7 Effective Selling a Put Option Strategies for 2025

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

Selling put options is a powerful way for traders to generate consistent income, acquire stocks at a discount, and capitalize on market volatility. Unlike buying options, which relies purely on predicting direction, selling options allows you to profit from time decay and neutral-to-bullish market conditions. However, not all selling a put option strategies are created equal. Each comes with its own risk profile, capital requirements, and ideal market conditions, making a tailored approach essential.

This guide moves beyond theory to provide a comprehensive rundown of the seven most effective methods used by both retail and professional traders. We'll break down the mechanics, offering actionable insights, practical examples, and specific implementation tips for each distinct strategy. Whether you're a conservative investor looking to enhance your portfolio's yield with the cash-secured put or an active trader seeking to leverage market dynamics with spreads, understanding these approaches is crucial. This article provides the blueprint to help you select and implement the right strategy for your financial goals, risk tolerance, and market outlook. We'll explore everything from the foundational cash-secured put and the popular Wheel Strategy to more advanced techniques involving spreads and volatility.

1. Cash-Secured Put

The cash-secured put is arguably the most foundational of all selling a put option strategies, prized for its conservative nature and dual-purpose potential. It involves selling a put option while simultaneously setting aside enough cash to buy 100 shares of the underlying stock at the strike price if the option is assigned. This approach effectively turns a potential obligation into a planned opportunity.

By selling the put, you collect an immediate premium, generating income. If the stock’s price stays above the strike price by expiration, the option expires worthless, and you keep the full premium for a high-probability profit. If the price drops below the strike, you are obligated to buy the shares at the strike price, but you do so at a discount to your original entry target, with the premium collected further reducing your cost basis.

Why It's a Top Strategy

This strategy is a favorite of value investors, most famously Warren Buffett. He has used cash-secured puts to generate millions in income on companies like Coca-Cola (KO), patiently waiting to either keep the premium or acquire shares at a price he deemed attractive. It’s a disciplined way to get paid while waiting for your target purchase price.

How to Implement It

- Select a Stock: Identify a high-quality stock you want to own for the long term.

- Determine Your Entry Price: Decide on the maximum price you are willing to pay per share. This will be your strike price.

- Secure the Cash: Ensure you have enough cash in your account to purchase 100 shares at that strike price (e.g., for a $150 strike, you need $15,000).

- Sell the Put: Sell a put option at your chosen strike price, collecting the premium.

Key Insight: The goal of a cash-secured put isn't just income. It's a strategic tool for acquiring quality assets at a predetermined, favorable price. The income is the reward for your patience.

Actionable Tips for Success

- Only Sell Puts on Stocks You Want to Own: This is the golden rule. Never use this strategy on a stock you wouldn't be happy to have in your portfolio.

- Sell into High Implied Volatility (IV): Premiums are richer when IV is elevated. Selling puts during periods of market fear or uncertainty can significantly boost your potential returns.

- Manage Your Position: If the trade moves against you but you no longer wish to own the stock, you can often "roll" the option to a later expiration date to collect more premium and delay assignment.

