Risks of Covered Calls: risks of covered calls explained

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

Covered calls are a go-to strategy for generating income, but there's a catch—the risks are real and often fly under the radar. Most investors get drawn in by the promise of easy premium income, but they forget about the capped upside potential, the surprisingly weak downside protection, and the chance of having your best stocks sold off at the worst possible time.

Getting these trade-offs right is the difference between a smart income strategy and a portfolio drag.

The Allure and Hidden Dangers of Covered Calls

It’s easy to see why covered calls are so popular. You own stock, you sell a call option against it, and you collect instant cash. The premium feels like free money—a simple way to turn your buy-and-hold positions into income-producing assets. It's often sold as a "win-win": you either pocket the premium if the stock sits still, or you sell your shares for a profit.

But that simple story glosses over the tough realities. The income you're collecting isn't a gift; it’s a trade-off. You're giving something up in return, and those compromises can seriously stunt your portfolio's growth over the long run.

While covered calls are one piece of the puzzle, a well-rounded approach looks at the bigger picture. If you're exploring ways to diversify your earnings, it’s worth checking out different strategies to create multiple income streams.

A Quick Look at Covered Call Risks

Before we get into the weeds, here’s a high-level look at the main risks you're taking on. Each one introduces a unique problem, from limiting your wins to offering a false sense of security when markets turn south.

| Risk Type | Core Problem | Primary Impact |

|---|---|---|

| Opportunity Cost | Your potential gains are capped at the strike price. | You miss out on significant profits if the stock skyrockets. |

| Market/Downside Risk | The premium provides only minimal loss protection. | You retain nearly all the downside risk of owning the stock. |

| Assignment Risk | Your shares can be "called away" before expiration. | You can unexpectedly lose your stock and miss future dividends. |

| Tax Inefficiency | Frequent assignments can trigger taxable events. | Short-term capital gains can reduce your net returns. |

This table lays out the core trade-offs. Now, let's explore why a quick glance isn't enough to protect your portfolio.

Why a Deeper Look Is Necessary

Too many investors get tunnel vision, focusing only on the premium they collect. They see it as pure profit and ignore what they’re giving up to get it. This guide is about moving past that surface-level thinking and looking at the full picture. We're going beyond theory and digging into the practical, data-driven analysis of what can actually go wrong.

The greatest risk in investing is often not what you see, but what you fail to consider. A covered call premium can blind an investor to the much larger opportunity cost and downside exposure they are accepting in exchange.

This isn’t just a list of things to worry about; it’s about learning to quantify the risks. You'll see exactly how capped gains can lead to long-term underperformance, why that premium income is a flimsy shield in a real market correction, and how a mechanical risk like early assignment can throw your entire investment plan off course.

By truly understanding these hidden dangers, you can shift from just collecting premiums to making sharp, strategic decisions that actually move you closer to your financial goals.

Why Capped Gains Stunt Your Portfolio Growth

Of all the risks tied to covered calls, one towers above the rest and is criminally underrated: opportunity cost.

Selling a covered call is like putting a ceiling on a rocket. You get a little cash upfront—the premium—but you agree to sell your shares if they hit the strike price. That trade-off feels fine in a flat market, but it’s a massive drag when a stock you own decides to take off.

While buy-and-hold investors are riding the wave, the covered call seller is stuck on the shore, forced to sell their shares far below the new market price. The small premium you pocketed? It often looks tiny compared to the monster gains you just missed.

This isn't just theory. It's a well-documented reason why covered call strategies consistently struggle to keep up with the broader market over the long haul.

The Data Proving Underperformance

To see the real-world impact, just look at the benchmarks. The Cboe S&P 500 BuyWrite Index (BXM) is the classic yardstick, tracking a portfolio that sells at-the-money covered calls on the S&P 500. When you pit it against the S&P 500 itself, the numbers tell a pretty clear story.

An analysis of the BXM from its start in 1986 through 2023 showed it delivered an annual return of just 8.2%. The S&P 500? It clocked in at 10.5%. That's a gap of more than two percentage points every single year.

That underperformance got even worse during the historic bull market after the 2009 financial crisis, shining a spotlight on the strategy's biggest weakness. If you want to dig into the numbers yourself, you can find some great additional insights on covered call strategies and how they perform in different market cycles.

The core trade-off of a covered call is selling away uncapped upside potential for a small, fixed premium. In a bull market, this is like trading a lottery ticket for a dollar—you get a guaranteed small win but forfeit the chance at a life-changing payout.

