What Is a Short Put? Learn the Strategy & Benefits

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

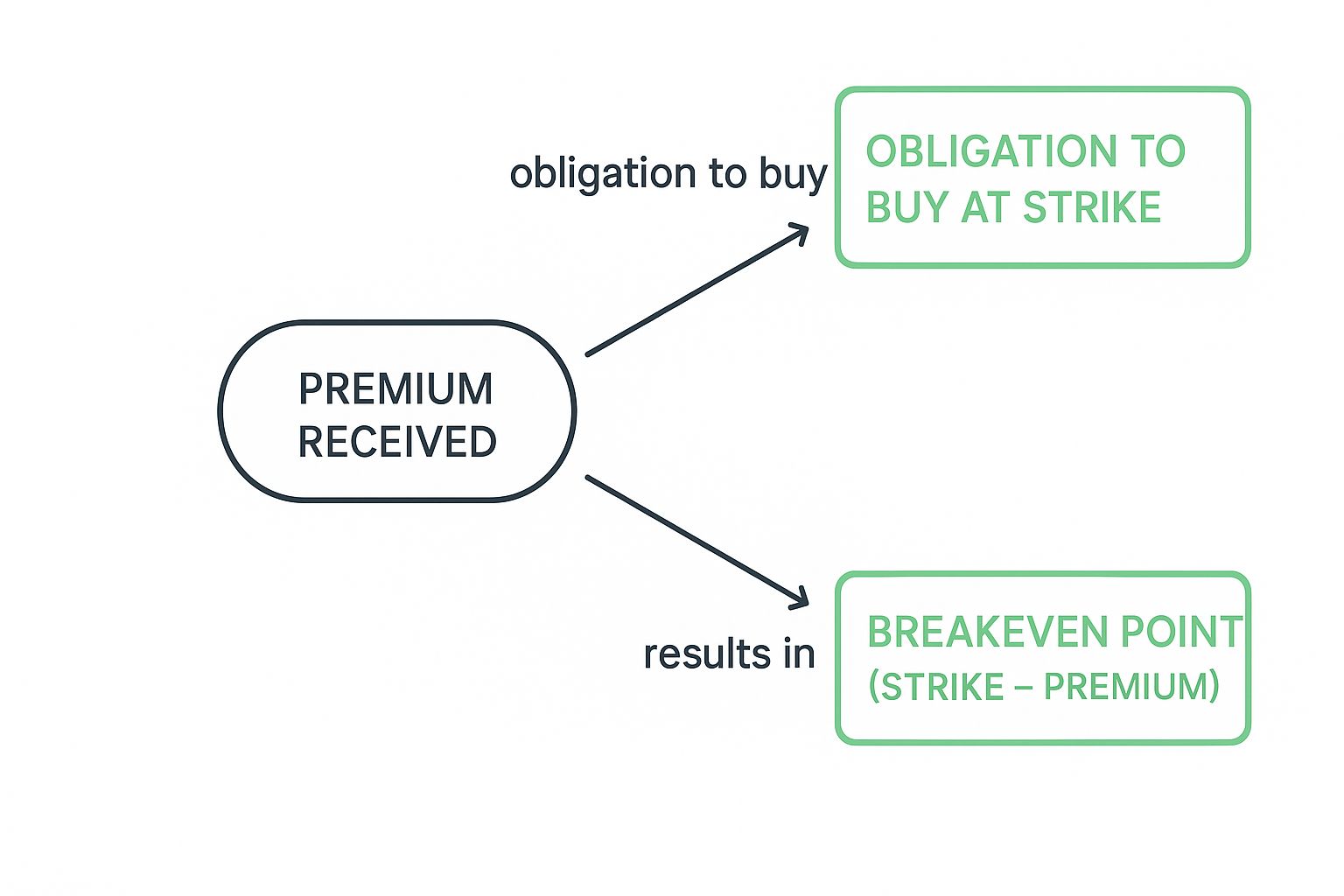

When you sell a short put, you're essentially getting paid to place a buy order on a stock you already like. You sell someone the right—but not the obligation—to sell a stock to you at a specific price (the strike price) by a certain date. For taking on this obligation, you get paid an immediate cash fee, known as a premium.

