Your Guide to an Options Income Strategy

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

What if your investment portfolio could do more than just sit there and (hopefully) grow in value over time? What if it could work a second job, generating a steady paycheck for you?

That’s the core idea behind an options income strategy. Instead of just waiting for stocks to go up, you actively generate cash flow by selling options contracts. It's a completely different way of thinking—moving from chasing long-term capital gains to creating a reliable, consistent income stream right now.

A New Way To Think About Your Portfolio

Most investors buy stocks and hope for the best. It's a passive waiting game that can take months, or even years, to pay off. An options income strategy flips that on its head, turning your portfolio into an active, cash-generating machine.

Think of it like being a landlord for the stocks you own. You collect regular "rent"—what traders call premium—from other investors who want the temporary right to buy or sell your assets at a specific price.

This isn't about perfectly timing the market or making wild predictions. It’s a numbers game focused on putting probabilities in your favor to collect that premium, week after week, month after month. It's an incredibly powerful approach, but let's be clear: this isn't a get-rich-quick scheme. It requires discipline, a bit of patience, and a solid grasp of how options work and the risks you're taking on.

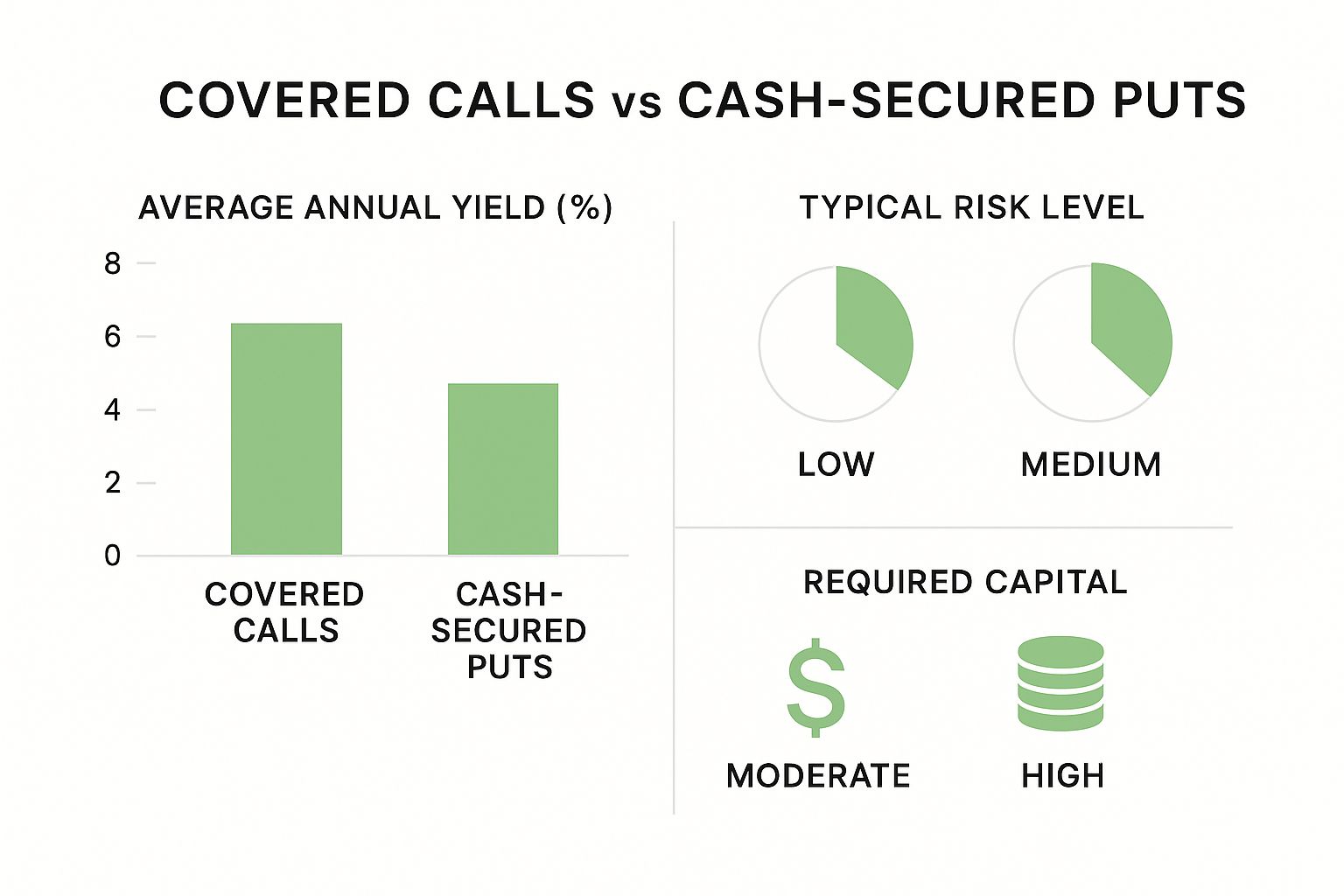

The image below gives you a quick snapshot of the two foundational strategies—Covered Calls and Cash-Secured Puts—and how they stack up in terms of yield, risk, and how much capital you need to get started.

As you can see, each strategy offers a different risk-and-reward profile. This allows you to pick an approach that actually fits your personal comfort level and the capital you have to work with.

Building Your Income Engine

At the heart of any solid income strategy are a few core techniques for selling premium. These are the workhorses designed to generate cash flow on a regular basis, often weekly or monthly. The income can be a great supplement to dividends or even become your primary source of returns.

The most common starting points are:

- Covered Calls: You sell call options on stock you already own. You get paid a premium upfront for agreeing to sell your shares at a set price if the stock climbs past it.

- Cash-Secured Puts: You sell put options on a stock you'd be happy to own anyway. You collect a premium for promising to buy the stock at a lower price if it drops—essentially getting paid to wait for a discount.

- Credit Spreads: This is a more defined-risk approach where you buy one option and sell another at the same time. It caps your potential loss while still letting you collect a net premium.

