Out of Money Call Options A Guide to Consistent Income

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

How to Trade Stock Options for Steady Weekly Income

Learn how to trade stock options with a simple, data-driven approach. This guide covers covered calls, puts, and risk management for consistent income.

An out of money (OTM) call option is a contract that gives you the right to buy a stock at a specific price (the strike price) that’s higher than where the stock is currently trading.

Think of it like holding a coupon for a future discount. The coupon only becomes valuable if the item’s price skyrockets past your coupon's value before it expires. Until then, it's just a piece of paper with potential.

What an Out of Money Call Option Really Means

To really get a feel for out-of-money calls, you have to understand their role in the broader stock market dynamics. At its heart, every options trade is a two-sided bet, with a buyer and a seller seeing the future differently. This is crystal clear with OTM calls.

The Buyer’s Perspective: The Hopeful Bet

For the buyer, an OTM call is pure speculation. They pay a small fee, called the premium, for the chance to control 100 shares of stock without having to buy them outright.

Their goal is straightforward: they need the stock price to climb—and not just a little. It has to surge past the strike price and cover the premium they paid just to break even. Anything above that is profit.

Imagine a stock is trading at $50. A buyer might snag a call option with a $55 strike price. It's an out-of-money call because $55 is higher than the current $50 price. They're betting the stock will soar past $55 before the option expires, turning their cheap bet into a big win.

The Seller’s Perspective: The Strategic Income Play

This guide is all about the other side of that trade—the seller. When you sell an OTM call, you’re taking the opposite stance. You collect that premium from the buyer right away as instant income.

Your bet is that the stock price will not reach the strike price by expiration. Simple as that.

When the option expires worthless, the seller keeps 100% of the premium. This strategy transforms options from a speculative gamble into a method for generating consistent, high-probability income.

This approach isn't about hitting home runs; it's about playing the odds. And the data shows the odds are heavily in the seller's favor.

Most out-of-money calls are just hopeful wagers that never pan out. CBOE data from 2019-2025 shows OTM calls expired worthless in approximately 75% of cases across millions of contracts. This makes selling them a surprisingly reliable income generator, while buyers are left fighting an uphill battle. You can dig into more of these historical options insights at spiderrock.net.

By selling these contracts, you position yourself to profit from the most common scenarios: the stock stays flat, goes down, or even rises a bit—as long as it stays below your chosen strike price.

Why Sellers Have a Statistical Advantage

When you sell an out of money call option, you're not trying to predict the future. You're playing the odds. Think of it like running an insurance company—you’re aligning yourself with the most probable outcomes, which is a powerful shift in mindset.

This gives you a built-in statistical edge over buyers. Two relentless forces work in your favor every single day: time decay and probability. Understanding how these stack the deck for you is the secret to turning options from a gamble into a consistent income generator.

The Power of Time Decay (Theta)

Picture an option's value as a melting ice cube. The moment you sell that call and collect the premium, the ice cube starts shrinking. Every day that passes, a little piece of its value melts away, no matter what the stock does.

This is time decay, or theta. For the buyer, it’s a constant headwind. For you, the seller, it's a direct tailwind. You want that ice cube to melt completely so you can pocket the entire premium.

As the expiration date gets closer, this decay speeds up. The final week of an option's life is when theta really works its magic, rapidly eroding whatever value is left. Time is your greatest ally.

Playing the Probabilities

The second part of your edge is pure math. An out-of-money call option has a strike price higher than the current stock price. For the buyer to make money, the stock has to climb all the way to that strike and then keep going to cover the premium they paid.

That’s a big move in a limited amount of time. It happens, but it’s the exception, not the rule. Far more often, the stock will:

- Go down.

- Stay flat.

- Go up, but not enough to reach your strike price.

In all three of those highly likely scenarios, the option expires worthless. You, the seller, keep 100% of the premium. You win by betting on the most common market behaviors.

By selling out of money call options, you are essentially selling a low-probability event to a speculator. Your profit comes from the high likelihood that their long-shot bet won't pay off by the expiration date.

The numbers don't lie. Historical CBOE data shows that sellers capture premiums in 70-85% of instances. For covered call sellers, this translates into real-world results. Users often report 15-25% annualized yields by flagging strikes where the probability of being assigned remains low.