2. Naked Put Selling

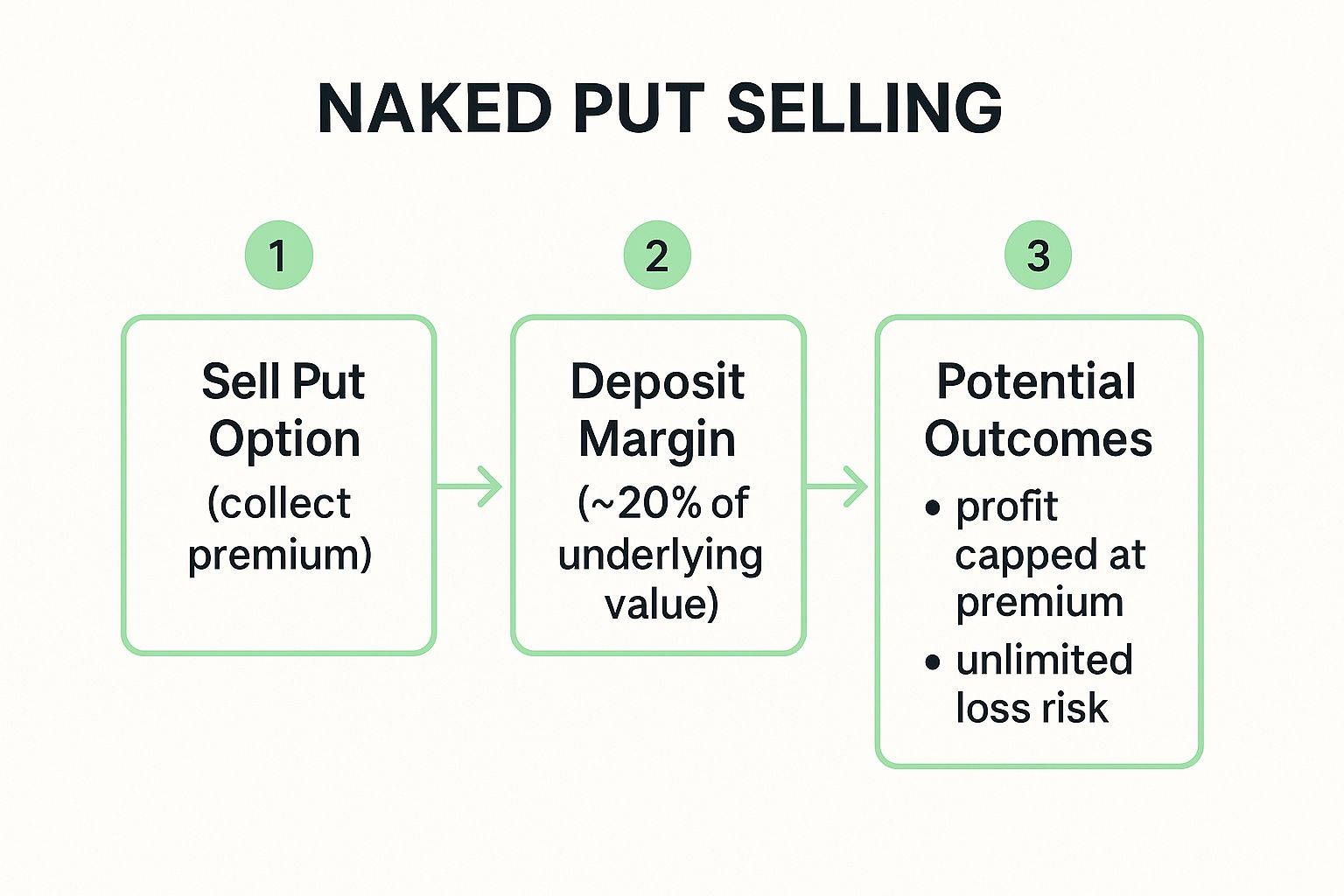

Naked put selling, also known as an unsecured short put, is a more aggressive cousin to the cash-secured put. This strategy involves selling a put option without setting aside the cash to purchase the underlying shares upon assignment. Instead, the trader only needs to post a smaller amount of capital, known as margin, to secure the position. This significantly increases capital efficiency, allowing for potentially higher returns on capital.

While it offers greater leverage, it also introduces a much higher degree of risk. If the stock price plummets far below the strike price, the seller is still obligated to buy the 100 shares at the strike. Without the cash secured, this can lead to substantial, theoretically unlimited losses, making it a strategy best suited for experienced traders with a high risk tolerance and a firm grasp on risk management principles.

The infographic below illustrates the basic process flow of a naked put trade, from initiation to the potential outcomes.

This visual process highlights the capital efficiency gained by using margin instead of cash, but also underscores the asymmetric risk profile where profit is capped while potential loss is not.

Why It's a Top Strategy

This strategy is favored by professional traders and hedge funds for its ability to generate significant income with less capital. Platforms like Tastytrade have popularized this approach among active retail traders, emphasizing a high-probability mechanical approach. The famous options trader Karen Bruton, "The Super Trader," reportedly used strategies like this to achieve phenomenal returns by methodically selling premium. To learn more about the mechanics, you can get a detailed breakdown of a short put on strikeprice.app.

How to Implement It

- Gain Options Approval: Ensure your brokerage account is approved for the highest level of options trading, which is required for selling naked puts.

