A Guide to Shorting Put Options for Income

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

When you "short" a put option, you're really just selling it. Think of it as collecting an immediate cash payment—the premium—in exchange for making a promise. That promise is to buy a stock at a specific price (the strike price) if it happens to drop below that level by a certain date.

It’s a go-to strategy for traders who are generally neutral to bullish on a stock. You don't need the stock to shoot to the moon; you just need it to not crash.

What Does Shorting a Put Option Actually Mean?

Selling a put is a lot like selling insurance on a stock you already like. The person buying the put from you is hedging their bets, paying you for protection in case the price falls. For that premium you pocket, you take on an obligation: to buy 100 shares of the stock at the strike price if it closes below that price when the contract expires.

This is the complete opposite of buying options, where you're betting on a big, dramatic price move. As the put seller, your best-case scenario is for the stock to stay put or, even better, climb higher. If that happens, the option expires worthless, and you just keep the cash. Simple as that.

The Two Core Motivations for Selling Puts

Most traders selling puts have one of two goals in mind. Figuring out which one is yours is the key to using this strategy the right way.

Generating Consistent Income: This is the most common reason. The goal is to collect the premium and have the option expire worthless. You keep the cash, no strings attached. Many traders do this month after month, creating a steady, predictable income stream from their portfolio. It’s like creating your own dividend.

Acquiring Stock at a Discount: This is the more strategic play. Let's say you've had your eye on a great company, but you think its current price is a little steep. You can sell a put with a lower strike price—the price you'd actually be happy to pay. If the stock drops and you get assigned, you end up buying the shares at your target price, and the premium you collected acts as an extra discount.

To help break it down, here’s a quick reference table for the key components you'll be working with when selling a put.

Breaking Down a Short Put Trade

| Component | What It Represents | Key Consideration for Sellers |

|---|---|---|

| Premium | The cash you receive upfront for selling the put. | This is your maximum potential profit on the trade. |

| Strike Price | The price at which you agree to buy the stock. | Choose a price you'd genuinely be comfortable owning the stock at. |

| Expiration Date | The date the option contract ends. | Shorter expirations have faster time decay, but longer ones often offer higher premiums. |

| Obligation | Your commitment to buy 100 shares per contract if assigned. | You must have the cash or margin available to fulfill this promise. |

Understanding these pieces is crucial because, unlike buying options, selling them comes with a defined obligation.

A great analogy is telling a home builder you'll buy a specific house for $500,000 if the market drops and its value falls below that in the next 60 days. The builder pays you a fee today for that guarantee. If the house's value stays high, you just pocket the fee. If it drops, you get the house you wanted at the price you were willing to pay.

This dual purpose makes selling puts an incredibly flexible tool. It’s not about wild speculation. It's a calculated move based on a solid opinion of a stock, with a clear understanding of the commitment you're making.

Your profit is always capped at the premium you received upfront. The risk, however, can be substantial if the stock plummets. That’s why picking the right stock and managing your risk are non-negotiable parts of any put-selling strategy, which we'll dive into next.

Getting Your Brokerage Account Set Up Right

Before you can even think about placing your first trade, you’ve got to get the boring (but critical) stuff out of the way. Shorting put options isn't like buying a few shares of stock. You can't just open a basic account and jump in.

Brokers need to know you understand the game. This means you have to apply for specific options trading privileges. It's their way of making sure you've thought through the risks and have the financial footing to handle the obligations that come with selling options.

Securing the Right Options Trading Level

To sell puts, you’ll generally need at least Level 2 or Level 3 approval from your broker. The exact level often depends on how you plan to sell them—using cash you already have or borrowing on margin.

- Cash-Secured Puts: This is where nearly everyone should start. It means you have enough cash in your account to buy the shares if you're assigned. It's straightforward and carries a much lower risk profile, so the approval level is typically lower.

- Naked Puts (Margin): This is the advanced version. You're selling puts without the full cash set aside, using your account's margin as collateral instead. It's far riskier, and brokers will require their highest options trading levels and a full margin account.

When you apply, you'll get a questionnaire about your trading experience, income, and investment goals. Be honest. They're just trying to confirm you grasp what you're getting into. A good options trading platform will guide you through this, but the responsibility is ultimately yours.

Understanding Your Collateral Obligation

Whether you’re using cash or margin, your broker is going to set aside collateral. Think of it as a security deposit. It’s the money held in your account to guarantee you can make good on your promise to buy the shares if the trade moves against you.

