A Definitive Guide to Short Call Options Strategies

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

Selling a short call option is a strategy where you agree to sell a stock you own at a set price, by a certain date. In return for making that promise, you get paid an immediate cash premium. It’s yours to keep, no matter what happens next.

Unpacking the Basics of Short Call Options

At its heart, selling a call is a neutral-to-bearish move. You're betting that a stock's price won't shoot up past a certain level before the option expires. If you’re right, the option expires worthless, and that premium you collected is pure profit.

Think of it like being an insurance provider. You collect a fee (the premium) from someone who wants protection against a specific event—in this case, a stock price soaring. If that event doesn't occur, you just pocket the fee. This is why it's one of the most popular strategies for passive income for investors looking to generate cash flow from their portfolios.

The Motivations Behind Selling Calls

So, why would a trader decide to sell a call? It usually boils down to generating income or making a strategic play on a stock's future. By selling calls over and over, you can create a consistent stream of cash that adds to your portfolio's returns.

It’s also a great way to act on a specific market view. If you think a stock has run up too high or is about to trade sideways for a while, selling a call lets you profit from that idea without needing the stock to actually fall. The main drivers for using short call options are:

- Generating Regular Income: The premium you collect is an immediate cash deposit into your account.

- Profiting in Neutral Markets: Unlike simply buying and holding, this strategy can make you money even if the stock price goes nowhere.

- Capitalizing on High Volatility: When the market gets jumpy, option premiums get juicier. This means sellers get paid more for taking on the risk.

Key Terms You Must Understand

To really get how short calls work, you need to know the lingo. These are the building blocks of the contract, and they dictate how a trade will play out. Flying blind here is not an option. For a deeper dive, our guide on how options trading works is a great place to start.

A short call is a strategy where your maximum profit is capped at the premium you collect upfront. But if you don't own the underlying stock, your potential loss is theoretically unlimited. This makes risk management absolutely critical.

Let’s quickly break down the core pieces of every short call trade.

To give you a clearer picture, here’s a quick summary of what makes up a short call option.

Short Call Option at a Glance

| Component | Description | Trader's Goal |

|---|---|---|

| Strike Price | The price you must sell the stock at if assigned. | To have the stock price stay below this level. |

| Expiration Date | The date the contract becomes void. | For the option to expire worthless on or before this date. |

| Premium | The cash you receive for selling the option. | To keep 100% of this amount as profit. |

These three components—the strike, the expiration, and the premium—are the foundation of your trade's risk, reward, and overall structure. Understanding how they work together is the first real step to using this strategy effectively.

Comparing the Main Types of Short Call Strategies

Selling a call option isn't a one-size-fits-all move. The approach you choose completely changes your risk, your potential reward, and the very reason you're placing the trade in the first place.

Getting these strategies straight is essential. It’s the only way to make sure your trades actually line up with your goals and how much risk you're comfortable taking on.

We'll break down the three main ways to play it: the conservative covered call, the high-stakes naked call, and the balanced short call spread. Let's see how they stack up.

The Covered Call: The Income Generator

The covered call is the bread and butter of options income for a reason. It's the most common and conservative way to sell calls, making it a perfect starting point for investors who already own at least 100 shares of a stock and want to put those shares to work.

The "covered" part is the key here. It means you already own the shares needed if the option gets assigned. No mad dash to the open market required; you just deliver the stock you're already holding.

- The Play: Own at least 100 shares of a stock and sell one call option against them.

- Who It’s For: Investors with a neutral to slightly bullish outlook who want to earn a premium and are okay selling their shares at the strike price.

- The Catch: Your risk isn't about losing money on the option itself. It’s the opportunity cost—if the stock soars past your strike price, your gains are capped.

Think of it like renting out a room in a house you own. You collect rent (the premium) with the understanding that you might have to sell the whole house (your shares) at a price you've already agreed on. It’s more about enhancing returns than pure speculation.

The Naked Short Call: The High-Risk Bet

On the complete opposite end of the spectrum is the naked short call. This is an advanced strategy with a risk profile that demands serious respect and market know-how. "Naked" means you sell the call option without owning the underlying 100 shares.

If the stock price moons and the option is assigned, you’re on the hook. You have to go buy 100 shares at the new, much higher market price, only to sell them at the lower strike price. This opens the door to theoretically unlimited losses. Why? Because there’s no ceiling on how high a stock's price can go.

This strategy is absolutely not for beginners. It’s for seasoned traders who are extremely confident in their bearish view and have the capital to handle the trade if it goes south.