Quantifying Your Edge

You don't have to guess. Modern trading platforms show you the data-driven probability of an option expiring worthless before you ever place a trade.

Metrics like delta are a great shortcut. An OTM call with a 0.20 delta has roughly a 20% chance of expiring in-the-money and an 80% chance of expiring worthless. This turns an emotional decision into a calculated one based on your personal risk tolerance. You can dive deeper into how these numbers work by checking out our guide on the probability of profit in options.

This statistical foundation is what makes selling OTM calls so powerful. You aren't looking for a needle in a haystack; you’re betting on the entire haystack.

Getting Paid: Proven Strategies for Selling OTM Calls

Alright, we've talked about the statistical edge sellers have. Now, let's put that theory into practice. Selling out-of-the-money call options isn't just an academic exercise; it's the engine behind some of the most reliable income-generating strategies out there. These are repeatable methods traders use month after month to collect premium while keeping a lid on risk.

The most common starting point—and for good reason—is the covered call. It's a favorite for income investors because it's straightforward and builds on an asset you probably already have in your portfolio. Let's dig into how it works in the real world, along with a few other powerful techniques.

The Covered Call: Your Portfolio's Income Engine

The covered call is the cornerstone strategy for anyone selling OTM calls. The "covered" part is what makes it so accessible: it simply means you own at least 100 shares of the stock for every call option you sell. Those shares are your collateral, your built-in safety net. If you get assigned, you already have the shares ready to deliver.

It really boils down to three simple steps:

- Own the Shares: Start with at least 100 shares of a stock you're happy to hold for the long haul.

- Sell the Call: Sell one OTM call option contract against those shares.

- Collect the Cash: The premium hits your account instantly. It's yours to keep.

Your goal is for the stock to stay below your strike price until expiration day. If it does, the option expires worthless. You keep the entire premium and—just as important—you keep your 100 shares. Then you can turn around and do it all over again for the next month.

The beauty of the covered call is that it serves two purposes at once. You're generating a steady stream of cash from stocks you already own, and each premium you collect effectively lowers your cost basis over time.

Think about it like this: You own 100 shares of XYZ Corp., which is trading at $45. You sell a call option with a $50 strike price that expires in 30 days and collect $1.00 per share, or $100 total. If XYZ just hangs out below $50 for the next month, that $100 is pure profit, and you're still holding your shares, ready to sell another call.

The Cash-Secured Put: A Bullish Way In

While we're focused on calls, I have to mention a sister strategy for bullish traders: the cash-secured put. Instead of selling a call on a stock you own, you sell an OTM put on a stock you want to own, but at a better price.

A put option gives the buyer the right to sell stock at a certain price. So when you sell a put, you're agreeing to buy the stock at your chosen strike if the price drops. To make this trade, you must have enough cash set aside to buy the 100 shares if you're assigned—that's the "cash-secured" part.

This strategy sets you up for one of two great outcomes:

- Scenario 1: The Stock Stays Above Your Strike. The put expires worthless. You keep the entire premium and didn't have to buy the stock. You literally got paid to wait for a dip that never came.

- Scenario 2: The Stock Drops Below Your Strike. You get assigned and have to buy the 100 shares at the strike price. But think about it—you're buying a stock you wanted anyway, and at a discount to where it was trading. Plus, the premium you collected makes your effective purchase price even lower.

It's a fantastic way to either generate income or get into a stock you believe in at a price you set.

Using Spreads to Define Your Risk

What if you don't own 100 shares of the underlying stock? Selling a "naked" or uncovered call is incredibly risky because your potential loss is theoretically unlimited. A much smarter approach is to use a credit spread.

With a call credit spread, you sell an OTM call option and, in the same trade, buy another call option even further out of the money.

The premium you get from the call you sold will be more than the premium you pay for the call you bought, so you collect a net credit. This structure puts a hard cap on both your maximum profit (the net credit) and your maximum loss right from the start. It gives you a built-in safety net, allowing you to profit from time decay and probability without the terrifying risk of a naked call.

How to Choose the Right Strike Price

Picking the right strike price is the single most important decision you'll make when selling an out-of-money call option. It's a classic balancing act.

Go too close to the current stock price, and you’ll pocket a nice, fat premium—but you run a high risk of having your shares called away. Go too far out, and the premium you collect might not even be worth the effort.

