Your Guide to the Covered Put Option Strategy

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

A covered put strategy is a clever way to approach the market when you’re moderately bearish on a stock. It’s a two-part move: you short the stock and simultaneously sell a put option against it. This isn't for traders expecting a stock to crash and burn, but rather for those who anticipate a gradual decline and want to generate some income while they wait.

What Is a Covered Put Option Strategy?

Think of it like being a landlord for a stock you're betting against. By shorting the stock, you're positioning yourself to profit if the price drops. At the same time, selling the put option is like collecting rent—you receive an upfront payment (the premium) from someone who wants the right to sell you that stock at a set price later on.

This combination creates a unique, income-focused bearish position. Your primary goal is still for the stock to fall, but the premium you pocket from the put option gives you immediate cash flow and adds a small buffer if the stock unexpectedly ticks upward.

Core Components of a Covered Put

At its heart, the strategy is a blend of two distinct trades that work in tandem:

- Shorting a Stock: This is your main bearish play. You borrow shares of a company and sell them on the open market, hoping to buy them back later at a lower price to return to the lender and pocket the difference.

- Selling a Put Option: You sell a put contract, which creates an obligation for you to buy 100 shares of that same stock at a specific "strike price" if the option buyer decides to exercise it. For taking on this obligation, you get paid an immediate premium.

The short stock position "covers" the obligation from the put you sold, hence the name. By combining the two, you can collect premium income while your short position works. To learn more about how this strategy is structured, check out this guide on covered puts from Saxo.

Covered Put vs. Standard Short Sale at a Glance

So, why not just short the stock and call it a day? The answer lies in the risk and reward profile, which is significantly altered by the sold put option. This table breaks down the key differences.

| Characteristic | Covered Put Strategy | Standard Short Sale |

|---|---|---|

| Market Outlook | Moderately Bearish / Neutral | Strongly Bearish |

| Primary Goal | Generate income and profit from a modest price decline | Profit from a significant price decline |

| Risk Profile | Unlimited (offset slightly by premium) | Unlimited |

| Profit Potential | Capped | High (but not unlimited) |

| Income Generation | Yes, from the option premium | No, relies solely on price movement |

As you can see, the covered put strategy is more nuanced than a simple bearish bet. It’s a tool for traders who believe a stock will either fall modestly or even trade sideways, allowing them to collect income while their bearish outlook unfolds. It trades some of the explosive profit potential of a pure short sale for a steady stream of premium.

Understanding the Mechanics and Components

To really get a handle on the covered put option strategy, you need to see how its two pieces—the short stock and the sold put—work together. They aren't just two separate trades you happen to place at the same time. Think of them as a team, where each part has a specific and vital role to play.

The short stock position is your primary bet that the stock's price is headed down. You're borrowing shares and selling them, hoping to buy them back later at a lower price. This is your core bearish move, and your profit hinges on the stock falling.

At the same time, you sell a put option. This is the income-generating side of the trade. By selling the put, you immediately collect a cash payment, known as the premium. This premium acts as a small financial cushion, giving you instant cash flow and slightly softening the blow if the stock unexpectedly rises.

How the Pieces Fit Together

The real power of this strategy comes from combining these two actions. The obligation you take on by selling the put (to potentially buy shares at the strike price) is "covered" by the fact that you're already short the stock. If the put gets assigned, you're simply forced to buy shares to close out your original short position.

This setup fundamentally changes the game compared to just shorting a stock outright. You're not just waiting for a price drop; you're getting paid to wait. For a great breakdown of how different income strategies compare, check out this visual guide to yield strategies.

