Top Selling Put Option Strategies for Steady Income in 2025

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Step-by-Step Covered Calls Example for Consistent Income

Unlock consistent income with our step-by-step covered calls example. This guide breaks down the strategy, risks, and outcomes to help you trade confidently.

Long Call and Short Put The Ultimate Synthetic Stock Guide

Unlock the power of the long call and short put strategy. This guide explains how synthetic long stock works, its benefits, risks, and how to execute it.

What is a Call Spread? A Clear Guide to Bull and Bear Spreads

What is a call spread? Discover how bull and bear spreads limit risk and sharpen your options trading strategy.

Selling options, particularly puts, offers a powerful way to generate consistent income, acquire stocks at a discount, or express a bullish to neutral market outlook. Unlike buying options, which often relies on predicting large price movements, selling put option strategies allows you to profit from time decay and volatility, effectively turning the passage of time into a revenue stream. This approach shifts the odds in your favor, as you collect a premium upfront and win if the stock price stays above a certain level, goes up, or even moves down slightly. For retail investors and experienced traders alike, mastering these techniques can transform a portfolio from a passive collection of assets into an active income-generating machine.

This guide moves beyond theory to provide a detailed roundup of the most effective selling put option strategies. We will break down each method with actionable insights, clear pros and cons, and specific use cases. You will learn not just what each strategy is, but how and when to implement it for optimal results. From the foundational Cash-Secured Put to more complex setups like the Put Credit Spread and the popular Wheel Strategy, this article will equip you with the knowledge to select and execute the right approach for your financial goals, risk tolerance, and market view.

1. Strategy 1: The Foundation - Cash-Secured Put

The cash-secured put is the cornerstone of conservative, income-generating selling put option strategies. It’s a straightforward approach where you sell a put option while simultaneously setting aside enough cash to buy the underlying stock at the strike price if the option is exercised. This strategy is foundational because it clearly defines your maximum risk and obligation from the outset.

Think of it as getting paid to place a limit order to buy a stock you already want to own, but at a lower price than it currently trades for. If the stock price stays above your chosen strike price by expiration, you simply keep the premium as pure profit.

How It Works: A Practical Example

Imagine a stock, XYZ, is currently trading at $52 per share. You believe it’s a solid company but would prefer to buy it at $50.

- Sell a Put Option: You sell one XYZ put option with a $50 strike price that expires in 30 days.

- Collect Premium: For selling this contract, you immediately receive a premium, let's say $1.50 per share, which totals $150 ($1.50 x 100 shares).

- Secure the Cash: Your broker will require you to hold $5,000 in cash ($50 strike price x 100 shares) in your account as collateral. This is the "cash-secured" part.

Key Insight: Your net cost to acquire the stock, if assigned, isn't the strike price. It's the strike price minus the premium you collected. In this case, your effective purchase price would be just $48.50 per share ($50 - $1.50).

When to Use This Strategy

The cash-secured put shines in specific scenarios:

- Bullish to Neutral Outlook: You should be comfortable owning the underlying stock. Use this when you expect a stock's price to either rise, stay flat, or dip only slightly.

- Acquiring Stock at a Discount: It’s an excellent tool for patiently entering a position in a high-quality company at a price you pre-determine.

- Generating Consistent Income: In sideways or slowly rising markets, you can repeatedly sell puts and collect premiums without ever being assigned the stock, creating a steady income stream.

This is one of the most fundamental selling put option strategies because it teaches discipline, risk management, and the core principle of getting paid for taking on a defined obligation.

2. Naked Put Selling

For traders with a higher risk tolerance and a deep understanding of market dynamics, the naked put (or uncovered put) represents a more aggressive, capital-efficient approach. Unlike its cash-secured counterpart, this strategy involves selling a put option without holding enough cash to purchase the underlying stock if assigned. The goal is the same: collect the premium and have the option expire worthless.

The primary advantage is leverage. Since you aren't setting aside the full cash value, your broker only requires a smaller amount of margin, freeing up capital for other trades. This strategy is popular among professional traders and hedge funds who use it for volatility harvesting and to express a strong bullish conviction without tying up significant capital.