The Short Call Spread: The Risk-Defined Alternative

So, what if you're bearish on a stock but the idea of unlimited risk from a naked call keeps you up at night? The short call spread (or bear call spread) is the perfect middle ground. It lets you bet against a stock while knowing your maximum possible loss from day one.

Here’s the setup:

- You sell a call option at a lower strike price to collect a premium. This is your main bet.

- You simultaneously buy another call option at a higher strike price. This one is your insurance policy.

That long call you buy puts a hard cap on your potential losses. If the stock rips upward, the gains on your long call will start to offset the losses from your short call. Your maximum loss is simply the difference between the two strike prices, minus the net premium you collected upfront.

Covered Call vs Naked Call vs Short Call Spread

To make it even clearer, let's put these three strategies side-by-side. Each one serves a very different purpose, and seeing them compared directly makes it easy to spot which one might fit your own trading style.

| Strategy Feature | Covered Call | Naked Short Call | Short Call Spread |

|---|---|---|---|

| Risk Profile | Limited | Unlimited | Defined & Limited |

| Reward Profile | Capped | Limited to premium received | Capped |

| Market Outlook | Neutral to Slightly Bullish | Bearish to Neutral | Bearish to Neutral |

| Capital Required | Own 100 shares | High (margin account) | Moderate (margin account) |

| Best For | Income generation | High-conviction bearish bets | Risk-managed bearish bets |

This defined-risk structure makes the short call spread a much more approachable strategy for traders who want to profit from a stock's sideways or downward move without the anxiety of unlimited exposure. Understanding these dynamics is crucial, especially since institutional players lean heavily on spreads. In fact, Commitment of Traders reports show that spreading strategies added 30% to the total short call open interest. You can explore more of this institutional positioning data on the CFTC's official site.

How to Read a Short Call Payoff Diagram

Theory is one thing, but seeing how your profit and loss will actually play out is what really matters. That's where a payoff diagram comes in. It's a simple visual that maps out every possible outcome for your trade by expiration.

Think of it like this: the vertical line (Y-axis) shows your profit or loss, and the horizontal line (X-axis) shows the stock's price. By tracing the line, you can instantly see what happens to your bottom line if the stock rips higher, drops, or just sits there. It’s a crystal-clear snapshot of your risk and reward.

Deconstructing a Naked Short Call Diagram

Let's start with the classic: a naked short call. This is when you sell a call option without owning the stock. Its payoff diagram has a very distinct, lopsided shape that tells you everything you need to know about the risk involved.

Imagine you sell one call option on XYZ stock at a $50 strike price. You collect a $2 per share premium, which comes out to $200 for the contract (100 shares).

The diagram clearly shows a trade with a hard ceiling on profit but a dangerously open floor for losses. Let’s pinpoint the key areas on the graph using our example:

- Maximum Profit: The flat part of the line is your best-case scenario. As long as XYZ closes at or below the $50 strike, the option expires worthless and you keep the entire $200 premium.

- The Break-Even Point: This is where the sloping line crosses zero. It’s simply the strike price plus the premium you collected: $50 + $2 = $52. If XYZ is exactly at $52 at expiration, you walk away with nothing gained and nothing lost.

- Unlimited Loss Zone: Once the stock moves past your $52 break-even, things get ugly. For every dollar the stock rises, your loss grows by $100 per contract. Since there’s no theoretical limit to how high a stock can go, your potential losses are uncapped.

The core takeaway from the diagram is simple: when selling a naked call, your upside is strictly limited to the premium, while your downside is dangerously open-ended. This visual makes the risk instantly apparent.

If you want to dive deeper into the math, we have a guide on how to calculate call option profit in different situations.

How Covered Calls and Spreads Change the Picture

Now, what happens when we manage that risk? Adding other components to the trade completely changes the shape of the payoff diagram, reflecting a much different risk profile.

1. The Covered Call Diagram

When you sell a covered call, you already own the 100 shares. While the diagram looks a lot like the naked call, the meaning is different. The "loss" isn't cash out of your pocket; it's an opportunity cost. It’s the extra profit you miss if the stock skyrockets past your strike. Your gains are capped, but you aren't exposed to the terrifying, unlimited cash losses of a naked position.

2. The Short Call Spread Diagram

A short call spread (or bear call spread) changes everything. By selling one call and buying another at a higher strike, you build a safety net. This completely flattens out the loss side of the diagram, creating a defined profit-and-loss "box." Your maximum profit is the net premium you collect, and your maximum loss is also capped, no matter how high the stock climbs. The risk is completely defined from the start.