For a cash-secured put, the math is simple but absolutely essential to understand. The collateral is the total cost to buy 100 shares at the strike price, minus the premium you pocketed for selling the put.

Collateral Calculation:

(Strike Price × 100) - Premium Received = Cash You Must Set Aside

Let's walk through a quick example. Say you sell one put option on XYZ stock with a strike price of $50, and you collect a $200 premium for it.

- Your potential obligation is $5,000 (to buy 100 shares at $50 each).

- Your broker will instantly "secure" $4,800 in your account ($5,000 obligation - $200 premium).

That $4,800 is now locked up. You can't use it for anything else until you either close the position or it expires worthless. This is the mechanism that ensures the money is there if XYZ drops below $50 and you're assigned the shares. Getting a handle on this capital requirement is the key to managing your risk and sizing your positions correctly.

Choosing the Right Stock, Strike, and Expiration

Okay, with your account funded and ready to go, the real work begins. Selling puts isn't about throwing darts at a board; it's a calculated strategy. Success comes from a repeatable process of picking the right company, the right strike price, and the right expiration date.

The first, and in my book, non-negotiable rule is this: only sell puts on high-quality, liquid stocks you would be genuinely happy to own for the long term. Why? Because if you get assigned, you become a shareholder. This simple filter is your first line of defense—it immediately weeds out speculative junk and keeps your strategy grounded in solid companies.

Finding Your Edge with Probability Metrics

Once you have a stock you like, it's time to dig into the data. We're not trading on gut feelings here. Instead, we use specific options metrics—the "Greeks"—to give us a statistical edge and help us understand the risk we're taking on.

For put sellers, two metrics are absolutely essential:

- Delta: Think of this as a quick way to gauge the probability of the stock price ending up below your strike at expiration. A Delta of 0.20 roughly translates to an 80% chance the option will expire worthless. Most conservative sellers I know aim for a Delta below 0.30 to keep the odds firmly in their favor.

- Theta (Time Decay): As an option seller, Theta is your best friend. It's the silent engine of this strategy. Theta measures how much value an option loses each day just because time is passing. The closer you get to expiration, the faster that value melts away—which is exactly what you want.

Before you even glance at an options chain, it helps to look at a chart. Using solid trading analysis platforms to spot key support and resistance levels gives you a huge advantage and a visual anchor for your trade.

A Practical Selection Workflow

Let's walk through a typical thought process for spotting a promising short put trade. You can apply this framework to pretty much any stock on your watchlist.

First, pull up a chart of the stock you're considering. Find a clear support level—a price where the stock has historically bounced and found buyers. This isn't just a random line; it’s your technical justification for believing the stock is unlikely to fall below that point.

Next, open the options chain and look at contracts expiring in about 30 to 45 days. This is often called the "sweet spot" for a reason. It offers enough premium to make the trade worthwhile, but you still get to benefit from that accelerating time decay.

Now, scan the put options for that expiration date. You're looking for a strike price that is below the support level you just identified on the chart and has a Delta of 0.30 or less. This powerful combination gives you a technical buffer zone and a high statistical probability of success. For a deeper dive on this, check out our guide on how to choose an option strike price.

Key Takeaway: The goal is to align your technical analysis (those support levels) with your probability analysis (Delta). When you find a strike price that ticks both boxes, you've likely found a high-quality trade setup.

The Tradeoff Between Premium and Probability

With every single trade, you're going to face an unavoidable tradeoff.

The further out-of-the-money you sell a put (meaning, a lower strike price), the higher your probability of winning becomes, but the less premium you'll collect. On the flip side, selling a put closer to the current stock price will net you a much fatter premium, but it comes with a significantly lower chance of success.

Your personal risk tolerance is what guides this decision.

- A conservative trader might aim for a 90% probability of profit (a tiny Delta of 0.10), happy to accept a smaller premium in exchange for greater safety.

- An aggressive trader might be perfectly comfortable with a 70% probability of profit (a Delta of 0.30) in order to capture a more substantial income.

This is where having access to data makes all the difference. Historical options data, systematically tracked since 1996, shows the sheer scale of this market. By 2018, the daily volume for Cboe S&P 500 options alone averaged around 720,000 contracts. Modern traders can now evaluate these risk-reward scenarios with a level of precision that was once impossible, all thanks to the rigorous tracking of metrics like implied volatility and the Greeks.