This is where we move from guesswork to a data-driven strategy. You don't have to guess. Instead, you can lean on a couple of key metrics to find that sweet spot that lines up with your income goals and what you’re willing to risk.

The two most important tools for this job are an option's Delta and the stock's Implied Volatility (IV). Nailing these two concepts will shift your approach from a hopeful bet to a calculated business decision, putting the odds back in your favor.

Using Delta to Estimate Probability

Think of Delta as your quick-and-dirty probability gauge. While its technical job is to measure how much an option's price changes for every $1 move in the stock, it doubles as a pretty solid estimate of an option's chances of expiring in-the-money.

For anyone selling OTM calls, this is pure gold.

- A call option with a 0.30 Delta has roughly a 30% chance of finishing in-the-money (and a 70% chance of expiring worthless).

- A call with a 0.15 Delta has about a 15% chance of being in-the-money at expiration (which means an 85% chance it expires worthless).

This lets you quantify your risk on the spot. If you’re okay with a 20% chance of your shares getting called away, you can hunt for calls with a Delta around 0.20. If you're more conservative, you might stick to Deltas of 0.10 or lower.

It's a simple metric that gives you a clear, logical place to start, taking emotion right out of the equation.

The Role of Implied Volatility

Your second key metric is Implied Volatility (IV). IV is basically the market's forecast for how much a stock's price is going to swing around. You can think of it as the "anxiety" that's priced into the options.

When IV is high, it's like a storm warning for the stock. The market anticipates bigger price swings, which makes options more expensive. For an options seller, high IV is your best friend.

Higher IV simply means you get paid more premium for taking on the exact same level of risk. A 0.20 Delta call on a high-IV stock is going to pay you a whole lot more than a 0.20 Delta call on a stock with low IV. Selling options when IV is cranked up can seriously boost your income over the long haul.