It's a fantastic way to either generate income or buy shares at a price you're truly comfortable with.

Breaking Down the Short Put

Let's use an analogy. Imagine you're eyeing a classic watch currently selling for $5,200. You'd love to own it, but you think that price is a bit steep. You'd feel much better buying it at $5,000.

So, you go to the seller and make a deal: "I promise to buy this watch from you for $5,000 anytime in the next 30 days if you want to sell it at that price." For making this guarantee, the seller pays you a $200 fee right now.

That $200 is yours to keep, no matter what happens. This is exactly how selling a put option works in the stock market. You're the one making the promise and collecting the fee upfront.

The core idea is simple: You are selling an obligation. You collect cash now in exchange for agreeing to potentially buy a stock later at a price you choose today.

This is why a short put is considered a neutral-to-bullish strategy. You're betting that the stock's price will either rise or stay flat, allowing you to simply pocket the premium.

Short Put Components at a Glance

To make this crystal clear, here’s a quick breakdown of the moving parts in every short put trade.

| Component | What It Means for You |

|---|---|

| Strike Price | The price at which you agree to buy the stock. You choose this. |

| Premium | The cash you receive upfront for selling the put option. |

| Expiration Date | The date the contract ends. Your obligation is over after this day. |

| Underlying Stock | The specific stock (e.g., AAPL, TSLA) the option is for. |

Understanding these components is the key to successfully managing your trades and achieving your financial goals with this strategy.

The Two Main Goals of Selling Puts

Traders usually sell puts with one of two specific objectives in mind:

- Generating consistent income. If the stock's price stays above your chosen strike price, the option simply expires worthless. The buyer won't exercise their right to sell you the shares, and you keep 100% of the premium as profit. Cha-ching.

- Buying a stock you want at a discount. Let's say you already want to own a stock, but you're waiting for a better price. By selling a put, you set your ideal entry point. If the stock drops to that price, you get assigned the shares—and the premium you collected acts as a rebate, lowering your effective cost basis even further.

At its heart, the short put is a versatile strategy. It allows you to be proactive, whether your goal is to make your cash work for you or to strategically enter a new stock position. For a deeper dive into the mechanics, you can find more details on short puts from resources like Euronext. This flexibility makes it a powerful tool for both income-focused and value-oriented investors.

How a Short Put Trade Actually Works

Alright, let's move from theory to practice and see how this plays out in the real world. Imagine you've been eyeing XYZ stock for a while. You're bullish on the company, but its current price of $105 feels a tad rich. Your research tells you that $100 would be a fantastic price to jump in.

So, what do you do? You could set a price alert and just wait. Or, you could get paid to wait by selling a put option.

You decide to sell one put contract with a $100 strike price that expires in 30 days. The moment you place the trade, a $200 premium ($2 per share) hits your brokerage account. That's your money to keep, no matter what happens next.

Now, the waiting game begins. Over the next 30 days, one of two things is going to happen.

Outcome 1: The Stock Stays Above Your Strike Price

This is the best-case scenario if your goal is simply to generate income. Fast forward 30 days, and let's say XYZ stock is happily trading at $108.

- Your put option is "out of the money." Why? Because the market price ($108) is much higher than your strike price ($100).

- The trader who bought your option has no incentive to use it. They wouldn't exercise their right to sell you shares at $100 when they could get $108 on the open market.

- The contract expires completely worthless, and your obligation to buy the shares disappears.

That $200 premium you collected upfront? It’s now 100% pure profit. You made money just by correctly predicting that the stock wouldn't crash below your target price.

Outcome 2: The Stock Falls Below Your Strike Price

Now, let's imagine the market wobbles a bit. On expiration day, XYZ stock has dipped to $98 per share. This changes things.

