Synthetic Covered Call: A Clear Guide to the synthetic covered call

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Define Covered Calls A Guide to Generating Consistent Income

Define covered calls with this practical guide. Learn to generate consistent income from your stocks, manage risk, and apply proven strategies for success.

A Trader's Guide to the Iron Condor Options Strategy

Discover the iron condor options strategy. This guide explains how to generate consistent income from range-bound stocks with real-world examples and tactics.

What is short call: A Practical Guide to Generating Income

what is short call? A concise guide to this income strategy, risk management, and how covered calls generate income.

A synthetic covered call is an options strategy that lets you generate income just like a traditional covered call, but without the hefty price tag of buying 100 shares of stock first. It's a clever way to perfectly mimic the risk and reward of owning stock and selling calls against it, all while using a fraction of the capital.

What Is a Synthetic Covered Call

Imagine you want to collect rent on a house but don't want to tie up hundreds of thousands in a down payment. That’s the big idea behind a synthetic covered call. Instead of buying the "property" (100 shares of stock), you gain control over it using a much smaller investment in options, which then allows you to "collect rent" by selling calls.

This strategy is built entirely with options to replicate the exact payoff of its traditional cousin. If you're new to the original strategy, you can get up to speed with our full definition of a covered call. The synthetic version is a favorite among savvy traders for a few key reasons:

- Capital Efficiency: It demands just a fraction of the capital needed to buy 100 shares, freeing up your cash for other opportunities.

- Identical Risk/Reward: It has the exact same profit and loss potential as owning the stock and selling a call.

- Massive Return on Capital (ROC): Because your initial investment is so much smaller, the percentage return on your deployed capital can be dramatically higher.

A Smarter Way to Generate Income

The core benefit is unmistakable: you get similar income potential with a whole lot less buying power tied up. Studies have shown that both the standard covered call and its synthetic twin have nearly identical success rates and profit outcomes over time. The real game-changer is the capital at risk.

For example, instead of shelling out $10,000 for 100 shares of a $100 stock, you might only need $2,000–$3,000 for the synthetic options position. This efficiency can easily boost your return on capital by 2-3x compared to the old-school method.

By mimicking stock ownership with options, the synthetic covered call provides a powerful tool for traders to generate consistent income, diversify their portfolio, and make their capital work much harder.

How to Build the Synthetic Covered Call Position

Building a synthetic covered call is a simple, two-step process. Think of it less like a complex Wall Street maneuver and more like assembling a piece of furniture. First, you build the base, then you add the functional top.

Here, the "base" is a clever options structure that perfectly mimics owning 100 shares of stock, but for a fraction of the capital. The "top" is the income-generating piece that pays you for your trouble. Let's walk through how to put it all together.

Step 1: Create the Synthetic Stock Foundation

The first and most important step is to replicate owning the stock itself. Instead of shelling out thousands for 100 shares, we're going to use two options contracts to create a position that behaves almost identically.

Buy a Long-Term, Deep In-the-Money (ITM) Call: This is your stock replacement. You want to pick an option with a distant expiration date—think LEAPS (Long-Term Equity Anticipation Security) that expire in six months to a year or more. The key is to choose a strike with a delta of .80 or higher. This ensures your option's price moves nearly dollar-for-dollar with the actual stock.

Sell a Put with the Same Strike and Expiration: Now for the magic. To complete your synthetic stock position, you sell a put option with the exact same strike price and expiration date as the call you just bought. The premium you collect from selling this put dramatically slashes the net cost of your long call, making the whole thing incredibly capital-efficient. If you want a deeper look at this side of the trade, our guide on shorting a put option has you covered.

That's it. This combo—a long ITM call and a short put with matching strikes and expirations—creates a position that mirrors the profit and loss profile of owning 100 shares of the stock.

Step 2: Add the Income-Generating Layer

Now that your synthetic stock foundation is in place, it's time to get paid. This is where the "covered call" part of the strategy clicks into place, and it couldn't be simpler.

All you have to do is sell a short-term, out-of-the-money (OTM) call against your synthetic stock position.

