A Practical Guide to Option Time Value Decay

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

Option time value decay, known as theta, is the quiet force that consistently puts money in the pockets of option sellers.

Think of it like a melting ice cube. Every single day, a small piece of an option's value disappears into thin air, regardless of what the stock price does. This steady, predictable decline is precisely what makes income strategies like covered calls and secured puts so powerful.

The Quiet Force That Earns You Income

At its core, option time value decay is what gives option sellers a built-in edge. While buyers need the stock to move their way—and fast—sellers have a much simpler ally: the clock. Every tick works in your favor, making the options you sold a little less valuable and bringing you closer to pocketing the full premium.

To really get this, you need to understand what an option's price is actually made of. It isn’t just one number; it’s a combination of two very different parts. Grasping this distinction is the first step to seeing why time decay is an income trader's best friend.

An Option's Two Core Components

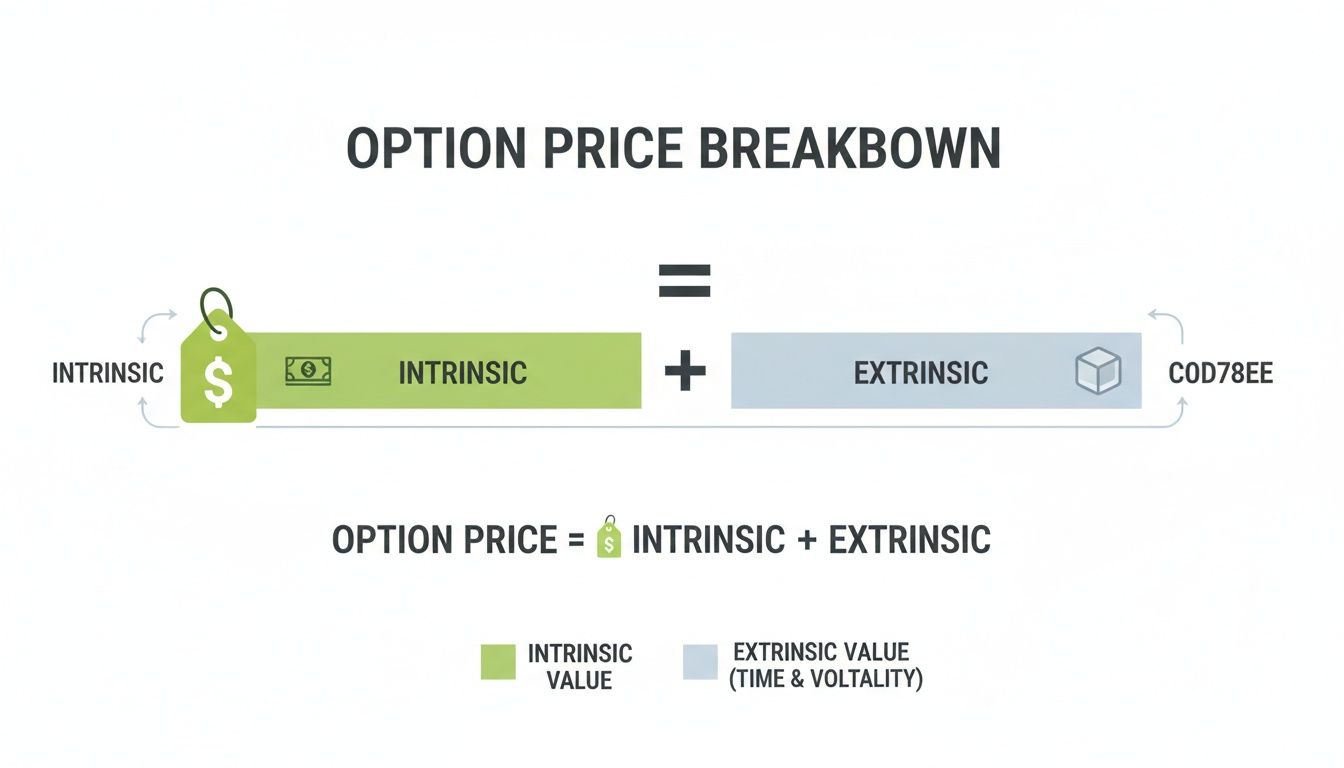

An option’s total price, or premium, is built from two key ingredients: its intrinsic value and its extrinsic value.