These strategies aren't some obscure Wall Street secret; they've become incredibly popular for creating an extra income stream, especially with well-known, liquid stocks. Selling covered calls on stable, blue-chip companies, for instance, lets you pocket upfront cash while simply agreeing to cap your potential upside.

Cash-secured puts work the other way around. You’ll need enough cash on hand to actually buy the stock if it gets "put" to you, but you get paid a premium while you wait. When you stick to a plan and manage your trades carefully, these strategies can be a fantastic way to generate steady cash.

To get a clearer picture of how these two beginner-friendly strategies differ, let's put them side-by-side.

Comparing Core Options Income Strategies

| Strategy | What You Do | Primary Goal | Ideal Market | Key Risk |

|---|---|---|---|---|

| Covered Call | Sell a call option on 100 shares of stock you already own. | Generate income from existing stock holdings. | Neutral to slightly bullish. | Missing out on big upside gains if the stock soars past your strike price. |

| Cash-Secured Put | Sell a put option, setting aside cash to buy 100 shares if the price drops. | Generate income while waiting to buy a stock you want at a lower price. | Neutral to slightly bearish. | Being forced to buy a stock that is continuing to fall in price. |

This table simplifies the core trade-offs. Both paths can lead to consistent income, but they are built for different market outlooks and personal goals.

It All Starts With Education

Before you even think about placing a trade, it’s critical to build a strong foundation of knowledge. Your greatest asset won't be a hot stock tip; it will be a deep understanding of how options work, how to manage risk, and how markets behave. You aren't just buying and selling—you're running a small business where your portfolio is the main asset.

An options income strategy is less about hitting massive home runs and more about hitting consistent singles. It's about making small, high-probability trades over and over again. Consistency is what builds a durable, long-term income stream.

For anyone looking to really dig in and learn the fundamentals of trading and strategy, the VTrader Academy is a great place to start. Building that foundational knowledge is the very first step toward turning your portfolio into a true income-generating machine.

Mastering the Core Income Engines

Alright, let's roll up our sleeves and dive into the two foundational engines of any solid options income strategy. These are the workhorses that, when you learn how to manage them, can turn your portfolio into a steady source of cash flow. We're going to focus on the two most common and accessible strategies out there: the covered call and the cash-secured put.

