A Trader's Guide to Time Decay in Options

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

Time decay, or Theta, is the slow, predictable drain on an option's value as it gets closer to expiring. The best way to think about it is like a melting ice cube: even if everything else stays the same, it gets smaller just because time is passing.

The Unseen Force Behind Every Option Trade

This decay is the silent, constant force chipping away at an option's extrinsic value, day after day. It's not a random market move; it's a fundamental part of how options work. Every contract has a finite lifespan, and as that clock ticks down, a piece of its premium vanishes.

Understanding Theta is the key difference between letting this force work against you and using it to your advantage. For anyone buying options, time decay is a daily headwind. But for option sellers, it’s a reliable tailwind pushing your trade forward.

In this guide, we'll demystify Theta, breaking down:

- Why it exists and how it speeds up over time

- The key factors that influence its pace

- Practical strategies to make that 'melting ice cube' work for your portfolio

Decoding Theta and the Mechanics of Decay

So, how do we actually measure this decay? It’s tracked by one of the options Greeks, a metric called Theta.

You’ll always see Theta as a negative number. Think of it as the amount of cash, in dollars, an option's price is expected to lose every single day—assuming nothing else changes.

Every option's price is made of two parts: its real, tangible value if exercised (intrinsic value) and the extra bit you pay for time and potential price swings (extrinsic value). Theta only cares about one thing: eating away at that extrinsic value.

For instance, an at-the-money option on a $100 stock with 30 days left might have a theta of around -0.05. This means, all else being equal, it’s set to lose five cents of its value every day just because the clock is ticking.

The Accelerating Nature of Time Decay

Here’s the critical part: this decay isn't a slow, steady drip. It gets faster and faster as the expiration date gets closer.

Think of it like a car rolling down a hill. It starts slowly, gradually picking up speed before plummeting in the final days. This acceleration is where the biggest risks and opportunities for option sellers lie.

This non-linear erosion is a foundational concept in options trading. Getting a handle on how it speeds up is essential, and you can dive into more detailed examples in our complete guide to options time decay.

The Key Factors That Influence Time Decay

Time decay isn’t some fixed, predictable force; its intensity, measured by Theta, shifts based on a few critical factors: how much time is left on the clock, the option's moneyness, and the market's implied volatility.

Think of an option with months left until it expires like an ice cube in a freezer—it melts, but very slowly. As you get closer to expiration, especially in the last 30-45 days, it’s like taking that ice cube out and putting it on the counter. The melt accelerates dramatically.

How Time Until Expiration Matters

An option far from its expiration date has a gentle, almost flat Theta curve. The value erodes day by day, but it’s barely noticeable.

But once an option enters its final month, that curve steepens into a cliff. The value starts to plummet as the clock runs out, which is exactly what option sellers are counting on.

How Moneyness Shapes Theta

An option’s position relative to the stock price—its moneyness—is a huge driver of Theta.

At-the-money (ATM) options, where the strike price is very close to the current stock price, hold the most extrinsic value. This makes their Theta the most negative, meaning they lose value the fastest. They are the epicenter of time decay.

On the other hand, options that are deep in-the-money (ITM) or far out-of-the-money (OTM) have much lower Theta values. Their decay is far more gentle because most of their value (or lack thereof) is already locked in.

Here’s a simple breakdown of how an option's moneyness dictates its sensitivity to time decay.

How Moneyness Affects Theta and Time Decay

| Moneyness | Extrinsic Value Level | Theta Value (Decay Rate) | Primary Risk/Benefit |

|---|---|---|---|

| In-the-Money (ITM) | Low | Low | Behaves more like the stock; less sensitive to time. |

| At-the-Money (ATM) | High | High | Maximum time decay; ideal for premium sellers. |

| Out-of-the-Money (OTM) | Very Low | Very Low | Low premium, but decays quickly and often expires worthless. |

As you can see, ATM options are where the action is for traders focused on capturing premium from time decay.

Finally, implied volatility plays a role too. When volatility is low, Theta tends to be higher, accelerating decay. When volatility is high, those inflated option premiums can partially cushion the blow from time decay, at least for a while.

