What is Vega in Options? Key Insights for Traders

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Mastering Option Extrinsic Value

Unlock the core of options trading by mastering option extrinsic value. Learn how time, volatility, and strategy impact your profits with this guide.

A Trader's Guide to Short Put Options

Discover how to use short put options to generate consistent income or buy stocks at a lower price. This guide covers key strategies and risk management.

8 Best Stocks for Put Selling in 2025

Discover the best stocks for put selling to generate consistent income. Our guide breaks down top picks, key metrics, and actionable strategies for success.

When you're trading options, you'll often hear people talk about "vega." But what is it, really? Simply put, vega tells you how much an option's price will move for every 1% change in its implied volatility. It’s the Greek that measures the impact of market fear and uncertainty on your position.

Understanding vega is your key to navigating the often-choppy waters of market sentiment.

What is Vega in Options Trading?

Think of vega as a volatility gauge. When the market gets jittery and uncertain about a stock's future, implied volatility (IV) tends to climb. Vega shows you exactly how much your option's price will react to that shift in mood.

The connection is direct. Let's say you have an option with a vega of 0.15. If implied volatility jumps by 1%, your option's premium will increase by $0.15, all else being equal. If IV drops by 1%, that same option loses $0.15 in value. It's a straightforward way to see how sensitive your contract is to the market’s changing expectations.

To get the full picture, it helps to understand how vega fits in with its siblings.

Why Vega is a Key Player

Vega is one of the foundational "Option Greeks," which are just a handful of metrics traders use to measure the different risks affecting an option's price. While Greeks like Delta (sensitivity to the stock's price) and Theta (time decay) get a lot of attention, vega isolates the powerful influence of market sentiment. For a deeper dive, check out our full explainer on what are option greeks.

Getting a handle on vega is especially critical during certain high-stakes moments:

- Before Earnings Reports: The run-up to an earnings call is prime time for volatility. The uncertainty pumps up IV, and vega tells you how much that matters.

- During Market Turmoil: Big economic news or geopolitical events can send waves of uncertainty across the entire market, cranking up IV on almost everything.

- Leading up to Major Announcements: Think new product launches or major regulatory decisions. These events are pure speculation magnets, and vega shows you the premium attached to that unknown outcome.

In simple terms, vega connects the market's "what if" scenarios directly to the price tag of your option. A higher vega means your option's value is more leveraged to changes in these future expectations.

If you’re an options seller—using strategies like covered calls or cash-secured puts—this isn't just nice to know; it's essential. When you sell an option, you become "short vega." This means you profit when implied volatility falls after you've already collected that juicy premium. It's the whole reason so many traders love to sell options when IV is sky-high, betting it will eventually cool off.

Vega at a Glance Core Principles

This table breaks down the core ideas behind vega into easily digestible pieces. It’s a handy reference for understanding how volatility impacts your trades.

| Concept | Simple Explanation | What It Means for Traders |

|---|---|---|

| Definition | Measures an option's price change for every 1% shift in implied volatility. | A direct gauge of how market fear or greed affects your option's value. |

| Option Buyers | They are "long vega," meaning they profit when implied volatility rises. | Higher IV increases the option's premium, creating potential profit. |

| Option Sellers | They are "short vega," meaning they profit when implied volatility falls. | Selling when IV is high allows you to collect a bigger premium, hoping it will decay. |

| Time to Expiration | Longer-dated options have higher vega than shorter-dated ones. | More time allows for more uncertainty, making long-term options more sensitive to IV changes. |

Understanding these principles is the first step. Next, let's look at how to put them into action with real-world scenarios.

The Link Between Vega and Implied Volatility

Vega doesn’t just exist on its own; it's completely tied to a concept called implied volatility (IV). The easiest way to think about implied volatility is as the market's collective gut feeling about a stock's future price swings. It’s the pulse of market sentiment—spiking when things feel uncertain and calming down when the coast looks clear.

So, where does vega fit in? Vega is the bridge connecting that market sentiment directly to the price of your option. It translates the market’s mood—anxious or calm—into a specific dollar value.

Think about the buzz before a big product launch or a Fed announcement. That speculation makes IV swell up. Vega is what tells you exactly how much that swelling will pump up your option's premium, even if the stock itself hasn't moved a penny. Getting a handle on this relationship is a game-changer for any options trader.