Mastering Risk Management for Short Calls

Selling call options can be a fantastic way to generate income, but it's a game of probabilities. If you ignore the risks, you’re just gambling. Real success isn't about chasing the highest premiums—it's about protecting your capital so you can stay in the game long enough for those probabilities to work in your favor.

The most common threat is assignment risk. This is when the option buyer exercises their right, forcing you to sell 100 shares of the stock at the strike price. It can happen anytime but is most likely when the option is deep in-the-money, especially as expiration gets closer and time value fades.

The Dangers of Gamma Squeezes

If you're trading naked short calls, there's a much bigger monster lurking in the closet: a gamma squeeze. This is when a stock's price explodes upward, partly because market makers are forced to hedge their own positions as a flood of calls go in-the-money. As the price rips higher, short call sellers have to buy shares to cover their positions, which just adds more fuel to the fire.

This isn't just theory. The 2020 COVID crash showed just how brutal these tail risk events can be, with gamma squeezes amplifying losses by as much as 300% in some under-hedged positions. It’s a harsh reminder that proactive risk management is non-negotiable.

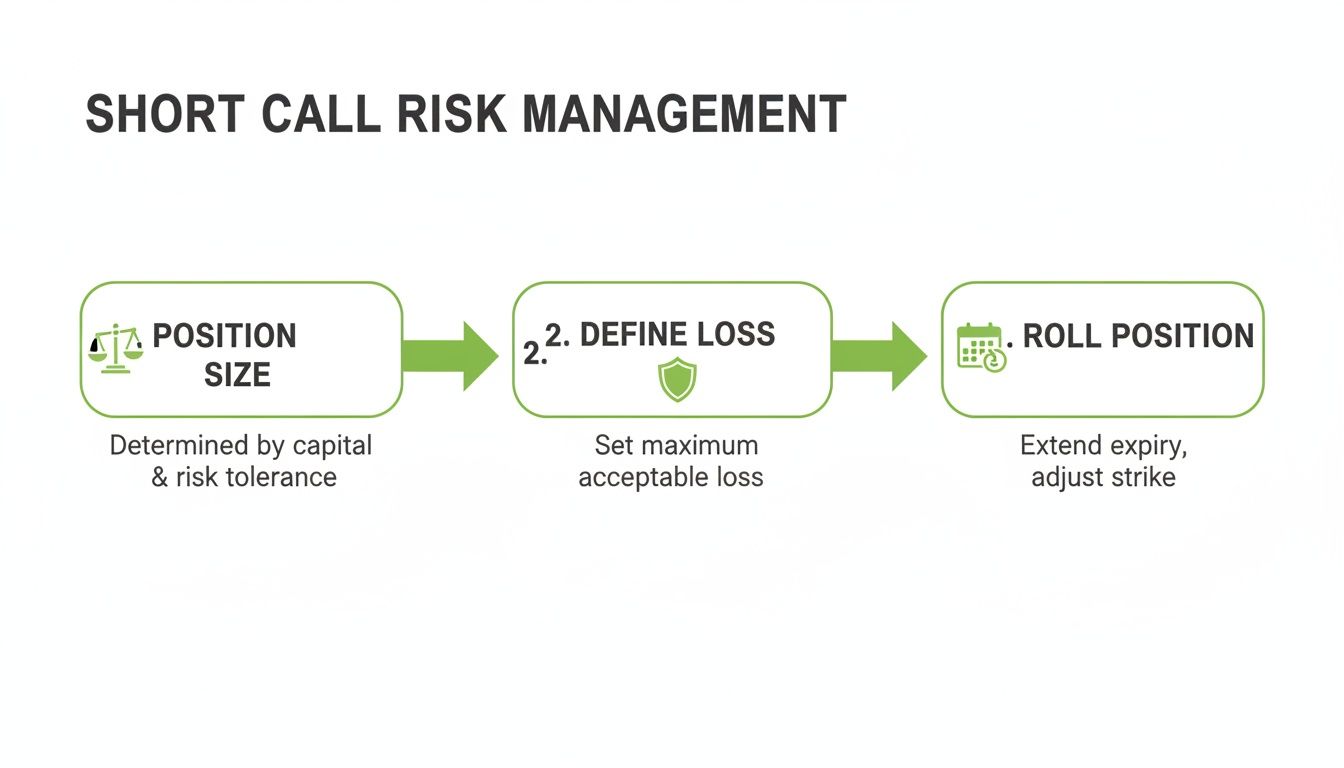

Proactive Risk Management Techniques

The best traders don't wait for a trade to go bad before they act. They have a plan from the start. Your goal should be to know your "uncle point"—the exact price where you'll either adjust or get out—before you even click the sell button. This means having a solid grasp of the options greeks. If you're not familiar, you can learn more about the options trading greeks in our detailed guide.