Think of this short call as your "rent check." By selling it, you collect an immediate premium, which is the whole point of the strategy. The goal is to do this over and over—every week or month—to generate a steady stream of income from your position.

Typically, you’ll sell calls with expirations 30 to 45 days out. This hits the sweet spot where time decay (theta) really starts to accelerate, working in your favor as a seller. The strike you pick comes down to your own risk tolerance and how you feel about the market, but you’re always balancing the premium you collect against the probability of the stock staying below that price.

Once you’ve sold that short call, your synthetic covered call is officially open for business.

Mapping Your Profit and Loss Scenarios

To really get a feel for the synthetic covered call, we need to look past the theory and map out what happens to your bottom line in the real world. Just like a traditional covered call, this strategy has a clear risk/reward profile that shines brightest when the market is flat or inching its way up. When your options expire, you’re basically looking at one of three outcomes.

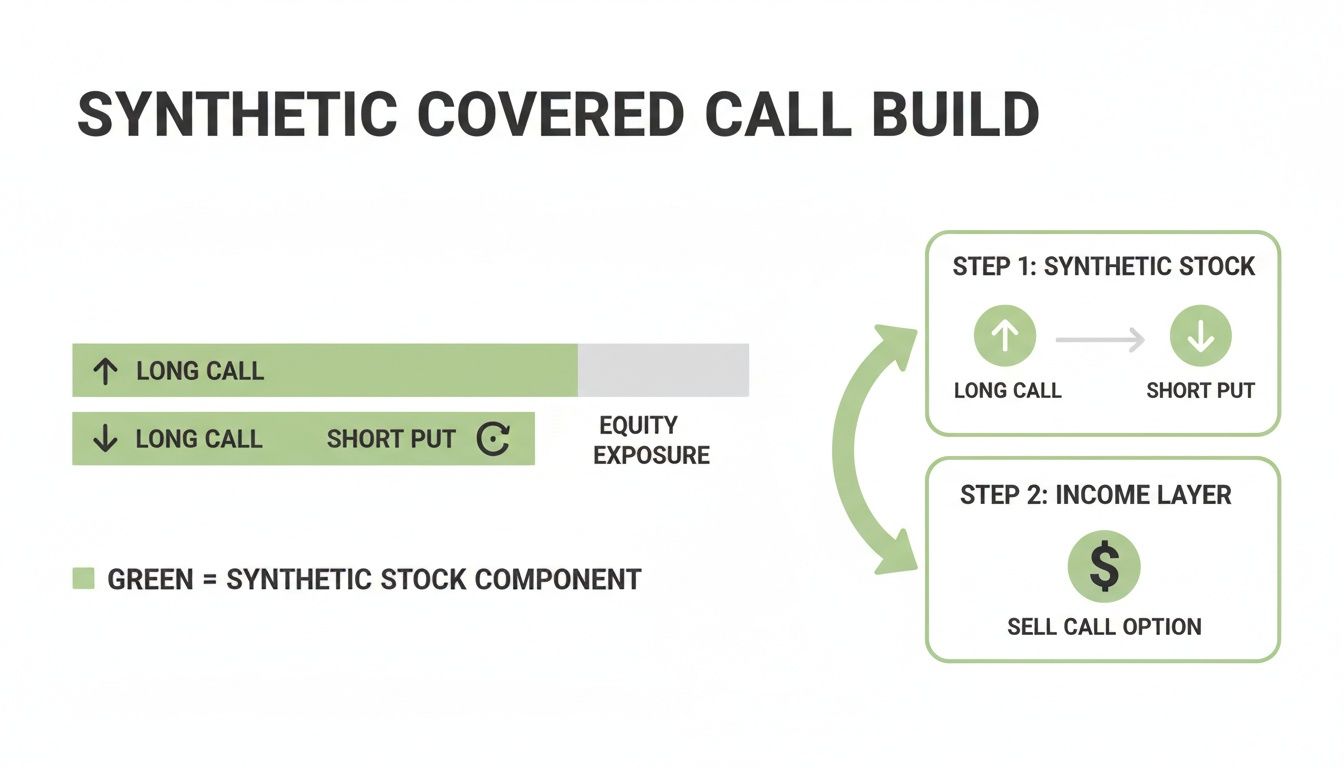

The whole trade is built in two parts: first, you create a synthetic stock position, and then you layer a stream of income on top of it. This visual shows how those pieces fit together.

