Mastering the Break Even Price for Options Trading

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

What Is Option Vega and How It Shapes Your Trades

Discover what is option vega and how it measures sensitivity to volatility. Learn to use vega to improve your covered call and secured put strategies.

What Is A Strike Price And How Does It Drive Profit?

What is a strike price? Learn how this single number determines an option's value, profit potential, and risk in our complete guide to options trading.

A Practical Guide to Option Time Value Decay

Master option time value decay with this guide. Learn how theta impacts covered calls and secured puts, and turn time into your greatest trading ally.

Before you even think about placing an options trade, there's one number that should be front and center: your break even price.

Think of it as your personal financial safety net. It’s the exact point where a trade flips from being a potential loss to a potential profit. Honestly, getting a grip on this single metric is what separates disciplined income investors from gamblers hoping for a lucky break.

Why Your Break Even Price Is Your Financial Safety Net

This guide is all about demystifying the break even price for two of the most popular income strategies out there: covered calls and cash-secured puts. We’ll walk through a clear, step-by-step way to calculate this number so you can start making smarter, more confident trading decisions.

Mastering this concept is the most direct path I know to managing your risk and pulling consistent income from your portfolio. It’s a lot like how successful businesses are laser-focused on ensuring overall business profitability; your break even price is the key to your own financial health in the markets.

The Core Concept of Breaking Even

At its heart, the break even price is simple: it's the point of no profit, no loss. But for an options seller, the premium you collect from the buyer is more than just instant cash. It’s a powerful tool that actively shifts this break-even point in your favor.

That premium creates a buffer against the stock moving against you, giving your trade a built-in margin of safety right from the start.

This is so vital because it completely redefines your risk. Instead of needing the stock to shoot up, you often just need it to stay above (or below, for puts) your new, improved break even price.

A trader's true risk isn't just the strike price they choose; it's the break even price that premium creates. This number dictates your real exposure and is the foundation of any sound options selling strategy.

What You Will Learn

We’re going to move way beyond simple definitions to give you knowledge you can actually use. Here’s what we’ll cover:

- How to Calculate Break Evens: Simple, repeatable formulas for both covered calls and cash-secured puts. No complicated math, I promise.

- How to Apply It Strategically: Learn to use the break even price to set realistic profit targets and filter for trades that actually match your comfort level.

- How to Account for Real-World Factors: We’ll also adjust your calculations for things like commissions and dividends to get a true picture of your potential outcome.

By the end, you'll see how this single calculation can totally transform your approach to generating income with options.

What Is the Break Even Price in Options?

When you’re trading options, the break even price is the magic number—the exact stock price where a trade results in zero profit and zero loss when the contract expires. Think of it as the tipping point, that financial dividing line separating a win from a loss. For those of us selling options, this isn't just a number; it’s a core part of our strategy.

The moment you sell an option, you collect a premium. This cash immediately acts as a powerful buffer. For a covered call, it effectively lowers your cost basis on the stock you own. For a cash-secured put, it reduces the net price you'd pay if you end up buying the shares. That premium is your built-in margin of safety.

This isn't a new concept. It's been a cornerstone of options trading since exchange-traded equity options launched back in 1973. Back then, traders worked with much longer time horizons, making a deep understanding of their break even price absolutely essential. You can dig into more of the backstory on the history of options at Option Samurai.

The True Purpose of Knowing Your Break Even

Knowing your break even point does more than just satisfy your curiosity; it fundamentally changes how you see and manage risk. It transforms a trade from a hopeful guess into a calculated position with a clearly defined risk-reward profile.

Before you even think about clicking "submit" on a trade, you should know the exact price the stock needs to stay above (or below) for you to avoid a loss. That clarity is what separates disciplined, consistent traders from the rest.