Over the long run, especially in markets that are trending up, that premium income is rarely enough to make up for the capital appreciation you leave on the table.

The Growth Stock Dilemma

This risk gets dialed up to eleven when you're holding growth stocks. Think about the tech or biotech companies with the potential for explosive, out-of-the-blue returns. A single great earnings report or a new product launch can send these stocks soaring by 20%, 50%, or even 100% in a flash.

Let's walk through an example. Imagine you own 100 shares of a hot tech stock at $50. You sell a covered call with a $55 strike and collect a $2 premium per share, pocketing a quick $200.

- Your Goal: Make a little extra income. Simple enough.

- The Reality: The company announces a breakthrough. The stock skyrockets to $80.

- The Outcome: Your shares get called away at $55. You made $7 per share ($5 from the stock's rise + $2 from the premium), for a total of $700. Nice, but the buy-and-hold investor's position is now worth $8,000—a $3,000 gain.

You captured just a tiny fraction of the stock's real move. That one event can set your portfolio back in a huge way, wiping out the benefit of months or even years of collecting small premiums. It's the perfect example of winning small battles but losing the war for long-term wealth.

How Premiums Fail as a Shield in Market Downturns

One of the most persistent myths about covered calls is that the premium you collect acts as a real safety net. It’s easy to think the cash you pocket provides a meaningful buffer if your stock takes a nosedive.

The reality? That protection is minimal, fixed, and almost always fails when you need it most.

Thinking of the premium as a shield is like using a small umbrella in a hurricane. It might keep your head dry for a second, but it won’t save you from the storm. When a stock drops hard, the small, one-time premium is quickly overwhelmed by the much larger loss on your shares. This is a critical risk many income-focused investors overlook.

Quantifying the Downside Exposure

The data from real-world market downturns paints a clear and sobering picture. We can look at popular covered call ETFs—which run this strategy on autopilot—to see how they hold up under pressure. These funds give us a transparent look at how the strategy performs at scale.

A classic example is QYLD, an ETF that sells covered calls on the Nasdaq-100 index (QQQ). While it does a decent job of smoothing out day-to-day bumps, its performance during major corrections reveals the strategy's core weakness.

- Reduced Volatility: Over a period that included the rough market years of 2018 and 2022, QYLD did lower the Nasdaq-100's volatility from 18.4% down to 11.8%.

- Drawdown Comparison: It also softened the worst drawdown from -32.6% for QQQ to -22.7% for QYLD.

A smaller loss is obviously better than a bigger one, but a -22.7% drop is still a massive hit to any portfolio. The premium collected clearly didn't prevent a major decline. It just proves that you, the investor, still shoulder the vast majority of the downside risk.

The True Cost of Chasing Yield

This problem gets even worse when investors chase higher yields by selling calls closer to the stock’s current price. Bigger premiums usually come from selling options with a higher probability of finishing in-the-money, which offers an even smaller buffer if the market turns south.

Research shows that this kind of yield-chasing can be destructive. One analysis of a Nasdaq-100 call-selling strategy from 2011 to 2023 found that targeting a modest 6% yield resulted in an annualized loss of -3.1%. Worse, aiming for a higher 12% yield led to a staggering annualized loss of -4.7%.

The conclusion is unavoidable: higher yields were directly correlated with bigger losses. You can explore the full breakdown of these covered call performance metrics for a deeper dive into this risk.

This highlights the dangerous trap of focusing only on income without a solid plan for managing risk. The premium isn't free money; it’s compensation for taking on nearly all of a stock's downside.

A covered call premium is a fixed benefit in exchange for an unlimited (though slightly buffered) risk. In a steep market decline, your profit is capped at the premium, but your potential loss is nearly identical to that of a buy-and-hold investor.

Understanding this dynamic is crucial. The premium you collect is derived from the option's time value and implied volatility—components that make up its extrinsic value. As an option nears expiration or if the stock drops, this value decays, but it rarely provides enough of a cushion to offset a serious capital loss. Learn more about how this works by reading our detailed guide on understanding extrinsic option value.

Ultimately, while covered calls can slightly reduce volatility, they are an ineffective tool for preserving capital during a real market downturn. Any investor relying on them for protection is likely to be disappointed when that protection is needed most.

Navigating Assignment and Dividend Disasters

Beyond the ups and downs of the market, some of the sharpest risks in selling covered calls are purely mechanical. Two of the most common traps—early assignment and losing a dividend you were counting on—often go hand in hand. These aren't about market sentiment; they're about the cold, hard rules of the options game.