How It Works: A Practical Example

Let's revisit stock XYZ, trading at $52 per share. An aggressive trader believes the stock is unlikely to drop below $50.

- Sell a Put Option: The trader sells one XYZ put option with a $50 strike price expiring in 30 days.

- Collect Premium: They collect the same $150 premium ($1.50 x 100 shares).

- Secure with Margin: Instead of securing with $5,000 cash, the broker requires a smaller margin amount, perhaps $1,000 (this amount varies based on the stock's volatility and broker-specific formulas).

Key Insight: The risk here is theoretically unlimited, as the stock could fall to zero. If assigned, the trader must buy 100 shares at $50, potentially at a massive loss and possibly triggering a margin call if they lack the funds.

When to Use This Strategy

The naked put is a tool for experienced traders and should be approached with extreme caution. It is most suitable when:

- Strongly Bullish Outlook: You have a high degree of confidence that the stock will remain well above the strike price through expiration.

- Maximizing Capital Efficiency: You want to generate income using less capital than a cash-secured put, allowing you to diversify across more positions.

- Active Risk Management: You are disciplined enough to monitor margin requirements closely, maintain strict position sizing (e.g., risking no more than 2-3% of your portfolio on one trade), and have a clear exit plan.

While powerful, this is one of the more advanced selling put option strategies due to its defined reward but undefined risk profile. For those looking to delve deeper, you can find a comprehensive guide on this put selling strategy on Strikeprice.app.

3. Put Credit Spread (Bull Put Spread)

The put credit spread, often called a bull put spread, is a defined-risk strategy that refines the concept of selling puts. Instead of just selling a put, you sell a higher-strike put and simultaneously buy a lower-strike put with the same expiration. This creates a "spread" that reduces both your potential profit and, more importantly, your maximum potential loss and capital requirement.

This is one of the most popular selling put option strategies because it allows you to generate income with a bullish-to-neutral outlook while strictly defining your risk from the moment you enter the trade. You profit if the underlying stock price stays above the strike price of the put you sold.

How It Works: A Practical Example

Let's say the SPY ETF is trading at $400 per share. You believe it will not drop below $390 in the next 45 days.

- Sell a Put Option: You sell one SPY put option with a $390 strike price.

- Buy a Protective Put: Simultaneously, you buy one SPY put option with a $385 strike price and the same expiration date.

- Collect a Net Credit: The premium received from the sold $390 put will be higher than the premium paid for the $385 put. Let's assume this results in a net credit of $1.50 per share, or $150 total. Your maximum risk is the width of the strikes minus your credit, which is $350 (($390 - $385) x 100 - $150).

Key Insight: The long put at the lower strike acts as insurance. It caps your maximum loss, making the bull put spread a capital-efficient alternative to the cash-secured put, especially for high-priced stocks.

When to Use This Strategy

The bull put spread is a versatile tool for income generation:

- Bullish to Neutral Outlook: Ideal for when you expect a stock to rise, stay flat, or fall only slightly. The stock just needs to stay above your short strike.

- High Implied Volatility: This strategy thrives when implied volatility is high, as it increases the premium you collect, providing a larger cushion.

- Defined-Risk Income: It’s perfect for traders who want to generate consistent income without the open-ended risk or large capital requirement of a cash-secured put. For more in-depth techniques, you can explore bull put credit spread strategies in detail.

