A Trader's Guide to Time Decay Options

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

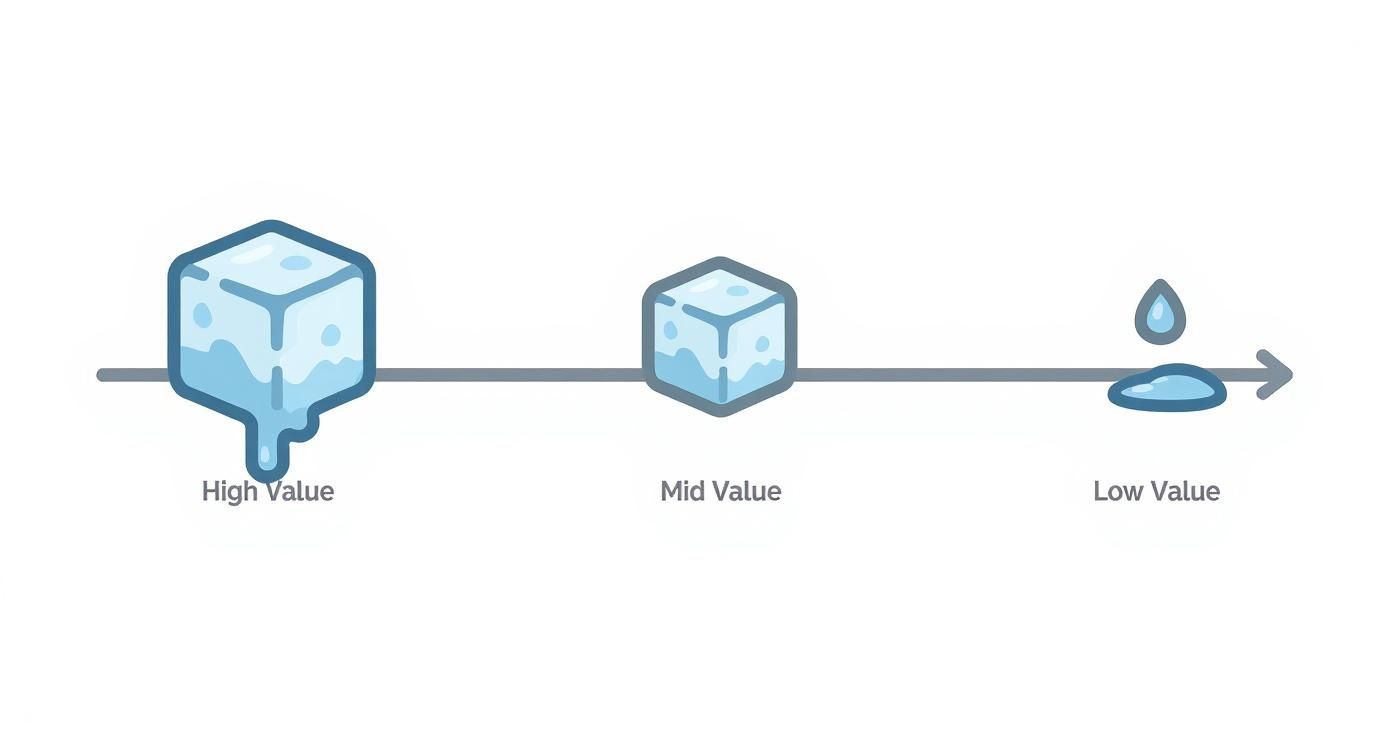

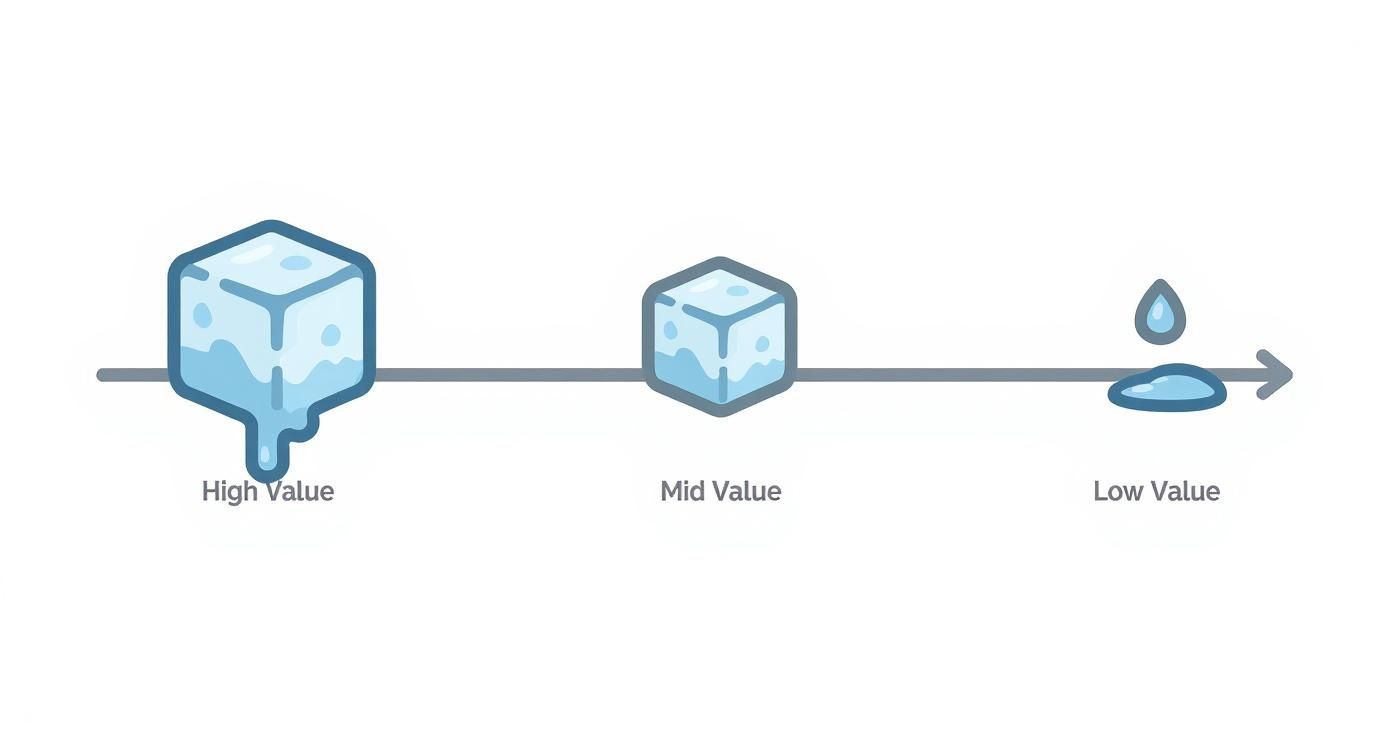

Imagine an option's value is like a melting ice cube on a hot day. The second you get it, it starts to shrink. This slow, unavoidable loss of value is what traders call time decay, or theta. It's one of the few predictable forces in options trading, and one you absolutely have to master.

What Is Time Decay in Options?

Time decay is the steady drop in an option's value as it gets closer to its expiration date. Every option contract has a finite lifespan, and each passing day makes it a little less valuable—even if the underlying stock price doesn't budge an inch.

For an option buyer, time decay is a constant battle. It’s the daily price you pay for the right to control a stock. This means the stock has to move in your favor, and fast, just to overcome this natural erosion.

On the flip side, time is an option seller's best friend. Sellers collect a premium upfront and then watch the clock work for them, as the option's value drips away day by day.

The Two Parts of an Option's Value

To really get how time decay works, you need to know that an option's price is made of two separate pieces. A deeper look at the difference between intrinsic vs extrinsic option value shows exactly what time decay attacks.

- Intrinsic Value: This is the option's "real" value if you exercised it right now. For a call option, it's how much the stock price is above the strike price. This part of the value is totally immune to time decay.