- Analyze the Underlying: Select a liquid stock or ETF you are bullish or neutral on. Analyze its implied volatility (IV) to ensure the premium is attractive.

- Choose Strike and Expiration: Sell an out-of-the-money (OTM) put with a high probability of expiring worthless, typically with 30-60 days to expiration.

- Monitor Margin: Place the trade and closely monitor your margin requirements to avoid a margin call.

Key Insight: Naked put selling transforms option selling from a stock acquisition tool into a pure income-generation and speculation strategy. Success hinges entirely on disciplined risk management, not on the desire to own the underlying stock.

Actionable Tips for Success

- Maintain Strict Position Sizing: Never risk more than 1-2% of your total portfolio capital on a single trade. This is non-negotiable for managing the unlimited risk.

- Use Stop-Loss Orders: Implement a clear plan to exit the trade if it moves against you. This could be a price-based stop-loss or a rule to close the position if the loss hits 2-3 times the premium received.

- Diversify Your Underlyings: Spread your risk by selling naked puts on a variety of non-correlated assets, such as different sectors or broad market ETFs.

3. The Wheel Strategy

The Wheel Strategy is a systematic, income-generating approach that combines cash-secured puts and covered calls into a continuous, repeatable cycle. It is one of the most popular selling a put option strategies because it creates multiple opportunities to generate premium from a single underlying stock, whether you end up owning the shares or not. The process begins with selling a cash-secured put.

If the put expires worthless, you keep the premium and repeat the process. If you are assigned the shares, you transition to the second phase: selling covered calls against your newly acquired stock. This allows you to generate additional income while holding the shares. The "wheel" completes when the shares are called away, and you can start the cycle over again by selling another put.

Why It's a Top Strategy

This strategy has been heavily popularized by communities like Reddit's r/thetagang and educational platforms like Tastytrade because it provides a clear, rule-based framework for generating consistent income. It’s ideal for investors who want to systematically lower their cost basis on quality stocks or simply produce a steady cash flow from their portfolio. The strategy thrives on stable, blue-chip stocks like Johnson & Johnson (JNJ), where you are comfortable holding the shares long-term if assigned.

How to Implement It

- Phase 1: Sell a Cash-Secured Put: Select a stock you want to own and sell an out-of-the-money put option, securing the position with cash.

- Evaluate at Expiration: If the put expires worthless, keep the premium and return to Step 1. If assigned, you buy 100 shares at the strike price.

- Phase 2: Sell a Covered Call: Now that you own the shares, sell an out-of-the-money call option against them to collect more premium.

- Complete the Cycle: If the call expires worthless, keep the premium and return to Step 3. If the shares are called away, you sell the stock at the strike price and return to Step 1 with your cash freed up.

Key Insight: The Wheel is not a get-rich-quick scheme; it's a methodical process for generating consistent income. Its power lies in its cyclical nature, allowing you to repeatedly profit from time decay and volatility on stocks you already want in your portfolio.

Actionable Tips for Success

- Focus on Quality Underlying Assets: The strategy's foundation is the willingness to own the stock. Only run the wheel on fundamentally strong companies you don't mind holding.

- Target 30-45 DTE: Sell options with 30-45 days to expiration (DTE) to capture the steepest part of the time decay (theta) curve for optimal income.

- Manage Actively: Consider rolling your positions when they reach 21 DTE or have captured 50% of the maximum profit. This allows you to redeploy capital efficiently and manage risk.

- Ensure Good Liquidity: Stick to stocks with high trading volume and tight bid-ask spreads to ensure you can enter and exit trades at fair prices.

4. Put Spread Strategies

Put spread strategies, specifically the bull put spread, offer a defined-risk alternative to selling naked or cash-secured puts. This approach involves selling a put option while simultaneously buying another put option with a lower strike price but the same expiration date. This structure creates a "spread" that limits both your maximum potential profit and your maximum potential loss.

By buying the lower-strike put, you purchase protection that caps your downside risk if the underlying stock price falls sharply. The trade-off is that this long put costs money, reducing the net premium you collect. However, it also significantly lowers the capital or margin required to enter the trade, making it one of the most capital-efficient selling a put option strategies available.

