A Trader's Guide to Options Time Decay

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to Extrinsic Value Option Profits

Unlock the power of the extrinsic value option. Learn what drives it, how to calculate it, and strategies to profit from time decay and volatility.

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

Time decay in options, what traders call Theta, is one of the few sure things in the market. It's the slow, steady erosion of an option's value as its expiration date gets closer.

Think of it like an ice cube melting on a hot day. It doesn't matter what else is happening—the ice is always melting. Time decay works the same way.

What Is Options Time Decay?

Every option has an expiration date, which acts like a ticking clock on its life. As that date draws nearer, the option's value naturally shrinks, even if the underlying stock price doesn't move an inch. This is a fundamental force every options trader has to deal with.

This "melting" portion of the option's price is what we call extrinsic value, or time premium. It's the price you pay for the possibility that the option will become profitable. Since time is a key ingredient in that possibility, the extrinsic value disappears as time runs out.

Understanding Theta

The Greek letter Theta (θ) is how we measure this daily decay. It tells you exactly how much value an option is expected to lose each day just from the passage of time.

For example, if an option has a Theta of -0.05, it’s expected to lose about five cents of its value every single day, assuming the stock price and volatility don't change.

This makes time a powerful, and often expensive, component of every option's price. Your success as a trader often comes down to one simple question: is time working for you, or is it working against you?

Now, here's the critical part: this decay isn't a straight line. It speeds up dramatically as expiration gets closer. An option with months left might only lose a few cents per day, but that same option could start losing several dollars a day in its final week. This acceleration is a huge risk for option buyers and a massive opportunity for option sellers.

How It Relates to Strike Price

The speed of this decay is also directly linked to an option's strike price relative to the stock's current price—what traders call its "moneyness."

At-the-money (ATM) options, for instance, are made up almost entirely of this extrinsic value, so they decay the fastest. In contrast, deep in-the-money or far out-of-the-money options have less time premium and decay more slowly. Understanding how to choose an option strike price is essential for aligning your strategy with how you want to manage time decay.

Why Theta Is a Buyer's Enemy and a Seller's Ally

To really get a handle on options time decay, you have to know which side of the clock you’re on. The relentless tick-tock can feel like a stiff headwind pushing you back or a powerful tailwind sending you forward. It all comes down to one thing: are you buying the option or selling it?

This two-sided nature of Theta is the most critical concept you’ll learn. Your relationship with time will define your entire trading approach—from the strategies you pick to the risks you’re willing to take.

The Buyer's Constant Battle Against Time

When you buy an option—a call or a put—you're paying a premium for a right. That premium is a mix of the option's real value (if it has any) and, crucially, its time value. You’re paying for the chance that the stock will make a big move in your favor before the contract expires.

For an option buyer, time is a depleting asset. Every single day that passes without a big move in the underlying stock, Theta is quietly eating away at your investment. It's a constant, unavoidable pressure working against you.

Think of it like buying a ticket to a big concert months in advance. Part of that ticket's value is the time leading up to the show—the anticipation, the hype. As the concert date gets closer, that time value just evaporates. The day of the show, the ticket is only worth its face value, and the time premium is gone for good.

This turns buying options into a race against the clock. To make a profit, the stock has to move far enough and fast enough in your direction to cover not just what you paid, but also the daily cost of options time decay.

The Seller's Greatest Advantage

Now, flip the script. For an option seller, that same time decay isn't a threat; it's your primary way to make money. When you sell an option, you get paid the premium upfront. Your goal is for that option's value to shrink, ideally all the way to zero.

Every tick of the clock works for you. As each day goes by, Theta chips away at the option's extrinsic value, pushing it closer to being worthless. This lets you pocket the entire premium you collected as profit. It's the engine behind some of the most popular income strategies out there.

- Covered Calls: You sell call options on stock you already own and collect the premium. If the stock price chops around or goes down, time decay helps the option expire worthless, and you keep the income.

- Cash-Secured Puts: You sell a put, which is a promise to buy a stock at a lower price. The premium you get acts as a cushion, and time decay works to erode your obligation, often letting you keep the cash without ever having to buy the shares.

The real power of selling options is turning time into your ally. As a seller, you generally want the stock to stay put or move in a way that doesn't put your option in the money. When that happens, you are literally getting paid to wait.

If you're looking to put this into practice, check out our guide on the covered call strategy and its results to see how these income strategies perform in the real world.