A critical detail that trips up many sellers is that the vast majority of stock options are American-style. This means the buyer can exercise their right to purchase your shares at any point before expiration, not just on the final day. Your shares can literally get called away on a random Tuesday, long before you expected.

This risk gets dialed up to eleven when dividends are in the picture, creating a scenario that can blindside even experienced sellers.

The Dividend Arbitrage Trap

So, why would a buyer ever exercise their option early? More often than not, it boils down to a simple calculation involving an upcoming dividend payment. This is a classic move known as dividend arbitrage.

The logic is pretty simple. If the dividend payout is bigger than the remaining time value (extrinsic value) left in the call option, it's profitable for the option holder to exercise, grab the shares, and collect the dividend for themselves.

Picture this:

- You own 100 shares of a solid, dividend-paying stock.

- You sell an in-the-money covered call to pocket some extra income.

- The company’s ex-dividend date is next week, and you’re looking forward to that cash hitting your account.

Then, out of the blue, you get a notification from your broker: your shares have been called away. The option buyer exercised early, specifically to snatch the dividend you thought was yours. Now, you’ve not only lost a long-term position but also the income you were counting on.

Early assignment isn't random; it's a calculated move. If your in-the-money call's time value dips below the upcoming dividend, your shares just became a prime target.

This is exactly where a tool that flags rising assignment probability becomes invaluable, giving you a heads-up before your shares disappear.

Having a system that monitors these conditions is the key to avoiding these nasty surprises and managing your positions proactively.

How to Mitigate Assignment and Dividend Risk

Losing your shares and the dividend is frustrating, but it’s not inevitable. The key is knowing which conditions make early assignment likely and having a plan to get out of the way before it happens.

Your go-to defensive move is to roll the position. This simply means buying back your current short call and selling a new one with a later expiration date, a higher strike price, or both. This move effectively resets your position and gets it out of the immediate danger zone. For a complete guide, check out our deep dive on the mechanics of rolling over options in our guide.

Here are a few practical steps you can take:

- Track Ex-Dividend Dates: Always know the ex-dividend dates for any stock you’ve written calls against. Put them on your calendar and be extra vigilant in the week leading up to them.

- Monitor Extrinsic Value: Keep a close watch on the time value of your in-the-money calls. If it drops below the dividend amount, your assignment risk goes through the roof.

- Set Up Alerts: Use a tool that sends you probability-based alerts. A notification that your assignment risk just leaped from 5% to 75% is the fire alarm telling you it's time to act—now.

The Hidden Tax and Volatility Traps You Must Avoid

Beyond the obvious risks—capped gains and limited downside protection—a couple of hidden traps can quietly eat away at your portfolio's performance. These are the annoying tax consequences from frequent assignments and a more advanced concept known as equity reversal risk.

Think of them like termites chewing on your financial foundation. You might not notice the damage at first, but over time, they can seriously weaken your returns. Let's drag these issues into the light so you can build a more solid strategy.

The Unseen Drag of Taxes

Every time your shares get called away, it’s not just a simple portfolio shuffle; it’s a taxable event. This mechanical outcome can have a surprisingly big impact on your net profits, especially if it’s happening over and over again.

When your shares are sold through assignment, you realize a capital gain or loss. If you’ve held those shares for less than a year, that gain gets taxed at your higher, short-term capital gains rate—the same as your ordinary income.

This can create a pretty painful scenario:

- You sell calls on a stock you've only owned for a few months.

- The stock pops, your shares get called away, and you lock in a nice profit.

- But then, a significant chunk of that profit goes straight to the taxman, shrinking the actual return you get to pocket.

This tax drag can turn what looks like a profitable strategy on paper into something far less efficient in the real world.

Unpacking Equity Reversal Risk

Now let's get into a more subtle but equally damaging risk. Selling a covered call is, at its core, a bet against a strong, sudden rally. You're basically saying, "I don't think this stock is going to surge past my strike price." But what happens when you’re wrong?

This is what’s known as equity reversal risk. It’s the danger you face when a stable, quiet stock suddenly reverses course and shoots skyward. While you’ve collected a small premium, you miss out on the entire explosive move, creating a massive opportunity cost. More importantly, this specific type of risk adds a lot of volatility to your portfolio without giving you a worthwhile return for taking it on.

It’s an incredibly inefficient risk. You're exposing yourself to the pain of missing a major rally for a reward that's often too small to justify it.

