A Trader's Guide to the Call Option Short Strategy

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Short a Put An Income Strategy for Options Traders

Learn how to short a put to generate consistent income. This guide covers the mechanics, risks, and strategies for successful put selling.

Synthetic Covered Call: A Clear Guide to the synthetic covered call

Understand the synthetic covered call: how it works, key benefits, risk controls, and practical examples.

Define Covered Calls A Guide to Generating Consistent Income

Define covered calls with this practical guide. Learn to generate consistent income from your stocks, manage risk, and apply proven strategies for success.

Selling a call option short means you're selling a contract to someone, collecting cash upfront (the premium). In return, you’re betting that the underlying stock's price won't shoot above a certain price by a specific date.

Think of it like selling insurance on a stock’s potential rally. You get paid right now for taking on the risk that the stock might surge later. Your goal? For the option to expire worthless, letting you pocket the entire premium.

Understanding the Short Call Strategy

At its heart, selling a call option is a neutral-to-bearish trade. You don't necessarily need the stock to crash. You're often just predicting it won't have a massive breakout. This makes the call option short a popular play for generating income, especially in markets that are just drifting sideways or ticking slightly down.

When you sell—or "write"—a call option, you’re creating a contract with a buyer. This contract gives them the right (but not the requirement) to buy 100 shares of a stock from you at a pre-agreed price, known as the strike price, at any point before the expiration date.

For giving them that right, you get an immediate cash payment called the premium. That money is yours to keep, no matter what happens next. It's also your maximum possible profit from the trade. You're hoping the stock price hangs out below the strike price, which would make the option useless to the buyer when it expires.

If you want to go deeper on the mechanics, check out our full guide on what is a short call option.

To really get it, you have to see both sides of the deal. The table below lays out how your position as the seller stacks up against the buyer’s.

Short Call Seller vs Long Call Buyer at a Glance

This table breaks down the fundamental differences between the person selling the short call and the person buying it.

| Attribute | Short Call Seller (Writer) | Long Call Buyer |

|---|---|---|

| Primary Goal | To collect the premium and have the option expire worthless. | For the stock price to rise significantly above the strike price. |

| Obligation | Obligated to sell 100 shares at the strike price if exercised. | Has the right, but not the obligation, to buy 100 shares. |

| Profit Potential | Capped at the premium received. | Potentially unlimited as the stock price rises. |

| Risk Potential | Potentially unlimited if the stock price rises dramatically. | Capped at the premium paid. |

As you can see, the seller and buyer have completely opposite objectives. The seller is playing for income with limited profit, while the buyer is swinging for the fences with limited risk.

Navigating the Risk and Reward of Selling Calls

When you sell a call option short, you're stepping into a trade with a very specific, unbalanced risk profile. It's something every trader needs to wrap their head around before jumping in.

The reward side is simple and clean: your maximum profit is the premium you collect upfront. That's it. If things go your way, you pocket the cash, and the trade is a success.

But the risk? That's a whole different animal. While your gain is capped, your potential loss is, in theory, unlimited. There's no ceiling on how high a stock's price can climb, which means your losses can keep mounting as the stock blows past your break-even point. This sharp contrast—a fixed reward versus unbounded risk—is the core challenge of the strategy.