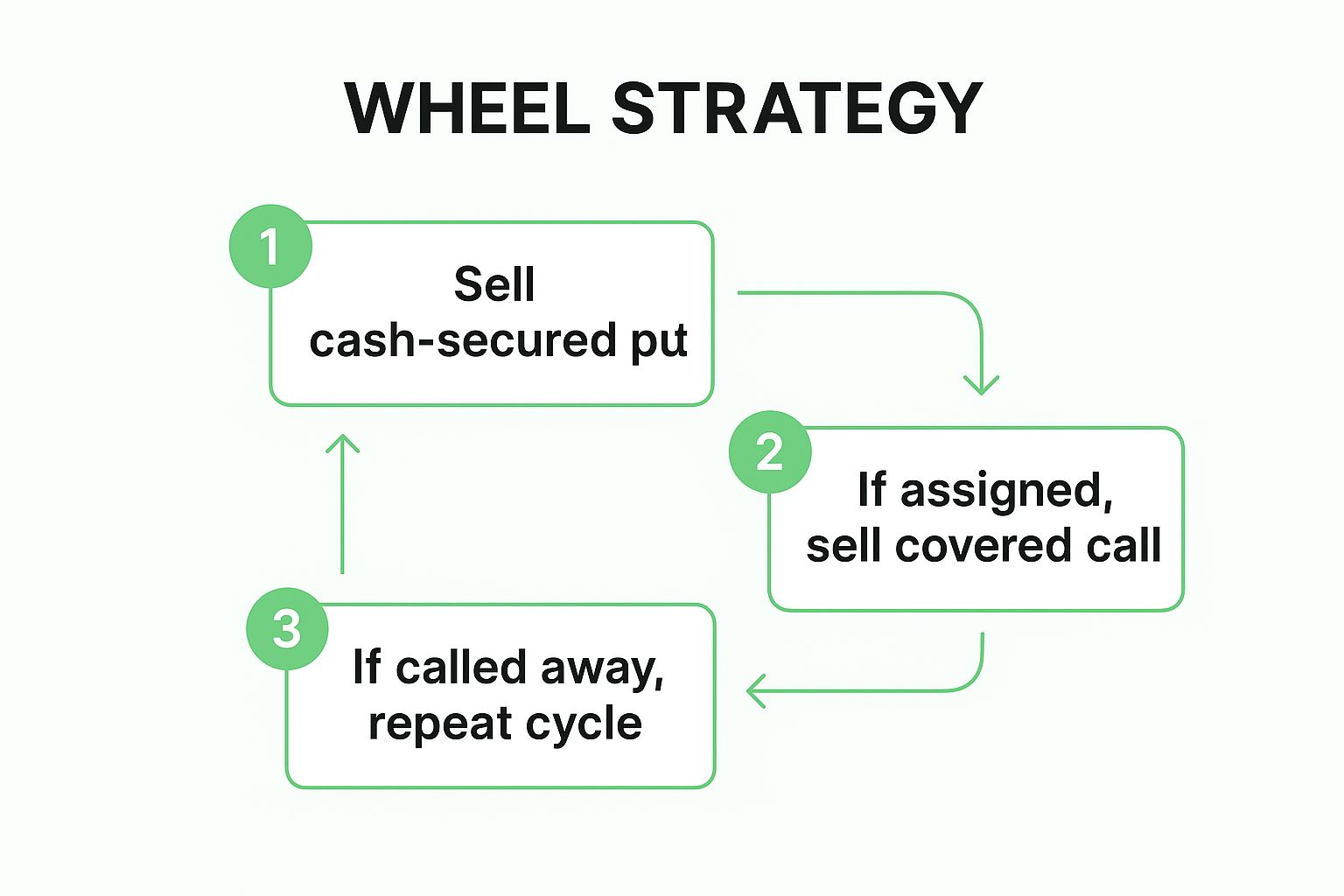

4. The Wheel Strategy

The Wheel Strategy is a systematic, cyclical approach that combines two foundational options strategies: the cash-secured put and the covered call. Popularized by online communities like Reddit's r/thetagang, it’s designed to generate consistent income by continuously selling options premiums on a stock you are comfortable owning for the long term.

Think of it as a complete income-generating system. You start by getting paid to try and buy a stock at a discount (selling a put). If you get the stock, you then get paid to hold it by selling calls against it. This two-part process is one of the most popular selling put option strategies for investors seeking a repeatable, rules-based method.

How It Works: A Practical Example

Let's use a stable, dividend-paying company like Procter & Gamble (PG), currently trading at $168 per share. You wouldn't mind owning PG but would prefer to acquire it closer to $165.

- Sell a Cash-Secured Put: You sell one PG put option with a $165 strike price and a 30-day expiration, collecting a premium of, say, $2.50 per share ($250 total). You secure this with $16,500 cash.

- Scenario A (Put Expires Worthless): If PG stays above $165, the put expires, and you keep the $250 premium as profit. You can then repeat step 1.