Covered calls carry an uncompensated equity reversal risk that inflates overall volatility without commensurate returns, eroding the strategy's appeal. It's like accepting the risk of a major car accident in exchange for a coupon for a free car wash—the potential downside far outweighs the guaranteed small gain.

Groundbreaking analysis from AQR Capital Management actually confirms this inefficiency. By breaking down the returns of a covered call strategy, they found that the exposure to "equity reversal" accounted for a huge portion of the strategy's total risk—around 23% to 24% across different time periods. Yet, this component contributed almost no return, dragging down the overall performance. You can dig into a deeper analysis of this uncompensated risk to see the full data.

This means you’re taking on a substantial hazard for virtually no reward. For investors trying to build wealth methodically, this hidden drag is a major problem you'd never spot by just looking at premium income. Smart platforms like Strike Price help traders sidestep these pitfalls by using data-driven probabilities and alerts to track contracts, allowing for more informed decisions that actually align risk with reward.

A Smarter Workflow for Selling Covered Calls

Knowing the risks of covered calls is one thing. Actually avoiding them in the heat of the moment is another. To go from theory to practice, you need a repeatable process—a workflow that turns complex analysis into a simple, reliable framework.

Instead of just chasing the biggest premium checks, this approach makes you stop and ask the right questions before you ever hit the sell button. It's all about making sure each trade lines up with why you own the stock in the first place.

Think of it as a pre-flight checklist for your trades. A structured process helps you balance the income you want with the long-term health of your portfolio, steering you clear of the most common mistakes. It's a lot like building effective personal productivity systems; a good system prevents unforced errors and keeps you focused on the goal.

Your Pre-Trade Checklist

Before selling any covered call, walk through these five questions. An honest answer to each one will help you sidestep the most common traps.

- What's my real outlook for this stock? Be honest. If you're wildly bullish and think the stock is about to rip higher, selling a covered call is probably a mistake. You'll just get frustrated by the opportunity cost. This strategy works best when you're neutral to moderately bullish.

- Is this premium worth the risk? Do the math. Is the premium you're collecting a tiny 0.5% of the stock's price? That might not be enough compensation for capping your upside and dealing with potential assignment headaches.

- What's on the calendar? Always check for earnings reports or, crucially, ex-dividend dates before your option expires. An upcoming dividend dramatically spikes the odds of early assignment if your call is anywhere near in-the-money.

- What are the tax consequences? If your shares get called away, are you looking at a short-term or long-term capital gain? Forgetting about taxes is an easy way to turn a seemingly profitable trade into a mediocre one.

- What's my escape plan? Decide now what you'll do if the stock rips past your strike price. Will you roll the position? Will you let the shares go? Will you buy the option back? Having a plan ready prevents you from making emotional decisions when the pressure is on.

