How to Set Financial Goals That Actually Work

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

When you’re setting financial goals, it’s all too easy to get stuck on vague wishes like “save more money” or “invest for the future.” Let’s be honest: a goal without a real plan is just a dream. This is especially true in finance, where fuzzy objectives almost never lead to real progress.

The biggest reason they fail? A total lack of clarity. Without a specific target and a deadline, there's no urgency and no real way to know if you're even on track.

From Wishful Thinking to Actionable Plans

This is where turning your financial wishes into something concrete becomes a game-changer. The difference between a simple wish and a powerful goal is a written-down, specific plan.

For example, "I want to save for a down payment" is a wish. It’s a nice thought, but it’s not a plan.

Now, consider this: "I will save $20,000 for a down payment on a house by putting aside $834 per month for the next 24 months." That’s a real, actionable goal. This level of detail makes your objective tangible and, more importantly, holds you accountable.

A goal that isn't measurable is just a wish floating in the wind. By assigning real numbers and dates, you give yourself a finish line to run toward.

This is where a simple but powerful framework can make all the difference. We’re talking about making your goals Specific, Measurable, Achievable, Relevant, and Time-bound—often called the SMART framework. It's a proven way to turn ambiguity into a clear roadmap. In fact, people who set structured goals are far more likely to hit them than those with vague ideas. You can see how this plays into the bigger picture of global financial health trends on reba.global.

The table below breaks down exactly how to transform a common financial wish into a powerful, actionable objective using this framework.

From Vague Wish to Actionable Goal

| Vague Goal | SMART Element | SMART Goal Example |

|---|---|---|

| "I want to generate extra income from my investments." | Specific | Generate income by selling options. |

| Measurable | Earn an extra $500 per month. | |

| Achievable | Use a portfolio of $50,000 to sell covered calls on existing stock positions. | |

| Relevant | The extra income will be used to pay down high-interest debt, accelerating my path to financial freedom. | |

| Time-bound | Achieve this monthly income target within the next 6 months. |

By applying each element, a fuzzy idea becomes a clear, focused objective. This is the kind of goal you can build a real strategy around.