How Moneyness Determines the Rate of Decay

Not all options are created equal, and they certainly don't melt at the same speed. The rate of options time decay is heavily influenced by where the option's strike price sits relative to the stock's current price—a concept traders call moneyness. Getting this relationship right is absolutely critical for picking the right option for your strategy.

An option’s state of moneyness tells you exactly where it stands in relation to the market. There are three possibilities:

- In-The-Money (ITM): The option already has real, intrinsic value. For a call, the strike price is below the stock price; for a put, the strike is above it.

- At-The-Money (ATM): The option's strike price is right around the current stock price. It has no intrinsic value, only extrinsic (time) value.

- Out-of-the-Money (OTM): The option has zero intrinsic value and would be worthless if it expired this second. For a call, the strike is above the stock price; for a put, it's below.

Key Insight: The amount of extrinsic value an option has is a direct measure of how much it will suffer from time decay. Because At-The-Money options are made up almost entirely of extrinsic value, they get hit the hardest by the ticking clock.

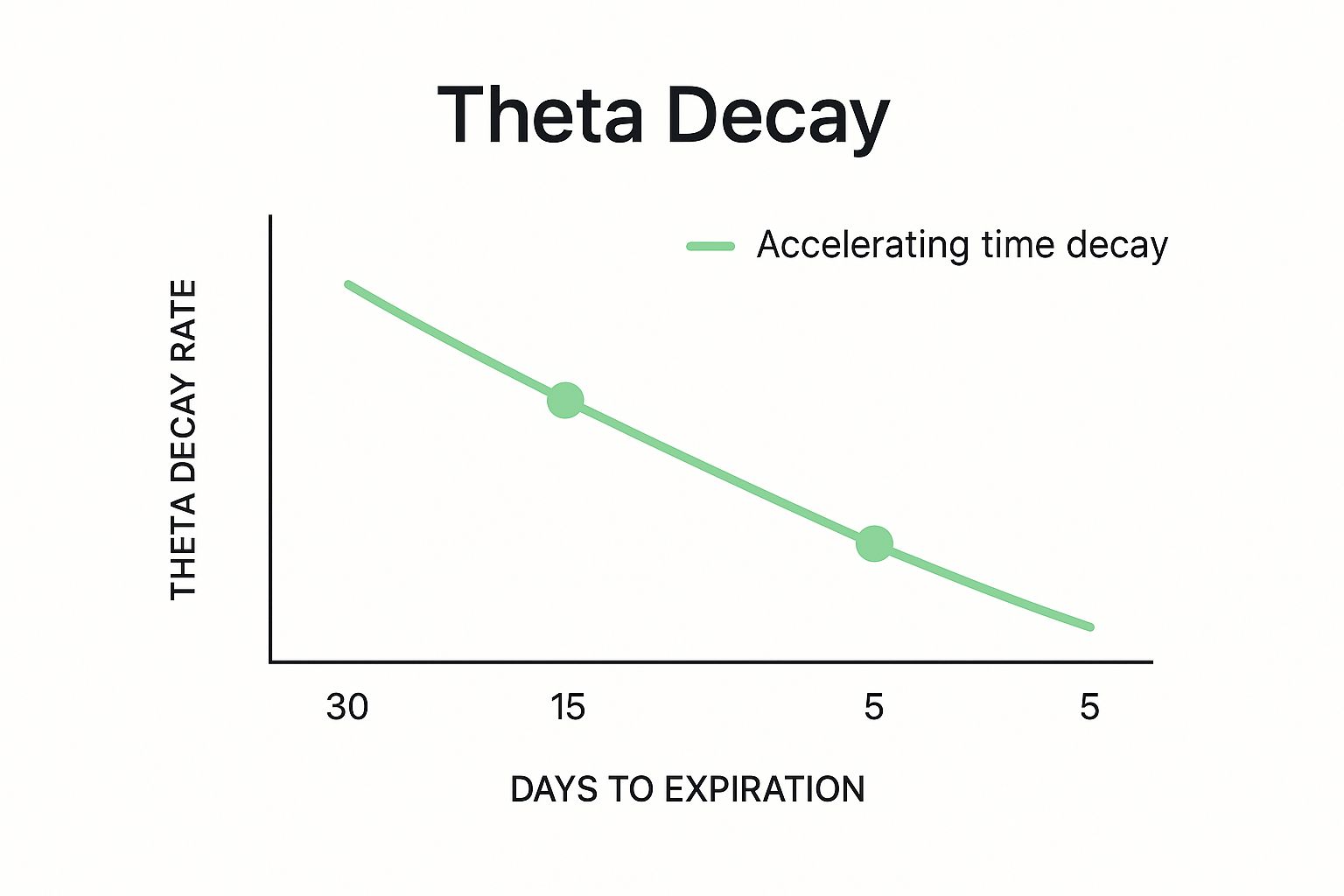

This chart really drives the point home. It shows how Theta decay isn't a straight line—it accelerates dramatically as an option gets closer to expiration, with the damage becoming most severe in those final weeks.

