Selling Naked Put (selling naked put): A Practical Guide to Income and Risk

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

Selling a naked put is an options strategy where you get paid a premium for agreeing to buy a stock you like at a lower price. Think of it as being paid to set a "buy limit" order on a stock you already want to own, making it a go-to method for traders focused on generating consistent income.

How Selling a Naked Put Generates Consistent Income

The best way to think about selling a naked put is to imagine you're acting like an insurance company for a stock. Another investor is worried the stock's price might fall, so you sell them an insurance policy—the put option.

For selling this "insurance," you get paid an immediate cash premium. That premium is yours to keep, no matter what happens next.

Your end of the bargain is simple: if the stock price drops below a specific price (the strike price) by a certain date (the expiration date), you're obligated to buy 100 shares at that strike price. But if the stock stays above your strike, the option expires worthless, you have no obligation, and you pocket 100% of the premium as pure profit.

The Core Mechanics of Income Generation

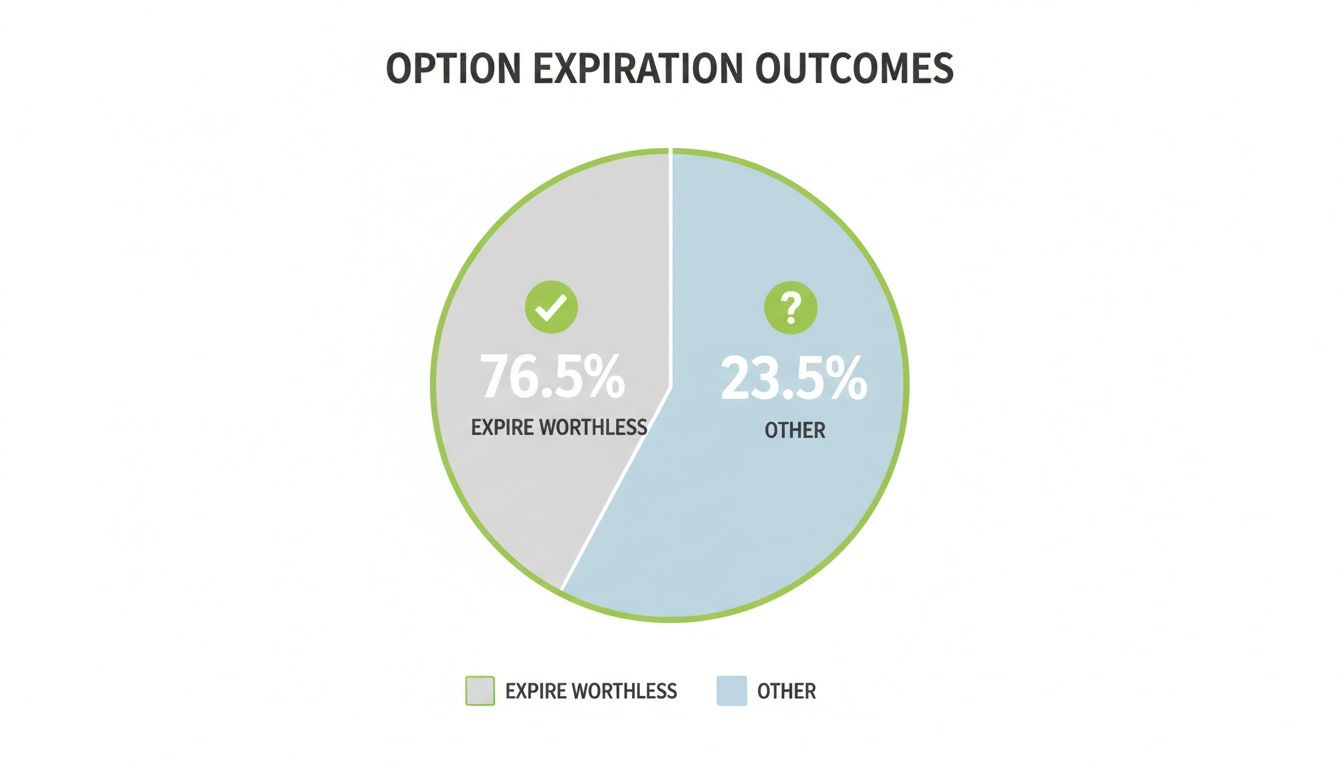

The primary goal here is for the option to expire worthless, which happens far more often than you might think. This gives sellers a natural statistical edge. A landmark study by the Chicago Mercantile Exchange (CME) analyzed three years of data and found that, on average, 76.5% of all options expired worthless.