These dynamics aren’t just theoretical—they impact billions of dollars in option premiums every single day. You can see a great breakdown in this Nasdaq analysis.

Moneyness and volatility are the dials that turn Theta’s aggressiveness up or down, controlling how quickly an option’s value erodes.

Getting a handle on how time decay works is absolutely essential for choosing your ideal trading time frame and building a strategy that works for you, not against you.

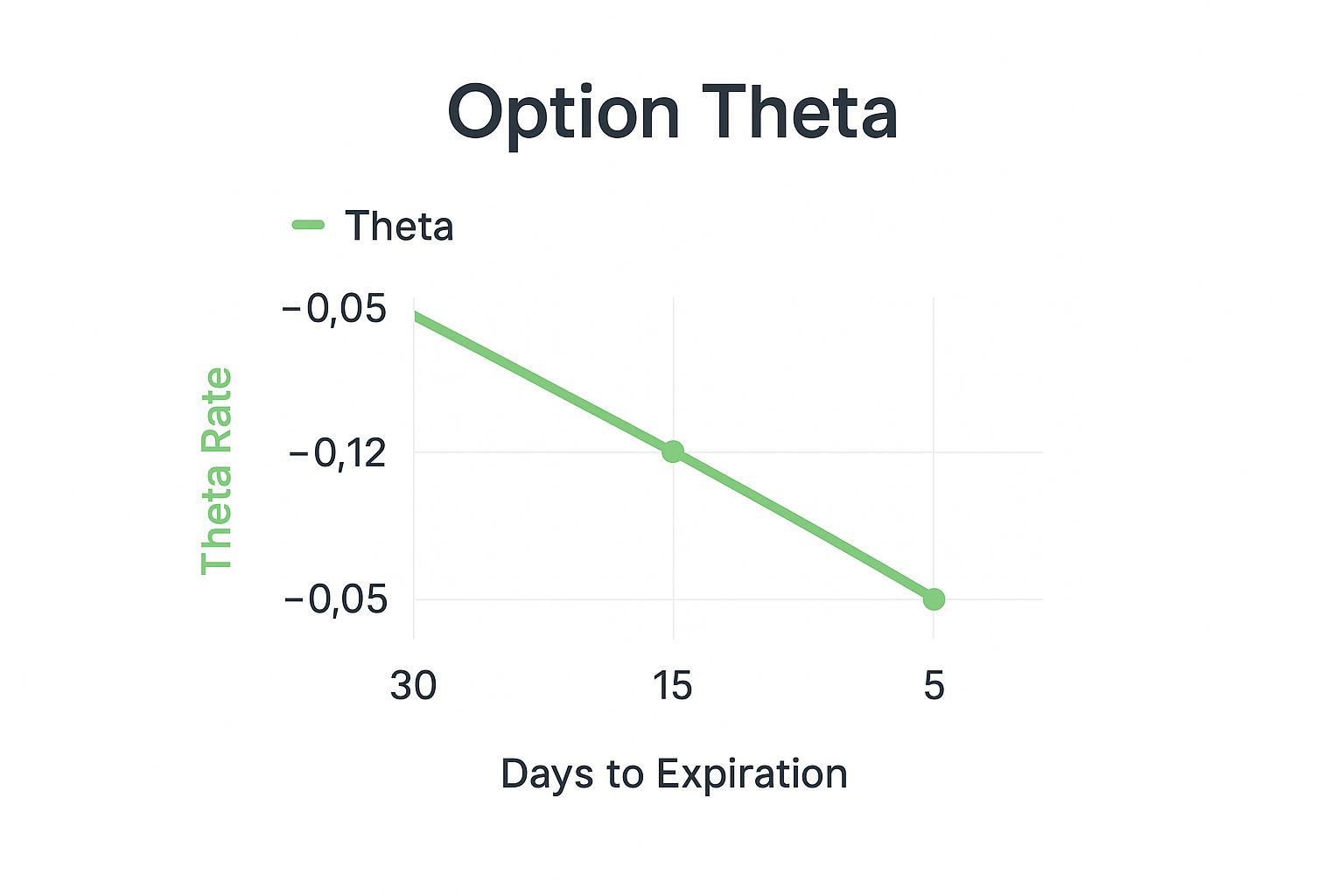

Visualizing the Theta Decay Curve

To really get a feel for how time decay works, you need to see it. Think of the Theta decay curve as a visual map of an option's value over time. For options with plenty of time left, the curve starts as a gentle, lazy slope.

