advanced strategy designed for traders who anticipate a moderate downward move or a significant spike in implied volatility. This strategy involves buying a certain number of put options at one strike price and simultaneously selling a larger number of puts at a lower strike price, creating a position that can often be established for a net credit or at a very low cost.

Unlike simpler put option selling strategies, the ratio spread has a unique risk-reward profile. It profits most when the stock price falls precisely to the short strike at expiration. However, because you sell more options than you buy, this position carries unlimited risk if the stock price plummets far below your short strike, making careful risk management essential.

How It Works: A Real-World Example

Let's say ABC Corp is trading at $55, and you expect it to drift down towards $50 but not crash. You also anticipate that volatility might increase around an upcoming earnings report. You decide to implement a 1x2 put ratio spread.

- Action: You buy one ABC $55 put option for $3.00 and simultaneously sell two ABC $50 puts for $1.50 each. Since the premium received ($1.50 x 2 = $3.00) equals the premium paid, you enter the trade for a net cost of zero (excluding commissions).

- Outcome 1 (Stock finishes at $50): This is the ideal scenario. The $55 put is worth $5.00, while the two $50 puts expire worthless. Your profit is the maximum possible, at $500.

- Outcome 2 (Stock finishes above $55): All options expire worthless. You have no profit or loss on the position.

- Outcome 3 (Stock drops to $40): The long put is worth $15, but the two short puts are each worth $10 (a $20 liability). You have a net loss of $500, and this loss will continue to grow as the stock falls further.

Actionable Tips for Success

This is a strategy for experienced traders with a strong directional view. Always establish a clear stop-loss or a plan to adjust the position if the underlying stock moves aggressively against you. The ideal time to use this spread is when you expect a stock to make a limited move or when implied volatility is low and expected to rise, as this increases the value of your net options position. Carefully monitor the position, especially as it approaches the short strike price, and be prepared to close it before expiration to lock in profits.

7. Short Strangle (Put Leg Focus)

For traders comfortable with defined risk, the Short Strangle expands on basic put option selling strategies by adding a call option to the mix. This undefined-risk strategy involves selling both an out-of-the-money put and an out-of-the-money call on the same underlying stock with the same expiration date. The goal is to profit from the stock staying within a specific price range, collecting premium from both sides while benefiting from time decay and a potential decrease in implied volatility.

This approach transforms option selling into a volatility play. While our focus remains on the put leg, the added short call doubles the premium received and widens the breakeven points. The strategy is most effective when you anticipate low volatility or a "volatility crush," such as after a major news event or earnings announcement, where implied volatility drops sharply.

How It Works: A Real-World Example

Let's consider a tech stock, ABC Inc., trading at $150. You believe it will trade in a range between $140 and $160 over the next month, and implied volatility is high ahead of its earnings report.

- Action: You sell an ABC put with a $140 strike and simultaneously sell an ABC call with a $160 strike, both expiring in 30 days. You collect a combined premium of $4.50 per share ($2.00 from the put, $2.50 from the call), for a total of $450.

- Outcome 1 (Stock stays between $140 and $160): Both options expire worthless. You keep the entire $450 premium as profit. This is the ideal scenario, often driven by post-earnings volatility crush.

- Outcome 2 (Stock drops to $138): The call expires worthless, but the put is in-the-money. Your position shows a loss, as the stock has breached your put's strike price. Your breakeven on the downside is $135.50 ($140 strike - $4.50 premium).

Actionable Tips for Success

To maximize this strategy, deploy it in high implied volatility environments, as this inflates the premium you receive. Earnings announcements are a prime opportunity, but be aware of the increased risk. A common professional approach is to manage the position early; consider closing the trade once you have captured 25% to 50% of the maximum potential profit. If the stock price tests either your put or call strike, be prepared to adjust the position by rolling it or converting it into an iron condor to define your risk.

8. Put Butterfly Spread

The Put Butterfly Spread is a sophisticated, low-cost strategy designed for neutral market outlooks. It profits when the underlying stock price remains within a specific, narrow range at expiration. This strategy involves selling two put options at a middle strike price while simultaneously buying one put at a higher strike and another at a lower strike, creating a position with limited risk and limited, but high-potential, reward.

This structure is one of the more advanced put option selling strategies, ideal for pinpointing price targets. You are essentially betting that the stock will be at a specific price (the middle strike) by expiration. It is a defined-risk strategy where the maximum loss is known upfront and is typically much smaller than the potential profit, offering an excellent risk-to-reward ratio.

How It Works: A Real-World Example

Imagine stock ABC is trading at $152, and you believe it will stay very close to $150 over the next month, perhaps ahead of an earnings report where you expect minimal movement. You can construct a put butterfly spread to capitalize on this.

- Action: You execute a 145/150/155 put butterfly by:

- Buying 1 ABC $155 put

- Selling 2 ABC $150 puts

- Buying 1 ABC $145 put

- Net Cost: This trade is often established for a small net debit, for example, $0.50 per share ($50 total). This $50 is your maximum possible loss.

