Risk Premium Meaning Your Guide to Investment Returns

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

At its core, the risk premium is simply the extra return an investor expects to get for picking a riskier investment over a totally safe one. It’s the reward for taking a chance.

What Does Risk Premium Actually Mean?

Ever wonder why some investments promise way higher returns than others? The answer almost always comes down to the risk premium.

Think of it as the financial world’s version of hazard pay—it’s the extra compensation you demand for stepping into a situation where the outcome isn’t guaranteed.

Imagine you have two job offers. One is a stable government job with a predictable salary. That’s your “risk-free” option. The other is from a hot tech startup. The base pay is lower, but they’re offering a huge chunk of stock options that could be worth a fortune. That potential windfall from the stock options? That's your risk premium. It’s the extra carrot you need to justify leaving the safety of a guaranteed paycheck.

The Core Components of Risk

In finance, this concept is everything. The risk premium is the extra slice of return an investor needs to feel good about choosing a risky asset over something rock-solid and risk-free.

Historically, the go-to benchmark for a risk-free rate is the yield on government bonds, like U.S. Treasury securities. Why? Because the U.S. government is considered pretty much guaranteed to pay its debts. You can explore more about how this benchmark is used in finance.

The risk premium isn't just a number; it's a measure of investor sentiment. A high premium signals fear and a demand for greater compensation, while a low premium suggests confidence in the market.

To really get what risk premium means, it helps to see how the sausage is made. Each component plays a specific part in an investor’s thinking.

Let's break down the key ingredients with a quick reference table. This makes it super easy to see how all the pieces fit together.

Breaking Down the Risk Premium

| Component | Simple Description | Example |

|---|---|---|

| Risk-Free Asset | Your baseline investment with a guaranteed return. Think of it as the safest bet you can make. | A 10-year U.S. Treasury bond yielding 3%. |

| Risky Asset | Anything with an uncertain outcome, from stocks and crypto to real estate. | A tech stock like AAPL or a high-yield corporate bond. |

| Expected Return | Not a promise, but a calculated guess of what a risky asset might return based on past data and forecasts. | Analysts predict a stock will return 8% over the next year. |

| The Premium | The difference between the two—the extra potential profit that makes the gamble worthwhile. | The 5% difference between the stock's expected return (8%) and the T-bond's yield (3%). |

As you can see, the premium is what bridges the gap between safety and uncertainty. It's the financial incentive that convinces an investor to move their money from a sure thing to a "maybe." Without it, no one would ever take a risk.

How to Calculate the Risk Premium

So, how do you actually figure out the risk premium? Thankfully, the math behind it is surprisingly simple. You don't need a complex algorithm—just a basic formula that clearly lays out the potential reward for stepping into a riskier investment.

Here's the core calculation:

Risk Premium = Expected Return on Investment - Risk-Free Rate

Let's break down what each of those pieces really means so the formula makes sense in the real world.

Understanding the Formula's Components

First up is the Expected Return. This isn't a guess or a guarantee. Think of it as an educated forecast based on historical data, market trends, and economic projections. It’s the annualized return an investor reasonably anticipates from an asset, like a specific stock or even a whole market index like the S&P 500. If you want to get a better handle on this part of the equation, you can learn more about how to calculate annualized return.

Next, we have the Risk-Free Rate. This is the return you could get from an investment with virtually zero risk. In the real world, we typically use the interest rate on a government-backed security, like a U.S. Treasury bill (T-bill), for this. Since it's extremely unlikely the U.S. government will default on its debt, its bond yield becomes the ultimate benchmark for a "safe" return. Any investment with more risk has to offer a better potential return to be worth it.

The risk premium calculation is one of the most foundational tools in finance. It puts a number on the extra compensation you should demand for taking your money out of a "sure thing" and putting it into something with an uncertain outcome.