Why It's a Top Strategy

This strategy is a favorite of traders who want to generate income with a neutral to bullish outlook while strictly controlling risk. Popularized by trading platforms and educators like Tom Sosnoff of Tastytrade, put spreads are used to capitalize on time decay and high implied volatility with a clear exit plan. Professional traders often use them around earnings announcements to profit from the post-event volatility crush.

How to Implement It

- Select an Underlying: Choose a stock, ETF, or index you believe will stay above a certain price level.

- Sell the Higher-Strike Put: Sell the "at-the-money" or "out-of-the-money" put option. This is your primary source of premium.

- Buy the Lower-Strike Put: Simultaneously, buy a further "out-of-the-money" put option with the same expiration. This is your protection.

- Collect the Net Credit: The difference between the premium received for the short put and the premium paid for the long put is your net credit, which is your maximum profit.

Key Insight: The primary advantage of a put spread is leverage and risk definition. You can control a position with far less capital than a cash-secured put, allowing for greater diversification and a precisely defined worst-case scenario.

Actionable Tips for Success

- Target a High Probability: Aim to sell the short put at a 16-30 delta. This gives you a high statistical probability of the option expiring worthless.

- Ensure Liquidity: Only trade spreads on underlyings with high options volume and tight bid-ask spreads to ensure you can enter and exit the position efficiently.

- Take Profits Early: Don't wait for expiration. A good rule of thumb is to close the position when you have captured 25-50% of the maximum potential profit. You can find more details in our complete guide explaining what option spreads are.

- Mind the Spread Width: Avoid spreads that are too narrow (e.g., less than $1 wide on stocks), as commissions can eat a significant portion of your potential profit.

5. Put Writing for Income Generation

This strategy reframes put selling from an occasional tactic into a systematic business, focusing squarely on generating consistent cash flow. Unlike other selling a put option strategies that might prioritize stock acquisition, this approach treats the collected premium as the primary objective. It involves regularly selling puts on a diversified portfolio of high-quality stocks and ETFs to create a steady stream of income.

This method is particularly popular among retirees and income-focused investors who aim to build a reliable monthly "paycheck" from their capital. The goal is not necessarily to own the underlying asset, but to have the options expire worthless, allowing the seller to retain the full premium and repeat the process.

Why It's a Top Strategy

Popularized by income-focused options educators and retirement planning advisors, this strategy provides a structured way to generate returns that often outpace traditional fixed-income investments. A retiree, for instance, might sell monthly puts on dividend aristocrat ETFs like the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) to supplement their Social Security or pension income, creating a predictable cash flow stream.

How to Implement It

- Build a Watchlist: Create a list of 20-30 high-quality, liquid stocks or ETFs with a history of stability, earnings growth, and ideally, dividends.

- Set Income Goals: Determine your target annualized return. A common goal for this strategy is 12-24% on the cash secured for the trades.

- Scan for Opportunities: Look for underlying assets on your list with an Implied Volatility (IV) Rank above the 30th percentile to ensure you are collecting sufficient premium.

- Sell Short-Dated Puts: Systematically sell out-of-the-money puts with 30-45 days to expiration, collecting premium across your diversified watchlist.

Key Insight: This is an active income strategy. Success hinges on consistency, diversification, and disciplined position management, treating your portfolio like a premium-generating business.

Actionable Tips for Success

- Maintain Strict Diversification: Avoid concentrating too much capital in a single stock or sector. Spread your risk across various industries and market capitalizations.

- Focus on Probability: Use delta as a rough guide for the probability of the option expiring worthless. Selling puts with a delta of 0.30 or less often provides a good balance of premium and safety.

- Have an Exit Plan: Decide in advance what you will do if a trade moves against you. Will you accept assignment, roll the position, or close it for a small loss? A clear plan prevents emotional decisions.

6. Volatility Crush Put Selling

Volatility crush put selling is a specialized strategy designed to capitalize on the rapid and predictable decline in implied volatility (IV) following a major, scheduled event like a company's earnings announcement. Before such events, uncertainty is high, which inflates option premiums. This strategy involves selling puts right before the event to capture this rich premium, expecting it to collapse once the uncertainty is resolved.