This built-in probability is the engine that drives income. You repeatedly collect premiums on positions you believe will stay above your chosen strike price, letting time and statistics work in your favor.

Below is an example of an options chain, which is where a trader would go to select a strike price to sell a put.

The image shows all the essential components for the trade: different strike prices, expiration dates, and the premiums you can collect for selling.

Understanding the Key Components

To pull this off successfully, you need to get comfortable with three core elements of the trade:

- Premium: This is the cash you get paid upfront for selling the put. It's your maximum potential profit on the trade. The size of the premium is influenced by things like time until expiration and market volatility, which are components of its extrinsic value. To learn more, check out our guide on how extrinsic option value works.

- Strike Price: This is the price you agree to buy the stock at if it's assigned to you. Choosing a strike price well below the current market price increases your probability of success, but it also means you'll collect a smaller premium. It's a classic risk-reward tradeoff.

- Expiration Date: This is the last day of the contract. As a seller, time decay is your best friend. The shorter the time to expiration, the faster the option's value erodes, which is exactly what you want.

Understanding the Risk and Reward Profile

Every investment strategy has a give-and-take between potential profit and possible loss, and selling naked puts is a perfect illustration of this dynamic. Before you even think about placing your first trade, you need to get comfortable with this profile. The good news? The reward side is incredibly straightforward.

When you sell a naked put, your maximum profit is the premium you collect upfront. This cash hits your account right away and is yours to keep, as long as the stock stays above your chosen strike price when the option expires. The best-case scenario is simple: you sell the put, the stock does what you expect, and you pocket the full premium for your trouble.

The Defined Reward

While your profit is capped, it’s also immediate. This is what makes selling naked puts such a powerful strategy for generating consistent income. Unlike buying a stock and just hoping it goes up, you know your exact maximum gain from the moment you open the position. Your goal is simply to let time pass and have the option expire worthless.

Analyzing the Downside Risk

Now for the other side of the coin: the risk. While it’s often hyped up, the risk of selling a naked put is substantial, but it's not unlimited. A stock's price can't drop below zero, so that's your absolute floor. The real risk is being forced to buy 100 shares of the stock at the strike price, even if the market price has tanked well below that level.

This is exactly why you should only sell puts on high-quality companies you'd genuinely be happy to own. If you get assigned, you aren't stuck with a "loss" in the typical sense. Instead, you've just bought a stock you already wanted at a nice discount from where it was trading.

It's a common mistake to see assignment as a failure. A much better way to think about it is as a strategic purchase. You're either getting paid to wait for your price, or you get to buy a great company at the exact price you wanted.

This simple shift in mindset changes the entire strategy. Your actual breakeven point on the trade isn't the strike price—it's the strike price minus the premium you collected.

Breakeven Price = Strike Price – Premium Received

Let's say you sell a $50 strike put and collect a $2 premium ($200 per contract). Your breakeven price is actually $48. You only start to lose money on the position if the stock drops below $48 per share by expiration. Any price above that—including the range between $48 and $50—means you still walk away with a profit or at least break even.

The chart below shows just how often options expire worthless, which is exactly what an option seller wants to see.

This data reveals the built-in statistical edge that sellers have. Time decay and probability are on your side.

History backs this up, too. In-depth analysis has shown that selling naked puts outperforms a simple buy-and-hold stock strategy 55% of the time across different market conditions. The strategy has even shown a 100% edge in down or flat markets, and its overall risk profile is just one-third of holding the shares directly. You can dig into the full research on the performance of selling puts to see the numbers for yourself.

Walking Through a Real-World Naked Put Trade

Theory is one thing, but seeing how a trade plays out in the real world is where it all clicks. Let's walk through a hypothetical trade from start to finish to really nail down the mechanics of selling a naked put—profit, risk, and all the potential outcomes.

Imagine you're bullish on a fictional tech company, 'Innovate Corp' (INVT), which is currently trading at $100 per share. You like the company and think it's a solid buy, but you feel the price is just a bit rich right now. You’d be more than happy to own it at a discount.