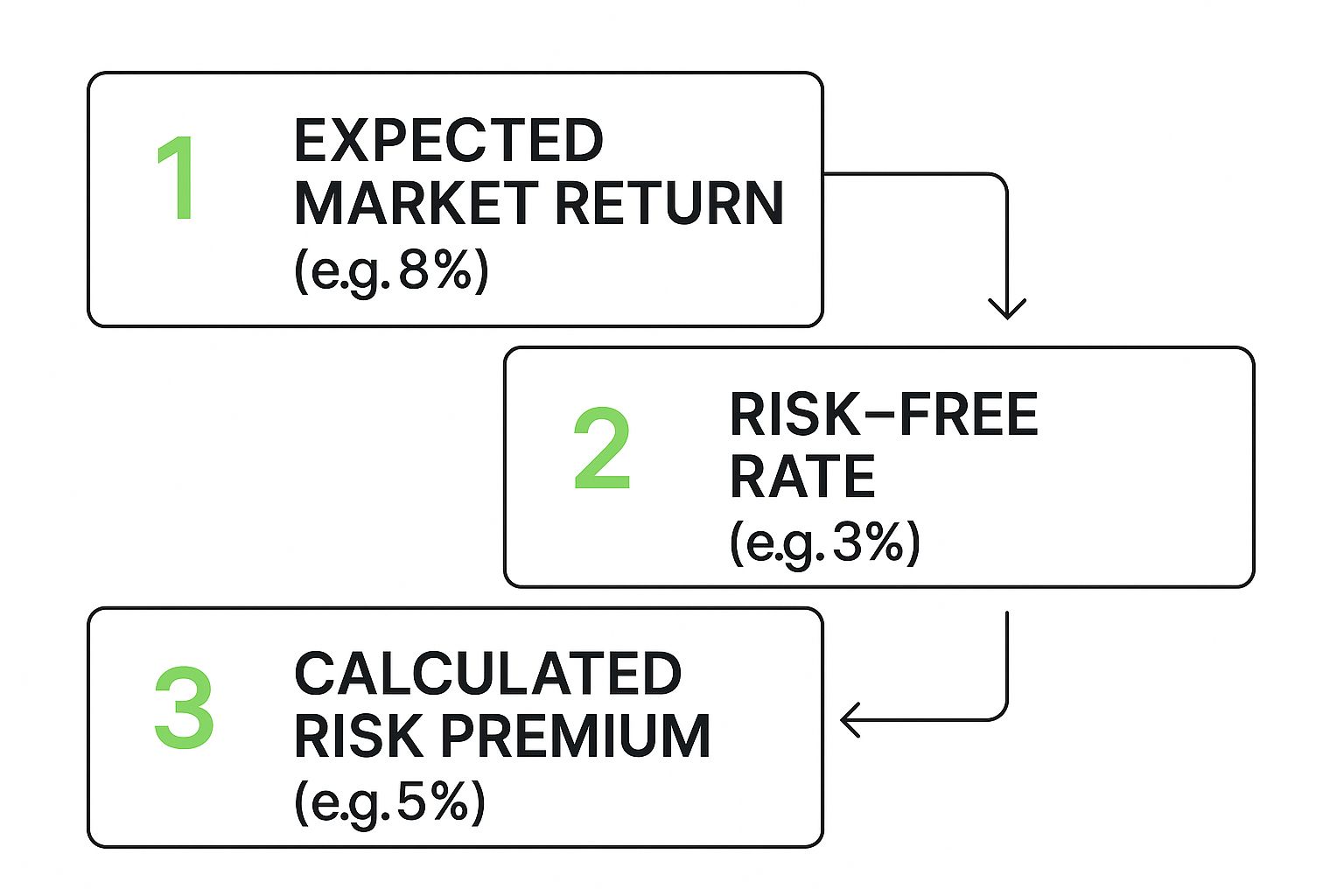

This visual breaks the whole process down into a simple, three-step flow.

As you can see, the risk-free rate acts as the baseline. The premium is everything you get on top of that for taking on the uncertainty.

Let’s run through a quick example. Imagine analysts project that the S&P 500 will return 8% over the next year. At the same time, the current yield on a 10-year Treasury bond (our risk-free rate) is sitting at 3%.

