What Is Moneyness in Options Explained Simply

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

When you're getting into options, there's one idea you have to nail down before anything else: moneyness. Think of it as a quick snapshot that tells you where an option stands right now. It boils down to a simple comparison: the option's strike price versus the stock's current price.

This relationship immediately tells you if the option has any real, tangible value if it were exercised this very second. Getting this right is the first step toward making smarter, more confident trades.

Why Moneyness Is Your First Step to Smarter Trading

Before you even think about placing a trade, you have to understand this one core concept. Let's use an analogy. Imagine your option is a ticket to a big game.

If your team is winning handily, that ticket is pretty valuable. If the game is tied, the outcome is up in the air, but there's still a lot of potential. But if your team is getting crushed, that ticket isn't worth much more than the paper it's printed on. Moneyness is just a way of asking, "How's my team doing right now?"

Every option falls into one of three categories:

- In-the-Money (ITM): The option has immediate, real value. Your team is winning.

- At-the-Money (ATM): The strike price and the stock price are practically the same. It’s a nail-biter.

- Out-of-the-Money (OTM): The option has no intrinsic value right now. Your team is losing.

That’s it. It’s the most basic indicator of whether an option is profitable at this exact moment.

Grasping this single idea is the foundation for every successful options strategy you will ever learn. It directly influences an option's price, risk, and potential for profit.

In this guide, we'll break down these three states and show you how they drive every decision you make. You'll see why understanding moneyness isn't just a "nice-to-have"—it's absolutely essential for building a profitable, sustainable trading approach. From picking the right strike price to managing your risk, it all starts here.

Decoding the Three States of Moneyness

To get the hang of moneyness, you need to learn the language. Every single option falls into one of three buckets, and each one tells a different story about where the option’s strike price stands in relation to the stock’s current price. Getting these states down—In-the-Money, At-the-Money, and Out-of-the-Money—is your ticket to reading any options chain like a pro.

Let's keep it simple. Imagine XYZ stock is trading at exactly $100 per share. The state of any XYZ option is determined purely by comparing its strike price to that $100 market price.

