How to Make Money Selling Puts: Your Ultimate Guide

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

So, what does it actually mean to sell a put?

Think of it like getting paid to make a promise: you're agreeing to buy a stock you already like, but only if it drops to a lower price you've chosen. In exchange for that promise, you collect an immediate cash payment, known as a premium.

It's a straightforward way to generate income from the very stocks you'd be happy to own anyway.

How Selling Puts Generates Real Income

At its core, selling a put is a simple contract. You're essentially selling an insurance policy to another investor who owns the stock. For offering this "price protection," you get paid that upfront, non-refundable premium.

From there, one of two things will happen. The beauty is, if you’ve picked your stock and price wisely, both outcomes can work in your favor. This is why the strategy is so powerful—it has defined possibilities. If you're looking for more real-time market talk, checking out places that offer professional options trading insights can be a great way to see how pros think.

To get a handle on this strategy, it helps to walk through some of the lingo first.

Key Terms in Selling Puts

Before we dive into the scenarios, let's break down the key terms you'll see. Understanding this vocabulary is the first step to trading with confidence.

| Term | Definition | Example |

|---|---|---|

| Premium | The cash you receive upfront for selling the put option. It's yours to keep no matter what. | You sell a put and immediately get $150 in your account. |

| Strike Price | The price at which you agree to buy the stock if it's assigned to you. | You agree to buy 100 shares of XYZ stock at $50. |

| Expiration | The date the option contract ends. Your obligation is over after this date. | The option expires on the third Friday of the month. |

| Assignment | When the stock price drops below your strike price at expiration, forcing you to buy the shares. | The stock is $48 at expiration, so you must buy it at your $50 strike. |

This table is a quick reference, but seeing these terms in action is where it really clicks.

The Win-Win Scenarios

So, what actually happens after you sell a put and collect your cash?

The most common outcome, and often the one you're hoping for, is that the stock’s price stays above your chosen strike price. When this happens, the option expires worthless.

- You keep 100% of the premium as pure profit.

- Your obligation disappears.

- You're free to sell another put and repeat the process.

The second outcome happens if the stock price does fall below your strike. In this case, you get "assigned" the shares.

This isn't a failure; it's a planned event. You're now obligated to buy 100 shares of the stock at the strike price you chose—a price that is now higher than where the stock is trading. But here's the key: the premium you collected acts as a built-in discount, lowering your true cost to acquire the stock.

A Real-World Example

Let's look at a stock that's been on a rollercoaster, like Tesla (TSLA), during its slide from 2023 to 2024. An investor who was bullish long-term could have sold a put option with a $200 strike price back when the stock was trading around $250.

For taking on that risk, they might have collected a premium of $15 per share, or $1,500 total.

If TSLA stayed above $200, they'd simply pocket the $1,500 and move on. But if it fell and they were assigned the shares at $200, their actual cost basis wouldn't be $200. It would be just $185 per share ($200 strike - $15 premium). That’s a massive discount on a stock they wanted to own in the first place.

Building Your Watchlist of Ideal Stocks

If you take away only one thing about selling puts, let it be this: only sell puts on companies you genuinely want to own. This isn't just a friendly suggestion—it’s the golden rule. It's the bedrock of a strategy that can actually last. You're not just a trader making quick bets; you're a potential long-term owner of a business.

This shift in mindset is everything. It pulls you out of the gambler's chair and puts you into the patient investor's seat. The goal isn't just to collect premium. The real win is getting assigned shares of a fantastic company at a price you were happy to pay. If the stock never drops and you just pocket the premium week after week? That's a fantastic bonus.

So, how do you find these gems? It all starts with building a focused, high-quality watchlist.

The Anatomy of a Great Candidate

Forget the trendy, speculative stocks that everyone's hyping up. Your watchlist should be filled with solid businesses that have proven themselves. Think of it like you're scouting for a championship team, not just a flashy player who might fizzle out after one game.

Here are the key traits to look for:

- Strong Financial Health: Hunt for companies with consistent profits, manageable debt, and positive cash flow. A healthy balance sheet is your first line of defense against nasty surprises.