The calculation is a piece of cake:

- 8% (Expected Return) - 3% (Risk-Free Rate) = 5%

That 5% is the Equity Risk Premium. It’s the extra slice of the pie you expect to get for choosing the ups and downs of the stock market over the cozy safety of a government bond. It's the price of admission for a shot at much higher growth.

Exploring the Equity Risk Premium

Of all the different types of risk premiums out there, the one you’ll hear about most is the Equity Risk Premium (ERP). Simply put, this is the extra return investors expect—even demand—for choosing to put their money into the stock market instead of a “safe” investment like a government bond.

Think about it: stocks are naturally riskier. They get tossed around by market volatility, blindsided by sudden economic news, and dragged down by company-specific problems. With all that uncertainty, you need a pretty good reason to buy stocks instead of just playing it safe. The ERP is that reason—it’s the potential reward for taking the plunge.

To really get a feel for the ERP, it helps to understand how assets are valued in the first place. A solid grasp of how to value stocks and shares provides great context for why investors set the return expectations they do.

The ERP as an Economic Barometer

You can think of the Equity Risk Premium as a real-time mood ring for the market. Its ups and downs tell a powerful story about how confident investors are feeling.

- A high ERP is a sign of fear. It means investors see a lot of risk on the horizon and are demanding a much bigger potential payout to make it worth their while.

- A low ERP signals widespread optimism. Investors are feeling good about the future and are willing to accept a smaller reward for taking on stock market risk.

The Equity Risk Premium isn't just a number for textbooks; it's a direct reflection of the fear and greed driving the market. Its fluctuations offer powerful clues about overall economic health and investor sentiment.

The 2008 financial crisis is a perfect real-world example. As markets around the world went into a freefall, fear took complete control. Investors dumped stocks and flocked to the safety of government bonds, which sent the ERP skyrocketing. Nobody was willing to touch equities without the promise of a massive potential return. This shows just how dramatically the ERP can shift when investors are more worried about protecting their capital than growing it.

Seeing the Risk Premium in Different Markets

The idea of a risk premium isn't just some stock market theory; it's a core principle you'll see everywhere you look in the investing world. To really get what the risk premium meaning is, you have to see it in action across different assets.

Let’s say you’re weighing two options. The first is buying shares in a rock-solid, blue-chip company like Microsoft. The second is buying a high-yield corporate bond from a newer, unproven company in a shaky industry.

Microsoft is a known entity with a long track record, making it a relatively safe equity bet. That newer company, on the other hand, comes with a much higher chance of defaulting on its debt. So, to convince you to lend them your money, their bond has to offer a much juicier interest rate.

That extra yield? That’s its risk premium. It’s the compensation you get for taking a bigger gamble.

Applying the Concept to Real Estate

Now, let's swap stocks and bonds for something you can touch: real estate. The exact same logic holds up.

Picture yourself deciding between two rental properties:

- Location A: A stable, well-established city. Rent growth is predictable and vacancy rates are low. You're not expecting wild appreciation, but the income feels secure.

- Location B: A "boomtown" that's growing like crazy. Property values are soaring, but the whole local economy hinges on one industry. The potential returns look amazing, but so does the risk of a crash.

An investor would demand a higher potential return from the boomtown property, either through a lower purchase price or higher rents. That extra potential profit is the risk premium—it's what you need to make the economic uncertainty and volatility worth your while.

At the end of the day, risk premium is a universal language. Whether you're analyzing stocks, bonds, or real estate, it’s simply the extra potential reward that convinces you to step away from the safer bet. It’s the market’s way of putting a price on uncertainty and paying those who are willing to take it on.

How Risk Premium Works in Options Trading

So far, we've talked about risk premium as a somewhat passive concept—the extra return you hope to get for taking a risk. But what if you could actively collect it?

This is where options trading comes in. It's one of the clearest examples of turning this abstract idea into a tangible source of cash flow.