- Outcome 1 (Stock at $150 at expiration): The position achieves maximum profit. The $155 put is worth $5, while the others expire worthless. Your profit is $450 ($500 gain - $50 initial cost).

- Outcome 2 (Stock closes above $155 or below $145): All options expire worthless, or their values offset each other. You lose your initial debit of $50.

Actionable Tips for Success

To effectively use a put butterfly, target stocks with high implied volatility, as this can allow you to enter the position for a lower debit or even a credit. Focus on highly liquid underlyings to ensure tight bid-ask spreads when entering and exiting the trade. Because pin risk is a concern, consider closing the position a few days before expiration if it has captured a significant portion of its potential profit. To learn more about the mechanics of multi-leg trades like this, you can explore detailed guides on option spreads on strikeprice.app.

Put Option Selling Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Cash-Secured Put | Moderate - requires cash collateral and monitoring | High - 100% cash for potential stock purchase | Conservative income, potential stock acquisition | Income investors, conservative portfolios, retirement accounts | Defined risk, no margin, steady premium income |

| Naked Put Selling | High - margin use and risk management needed | Moderate - margin and buying power required | Higher returns with higher risk and margin calls | Experienced traders, professional options strategies | High capital efficiency, flexibility, potential high profits |

| Put Credit Spread | Moderate - involves buying and selling puts simultaneously | Moderate - lower margin than naked puts | Defined risk/reward, limited losses and profits | Income strategies, earnings plays, lower margin accounts | Limited risk, lower capital, flexible profit taking |

| The Wheel Strategy | High - combines multiple option strategies with active management | High - capital tied up in puts and assigned stocks | Continuous premium with cyclical stock assignment and calls | Sideways to slightly bullish markets, patient traders | Systematic income, mechanical approach, adaptable markets |

| Short Put Ladder | High - multiple strike prices and position tracking | High - capital for multiple strikes | Multiple profit scenarios, diversified exposure | Volatile markets, gradual scaling, sector-specific plays | Diverse strike exposure, scalable, adaptable |

| Put Ratio Spread | High - complex structure, requires active management | Moderate - cost varies by spread structure | Profits from moderate bearish moves, unlimited downside risk | Strong directional conviction, volatility plays | Potential credit, defined profit zone, lower cost than puts |

| Short Strangle (Put Leg Focus) | High - managing both calls and puts with undefined risk | High - margin for both option legs | Wide profit zone from time decay and low volatility | Range-bound markets, volatility crush plays, earnings | High premium, profits from volatility decrease and time decay |

| Put Butterfly Spread | High - multi-leg strategy with precise strike selections | Low to moderate - low capital but multiple commissions | Limited risk/reward, profits if underlying near middle strike | Low volatility range-bound markets, precise support/resistance plays | Defined risk, high probability small profits, low capital |

Choosing Your Strategy and Executing with Confidence

Navigating the world of options trading can seem complex, but as we've explored, a structured approach to put option selling strategies can transform market uncertainty into a source of consistent income. You now have a comprehensive toolkit at your disposal, ranging from the foundational Cash-Secured Put to more nuanced structures like the Short Put Ladder and Put Butterfly Spread. The journey to success does not require mastering every single strategy overnight. Instead, it begins with honest self-assessment.

Your ideal strategy is a direct reflection of your personal financial landscape. Consider these core factors:

- Capital Availability: Are you working with a modest account best suited for defined-risk plays like Put Credit Spreads, or do you have the capital to comfortably secure puts on higher-priced stocks for the Wheel Strategy?

- Risk Tolerance: How do you react to market volatility? The defined-loss nature of a spread might be more suitable for a conservative investor, while a trader with a higher risk appetite might be comfortable managing a Short Strangle.

- Market Outlook: Your view on a specific stock or the broader market dictates your approach. A neutral-to-bullish forecast aligns perfectly with most put selling strategies, but the degree of your conviction will help you choose between a simple secured put and a more complex ratio spread.

From Theory to Profitable Practice

Understanding the mechanics of these strategies is the first step. The second, and arguably more critical step, is execution. Successful options sellers do not rely on intuition or guesswork; they operate on data and probabilities. Knowing the probability of a trade finishing in-the-money is not a luxury, it is a necessity for long-term portfolio health. This is where you transition from being a market participant to a strategic operator.

By embracing a data-driven mindset, you can precisely quantify risk and reward. This allows you to select strike prices that align with your desired probability of success, ensuring you are compensated appropriately for the risk you undertake. Managing your positions becomes a systematic process rather than an emotional reaction to market noise. This disciplined approach is the true cornerstone of generating reliable income through selling puts.

Mastering a few of these put option selling strategies can profoundly impact your financial journey, turning your portfolio into an active income-generating machine. The key is to start with a strategy that fits your profile, commit to a data-informed decision-making process, and execute with the confidence that comes from preparation and powerful tools.

Ready to stop guessing and start selling puts with data-driven precision? Strike Price provides the real-time probability metrics and portfolio management tools you need to implement these strategies effectively. Find high-probability trades and manage your income portfolio with confidence at Strike Price.