- Market Leadership: Does the company have what Warren Buffett calls a "moat"? A durable competitive advantage? Industry leaders are simply more resilient when the market gets choppy.

- Consistent Performance: Steer clear of companies with wild earnings reports or insane price swings. You want businesses that show steady, predictable growth over time.

A critical mistake I see beginners make is chasing those juicy premiums from volatile, unproven stocks. That's a fast track to blowing up your account. Getting assigned shares of a company like Peloton (PTON) after it cratered 97% from its peak wouldn't have been a strategic entry—it would have been a portfolio disaster.

Stick to building a list of household names and established leaders you actually understand and would be happy to own for the long haul.

The Importance of Options Liquidity

Once you have a list of fundamentally sound companies, there's one more crucial filter: options liquidity. Just because a company is great doesn't mean its options are easy to trade. Trying to trade options on a stock with low liquidity is a nightmare.

Liquidity is just a fancy word for how easily you can buy or sell an option without tanking the price. It boils down to two main things:

- High Open Interest: This is the total number of option contracts that are still active. A big number—think thousands or tens of thousands—means there are plenty of buyers and sellers.

- Tight Bid-Ask Spread: This is the tiny gap between what buyers are willing to pay (the bid) and what sellers are asking for (the ask). A tight spread of just a few cents means you’re not losing money just to get in and out of a trade.

A stock like Apple (AAPL) has insane liquidity, making it a breeze to trade. A small, obscure company, on the other hand, might have huge spreads that eat up all your potential profit and make it nearly impossible to manage your position. Stick to stocks where the options market is deep and active.

You’ve built a solid watchlist of companies you'd be happy to own. Now comes the part where strategy really takes shape.

Choosing the right strike price and expiration date is probably the single most important decision you'll make when selling puts. This choice is what dials in your potential profit, your risk, and the odds of actually having to buy the stock.

The Great Trade-Off: Safety vs. Income

At its core, selling puts is a balancing act between safety and income.

You can sell a put that's far out-of-the-money (OTM), giving you a great chance the option will expire worthless. When that happens, you just pocket the premium, no strings attached. The catch? These safer bets pay less.

On the other hand, selling a put closer to the current stock price—or even at-the-money (ATM)—will land you a much bigger premium. But it also dramatically increases the risk that you’ll be assigned the stock if the price takes a dip.