When you sell an options contract, like a covered call, the money you receive upfront is called the premium. This isn't just free money; it's the risk premium in its purest form. You're being directly compensated for taking on a specific obligation, like agreeing to sell your shares at a set price.

Think of it this way: the options seller gets paid for taking on the risk that the stock's price might skyrocket past their selling price, meaning they'd miss out on any extra gains. That payment is the premium.

The Covered Call: A Real-World Example

Let's make this concrete. Imagine you own 100 shares of XYZ Corp., currently trading at $50 per share. You decide to sell a covered call contract with a strike price of $55 that expires in one month. For selling this contract, you immediately collect a $200 premium.

What just happened here?

- You collected the premium: That $200 is your risk premium. It's your reward for agreeing to sell your shares for $55, even if the stock shoots up to $60 or beyond.

- You accepted a risk: Your potential profit is now capped. No matter how high the stock goes before the contract expires, the most you can get is $55 per share.

By selling the covered call, you transformed a theoretical risk premium into immediate cash in your account. You are literally being paid to limit your upside potential—a powerful income-generating strategy for investors looking to boost their portfolio returns.

Understanding what goes into that premium is key. To get a better handle on the factors that determine its value, check out our guide on how to calculate option premium. In short, the options seller is paid for providing a kind of insurance to the buyer, and that payment is the premium they earn for shouldering the risk.

Why This Matters for Your Investment Strategy

So, what’s the bottom line for your own portfolio? Understanding risk premium isn’t just academic—it's fundamental to making smart investment choices. It helps you see that every decision is a trade-off between safety and potential reward.

When you grasp this concept, you can start building a portfolio that actually matches your financial goals and comfort with risk. A younger investor might deliberately seek out investments with a higher risk premium to chase long-term growth. On the other hand, someone nearing retirement will likely lean toward a lower-premium portfolio to preserve their capital.

Aligning Risk With Your Goals

Ultimately, risk premium isn't just financial jargon. It’s the framework that empowers you to decide what level of risk is actually worth the potential return. This idea is central to both growing your portfolio and protecting it from unexpected hits.

The risk premium is the invisible force guiding your investment choices, helping you quantify whether the potential reward of an asset is worth the uncertainty you must accept to own it.

While chasing returns is exciting, a complete strategy also requires a solid handle on effective risk management planning to safeguard your financial future. It's about more than just picking winners; it’s about building a portfolio that can weather the storms.

For a deeper dive, check out our guide on https://strikeprice.app/blog/managing-investment-risk. After all, knowing how much you’re willing to lose is just as important as knowing how much you hope to gain.

Common Questions About Risk Premium

Even after you get the hang of the basics, a few questions always seem to pop up. Let's clear up some of the finer points so you know exactly how risk premium works in the real world.

Is a Higher Risk Premium Always a Good Thing?

Not really. A high risk premium does signal a higher potential reward, but it’s high for a reason: investors see a ton of risk. An unusually high premium can be a red flag, suggesting an asset is way too speculative or that the market is just plain scared.

Ultimately, the "best" premium comes down to your own stomach for risk. An aggressive investor might chase those higher premiums for the shot at big growth. A more conservative one will likely sleep better with the stability of lower-premium, safer assets. It’s all a balancing act between what you could gain and what you’re willing to lose.

Can a Risk Premium Go Negative?

Yes, but it's pretty rare. A negative risk premium happens when the expected return on a risky asset is actually less than the risk-free rate.

You might see this during moments of extreme market panic, like the 2008 financial crisis. Back then, investors were so desperate to find a safe harbor that they flooded into government bonds, willing to accept tiny returns just to protect their money. A negative premium is a clear sign that the market cares a lot more about avoiding losses than it does about making any gains.

Ready to stop just reading about risk premium and start using it to build a consistent income strategy? Strike Price gives you the data-driven tools to sell options with confidence. Our platform shows you the real-time probability of success for every single trade, helping you maximize your premium while keeping risk in check. Start your free trial today and see how much you can earn.