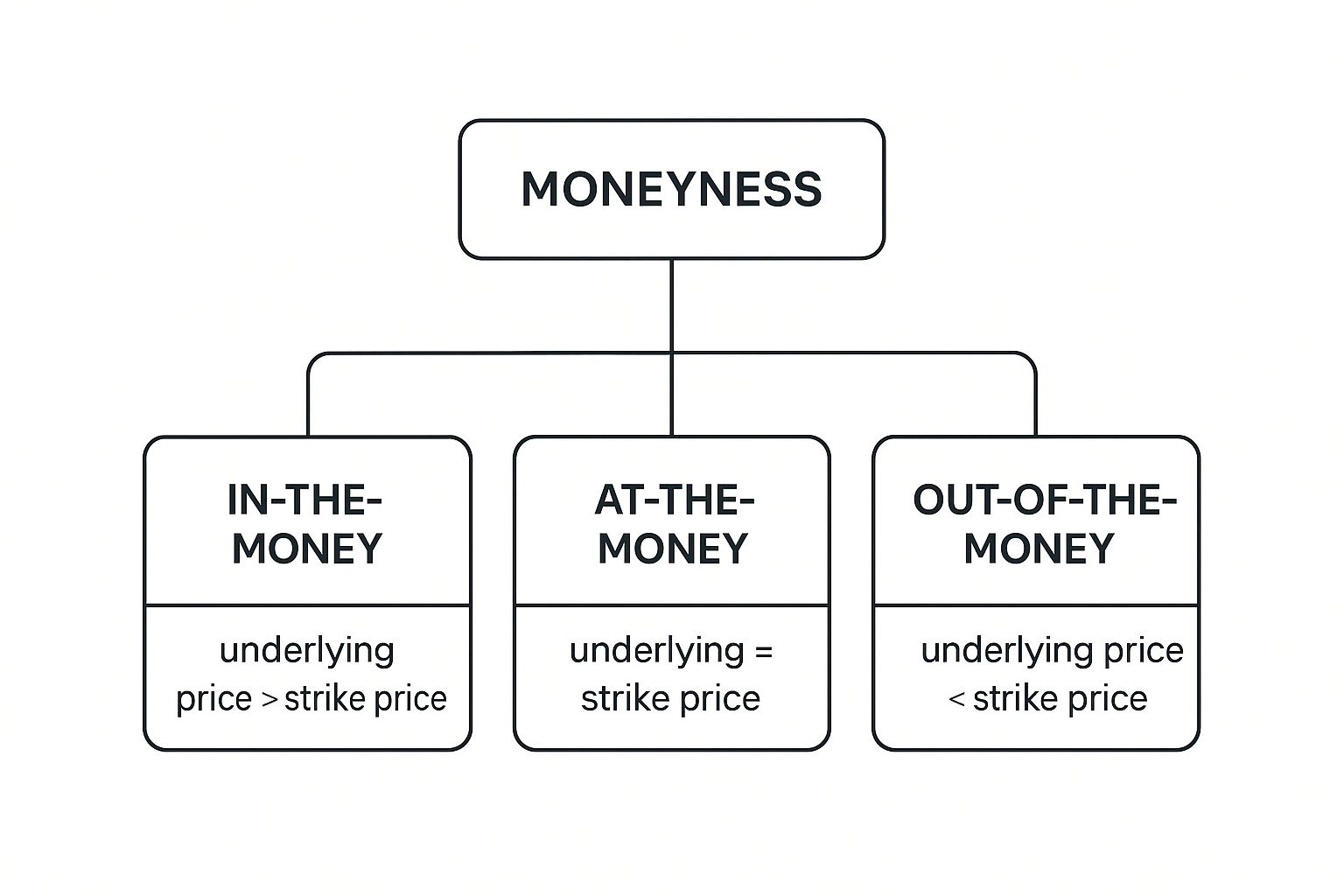

This image gives you a quick visual of how these three categories stack up.

As you can see, moneyness is all about whether the stock is trading above, below, or right at an option's strike price.

In-the-Money (ITM)

An option is In-the-Money (ITM) when it has intrinsic value. That’s just a fancy way of saying you could exercise it right now for an immediate paper profit (not counting the premium you paid to buy it). Think of it as already holding a winning lottery ticket.

- For a Call Option: A call with a $95 strike price is ITM. It gives you the right to buy XYZ at $95 when it's trading for $100, locking in a $5 per share gain.

- For a Put Option: A put with a $105 strike price is ITM. This one gives you the right to sell XYZ at $105 when it's only worth $100, also securing a $5 per share gain.

At-the-Money (ATM)

An option is At-the-Money (ATM) when its strike price is the same as (or super close to) the current stock price. There's no intrinsic value here; it's all about potential.

This is the coin-toss of options. It holds the most uncertainty, which means it also has the highest amount of time value packed into its price. You can see how this works in our guide to understanding options time decay.

For both calls and puts, an ATM option on our XYZ stock would have a strike price of $100. Exercising it would be a wash—you'd buy or sell the stock at its current market price.

Out-of-the-Money (OTM)

Finally, an option is Out-of-the-Money (OTM) when exercising it would be a losing move. It has zero intrinsic value and is made up entirely of extrinsic value—basically, the hope that the stock price makes a big move in your favor before the option expires.

- For a Call Option: A call with a $105 strike price is OTM. Why would you exercise your right to buy the stock at $105 when you can get it on the open market for $100?

- For a Put Option: A put with a $95 strike price is OTM. It makes no sense to sell your shares for $95 when they’re currently worth $100.

