A Guide to the Sell Puts Strategy for Income

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

What Is Risk Adjusted Return? A Practical Guide

What is risk adjusted return? This guide explains how to measure it with the Sharpe Ratio, how to interpret the numbers, and why it's key to smarter investing.

What if you could get paid for simply agreeing to buy a stock you already want, but at a lower price? That’s the simple, powerful idea behind the sell puts strategy. It’s a fantastic way for investors to generate instant cash flow while patiently waiting for the perfect entry point on a quality company.

Understanding the Sell Puts Strategy

At its core, selling a put is like making a contract with another trader. As the put seller, you agree to buy 100 shares of a stock at a specific price (the strike price) if the stock drops to or below that level by a certain date (the expiration date).

For taking on that obligation, you get paid an upfront, non-refundable cash payment called a premium. Think of it like a real estate developer paying a landowner for the right to buy their property at a set price later on. The landowner gets to keep that payment whether the developer buys the land or not.

That simple transaction is what makes selling puts so compelling. It fits perfectly into a patient, value-focused investment plan and offers two distinct paths to a win.

The Two Winning Scenarios

When you sell a put option, there are really only two main outcomes. The great part? Both can be considered a win if you’ve picked a company you genuinely believe in.

- Outcome 1: The Stock Stays High. If the stock's price stays above your chosen strike price when the contract expires, the option simply becomes worthless. The buyer has no reason to sell you their shares at a discount when they could get more on the open market. In this scenario, you just keep 100% of the premium you collected. Pure profit.

- Outcome 2: You Buy the Stock at a Discount. If the stock price does fall below your strike price, the buyer will likely "assign" the shares to you. This means you’re now obligated to buy the stock at the strike price. But since this was a company you wanted to own anyway, you've just successfully bought it at your target price—and your actual cost basis is even lower thanks to the premium you already pocketed.

This dual-outcome nature flips the typical investment script on its head. Instead of just hoping a stock goes up, you can be content whether it stays flat, rises, or even dips a little.

The beauty of this strategy is that it generates cash flow in the meantime, making it a win-win situation. You either keep the income or you buy a stock you wanted at a lower price.

Essential Components of the Trade

To really get how this works, let's break down the key pieces of every put-selling trade. Getting these terms down is the first step to executing the strategy with confidence.

- The Underlying Stock: This is the company you’re focused on. The golden rule is to only sell puts on stocks you genuinely want to own for the long haul.

- The Premium: This is the immediate cash income you receive for selling the put. It’s yours to keep, no matter what happens.

- The Strike Price: This is the price per share you agree to buy the stock at if you get assigned.

- The Expiration Date: This is the date the contract expires. After this date, your obligation to buy the stock is gone.

The Mechanics of Selling Cash-Secured Puts

Alright, let's move from theory to practice. To really get comfortable with selling puts, you need to understand how to set up a trade correctly and safely. We're going to focus only on cash-secured puts, a critical distinction that makes this strategy much safer than its "naked" cousin.

So, what does cash-secured actually mean? It’s simple: you have enough cash set aside in your brokerage account to buy the shares if you get assigned. If you sell one put option contract with a $50 strike price, you need to have $5,000 ($50 strike x 100 shares) in cash ready to go. This one rule turns a potentially risky trade into a defined, manageable investment.

Your Step-by-Step Execution Plan

Putting on your first trade is a lot less complicated than you might think. The real key is being intentional with every step. This isn't about staring at complex charts; it's about a logical, repeatable process that fits your goals.

Here’s a simple framework to follow:

- Find a Quality Stock: This is easily the most important step. Only sell puts on companies you’d genuinely be happy to own for the long haul. Look for stable businesses you believe are trading near a fair price.

- Choose Your Strike Price: Pick a strike price that’s below the stock’s current market price. This builds in a margin of safety, giving the stock some room to fall before you’re on the hook to buy.

- Select an Expiration Date: Decide how long you want the contract to last. Shorter expirations, like 30-45 days, often give you a better annualized return on your cash. Longer ones can offer higher premiums upfront, but tie up your capital for longer.

- Place the Trade and Collect the Premium: Once you have your terms set, place a "Sell to Open" order with your broker. The cash premium hits your account almost instantly.

A Real-World Trade Example

Let's walk through an example to make this crystal clear. Imagine you've been watching XYZ Corp, a great company currently trading at $100 per share. You think it's a decent price, but you'd love to buy it at a discount.