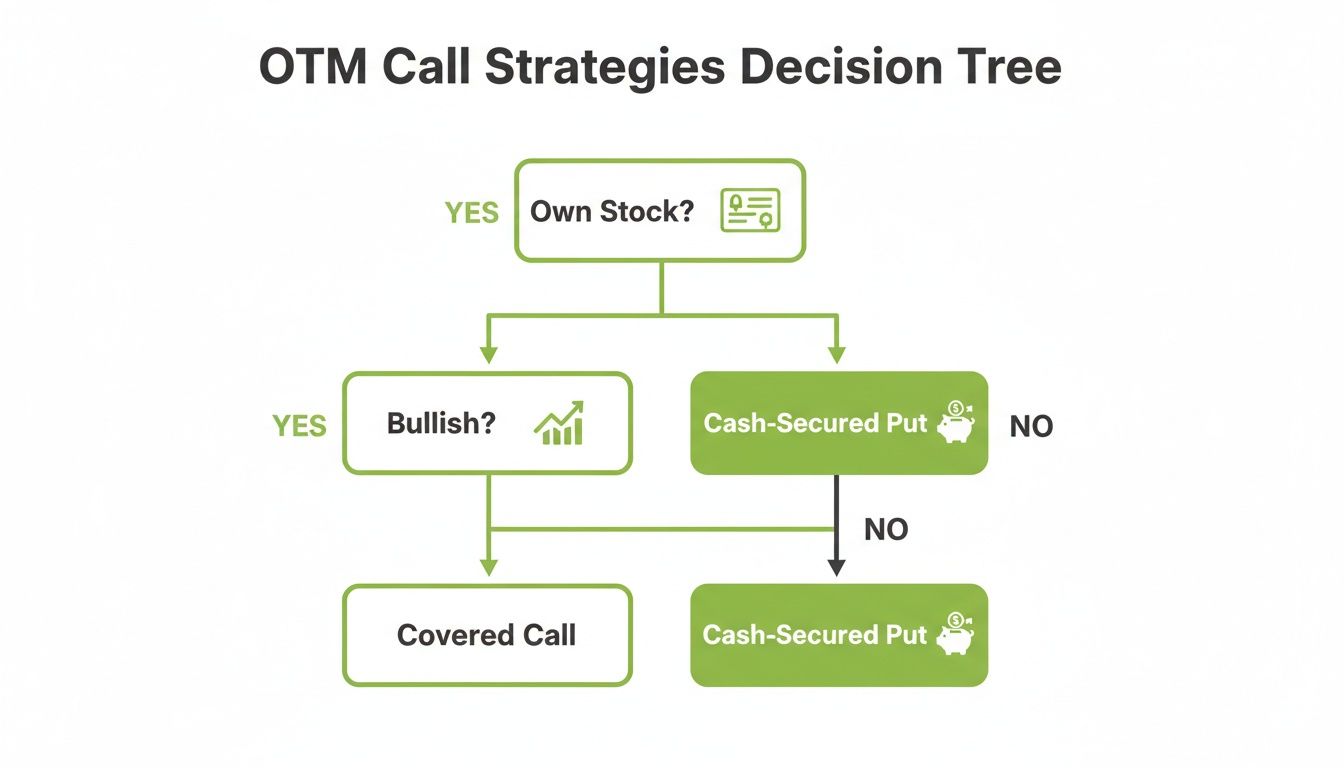

This decision tree gives you a simplified framework for figuring out which OTM income strategy fits your situation.

As you can see, the first question is always whether you own the underlying shares, which points you toward the right income-focused strategy from the start.

Developing a Risk Management Framework

Choosing the right strike is just step one. You also need a game plan for when things don’t go your way. What happens if the stock suddenly rallies and threatens to blow right past your strike price? This is where disciplined risk management saves the day.

Instead of panicking, successful sellers often "roll" their position. It’s a two-step move:

- Buy to Close your current short call option (you’ll probably take a small loss here).

- Sell to Open a new call option with a later expiration date and, usually, a higher strike price.

This maneuver often results in a net credit, meaning you collect more cash. You're effectively buying yourself more time for the trade to work out and pushing your break-even point higher. Another powerful tool is using spreads to define your risk from the very beginning. You can learn more by checking out our detailed guide on what an options spread is and how it can protect your downside.

A Real-World Covered Call Walkthrough

Theory is great, but the real learning happens when you see a trade play out from start to finish. Let's walk through a complete covered call trade, using a realistic scenario to connect all the dots—from picking the right out of money call to collecting the premium and handling the final outcome.

Let's say you own 100 shares of Microsoft (MSFT). You’ve held them for a while and you're still bullish long-term, but you'd like to put those shares to work and generate some extra cash.

Setting the Scene: The Initial Position

First things first, let's lay out our starting point. You have to own the underlying shares before you can sell a call against them—that’s what makes the call "covered."

- Your Holding: 100 shares of Microsoft (MSFT)

- Current Stock Price: MSFT is trading right at $425 per share.

- Your Outlook: You think MSFT will probably trade flat or creep up a bit over the next month. You aren't expecting a massive breakout, but you wouldn't be upset if you sold your shares at $440.

This setup makes you a perfect candidate to sell an OTM call option and collect some immediate income.

Choosing the Right OTM Call

Okay, time to open your brokerage's option chain for MSFT. You're looking for an expiration date about 30 days out. This is a sweet spot—it gives time decay enough runway to work for you without locking up your shares for too long.

You see a few different strike prices available. Remembering that it's all a trade-off between premium and probability, you check out a few OTM options.

- The $430 strike is tempting. It pays a nice premium, but its Delta is higher, meaning there's a greater chance your shares get called away.

- The $450 strike is much safer. It has a very low Delta, but the premium you’d collect is pretty small.

You decide to split the difference, picking a strike that lines up with your personal outlook. The $440 strike price feels right. It's far enough OTM that the stock needs a real rally to get there, giving you a high probability of success.

Let's assume the $440 call expiring in 30 days is trading for a premium of $5.00 per share. When you sell one contract (which covers your 100 shares), you instantly collect $500.

That $500 hits your account right away. It's yours to keep, no matter what happens next. This is the core engine of the covered call strategy. For a deeper dive, check out our complete covered call strategy for income guide.

Analyzing the Trade Scenarios

Once the trade is on, there are really only two ways this can end at expiration. Let's crunch the numbers for both scenarios to see how your profit and loss shakes out.

Scenario 1: MSFT Closes Below $440

This is the outcome you're hoping for. If MSFT stock is trading at any price below $440 on expiration day—whether it's $439.99, $425, or even $400—the OTM call option you sold simply expires worthless.

- Profit: You keep the entire $500 premium, free and clear.

- Your Shares: You keep your 100 shares of MSFT.

- Next Step: You're now free to sell another call option for the following month and repeat the whole process.