Setting Up the Trade

Instead of just sitting on the sidelines hoping the price drops, you decide to get paid to wait. You pull up your brokerage account and put on the following trade:

- Action: Sell to Open 1 INVT Put Contract

- Strike Price: $95 (This is the price you're willing to buy the stock for)

- Expiration Date: 45 days from now

- Premium Collected: $2.00 per share, which comes out to $200 total ($2.00 x 100 shares)

The moment you place this trade, that $200 in cash hits your account. That’s your maximum potential profit. Now, let’s quickly break down the key numbers that define your position.

Calculating Your Trade Metrics

One of the great things about options is that you can map out your key thresholds before the market even moves.

- Maximum Profit: Your best-case scenario is that the option expires worthless. You get to keep the entire $200 premium. Simple as that.

- Breakeven Price: This is the line in the sand where you start to take a loss. To find it, just subtract the premium from the strike price: $95 Strike - $2 Premium = $93 per share. As long as INVT stays above $93 at expiration, you will not lose money on the trade.

- Margin Requirement: Since this is a naked put, your broker doesn’t make you set aside the full $9,500. Instead, they'll calculate a margin requirement using their own formula, which might be somewhere around $1,500 - $2,000. This capital efficiency is what attracts many traders to naked puts.

Your breakeven price of $93 gives you a nice cushion. With the stock currently trading at $100, it has to fall more than 7% before your position even starts to show a loss at expiration.

Exploring the Three Potential Outcomes

Fast forward 45 days. As the expiration date rolls around, one of three things is going to happen:

Scenario 1: The Ideal Outcome (INVT closes above $95)

If INVT stock closes anywhere above your $95 strike price—let's say it rallies to $105—the put option expires worthless. The buyer has no reason to exercise it. You keep the full $200 premium, your margin is freed up, and the trade is over. Maximum profit achieved.

Scenario 2: The Strategic Acquisition (INVT closes between $93 and $95)

What if INVT drifts down and closes at $94? The option is now "in-the-money," which means you'll be assigned. You're now obligated to buy 100 shares of INVT at your agreed-upon price of $95 per share. While the market says the stock is worth $94, your effective cost is actually your breakeven of $93 per share ($95 strike - $2 premium). You now own a stock you wanted, and you got it at a discount.

Scenario 3: The Unfavorable Outcome (INVT closes below $93)

Now, let's say some bad news hits and INVT plummets to $90. You are still assigned 100 shares at $95 each. Your effective cost is $93 per share, but the stock is only trading at $90. This leaves you with an unrealized loss of $300 ($93 breakeven - $90 market price x 100 shares). This is where the risk becomes real: you have to be prepared for the stock's downside.

To tilt the odds in your favor, many traders focus on selling puts with a high probability of success. Modern tools often suggest selling puts with low delta values, like 0.14, which corresponds to an 86% chance of the option expiring worthless. This data-driven approach helps build a buffer against losses. If you're interested, you can watch a great video that breaks down how to use probabilities when selling puts for consistent income.

Ultimately, this example shows that selling a naked put is a calculated strategy with clearly defined outcomes—not a blind gamble.

How to Select the Right Stocks and Strike Prices

Any successful naked put strategy really boils down to two key decisions: which stock you pick and which strike price you sell. Get these right, and the strategy becomes a calculated, income-generating machine. But get them wrong, and you're just gambling.

Think of stock selection like pouring the foundation for a house. If it’s weak, everything you build on top of it is at risk. That's why the first rule is simple: only sell naked puts on high-quality companies you genuinely want to own for the long term.

This one filter immediately weeds out the speculative, volatile, or financially shaky companies. The goal isn't to chase the highest possible premium; it's to engage with solid businesses whose fundamentals you trust.

Identifying Quality Stocks for Put Selling

A great candidate for selling naked puts is a company you’d actually be happy to buy and hold if you get assigned the shares. This mindset completely changes the game from "avoiding assignment" to "strategic acquisition at a discount."

So, what should you look for?

- A Stable Price History: Sure, all stocks move, but you want to avoid the ones with wild, unpredictable swings. Look for established companies with a track record of steady growth or stability.

- Strong Financials: A healthy balance sheet, consistent earnings, and a real competitive advantage are non-negotiable. You want to own businesses that can ride out an economic storm.

- Plenty of Liquidity: Stick to stocks with high trading volume and options chains with tight bid-ask spreads. This just means you can get in and out of your trades easily without losing money to slippage.

- Personal Conviction: You need to have a bullish or at least neutral long-term view of the company. If you believe in its future, being assigned the stock starts to look like a welcome opportunity, not a failure.