- Scenario B (Assignment): If PG drops below $165, you are assigned 100 shares. Your cost basis is $162.50 per share ($165 strike - $2.50 premium). You now own the stock.

- Sell a Covered Call: Now holding 100 shares of PG, you sell a covered call option, perhaps with a $170 strike, collecting another premium. If the stock is called away, you make a profit on the shares and are back to cash, ready to restart the wheel.

Key Insight: The Wheel Strategy turns stock ownership from a passive holding into an active income source. Instead of just waiting for capital appreciation, you are constantly generating cash flow from the asset through premiums.

The following infographic illustrates the continuous, three-step cycle of The Wheel Strategy.

This visual flow highlights how the strategy seamlessly transitions from selling puts to selling calls and back again, creating a perpetual income engine.

When to Use This Strategy

The Wheel Strategy is ideal for specific long-term objectives:

- Systematic Income Generation: It excels for investors who want a structured, repeatable process for earning regular premiums from the stock market.

- Acquiring Quality Stocks: It's a disciplined way to build positions in high-quality, dividend-paying companies over time, lowering your cost basis with each put premium.

- Long-Term Bullish or Neutral Outlook: This strategy works best on stocks you believe in fundamentally and are happy to hold through market fluctuations. It is not suitable for highly volatile or speculative assets.

This comprehensive approach is one of the most complete selling put option strategies, as it provides a plan for every outcome, from the initial put sale to managing the shares if assigned.

5. Strategy 5: The Advanced - Short Put Ladder

The short put ladder is an advanced strategy designed for seasoned traders looking to create a diversified, multi-layered income stream from a single underlying asset. This method involves selling multiple put options at different strike prices and, often, different expiration dates. This "laddering" approach spreads risk across various price points and time horizons, aiming to maximize premium collection while managing overall portfolio exposure.

Think of it as building a tiered safety net. Instead of making one big bet on a single price level with a cash-secured put, you are strategically placing smaller bets at descending price levels. This allows you to collect multiple premiums and gives you more flexibility to manage the position if the stock moves against you.

How It Works: A Practical Example

Let's assume an index ETF, SPY, is trading at $450. A professional trader, expecting volatility but generally bullish over the long term, wants to establish a position while generating significant income.

- Sell Multiple Puts: The trader sells several put contracts at staggered strike prices. For instance:

- Sell a 30-day put at a $440 strike.

- Sell a 60-day put at a $430 strike.

- Sell a 90-day put at a $420 strike.

- Collect Premiums: The trader collects a separate premium for each of these puts, immediately boosting their cash flow. The longer-dated, lower-strike puts will have lower premiums individually, but they combine to create a substantial total credit.

- Manage Margin: Unlike a fully cash-secured position for each leg, traders often use portfolio margin for this strategy. The broker calculates the total potential risk of the laddered position and sets a corresponding margin requirement, which is crucial to monitor.

Key Insight: The primary advantage is diversification of risk. A minor drop in SPY might only affect the highest strike put, leaving the lower rungs of the ladder untouched and profitable. This is one of the more sophisticated selling put option strategies because it requires active management.

When to Use This Strategy

The short put ladder is best suited for specific, well-capitalized traders:

- Constructing a Position Over Time: It’s ideal for systematically building a large position in a stock or ETF you have high conviction in, allowing you to scale in at progressively better prices.

- High Volatility Environments: During periods of market uncertainty, implied volatility is high, which inflates option premiums. A put ladder allows you to capitalize on these richer premiums across multiple strikes.

- Active Portfolio Management: This is not a "set it and forget it" strategy. It requires careful monitoring of each leg, systematic rolling procedures, and vigilant attention to margin. For a deeper dive, explore advanced options risk management to understand the complexities involved.

This professional-grade approach transforms simple put selling into a dynamic, multi-faceted income generation engine, but its complexity demands significant expertise and discipline.

6. Strategy 6: The Put Ratio Spread

The put ratio spread is a more complex strategy designed for traders with a neutral to moderately bearish outlook on a stock. It involves buying a number of put options and selling a smaller number of put options with a higher strike price, often aiming for a net credit or very low cost to enter the position. This setup creates a unique profit window if the stock price declines moderately.