As you can see, the synthetic stock (a long call and a short put) forms the foundation. From there, you sell a short call against it to start generating that recurring income.

Maximum Profit Scenario

You'll hit your maximum profit if the underlying stock closes at or above the strike price of your short call when it expires. When this happens, you’ve reached the profit ceiling for this particular trade. Think of it as a successful income cycle.

The formula for this is pretty simple: it’s the premium you collected from selling the short call, plus the difference between that short call’s strike and the breakeven price of your synthetic stock. Because your gains are capped, this isn't the strategy for catching a massive rally. It's built for steadily collecting income. Our guide on how to calculate call option profit breaks down these mechanics in more detail.

Breakeven Point

Your breakeven point is the exact stock price where you don't make or lose a dime. For a synthetic covered call, you find this by taking the strike price of your synthetic stock legs (the long call and short put) and subtracting the net credit you received for opening the entire three-legged position.

If the stock lands precisely on this number at expiration, your P/L is zero. Knowing this level is absolutely critical for managing your risk.

Maximum Loss Scenario

While the profit is capped, the potential for loss is substantial—just like owning the stock outright. Your maximum loss happens if the stock price goes to zero. In that worst-case scenario, your loss would be the initial cost to set up your synthetic stock position, minus the premium you collected from the short call.

That said, the strategy's design has a historically proven edge. For example, the CBOE S&P 500 30-Delta BuyWrite Index (BXMD), which is basically a covered call strategy, actually outperformed the S&P 500 by 0.43% annually over a 32-year period. This long-term data shows how the premium you collect adds yield and provides a cushion against volatility—a benefit that gets a serious boost from the capital efficiency of a synthetic covered call.

The Strategic Advantages of Going Synthetic

The benefits of a synthetic covered call go way beyond just sidestepping the initial stock purchase. This strategy packs a suite of tactical advantages that help traders become more efficient, flexible, and strategic with their money. By swapping out stock for options, you’re essentially unlocking a modern approach to generating income.

The most famous advantage is a massively improved Return on Capital (ROC). Picture this: a traditional covered call and a synthetic one both net you a $200 profit. The old-school trade might tie up $10,000 in stock (a 2% return), while the synthetic version might only require $2,500 of your capital (an 8% return). You make the exact same dollar profit, but your percentage return gets a serious boost.

This capital efficiency is really the heart of the strategy. It lets you hit your income targets with a much smaller investment, freeing up cash to diversify or jump on other opportunities.

Superior Flexibility and Adjustability

Let's face it, managing a position built entirely from options is far more nimble than wrestling with 100 shares of stock. When the market turns against you or you just have a change of heart, adjusting an options-only position is a piece of cake.

You can easily roll the short call to a different strike or a later expiration to pull in more premium or simply give the trade more time to breathe. This kind of flexibility allows for dynamic risk management without the friction—and higher transaction costs—of buying or selling big blocks of shares. It's a perfect setup for active traders who love to fine-tune their positions as the market evolves.

Reduced Assignment and Tax Considerations

Another slick benefit comes from using long-term options, like LEAPS, for your synthetic stock leg. These options are almost never exercised early by the person on the other side of the trade. Why? Because doing so would mean they’d have to forfeit all the remaining time value, which can be pretty substantial. This gives you a stable foundation to sell your short-term calls against.

On top of that, trading options can open the door to potential tax efficiencies. Depending on where you live and your holding periods, gains from options might get a different tax treatment than short-term gains from stock. While it's probably not the main reason to pick the strategy, it's a nice perk for savvy investors looking to optimize their whole financial picture. Each of these advantages shows exactly why the synthetic covered call has become a go-to for modern income investors.