As you can see, the value lost each day snowballs the closer you get to the end date. What starts as a slow drip becomes a waterfall.

Where Time Decay Hits Hardest

To make this tangible, think of it like three different ice cubes. The In-The-Money (ITM) option is like a big, solid block of ice. The Out-of-the-Money (OTM) option is a tiny ice chip. But the At-The-Money (ATM) option? That’s just a chunk of slush.

Which one melts the fastest? The slush, of course. It has the least solid structure—just like an ATM option, which has no solid intrinsic value to prop up its price.

Real-world data backs this up. ATM options consistently show the highest Theta decay because their extrinsic value is at its absolute peak. For example, an ATM call on a stock trading near $212.50 might lose $0.10 per day as expiration approaches. Meanwhile, a far OTM call with a $230 strike might only lose $0.06 per day, simply because it has less premium to burn away. This dynamic is the bread and butter of options sellers, who aim to collect that eroding value. You can find more details on how exchanges track this on financial education sites. Discover more insights about options decay on Schwab.com.

Comparing Time Decay Across Different Strike Prices

Let's break down how Theta impacts each type of option. The table below compares how time decay behaves across the different states of moneyness for the same underlying stock and expiration.

| Option Type (Moneyness) | Primary Value Component | Rate of Time Decay (Theta) | Trader Implication |

|---|---|---|---|

| At-The-Money (ATM) | Almost entirely extrinsic value | Highest. The option has the most time premium to lose, so decay is rapid and aggressive, especially near expiration. | Ideal for option sellers looking to maximize income from time decay, but extremely risky for buyers who need a fast, significant stock move. |

| Out-of-The-Money (OTM) | Entirely extrinsic value, but very little of it | Low to Moderate. Far-OTM options have very little premium to start with, so their daily decay in dollar terms is small. | Buyers are attracted to the low cost, but these are lottery tickets that often expire worthless. Sellers receive minimal premium for taking on the risk. |

| In-The-Money (ITM) | Mostly intrinsic value, with some extrinsic value | Low. Deep ITM options behave more like the underlying stock. They have less time premium, so daily decay is minimal. | Buyers use these to get stock-like exposure with less capital. Sellers avoid deep ITM options as there's little time premium to collect. |

Ultimately, your choice of strike price is a strategic decision about how you want to engage with options time decay. Buyers often try to find a sweet spot—maybe slightly OTM or ITM—to soften the blow of decay. Sellers, on the other hand, frequently gravitate toward ATM options to harvest the fastest-decaying premium they can find.

Navigating the Time Decay Curve

One of the most dangerous mistakes a new trader can make is thinking options time decay is a slow, steady drip. It’s not. Far from it. Time decay, or Theta, doesn't move in a straight line. It follows a dramatic curve, starting off slow and then accelerating into a freefall as expiration gets closer.

Understanding this time decay curve isn't just theory—it’s a fundamental part of surviving and thriving in the options market. Getting it wrong is like misjudging the speed of an oncoming train. The results for your portfolio can be just as devastating.

Think of it like a snowball rolling down a long hill. At the top, with months left until an option expires, the snowball is small and picks up speed very gradually. The day-to-day change is almost unnoticeable. Here, an option might lose just a tiny sliver of its value each day.

But as that snowball barrels toward the bottom of the hill—representing the final 30-45 days before expiration—it gets exponentially bigger and faster. The slow roll has turned into a thundering avalanche. In this final month, the daily loss of value becomes severe, catching many unprepared option buyers completely off guard.

The Final 30 Days: The Danger Zone

This period of rapid decay is what many traders call "the danger zone" for anyone buying an option. If you're holding a long call or put contract inside this final month, you're fighting an increasingly tough uphill battle. Your trade doesn’t just need to be right on the stock's direction; it has to move fast enough to outrun the accelerating time decay.