While both are built to generate income by selling options contracts, they have different jobs and work best in different market scenarios. Getting a real feel for how each one operates is the first hands-on step toward building your own income plan.

The Covered Call: Your Portfolio's Landlord

The covered call is probably the most popular options income strategy, especially for people who already own stocks. The idea is refreshingly simple: you agree to sell shares you already own at a set price sometime in the future. In exchange for making that promise, you get paid a premium right now, upfront.

You're "covered" because you physically own the 100 shares required to make good on the deal if the buyer decides to exercise their option.

Think of it like being a landlord for your stocks. You still own the property (the stock) and collect any rent (dividends), but you also collect an extra payment (the premium) from a tenant who wants the option to buy it from you later.

A Real-World Example

Let's say you own 100 shares of Company XYZ, which is currently trading at $50 per share. You think the stock is going to trade flat or maybe creep up a little over the next month. This is a perfect spot for a covered call.

- You sell one call option with a $55 strike price that expires in 30 days.

- Just for selling that contract, you immediately collect a premium of $2.00 per share, or $200 total. That money is yours to keep, no matter what happens next.

By selling this call, you’ve generated an immediate 4% return on your $5,000 position ($200 premium / $5,000 value). The trade-off? You've agreed to cap your potential gains at the $55 strike price for the next 30 days.

The Cash-Secured Put: Getting Paid to Be Patient

The cash-secured put is the other side of the income coin. It's a fantastic strategy when you want to buy a stock but think you can snag it for a better price than it's at today. Instead of just buying it, you get paid to wait for the price to drop to your target.

Here, you sell a put option and set aside enough cash to buy 100 shares of the stock at the strike price if you have to. You're "cash-secured" because the money is already in your account, ready to go if the stock price falls and the option is assigned to you.

A Real-World Example

Let's stick with Company XYZ. You'd like to own it, but you feel the current $50 price is a little steep. You'd be happy to buy it at $45 a share, though.

- You sell one put option with a $45 strike price that expires in 30 days.

- For taking on this obligation, you collect a premium of $1.50 per share, or $150 total. You also park $4,500 in your account ($45 strike x 100 shares) to secure the trade.

This setup gives you two great potential outcomes. If XYZ stays above $45, the option expires worthless, and you simply pocket the $150 premium as pure profit. If the stock does drop below $45, you get to buy the shares at your target price—and your actual cost basis is even lower because of the premium you collected.

These two strategies are the cornerstones for countless successful income portfolios. And while they are powerful, they're really just the beginning. To see what else is possible, check out our guide on 9 proven equity option strategies to boost returns in 2025. For those comparing different ways to generate consistent returns, looking into alternatives like securing guaranteed income in retirement can provide a much broader perspective.

Using Probabilities to Manage Your Risk

Successful options income trading isn’t about gazing into a crystal ball. Far from it. It’s about becoming a sharp manager of risk, putting on trades where the odds are consistently in your favor. This is where we graduate from the basic mechanics and start making smart, data-driven decisions.

At the heart of this approach is a simple truth: every option contract has probabilities baked right into its price. And you don't need a math PhD to use them. The most practical and powerful metric for this is called Delta.

Meet Delta: Your Probability Gauge

Think of Delta as your go-to gauge for an option's likelihood of finishing "in-the-money" (ITM) when it expires. While it has a more technical definition, for an income seller, its best use is as a quick-and-dirty probability estimate.

For instance, a call option with a Delta of 0.30 has roughly a 30% chance of expiring ITM. Flip that around, and you get a 70% chance it will expire worthless—which is exactly what you want as the seller. This one number transforms a hopeful guess into a calculated risk.

By focusing on Delta, you shift from hoping a trade works out to knowing the statistical probability of success before you ever click "sell." This is the foundation of a sustainable options income strategy.

This lets you dial in your strategy. Are you more conservative? You might stick to selling options with a Delta of 0.20 or less, giving you an 80%+ probability of keeping the entire premium. Willing to take on a bit more risk for more income? You could venture into the 0.30 to 0.40 Delta range.