You decide to sell one cash-secured put contract with a $95 strike price that expires in 30 days. For making this agreement, you immediately get paid a premium of $1.50 per share. That’s $150 ($1.50 x 100 shares) deposited right into your account.

At the same time, you've set aside $9,500 in your account, ready to buy those 100 shares of XYZ at $95 if the price drops below that by expiration.

Key Takeaway: If XYZ stays above $95, the option expires worthless. You just keep the $150 as pure profit—a 1.6% return on your secured cash in just one month. If it falls and you're assigned, your actual purchase price isn't $95. It's $93.50 ($95 strike - $1.50 premium), a fantastic discount from the $100 price when you started.

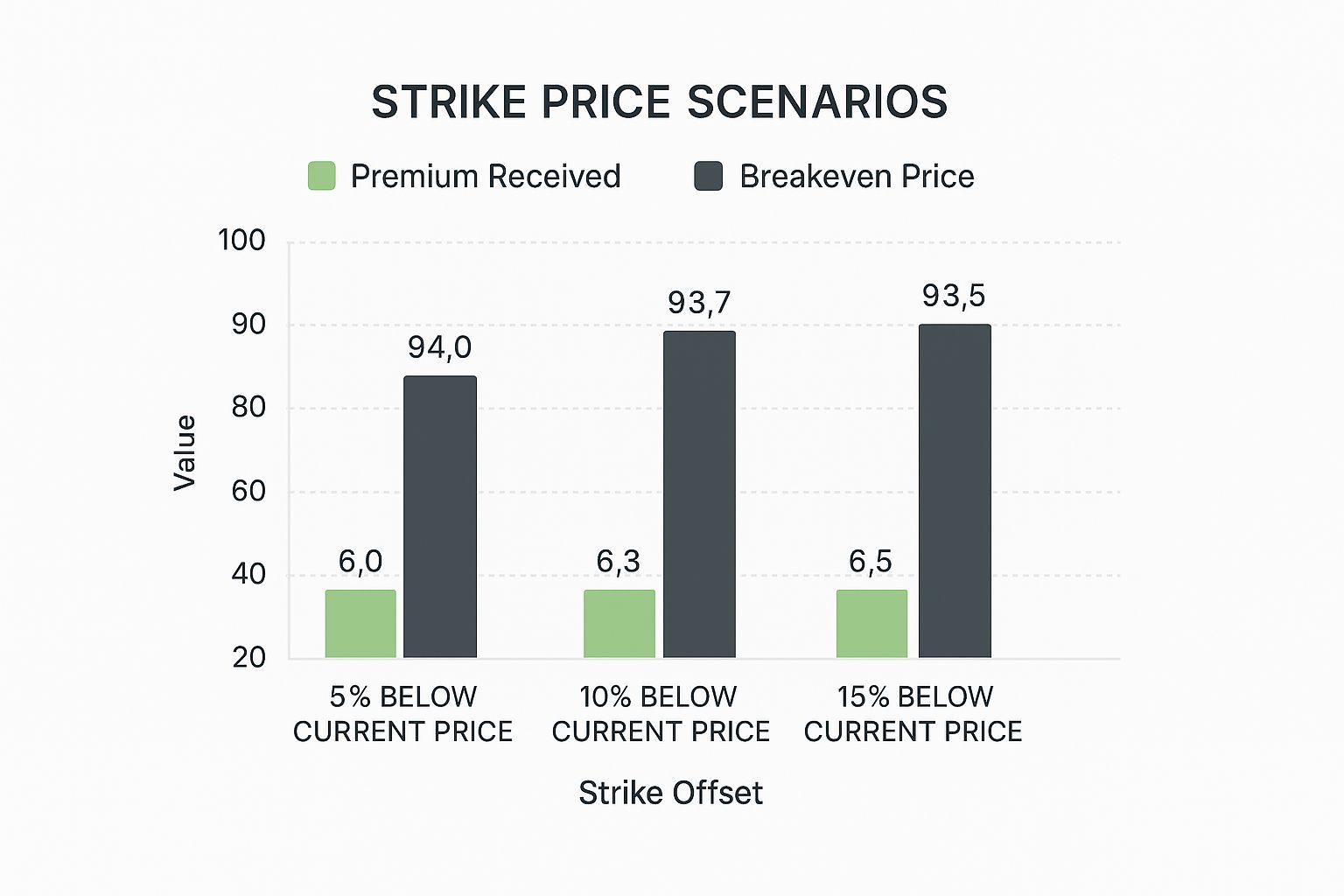

This infographic breaks down how picking different strike prices changes the premium you get and your final breakeven point.