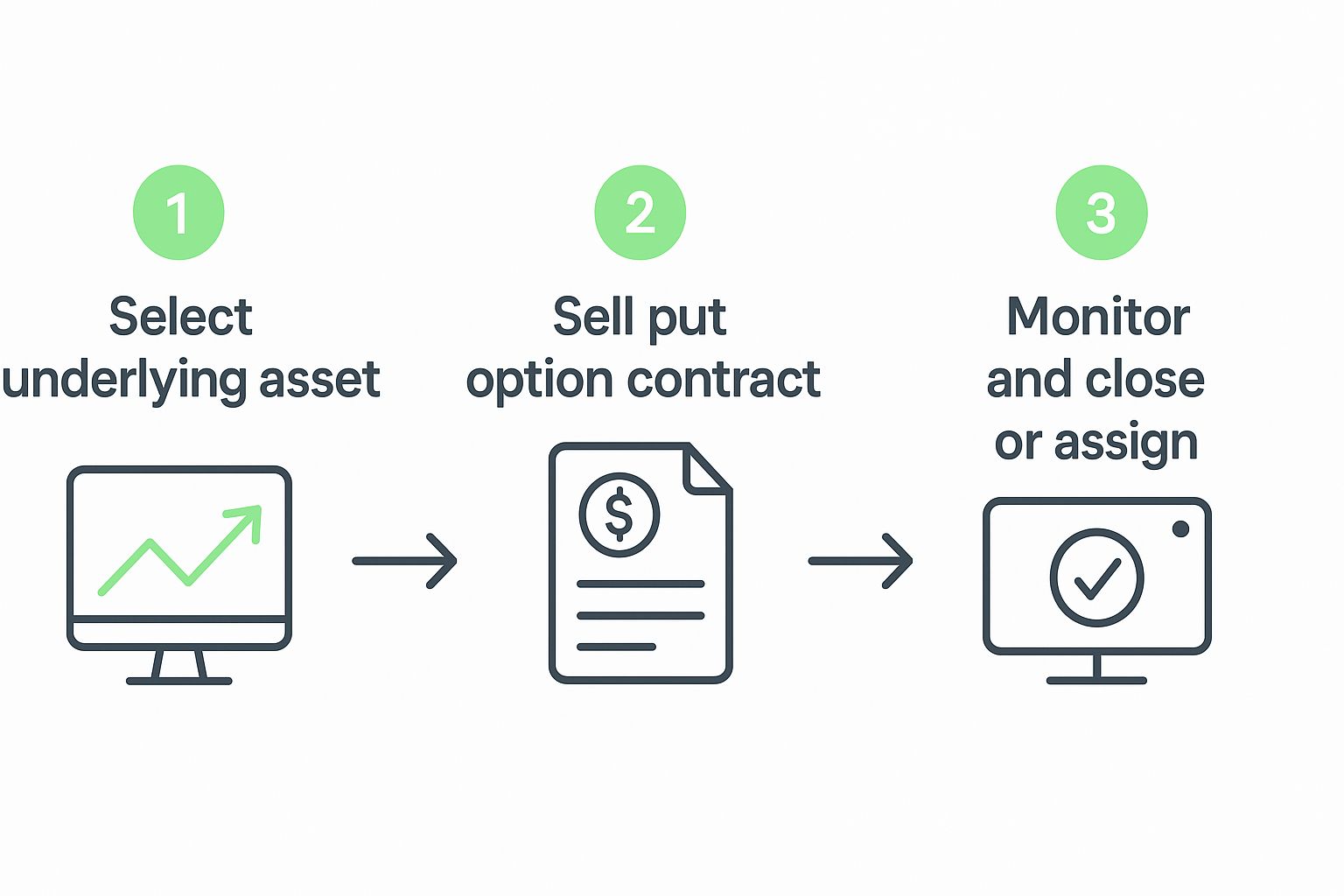

This flowchart breaks down the basic path of a put-selling trade, from picking your spot to seeing it through.

It’s a simple but powerful framework: have a plan for every trade, from start to finish.

Finding Your Sweet Spot

So, how do you decide? It really comes down to your personal comfort with risk and what you're trying to achieve.

A lot of traders, especially when they're starting out, stick with more conservative OTM puts. A great tool to help with this is Delta. You can find it in almost any options chain, and it doubles as a rough estimate of the probability that an option will end up in-the-money.

For example, a put with a 0.20 Delta has roughly a 20% chance of being assigned. Simple as that.

To really get the hang of these mechanics, check out our guide on how to choose an option strike price. It’s also worth understanding how to calculate stock volatility, since that's what drives option premiums and the potential for big price swings.

To visualize the choice you're making, here’s a quick comparison of OTM versus ATM puts.

Strike Price Selection Trade-Offs

| Characteristic | OTM Puts | ATM Puts |

|---|---|---|

| Premium Income | Lower | Higher |

| Probability of Success | Higher | Lower (~50%) |

| Risk of Assignment | Lower | Higher |

| Best For | Conservative, income-focused traders | Aggressive traders seeking max premium |

There's no universally "best" strike price. The right one is the one that fits your goal for that specific trade. Are you hunting for maximum income, or is a high probability of keeping the premium more important? Your answer points you to the right strike.

Picking an Expiration Date

The expiration date is just as crucial as the strike price. It's tempting to sell weekly options for that quick premium hit, but it’s a double-edged sword. The short timeframe gives you almost no room to breathe if the stock moves against you.

I’ve found that selling options with 30 to 60 days until expiration hits a nice sweet spot.

This window gives the trade enough time to work out in your favor and gives you the flexibility to manage the position if things get dicey. The premium decay is still working for you, but you're not pinned against a wall by a ticking clock.

Interestingly, some research shows that even longer-dated options can be more profitable. One study found that selling puts on the S&P 500 with 90 to 180 days to expiration has been a highly effective strategy going all the way back to 2000. It’s a different approach that captures a nice blend of meaningful premium and manageable risk.