Long Vega vs. Short Vega Positions

Your exposure to vega boils down to one simple question: did you buy or sell the option? This puts you in one of two camps—"long vega" or "short vega"—and each side has a completely different playbook.

Long Vega (The Buyer): When you buy any option, whether a call or a put, you're long vega. This means you want implied volatility to go up. A rising IV inflates the value of the option you're holding, which is exactly what you're hoping for. A trader buying calls right before an earnings report is making a classic long vega play.

Short Vega (The Seller): When you sell an option, like in a covered call or cash-secured put strategy, you become short vega. Here, your goal is the exact opposite. You profit when implied volatility drops. You collected a nice, juicy premium when IV was high, and now you want that volatility to evaporate so the option becomes cheaper to buy back (or, ideally, expires worthless).

This is the fundamental dynamic behind most options income strategies. If you want to dive deeper, our guide explains how to calculate implied volatility and how it truly impacts your trades.

Being short vega is a lot like being an insurance company. You get paid a premium upfront to take on risk. You make the most money when the "disaster" (a big volatility spike) never actually happens, letting the value of that policy you sold just melt away.

Let's put it into practice. Say a stock is trading at $50 and you sell a covered call that has a vega of 0.12. You sold it right before a big industry conference, so IV was high. After the event, the uncertainty is gone, and IV drops by 5%.

Because you are short vega, that "volatility crush" works in your favor. The option's price will drop by $0.60 (5 x 0.12) from the change in IV alone, pushing you closer to maximum profit.

Knowing whether you're long or short vega is non-negotiable. It tells you if market uncertainty is your ally or your enemy, and that insight lets you structure your trades to match what you think will happen next. It’s the difference between just making a trade and truly having a strategy.

Seeing Vega's Impact on Option Prices

Theory is great, but seeing how vega actually moves the needle on an option's price is where it all comes together. Let's walk through a simple example to show you exactly how this plays out in dollars and cents.

Let's say you're looking at a call option for XYZ stock. After learning how to read option chains, you pull up the contract and find these key details:

- Current Option Premium: $3.00 (or $300 per contract)

- Vega: 0.25

Think of that 0.25 vega as your volatility gauge. It tells you that for every 1% change in implied volatility (IV), the option's price should change by about $0.25, all else being equal.

Scenario One: Volatility Spikes

Imagine some unexpected good news about XYZ's industry hits the wires. Suddenly, the market isn't so sure where the stock is headed next, and this uncertainty causes implied volatility to jump by 2%.

So, what does this do to your option premium? The math is straightforward.

2% Change in IV x 0.25 Vega = $0.50 Increase in Premium

The option's theoretical price is now $3.50 (the original $3.00 plus the $0.50 kick from vega). Just like that, a shift in market sentiment made the option more valuable, even if the stock price didn't budge an inch.

Scenario Two: Volatility Drops

Now, let's flip the script. What if an earnings announcement that everyone was watching turns out to be a total dud? The uncertainty vanishes, and implied volatility drops by 2%.

The calculation works the same way, just in reverse.

2% Drop in IV x 0.25 Vega = $0.50 Decrease in Premium

In this situation, the option’s new theoretical price would fall to $2.50 (the original $3.00 minus the $0.50 vega impact). This phenomenon is often called a "volatility crush," and it's something option sellers love to see, especially when they sell contracts with inflated IV.

The key takeaway here is that vega isn’t a fixed number. It’s always in flux, changing based on how much time is left until expiration and how close the option's strike price is to the current stock price. This is exactly why keeping a close eye on your positions is non-negotiable for serious traders.

What Factors Change an Option's Vega

An option's vega isn't a "set it and forget it" number. It’s always in flux, reacting to the market's ever-changing mood. Two key forces are constantly pushing and pulling on it: the amount of time left until the option expires, and how close its strike price is to the underlying stock’s current price—what traders call "moneyness."

If you want to manage your trades effectively, you have to get a handle on these two factors. They dictate just how sensitive your position is to shifts in market fear or greed and can completely change the risk-reward profile of your trade over time.