Intrinsic value is the real, tangible value an option would have if you exercised it right this second. Extrinsic value is everything else—it's the "hope" or "potential" that buyers are willing to pay for. It’s the premium for time, volatility, and the possibility of a future profit.

Time decay does not touch an option’s intrinsic value. It exclusively eats away at the extrinsic value—the very portion that option sellers aim to capture as income.

This is a critical point. When you sell an option, you are primarily selling that blob of extrinsic value. Time decay is the natural process that converts that value into your profit, day by day, as long as the stock behaves.

Option Premium at a Glance: Intrinsic vs Extrinsic Value

The table below breaks down these two components to make it crystal clear what part of the option premium is actually melting away.

| Component | What It Represents | Affected by Time Decay? | Example |

|---|---|---|---|

| Intrinsic Value | The "real" or tangible value an option holds if exercised right now. | No | A call with a $45 strike is worth at least $5 if the stock is trading at $50. |

| Extrinsic Value | The "potential" or "hope" value based on time and volatility. | Yes | The extra premium paid above the intrinsic value, which decays daily. |

This separation is everything. That daily process of option time value decay is what turns the extrinsic value you sold into realized cash in your account, assuming the stock price doesn't make a big, unexpected move against you.

For a deeper dive into this key component, you can learn more about how extrinsic option value is calculated and what drives it. Understanding this dynamic is the foundation for building a consistent income stream from selling options.

The Two Ingredients of an Option's Price

Every option’s price—its premium—is a mix of two distinct parts. Getting a handle on this split is the first step to understanding how option time value decay works and why it’s such a powerful force for income-focused traders. The two ingredients are intrinsic value and extrinsic value.

Think of intrinsic value as the option's "real" or "cash-in-hand" worth. It’s the concrete value you'd get if you exercised the option this very second. If an option has no immediate, exercisable value, its intrinsic value is zero. It’s a simple, black-and-white calculation.

Extrinsic value, on the other hand, is the fuzzier part of the premium. It represents the "hope" or "potential" that the option will gain value before it expires. Buyers are willing to pay this extra amount for the remaining time and the possibility of a big price swing in their favor.

Intrinsic Value The Solid Foundation

Intrinsic value is just the amount an option is in-the-money. It's a hard number that isn't swayed by time, volatility, or market sentiment.

Here’s how to spot it in seconds:

- For a Call Option: Intrinsic value only exists if the stock’s current price is above the strike price. It’s simply the difference between the stock price and the strike price.

- For a Put Option: Intrinsic value only exists if the stock’s current price is below the strike price. It’s the difference between the strike price and the stock price.

If an option is out-of-the-money or at-the-money, its intrinsic value is $0. This part of the premium is locked in by the stock's current price and does not decay over time.

Extrinsic Value The Melting Premium

Extrinsic value is everything else in an option's premium. It's the part that is completely exposed to time decay, and as an option seller, it’s the component you’re most interested in. When you sell a covered call or a secured put, you are essentially selling this chunk of "hope" to a buyer.

The crucial takeaway is this: time decay exclusively erodes extrinsic value. As a seller, your goal is to watch this component shrink day by day, ultimately converting the premium you collected into realized profit.

Let’s run through a quick example to make this crystal clear.

Example A Covered Call

Imagine you own 100 shares of XYZ stock, currently trading at $52 per share. You decide to sell a covered call with a $55 strike price that expires in 30 days. For this, you collect a premium of $2.00 per share ($200 total).

Let’s break down that $2.00 premium:

- Intrinsic Value: The stock price ($52) is below the strike price ($55), so this call is out-of-the-money. Its intrinsic value is $0.

- Extrinsic Value: The entire $2.00 premium is pure extrinsic value. This is the amount a buyer is paying for the chance that XYZ rallies past $55 in the next 30 days.

As the seller, your job is to let time decay do its work, eroding this $2.00 of extrinsic value down to nothing so you can keep the $200 premium. This simple concept is the engine behind generating consistent income. For a complete picture of how premiums are priced, our guide on the valuation of options digs much deeper.