Ultimately, there is no single "best" strike or expiration. The right choice is the one that lines up with your market outlook, your income goals, and most importantly, your own comfort level with the risk involved.

How to Manage Your Trade and Control Risk

Placing the trade is just the beginning. The real skill in selling puts isn't the entry—it's how you manage the position from that moment on. This is what separates traders who generate consistent income from those who just ride the market's unpredictable swings.

Your main job now is to be a risk manager. First rule: smart position sizing. Never, ever over-leverage your account on a single idea. A good rule of thumb is to keep any single cash-secured put from taking up more than 5% of your portfolio's value. This ensures one bad trade won’t sink your whole strategy.

The Three Possible Trade Outcomes

Once you’ve sold a put, your trade can only end in one of three ways. Knowing these outcomes ahead of time is critical. It prepares you to act decisively instead of reacting emotionally when the market moves.

- Expire Worthless: This is the best-case scenario. The stock price stays above your strike price, the option expires worthless, and you keep 100% of the premium you collected. Nothing else to do.

- Close Early for a Profit: You don't always have to wait until expiration. If the option’s value drops quickly—say, you've captured 50% of the premium in just a week—you can buy it back to close the position and lock in that profit. This frees up your cash for the next opportunity.

- Assignment: If the stock price falls below your strike at expiration, you'll be "assigned." This means you're obligated to buy 100 shares of the stock at that strike price. This is exactly why you should only sell puts on companies you truly wouldn't mind owning.

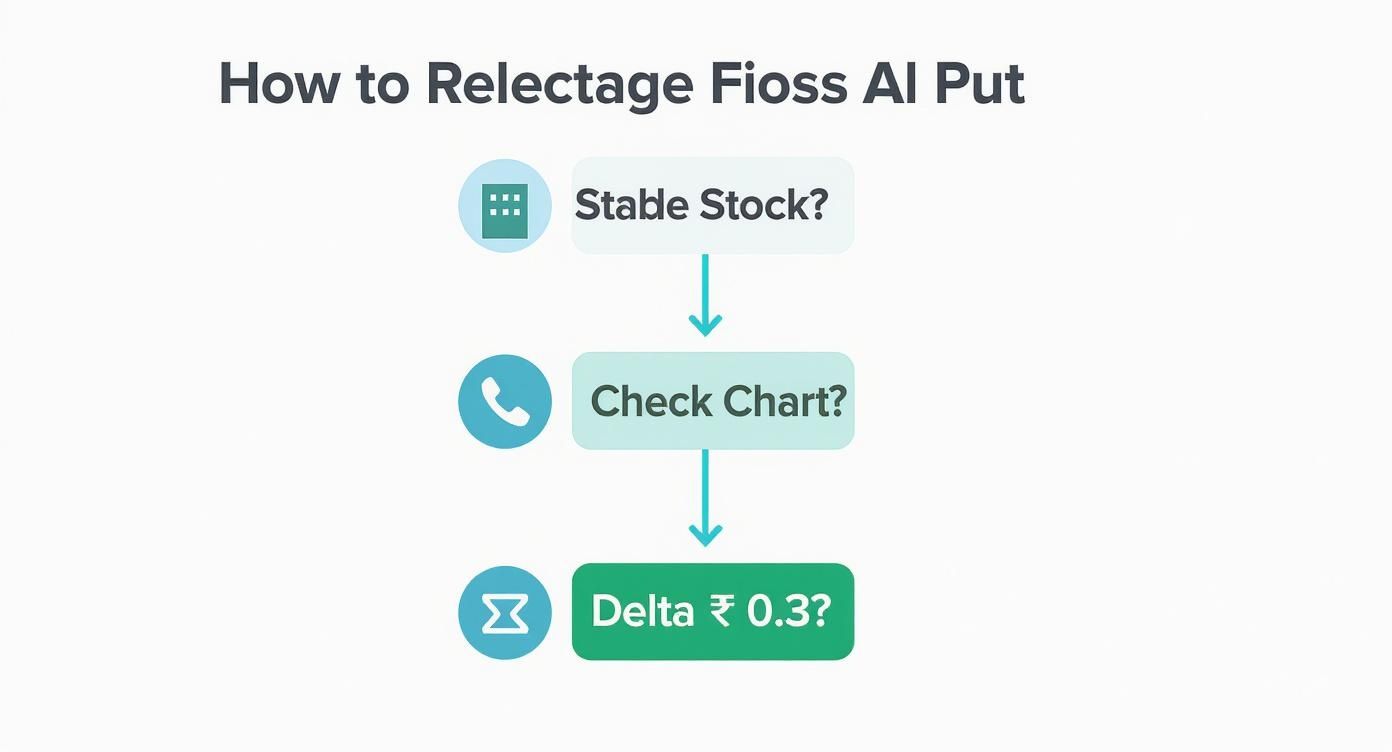

This simple flowchart lays out a high-level process for spotting a potential short put trade.