Scenario 2: MSFT Closes Above $440

Now, what if MSFT has a great month and rallies past your strike price, closing at $445? Your shares will be "called away." This just means you're obligated to sell your 100 shares at the $440 strike price you agreed to.

This isn't a bad thing at all—in fact, it's your maximum profit scenario for this trade.

Here's how your total profit breaks down:

- Stock Gains: Your shares were worth $425 and you sold them for $440. That’s a $15 per share gain, or $1,500 total.

- Premium Income: You also keep the $500 premium you collected when you opened the trade.

Your total profit adds up to $2,000 ($1,500 from the stock's appreciation + $500 from the option premium). Sure, you missed out on the gains above $440, but you locked in a fantastic, predefined return. Now you can take that cash and find a new opportunity, or maybe wait for MSFT to dip before buying back in.

Turning Options from a Gamble into a Strategy

We've covered a lot of ground, moving from the basic mechanics of options to real, practical trades. The goal all along has been to pull back the curtain on out of money call options and show how they can become a reliable part of your portfolio.

It’s all about a fundamental shift in mindset. You're not making speculative bets anymore. You're building a repeatable, data-driven process for generating income.

Think of it this way: buying an OTM call is like buying a lottery ticket. You need a huge, unlikely move in your favor to win. But when you sell that same call, you’re the one running the lottery. You win if the stock stays flat, goes down, or even climbs a little. You profit from the most probable outcomes.

When you consistently sell high-probability OTM call options, you’re no longer just guessing which way the market will go. You’re running a business, collecting regular income by letting time and statistics do the heavy lifting for you.

This discipline is what transforms options trading into a genuine plan. By using proven methods like the covered call, you put the statistical edge squarely in your corner. The key isn't trying to predict the future—it's about consistently picking trades where the odds are stacked in your favor. It’s a methodical way to build a steady income stream and turn all that market noise into consistent cash flow.

Common Questions About OTM Call Options

Jumping into selling options always brings up a few “what if” scenarios. Getting your head around these is the key to turning theory into a real, repeatable strategy. Let’s tackle the most common questions traders have about selling out of money call options.

What Happens If My OTM Call Option Is Assigned?

This is easily the #1 question, and the answer is simpler than you’d think. If the stock price cruises past your strike price by expiration, your shares might get “called away.” All this means is you’re obligated to sell your 100 shares at the strike price you agreed to.

You still keep 100% of the premium you collected upfront. In fact, for a covered call, this is the max profit scenario. Many income-focused traders don’t see assignment as a failure at all—they see it as a successful, completed trade. You can then take that cash and hunt for the next opportunity, or just wait for a better price to get back into your original stock.

Is Selling Out of Money Calls Completely Risk-Free?

No strategy in the market is totally risk-free. With covered calls, your main risk is opportunity cost. If the stock you sold a call on suddenly skyrockets way past your strike price, you’ll miss out on all that extra upside. You’re locked in to sell at the lower strike price.

On the flip side, the premium you collect only provides a small cushion if the stock takes a nosedive. Your shares will still lose value, and that premium will only offset a tiny bit of the loss. This is exactly why the strategy is best for quality stocks you’re happy to own for the long haul anyway.

The goal isn’t to erase risk—it’s to manage it intelligently. When you sell OTM calls on stocks you believe in, you’re aligning the risks with your long-term goals. You’re just trading a little bit of upside potential for consistent income.

How Far Out of The Money Should I Sell My Calls?

This really boils down to your personal comfort zone and how much income you’re trying to generate. It’s a classic trade-off between how much you can make and how likely you are to make it.

- Closer Strikes: Selling a call closer to the current stock price will net you a much bigger premium. The catch? The chance of having your shares called away is a lot higher.

- Farther Strikes: Selling a strike way out in the distance is much safer. It has a high probability of expiring worthless, but the premium you’ll collect will be smaller.

The best way forward is to stop guessing and start using data. Platforms that show you the probability of each strike expiring worthless are a game-changer. They let you find that sweet spot between income and safety that actually fits your financial goals.

At Strike Price, we get rid of the guesswork. Our platform gives you real-time, data-driven probabilities for every single strike price, helping you make smarter, more confident decisions. Find the perfect balance between premium income and safety to consistently meet your financial goals. Start your free trial at Strike Price today.