Your Guide to the Selling Put Options Strategy

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

What Is Risk Adjusted Return? A Practical Guide

What is risk adjusted return? This guide explains how to measure it with the Sharpe Ratio, how to interpret the numbers, and why it's key to smarter investing.

What if you could get paid to buy a stock you already like, but at a price you actually want to pay? That's the core idea behind selling put options. It essentially turns you into an insurance provider for the stock market. You collect an upfront payment, called a premium, for simply agreeing to buy a stock at a set price if it happens to dip below that level by a certain date.

What Is Selling Puts, Really?

At its heart, selling puts is a strategy for generating consistent income. It’s a go-to for investors who want to create a steady cash flow from their portfolio, rather than just waiting around for stock prices to go up.

Think of it this way: another investor is worried about a stock's price dropping and wants to buy some protection. You, as the put seller, can provide that protection. You collect a fee (the premium) for your promise. If the stock stays above the agreed-upon price (the strike price), you just keep the premium as pure profit. The contract expires, your obligation vanishes, and you move on.

The Two Main Goals of Selling Puts

This strategy is so popular because it serves two powerful, distinct goals. Your own motivation will determine how you pick and manage your trades.

- Generating Regular Income: Many traders use this strategy with zero intention of ever owning the stock. Their only goal is to collect premiums from options they believe will expire worthless. This turns market stability and time decay into a reliable source of income.

- Acquiring Stock at a Discount: For value-minded investors, this is a brilliant way to get paid while waiting for the right entry point. You find a great company you'd love to own and sell a put at the discounted price you’re happy to pay. If the stock drops and you get assigned the shares, you end up buying them at your target price—and your effective cost is even lower thanks to the premium you pocketed.

To make this crystal clear, let's break down the moving parts of a typical put-selling trade.

A Quick Look at Selling a Put Option

This table breaks down the essential parts of a cash-secured put sale for easy understanding.

| Component | What It Means for You | Example (Stock XYZ at $50) |

|---|---|---|

| Strike Price | The price at which you agree to buy the stock. | You sell a $45 put, agreeing to buy XYZ at $45 per share. |

| Expiration Date | The date your agreement ends. | You choose an option that expires in 30 days. |

| Premium | The cash you receive upfront for making the promise. | You collect a $1.50 premium per share, or $150 total ($1.50 x 100 shares). |

| Assignment | When you are required to buy the stock at the strike price. | If XYZ drops to $44 at expiration, you must buy 100 shares at $45 each. |

| Your Outcome | You either keep the premium for free or buy the stock at a discount. | If assigned, your effective cost is $43.50 per share ($45 strike - $1.50 premium). |

As you can see, you either walk away with free cash or you buy a stock you wanted anyway, but at a better price than it was when you started.

Key Takeaway: Selling puts lets you either generate income from stocks you don't even own or buy stocks you do want at a lower effective price. Either way, you get paid upfront for taking on the obligation.

This dual purpose makes selling puts an incredibly versatile tool. You aren't just betting on a stock going up; you can profit when a stock goes up, stays flat, or even drops a little. This guide will walk you through exactly how to put this powerful strategy to work, starting with the core mechanics and moving toward real-world application.

How Selling Puts Actually Works Step by Step

Alright, let's move from theory to what a real trade looks like. The selling put options strategy can feel a bit abstract at first, but it really just boils down to a clear, repeatable process. Once you see the steps, the whole thing starts to click.

It all starts with the stock itself, not the option. The most important rule—and I can't stress this enough—is to only sell puts on high-quality companies you genuinely want to own. This isn't a lottery ticket; it's a strategic way to either get paid to wait or buy a great stock at a discount. If you wouldn't be happy owning the shares at your chosen price, don't sell the put. Simple as that.

The Three Core Decisions

After you've pinpointed a company you believe in, you have three key decisions to make. These choices will define your potential income, your risk, and the entire trade's outcome.