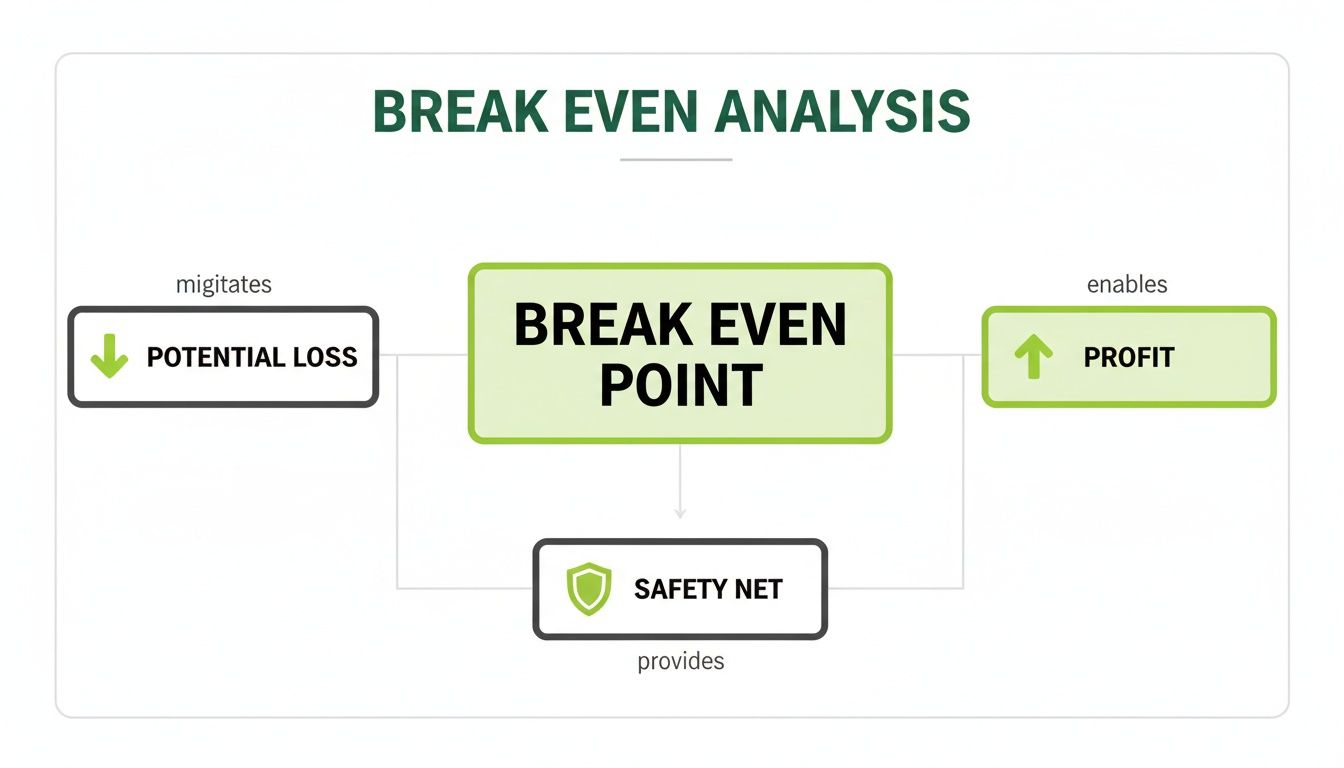

This visual captures it perfectly—the break even price is your safety net between a potential loss and a potential profit.

The premium you collect creates that buffer zone, turning a simple trade into a structured position with a clear boundary for risk.

Break Even Formulas at a Glance

Calculating your break even price is refreshingly simple. Unlike some of the more complex indicators out there, the math is direct and gives you an immediate, actionable insight into your trade’s structure. It's the first step toward taking full control of your options selling strategy.

The break even price isn't a defensive metric you check after the fact. It’s an offensive tool you use to proactively pick trades that fit your risk tolerance from the very start.

For the two most common income-focused strategies we'll be covering, the formulas are straightforward. Here's a quick reference table to keep handy.

Break Even Formulas for Options Sellers

This is a quick reference guide for calculating the break even price for the two most common income-generating options strategies.

| Strategy Type | Calculation Formula |

|---|---|

| Covered Call | Stock's Cost Basis - Premium Received = Break Even Price |

| Cash-Secured Put | Strike Price - Premium Received = Break Even Price |

These simple formulas are your foundation for managing risk. They empower you to see past the flashy premium and understand your true exposure on every single trade you make.

How to Calculate the Break Even for Covered Calls

The covered call is a classic strategy for a reason: it's a straightforward way to generate income from stocks you already own. But its success really boils down to one simple number: the break-even price. This is the figure that tells you exactly how much downside protection your premium is buying you.

Let's get right to it. The formula is refreshingly simple. You just need two things you already know: what you paid for your stock and the premium you collected for selling the call.

Break Even Price = Your Stock's Cost Basis – Premium Received Per Share

Think of this as your new, adjusted cost basis for the shares. It’s the price the stock can fall to before your total position—the stock plus the cash from the premium—starts to show an unrealized loss. Every dollar of premium you collect directly chips away at your risk.

A Real World Covered Call Example

Let’s put this into action so you can see how it works.

Imagine you own 100 shares of Microsoft (MSFT), and you bought them at an average price (your cost basis) of $400 per share.

You decide to sell one covered call contract against those shares to bring in some extra cash. You pick a call option with a $420 strike price and collect a premium of $5 per share. Since one contract covers 100 shares, you immediately get $500 deposited into your account ($5 x 100 shares).