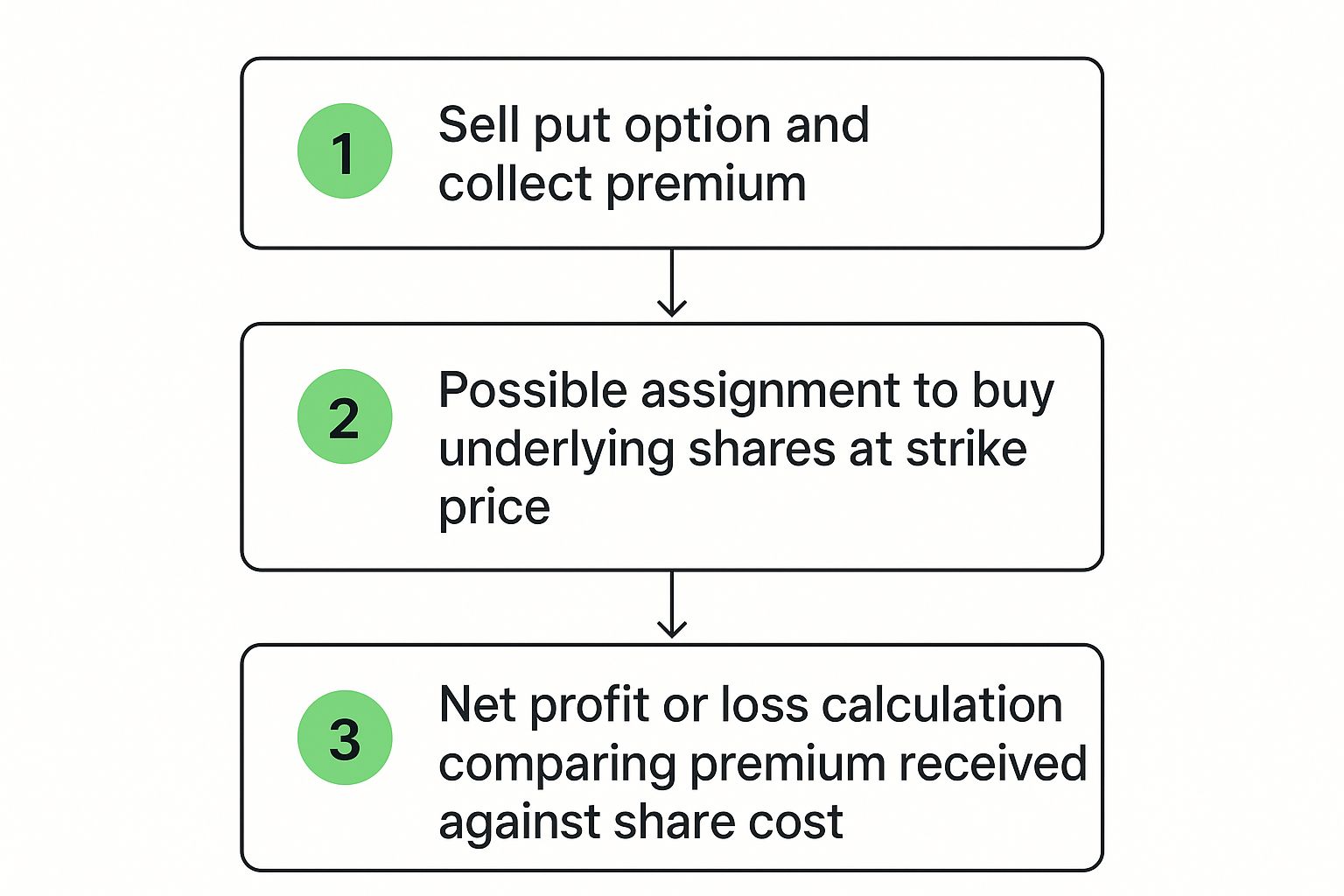

The flowchart below maps out the typical lifecycle of a covered put trade.

As you can see, the premium gives you an immediate return, while the potential for assignment is directly tied to closing out your short position, which shapes the final outcome of the trade.

Key Terms in Action

To make sense of the mechanics, you need to be comfortable with a couple of key terms in this context:

- Strike Price: This is the price where you've agreed to buy the stock if the put option you sold is exercised. Picking the right strike is a huge part of the strategy, as it sets your profit ceiling and assignment risk.

- Expiration Date: This is the deadline. The put option contract expires on this date, and your bearish prediction needs to come true before then for the trade to work out as planned. As an option seller, time decay (theta) is your friend here.