Smart Risk Management and Handling Assignment

Selling puts for income isn't just about picking winners and collecting premium. The real skill—what separates the pros from the rookies—is knowing exactly what to do when a trade moves against you. This is where discipline pays the bills.

I can't stress this enough: only sell puts on high-quality stocks you would be happy to own at your strike price. Burn this rule into your brain. It single-handedly turns a potential "loss" into a planned stock purchase at a fantastic discount.

If you truly embrace this mindset, the fear evaporates. Getting assigned isn't a failure anymore; it’s just the other favorable outcome you planned for from day one.

Managing a Challenged Position

So, what do you do when a stock starts inching down toward your strike price before the expiration date? Whatever you do, don't panic. Panic is not a strategy. You have a powerful tool in your back pocket: rolling the option.

Rolling is a two-part move you execute at the same time:

- You buy to close your current short put, taking it off the books.

- You sell to open a brand new put on the same stock, but with a later expiration date.

Most of the time, you'll also "roll down" to a lower strike price. This maneuver is brilliant because it accomplishes a few things at once. It buys your trade more time to be right, lowers your potential purchase price even further, and almost always nets you another credit, which chips away at your cost basis.

A classic mistake is to "wait and see" until the final days. The sweet spot for rolling a position is when it still has a few weeks of life left. This gives you more time value to play with, making it much easier to collect a credit and adjust your position without breaking a sweat.

The Assignment Process Demystified

Okay, it happened. The stock closed below your strike at expiration. Pop the champagne—you're about to become a shareholder! This process is called assignment, and the best part is it's completely automatic. Your broker handles everything.

When you check your account that weekend, you'll see two things have changed:

- The cash needed to buy the shares (100 shares x your strike price) will be gone.

- In its place, 100 shares of the underlying stock will appear in your portfolio.

That's it. You are now the proud owner of a great company at the exact price you wanted, and your real cost is even lower because of the premium you pocketed upfront. A solid grasp of these mechanics is the bedrock of any good options risk management plan. If you're curious about broader financial protection ideas, learning about hedging strategies can also add some valuable perspective.

Turning Assignment into a New Income Stream

Your journey doesn't stop at assignment. In fact, a whole new one begins. Those 100 shares sitting in your account are now the perfect asset to start selling covered calls against. This is the other side of the income coin, letting you generate a second stream of premium from the stock you now own.

This smooth transition from selling a cash-secured put to selling a covered call is so common it has its own name: "The Wheel Strategy." While it’s a fantastic way to think about the lifecycle of a trade, it’s not a magic money machine. It still demands careful management and the awareness that some stocks might take their sweet time to recover.

The key is to see assignment not as an endpoint, but as a strategic pivot.

A Real-World Put Selling Walkthrough

Theory is great, but let's roll up our sleeves and see how this actually works in practice. This isn't just about placing a trade; it’s about building a repeatable framework for making money by selling puts.

For this walkthrough, we’ll use a company most of us know and trust: Microsoft (MSFT). Let's say it's currently trading at $450 a share.

We like the business, believe in its long-term story, and—crucially—would be perfectly happy to own it at a lower price. That right there is the golden rule. If you wouldn't be thrilled to buy the stock at a discount, don't sell a put on it.

Finding the Opportunity

First things first, we pull up the options chain. We're looking for an expiration date that gives us a nice balance of premium and time. For many traders, the sweet spot is around 45 days out.

Our goal is to sell an out-of-the-money (OTM) put. This gives us a higher probability of the trade expiring worthless, which is exactly what we want. Looking at the chain, we spot a put with a $430 strike price.

Here's the breakdown of this potential trade:

- Current Stock Price: $450

- Strike Price: $430

- Expiration: 45 days away

- Premium: $5.50 per share (or $550 per contract)

This trade feels pretty solid. We’re giving ourselves a $20 cushion (that’s nearly a 4.5% drop from the current price), and the premium is nothing to sneeze at.

Calculating the Numbers

Before you ever click "sell," you have to know your numbers. This part is non-negotiable.