As you can see, a lower strike price means less cash in your pocket today, but it also gives you a lower breakeven point and a bigger margin of safety.

And this isn't just a neat trick; the strategy has a solid track record. The CBOE S&P 500 PutWrite Index (PUT), which tracks a similar strategy, has shown impressive long-term results since it started in June 1986. Research shows it generated an annual compounded return of about 9.54% through 2018, nearly keeping pace with the S&P 500 but with way less volatility. It had a much lower standard deviation (9.95% vs. the S&P 500's 12.08%), leading to a superior risk-adjusted return. You can explore the full findings on risk-adjusted returns here.

Navigating the Risk and Reward Profile

Every options strategy comes with its own trade-offs, and selling puts is no different. The good news? Both your maximum gain and your maximum risk are crystal clear the moment you enter the trade. No surprises.

Let's start with the fun part: the reward. It's beautifully simple. Your max profit on any single put you sell is always the premium you get paid upfront. You collect that cash immediately, and it's yours to keep, no matter what happens next.

The dream scenario is for the stock price to stay above your chosen strike price. If it does, the option expires worthless, and you walk away with the entire premium as pure profit.

Understanding Your Maximum Reward

The real goal here is to repeat this process, month after month, generating a steady drip of income from those premiums. While one trade won’t make you a millionaire, the cumulative effect can be incredibly powerful. Just remember, this is an income strategy, not a get-rich-quick scheme.

Maximum Profit = Premium Received

So, if you sell a put and collect a $200 premium, your maximum possible gain from that trade is exactly $200. You can't make a penny more, even if the stock shoots to the moon. This capped upside is the price you pay for getting consistent cash flow right now.

Decoding the Primary Risk: Assignment

The main risk when selling a put is assignment. This is your obligation to buy 100 shares of the stock at the strike price if the share price drops below it by expiration.

This might sound scary, but if you’ve followed the golden rule—only sell puts on stocks you genuinely want to own at that price—it's not a disaster. It's just your plan B kicking in.

Your risk isn't unlimited; it's defined by the strike price. In a true worst-case scenario where the stock goes to zero, you'd still be on the hook to buy the shares at the strike. This is exactly why we focus on high-quality, stable companies you believe in.

The number you really need to watch is your breakeven point. It's not just the strike price; it's the strike price minus the premium you already pocketed.

- Breakeven Price = Strike Price - Premium Per Share

Let’s say you sell a $50 strike put and receive a $2.00 per share premium. Your actual breakeven is $48. As long as the stock stays above $48, you're in the green.

A More Conservative Way to Buy Stock

A lot of investors mistakenly think selling puts is inherently risky. But when you compare it to just buying a stock outright, it can actually be a more conservative way to open a position.

Think about it: if you buy 100 shares of a stock at $50, your downside risk begins immediately from that $50 price point.

But by selling a $50 strike put for a $2.00 premium, your risk doesn't even kick in until the stock falls below your $48 breakeven. You’ve literally built yourself a 4% buffer against a price drop.

Let's take a look at how these two approaches stack up side-by-side.

Risk vs Reward Comparison of Selling Puts and Buying Stock

This table breaks down the key differences between selling a put and buying the stock directly, using our example of a $50 stock.

| Scenario | Sell Puts Strategy | Buying Stock Outright |

|---|---|---|

| Maximum Profit | Capped at the premium received ($200) | Unlimited (as high as the stock price can go) |

| Maximum Risk | (Strike Price - Premium) x 100 shares = $4,800 | Stock Price x 100 shares = $5,000 |

| Breakeven Point | Strike Price - Premium = $48 | Purchase Price = $50 |

As you can see, selling the put not only lowers your breakeven but also reduces your maximum potential loss if the company were to go bankrupt.

Historical data backs this up. A Goldman Sachs study found that selling one-month at-the-money puts on the S&P 500 had a positive outcome in 8 out of 10 years. The strategy captured around 66% of the market’s upside while only taking on 55% of the downside in negative months.

Of course, your net profit is always affected by taxes. It's smart to stay aware of the current Capital Gains Tax rate that will apply to your gains.

Finally, don't forget about volatility. Higher volatility usually means juicier premiums, which is great for us as sellers. But it also signals more uncertainty. Getting a handle on how volatility impacts option prices means getting familiar with the options Greeks. You can learn more about options trading Greeks in our article. This knowledge is what helps you find that sweet spot between income and risk—letting you structure trades you can sleep well with at night.