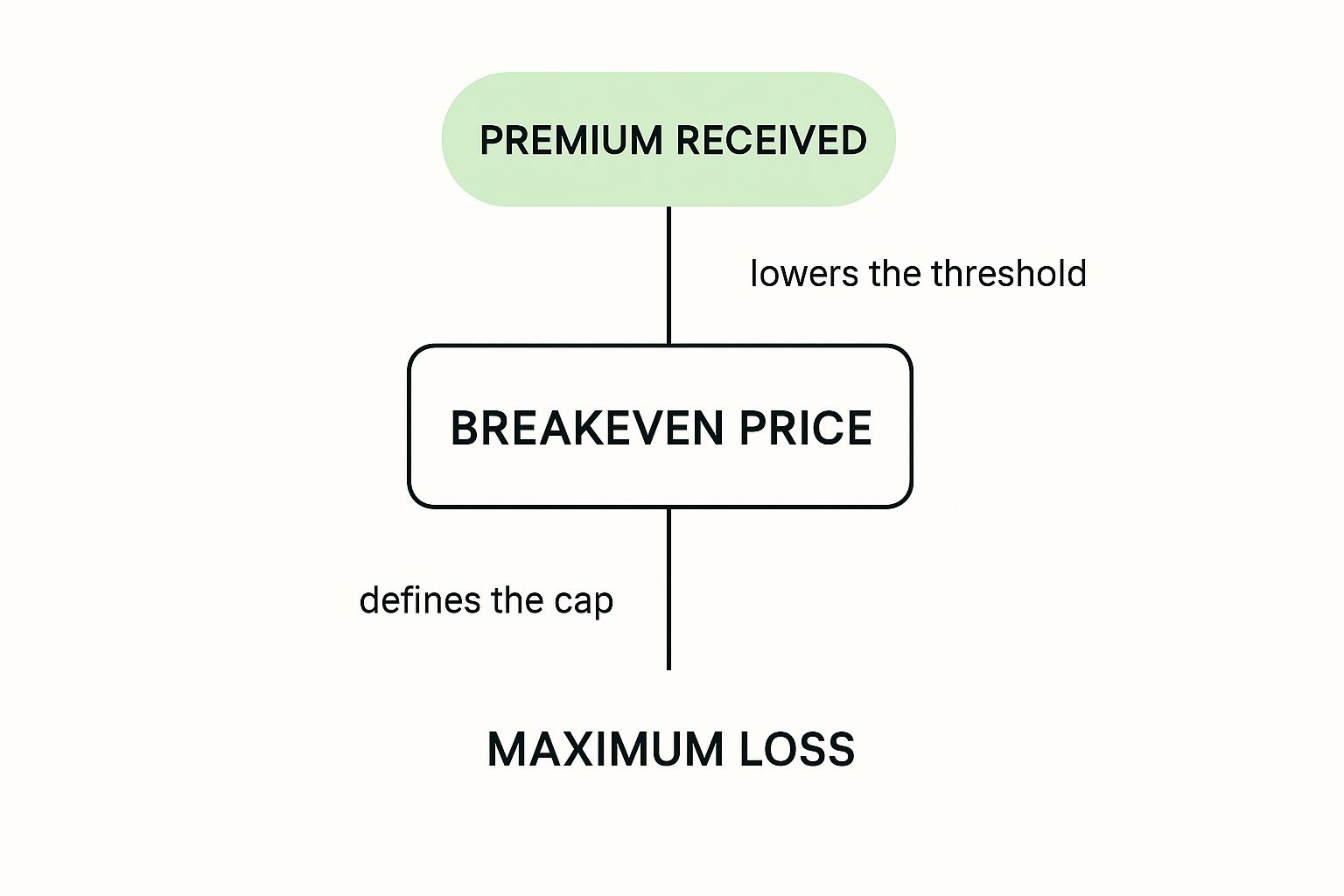

The infographic below really brings home the key parts of a short call's financial outcome.

As you can see, the premium you receive gives you a small buffer, pushing your break-even price up a bit before a trade starts costing you money.

Calculating Your Position

Let's walk through a real-world example to make this concrete. Say you sell one call option on XYZ stock with a strike price of $50. For selling it, you collect a premium of $2.00 per share, which comes out to $200 since one contract controls 100 shares.

Here’s how that plays out:

- Maximum Gain: Your profit is capped at the $200 premium you took in. You hit this best-case scenario if XYZ closes at or below $50 on expiration day.

- Break-Even Point: You find this by adding the premium to the strike price: $50 (Strike) + $2 (Premium) = $52. You don't start losing money until the stock price climbs above $52 a share.

- Potential Loss: Now, what if XYZ takes off and hits $60? You’re on the hook to sell shares at $50 that are now trading for $60. That’s a $1,000 loss on the shares, offset by your $200 premium, for a net loss of $800.

This lopsided payoff structure is exactly why time decay is a short call seller's best friend. You're rooting for the clock to run out while the option is still out-of-the-money. You can dive deeper into how time impacts options in our guide to understanding time decay in options trading.

To really know if your short call strategy is working, you have to move beyond theory. Diligently tracking your wins and losses is the only way to understand your true risk-reward profile and see if you’re actually profitable in the real world.

By consistently mastering the tracking of your trading outcomes, you get a clear, honest picture of what's working and what isn't. That’s how you make smarter adjustments and improve over time.

When This Trading Strategy Makes Sense

Selling a short call option isn't an everyday tool. It’s a specific play that really shines when you’ve got a neutral-to-bearish outlook on a stock. This is your go-to move when you expect a stock to stay flat, drift down, or maybe inch up just a little.

Think of it as a strategy for stagnation. It thrives in those sideways, range-bound markets where explosive upward moves just don't seem likely. The goal here is to generate steady income, and that’s exactly what this approach is designed for when the market isn’t handing you clear directional trades.

But your market view is only half the picture. The other piece of the puzzle is implied volatility (IV), which is basically the market’s forecast for how much a stock’s price might swing. When IV is high, option premiums get richer, making it a very tempting time to be a seller.

The perfect setup for a short call seller is to open a trade when implied volatility is high—so you collect a bigger premium—and then watch that volatility drop before the option expires.

This dream scenario lets you profit from both time decay (theta) and a potential drop in the option's price due to falling volatility, a phenomenon traders call a "volatility crush."

High Volatility: A Double-Edged Sword

High IV is both an opportunity and a warning sign. Yes, call sellers can collect fatter premiums when volatility is up, but it also signals a much riskier environment.

For instance, during the 2020 market panic, IV on some U.S. equity options briefly shot above 80%. This created massive premium opportunities for sellers, but many who weren't properly hedged got wiped out when the market rebounded with incredible force. You can find more insights on how option prices react to volatility at Optionistics.

So, the sweet spot for selling a short call option is when:

- You have a strong conviction the stock won’t surge past your strike price.

- Implied volatility is high, offering an attractive premium for the risk you’re taking on.