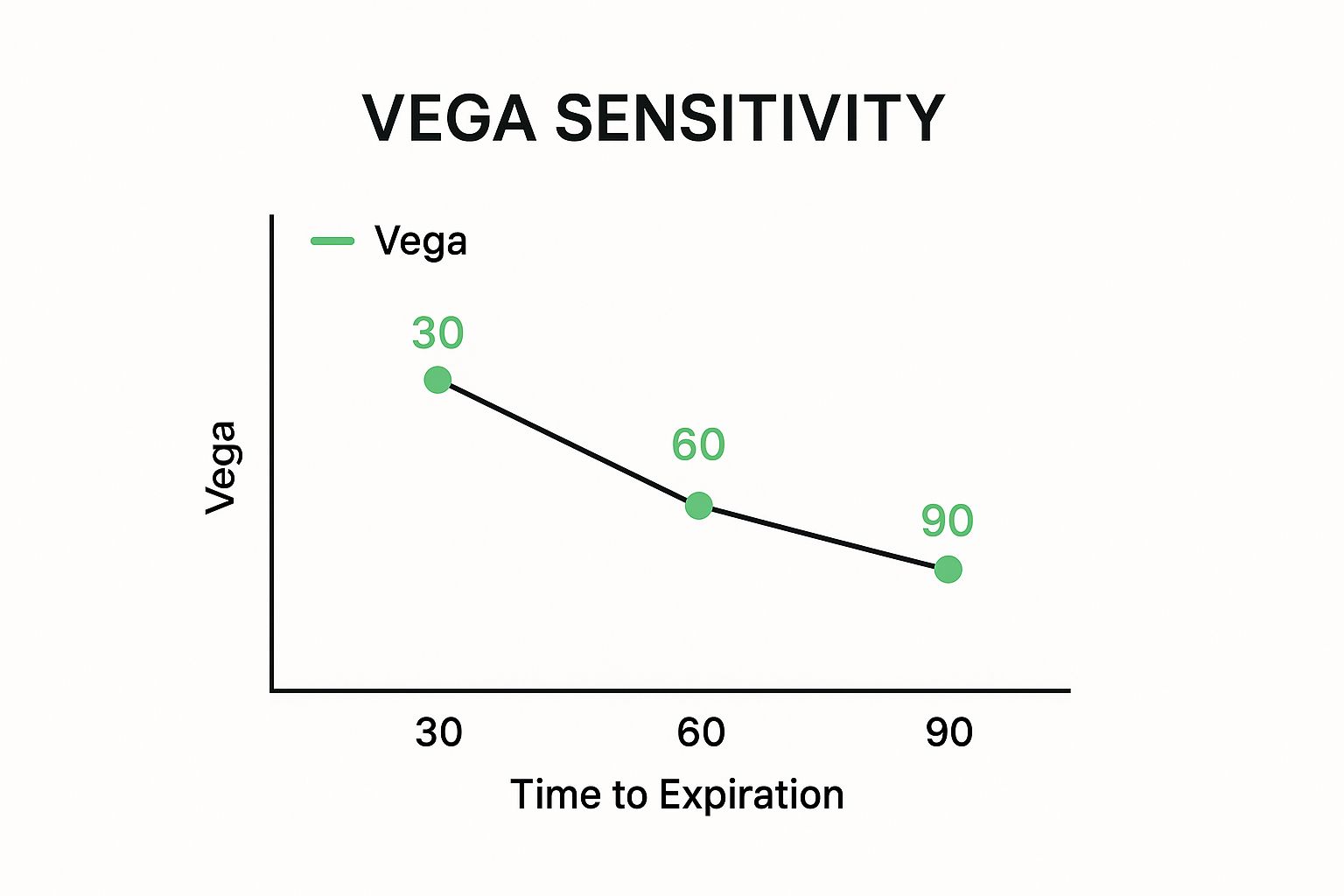

The Role of Time to Expiration

Time is probably the biggest single influence on an option's vega. The rule of thumb is pretty straightforward: the more time an option has until expiration, the higher its vega will be.

But why is that? Think of it this way: a longer time horizon just leaves more room for chaos. An option with nine months left on the clock has a ton of opportunities for a big news event, a shocking earnings report, or a sudden market downturn to send the stock price flying. All that potential for the unknown gets baked into the option's price as higher implied volatility, and vega is simply measuring the sensitivity to that potential.