Understanding the Time Decay Curve

The erosion of an option's extrinsic value doesn't happen in a straight line. Think of it less like a steady, predictable drip and more like a slippery slope that gets steeper and faster the closer you get to the bottom. This non-linear pattern is the time decay curve, and it's a concept every option seller needs to master.

For options with plenty of time left on the clock, say 90 days or more, the extrinsic value barely budges from one day to the next. The clock is definitely ticking, but the decay is slow and gentle. But as the expiration date gets closer, that slow trickle turns into a torrent.

The Acceleration of Time Decay

The rate of decay really picks up steam in the final 30 to 45 days of an option's life. Many traders call this the "sweet spot" for selling covered calls and secured puts. During this window, you capture the most value from time decay in the shortest amount of time, which is exactly why so many income-focused traders sell shorter-dated contracts.

To see how this works, imagine selling a 90-day option:

- Days 90 to 60: The option might lose only a tiny fraction of its extrinsic value. Time decay is minimal.

- Days 60 to 30: The decay starts to pick up speed, becoming more noticeable each week.

- Days 30 to Expiration: This is where the magic happens for sellers. The option's time value begins to plummet, losing a significant chunk of its worth each day.

This infographic breaks down how an option's price is built, with the extrinsic value being the "ice cube" portion that melts away.

As you can see, the option's total price is a mix of its solid intrinsic value and its melting extrinsic value—the part that time decay targets.

Quantifying the Decay Curve

This accelerated erosion isn't just a theory; it's a measurable phenomenon backed by real market data. Historical analysis of index options like SPX and SPY consistently shows that an option's extrinsic value erodes slowly at first, then much faster in its final month.

For example, a 30-day at-the-money call with a Theta of −0.05 and a $3.00 premium is expected to lose about $0.05 every day. That's a daily value loss of 1.7%, which can lead to a 50% drop in time value over just one month, assuming the stock price and volatility stay put.

The key takeaway is simple but powerful: an option loses roughly one-third of its time value in the first half of its life and the remaining two-thirds in the second half.

This decay is quantified by Theta, one of the core metrics known as the "Greeks." Theta measures how much an option is expected to lose in dollar value each day simply from the passage of time. As an option gets closer to expiration, its Theta value increases, signaling a faster rate of decay.

For a deeper look at how Theta works with the other key metrics, check out our complete guide to the option trading Greeks. By understanding this curve, sellers can position themselves to profit from this predictable decline, turning time itself into a reliable source of income.

Forces That Influence the Speed of Decay

While the calendar is the main engine driving option time value decay, it’s not the only thing at play. The speed at which your option premium disappears is a dynamic process, influenced by a few key market forces.

Understanding these drivers is the difference between passively watching the clock and actively picking contracts that fit your income goals and risk tolerance. Three big factors control how fast that decay happens: the time left until expiration, implied volatility, and the option's moneyness.

The Role of Implied Volatility

Think of implied volatility (IV) as an "inflator" for an option's extrinsic value. It’s the market’s best guess on how much a stock’s price will swing in the future.

When IV is high, it pumps up the premium because there's a greater perceived chance of a big price move. For sellers, this is great news—it creates a much larger pool of extrinsic value to capture as time passes. But it's a trade-off. High IV also signals higher risk. A stock with high IV is expected to be more erratic, which boosts the odds of a sharp move against your position.

High implied volatility acts like a balloon, inflating an option's extrinsic value. This gives sellers more premium to collect but also means the balloon is more susceptible to popping if the stock makes a sudden, unexpected move.

On the flip side, when IV is low, options carry less extrinsic value. You'll collect smaller premiums, but the underlying stock is generally expected to be more stable, making it a lower-risk, lower-reward play.

How Moneyness Shapes the Decay Rate

The option's "moneyness"—where the strike price sits relative to the stock price—is arguably the most critical factor in determining how much dollar value is lost to decay. It dictates just how much extrinsic value an option holds in the first place.

Here’s how it breaks down:

- At-the-Money (ATM) Options: These options, where the strike is right next to the stock price, are packed with the maximum amount of extrinsic value. Because of this, they lose the most money to time decay each day.

- Out-of-the-Money (OTM) Options: These options are pure extrinsic value. While they decay to zero if they stay OTM, the total dollar amount lost each day is smaller than for ATM options because their starting premium is lower.