Key Takeaway: An option can lose a huge chunk of its remaining time value—sometimes more than half—in the last 30 days of its life. The value that took months to erode slowly can evaporate in just a few weeks or even days.

This is exactly why so many seasoned option buyers sell or roll their positions before they hit that 30-day window. They lock in their gains before the accelerating decay has a chance to wipe them out, knowing the risk of holding on often outweighs any potential reward.

Why Sellers Target Short-Dated Options

Now, let's flip the script. This exact same dynamic is what makes selling options so appealing. Theta is one of the most predictable forces in options pricing, and savvy traders use it to generate consistent income. While decay is slow when an option has over a month left, it speeds up dramatically in the last 30 days.

For example, a $3.00 option premium with a Theta of -0.05 is losing about 1.67% of its value every single day. In high-volume markets like the S&P 500 (SPX), sellers specifically target this period of rapid decay to generate returns, which can reach 10-20% annually on their capital when managed correctly. You can learn more about the principles behind this from industry experts. Explore the advanced concepts of Theta on OptionsEducation.org.

Sellers of covered calls and cash-secured puts often zero in on contracts with 30-45 days to expiration for a few good reasons:

- Maximum Decay Rate: They jump in right when Theta really starts to pick up speed.

- Higher Premiums: These options still have enough time value left to make the premium they collect worthwhile.

- Faster Capital Turnover: They can collect the premium and get out of the trade relatively quickly, freeing up their cash for the next opportunity.

By truly understanding the time decay curve, you can time your entries and exits like a pro. For buyers, it means knowing when to get out. For sellers, it means knowing exactly when to get in to catch that wave of decaying premium at its most powerful.

Strategies to Manage and Exploit Time Decay

Knowing the theory behind options time decay is one thing. Putting that knowledge to work is what really separates successful traders from everyone else.

Theta can be a destructive force working against you or a powerful ally in your corner. The strategies you choose will determine which side of that fence you're on. Here, we'll turn theory into action with a playbook for both managing and exploiting time decay.

Whether you're an option buyer trying to survive Theta's constant drain or a seller looking to harness it for steady income, there's a strategy for you. The key is to consciously choose your relationship with time instead of letting it dictate your results.

Strategies for Option Buyers to Mitigate Decay

For an option buyer, the clock is always ticking. Loudly.

Your main challenge is giving your trade enough time to play out without letting Theta chew through your premium. You can't eliminate time decay—that’s impossible—but you can definitely slow it down and lessen its bite.

Buy More Time with LEAPS: One of the smartest ways to slow decay is to buy options with a much longer shelf life. Long-Term Equity AnticiPation Securities (LEAPS) are simply options with more than a year until they expire. Because they're so far from the steepest part of the decay curve, their daily Theta is tiny. This gives your trade plenty of breathing room to mature.

Use Vertical Spreads to Cap Risk: Instead of just buying a single call or put, you can build a vertical spread. This involves buying one option and simultaneously selling another one further out of the money. Doing this immediately cuts your net cost, which means less of your capital is exposed to time decay. While it does cap your potential profit, it also dramatically lowers your breakeven point and the damage Theta can inflict.

These defensive moves help buyers stay in the game longer, shifting the odds just a little more in their favor by taming the corrosive effect of time.

Harnessing Theta for Income Generation

For option sellers, the game is proactive, not defensive. The goal here is to put yourself in a position where the passage of time directly translates into profit.

You are, in effect, selling a "wasting asset" to someone else and collecting the premium as it melts away.

Key Concept: Successful options selling isn't about predicting massive market swings. It's about finding situations where time decay is predictable and positioning yourself to collect it. You are selling time, and Theta is your profit engine.

Let's walk through some of the most reliable income-focused strategies.

Selling Covered Calls: This is a cornerstone strategy for anyone who owns stock. You sell a call option against shares you already hold in your portfolio. You get paid the premium upfront, and time decay immediately starts working for you, chipping away at the value of the option you sold. If the stock price stays flat, goes down, or only inches up, the option will likely expire worthless, and you keep the full premium as income.

Selling Cash-Secured Puts: This is a popular way to either generate income or buy a stock you want to own at a discount. You sell a put option and set aside the cash needed to buy the shares if you get assigned. Just like a covered call, time decay erodes the option's value. If the stock stays above the strike price, the option expires worthless, and you pocket the premium.