The core principle is that the market overpays for protection against the unknown. Once the earnings numbers are released or a decision is announced, the "unknown" becomes "known," and the implied volatility plummets, drastically reducing the option's value. This allows the seller to potentially buy back the put for a quick profit, often within hours or a few days, regardless of the stock's minor price movements.

Why It's a Top Strategy

This strategy is favored by professional traders and volatility arbitrage funds because it exploits a recurring market inefficiency known as the "volatility risk premium." While individual events are unpredictable, the pattern of IV expansion before an event and contraction after is highly consistent. Selling puts on Apple (AAPL) just before its quarterly earnings report is a classic example; IV might drop from 40% to 25% overnight, crushing the premium value for a swift gain.

How to Implement It

- Identify an Event: Find a stock with an upcoming earnings report or another major catalyst (like an FDA decision).

- Analyze IV Levels: Look for elevated implied volatility compared to the stock's historical volatility. The higher the IV, the richer the premium.

- Sell an Out-of-the-Money Put: Shortly before the event (often the day of), sell a short-term, out-of-the-money put option. This maximizes the impact of the volatility crush.

- Close for a Profit: As soon as the event passes and IV collapses, aim to buy back the put option at a much lower price to lock in the profit.

Key Insight: This strategy isn't primarily a bet on the stock's direction; it's a bet on the direction of volatility. You are selling overpriced uncertainty and buying it back once certainty is restored.

Actionable Tips for Success

- Enter Late, Exit Early: Place your trade as close to the event as possible (e.g., within the final hours of the trading day before earnings) and plan to exit quickly afterward.

- Set Realistic Profit Targets: Aim for a quick profit of 25-40% of the premium collected. Don't get greedy waiting for the option to expire worthless, as this reintroduces directional risk.

- Avoid True Binary Events: Steer clear of small-cap biotech stocks awaiting FDA approval. While the IV crush is massive, a negative outcome can cause a stock price collapse that overwhelms any premium collected.

- Understand Volatility Dynamics: Success with these selling a put option strategies requires a firm grasp of IV. For those looking to deepen their understanding of how market expectations influence option prices, exploring the concept of an implied volatility surface can be highly beneficial.

7. Scale-Down Put Selling

Scale-down put selling is a disciplined, defensive strategy that applies the principles of dollar-cost averaging to options trading. It involves systematically selling put options at progressively lower strike prices as a stock you want to own declines, allowing you to generate income while averaging down your potential cost basis. This approach turns a market downturn into a strategic accumulation opportunity.

Instead of committing all your capital at one price point, you sell an initial put. If the stock drops, you sell another put at a lower strike price, collecting more premium and setting an even more attractive entry point. This continues at predetermined levels, ensuring you are either consistently paid to wait or are acquiring shares at an increasingly better average price.

Why It's a Top Strategy

This method is a favorite among value investors who see market corrections not as a crisis but as a buying opportunity. It embodies Warren Buffett's philosophy of being greedy when others are fearful, but in a structured, risk-managed way. For example, if a high-conviction stock drops from $60, you might sell puts at $50, then $45, and even $40, systematically lowering your potential entry cost while earning income along the way.

How to Implement It

- Identify a High-Conviction Stock: Choose a fundamentally strong company you are comfortable owning a larger position in over the long term.

- Define Your Tiers: Predetermine the price levels at which you will sell puts (e.g., every $5 or 10% drop).

- Set Position Size: Decide how many contracts you will sell at each tier, ensuring you have enough capital to secure each one.

- Execute Systematically: Sell your first put at the highest strike. If the stock falls to your next level, sell the next put, and so on.

Key Insight: Scale-down put selling transforms a falling stock from a source of anxiety into a calculated opportunity. It removes emotion from the buying process and replaces it with a disciplined, tiered accumulation plan.

Actionable Tips for Success

- Reserve for “Best Ideas” Only: This strategy requires strong conviction. Only use it on companies with durable competitive advantages and strong balance sheets that you believe will recover.

- Maintain Strict Size Limits: Do not get carried away and sell more puts than you can afford to have assigned. Stick to your predetermined allocation for each tier.

- Focus on Dividend Payers: If you are assigned shares, a healthy dividend can provide additional returns while you wait for the stock price to rebound, enhancing your total return.