- Choose the Stock: As we just covered, this is your foundation. Your homework should tell you it’s a business you'd want to hold for the long haul, not just some stock with juicy premiums.

- Select the Strike Price: This is the price you're agreeing to buy the stock for. A strike price way below the current market price is safer but pays you less. One that's closer to the current price is riskier but generates more income. It’s a classic risk vs. reward tradeoff.

- Decide on an Expiration Date: This is when your agreement ends. Shorter expirations (think 7-45 days) make time decay work in your favor faster, but longer-dated options usually offer higher upfront premiums.

These three inputs—the stock, the strike price, and the expiration—are what determine the premium you collect. That cash hits your account right away, and it's yours to keep, no matter what happens. It's your payment for taking on the obligation.

A Real-World Example Step by Step

Let's walk through a trade to make this concrete. Say you've been watching Company ABC, currently trading at $105 a share. You've done your research, you like the business, but you'd feel a lot better getting in at a lower price. You decide $95 would be a fantastic entry point.

You pull up the options chain for ABC on your brokerage platform. You find a put option with a $95 strike price that expires in 30 days. The premium for selling this put is $2.00 per share. Since one options contract controls 100 shares, selling one contract instantly puts $200 in your pocket ($2.00 premium x 100 shares).

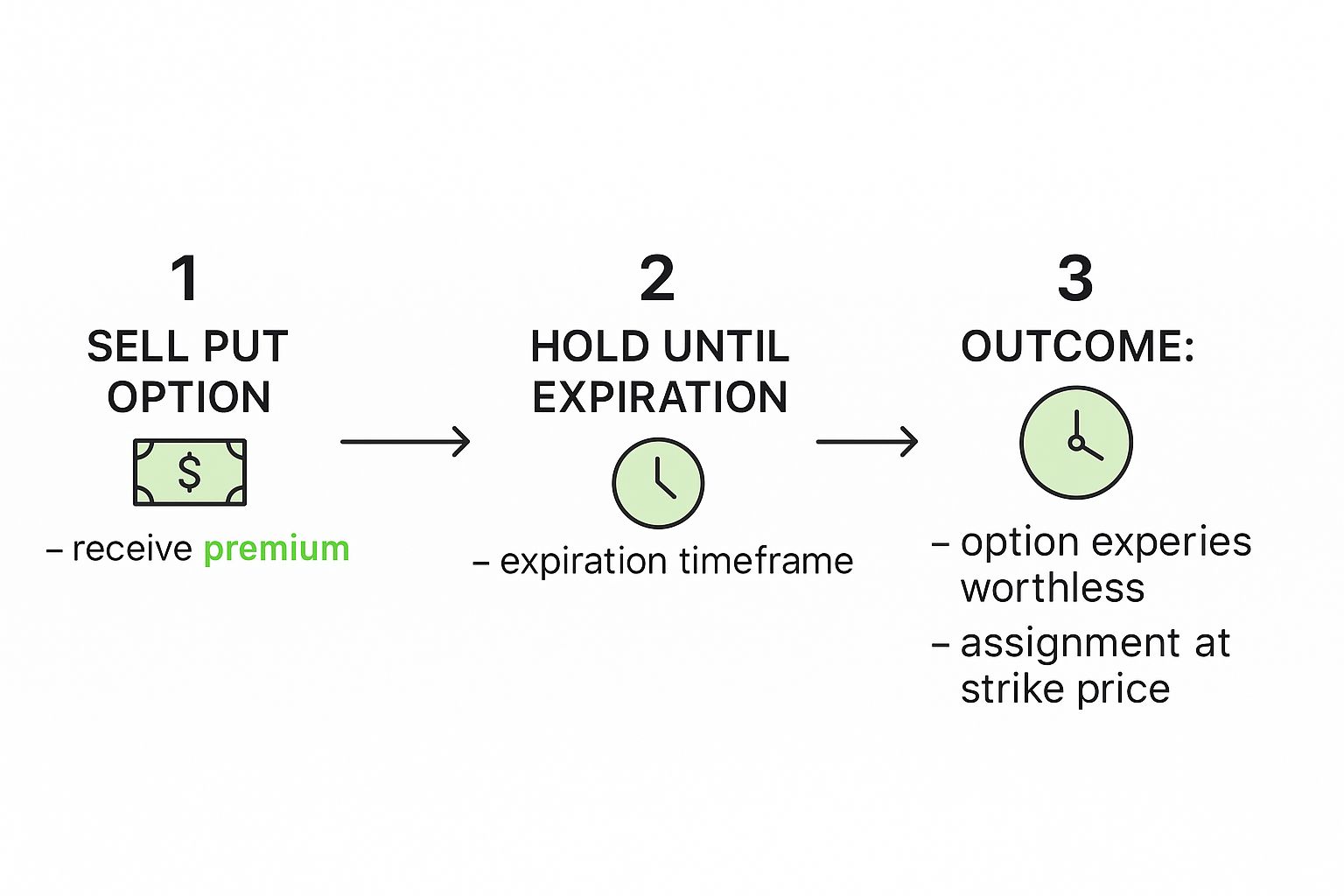

This quick visual breaks down the flow of the trade, from collecting your cash to the two potential outcomes.

As you can see, you sell the put and then you wait. Once your trade is on, you just let the clock run down. At expiration, one of three things will happen.

The Three Possible Outcomes

When that 30-day mark hits, your trade will resolve in one of these ways.

Outcome 1: The Option Expires Worthless (The Goal)

- Condition: Company ABC’s stock price stays above $95.

- Result: The put option you sold is now worthless. Your promise to buy the stock is erased. You simply keep the $200 premium as pure profit. This is the ideal scenario for income-focused sellers—you got paid without having to buy a single share.

Outcome 2: You Get Assigned the Stock

- Condition: Company ABC’s stock price drops below $95 (let's say it falls to $92).