On the flip side, as an option gets closer to its expiration date, its vega starts to wither away. With just a few days left, there's not much time for a dramatic event to happen. The outcome is becoming more certain, so the option's value becomes far less sensitive to changes in market sentiment.

This chart really brings the concept to life, showing how vega decays as expiration looms, assuming everything else stays constant.

As you can see, vega is at its highest for those longer-dated options and then drops off a cliff as the final trading day gets closer.

How Moneyness Impacts Vega

The second piece of the puzzle is the option's strike price relative to where the stock is trading right now. Vega always hits its peak for at-the-money (ATM) options—those where the strike price is practically the same as the current stock price.

This just makes sense when you think about it. An ATM option is balanced on a knife's edge. Its final outcome is completely up in the air. A small move in the stock could tip it into profitability (in-the-money) or leave it worthless (out-of-the-money). Because its fate is so uncertain, its price is incredibly sensitive to any shifts in implied volatility.

In contrast, options that are deep in-the-money (ITM) or way out-of-the-money (OTM) have much lower vega.

- Deep ITM Options: These contracts start acting more like the stock itself. Most of their value comes from their real, intrinsic worth, so a little change in volatility doesn't move the needle much.

- Far OTM Options: These are the long shots. The odds of them ever becoming profitable are slim, so even a huge spike in market volatility has a tiny effect on their already low price.

A great way to think about it is that vega is a measure of uncertainty. It peaks where the outcome is least certain (at-the-money) and fades away as the outcome becomes more of a sure thing (deep ITM or far OTM).

To see how this plays out, let's look at a few examples for the same stock but with different strikes and expiration dates.

How Vega Changes Across Different Strikes and Expirations

This table illustrates how both an option's time to expiration and its moneyness affect its vega.

| Option Status | Vega Value (30 Days to Expiration) | Vega Value (90 Days to Expiration) | Reasoning |

|---|---|---|---|

| Out-of-the-Money ($110 Strike) | Low (e.g., 0.12) | Moderate (e.g., 0.20) | Less sensitive, but more time allows for more potential impact from volatility. |

| At-the-Money ($100 Strike) | High (e.g., 0.25) | Very High (e.g., 0.35) | Peak sensitivity due to maximum uncertainty, amplified by a longer time horizon. |

| In-the-Money ($90 Strike) | Low (e.g., 0.12) | Moderate (e.g., 0.20) | Value is more intrinsic; less affected by volatility changes. |

Notice how the at-the-money option is the most sensitive in both timeframes, and how adding more time (from 30 to 90 days) pumps up the vega across the board.

Using Vega in Your Trading Strategies

Knowing the textbook definition of vega is one thing. Actually putting that knowledge to work is what really separates the consistently profitable traders from everyone else. For those of us selling options—think covered calls or cash-secured puts—vega isn't just a concept; it's a powerful tool for generating income.

When you sell an option, you are "short vega." This simply means you have a vested interest in seeing implied volatility go down. Why? Because a drop in IV deflates the option's premium, and that pushes your position closer to its maximum profit. This is the entire game when it comes to selling options when the market gets fearful.

Capitalizing on the "Volatility Crush"

A classic play for any short vega trader is to pounce on moments of peak uncertainty. Think about the days leading up to a big earnings report or a major Federal Reserve announcement. Implied volatility tends to swell during these times, pumping up option premiums to unusually high levels.

By selling an option right then, you're collecting that richly inflated premium. Once the event happens and the uncertainty is gone, IV almost always plummets. This sudden drop is what traders call a "volatility crush" or "vega crush," and it’s a beautiful thing to see when you’re short options. It rapidly erodes the value of the contract you sold, working directly in your favor.

The goal is simple: sell high, buy back low. By selling options when implied volatility is elevated, you're positioning yourself to profit from the inevitable return to normalcy.

For anyone using a platform like Strike Price, this strategy moves from theory to practice. The platform's real-time probability metrics can help you spot when premiums are especially fat due to high IV. This is a clear signal for a potentially great entry point on a covered call or put sale. The key is to get paid for taking on risk when the market is anxious, then let the calm that follows do the heavy lifting for you.