The Unavoidable Risk-Reward Trade-Off

This brings us to a fundamental law of options trading: higher premium always means higher risk. It’s easy to get drawn to the juiciest premiums, but they're high for a reason. They belong to options with a higher Delta, meaning a greater statistical chance the trade will go against you.

Finding your personal sweet spot is everything. It’s a balance between your hunger for income and your tolerance for risk. A trade that lets you sleep at night is always better than a high-stress gamble, no matter the potential payout.

Here’s a simple way to think about it:

- Low Delta (e.g., 0.15): This is a high-probability trade (around 85% chance of success). The premium will be smaller, but the trade is considered much safer.

- Moderate Delta (e.g., 0.30): A balanced approach. You get a solid probability of success (around 70%) and a more substantial premium. This is a popular target for many income traders.

- High Delta (e.g., 0.50): This is a 50/50 shot. The premium is very tempting, but the risk of getting assigned is significant. It's less of an income play and more of a directional bet.

Build Smart Risk Management Habits

Probabilities are your guide, but they are not a guarantee. The market will always find a way to surprise you. That’s why any solid options income strategy must be built on disciplined risk management. For a much deeper look at this, check out our complete playbook on options trading risk management.

Start by building these core habits:

- Use Smart Position Sizing: Never go all-in on one trade. A good rule of thumb is to not risk more than 2-5% of your capital on any single position.

- Have a Clear Exit Plan: Know what you’re going to do before you even enter the trade. Decide ahead of time where you'll take profits or cut your losses if the stock makes a sharp move against you.

- Plan for Adjustments: Sometimes, a trade that starts to go sour can be "rolled" to a later date for more premium. Planning how and when you might adjust a trade can turn a potential loser into a break-even or even a small win.

How to Select the Right Stocks for Income

Not all stocks are created equal when you're running an options income strategy. The truth is, the underlying asset you pick is the single most important decision you'll make. It dictates everything—your potential for steady income and your exposure to risk. Think of it like building a house: a shaky foundation will bring down everything you build on top of it, no matter how well-crafted.

The best approach? Stick to high-quality, stable companies you wouldn't mind owning for the long haul. This isn't the playground for speculative, high-flying stocks. The goal here is to generate reliable cash flow, not to gamble on massive price swings.

The Non-Negotiable Traits of an Income Stock

As you scan for potential candidates, a few specific characteristics should be at the top of your list. These aren't just suggestions; they're critical traits that create an environment where selling options is more predictable and a lot less stressful. Ignore them at your own peril.

Your checklist should include:

- Strong Financial Health: Look for companies with a history of consistent earnings, healthy balance sheets, and a proven business model. Financially sound companies are far less likely to suffer a sudden, catastrophic price drop that could wreck your entire position.

- Manageable Volatility: You need some volatility to generate a decent premium, but extreme volatility is your enemy. You want stocks that trade in a relatively predictable range—not ones that can double or get sliced in half on a rumor.

- High Options Liquidity: This is a big one, and it's where many new traders get tripped up. You absolutely must focus on stocks that have a very active options market with high trading volume.

Liquidity is everything. It's the grease that keeps the gears of your income machine turning smoothly. Without it, you're stuck.

High liquidity means there are always plenty of buyers and sellers ready to trade. This is what keeps the bid-ask spread—the tiny gap between the highest price a buyer will pay and the lowest price a seller will accept—nice and tight. A tight spread ensures you get a fair price every time you enter or exit a trade, which has a massive impact on your profitability over the years.

Why Liquidity Is Your Best Friend

Imagine trying to sell a rare, obscure piece of art. You might have to wait weeks or even months to find a buyer, and when you finally do, you'll probably have to accept a price far lower than you wanted. Now, imagine selling a brand-new iPhone. Buyers are everywhere, the market price is clear, and the transaction is fast.

That's the difference between an illiquid and a liquid market.