Here are three core techniques every short-call seller should know:

- Rolling the Position: Let's say the stock moves against you, but you still think your original idea is sound. You can "roll" the option by buying back your short call and selling a new one with a later expiration date, usually at a higher strike. The goal is to collect a net credit, which buys you more time and improves your break-even point.

- Using Call Spreads: The easiest way to avoid unlimited risk is to never take it on in the first place. A short call spread (or bear call spread) caps your maximum loss from day one. You do this by buying a cheaper, further out-of-the-money call to act as protection. Think of it as an insurance policy against a runaway stock.

- Proper Position Sizing: This might be the most important rule of all. Never bet the farm on a single trade. A good rule of thumb is to risk no more than 1-2% of your total portfolio value on any one trade. This discipline ensures that a few bad trades won't wipe you out.

Risk management is the art of staying in the game. It ensures that no single bad trade can take you out of the market, allowing the high-probability nature of selling options to work in your favor over the long term.

Ultimately, managing short calls is about discipline. Have a clear plan for every possible outcome. By understanding assignment, respecting gamma, and using tools like rolling, spreads, and smart sizing, you can turn what feels like a high-risk gamble into a repeatable, strategic way to generate income.

A Step-by-Step Guide to Placing Your First Trade

Alright, we've covered the theory. Now it's time to get practical. Placing your first short call option trade isn't about throwing darts at a board; it's a clear, repeatable process that turns an idea into a structured strategy.

This guide will walk you through the essential decisions you’ll make, from picking the right stock all the way to managing the trade after it's live.

Selecting the Right Underlying Stock

First things first: you need to choose the right stock. Not every stock is a good candidate for selling options. You're looking for companies with high liquidity, which is just a fancy way of saying there are tons of buyers and sellers for both the stock and its options.

High liquidity means you get tighter bid-ask spreads, so you can get in and out of your trades at fair prices without getting clipped by slippage. A stock with predictable volatility also helps, making it easier to forecast a likely trading range—which is the name of the game when selling short call options.

The Art of Choosing a Strike Price

Got your stock? Great. The next big decision is picking a strike price. This is where you directly influence both your potential income and your odds of success. It's the classic trade-off between risk and reward.

- At-the-Money (ATM) Strikes: These are strikes right around the current stock price. They pay the highest premiums but come with a roughly 50% chance of ending up in-the-money.

- Out-of-the-Money (OTM) Strikes: These strikes are above the current stock price. The premiums are smaller, but they have a much higher probability of expiring worthless—which is exactly what we want.

A great rule of thumb for gauging this probability is to look at the option's delta. A call option with a 0.30 delta can be loosely translated to a 30% chance of expiring in-the-money, giving you, the seller, a 70% chance of success. This isn't just theory; market data backs it up. In busy trading sessions, it's common to see 75% of short calls placed between a 0.2 and 0.5 delta, hitting that sweet spot. For a deeper dive, the CBOE offers extensive historical options data that can give you a feel for market sentiment.

Think of your strike price as your line in the sand. It’s the price where your trade starts to feel some heat. Choosing the right one isn't about perfection; it’s about matching the premium you collect to the risk you’re willing to take on.

Choosing an Optimal Expiration Date

The expiration date sets the clock on your trade. This decision is all about harnessing the power of time decay, or theta. As an options seller, theta is your best friend. Every single day, it quietly eats away at the value of the option you sold, pushing it closer to zero.

Options with shorter expirations—usually 30-45 days out—experience the most rapid time decay. This makes them a favorite for sellers looking to collect premium fast. The catch? You have less time for the stock to behave if it initially moves against you. Longer-dated options give you more breathing room for the trade to work out, but that time decay happens much more slowly.

The flowchart below walks through the key risk management steps once your trade is live, from setting it up to making adjustments.

This really drives home the point that a trade isn't "set it and forget it." How you manage your position size, define your stop-loss, and know when to roll are what separate amateurs from pros.

Managing and Monitoring Your Live Trade

Once you've sold that call, the real work begins. You need to keep an eye on things. Have a clear game plan for two scenarios: what you’ll do if the trade goes your way, and what you’ll do if it goes against you.

Set up price alerts on the underlying stock. This is where platforms like Strike Price are a game-changer. You can get notifications if the stock price gets too close to your strike or if the probability of assignment suddenly spikes. It helps you make decisions based on data, not gut feelings.