How to Choose the Right Stocks and Options

The success of your sell puts strategy comes down to two big decisions: the company you pick and the option you sell. A great trade setup on a terrible company is a recipe for disaster. But even with a fantastic company, the wrong option can kill your returns or expose you to needless risk.

This isn't about guesswork; it's about building a repeatable framework. You start by finding high-quality, stable companies you actually want to own for the long haul. Only then should you even glance at the options chain.

Selecting the Right Company

Before you even think about premiums or strike prices, you have to be a stock-picker first and an option seller second. The golden rule here is simple and non-negotiable: only sell puts on stocks you would be happy to own at the strike price.

This one shift in mindset immediately filters out the junk and focuses your attention on businesses with solid fundamentals. Getting the stock assigned shouldn't feel like a punishment—it should feel like you just bought a great asset at the discount you wanted.

Here’s a quick checklist to guide your stock selection:

- Strong Financial Health: Look for companies with consistent revenue growth, healthy profit margins, and debt they can easily manage. A solid balance sheet is a sign of a business that can handle a market downturn.

- A Competitive Moat: Does the company have something that protects it from competitors? This could be a powerful brand, network effects, or unique tech that keeps rivals at bay.

- Reasonable Valuation: Avoid selling puts on stocks that are flying high on hype. Even great companies are bad investments if you overpay. Find stocks trading at or near what you believe is fair value.

- Positive Long-Term Outlook: You’re agreeing to potentially own this company, so make sure it's in an industry with a bright future. Is this a business you believe in for the next several years?

By focusing on high-quality companies, you turn the "worst-case scenario" of assignment into your planned "best-case scenario" for buying the stock. The goal is to be happy with either outcome—keeping the premium or buying the shares.

Choosing the Optimal Option Contract

Once you've zeroed in on your target company, it's time to pick the specific option that fits your goals. This is a balancing act between maximizing your income (the premium) and managing your risk (the probability of assignment). The two main levers you can pull are the strike price and the expiration date.

The Art of Picking a Strike Price

Your strike price directly impacts both the cash you collect and your margin of safety. A strike closer to the current stock price will pay more, but it also has a higher chance of assignment. Go further away, and you get more protection but a smaller check.

A fantastic tool for this is the option Greek known as Delta. While its technical definition is a bit dense, for a put seller, Delta gives you a quick estimate of the probability that the option will expire in-the-money (meaning the stock price is below your strike).

- A put option with a 0.30 Delta has an approximate 30% chance of expiring in-the-money.

- A put with a 0.15 Delta has roughly a 15% chance of expiring in-the-money.

For income-focused traders who want to minimize assignment, selling puts with a Delta between 0.10 and 0.30 is a popular sweet spot. It balances a decent premium with a high probability of success. For a deeper look at this, our guide on how to choose an option strike price breaks it down even further.

Selecting the Best Expiration Date

The final piece of the puzzle is the expiration date. This determines how long your capital is tied up and directly influences your rate of return.

- Shorter Expirations (30-45 Days): This is often considered the sweet spot. These options benefit from faster time decay (theta), meaning their value erodes more quickly as time passes—which is exactly what you want as a seller. This lets you generate income more often and put your capital back to work on new trades.

- Longer Expirations (60+ Days): These contracts offer bigger upfront premiums, but they lock up your cash for longer and are more sensitive to big price swings. The rate of time decay is also much slower at first, which works against you.

Ultimately, you want to create a methodical process. First, find a great business you want to own. Second, use a tool like Delta to pick a strike that fits your risk tolerance. Finally, choose an expiration that maximizes your potential annualized return. This structured approach takes the emotion out of it and helps turn your sell puts strategy into a consistent, income-generating machine.

A Game Plan for Managing Your Open Positions

Placing the trade is just the opening move. Real success with selling puts comes down to how you manage the position from that moment until expiration.

Having a clear playbook ahead of time is what separates proactive investors from reactive speculators. It takes emotion out of the driver's seat.

The good news? There are really only three ways a trade can play out. If you prepare for each one, you’ll know exactly how to handle whatever the market throws at you, making sure every outcome still lines up with your goals.

Scenario 1: The Ideal Outcome

This is the best-case scenario and, frankly, the most common one for a well-picked trade. The stock price does what you want: it stays flat, climbs higher, or maybe even dips a little—but it always stays above your strike price when the expiration date hits.

When this happens, your job is simple. Do nothing.