- Result: You get "assigned." You now have to make good on your promise and buy 100 shares of ABC at your $95 strike price, costing you $9,500. But remember that $200 premium? Your true cost basis is actually $93 per share ($95 strike - $2 premium). You now own a great company at a price you wanted all along.

Outcome 3: You Roll the Option

- Condition: The stock is trading near or below your strike as expiration gets close, and you'd rather not get assigned just yet.

- Result: You can "roll" the trade. This means you buy back your current put option (closing it out) and sell a new one with a later expiration date. Often, this move still results in another net credit, so you collect more premium and give the stock more time to recover.

Mastering this flow is the core of a successful put-selling strategy. And if you already own stocks and want to apply similar logic, you might want to look into how to sell covered puts, which blends ownership with income generation. By getting comfortable with these mechanics, you can start turning market probabilities into a steady paycheck.

Unlocking Better Risk-Adjusted Returns

While generating income is a great perk, the real reason many experienced investors use a selling put options strategy is for its power to deliver better risk-adjusted returns. It’s not just about what you make; it’s about how much risk you have to take to make it. Selling puts gives you a structural edge that can smooth out the ride and lead to more consistent growth over the long haul.

The secret sauce is the premium you collect right away. This isn't just a small bonus—it’s a powerful, built-in cushion against market drops. Every dollar of premium you get directly lowers your risk on the trade.

Let's look at an example. Imagine two investors want to buy a stock that's currently trading at $100. Investor A just buys 100 shares, costing them $10,000. Investor B, on the other hand, sells a $100 put option and collects a $3 premium, which comes out to $300. If the stock gets assigned, Investor B also buys 100 shares for $10,000, but their actual cost basis is only $9,700 because of that premium. They start their investment with an immediate 3% advantage.

Thriving in Different Market Conditions

That premium cushion makes selling puts an incredibly versatile tool. Unlike simply buying and holding stock, which only makes money when the price goes up, selling a put can be profitable in a few different scenarios.