Know your exit strategy before you even enter the trade. A common rule of thumb is to close the position early once you’ve banked 50% of the maximum potential profit. This locks in your gains, frees up your capital for the next opportunity, and saves you from sweating it out for the last few pennies of premium. On the flip side, have a pre-defined point where you'll either cut your losses or roll the position if the stock makes a strong move against you.

Common Questions About Short Call Options

Jumping into the world of short call options can feel like learning a new language. You've got the basics down, from payoff diagrams to the risks involved, but a few practical questions might still be nagging you. Let's tackle the most common ones to clear up any confusion before you start trading.

When Is the Best Time to Sell a Call Option?

Timing is everything, and that’s especially true when selling calls. The sweet spot for selling a call is when you’re neutral to bearish on a stock. You don't need the stock to crash—you just need to be reasonably sure it won't skyrocket past a certain price before the option expires.

This strategy really comes alive when implied volatility (IV) is high. Think of high IV as market anxiety; it pumps up the price of options. For sellers, that’s great news. It means you collect bigger premiums for taking on the same amount of risk.

A classic setup is to sell calls right after a stock has had a big run-up. This lets you hit two birds with one stone:

- Higher Premiums: Volatility tends to stay high after a big move, keeping option prices juicy.

- Likely Consolidation: Stocks can't go up forever. After a rally, they often pause or pull back, creating the perfect environment for a short call to profit as time ticks away.

What Happens if My Short Call Option Is Assigned?

Assignment is just part of the game when you sell options, and you have to be ready for it. If your short call option gets assigned, you are now obligated to follow through on your end of the deal: selling 100 shares of the stock at the strike price.

What that actually means for your account depends on which type of short call you sold.

Assignment isn't a random event. It's the logical outcome for an in-the-money option. While it can technically happen anytime, it's most common at expiration when the stock is trading above your strike.

The whole process is handled by your broker automatically, but the results are very different:

- For a Covered Call: If you sold a covered call, the 100 shares you already own are simply sold at the strike price. Your position is closed, and you get the cash. Simple as that.

- For a Naked Call: This is where things get dangerous. With a naked call, you don't own the shares. Your broker will force you to buy 100 shares at the current market price—which is now higher—so you can turn around and sell them to the option buyer at the lower strike price. This locks in your loss.

How Do I Choose the Right Strike Price for a Short Call?

Picking the right strike price is the most strategic part of selling a call. It's a constant tug-of-war between how much premium you want to collect and how much risk you're willing to take. Your choice is a direct bet on your probability of success.

Think of it like setting a high-jump bar for the stock. A lower bar is easier for the stock to clear (getting you assigned) but pays you more for the risk. A higher bar is much safer, but the payout is smaller.

A smart, data-driven way to make this decision is by looking at the option's delta. Delta is one of the "Greeks," and it gives you a rough estimate of the probability that an option will finish in-the-money.

For example, a call with a 0.25 delta has roughly a 25% chance of being assigned. This also means you have a 75% chance that the option will expire worthless, letting you pocket the entire premium. It's a much better approach than just guessing.

Can I Lose More Than the Premium I Collected?

Yes. Absolutely. And this is the most important risk to understand. The answer, however, depends entirely on which short call strategy you're using. Their risk profiles aren't even in the same ballpark.

For a naked short call, your potential loss is theoretically unlimited. That’s not a scare tactic. Since there’s no limit to how high a stock’s price can go, there’s no limit to how much you can lose. As the stock climbs past your break-even point (strike price + premium), your losses mount dollar for dollar.

Fortunately, other strategies are designed to avoid this kind of disaster.

- Covered Calls: Your risk here isn't a cash loss but an opportunity cost. If the stock blasts off way past your strike, you just miss out on those extra gains because you're forced to sell your shares at the lower strike price.

- Short Call Spreads: This strategy has a defined and capped maximum loss. By buying another call further out as protection, you put a ceiling on your potential risk. You know the most you can possibly lose before you even place the trade.

Understanding these differences is non-negotiable. A naked call might offer the biggest premium, but it comes with a risk that can wipe you out. For most traders, risk-defined strategies like covered calls and spreads are a much smarter way to build consistent income.

Ready to stop guessing and start making data-driven decisions with your options trades? Strike Price gives you the real-time probability metrics you need to select the perfect strike, monitor your positions with smart alerts, and build a consistent income stream from selling options. Turn your market insights into strategic action today. Learn more at https://strikeprice.app.