Now, let's plug those numbers into our formula to find your break-even price:

- Start with your cost basis: $400 per share.

- Subtract the premium received: $5 per share.

- Calculate the result: $400 - $5 = $395.

Just like that, your new break-even price on MSFT is $395. This means the stock could drop from its current price all the way down to $395 before your position, including the cash you pocketed, is in the red.

That $5 premium has created a real, tangible cushion against a drop in the stock price. You've turned a static holding into an income-producing asset with a built-in margin of safety.

Why This Calculation Matters

This simple math is powerful because it completely reframes how you look at your investment. You're no longer just a passive shareholder hoping the stock only goes up. You've actively taken a step to reduce your risk and build a buffer against minor market pullbacks.

This proactive mindset is at the heart of consistent options selling. To see how this plays out in different situations, take a look at our guide with more covered calls examples.

Knowing your break-even point gives you the confidence of knowing exactly how much breathing room a trade has before it turns against you. It's the first, and most important, step in managing your risk like a pro.

How to Calculate the Break Even for Cash Secured Puts

Let's shift gears and apply this same logic to another fantastic income strategy: the cash-secured put. This one is a favorite for traders who already want to buy a stock but are happy to get it at a discount.

When you sell a put, you're essentially agreeing to buy 100 shares at a certain strike price if the stock drops. For taking on that obligation, you get paid a premium right away.

The break-even calculation here is just as simple, but it’s powerful. It reveals the true price you’d end up paying for the shares if they get assigned to you.

Break Even Price = Strike Price of the Put – Premium Received Per Share

This formula tells you your effective cost basis. It’s not just the strike price; it’s the strike price minus the cash you collected upfront. That premium gives you an immediate, built-in discount on your potential purchase.

A Practical Cash Secured Put Example

Let's say you've been watching the SPDR S&P 500 ETF (SPY) and you'd love to own 100 shares. But you think its current market price of $500 is a bit rich. This is the perfect setup for a cash-secured put.

You decide to sell one put option contract with a $490 strike price. For doing this, you collect a premium of $6 per share, which means $600 ($6 x 100 shares) lands in your account instantly.

Now, let's nail down your break-even point:

- Start with the strike price: $490 per share.

- Subtract the premium you received: $6 per share.

- Calculate your true entry point: $490 - $6 = $484.

Your break-even price is $484. If SPY drops below $490 and you get assigned the shares, your actual cost isn't $490. Thanks to that premium, your cost basis is really $484 per share. You've just engineered a better entry price for yourself.

Getting comfortable with these numbers is everything. Using a dedicated cash-secured put calculator can make it much faster to model different scenarios before you commit.

Why This Number Is So Powerful

This approach puts you in the driver's seat. You’re not just reacting to the market; you're setting your own terms.

For example, if you sell a put on a $50 stock with a $48 strike and collect a $1.50 premium, your break-even is $46.50. That premium acts as a buffer. During the 2020 market crash, traders who didn’t understand their break-even points faced massive losses. Those whose premiums created a solid cushion, however, were able to ride out the storm and thrive on the rebound.

Knowing your break-even ensures you're comfortable owning the stock at a level that already has a discount baked in. It turns market volatility from a threat into a strategic advantage.

How Real-World Factors Affect Your Break Even

The basic formulas give you a clean, essential starting point. But let's be honest—real-world trading isn't that neat and tidy. A few sneaky factors can shift your true break-even price, and knowing how to account for them is what separates the pros from the amateurs.

Think of it like running a small business. You have to track every little expense, right? Ignoring these details means your safety net isn't as strong as you think it is. The two most common culprits that will mess with your numbers are trading commissions and corporate actions like dividends.

Factoring in Commissions and Fees

Every trade costs something. While many brokers now offer commission-free stock trading, options contracts usually still carry small fees, typically between $0.50 and $0.65 per contract. It might not sound like much, but it directly eats into the net premium you collect.

Let's jump back to our covered call example. You sold a call for a $5.00 premium, bringing in $500. But if your broker charges a $0.65 commission to open the trade and another $0.65 if it expires worthless, your total round-trip cost is $1.30.

This shrinks your net premium from $500 down to $498.70, which works out to $4.987 per share. A small change, but a change nonetheless.

Adjusted Break Even = Cost Basis – (Premium Received – Commissions Per Share)

$400 – $4.987 = $395.013

Your true break-even price just crept a little bit higher. On a single trade, it's a minor adjustment. But stretch that out over hundreds of trades a year, and those fees really start to add up. You have to track them to get a real picture of your performance.