It reinforces the core idea: combine fundamental company quality with a solid check of the chart and probabilities to filter for better setups.

Managing a Trade That Moves Against You

So, what happens when the stock drops and starts getting uncomfortably close to your strike price? Panicking isn't a strategy. The most powerful tool in a put seller’s kit is the roll.

Rolling a position means you buy back your current short put and sell a new one, all in one transaction. The new one will have a later expiration date, and you'll often "roll down" to a lower strike price, too. The goal is to collect a net credit from this transaction, which gives your trade more time to work out and lowers your breakeven point.

Here’s an example of a roll:

You sold a $50 strike put for a $1.00 credit that expires in 15 days. The stock dips to $51, and your position is now showing a loss. You could roll it by:

- Buying to Close: Your current $50 put (let's say it now costs $2.50).

- Selling to Open: A new $48 strike put that expires in 45 days for a $3.00 credit.

In this case, you collect a net credit of $0.50 ($3.00 received - $2.50 paid). You’ve successfully pushed the trade further out, lowered your obligation price from $50 to $48, and even pocketed a little more cash.

The decision to roll or just take the assignment comes down to your conviction in the stock. If you're still bullish on the company, rolling is often a smart defensive move.

When to Close a Losing Trade

Not every trade can be saved. Sometimes, the best move is simply to cut your losses and live to trade another day. The data is very clear on this.

One study looked at over 41,600 short put trades and found something interesting. During periods of high market volatility (when the VIX is high), traders who closed their losing positions early did better than those who stubbornly held on. In choppy markets, price swings get bigger, and waiting can just dig a deeper hole.

A pre-defined exit plan is crucial. A common rule of thumb is to consider closing the position if the loss hits 2x or 3x the original premium you collected. This prevents a small, manageable loss from snowballing into a catastrophic one. For more ideas on building a solid exit plan, our guide on the best practices for risk management offers an excellent framework.

Ultimately, good trade management is proactive, not reactive. It's about knowing your options—pun intended—before you're in a tough spot and executing your plan with discipline. That's how you protect your capital and build long-term success with this strategy.

Real-World Examples: When Selling Puts Goes Right (and Wrong)

Theory is great, but seeing how these trades play out in the wild is where the real learning happens. Let's walk through two different scenarios. First, we'll look at a trade that goes exactly as planned. Then, we'll dive into a trickier situation that forces us to make some decisions.

The Winning Trade: A Smooth Ride to 100% Profit

Let's say a well-known tech giant, which we'll call "Innovate Corp" (INVC), is trading at $185 a share. The company just had a strong earnings report, but the stock has pulled back a bit and is now hovering near a solid support level around $180. Your homework suggests the company is fundamentally sound, and you don't see it breaking below that $180 floor anytime soon.

This looks like a perfect spot to sell a cash-secured put and generate some income.

You open up the options chain for INVC and zero in on contracts expiring in 40 days. That feels like a good sweet spot—enough premium to make it worthwhile, with plenty of time for theta decay to do its thing.

You land on the $175 strike put. It has a Delta of 0.22, which tells you there's roughly a 78% chance it will expire worthless. Even better, that strike price sits comfortably below the $180 support level, giving you an extra cushion. For selling this put, you collect a $2.50 premium per share, which comes out to $250 for the contract.

Once you place the trade, your brokerage account instantly sets aside $17,250 in collateral (($175 strike x 100 shares) - $250 premium). Now, you wait.

Over the next few weeks, INVC behaves just like you hoped. The stock bounces cleanly off the $180 support and starts grinding its way up toward $190. With each passing day, the value of the put you sold melts away thanks to time decay. The option's value drops from $250 to $150, then to $50, and finally, it's worth just a few bucks.

On expiration day, INVC closes at $192. Since the stock is way above your $175 strike, the put option expires completely worthless.