Understanding and Managing the Inherent Risks

Every options strategy has its own flavor of risk, and the synthetic covered call is no different. It's fantastic for capital efficiency, but ignoring the potential downsides is a recipe for disaster. Smart risk management isn't about dodging losses forever—that's impossible. It's about having a plan so you can trade with your head, not over it.

The main risk is pretty straightforward: a nosedive in the stock's price. Because you've built a position that acts just like owning 100 shares, its value will drop almost dollar-for-dollar if the underlying stock tanks. That premium you collected from the short call helps a bit, but it’s a small life raft, not a submarine, in a major downturn.

Key Risks to Keep on Your Radar

Beyond the stock simply falling, a couple of other forces are always at play. Keeping an eye on them can be the difference between a smooth trade and a messy one.

- Theta Decay on Your Long Call: Time isn't always on your side here. While theta (time decay) is great for your short call, it's constantly nibbling away at the value of your long call. This is especially true if it isn't a long-dated LEAPS option. This slow bleed can become a real drag if the stock just sits there, going nowhere.

- Early Assignment on Your Short Call: This is a classic worry for anyone selling options. If your short call gets deep in-the-money, particularly with a dividend date coming up, the buyer might exercise their right to grab the shares from you early. It's manageable, but it instantly flips you into a short stock position that you'll have to deal with.

The point isn't to be afraid of these risks, but to be prepared for them. The moment you accept that your synthetic position acts like stock, you're on the right track to managing it through whatever the market throws at you.

Getting Ahead of the Game

The best defense is a good offense. Instead of waiting for trouble to find you, you can use a few tried-and-true techniques to manage your synthetic covered call from day one.

One of the most powerful moves in your playbook is rolling your position. If the stock moves against you or your market view changes, you can "roll" the short call. This just means buying back the call you sold and selling a new one—maybe at a different strike price or a later date—usually collecting another credit in the process.

Setting your exit points before you enter the trade is non-negotiable. Know your max pain point (your stop-loss) and your profit target. This takes the emotion out of the equation and stops a small, manageable loss from spiraling into a big one. Using your platform’s tools to set alerts on your trade can make sticking to your rules almost automatic.

A Practical Checklist for Staying Safe

To make risk management even more concrete, here's a checklist to run through. Think of it as your pre-flight inspection before and during a trade.

| Risk Factor | Management Action | Tool/Metric to Use |

|---|---|---|

| Sharp Price Drop | Set a pre-defined stop-loss based on the underlying stock price or a percentage of the total position value. | Brokerage alerts, support/resistance levels on a chart, max loss calculation. |

| Theta Decay on Long Call | Use a longer-dated LEAPS option for the long call leg to slow down time decay. Regularly review the trade's P/L. | Option's theta value, P/L tracking in your brokerage platform. |

| Early Assignment Risk | Avoid selling short calls right before an ex-dividend date, especially if they are deep in-the-money. | Dividend calendar, probability of assignment tools (like those in Strike Price). |

| Emotional Decisions | Define your profit target and maximum loss before entering the trade and stick to the plan. | Trading plan, journaling, automated alerts to enforce exit points. |

| Stagnant Stock Price | If the stock isn't moving, consider rolling the short call down or out to collect more premium to offset the long call's decay. | Chart analysis for price trends, option chain to find new rolling opportunities. |

Thinking through these steps doesn't guarantee every trade will be a winner, but it dramatically improves your odds of staying in the game long-term by protecting your capital from preventable mistakes.

Finding and Managing Trades with Data

Theory is one thing, but making real money from options is all about execution. When you move from understanding a synthetic covered call to actually trading one, data becomes your best friend. The right tools can turn a seemingly complex strategy into a reliable, repeatable income engine by helping you pinpoint the best opportunities and manage them with confidence.

It all starts with picking the right short call strike. This is a delicate balance—you want to collect a nice premium, but you also want a high probability of keeping it. This is where smart, data-driven decision making comes into play. Instead of just guessing, you can use real-time probability metrics to stack the odds in your favor.

Selecting Strikes with Probability Metrics

Modern trading tools analyze mountains of market data to give you a simple percentage: the probability of a stock finishing above or below a certain price by expiration. For a synthetic covered call, a common goal is to sell a call with a 70-85% chance of expiring worthless. That statistical edge is how you consistently find trades that fit a conservative income plan.