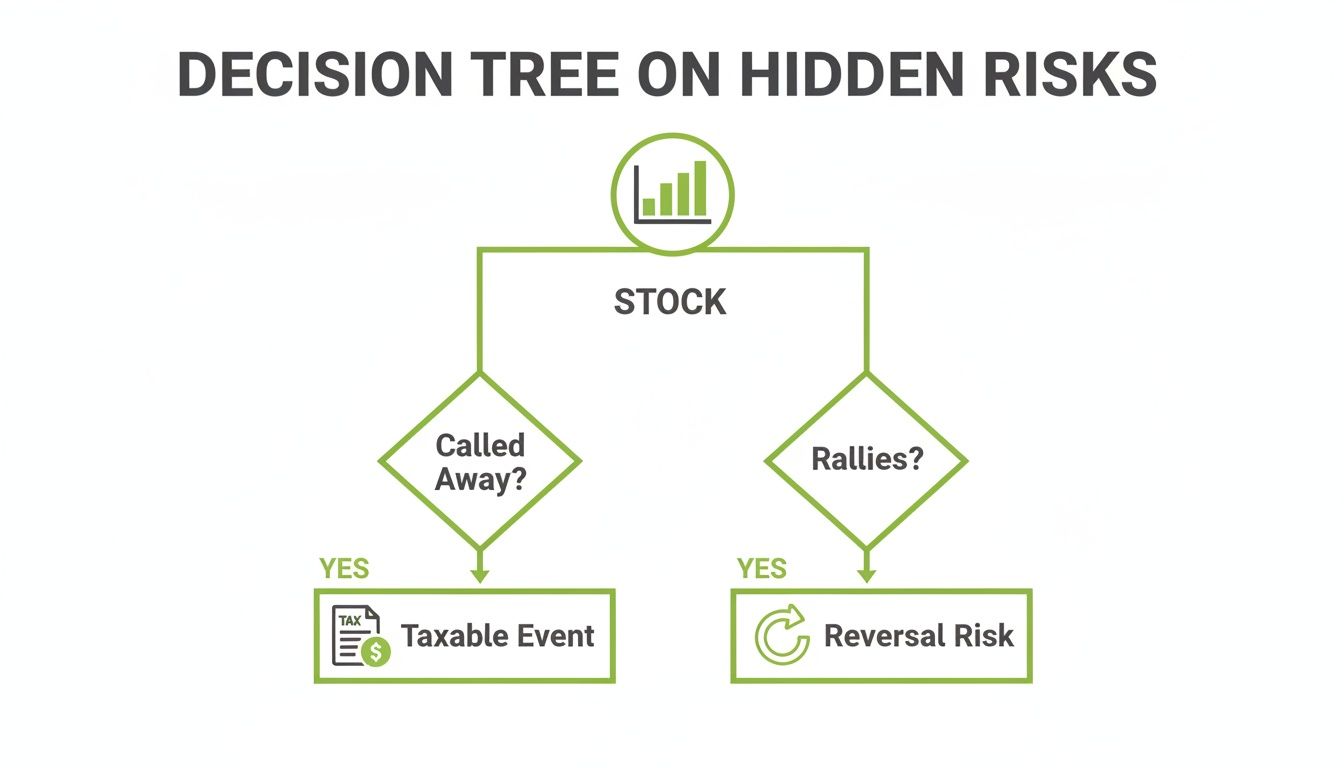

This decision tree shows how even a simple stock position can branch into more complex outcomes, like creating a taxable event or forcing you to decide whether to buy the stock back at a higher price.

The key takeaway is that both paths—letting your shares get called away or watching the stock rally past your strike—come with their own unique set of risks you have to manage.

Using Probability to Make Better Decisions

Modern tools can add a powerful layer of data to this workflow. Instead of just guessing, you can use probability metrics to put a number on your risk.

A smarter workflow isn't about eliminating all risk—it's about choosing which risks you get paid to take. Using probability helps you see if the compensation (the premium) is fair for the risk you're accepting.

Platforms that show you the probability of a stock finishing above your strike can completely change your decision-making. Seeing there's a 70% chance your shares will be called away makes that "opportunity cost" risk feel very real and immediate. This lets you trade with your eyes wide open, fully aware of the odds.

For a deeper dive into creating a repeatable system, check out our complete guide on building a covered call strategy for income.

Common Questions About Covered Call Risks

To wrap things up, let's tackle a few of the most common questions that pop up when traders are learning the ropes. Think of these as quick, practical answers to solidify what we've covered.

Are Covered Calls a Good Strategy?

Yes, but it’s all about timing and context. Covered calls shine in flat or slightly bullish markets—basically, when you don't expect a stock to rocket upward. The perfect scenario is a neutral outlook on a stock you wouldn't mind selling at your chosen strike price anyway.

They’re a poor fit for high-growth stocks in a roaring bull market or for any stock that's in a steep nosedive. Success really comes down to using data to get a realistic read on the probability of the stock blowing past your strike.

What Should I Do if My Stock Drops Hard?

If the underlying stock price takes a significant hit, you have a few ways to play it. The simplest move is to just let the call expire worthless. You’ll keep the premium you collected, which will soften the blow of the unrealized loss on your shares.

Another option is to "roll down and out." This means buying back your current call and selling a new one with a lower strike price and a later expiration date. You get to collect another premium to lower your cost basis, but you also cap your potential rebound at that new, lower price. If you think the stock is headed for a much deeper fall, it's often best to just close the position and not sell any new calls.

Getting your shares called away isn't inherently good or bad. It all comes back to your original goal for that stock. Were you aiming to sell for a profit, or hold it for the long run?

Is It Always a Bad Thing to Get Assigned?

Not at all. If your goal was to exit the position at a specific price, getting your shares called away is a mission accomplished. You hit your target price and you pocketed an extra premium for your trouble. That's a clear win.

The downside of assignment really only kicks in when you wanted to hold the stock for long-term growth. In that case, having your shares taken just before a major rally means you're forced to watch those gains from the sidelines. Your original intent for owning the stock is what makes assignment a success or a missed opportunity.

Ready to stop guessing and start making data-driven decisions? Strike Price gives you the real-time probability metrics and smart alerts you need to navigate the risks of covered calls with confidence. Trade smarter, not harder. Start your free trial today at strikeprice.app.