- You’re comfortable accepting a defined, limited profit in exchange for a high probability of success.

The Covered Call: A Much Safer Approach

That "unlimited risk" of selling a naked call is, understandably, a dealbreaker for most investors. Luckily, there's a much safer, widely used alternative for generating income from options: the covered call.

This strategy completely flips the risk equation on its head.

A covered call means you sell a call option only when you already own at least 100 shares of the underlying stock. Those shares you're holding act as your built-in collateral, "covering" your obligation to deliver them if the option is exercised. Your potential for unlimited loss simply vanishes.

If the stock price skyrockets and the buyer exercises their option, there’s no need to panic. You don't have to scramble to buy shares on the open market at a crazy high price. You just deliver the shares you already have at the agreed-upon strike price.

Covered Calls Versus Naked Calls

The core difference boils down to one simple thing: owning the stock. This single factor creates two entirely different risk profiles. One is a conservative income play; the other is a high-stakes bet.

The covered call transforms the short call from a strategy with uncapped risk into a conservative tool for earning extra yield on stocks you already hold in your portfolio.

Let's break down how the two approaches really stack up:

- Risk Profile: A naked short call has unlimited risk. A covered call's risk is limited to the opportunity cost of selling your shares at a price lower than the current market.

- Margin Requirement: Selling naked calls usually requires a significant margin deposit because of the high risk. Covered calls typically have no additional margin requirement, since your shares secure the position.

- Primary Goal: The goal of a naked call is pure speculation on the stock's direction. The covered call is all about generating consistent income from a stock position you already own.

For a deeper dive into this popular income strategy, check out our complete guide on what covered call options are and how they work.

How to Manage Your Short Call Positions

Selling a call isn’t a “set it and forget it” trade. Real success comes from actively managing your position to lock in profits and keep your capital safe. Your first big decision is picking the strike price, and it’s a balancing act. A strike closer to the current stock price will net you a much juicier premium, but it also dials up the risk of the option finishing in-the-money. Go further out, and you’re safer, but the payout is smaller.

This is where time decay, or Theta, becomes your best friend. Every single day that ticks by, a little bit of the option's value disappears. That erosion works in your favor as a seller. The goal is to let Theta do its thing while the stock hopefully stays put below your strike.

Selling calls has long been a go-to income strategy, and for good reason: a huge number of options expire worthless. Some studies suggest that figure is around 70–80%, which puts the long-term odds in the seller’s corner. You can dive into more of the data yourself by checking out market statistics on the CBOE website.

Key Management Actions

Even with time decay on your side, you have to be ready to make a move. This isn’t passive investing.

A concept you absolutely must understand is assignment risk. If the stock price shoots past your strike, especially as the expiration date gets closer, the buyer will likely exercise their right. When that happens, you get "assigned," meaning you’re forced to sell 100 shares of the stock at the strike price. For a naked call, that’s a disaster—you’d have to buy those shares at the new, high market price and take a massive loss.

Proactive management is what separates a steady income strategy from a painful losing trade. Always know how you're getting out before you even get in.

To avoid getting burned, you need a clear exit plan. Here are the two most common moves:

- Buy to Close for a Profit: You don't have to ride it out until expiration. If you’ve already collected a nice chunk of the premium—say, 50-75%—you can simply buy back the same call option to close out the trade and lock in your profit.

- Cut Losses Early: If the stock starts rallying against you, don't just sit there and hope. Buy back the call to close it for a small, manageable loss. Waiting for it to "come back" is how small losses turn into big ones.

Common Questions About Selling Call Options

Let's dig into a few of the most common questions traders have about selling call options. Getting these concepts straight is the key to trading with confidence.

Naked Calls Versus Covered Calls

What's the real difference between a naked call and a covered call? It all comes down to one thing: whether you actually own the underlying stock.

A covered call means you own at least 100 shares for every call option you sell. Those shares are your collateral, which is why it's considered a safer strategy. Your "risk" is simply having to sell your shares at the strike price, even if the market price goes higher.

A naked call is the opposite. You sell the option without owning any shares, which exposes you to theoretically unlimited risk if the stock price skyrockets.

So why would anyone take that kind of risk? Traders use naked calls when they have a very strong belief that a stock won't rise above a certain price. It's a way to earn a small, defined profit without needing the cash to buy the stock first.

Understanding Assignment Risk

What happens if my short call option gets assigned?

If your short call is "in-the-money" when it expires (meaning the stock price is above your strike price), you should expect to be assigned. Assignment means you are now obligated to sell 100 shares of the stock at the strike price you agreed to.

Assignment isn't a maybe; it's the mechanical conclusion of an in-the-money short option. Your obligation is to deliver the shares at the agreed-upon price, whether you own them or not.

If it was a covered call, no problem—you simply deliver the 100 shares you already own. Your position is closed out just as you planned.

But if it was a naked call, your broker will force you to buy those 100 shares at the current high market price just so you can turn around and sell them at the lower strike price. That's where the big losses can happen.

Ready to turn guesswork into informed action? Strike Price provides real-time probability metrics for every strike, helping you balance safety and premium yield. Start making smarter, data-driven trades today.