Key Takeaway: The covered put is a unified trade. The short stock gives you the bearish angle, while the sold put brings in cash and defines exactly how you'll close out your short if you get assigned.

By balancing these two parts, traders can craft a position that makes money if a stock drops moderately or even just stays flat. We break this down even further in our comprehensive guide where we have covered puts explained from top to bottom. Ultimately, it’s this interplay between shorting the stock and selling the put that makes this such a powerful, income-focused strategy.

Analyzing the Risk and Reward Profile

Every trading strategy has a unique financial fingerprint. Before you ever place a trade, you need to understand the risk and reward profile of the covered put option strategy. This isn't your average, clear-cut trade—it has an asymmetrical profile that demands respect.

At its core, the strategy's profit is capped. The absolute best-case scenario is when the stock price tumbles to or even past the strike price of the put you sold. Once that happens, your maximum possible gain is locked in.

The risk side of the equation, however, is where you need to pay close attention. Because a covered put starts with a short stock position, your potential loss is theoretically unlimited. If the stock unexpectedly rallies instead of falls, the losses on your short shares can mount quickly, blowing right past the small premium you collected.

Calculating Your Maximum Profit

Your max profit comes when the stock price drops to or below the strike price of your sold put. At that point, you'll be assigned the shares, which neatly closes out your initial short position. It’s a clean exit.

The formula is pretty straightforward:

Max Profit = (Price Where Stock Was Shorted – Strike Price of Sold Put) + Premium Received

Let's say you short a stock at $50, sell a $45 strike put, and collect a $2 premium. Your maximum profit is $7 per share. That's calculated as ($50 - $45) + $2.

The Breakeven Point

The breakeven point is where you neither make nor lose money. For a covered put, this price is actually above where you shorted the stock because the premium you pocketed gives you a small buffer. If the stock moves above this price at expiration, you're in the red.

- Breakeven Formula: Short Sale Price + Premium Received Per Share

- Example: If you shorted the stock at $50 and collected a $2 premium, your breakeven price is $52. The trade loses money if the stock finishes above $52.

It’s this specific risk-reward dynamic that makes quantitative trading platforms classify the covered put as a sophisticated strategy. You're combining a short stock position with a short put, a structure with margin requirements and a risk profile best suited for experienced traders. You can see how these advanced strategies are modeled on platforms like QuantConnect.

Ultimately, while a covered put is a clever way to generate income from a bearish outlook, its unlimited risk profile cannot be ignored. That premium gives you a cushion, but it won’t save you from the very real danger of a sharp, unexpected rally.

Alright, let's break down the theory and see how a covered put plays out in the real world. Abstract ideas are one thing, but putting actual numbers to a trade makes everything click.

We'll follow a fictional company, TechCorp Inc. (TCOR), to walk through this trade from start to finish.

Let's say you've done your homework and believe TCOR, which is currently trading at $100 a share, is a bit overvalued. You're not predicting a total collapse, just a modest dip over the next month or so. This is a classic setup for a covered put.

Here’s how you’d set it up:

- Leg 1 (Short Stock): You short 100 shares of TCOR right at the $100 market price.

- Leg 2 (Sell Put): At the same time, you sell one TCOR put option contract with a $95 strike price that expires in 30 days.

- Income Received: For selling that put, you immediately collect a premium of $3 per share. That's $300 in your pocket ($3 x 100 shares).

The trade is on. Your position is established, and now all you have to do is wait until the expiration date to see where TCOR's stock price lands. Let's explore three different scenarios to see the full range of outcomes.

Scenario 1: Maximum Profit (The Best-Case Scenario)

This is exactly what you hoped for. At expiration, TechCorp’s stock has fallen and is now trading at $92 per share.

Because the stock price ($92) is below the put's $95 strike price, the person who bought your put option is going to exercise it. This is good news for you.

You're now obligated to buy 100 shares of TCOR at the agreed-upon $95 strike. This purchase perfectly closes out the 100 shares you shorted earlier.