This strategy is one of the more advanced selling put option strategies because while it can be established for a credit, it carries the risk of significant, theoretically unlimited losses if the stock price drops sharply. It's a nuanced approach favored by traders who have a specific price target in mind for a stock's potential dip.

How It Works: A Practical Example

Let's assume stock ABC is trading at $100 per share. You believe it might dip slightly, perhaps around an earnings announcement, but you don't expect a catastrophic collapse.

- Sell a Higher-Strike Put: You sell one ABC put option with a $100 strike price (at-the-money). Let's say you collect a premium of $4.00 for this, or $400.

- Buy Lower-Strike Puts: Simultaneously, you buy two ABC put options with a $90 strike price (out-of-the-money). Let's say these cost $1.50 each, for a total debit of $3.00, or $300.

- Establish for a Credit: Your net position is a credit of $1.00 per share, or $100 total ($400 collected - $300 paid). You get paid to open the trade.

Key Insight: Your maximum profit is achieved if the stock closes exactly at the lower strike price ($90) at expiration. Below that point, your profit begins to erode, and you face significant risk because you are effectively short one uncovered put option.

When to Use This Strategy

The put ratio spread is a specialized tool best used in precise market conditions:

- Moderately Bearish Outlook: You expect the stock to fall, but only to a specific price level (your long put strike). It's ideal for profiting from a limited downside move.

- High Implied Volatility: This strategy benefits from high implied volatility, as it increases the premium you receive for the option you sell, helping you establish the position for a larger credit.

- Targeting a Specific Price: It’s used when you have a strong conviction that a stock will land at or near a particular price point by expiration, such as after an earnings report. Be prepared to manage the position actively, as holding until expiration can be risky.

7. Short Straddle (Put Side Focus)

The short straddle is a high-probability, market-neutral strategy designed to profit from time decay and a decrease in implied volatility. It involves simultaneously selling a put option and a call option with the same strike price and expiration date. While this strategy involves both a put and a call, the put side is a critical component for income generation and risk management, making it an advanced evolution of selling put option strategies.

A short straddle benefits most when the underlying stock price remains very close to the strike price at expiration. You are essentially betting that the stock will not make a significant move in either direction. The maximum profit is the total premium collected from selling both the put and the call, which is realized if the stock closes exactly at the strike price on expiration day.

How It Works: A Practical Example

Let’s look at a high-volatility scenario, like an upcoming earnings announcement for stock XYZ, currently trading at $100. Implied volatility is elevated because the market expects a big price move, but you believe the reaction will be muted.

- Sell a Straddle: You sell one XYZ put option with a $100 strike price and one XYZ call option, also with a $100 strike price, both expiring in 15 days.

- Collect Premium: Due to high implied volatility, the premium is rich. You receive $4.00 for the put and $4.20 for the call, for a total credit of $8.20 per share, or $820 per straddle.

- Define Breakeven Points: Your position is profitable if XYZ stays between your two breakeven points at expiration: the strike price plus and minus the total premium. In this case, the range is $91.80 ($100 - $8.20) to $108.20 ($100 + $8.20).

Key Insight: The short straddle's primary profit drivers are theta (time decay) and vega (volatility). You want time to pass quickly and implied volatility to drop (a "volatility crush"), both of which are common after an earnings event.

When to Use This Strategy

The short straddle is an advanced strategy best reserved for specific market conditions:

- High Implied Volatility: It is most effective when IV is high, such as before earnings, an FOMC announcement, or other major news. This ensures you collect a substantial premium, widening your breakeven points.

- Neutral Outlook on Price: Use this when you anticipate the underlying asset will trade in a tight range and not experience a major price swing.

- Active Risk Management: This is not a "set and forget" strategy. It requires active monitoring and a clear plan to manage the position if the stock price moves sharply, as the risk is theoretically unlimited.