- Bullish Market: If the stock climbs, the put option expires worthless. You just keep the premium as pure profit.

- Neutral Market: If the stock trades sideways and doesn't move much, the option still expires worthless, and you pocket the premium.

- Slightly Bearish Market: Even if the stock dips a little but stays above your strike price, you still get to keep the entire premium.

This flexibility means you don’t have to be a perfect market timer to succeed. You’re essentially getting paid for the stock not to fall too far, which is a much higher probability bet than trying to guess its exact direction. If you're interested in building a regular cash flow, our deep dive on put selling for income explores this side of the strategy in more detail.

The Data Backs It Up

This isn't just theory; the historical performance data tells a very compelling story. Put-selling strategies have often delivered returns on par with major stock indexes, but with a lot less turbulence along the way.

A comprehensive study looking at a 32-year period found that the CBOE S&P 500 PutWrite Index (PUT) achieved an annual return very similar to the S&P 500. The key difference? It did so with significantly lower volatility, resulting in a superior risk-adjusted return.

The study showed the PUT index had an annualized Sharpe ratio of 0.65 compared to 0.49 for the S&P 500. That’s a key metric that basically says you get more bang for your buck in terms of risk.

This data-backed resilience is why so many investors are drawn to this strategy. By consistently collecting premiums, you’re either lowering your cost basis on stocks you want to own anyway or just generating income from market stability. It’s a methodical approach that helps build a more resilient portfolio, one that’s less shaken by the wild swings of the market and can create a smoother path to your financial goals.

Managing Risk and Avoiding Common Mistakes

Every strategy has its risks, and selling puts is no different. It's easy to get focused on collecting those sweet premiums, but ignoring the potential downsides is the fastest way to turn a profitable strategy into a losing one. Real success comes from understanding and managing these risks before you even think about placing a trade.

The biggest risk is simple but serious: you could be forced to buy a stock at your strike price after it has tanked, leaving you with an instant paper loss. This is called assignment, and it's where discipline and a good plan make all the difference. With the right approach, you can trade with confidence, not carelessness.

The Golden Rule of Put Selling

There's one principle that should guide every single put you sell. It's non-negotiable.

Only sell put options on high-quality companies you genuinely want to own at the strike price.

Think of it this way: if you get assigned the shares, it shouldn't feel like a disaster. It should feel like your backup plan worked—you just bought a great company at a price you already decided was a bargain. If the thought of owning that stock at that price makes your stomach churn, you're not managing risk. You're just gambling.

Your Pre-Trade Risk Mitigation Checklist

A little prep work goes a long way in preventing big mistakes. Before you even think about hitting the "sell" button, it's a good idea to run through a quick mental checklist. These steps are your first line of defense against the most common (and costly) errors that trip up traders.

Here’s a simple table to help you build that habit.

Your Pre-Trade Risk Mitigation Checklist

| Checklist Item | Why It's Important |

|---|---|

| Use Cash-Secured Puts | This is the only responsible way for most investors. It means you have the cash set aside to buy the 100 shares if assigned, preventing catastrophic losses from a "naked" position. |

| Check Your Position Size | Never go all-in on one trade. A good rule of thumb is to keep any single options position to just 2-5% of your total portfolio. This ensures one bad trade won't sink your whole account. |

| Have a Clear Exit Plan | Decide before you trade what you'll do if the stock soars (take profits early?) or if it drops (accept assignment or roll the option?). Making the decision ahead of time keeps emotion out of the driver's seat. |

Sticking to a checklist like this turns a potentially stressful process into a disciplined, repeatable one. For a more comprehensive look at these techniques, our detailed guide on options risk management provides a deeper dive into protecting your portfolio.

Common Pitfalls to Avoid

Plenty of new traders fall into the same traps. Just knowing what they are is half the battle.

One of the most tempting mistakes is chasing high premiums on junky stocks. Volatile, speculative companies often offer huge premiums because the risk of them collapsing is sky-high. This is the classic "picking up pennies in front of a steamroller" scenario—those small, quick gains just aren't worth the risk of getting flattened.