Let’s tally up the profit:

- Profit from the Short Stock: You shorted at $100 and covered (bought back) at $95, making a $5 per share profit. That's $500.

- Profit from the Sold Put: You keep the entire $300 premium you collected upfront.

- Total Net Profit: A tidy $800 ($500 + $300).

This is your maximum possible gain, achieved because the stock dropped below your put's strike price.

Scenario 2: The Stock Dips, But Not by Much

In this outcome, you were right about the direction, but the stock didn’t fall as far as you expected. At expiration, TCOR is trading at $98 per share.

Since the stock price ($98) is still above the $95 strike price, the put option you sold expires worthless. The buyer has no incentive to exercise it.

You keep the full $300 premium, but your short stock position now has an unrealized loss. You shorted at $100, and the stock is at $98, so you're technically down $2 per share ($200). If you close the entire position at this point, you still walk away with a $100 net profit.

Scenario 3: The Stock Rises (The Risk Scenario)

This is the one that stings. Your bearish call was wrong, and TCOR rallied instead. At expiration, the stock has climbed to $107 per share.

Just like in the last scenario, the $95 put option expires worthless. You get to keep the $300 premium, no matter what.

The problem, however, is your short stock position.

- Loss from Short Stock: You shorted at $100, but now the stock is at $107. To close your position, you'd have to buy it back for a $7 per share loss ($700 total).

- Profit from Premium: The $300 premium helps soften the blow.

- Total Net Loss: Your net result is a -$400 loss (-$700 loss + $300 profit).

Covered Put Scenario Analysis for TechCorp Inc.

To make these outcomes even clearer, let's lay them out in a table. This helps visualize how the profit and loss from each part of the trade—the short stock and the sold put—combine to give you a final net result.

| Scenario | Stock Price at Expiration | Profit/Loss from Short Stock | Profit/Loss from Sold Put | Total Net Profit/Loss |

|---|---|---|---|---|

| Max Profit | $92 | +$500 ($100 short - $95 cover) | +$300 (Keep premium) | +$800 |

| Slight Drop | $98 | +$200 ($100 short - $98 cover) | +$300 (Keep premium) | +$500 |

| Stock Rises | $107 | -$700 ($100 short - $107 cover) | +$300 (Keep premium) | -$400 |

As this table and the examples show, learning how to sell covered puts is all about weighing the income you generate from the premium against the very real, unlimited risk you take on with the short stock position. Understanding these calculations is the key to managing this powerful—but advanced—strategy.

When to Use the Covered Put Strategy

Any trading strategy is only as good as its timing. Knowing when to deploy the covered put option strategy is just as critical as knowing how to execute it. This isn't a silver bullet for every market scenario; it's a specific tool that shines under the right conditions.

The sweet spot for a covered put is a moderately bearish or sideways market. You should have a strong belief that the underlying stock is heading for a slow, grinding decline or will simply trade flat for a while. This is not the right play if you think the market is about to fall off a cliff, as your profit is capped by the premium you collect.

Key Insight: The covered put is all about income-focused bearishness. You're trading the explosive profit potential of a pure short sale for the chance to generate premium income while you wait for a modest drop in price.

Think of it as monetizing a period of expected weakness, not betting on a total collapse. Beyond your own analysis, it pays to understand what the rest of the market is thinking. Getting a read on sentiment can be a game-changer for timing your entries, and there are great resources available for using market sentiment analysis for trading.

Selecting the Right Stocks

Not every stock is a good candidate for a covered put. The best choices have a few key traits that make the strategy much easier to manage and, frankly, more likely to succeed.

You'll want to look for stocks with:

- Sufficient Liquidity: High trading volume and tight bid-ask spreads are non-negotiable, for both the stock and its options. This ensures you can get in and out of your position smoothly without losing your edge to price slippage.

- Reasonable Volatility: This is a balancing act. While higher implied volatility (IV) means juicier premiums, it also screams "higher risk!" A stock that moves in a relatively stable, predictable way is often a safer bet than one known for wild, unpredictable swings.