Put Option Strategies Comparison Matrix

| Strategy | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Cash-Secured Put | Moderate 🔄 | High capital required (100% cash collateral) | Limited profit (premium), possible stock ownership 📊 | Income generation, acquiring desired stocks at a discount | Conservative income, lowers cost basis, lower risk than naked puts ⭐ |

| Naked Put Selling | Moderate to High 🔄 | Moderate capital (margin-based), requires margin monitoring | Higher returns with higher risk 📊 | Bullish outlook, leverage to maximize premium income | Efficient capital use, higher returns, multiple positions possible ⭐ |

| Put Credit Spread | Moderate 🔄 | Moderate margin approval for spreads | Limited risk and reward, profits from time decay 📊 | Limited risk income strategies, high win rate targeting | Defined risk, lower margin requirements, high win rates ⭐ |

| The Wheel Strategy | Moderate 🔄 | High capital (owning underlying stocks) | Consistent income over cycles 📊 | Sideways to moderately bullish markets, long-term investing | Systematic, mechanical income generation, reduces emotional trades ⭐ |

| Short Put Ladder | Advanced 🔄 | Moderate to High, requires active management | Diversified income with scaled risk 📊 | Larger portfolios, volatile markets | Risk diversification, flexible management, higher returns ⭐ |

| Put Ratio Spread | Advanced 🔄 | Moderate margin, complex risk profile | Profit from moderate bearish moves, unlimited downside risk 📊 | Neutral to bearish with volatility focus | Profits from moderate moves, low cost, benefits volatility expansion ⭐ |

| Short Straddle (Put Side Focus) | Advanced 🔄 | High margin, requires careful risk management | High premium income, unlimited risk 📊 | High IV, range-bound markets | High premium, profits from time decay on both sides ⭐ |

From Strategy to Action: Choosing Your Path to Income

Navigating the world of selling put option strategies can feel like learning a new language, but as we've explored, each strategy is simply a different tool designed for a specific purpose. From the foundational safety of the Cash-Secured Put to the more complex, multi-leg structure of a Short Put Ladder, the common thread is the proactive generation of income by leveraging market expectations and time decay.

You've seen how the Wheel Strategy methodically transforms premium collection into stock ownership and back again, offering a systematic approach for long-term investors. We've also detailed how spreads, like the Put Credit Spread, provide a crucial risk-management layer, allowing you to define your maximum loss upfront and participate in bullish moves with less capital. Understanding these nuances is the first step toward moving from passive observation to active participation in the markets.

Key Takeaways for Your Trading Journey

The core lesson is that successful options selling isn't about chasing high-risk, high-reward gambles. Instead, it’s about strategic positioning, risk management, and consistency.

- Risk Defines the Strategy: The primary differentiator between these approaches is how they manage risk. A Naked Put offers high potential premium but carries significant, undefined risk, whereas a Put Credit Spread caps your potential loss, making it a more controlled trade.

- Market Outlook is Paramount: Your view of the underlying asset dictates your choice. A solidly bullish outlook might favor a simple Cash-Secured Put, while a moderately bullish or neutral stance could be better served by a Put Credit Spread or the Wheel.

- Capital Efficiency Matters: Strategies like the Put Credit Spread and Naked Put (with appropriate account levels) are more capital-efficient than a Cash-Secured Put, allowing you to deploy your funds across more opportunities. This efficiency, however, often comes with a different risk profile.

Your Actionable Next Steps

Mastery comes from application. The true value of learning about these selling put option strategies is unlocked when you start putting them into practice, even on a small scale. Begin by paper trading the strategies that resonate most with your risk tolerance and investment goals. This allows you to experience the mechanics of order entry, profit-taking, and risk adjustment without committing real capital.

As you gain confidence, select one or two core strategies to implement with small, manageable position sizes. The goal is not to get rich overnight but to build a consistent, repeatable process for generating income. Track your trades, analyze your decisions, and refine your approach. This deliberate practice is what separates seasoned options sellers from hopeful speculators and builds a foundation for sustained portfolio growth.

Ready to move from theory to execution with confidence? Strike Price provides the essential tools for identifying, analyzing, and managing your options trades. Use our guided probability-based screeners and real-time alerts to find the best selling put option strategies for your portfolio. Start your free trial today and take control of your income generation at Strike Price.