But as expiration gets closer, that gentle slope turns into a steep, cliff-like drop, especially in the last 30 to 45 days. This is where the magic happens for options sellers.

Understanding this curve helps you find the sweet spot for selling contracts — that window where decay speeds up enough to be profitable, but you still have time to manage the trade if things go sideways. It’s about moving from guesswork to making sharp, informed decisions.

The chart below shows exactly how the daily loss in an option's value (its Theta) picks up speed as the clock runs down.

As you can see, the value lost per day more than doubles between the 30-day and 15-day marks. That acceleration is what income-focused traders live for.

Putting Time Decay to Work for You

Alright, now it’s time to make time decay in options work for you. Strategies built around profiting from Theta are all about selling options premium and letting the clock do the heavy lifting.

The most straightforward approach is the covered call. You sell call options against stock you already own, which puts immediate income into your pocket. A cash-secured put works in a similar way—you sell a put option while setting aside enough cash to buy the stock if it gets assigned.

Want to see these principles in action? You can gain some great insights by checking out live options trading sessions where pros apply these concepts in real-time.

For the more seasoned trader, strategies like iron condors and credit spreads are designed to profit when a stock stays within a specific price range. You collect the premium upfront as Theta steadily erodes the value of the options you sold.

Every one of these strategies uses Theta as its primary profit engine. If you want to get a better handle on all the metrics that drive these trades, our detailed guide on https://strikeprice.app/blog/what-are-option-greeks is the perfect place to start.

Common Questions About Time Decay and Theta

Once you get the hang of the basics, a few specific questions about time decay in options always seem to pop up. Let's run through the most common ones to clear up how Theta really behaves out in the wild.

Does Theta Decay on Weekends?

Absolutely. Time decay is relentless—it chips away at an option's value over weekends and holidays, too. Even though the markets are closed, the clock never stops ticking.

This is exactly why you'll often see a noticeable drop in an option's extrinsic value first thing on a Monday morning. The market makers have already priced in the decay for Saturday and Sunday before the closing bell on Friday.

Can Theta Ever Be Positive?

For anyone holding a long call or put, Theta is always your enemy—it's a negative number pulling value from your position. However, it's entirely possible for your overall portfolio to have a positive Theta.

If you're a net seller of options (meaning you've sold a covered call or a cash-secured put), your position actually has a positive Theta. You’ve set yourself up to profit as time passes and the options you sold slowly lose their value.

What Is the Sweet Spot for a Theta Strategy?

Traders who want to make time decay work for them usually focus on selling at-the-money (ATM) or slightly out-of-the-money (OTM) options.

The ideal timeframe is often considered to be between 30 and 60 days until expiration. This window represents the "sweet spot" on the decay curve, where Theta's acceleration gives you a great balance of premium income versus the risks you're taking on.

How Can Option Buyers Mitigate Time Decay?

When you're buying options, Theta is the headwind you're constantly fighting. To lessen its impact, you have a couple of solid moves:

- Buy More Time: Go for options with 90+ days left until expiration. Their daily Theta decay is much, much lower.

- Buy ITM Options: In-the-money (ITM) options have far less extrinsic value to begin with, which means they have less value to lose to decay.

Getting these details right is crucial, especially when you think about what happens when options expire and how that final outcome is shaped by decay.

Ready to turn time decay into your greatest ally? Strike Price gives you the data-driven probabilities you need to sell options with confidence. Stop guessing and start earning consistent income. Join Strike Price and optimize your options strategy today!