In this scenario, your obligation is triggered. Because the stock price ($98) is below your strike price ($100), the option is "in the money," and you will be assigned the shares.

Your broker will automatically buy 100 shares of XYZ on your behalf at your agreed-upon strike price of $100 per share. This will cost $10,000 (100 shares x $100).

But wait—don't forget about that $200 premium you pocketed at the start. That cash effectively lowers your cost. Your true cost basis isn't $100 per share; it's actually $98 per share ($10,000 cost - $200 premium) / 100 shares.

You now own the stock at the exact same price it's trading on the market, but you essentially got a built-in discount to start your position. Not a bad deal at all.

Visualizing Your Profit and Loss

Talking about a strategy is one thing, but seeing how it plays out with real money on the line is another. This is where a payoff diagram becomes one of the most useful tools in a trader's arsenal. It’s a simple chart that gives you an instant snapshot of your potential profit or loss for a short put trade at any possible stock price at expiration.

Think of it like this: the horizontal line (the x-axis) shows the stock's price, and the vertical line (the y-axis) shows your P&L. Plotting the trade gives you a clean, visual map of the risk you're taking and the reward you're aiming for, all before you put a single dollar to work.

The classic shape of a short put payoff diagram immediately highlights its defined profit and risk zones. You can see how the profit gets capped—that flat horizontal line—at the premium you collected. On the other hand, the potential loss grows as the stock price tanks below your strike price.

Reading the Payoff Graph

The shape of this graph tells the entire story. That flat top? That's your maximum profit. It’s the premium you were paid upfront, and you get to keep all of it as long as the stock finishes at or above your strike price when the option expires.

But if the stock price starts to fall below the strike, the line begins to slope down and to the left. This is where your losses start to kick in. The exact spot where that line crosses from profit into loss territory is your break-even point.

Your break-even point is simply the strike price minus the premium you received. If the stock falls below this level at expiration, your position will be sitting on a loss.

This visualization is incredibly powerful. It transforms abstract numbers and possibilities into a concrete picture, letting you see and feel the financial consequences of your trade across every potential outcome. It's about moving from theory to practical application.

Understanding the Risk and Reward

Let's talk about the two sides of any trade: what you can make and what you can lose. With a short put, the reward side is wonderfully simple. Your maximum profit is always limited to the cash premium you pocketed when you sold the contract. That's it. You know your best-case scenario right from the start.

This isn't just a hopeful guess; market data backs it up. Looking at major indices, a surprising number of put options—often somewhere between 50-70%—simply expire worthless. Why? Because the stock price never dropped below the strike. This statistical edge is precisely why so many traders rely on selling puts for consistent income. For a closer look at the numbers, you can explore these option statistics on Corporate Finance Institute.

Now for the other side of the coin: risk. Selling a "naked" put, meaning one without any backup plan, is where the danger lies. If the stock price takes a nosedive, your theoretical loss could be huge—the entire strike price (times 100 shares) minus the small premium you collected. Imagine the company going bankrupt and the stock hitting zero. That's the nightmare scenario.

The Safer Approach A Cash Secured Put

This is exactly why smart retail traders almost exclusively use a much safer version of this strategy: the cash-secured put. The name tells you everything you need to know. You're securing the trade with cash.

By setting aside enough cash to buy 100 shares at the strike price, you fully collateralize your obligation. This simple step transforms the trade from a high-risk speculation into a disciplined stock acquisition method.

Let's say you sell one put with a $50 strike price. To do this the "cash-secured" way, you'd need to have $5,000 ($50 x 100 shares) sitting in your account as collateral. This guarantees you can make good on your end of the deal if you get assigned, and it forces you to acknowledge your total capital at risk upfront.

This approach completely flips the risk profile. Suddenly, you're prepared for either outcome. You either keep the premium as pure profit, or you get to buy a stock you already wanted at the exact price you were willing to pay. Our complete guide on selling cash-secured puts walks through this more conservative method step-by-step, showing you how to minimize the danger while keeping the strategy's core benefits.