The Iron Condor for Neutral Markets: For traders who think a stock will stay stuck in a specific price range, the iron condor is a pure play on time decay. This strategy involves selling both a call spread and a put spread on the same stock. You collect a net premium, and you profit as long as the stock price remains between your short strikes at expiration. The profit comes almost entirely from both spreads losing their extrinsic value as time passes.

These approaches completely flip the script on time, turning it from an expense into a revenue stream. To dig deeper into these methods, check out our detailed guide on 7 proven options income strategies for steady gains in 2025.

Ultimately, mastering these strategies comes down to a solid understanding of risk and reward. But beyond just managing time decay, smart traders also think about their long-term financial health and how to improve your tax position as a share trading business. By combining strategic option plays with sound financial planning, you can build a more resilient and profitable trading operation. The goal is to stop reacting to the market and start methodically using its own mechanics, like time decay, to your advantage.

Answering Your Questions on Time Decay

Even after you get the hang of the basics, it's natural to have questions about the finer points of options time decay. Let's tackle some of the most common ones traders ask. This will help lock in what you've learned and clear up any lingering confusion.

Does Time Decay Happen on Weekends and Holidays?

Yes, absolutely. Theta doesn't care if the market is open or closed—it represents decay over a full calendar day, not just a trading day. While you're enjoying your weekend, time is still marching forward, and your option is getting closer to expiration.

This is why you might see an option's price open lower on Monday than it closed on Friday, even if the stock itself hasn't budged. That's the market pricing in two full days of options time decay.

Option sellers love this phenomenon, often calling it "weekend decay." For them, it's like getting paid while the markets are quiet—a core benefit of holding short option positions over a weekend or holiday.

How Does Implied Volatility Affect Time Decay?

Implied volatility (IV) and time decay (Theta) are two sides of the same coin—the extrinsic value coin. They have a direct and incredibly important relationship.

When IV is high, the market is essentially betting on a big price swing. This makes options more expensive because there's a greater perceived chance they'll finish in-the-money. This inflated premium means there's more extrinsic value to decay, so Theta is also higher. The option simply has more value to lose each day.

Key Relationship: High implied volatility creates higher option premiums. This, in turn, means there is more value for Theta to chip away at each day. A sudden spike in IV can even temporarily overpower time decay, causing an option's price to rise as time passes.

On the flip side, when IV is low, options are cheaper. There's less extrinsic value to burn off, so Theta is lower. This is why option sellers are looking for a two-for-one deal: the steady passage of time (positive Theta) and a drop in implied volatility (often called a "vega crush"), as both forces push the option's value down.

Can I See an Option's Time Decay Rate?

You can, and you absolutely should. Nearly all modern trading platforms display the "Greeks" for every option contract available. To see the exact rate of time decay, you'll want to look for the value labeled Theta.

For a single option you might buy, Theta is almost always shown as a negative number. It tells you exactly how much value that contract is expected to lose per day from time decay alone.

- Example: A Theta of -0.05 means the option is set to lose about $0.05 in value every day, assuming the stock price and volatility don't change.

- Application: A Theta of -0.20 signals a much faster burn rate, with the option losing $0.20 daily. You'll often see this with at-the-money options that are very close to expiring.

By scanning the Theta values across different strikes and expirations, you get a direct comparison of how quickly each option is melting. This data is non-negotiable for making smart decisions, whether you're trying to sidestep decay as a buyer or harness it as a seller.

What Is the Difference Between Linear and Non-Linear Decay?

This is a critical concept that trips up a lot of traders. If decay were linear, an option would lose the same chunk of value every single day. But that's not how it works. Options time decay is non-linear, meaning the speed of decay changes dramatically over the option's life.

Think of it like a melting ice cube:

- Far from Expiration (90+ days): The decay is painfully slow, almost flat. The daily loss in time value is tiny, like an ice cube barely dripping in a freezer.

- Approaching Expiration (30-45 days): The decay starts to pick up speed. The drips become more frequent as the decline in time value gets steeper.

- Final Week of Expiration: The decay turns into a waterfall. The option can hemorrhage a huge portion of its remaining value in just a few days as the ice cube melts rapidly on a hot sidewalk.

This non-linear curve is precisely why holding long options into that final month is so dangerous—and why selling short-dated options is such a popular strategy for generating income.

Ready to stop guessing and start using data to your advantage? Strike Price provides real-time probability metrics for every strike, turning the complexities of time decay and risk into clear, actionable insights. Make smarter selling decisions today by visiting https://strikeprice.app.