A More Advanced Approach: Vega-Neutral Trading

While most income traders are happy to be short vega, some advanced traders take a completely different route: they aim for neutrality. Vega-neutral trading is all about carefully constructing a portfolio of both long and short options so that your overall position is immune to changes in implied volatility.

This is a sophisticated risk management technique. By combining different options contracts, you can create a portfolio with an overall vega of zero, effectively insulating its value from IV swings. You can find more detailed information on vega-neutral strategies on IG.com.

For the average options seller, though, the main focus will almost always be managing a short vega position. The big takeaways are pretty straightforward:

- Timing is everything. Open your short option positions when IV is historically high to collect the biggest premium possible.

- Know your risk. As an option seller, a sudden, unexpected spike in volatility is your number one enemy. Always be aware of your exposure.

- Let the calendar be your friend. As an option gets closer to expiration, both time decay (theta) and a potential drop in vega can work together to benefit your short position.

By truly understanding what vega is in options and weaving that knowledge into your strategy, you can start making much sharper decisions and strategically use market sentiment to your advantage.

Putting Vega to Work: Your Pre-Trade Checklist

Before you pull the trigger on your next trade, it's worth taking a moment to run through a quick mental checklist. Thinking like a pro means moving beyond just price and direction; it's about seeing the full picture, and volatility is a huge part of that.

These questions will help you bake vega analysis into your routine, turning a potential blind spot into a strategic advantage.

Key Questions to Ask Before Every Trade

Is Volatility High or Low Right Now?

First things first, get a feel for the current environment. Check the stock's implied volatility (IV) and see how it stacks up against its own history. Selling options when IV is jacked up means you're collecting a much richer premium, which acts as a bigger buffer if the trade moves against you.Am I a Buyer or a Seller?

This is the big one. If you’re buying an option, you’re "long vega"—you want volatility to explode. If you’re selling an option, like in a covered call or cash-secured put strategy, you’re "short vega." Your ideal scenario is for volatility to calm down or collapse entirely.How Much Time is Left on the Clock?

Don't forget that time is a major factor. Vega is much higher for options with a lot of time left until expiration. Selling a contract that expires in 90 days makes your position way more sensitive to shifts in IV than selling one that expires next Friday.

Asking these three simple questions frames every trade in the context of volatility. It takes the idea of vega from a textbook definition and turns it into a practical tool you can use to make smarter, more informed decisions.

Common Questions About Vega, Answered

Even after getting the basics down, a few questions about vega tend to pop up again and again. Let's tackle them head-on to clear up any lingering confusion and help you trade with more confidence.

Can Vega Ever Be Negative?

For a single, standard call or put option you buy, vega is always a positive number. It's just how the math works—when implied volatility goes up, the option's price goes up. When IV goes down, the price goes down. Simple as that.

But here’s the important part for sellers: you can build a position with negative vega. By selling an option, like a covered call or a cash-secured put, you flip the script. You become "short vega," which means your position actually benefits when volatility drops.

How Is Vega Different from Gamma?

It's easy to get these two Greeks mixed up, but they measure completely different things. Vega is all about an option's sensitivity to changes in implied volatility. Gamma, on the other hand, measures how much an option's Delta changes as the underlying stock price moves.

Here's a simpler way to think about it:

- Vega asks: "How will my option's price change if the market's fear level changes?"

- Gamma asks: "How fast will my directional exposure change as the stock price moves?"

So, vega is about the market's mood, while gamma is about the speed of price changes.

What Is a Vega Crush After Earnings?

A "vega crush" (sometimes called a volatility crush) is a trader's term for the sudden, sharp drop in an option's implied volatility right after a big, scheduled event like an earnings report. In the days leading up to the announcement, uncertainty is sky-high, which pumps up the IV.

Once the earnings are released—good or bad—the big unknown is gone. That certainty causes implied volatility to collapse almost instantly. This "crush" vaporizes a chunk of the option's premium, which is fantastic news for option sellers who now get to buy back their short positions for much cheaper.

Ready to stop guessing and start making data-driven decisions? Strike Price provides real-time probability metrics to help you identify high-premium opportunities with the right level of risk for your strategy. Turn market volatility into your ally by finding the best moments to sell covered calls and puts. Explore your options at https://strikeprice.app.