When you focus on these pillars, you create a universe of potential trades where the "worst-case scenario"—buying the stock—is actually a planned and desired outcome. For a deeper look at this, check out our guide on finding the best stocks for put selling for more specific criteria.

Using Probabilities to Select a Strike Price

Once you’ve got your stock, the next big decision is the strike price. This is where you fine-tune the balance between safety and income. Selling a put closer to the current stock price brings in a higher premium, but it also means a higher chance of assignment. Selling a put further away is safer, but the reward is smaller.

So, how do you make a smart choice? You lean on probabilities.

One of the best tools for this is an option's Delta. Delta is an option "Greek" that tells you how much an option's price should change for every $1 move in the stock. But for put sellers, it has a second, even more useful meaning: it gives you a rough estimate of the probability that the option will expire in-the-money.

A put option with a Delta of 0.20 can be read as having an approximate 20% chance of expiring in-the-money. This means you have an 80% chance of it expiring worthless. That makes Delta an incredibly powerful, data-driven guide for managing your risk.

Using Delta lets you put a number on your personal risk tolerance. A conservative trader might stick to selling puts with a Delta of 0.15 or lower, giving them a very high probability of success. A more aggressive trader might sell at a 0.30 Delta to collect more premium, accepting the higher chance of getting the stock.

The Tradeoff Between Safety and Premium

This relationship—between the strike's distance from the stock price, the premium you collect, and the probability of assignment—is the absolute core of strike selection.

- Further Out-of-the-Money (Lower Delta): These strikes are well below the current stock price. They give you a bigger cushion, as the stock has to fall quite a bit before your position is at risk. The tradeoff? A much smaller premium.

- Closer to the Money (Higher Delta): These strikes are right near the current stock price. They pay much higher premiums precisely because the probability of the stock dropping to that level is greater. The assignment risk is higher, but so is your potential income.

Ultimately, the "right" strike price is the one that lines up with your goals. If you actually want to acquire the stock at a discount, a strike closer to the current price might be perfect. If your goal is pure income with the lowest possible risk, you'll want to select a strike much further away. This data-first approach takes the emotion and guesswork out of the equation, letting you build a strategy that truly fits you.

Essential Risk Management Techniques for Put Sellers

Being a successful put seller has less to do with picking winners and more to do with being a disciplined risk manager. The best traders I know live by one rule: protect your capital first, chase profits second. Without a solid game plan for managing risk, even a great strategy can blow up an account.

The absolute foundation of this is position sizing. It’s just a fancy way of saying you need to control how much you're betting on any single trade. A classic rookie mistake is selling way too many contracts just because the margin requirement looks small. Don't fall for it.

A smart rule of thumb is to never risk more than 2-5% of your total account on a single position. This keeps you in the game. One bad trade won't wipe you out, and you’ll live to trade another day.

The Art of Rolling a Challenged Position

Let's be real: some trades will go against you, no matter how well you plan. When a stock price drops and starts testing your short put, you don't have to just sit there and hope. This is where one of the most powerful defensive moves comes into play: rolling the position.

Rolling is a two-part move you do at the same time:

- Buy to close your current short put.

- Sell to open a new put on the same stock.

Typically, you'll roll to a lower strike price and a further expiration date. This simple adjustment buys you more time to be right and gives you a bigger cushion. Better yet, you can often do this for a net credit, meaning you actually get paid more premium to give yourself a better shot at success.

Using Stop-Loss Orders on Options

Another way to draw a clear line in the sand is with a stop-loss order on the option premium itself. We all know about stop-losses for stocks, but they’re incredibly useful for options, too. The idea is simple: if the premium of the put you sold spikes to a certain price, your broker automatically buys it back for you.

Let's say you sell a put for a $2.00 premium ($200 credit). You could set a stop-loss to automatically buy it back if the price doubles to $4.00. This move caps your maximum loss on that trade at $200, preventing a small mistake from turning into a disaster.

This takes the emotion out of the exit. In a volatile market, reducing financial uncertainty through careful planning is the only way to stay sane and profitable.

Diversification and Defined-Risk Alternatives

Finally, don't put all your eggs in one basket. Just like with stocks, you need to spread your options trades across different, non-correlated stocks and industries. You don't want a bad earnings report in the tech sector to sink your entire portfolio.

And if the "undefined risk" of a naked put still keeps you up at night, there's a simple fix. Take a small piece of the premium you collected and use it to buy a cheaper, further out-of-the-money put. Boom—you’ve just converted your trade into a defined-risk position.