Moneyness States for Call and Put Options

It can be tricky to remember how these states apply to both calls and puts. Here’s a quick reference table to make it crystal clear.

| Moneyness State | Call Option Condition | Put Option Condition | Has Intrinsic Value? |

|---|---|---|---|

| In-the-Money | Stock Price > Strike Price | Stock Price < Strike Price | Yes |

| At-the-Money | Stock Price ≈ Strike Price | Stock Price ≈ Strike Price | No |

| Out-of-the-Money | Stock Price < Strike Price | Stock Price > Strike Price | No |

This table is a great cheat sheet to keep handy. It neatly summarizes the relationship between the stock price and strike price that defines whether a call or put is ITM, ATM, or OTM and whether it holds any intrinsic value.

How Moneyness Drives the Price of an Option

Knowing how to label an option as ITM, ATM, or OTM is just the start. The real magic happens when you understand how moneyness is the engine that drives an option's price. The premium you pay or collect for any option is really just a mix of two key ingredients: intrinsic value and extrinsic value.

Think of intrinsic value as the option's "right now" profit. If you could exercise it this very second, how much would it be worth? Moneyness is directly tied to this, because only In-the-Money (ITM) options have intrinsic value. An OTM option has zero. Simple as that.

Extrinsic value is the fun part—it's the "what if" value. It's the extra cash traders are willing to pay for the chance that an option will become profitable later. This value is fueled by things like time left until expiration and how much the market expects the stock to bounce around (volatility).

The ATM Paradox: Why Zero Intrinsic Value Costs More

This is where things get counterintuitive. You'd think the options with real, tangible value (ITM) would always be the most expensive. Not always. In fact, At-the-Money (ATM) options, which have exactly zero intrinsic value, often have the highest premiums of all. Why on earth would that be?

It all comes down to extrinsic value. ATM options are sitting right on the fence. They hold the absolute most uncertainty about which way the stock will go next, and in the options world, uncertainty is expensive. This maximum uncertainty pumps up their extrinsic value to the highest possible level.

Moneyness doesn't just describe an option's current state; it dictates its entire pricing DNA. The balance between intrinsic and extrinsic value shifts dramatically depending on where an option sits relative to the stock price.

Looking at historical data, this pattern holds up. For options with around 30 days until they expire, it's not uncommon to see ATM contracts command premiums up to 50-70% higher than comparable OTM options. That massive difference is a direct result of their peak time value and uncertainty.

How Moneyness Shapes Risk and Reward

This pricing dynamic completely changes how you should think about your strategy. As an option gets further away from the current stock price—either deep ITM or way OTM—its price becomes less sensitive to small wiggles in the stock.

- Deep ITM Options: These are almost pure intrinsic value. Their price moves nearly dollar-for-dollar with the stock, making them feel more like owning the stock itself rather than a leveraged bet.

- Far OTM Options: These are pure extrinsic value. They're cheap lottery tickets, but they need a huge move in the stock price just to break even, let alone turn a profit.

- ATM Options: These are the sweet spot. They offer the most balanced risk-reward profile and are the most sensitive to changes in the stock's price. We measure this sensitivity with a metric called Delta, which is closely linked to moneyness. To learn more, check out our guide on what Delta is in options trading.

Thinking Like a Pro: How to Calculate Moneyness

Going beyond simple labels like ITM or OTM is what separates seasoned traders from beginners. Pros don't just see categories; they see degrees. Calculating moneyness as a percentage gives you a precise way to measure an option's position, making it easier to compare different contracts and size up their risk.

The calculation itself is pretty straightforward. For a call option, you just find the difference between the stock price and the strike price, then divide that result by the strike price.

Let's walk through a quick example.

- Stock Price: $100

- Call Strike Price: $90

- Calculation: ($100 - $90) / $90 = 0.111

This tells us the option is 11.1% in-the-money. That single number gives you a specific, quantifiable measure of where the option stands—far more useful than just knowing it's "in the money."

Putting the Numbers into Context

This percentage isn't just an abstract figure; it's directly tied to an option's intrinsic value. You can explore the details of how https://strikeprice.app/blog/intrinsic-vs-extrinsic-option-value. For a deeper look into the analytical methods that drive options valuation, the principles of quantitative analysis in finance provide some fantastic context.