The Impact of Dividends and Early Assignment

Dividends throw another interesting wrinkle into the mix, especially if you're selling covered calls. When a stock is about to pay a dividend, you'll often see call option premiums get a little juicier. Why? Because buyers are willing to pay more for the chance to own the stock and pocket that upcoming dividend payment.

This can look like a fantastic opportunity to collect a bigger premium. The catch? It also dramatically increases your risk of early assignment. A call buyer might decide to exercise their option right before the ex-dividend date, forcing you to sell your shares so they can collect the dividend instead of you.

If your call gets assigned early:

- You’re forced to sell your shares at the strike price.

- You completely miss out on the dividend payment.

- You also lose whatever time value was left in the option.

This completely flips the script on your trade's outcome. What started as a simple income play can quickly turn into a missed opportunity. This dance between dividends and premiums is exactly why a solid grasp of option time decay is so critical for sellers.

Bottom line: Always, always be aware of ex-dividend dates when you’re selling calls on dividend-paying stocks.

Using Your Break Even to Make Smarter Trades

This is where the break even price stops being just a number and becomes a powerful part of your trading strategy. Instead of just taking whatever premium the market is offering, you can flip the script and work backward. It’s a proactive approach that completely changes how you find and select your trades.

Start by setting your own rules. Before you even look at an options chain, decide on the risk you're willing to take for a specific trade. For a covered call, maybe you decide you’re comfortable with the stock dropping 7% before your position is in the red.

Setting Your Own Terms

With that 7% risk level locked in, your mission is simple: hunt for a contract that gets you there. You’ll scan the options chain looking for a strike price and premium that, when combined, lower your break even price to that exact downside buffer you need.

This method puts you in the driver’s seat. You’re no longer just a price-taker, passively accepting what’s available. You're actively filtering the entire market for opportunities that fit your risk tolerance and income goals perfectly.

Mastering the break even price isn't just about math; it's about turning options selling into a calculated, repeatable process for building your portfolio on your own terms.

This is what separates consistently profitable options sellers from those just reacting to the market's noise. By leading with your break even, you make sure every single trade you enter is one you’re genuinely comfortable with from the start. And as your options skills grow, understanding the fundamentals of how to invest in US stocks provides a solid foundation for your entire portfolio.

From Reactive to Proactive Trading

It sounds like a small shift in thinking, but the impact is huge. It forces you to operate like a business owner, carefully managing your risk on every transaction.

- You define the risk first. Instead of asking what premium you can get, you decide what risk you’ll accept.

- You hunt for the right premium. Your job is to find the option that pays you enough to create your desired safety net.

- You trade with confidence. Any trade you enter this way has already been pre-qualified to fit your personal financial plan.

Frequently Asked Questions

When you're first getting the hang of selling options, a few common questions always seem to pop up. Let's tackle them head-on, because getting these concepts straight from the start is what builds the confidence to trade effectively.

Is My Break Even Price a Guarantee?

Nope. Think of your break even price as a signpost, not a guarantee. It's a static number calculated the moment you enter the trade, showing you the exact stock price where you'll be flat — no profit, no loss — at expiration.

But remember, the market doesn't stand still. The value of your option contract is constantly changing before its expiration date. This means you can often close a trade for a profit even if the stock hasn't reached your break even point, simply because there's enough time value left in the option.

What if the Stock Goes Way Below My Break Even?

If the stock takes a nosedive far below your break even, your position will show an unrealized loss. For a covered call, it means the drop in your share value is bigger than the premium you pocketed.

For a cash-secured put, if the stock is below your break even when the contract expires, you'll be assigned the shares. The bright side? Your effective cost for those shares will be lower than what someone would pay buying them on the open market that day, thanks to the premium you collected.

Your break even price is your main risk benchmark. It pinpoints the exact spot on the chart where a trade starts to eat into your initial capital, letting you set smart alerts and manage the position before things go wrong.

Can My Break Even Price Change After I Place the Trade?

Yes, and this is a big one that trips up a lot of new traders. Your initial break even price isn't set in stone. Several actions can shift it:

- Rolling the Option: When you "roll" an option to a later expiration date for a net credit, that extra cash you collect pushes your break even point even lower.

- Commissions: As we mentioned earlier, transaction fees eat into your net premium, which nudges your break even price up slightly.

- Dividends: If you're holding a covered call and collect a dividend, that income effectively lowers your cost basis on the stock, which in turn improves your overall break even.

Keeping track of these moving parts is the key to knowing your true performance over the life of a trade.

Ready to stop guessing and start making data-driven decisions? Strike Price gives you the real-time probability metrics and smart alerts you need to master your break even price and turn options selling into a consistent income stream. Find your edge today at https://strikeprice.app.