- In-the-Money (ITM) Options: These are a mix of intrinsic and extrinsic value. The deeper in-the-money an option gets, the less extrinsic value it has, which means it decays much more slowly.

An Illustrative Example

Let's make this real. Imagine stock XYZ is trading at $100 a share. We’ll compare three call options that all expire in 30 days:

| Strike Price | Moneyness | Extrinsic Value (Example) | Daily Theta (Decay) |

|---|---|---|---|

| $100 | At-the-Money | $4.00 | -0.12 |

| $105 | Out-of-the-Money | $1.50 | -0.07 |

| $95 | In-the-Money | $2.00 | -0.08 |

As you can see, the $100 ATM call has the most extrinsic value to lose and the highest Theta. It bleeds $0.12 per day just from the clock ticking. The OTM and ITM options have less extrinsic value on the table, so their daily decay is slower.

For sellers looking to maximize their income from option time value decay, at-the-money strikes offer the most premium to harvest. This shows that theta isn’t just about time—it’s a dynamic force you can strategically influence through smart strike selection.

Making Time Decay Your Greatest Ally

So far, we’ve talked about option time value decay as this unstoppable force, almost like gravity. But it's time to flip that script. For option sellers, time decay isn't something that just happens to you—it’s an active source of income. You can learn to make this predictable erosion your best friend in the market.

While option buyers are in a constant race against the clock, sellers get to sit back and watch it work for them. Every tick of that clock can translate directly into profit. This gives anyone selling covered calls or secured puts a massive structural advantage.

Theta: The Seller's Paycheck

In the world of options, this daily profit has a name: Theta. For an option buyer, Theta is a negative number—a small loss each day. But when you're the seller, that Theta turns positive. It represents how much premium you can expect to pocket every single day, assuming the stock price and volatility don’t change.

This isn’t just a hunch; it’s baked into the math. The famous Black–Scholes model, a cornerstone of options pricing, identifies Theta as the specific rate an option’s price should fall daily. As a seller, you are always on the "positive Theta" side of the trade, benefiting as the extrinsic value you sold melts away. You can get more great insights on how Theta puts sellers at an advantage at tastylive.com.

Generating Income with Covered Calls

Let's see this in action. Say you own 100 shares of ABC stock, currently trading at $48. You think the stock will probably hover around this price or maybe creep up a little over the next month. You can sell a covered call to generate some income while you wait.

You pick a contract with these details:

- Strategy: Sell one covered call contract

- Strike Price: $50 (out-of-the-money)

- Expiration: 30 days

- Premium Collected: $1.50 per share ($150 total)

- Theta: +0.04 (meaning you earn approx. $4 per day)

You just collected $150 upfront. Now, your goal is for ABC to stay below $50 by expiration. If it does, the option expires worthless, you keep the full $150, and that $4 per day you earned from Theta is now realized profit. You literally got paid to wait.

Acquiring Stock at a Discount with Secured Puts

Time decay is just as powerful when you're selling secured puts. Let’s imagine you want to buy 100 shares of XYZ, which is trading at $102. You like the stock, but you'd love it even more at $100.

A secured put lets you either buy the stock at your target price or get paid for your patience.

- Strategy: Sell one cash-secured put contract

- Strike Price: $100 (out-of-the-money)

- Expiration: 30 days

- Premium Collected: $2.00 per share ($200 total)

- Theta: +0.06 (meaning you earn approx. $6 per day)

Selling an option isn't just a trade; it's a transaction where you are explicitly selling time. The premium you collect is the payment you receive for taking on the obligation until a specific date.

If XYZ stays above $100, the option expires worthless. You keep the $200 premium, having earned $6 per day from time decay alone. If the stock drops below $100, you get to buy the 100 shares at your target price of $100. But because you kept the $200 premium, your real cost basis is just $98 per share.

In both of these classic strategies, option time value decay is the engine driving your returns. It turns the simple, unstoppable passage of time into a reliable income stream.

Turning Theory into Profit with Smarter Tools

Knowing the theory behind option time value decay is one thing. Actually turning that knowledge into consistent income? That's a whole different ballgame.