In the real world, traders quantify moneyness using percentages or ratios just like this. Interestingly, exchange data shows that option open interest often clusters around slightly out-of-the-money strikes—typically 2-5% OTM—as many traders feel these offer a balanced risk-to-reward profile.

Thankfully, you don't have to break out the calculator every time. Most modern trading platforms make it incredibly simple to see moneyness. They often use color-coding right in their option chains—for instance, shading all ITM options in blue—so you can see the status of every available strike in a single glance. It’s a visual shortcut that makes your analysis faster and much more intuitive.

Putting Moneyness to Work in Your Trading Strategy

This is where the theory hits the road. Understanding moneyness isn't just an academic exercise—it's the bedrock of almost every options trade you'll make.

Every decision, from the strike price you pick to how you manage your risk, comes down to whether an option is ITM, ATM, or OTM. That single choice dictates the cost, risk, and potential reward of your entire position.

For an options buyer, it boils down to a classic tug-of-war between cost and probability. Are you swinging for the fences with a cheap, high-leverage Out-of-the-Money (OTM) option, or playing it safer with a pricier In-the-Money (ITM) contract?

- Buying OTM Options: Think of these as lottery tickets. They’re cheap, and if the stock makes a massive move in your direction, the percentage returns can be enormous. The catch? The odds are stacked against you, and they have a very high chance of expiring worthless.

- Buying ITM Options: This is the safer play. They cost more upfront because they already have intrinsic value built in, which gives you a much higher probability of success. The trade-off is that your potential return on investment is lower compared to a winning OTM bet.

A Seller's Perspective on Moneyness

For options sellers—especially those running income strategies like covered calls or cash-secured puts—moneyness is everything. The game is to collect premium from options that will almost certainly expire worthless.

This makes selling OTM options the bread and butter for most premium sellers.

When you sell an OTM call, you collect a premium while giving the stock room to climb before your shares get called away. Likewise, selling an OTM put lets you pocket income while only obligating you to buy the stock if it falls below a price you’re already comfortable paying.

Selecting an option isn't about randomly picking a strike price. It's a strategic decision about risk, reward, and probability, all guided by the concept of moneyness.

For sellers, the further OTM you go, the higher your odds of the option expiring worthless... but the less premium you’ll collect. Finding that sweet spot between safety and income is the art of selling options. It all starts with a solid grasp of moneyness, turning what feels like guesswork into a calculated, strategic decision.

A Few Final Questions on Moneyness

To wrap things up, let's run through a couple of the most common questions traders have about moneyness. Getting these straight will help lock in the concepts and clear up any lingering confusion.

Can an Option's Moneyness Change Over Time?

Absolutely. Moneyness isn't set in stone. It's a living, breathing thing that shifts with every single tick of the underlying stock's price.

An Out-of-the-Money (OTM) option can wander into At-the-Money (ATM) territory and then become In-the-Money (ITM) if the stock moves in its favor—and it can just as easily go the other way. This constant flux is precisely why active traders keep a close eye on moneyness throughout the entire life of a trade.

Is It Better to Buy ITM or OTM Options?

That’s the million-dollar question, isn't it? The honest answer is: neither is inherently "better." The right choice boils down entirely to your strategy, your goals, and how much risk you’re willing to stomach.

- ITM options are the safer bet. They have a higher probability of ending up profitable, but you'll pay more for that safety.

- OTM options are much cheaper and offer a ton of leverage if you're right. But—and it's a big but—they also have a much higher chance of expiring completely worthless.

Your specific goal for that trade is what decides which one makes sense for you.

Key Takeaway: An option's moneyness is tied directly to its Delta, which is a quick way to estimate how its price will react to the stock's movement. Deep ITM calls have Deltas near 1.0, making them behave almost exactly like the stock. Far OTM options have Deltas closer to zero, meaning they barely flinch at small price changes.

Ready to stop guessing and start selling options with confidence? Strike Price provides real-time probability metrics for every strike, helping you balance safety and premium income. Turn guesswork into informed action today.