The put option you sold expires worthless, and your obligation to buy the shares just evaporates. The premium you collected upfront is now 100% yours to keep. Your cash is freed up, ready for the next trade.

This is the bread and butter of using puts for income. You collect your premium, rinse, and repeat. It's a fantastic way to build a consistent stream of cash flow from your portfolio.

Scenario 2: The Art of the Roll

But what if the stock price drops and starts getting uncomfortably close to your strike as expiration approaches? This is where a powerful move called rolling the position comes into play. It’s your way of buying more time for the trade to work out, and you can often collect more premium in the process.

Rolling is a two-part move you do at the same time:

- Buy to Close: You buy back the put option you originally sold (often for a small loss or break-even).

- Sell to Open: You immediately sell a new put option on the same stock, but with a later expiration date and usually a lower strike price.

This little maneuver is incredibly strategic. It extends your timeline, giving the stock more room to recover. By dropping the strike price, you create a bigger safety buffer. Best of all, the new premium you collect almost always covers the cost of closing the old trade, often leaving you with an extra credit.

While selling puts is an income strategy, it helps to understand the bigger picture. Gaining insights into active trading strategies like day trading Nasdaq futures can give you a better feel for market dynamics and managing positions.

Scenario 3: Embracing Assignment

Finally, there’s the scenario where the stock price falls decisively below your strike, and you get assigned the shares. This isn't a failure—it's the other planned outcome.

You now own 100 shares of a company you already decided you wanted, and you bought them at the discount price you chose from the start.

Your true cost basis for the stock isn't even the strike price. It's the strike price minus the premium you were paid. You got the stock for cheaper than anyone who just bought it at the strike. From here, you shift from being an options seller to a shareholder. You can either hold for the long term or start selling covered calls against your new shares to generate more income.

This kind of proactive management is a key part of any solid trading plan. For a deeper dive into building a more resilient portfolio, check out some of the best practices for risk management.

A Few More Things to Keep in Mind

Even when you've got a handle on the basics of selling puts, a few specific situations always pop up. Let's walk through the most common questions that traders run into.

Getting these details right is what separates a decent strategy from a great one. We'll cover how dividends, risk limits, and taxes work in the real world.

How Do Dividends Affect Your Puts?

This one comes up a lot. What happens when the stock you've sold a put on pays a dividend?

As the put seller, you're not a shareholder, so you won't get the dividend check. But that doesn't mean it can't affect your trade.

On the ex-dividend date, the stock's price usually drops by the dividend amount. That sudden dip could be just enough to push your put option into the money, upping the odds of assignment.

Heads Up: An options buyer might exercise their in-the-money put early—right before the ex-dividend date. Why? To sell the shares at the higher, pre-dividend price. Always keep an eye on ex-dividend dates for any stock where you have an open put.

Can I Lose More Than My Secured Cash?

With a true cash-secured put, the answer is a firm no. Your maximum loss is locked in the moment you open the trade.

Your brokerage makes sure you have the cash on hand to cover the worst-case scenario, which is the stock going to zero.

Here's the math on your max loss: (Strike Price - Premium Received) x 100 shares.

- Example: You sell one put with a $50 strike price for a $2.00 premium.

- You set aside $5,000 in cash to secure it.

- If the stock becomes worthless, you have to buy 100 shares for $5,000.

- But you already collected a $200 premium, so your net cost is actually $4,800.

That $4,800 is the absolute most you can lose. The "cash-secured" part is your built-in safety net. It literally prevents you from losing more than you committed.

How Is Selling Puts Taxed?

The tax situation depends entirely on how the trade ends. The IRS treats the two main outcomes very differently.

First, the most common scenario: the option expires worthless. The premium you collected is taxed as a short-term capital gain. Simple as that. It doesn't matter if you held the position for two weeks or two months.

The second outcome is getting assigned and having to buy the stock.

When you're assigned on a put, the premium you received is not taxed right away. Instead, it lowers your cost basis for the shares you just bought. This will come into play later when you eventually sell the stock.

For instance, if you're assigned on a $50 strike put after collecting a $2.00 premium, your cost basis for the stock isn't $50. It's $48 per share. This lower basis means you'll have a larger taxable gain (or a smaller loss) down the road. Of course, it's always smart to run this by a qualified tax pro for advice specific to your situation.

Ready to stop guessing and start selling puts with data-driven confidence? Strike Price gives you the real-time probability metrics you need to balance safety and income. Get smart alerts, track your performance, and find the best opportunities that fit your exact risk tolerance. Transform your options selling into a strategic, income-generating process with Strike Price today.