Another huge error is ignoring the fundamentals. Sure, the premium is nice, but the underlying business is what truly matters. If a company has weak financials, falling revenue, or a busted business model, no amount of premium can justify the risk of being forced to own its deteriorating stock.

Finally, be wary of the "Wheel Strategy" trap if you don't understand its flaws. The strategy involves getting assigned and then selling calls, but it can fail spectacularly in a long bear market. You can end up tying your capital to a losing stock for years, forced to get more bullish on it precisely when it's showing the most weakness. That's a recipe for disaster.

Adapting Your Strategy for Any Market

A smart put-selling strategy isn't a rigid, one-size-fits-all plan. It’s more like a versatile tool in your workshop, one you can adjust and fine-tune for whatever the market throws at you. The way you approach a roaring bull market should look very different from your plan during a slow, sideways grind.

Instead of trying to outsmart the market by predicting its next big move, this flexibility lets you react to the environment you're actually in. It shifts your focus from forecasting to probability, giving you a way to generate returns no matter which way the winds are blowing. With just a few small tweaks, you can keep hitting your financial goals.

Thriving in a Flat or Sideways Market

When the market seems stuck in neutral, a lot of traditional strategies just stall out. For a put seller, though, this is the perfect time to generate income.

In a flat market, stocks tend to bounce around within a predictable range. This makes selling out-of-the-money puts incredibly effective. The goal here is simple: pure income. You pick a strike price far enough below the current trading range that the odds of assignment are very low.

As the days tick by, time decay—what traders call Theta—goes to work. The option's value slowly erodes, and you can often close your position for a profit long before it expires, or just let it expire worthless. You’re turning market boredom into a steady paycheck.

Key Insight: A flat market is a put seller's best friend. While everyone else is waiting for a breakout, you can consistently collect premiums from options that are quietly losing value, turning market stagnation into a cash flow machine.

Using Puts as a Buffer in a Bearish Market

So, what about when the market turns sour? A full-blown crash is risky for everyone, but a moderately bearish or declining market can still be a great place for a disciplined put seller. That premium you collect acts as a vital buffer, giving you a cushion against small to medium price drops.

In this kind of market, you'd want to adjust your strategy:

- Select lower strike prices: This gives you a much bigger margin of safety before you risk getting assigned the shares.

- Focus on high-quality stocks: You should only sell puts on fundamentally solid companies you’d be happy to own, even through a downturn.

- Use shorter expiration dates: This reduces your exposure to risk and lets you reassess your positions more often.

If the stock drops but stays above your strike, you just keep the premium. And if it does fall below and you get assigned the shares, that premium you already collected effectively lowers your purchase price. You end up with a better cost basis than someone who just bought the stock outright during the decline.

The Statistical Edge and Tax Benefits

This adaptability isn't just a nice theory; it's backed by some serious data. Looking at performance from 1986 all the way through 2023, a fully collateralized put-writing strategy on the S&P 500 has often beaten simply owning the index when markets are moderately bullish, flat, or even declining. You can read more about these insights on put-writing performance. The premiums work as both income and a buffer, smoothing out the ride.

On top of that, the tax man can be a little kinder to options traders. In the U.S., gains from broad-based index options like SPX often fall under IRS Section 1256. This is a big deal, because it means 60% of your gain is treated as a long-term capital gain, no matter how long you held the position. That can lead to a much lower tax bill compared to short-term stock trading, giving a real boost to your after-tax returns.

How to Find and Analyze the Best Trades

Alright, now that we’ve got the theory covered, it's time for the fun part: finding the right trades. This is where the art and science of options trading really come together. It's about moving from a company you like to picking the exact contract that fits your goals.

Alright, now that we’ve got the theory covered, it's time for the fun part: finding the right trades. This is where the art and science of options trading really come together. It's about moving from a company you like to picking the exact contract that fits your goals.