Shifting your focus from just the premium amount to the probability of profit (POP) is a game-changer. It moves you from being a speculator to an operator running a calculated income business. This data-first mindset is the bedrock of long-term consistency.

This screenshot from Strike Price shows you exactly how these probabilities are baked right into the option chain.

You can see the likelihood of each strike finishing in-the-money at a glance, letting you make quick, informed decisions without getting lost in the weeds.

Proactive Management with Smart Alerts

Once your trade is live, data is still your co-pilot. Smart alerts can watch your positions for you, sending you a notification if the probability of assignment on your short call starts to creep up. Think of it as an early warning system. It gives you a heads-up to roll your position or close it out before it becomes a problem, keeping you firmly in the driver's seat.

Better yet, planning tools can help you work backward from your income goals. You can punch in your desired weekly or monthly return, and these systems will scan the market for synthetic covered call opportunities that meet your specific targets and risk profile. This transforms your trading from a series of one-off bets into a structured, goal-oriented process for building wealth.

Common Questions About This Strategy

Diving into a new options strategy always brings up a few questions. Let's tackle some of the most common ones about the synthetic covered call so you can trade with more confidence.

What Happens If My Short Call Is Assigned Early?

If your short call gets assigned, you’ll suddenly find yourself short 100 shares of the stock. The first thing to remember is: don't panic. This is a normal part of selling options, and your position has a built-in solution.

That long, deep in-the-money call option you own is your escape hatch. To get rid of the short stock position, you simply exercise your long call. This lets you buy 100 shares at its strike price, which instantly cancels out the short shares you owe. Of course, proactive management, like rolling your short call forward before it expires, can help you avoid assignment altogether.

Is This Strategy Better Than a Regular Covered Call?

That really depends on what you're trying to accomplish.

For pure capital efficiency and maximizing your Return on Capital (ROC), the synthetic covered call is almost always the winner. It gives you the exact same income potential but ties up significantly less of your money, freeing up that capital for other trades.

However, a traditional covered call is simpler to understand for beginners. Plus, you get to collect any stock dividends, which the synthetic version misses out on. If simplicity and dividend checks are more important to you than ROC, the classic covered call might be a better fit.

What Are the Best Stocks for This Strategy?

This strategy is all about stability. You want to look for blue-chip stocks or highly liquid ETFs that you’re neutral to slightly bullish on. High volatility is your enemy here—a sudden, sharp drop in price can lead to major losses, just as if you owned the stock outright.

The ideal stocks should also have:

- High options volume to make sure you can get in and out of your trades without a headache.

- Tight bid-ask spreads to keep your transaction costs and slippage to a minimum.

The goal is to find stocks that are either flat or slowly trending upward. That’s the sweet spot where you can repeatedly sell calls and collect premium without the underlying price moving dramatically against you.

By focusing on high-quality, liquid underlyings, you create a more stable foundation for generating consistent income and reduce the risk of being caught in an illiquid market. For those new to investment strategies, exploring general investor resources can provide foundational knowledge and context for wealth management.

Why Use LEAPS for the Long Call?

Using a LEAPS (Long-Term Equity Anticipation Securities) option for your long call leg is a savvy move to sidestep time decay. With expirations more than a year out, LEAPS are far less affected by the daily theta erosion that chews away at the value of short-term options.

A deep in-the-money LEAPS call with a high delta (think .80 or higher) behaves almost exactly like owning 100 shares of the stock, but at a fraction of the cost. This setup gives you a stable, long-term asset that you can sell dozens of weekly or monthly short calls against, effectively turning it into a consistent income-generating machine.

At Strike Price, we turn complex data into clear, actionable insights for your synthetic covered call trades. Our platform provides real-time probability metrics to help you select the safest strikes, smart alerts to warn you of rising assignment risk, and planning tools to help you meet your income goals. Stop guessing and start trading with a statistical edge. Learn more about how Strike Price can help you generate consistent income.