For anyone curious about that setup, check out our deep dive on the put credit spread.

By layering these techniques—smart sizing, rolling, stop-losses, and diversification—you can trade naked puts with confidence. It stops being a high-stakes gamble and becomes a calculated, repeatable method for generating income.

When to Use the Naked Put Strategy for Best Results

Knowing when to deploy a naked put is half the battle. This isn’t a strategy you pull out of the toolbox for every market condition or every stock. It’s a specialized tool that works best under the right circumstances and with a specific mindset.

The most common reason traders sell naked puts is to generate consistent income in neutral-to-bullish markets. Think of times when you expect a stock to either trade sideways or climb slowly. These are the sweet spots.

In this kind of environment, time decay (theta) is your best friend. Every day that passes chips away at the value of the put option you sold, inching you closer to keeping the full premium. The strategy is built for stability or a gentle upward drift—not for wild, unpredictable price swings.

Using Puts to Buy Stocks on Sale

Beyond just collecting premium, selling puts has a brilliant secondary use: acquiring a stock you already want at a discount. This simple shift in perspective turns assignment from a risk into a goal.

Let's say you've done your homework on a great company, but its current price feels a little rich. Instead of just setting a limit order and hoping it hits, you can sell a naked put at the price you actually want to pay.

This move literally pays you to wait.

- If the stock stays above your strike, the option expires worthless. You pocket the entire premium and are free to sell another put, collecting more income while you continue to wait.

- If the stock drops below your strike, you get assigned the shares. You now own the company at your target price, and your actual cost basis is even lower thanks to the premium you collected upfront.

This is what makes selling puts so powerful. It's either a successful income trade or a successful stock purchase at a price you already wanted. For a disciplined investor, it can feel like a win-win scenario.

The Right Mindset for Success

At the end of the day, selling naked puts is not a get-rich-quick scheme. It’s a methodical strategy for patient, income-focused investors who understand the underlying company.

It’s most effective when you’re mildly bullish or neutral on a stock and have the discipline to handle the trade if it moves against you. This means being both financially and emotionally prepared to own 100 shares per contract if you get assigned.

When you view the strategy through this lens, a simple options trade becomes a core part of a smart, long-term investment plan.

Frequently Asked Questions About Selling Naked Puts

Even after you get the hang of it, a few questions tend to pop up again and again. Let's tackle the most common ones to clear up any confusion you might have about selling naked puts.

Is Selling a Naked Put Really an Unlimited Risk Strategy?

This is probably one of the biggest myths in options trading. While the potential loss is definitely significant, it is not infinite. A stock’s price can’t drop below zero, which puts a hard floor on how much you can lose.

Your maximum loss happens if the stock goes to zero. In that nightmare scenario, your loss would be (Strike Price x 100) - Premium Received. The risk is huge and needs to be managed carefully, but it’s fundamentally capped.

What Is the Difference Between a Naked Put and a Cash-Secured Put?

The real difference comes down to collateral. With a cash-secured put, you have to keep enough cash in your account to actually buy 100 shares at the strike price if you get assigned. If you sell a $100 strike put, that means having $10,000 in cash sitting there, ready to go.

A naked put, on the other hand, uses your broker’s margin instead of your own cash. The margin requirement is usually just a fraction of the full cash amount, which makes it a more capital-efficient way to sell the exact same put. That leverage, however, is a double-edged sword—it also magnifies your risk if the trade goes against you.

At their core, a naked put (when collateralized properly) and a cash-secured put are the same trade. The risk and reward profile is identical; the only difference is the capital used to back the position.

How Does Implied Volatility Affect Selling Naked Puts?

Implied volatility (IV) is a put seller's best friend. When IV is high, the market is expecting bigger price swings, which pumps up option premiums. This is the sweet spot for selling naked puts because you collect more income for taking on the same level of risk.

The dream scenario is selling a put when IV is high and then watching it drop during the life of the trade. This is often called a "vega crush," and it can make your position profitable even if the stock price doesn't budge.

For active traders using strategies like selling naked puts, understanding the broader financial context is crucial. You might also want to explore how to improve your tax position as a share trading business.

Take the guesswork out of selling options. Strike Price provides real-time probability data for every strike, so you can confidently select trades that match your income goals and risk tolerance. Start your free trial today and turn probability into profit.