Your main tool for this job is the options chain. Think of it as a detailed menu for any given stock, laying out all the available put and call contracts. It shows you a range of strike prices, expiration dates, and, most importantly, the premiums you can collect. Getting comfortable reading this menu is the first real step toward making confident trades.

Decoding the Options Chain

At first glance, an options chain can feel like staring at a wall of numbers. But for a solid selling put options strategy, you only need to zoom in on a few key details to start making smart moves.

Here's what you're looking for:

- Strike Price: This is the price you're agreeing to buy the stock at if you get assigned.

- Expiration Date: This is when your contract—and your obligation—ends. A great sweet spot is often 30-45 days out. It gives you a nice balance of premium income without taking on too much long-term risk.

- Bid/Ask Spread: This is the tiny gap between what buyers are willing to pay (bid) and what sellers are asking for (ask). You want this spread to be tight. A narrow spread means the option is liquid, making it easier and cheaper to get in and out of your trade.

These are the building blocks. But the real edge comes from understanding a few metrics known as "the Greeks." Don't worry, you don't need a math degree to use them.

Using Key Metrics to Your Advantage

For selling puts, we can boil it down to just three Greeks that matter most: Delta, Theta, and Implied Volatility (IV).

Key Insight: Getting a handle on these three metrics is what separates passive participants from active strategists. They let you measure risk, see how time is working for you, and spot the best moments to sell for maximum premium.

Let's quickly break them down:

- Delta (Probability of Assignment): Think of Delta as a rough shortcut for an option's probability of expiring in-the-money. A put with a .20 Delta has about a 20% chance of getting assigned. This is huge because it allows you to pick trades that match your personal risk tolerance. Lower Delta means lower risk, but also a lower premium.

- Theta (Time Decay): As an options seller, Theta is your best friend. It measures how much value an option loses every single day just because time is passing. You want to sell puts with a healthy Theta because it means the contract is constantly getting cheaper, which works in your favor.

- Implied Volatility (IV): This metric is the market’s best guess on how much a stock will move. Higher IV means fear and uncertainty are up, which translates directly to higher option premiums. The best time to sell puts is when IV is high because you get paid more for taking on the same amount of risk.

Beyond the basics, understanding the raw volatility of a stock is critical for pricing risk. Learning how to calculate stock volatility can give you a major leg up. The game really changed for retail traders in the mid-1990s when detailed options data became widely available. This access to historical data and IV metrics allows us to analyze and backtest put-selling strategies with a level of precision that just wasn't possible before.

A Few Common Questions About Selling Puts

As you get comfortable with the idea of selling puts, a few questions always pop up. Let's tackle them head-on so you can feel confident making your first trade.

What’s the Minimum I Need to Start?

There's no official dollar amount, but the real answer is: you need enough cash to make good on your promise. If you get assigned, you have to buy 100 shares at your chosen strike price.

So, if you sell a put on a $20 stock with a $15 strike, you'll need $1,500 in your account, set aside just for that trade.

Do I Have to Wait Until Expiration?

Nope, not at all. You can close your position anytime by simply buying back the exact same put option you sold.

Many traders do this to lock in a profit quickly. Say you sell a put and collect a $150 premium. A week later, its value drops and you can buy it back for just $40. You just pocketed a $110 profit without having to wait out the full month.

Key Takeaway: You're always in the driver's seat. You can take profits early, let the option expire, or even "roll" it to a later date to collect more premium.

What Happens If the Stock Pays a Dividend?

If you sell a put, you don't receive the dividend. Why? Because you don't actually own the stock.

Dividends are only for shareholders who are on the books by the ex-dividend date. Your profit comes purely from the premium you collected for selling the put.

Ready to stop guessing and start making data-driven decisions? Strike Price provides real-time probability metrics for every trade, helping you balance safety and premium to meet your income goals. Turn your guesswork into a winning strategy.