First, the easy part: maximum profit. It's the premium you collect right away, which is $550. If MSFT closes above $430 at expiration, that money is all yours.

Next, we need our breakeven price. This is the line in the sand where we start losing money if we get assigned the shares.

Breakeven Price = Strike Price - Premium Received $430 - $5.50 = $424.50

This means as long as Microsoft stays above $424.50, we won't lose money on this position, even if we do end up buying the shares. We've effectively built a significant margin of safety into our trade.

This defensive posture is a key reason put selling can be so powerful. A detailed 10-year Goldman Sachs study found that during ugly years like 2007 and 2008, selling puts on the S&P 500 actually beat the index's total return by 3% and 14%, respectively. It shows just how resilient the strategy can be. You can dive into the full put selling performance analysis on their site.

Creating a Game Plan

Okay, we have our trade. Now we need a plan for both possible outcomes.

Scenario 1: MSFT Closes Above $430 This is our best-case scenario. The option expires worthless, and we keep the entire $550 premium as pure profit. We're now free to rinse and repeat, finding another put to sell and generating more income. For well-chosen OTM puts, this is the most frequent outcome.

Scenario 2: MSFT Closes Below $430 In this case, we get assigned 100 shares of MSFT at our strike price of $430. The total cost will be $43,000, but because we collected that premium upfront, our effective purchase price is really $424.50 per share.

We now own a world-class company at a discount to where it was trading. The best part? We can immediately turn around and start selling covered calls against our new shares to generate even more income. We've turned a "losing" trade into a new income stream.

Common Questions About Selling Puts

As you get more comfortable with selling puts for income, a few questions always seem to come up. It's a strategy with its own unique risk profile and capital needs, so it’s smart to get these things straight before you ever place a trade. Getting clear on the details is how you build real confidence.

Let's walk through some of the most common ones I hear from traders just starting out.

Is Selling Puts Actually Safer Than Buying Stock?

This is a great question because it cuts right to the core of the strategy. And in many ways, yes, selling a cash-secured put can absolutely be safer than buying a stock outright at its current market price.

Think about it. When you buy 100 shares of a stock, your risk is immediate. If that stock drops $10, you're down $1,000, plain and simple.

But when you sell an out-of-the-money put, you give yourself a cushion. You only start taking on the downside risk after the stock has already fallen past your strike price. If a stock is trading at $100 and you sell the $85 put, it has to fall more than 15% before you're even on the hook to buy it. On top of that, the premium you collected lowers your breakeven price even more. That built-in margin of safety is a huge advantage.

How Much Money Do I Really Need to Start?

There's no magic number here—it all comes down to the stocks you want to trade. The unbreakable rule for cash-secured puts is that you must have enough cash in your account to buy 100 shares of the stock at the strike price you choose.

The math is simple:

Capital Required = Strike Price x 100

So, if you want to sell a put on a $20 stock with an $18 strike, you’ll need $1,800 in cash set aside. For a pricier name like Nvidia with a $900 strike, you're looking at $90,000. This is exactly why most new put-sellers start with lower-priced, high-quality stocks or ETFs to keep their capital needs in check.

What Are the Basic Tax Implications?

When it comes to taxes on selling puts, the rules are fairly direct, but it's always smart to run things by a tax pro. You really only have two main outcomes to think about.

If your put option expires worthless, the premium you pocketed is taxed as a short-term capital gain in the year it expires. It’s treated just like regular income. But if you get assigned the shares, things work differently. The premium isn't taxed right away. Instead, it lowers the cost basis of the stock you were just forced to buy.

For example, if you're assigned at a $50 strike and you had collected a $2 premium, your new cost basis for tax purposes is $48 per share. This can be a nice benefit, as it pushes the tax event down the road until you eventually sell the stock. It's also a key part of the puzzle when you start selling covered calls, a strategy we cover in our guide on how to sell covered puts.

Ready to stop guessing and start making data-driven decisions? Strike Price gives you the real-time probability metrics you need to sell puts more profitably. Track your contracts, get smart alerts, and find the perfect balance between premium income and safety. Transform your options trading today.