The Result: The full $250 premium is yours to keep, pure profit. Your collateral is freed up, and you're ready to hunt for the next trade. This is the textbook definition of a perfect short put.

The Challenging Trade: Navigating a Downturn

Now for a more realistic scenario where things get a little messy.

Imagine a solid industrial company, "Global Motors" (GM), is trading at $52 per share. You think the company is a bit undervalued and you'd actually be happy to own it down around the $48 mark.

You decide to sell a GM put option with a $50 strike, expiring in 35 days. You collect a premium of $1.80 ($180 per contract). The stock seems stable, and everything looks good. But a week later, some unexpected bad news hits the auto industry, and GM stock starts to slide.

The share price drops to $50.50, putting your short put right "at-the-money" and showing a paper loss. This is no time to panic. It’s time for active management. You still like the company long-term, but you’d rather not get assigned shares at $50 if the stock keeps falling.

You decide to "roll" the position. This is a single trade that accomplishes two things at once:

- Buy to Close: First, you buy back the $50 strike put you originally sold. Since the stock fell, the option's price has gone up to $2.90 ($290).

- Sell to Open: At the same time, you sell a new put. You push the strike price down to $48 and the expiration date out to 60 days from now. This new put brings in a fresh premium of $3.50 ($350).

So, what just happened? You paid $290 to get out of your old trade but collected $350 to enter the new one. The net result is an additional credit of $60.

By rolling the trade, you’ve successfully:

- Lowered your risk: Your new obligation is to buy GM at $48, not $50.

- Bought more time: You now have 60 days for the stock to turn around.

- Increased your profit potential: You've added another $60 to the initial $180, bringing your total potential profit to $240.

This simple adjustment gives your trade breathing room. If GM recovers, you can still book a nice profit. And if it keeps falling and you get assigned at $48, you’ll be buying the shares at an even better price than you originally wanted—and your cost basis will be even lower thanks to the extra premium you collected.

Common Questions About Selling Puts

Even with the best game plan, a few questions always pop up when you're digging into a new strategy. Let's run through some of the most common ones traders ask when they first start selling puts. Getting these cleared up from the start builds confidence and helps you trade smarter right out of the gate.

A lot of traders start with the big one: What's the absolute worst-case scenario? It’s a great question because it cuts right to the heart of risk management.

What Is the Maximum Loss on a Short Put?

If the stock you sold a put on goes all the way to zero, your maximum loss is pretty substantial. The math is simple: it’s the strike price times 100 shares, minus the premium you pocketed upfront.

Let's say you sell a put with a $50 strike price and collect a $2 premium (that's $200 in your account). Your maximum loss would be:

($50 Strike Price × 100 Shares) - $200 Premium = $4,800

This is exactly why the golden rule is to only sell puts on stocks you genuinely want to own at that strike price. Your willingness to become a shareholder is the entire strategy's safety net.

Can You Short Puts in a Retirement Account?

Yes, you can, but there's a catch. In an IRA, this is almost always done as a cash-secured put. This just means your broker requires you to have enough cash on hand to buy the 100 shares if you get assigned.

You can't sell "naked" puts that use margin in a standard retirement account. It's always a good idea to check your specific broker's rules, since they're the ones who set the options trading levels and permissions for IRAs.

How Does Market Volatility Affect Short Puts?

High volatility is the classic double-edged sword for put sellers. You have to understand both sides of it to make it work for you.

On one hand, higher volatility pumps up option premiums. This is the good part. It means you get paid more for taking on the same risk, which can seriously boost your income.

On the other hand, volatility means bigger, more unpredictable price swings. This raises the odds that the stock could take a nosedive below your strike price, leading to assignment.

Many experienced traders actually go hunting for opportunities to sell puts when volatility is high, specifically to collect those juicy premiums. But it’s not a free lunch. This approach demands strict position sizing and a rock-solid risk management plan.

Historically, though, this has been a winning approach. Put-writing strategies have shown impressive performance over the long haul. A massive 32-year study found that the Cboe PutWrite Index (PUT) delivered an annualized compound return of around 9.54%—with significantly less volatility than the S&P 500. You can dive into the full put-writing index performance study to see all the data for yourself.

Ready to stop guessing and start selling options with a statistical edge? Strike Price gives you the real-time probability data you need to make smarter, more confident decisions. Ditch the uncertainty and start generating consistent income with data-driven alerts and a platform built for sellers. Join thousands of traders at Strike Price today!