7 Put Option Selling Strategies Compared

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Cash-Secured Put | Moderate 🔄 | High cash collateral (100% of strike ×100)⚡ | Income from premium, potential stock ownership📊 | Neutral to bullish, elevated IV levels💡 | Immediate income, lower risk vs naked puts⭐ |

| Naked Put Selling | High 🔄 | Margin account with ~20% margin plus premium⚡ | High returns, unlimited risk📊 | Experienced traders, high capital efficiency💡 | Superior capital efficiency, higher returns⭐ |

| The Wheel Strategy | Moderate to High 🔄 | Significant capital for stock ownership⚡ | Consistent income & disciplined trading📊 | Sideways to mildly bullish markets💡 | Mechanical approach, reduces emotional bias⭐ |

| Put Spread Strategies | Moderate 🔄 | Lower capital vs naked puts⚡ | Defined risk and limited profit📊 | Neutral to bullish markets, risk-averse investors💡 | Limited loss, higher probability of success⭐ |

| Put Writing for Income | Moderate 🔄 | Moderate capital, focus on liquid underlyings⚡ | Steady income flow 📊 | Income-focused traders, retirees💡 | Consistent monthly income, flexible strike selection⭐ |

| Volatility Crush Put Selling | High 🔄 | Moderate capital, event/timing intensive⚡ | Rapid profits from IV collapse📊 | Post-earnings/events, short holding periods💡 | High win rate, fast profit realization⭐ |

| Scale-Down Put Selling | High 🔄 | Large capital reserves for multiple strikes⚡ | Income with cost averaging during dips📊 | Bear markets, value investing💡 | Generates income & lowers avg cost basis⭐ |

Choosing Your Path to Consistent Premiums

Navigating the world of options trading can seem complex, but as we've explored, a handful of powerful selling a put option strategies can consistently generate income and create opportunities to acquire quality stocks at a discount. From the foundational safety of the Cash-Secured Put to the more intricate timing of a Volatility Crush play, each approach offers a distinct risk-reward profile tailored to different market conditions and investor goals.

The journey from novice to proficient options seller is not about memorizing definitions. It's about developing an intuitive understanding of which tool to pull from your toolkit. A Cash-Secured Put is your reliable workhorse for steady income, while the Wheel Strategy transforms it into a long-term portfolio-building engine. Meanwhile, Put Spreads provide a crucial lever for managing risk and capital, allowing you to participate in premium selling with a defined, limited downside.

From Theory to Profitable Practice

Ultimately, the strategies detailed in this article are frameworks, not rigid formulas. Your success will hinge on disciplined application, consistent risk management, and a commitment to continuous learning. The most critical takeaways to carry forward are:

- Define Your Objective: Are you purely seeking income (Put Writing for Income), aiming to acquire stock (Cash-Secured Put), or speculating on volatility changes (Volatility Crush)? Clarity of purpose dictates your strategy choice.

- Know Your Risk Tolerance: A Naked Put offers the highest premium potential but carries theoretically unlimited risk. A Put Spread, by contrast, caps both your potential profit and your maximum loss, making it a more conservative choice. Always align the strategy with your personal comfort level.

- Adapt to the Market: Market conditions are dynamic. High implied volatility can make strategies like the Volatility Crush particularly lucrative, while low volatility might be better suited for simple Cash-Secured Puts on stable, blue-chip stocks.

Your Next Steps in Options Mastery

Mastering these concepts transforms options selling from a speculative gamble into a calculated, probability-driven business. The goal is to consistently place high-probability trades that align with your financial objectives. To continuously hone your skills and explore diverse trading methodologies, including advanced options techniques, consider leveraging resources like the vTrader Academy for further education.

Embracing the art and science of selling a put option strategies is a powerful step toward taking control of your investment returns. Start with a single strategy, implement it with a small amount of capital, and meticulously track your results. As you build confidence and experience, you can gradually expand your repertoire, creating a resilient and profitable options portfolio designed for long-term success.

Ready to move beyond theory and implement these strategies with data-driven confidence? Strike Price provides real-time probability metrics and risk analysis to help you identify the most profitable and secure put-selling opportunities. Make smarter, faster decisions by trying Strike Price today.