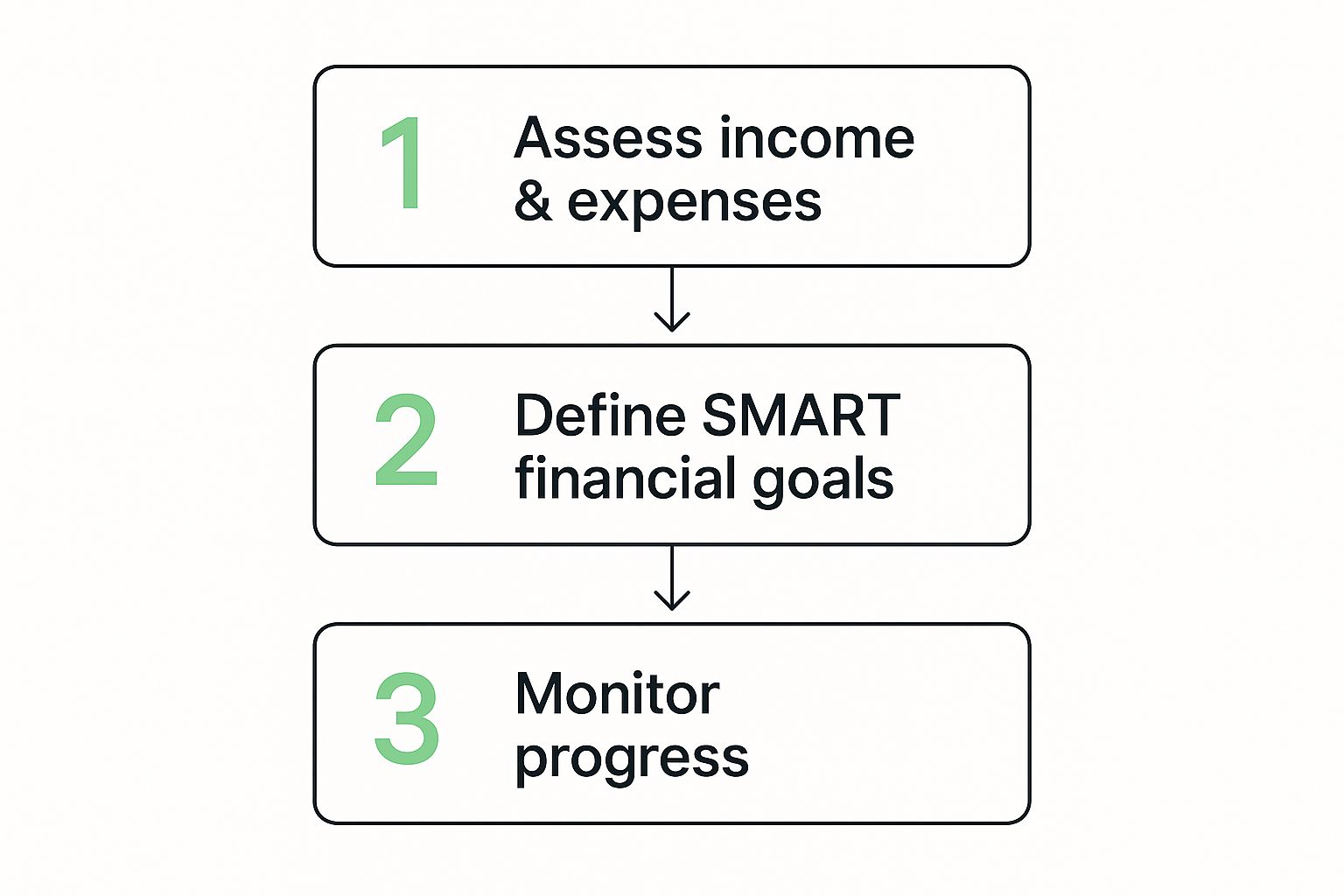

As the visual shows, successful goal-setting isn't a one-and-done activity. It’s a continuous cycle of assessing where you are, defining where you want to go, and constantly monitoring your progress. Of course, this process also means getting comfortable with managing investment risk as you build and execute your strategy.

Defining What You Truly Want from Your Money

Before you can build a solid financial strategy, you have to know your "why." What do you really want your money to do for you? This isn't just about the numbers; it's about connecting your goals to something meaningful. That connection is what keeps you motivated, especially when the market gets choppy or the process feels like a grind.

Think about it this way: a goal to "save $10,000" is just an instruction. It's sterile and abstract. But a goal to "save $10,000 for a down payment on a house in that sunny suburb where the kids can play outside"? Now that’s an inspiration. It creates a powerful mental picture you can actually work toward.

Categorize Your Aspirations by Timeline

A great first step is to just brainstorm everything you want to achieve financially. Don't filter yourself. Once you have a list, start sorting it by time horizon. This simple exercise brings clarity to your ambitions and shows you what needs your attention now versus what can be planned for later.

I find it helps to group them into three buckets:

- Short-Term (1-3 Years): These are your immediate wants and needs. Think about finally taking that two-week trip to Italy, paying off a high-interest credit card, or building up an emergency fund.

- Mid-Term (3-10 Years): These goals are bigger and need more runway. This is where things like saving for a down payment on a home, funding a small business, or starting a college fund for a child usually land.

- Long-Term (10+ Years): This is the big picture. We're talking about financial independence and creating the retirement you've always envisioned decades from now.

Your financial goals are a direct reflection of your personal values. Defining them clearly ensures you're building a life that genuinely aligns with what's most important to you, not just what you think you should be doing.

Part of this process is also getting honest with yourself about risk. Your strategy for a short-term goal like a vacation fund should look very different from a long-term retirement plan. A critical piece of the puzzle is understanding your risk aversion because it directly influences the kinds of options strategies you'll feel comfortable with. This insight is what helps you set financial goals you'll actually stick with.

Build Your Financial Safety Net First

Before you even think about earmarking cash for exciting goals like a vacation or an investment, there’s a critical first step you can’t afford to skip: building your financial safety net. This is your emergency fund, and it’s the absolute bedrock of a solid financial plan.

Without it, a single unexpected event—a job loss, a surprise medical bill, a major car repair—can completely derail your progress on every other goal you have. Think of it like the foundation of a house. You wouldn't start putting up walls on shaky ground, right? Your emergency fund provides the stability you need to pursue your other ambitions with confidence.

Calculating Your Ideal Fund Size

So, how much do you really need stashed away? The old rule of thumb was three to six months of living expenses, but the game has changed. Given recent economic shifts, many experts now advise a more conservative approach.

Financial pros now widely recommend having between 6 to 9 months' worth of your essential living expenses in a liquid, easily accessible account. This updated guideline reflects the reality of a tougher job market and rising costs, giving you a much more robust cushion.

That number can feel intimidating, so don't let it discourage you. The key is to start small and build momentum.

Your first target doesn't need to be your final one. Focus on saving an initial $1,000. This amount alone is enough to handle many common emergencies and gives you a powerful psychological win to build upon.

Once you hit that milestone, keep contributing until you reach your full 6-to-9-month target. A great way to structure this is with a CD ladder emergency fund strategy, which allows parts of your money to earn higher interest while still remaining available in staggered intervals.

Just remember the most important rule: this money is for true emergencies only. It's not a vacation top-up or a down payment supplement. Establishing that discipline is what creates a secure foundation, freeing you up to chase your bigger financial goals without fear.

Create a Strategic Plan to Eliminate Debt

High-interest debt, especially from credit cards, is like an anchor dragging down your financial dreams. Once you’ve got a starter emergency fund in place, making a plan to kill this toxic debt should be your absolute top priority. This isn't just about paying bills—it's about freeing up your income to build actual wealth.

Tackling your debt is one of the most powerful, proactive steps you can take. And if you're feeling overwhelmed, know that you're in good company. Over 35% of Americans have set a goal to pay down or pay off debt this year, making it a massive financial focus for millions. You can see more on these financial goal trends on NerdWallet.com.