The global options market is booming—a record 68 million contracts were traded on a single day in February 2023. But that activity is highly concentrated in large-cap stocks like Apple and Nvidia. While the volume is tempting, it’s also worth noting that retail traders lost over $2 billion in options premiums from 2019 to 2021, a stark reminder of the risks of trading without a sound strategy. Focusing on highly liquid stocks gives you access to the most active markets and the flexibility to manage your positions effectively.

A Smarter Alternative: Exchange-Traded Funds (ETFs)

If picking individual stocks feels a little daunting, there’s a fantastic alternative: Exchange-Traded Funds (ETFs). ETFs that track major indices like the S&P 500 (SPY) or the Nasdaq 100 (QQQ) are some of the most liquid financial instruments on the planet.

Using ETFs for your income strategy gives you two powerful advantages right out of the gate:

- Instant Diversification: Instead of betting on a single company's fate, you're spreading your risk across hundreds of them. This diversification helps smooth out the wild price swings that can happen with any one stock.

- Unmatched Liquidity: The options markets for major ETFs are incredibly active, meaning you can almost always get in and out of trades at a fair price with minimal friction.

Whether you go with blue-chip stocks or broad-market ETFs, the underlying principle is exactly the same. You want to build your strategy on a foundation of high-quality, liquid assets you'd be happy to own. This discipline is essential for both covered calls and the strategy of selling cash-secured puts, where the ultimate goal is to get paid to acquire great companies at a discount.

Common Mistakes and How to Sidestep Them

Jumping into any options income strategy without knowing the common pitfalls is like trying to cross a minefield blindfolded. While these strategies are powerful, a few simple missteps can wreck your progress and turn a source of steady income into a source of constant stress. The trick is to see these traps long before you fall into them.

Let's be real about what separates the consistent earners from everyone else. It almost always boils down to discipline and steering clear of the most tempting—and destructive—trading habits.

Chasing Yield on Volatile Stocks

The most common mistake by far is chasing yield. You spot a stock with ridiculously high options premiums and think you’ve hit the jackpot. But that fat premium is actually a flashing red light. It signals massive uncertainty and high implied volatility, which means the stock is primed for wild price swings.

Selling a covered call on a stock that suddenly nosedives, or a cash-secured put on a company that drops terrible news, can saddle you with big losses. That little bit of income you collected will feel like a pathetic consolation prize. The fix is straightforward: stick to high-quality, stable companies you actually understand and wouldn't mind owning for the long haul.

The Psychological Traps of Trading

Sometimes, your own brain is your worst enemy. Two psychological traps seem to catch options income traders more than any others.

- Fear of Missing Out (FOMO): This one stings. You sell a covered call, and the stock blasts right past your strike price. You start calculating the "missed" gains and kick yourself for it. This feeling can tempt you to abandon your entire strategy and start chasing hot stocks, which almost never ends well.

- Panic Selling: The flip side. You sell a cash-secured put, the stock dips a little, and your position shows a small paper loss. Fear kicks in. You close the trade for a loss, only to watch the stock bounce back a few days later.

An options income strategy is a business, not a lottery. Remind yourself that the goal is consistent cash flow, not capturing every last dollar of a stock's explosive move. A successful trade is one that follows your plan.

To fight these feelings, you need a rock-solid plan. Know your profit target and your maximum acceptable loss before you ever click "buy" or "sell." This pre-commitment stops you from making emotional, in-the-moment decisions that will sabotage your long-term results.

Trading Around Unpredictable Events

Another classic blunder is selling options right before a highly unpredictable event, like an earnings announcement. Yes, the premiums are sky-high, but you're essentially betting on a coin flip. Even fancier strategies like straddles, which are designed to profit from big moves, often get crushed in this environment.

Just look at the historical data for one-day straddles around earnings. It tells a grim story. While the average return was around 10.3%, that number was massively skewed by a few lottery-ticket wins. The median return? A painful -6.3%. Winning trades only happened about 44% of the time. This shows that more often than not, these supposedly "high-probability" event-based trades lose money. You can explore more on these statistical findings and their impact on trading decisions.