When to Use a Short Put Strategy

Knowing how a short put works is one thing. Knowing when to use it is where the real skill comes in. This isn't a strategy you can just throw at any market condition; its power is unlocked when you align it with the right outlook and your specific goals.

There are really two main scenarios where selling a put shines.

The first, and probably most common, reason traders sell puts is for consistent income generation. Think about a stock you've been watching. You don't see it crashing anytime soon—maybe it will trade sideways, stay flat, or even climb a bit over the next month. By selling a put option on that stock, you collect an immediate cash premium. If the stock stays above your strike price, that money is yours to keep, free and clear.

It's a lot like getting paid rent on a stock you haven't even bought yet. You're simply monetizing your view that the stock will hold its ground. Countless investors use this method to generate a steady cash flow from their portfolios. You can dive deeper into this powerful approach in our guide on put selling for income.

Using Short Puts to Buy Stock Cheaper

The second killer application for a short put is as a strategic tool to buy stock. Let's say you love a company, but you think its current price is just a bit rich. You have a specific price in mind where you’d happily become a shareholder.

Instead of setting a simple limit order and waiting (for potentially nothing), you can sell a put at that target price.

By selling a put, you essentially get paid to wait. If the stock drops to or below your strike price by expiration, you’ll be assigned the shares—at the exact price you wanted to pay.

And if the stock never hits your target? The option expires worthless. You won't get the shares, but you keep 100% of the premium you collected upfront. It’s a true win-win: either you buy the stock you wanted at a discount (your strike price minus the premium you received), or you get paid for trying. This turns a passive waiting game into an active, income-producing strategy.

Common Questions About Selling Puts

As you start to get the hang of short puts, a few questions always seem to pop up. Getting these sorted out is crucial for building the confidence you need to actually use this strategy in your own account. Let's tackle some of the most common ones I hear from traders.

What Is the Difference Between a Short Put and a Long Put?

The easiest way to think about this is that they are polar opposites.

When you sell a short put, you’re taking a neutral-to-bullish stance on a stock. You get paid a premium upfront for taking on the obligation to buy the stock if it drops below your chosen strike price.

A long put, on the other hand, is a straight-up bearish bet. You pay a premium to get the right—but not the obligation—to sell a stock at a specific price. Here, you're hoping the stock price tanks, making your contract more valuable.

With a short put, your profit is capped at the premium you collect. With a long put, your loss is capped at the premium you paid.

This core difference in risk, reward, and your market outlook means they are completely different tools for entirely different jobs.

What Does a Cash-Secured Put Mean?

A cash-secured put isn't just a different name for a short put; it's the responsible way to sell one. For many income-focused investors, this is their bread and butter. It simply means you have enough cash set aside in your account to actually buy the shares if you get assigned.

For instance, if you sell one put contract with a $50 strike price, you need to have $5,000 in cash ($50 strike x 100 shares) reserved as collateral. This proves to your broker (and yourself) that you can make good on your end of the deal without needing margin. In fact, many brokers flat-out require this for certain account types.

For those interested in a similar but distinct strategy, you can also learn more about how to sell covered puts, which is a tactic used for stocks you already own.

What Happens When a Short Put Is In the Money?

When your short put’s expiration date arrives, if the stock is trading below your strike price, the option is considered “in the money.” When this happens, you can almost always expect to be assigned.

The process is typically automatic. Your broker will take the cash you set aside and use it to buy 100 shares of the stock for you at the strike price. The next thing you know, those shares will appear in your account, and congratulations—you're now a shareholder.

At Strike Price, we help you turn this process from a gut feeling into a data-driven decision. Our platform shows you the real-time probability of assignment for every single strike, so you know the statistical risk before you ever click "sell." Sign up for Strike Price today and start making smarter, more confident income-focused trades.