Choose Your Debt-Reduction Method

Before you can attack the debt, you need a crystal-clear picture of what you're up against. A crucial first move is to understand your complete financial standing by learning how to get your free credit reports. Once you've got a list of all your debts, interest rates, and balances, you can pick a proven strategy that clicks with your personality.

The two most popular approaches are the avalanche and the snowball methods.

- The Avalanche Method: You’ll make minimum payments on everything but throw every extra dollar you have at the debt with the highest interest rate. From a pure math perspective, this saves you the most money over time.

- The Snowball Method: With this one, you focus on wiping out the smallest balance first, no matter the interest rate. This strategy is all about psychology—it gives you quick wins that build momentum as you knock out each debt one by one.

The "best" method is whichever one you'll actually stick with. Whether you're driven by math (avalanche) or momentum (snowball), consistency is what gets you to a zero balance.

Once that high-interest debt is gone, you can redirect all that freed-up cash flow. This is where things get exciting—you can start seriously accelerating your other goals, like investing. The money you were sending to credit card companies can now go to work for you, maybe by exploring different options selling strategies to generate income for your future.

Automate Your Savings to Ensure Success

A great goal is one thing, but consistent action is what actually builds wealth. Here's a hard truth: willpower is a limited resource. Relying on it to save money each month is a recipe for failure. The most successful people I know don't depend on discipline; they put their progress on autopilot.

This is where you can seriously accelerate your financial goals.

The most powerful habit you can build is to "pay yourself first." It’s not just a catchy slogan; it's a game-changing strategy. The moment your paycheck lands, a predetermined portion should automatically move into your savings and investment accounts—before you even have a chance to spend it.

Think of it this way: you’re treating your financial future with the same priority as your rent or mortgage. It becomes a non-negotiable bill you pay to yourself, turning saving from a monthly chore into an effortless background process.

Make Automation Work for You

Getting this set up is surprisingly simple. Most banks let you schedule recurring transfers right from their online portal or mobile app.

- For Savings: Set up a weekly or bi-weekly transfer to a high-yield savings account. This is perfect for building up an emergency fund or a down payment.

- For Investing: Arrange for automatic deposits into your brokerage account. This ensures you're consistently funding your retirement goals or, if you're an options seller, building the capital for your trading portfolio.

Automating your contributions means every single paycheck pushes you closer to your target, all without you having to lift a finger. It’s the ultimate hack for beating procrastination and staying on track.

This system is the perfect partner to a smart tracking routine. You don't need to obsess over balances daily. A quick monthly check-in with a finance app or a simple spreadsheet is all it takes to confirm you’re on course. This kind of automation is a cornerstone of solid financial planning and is critical for effective options trading risk management, because it supplies the consistent capital needed to execute your strategy without letting emotion get in the way.

Answering Your Top Financial Goal Questions

Even with a solid plan in hand, you're bound to run into questions. It's totally normal. Getting stuck is just part of the process when you're figuring out how to set and hit financial goals. Having direct answers ready can make all the difference in keeping your momentum going.

Let's dig into a few of the most common hurdles people face on their financial journey.

What if I Have Multiple Financial Goals?

Trying to save for a house down payment, beef up your retirement fund, and plan a vacation all at once? It’s a classic problem. You feel pulled in a million directions, and it's easy to feel like you're not making real progress on any of them.

A great way to handle this is to sort your goals by both timeline and necessity. Before anything else, get your foundation right. That means building at least a starter emergency fund and aggressively paying down any high-interest debt, like credit cards. Think of these less as goals and more as non-negotiables for your financial health.

Once that's handled, you can start dividing and conquering. For example, you might decide to channel 50% of your extra monthly cash toward a medium-term goal like that down payment, with the other 50% going straight into your long-term retirement accounts. The trick is to be intentional with where every dollar goes instead of just letting your money drift.

How Often Should I Review My Goals?

One of the biggest mistakes I see is the "set it and forget it" approach. Your financial plan isn't meant to be carved in stone; it should be a living, breathing document that evolves with you.

As a general rule, a deep-dive review of your goals at least once a year is a good rhythm. This annual check-in is your chance to make adjustments based on things like a pay raise, a career change, or just shifting priorities.

You should also revisit your financial goals after any major life event—a new job, a marriage, or the birth of a child. For tracking day-to-day progress, a quick monthly check-in is perfect for ensuring you're hitting your savings targets.

I Feel Overwhelmed and Don't Know Where to Start

Feeling paralyzed by the sheer amount of information out there? Take a deep breath and focus on one simple, powerful action: track your spending for one month.

That's it. Don't worry about changing anything just yet—your only job is to observe. Grab a notebook or a free app and just watch where your money is actually going. This single exercise cuts through all the noise and gives you the hard data you need to move forward. It will show you exactly where you can find the cash to start funding your very first, most important goal.

Ready to turn your financial goals into a reality with a data-driven strategy? Strike Price empowers you to generate consistent income by showing you the real probabilities behind every options trade. Stop guessing and start making informed decisions. Explore how Strike Price can help you achieve your income targets today.