The smarter play is to just sit it out. Avoid selling short-term options that expire right after an earnings call. Let the dust settle, then see where things stand. It’s far better to collect a smaller, more reliable premium than to risk a huge loss on a binary event you can't possibly control. By sidestepping these common mistakes, you build the discipline needed for a durable and successful options income strategy.

Your Options Income Questions Answered

Alright, let's talk about the practical side of things. Once you start moving from reading about options income to actually trading, a lot of real-world questions pop up. It's a big step, and getting clear answers can make all the difference in building your confidence.

This section is all about tackling those common "what if" scenarios. We'll clear up the final hurdles so you can start your income journey with a solid grasp of what to expect.

How Much Money Do I Need to Start?

This is usually the first question on everyone's mind, and the honest answer is: it depends entirely on the strategy you choose. The starting capital for covered calls and cash-secured puts is very different.

With a covered call, you need to own at least 100 shares of the underlying stock first. So, if you've got your eye on a stock trading at $50 a share, you'll need $5,000 in that stock before you can sell a call ($50 x 100 shares). This makes it a great fit if you already have an established portfolio.

A cash-secured put, on the other hand, is all about the cash you have on hand. To sell a put with a $45 strike price, you just need to have $4,500 in your account to "secure" the trade ($45 x 100 shares). This can be a more accessible starting point if you're working with cash instead of existing shares.

The Takeaway: There's no magic number. Your starting capital simply determines which stocks are in your playground—whether that means owning 100 shares outright or having enough cash to back a put sale.

What Happens If My Option Is Assigned?

"Assignment" can sound scary, but for an income trader, it's often just part of the plan. It's not a failure; it’s simply the other side of the contract playing out exactly as designed.

Here’s how it breaks down for our two main strategies:

- Covered Call Assignment: If the stock price closes above your strike at expiration, you'll be assigned. This just means you sell your 100 shares at the strike price you agreed to. You keep the premium you collected from day one, and you've hit your maximum profit for that trade.

- Cash-Secured Put Assignment: If the stock price drops below your strike at expiration, you'll be assigned. In this case, you fulfill your end of the deal and buy 100 shares at that strike price, using the cash you had set aside. You now own a stock you wanted at a price you liked, and you still keep the premium.

In either scenario, assignment isn't a surprise—it's one of the two outcomes you prepare for from the very beginning.

Can I Lose More Than the Premium I Collect?

Yes, absolutely. This is a critical point to understand. While your profit on any single trade is capped by the premium, your potential loss is not. Selling options for income doesn't eliminate risk—it just reframes it.

Think about it this way: with a covered call, your risk is essentially the same as owning the stock. If the stock's price tanks, the small premium you collected will only offer a tiny cushion against a much larger loss on your shares.

With a cash-secured put, if you get assigned, you're now the owner of a stock whose price is falling. The risk is that it keeps falling well below the price you were forced to buy it at. That premium you collected helps lower your cost basis, but it won't save you from a major loss if the underlying company is fundamentally weak. This is exactly why choosing high-quality stocks you wouldn't mind owning is non-negotiable.

How Do I Choose the Right Expiration Date?

The expiration date you pick has a direct impact on both your income and your risk. The main choice is between shorter-term weeklies and longer-term monthlies.

Shorter-dated options, like those expiring in 7 to 14 days, are great for taking advantage of rapid time decay (theta). This lets you collect premiums more often, which can really start to compound your income. In fact, a 2025 Cboe report noted that zero-days-to-expiration (0DTE) options now make up about 60% of all S&P 500 options volume—a huge shift showing just how popular short-term trading has become.

On the flip side, longer-dated options—say, 30 to 45 days out—usually come with bigger upfront premiums and give your trade more time to be "right." But, they also tie up your capital for longer and are slower to react to market shifts.

Ultimately, it comes down to your personal style. Many income traders find their sweet spot selling options that are 20-45 days from expiration, as it strikes a nice balance between meaningful premium and manageable risk.

Ready to stop guessing and start making data-driven decisions? The Strike Price platform gives you the real-time probability metrics you need to master your options income strategy. Track your contracts, get smart alerts, and build a consistent income stream with confidence. Turn your portfolio into an income machine with Strike Price today!