Using It as a Strategic Entry Point

Here’s where things get interesting. You can use a covered put as a clever way to acquire a stock you’d like to own, but only if you can get it at a lower price. It's a bit like its cousin, the cash-secured put, but starts with a short stock position. If you want to see how that works, our guide on a cash-secured put example offers more detail on that related strategy.

If the stock price does fall and your sold put gets assigned, you're forced to buy the shares at the strike price. This action automatically closes out your initial short stock position.

The end result? You've just established a long position in the stock at a cost basis that was effectively lowered by the premium you pocketed upfront. It's a slick, tactical way to enter a long position with a built-in discount.

Common Mistakes to Avoid

Every great strategy has its weak spots, and the covered put is no different. A few common missteps can easily turn a smart, income-generating idea into a painful lesson. Let's walk through the big ones so you can sidestep them.

First and foremost, don't get the direction wrong. This is a bearish play, pure and simple. If you set up a covered put on a stock that's secretly coiling for a major rally, you're going to have a bad time. Your short stock position will rack up losses much faster than the small premium you collected can ever hope to cover.

Another classic error is getting mesmerized by juicy premiums. When you see high implied volatility (IV), the premiums for selling options look incredibly tempting. But high IV is the market screaming that it expects a big, wild price swing. It's a flashing yellow light—a sign of higher risk, not just a free lunch.

Neglecting Your Exit Plan

Perhaps the most dangerous mistake of all is entering a trade without knowing exactly how you'll get out. "I hope it turns around" is not a strategy—it's a recipe for disaster.

You absolutely must decide on your exit points before you place the trade. Know the exact price where you'll cut your losses if the stock moves against you, and then stick to it without letting emotion get in the way. A small, manageable loss can quickly spiral out of control if you don't have that discipline.

This isn't just true for covered puts; it's the foundation of all successful option-selling. In fact, when researchers looked at U.S. equity data from 1993-2020, they found that disciplined covered call strategies often beat a simple buy-and-hold approach. That study was on calls, but the lesson is universal: systematically writing options and managing risk pays off. You can read the full research about these option strategies if you want to dive deeper.

Ultimately, keeping your covered put trades on the right track boils down to a few key actions:

- Confirm Your Bearish Thesis: Don't just guess. Make sure your analysis gives you a strong reason to believe the stock will fall or trade sideways.

- Respect Implied Volatility: Understand that a big premium means the market is pricing in big risk. Treat it with caution.

- Have an Ironclad Exit Strategy: Know your maximum pain point before you enter. Have a plan—or even a standing order—to get out and limit your losses.

Frequently Asked Questions

When you’re exploring a new options strategy, a few questions always pop up. Here are some straightforward answers to the most common ones about covered puts.

What Is the Difference Between a Covered Put and a Naked Put?

The key difference, as the name suggests, is the "cover." When you use a covered put, you're also holding a short stock position. That short stock acts as a direct hedge against the risk of the put option you sold.

A naked put, on the other hand, is sold without that safety net. You're selling the put option and hoping for the best, with no underlying stock position to offset potential losses.

This makes a naked put far riskier. If the stock price craters, the naked put seller is on the hook to buy shares at the much higher strike price, staring at a significant loss with nothing to cushion the blow.

Is a Covered Put a Bullish or Bearish Strategy?

A covered put is a bearish to neutral strategy, plain and simple. You're making two moves that both bet on the stock's price going down or, at the very least, staying flat.

First, you short the stock because you expect it to fall. Second, you sell the put option to collect some premium income while you wait for that drop. It’s a strategy built for a declining market and has no place in a bullish outlook.

Key Takeaway: If the stock price is below the strike at expiration, assignment simply closes your short position. You are obligated to buy shares at the strike, which covers the shares you initially borrowed and sold.

Ready to stop guessing and start making data-driven options trades? Strike Price provides real-time probability metrics to help you balance safety and premium income. Transform your options selling from a gamble into a strategic process. Find your edge with Strike Price today!