This is where the right tools come in, bridging the gap between textbook concepts and a real-world, data-driven strategy. Instead of guessing, you can use real-time analytics to make smarter, more confident decisions.

Platforms like Strike Price are built for exactly this. They help you stop just knowing about theta and start actively harvesting it. With real-time probability metrics, you can see the statistical likelihood of a contract expiring out-of-the-money at a glance. It's all about balancing your desire for a fat premium with a level of risk you can actually sleep with at night.

From Manual Scans to Smart Alerts

Let's be honest, manually hunting for the perfect covered call or secured put is a grind. You’re juggling strike prices, expiration dates, and implied volatility levels, all while the market is changing by the second.

Smart tools flip that script.

You just set your criteria one time, things like:

- Your Income Target: Tell it the minimum premium you want to collect.

- Your Safety Threshold: Set a probability of success you're comfortable with, like an 85% chance of expiring OTM.

- Your Timeframe: Focus only on contracts in that 30-45 day sweet spot where decay really kicks in.

The platform does all the heavy lifting from there, sending you smart alerts when it finds a contract that checks all your boxes. You spend less time searching and more time executing high-probability trades. To stay on top of the firehose of market information, many traders also use resources like an AI summary of articles for smarter reading.

Capitalizing on Accelerated Decay

This data-driven approach is especially powerful when it comes to capturing accelerated decay.

Think about ultra-short-dated contracts, like 0DTEs (zero-days-to-expiration). They're an extreme, intra-day version of time decay. A 0DTE spread that might trade for $1.50 late in the morning can easily lose 50–70% of its remaining value in the last couple of hours if the stock price just stays put.

For income sellers using tools with real-time analytics, this isn't just noise—it's a clear opportunity you can monitor and harvest with precision.

By leaning on real-time probability and Theta metrics, traders can turn the predictable nature of option time value decay from a market principle into a consistent, measurable source of income.

Ultimately, these tools help you build a system. You stop making isolated, one-off trades and start running a consistent, rule-based income strategy—all while keeping a firm grip on your risk.

Frequently Asked Questions

Even after you get the hang of it, some questions always pop up when putting time decay to work. Let's tackle a few of the most common ones to sharpen your understanding.

Does Time Decay Stop When the Market Is Closed?

Nope. Time decay is the one thing in the market that never sleeps. It works every single calendar day — weekends and holidays included.

This is a huge edge for option sellers. An option’s extrinsic value is almost always lower on Monday morning than it was on Friday afternoon, all else being equal. You’re essentially collecting premium for two "free" days of decay over the weekend. It's a quiet, powerful force working in your favor.

How Do I Find Options with the Best Time Decay?

The "best" time decay really depends on what you're trying to accomplish. At-the-money (ATM) options usually have the most extrinsic value, which means they decay the fastest in raw dollar terms. They offer the biggest paycheck for sellers.

But there's a catch. They also carry the highest risk of being assigned because the stock price is sitting right there at your strike. Out-of-the-money (OTM) options have a slower decay but a much better chance of expiring worthless, making them a safer play for a smaller premium.

The sweet spot is finding the right balance between grabbing premium and managing your risk. Smart platforms solve this by showing you the real, data-driven probability for each strike, so you can find the trade-off that fits your comfort zone.

Can I Still Lose Money Selling Options, Even with Time Decay?

Absolutely. Time decay is a strong tailwind, but it's no guarantee of a winning trade. A sharp, sudden move against your position can easily wipe out any gains you’ve made from theta decay.

If you’re selling a covered call, that risk is the stock price tanking. If you're selling a secured put, the danger is the stock dropping far below your strike, forcing you to buy shares for much more than they're currently worth.

This is exactly why risk management is everything. Success here isn't just about collecting premium; it’s built on a few key pillars:

- Picking high-probability strikes to put the odds on your side from day one.

- Actively managing your positions, not just setting and forgetting them.

- Understanding that time decay is your friend, but it can't save you from a bad trade.

When you combine the built-in advantage of time decay with smart trade selection and disciplined risk management, you have a repeatable recipe for generating consistent income.

Ready to stop guessing and start making data-driven decisions? Strike Price provides real-time probability metrics and smart alerts to help you consistently monetize option time value decay while managing your risk. Discover a smarter way to sell options at https://strikeprice.app.