- Extrinsic Value: This is the "time value" or "hope value." It's the premium paid for the potential of the stock to move and the time left for that to happen. Time decay exclusively eats away at extrinsic value.

As an option gets closer to expiring, there’s less time for anything exciting to happen, so that "hope" value starts to evaporate.

An option is a wasting asset. Its value is guaranteed to go down over time, all else being equal. Understanding and managing time decay isn't optional—it's essential for long-term success.

This decay isn't a straight line, either. It starts off slowly but picks up speed like a runaway train in the last 30-45 days of an option's life. This acceleration makes short-dated options a minefield for buyers but a goldmine for sellers. Getting a handle on this dynamic is the first step toward building strategies that either dodge the decay or put it to work for you.

To simplify these concepts, here’s a quick-reference table.

Time Decay Core Concepts at a Glance

This table provides a quick summary of the essential principles of option time decay, also known as theta.

| Concept | Brief Explanation |

|---|---|

| Wasting Asset | An option's value naturally declines over time, eventually reaching zero if it expires out-of-the-money. |

| Buyer's Enemy | For option buyers, time decay is a constant negative force that erodes the value of their position every day. |

| Seller's Friend | For option sellers, time decay is a positive force, as it reduces the liability of the option they sold. |

| Extrinsic Value | Time decay only affects the extrinsic (or "time") value of an option, leaving its intrinsic value untouched. |

| Acceleration | The rate of decay is not linear; it accelerates significantly as the option gets closer to its expiration date. |

This foundation is crucial because every options strategy, whether simple or complex, is affected by theta's relentless march forward.

How Theta Measures the Speed of Time Decay

If time decay is the slow, inevitable march toward an option's expiration, then theta is its speedometer. It’s the specific number, one of the essential options Greeks, that tells you exactly how much value an option is expected to lose each day.

For an option buyer, theta is a constant headwind. For a seller, it's the wind at their back.

When you look up an option's details, you'll see theta shown as a negative number, maybe something like -0.05. This isn't just theory; it translates directly to your bottom line. It means, all else being equal, the option's premium will drop by $0.05 every day. Since one options contract controls 100 shares, a theta of -0.05 means the contract holder is losing $5 per day.

Think of theta as the daily rent you pay to hold an option. For buyers, it’s the cost of keeping the trade alive. For sellers, it's the daily income they collect as time ticks by.

This daily erosion hits hardest on at-the-money (ATM) options because they have the most time value to lose. An ATM call with 30 days left and a theta of -0.05 will feel that decay acutely, especially if the stock just sits there. You can get more practical examples of how theta works from experts like Schwab's learning center.

The Decay Isn't a Straight Line—It Accelerates

Here’s the critical part: time decay doesn’t happen at a steady pace. It’s more like a boulder rolling down a hill. It starts slow, but it picks up dangerous speed as it gets closer to the bottom.

An option with 90 days left might lose value at a snail's pace. But in its final 30 days, that same option starts bleeding value at an alarming rate.

This infographic nails the concept. An option's value is like an ice cube—it melts much, much faster right at the end.

As the visual shows, the most dramatic drop in extrinsic value happens in that final month, which is why holding onto short-dated options is so risky if you're a buyer.

Visualizing the Theta Decay Curve

If you plot an option's time value against the days left until it expires, you get what’s known as the theta decay curve. It’s the perfect way to see this acceleration in action.

As you can see from the curve, the value holds up reasonably well for the first two-thirds of the contract's life, but then it absolutely falls off a cliff.

Understanding this curve is vital, but remember, theta is just one piece of the puzzle. To see the whole picture, you need to be familiar with all the options trading greeks. They help you understand your risk not just from time, but from price moves and changes in volatility, too.

Choosing Your Side: Buyer vs. Seller

Every options trade is a tug-of-war against the clock, with a clear winner and loser in the battle over time decay. The side you pick—buyer or seller—determines whether time is your worst enemy or your best friend. It’s a fundamental conflict that shapes your entire approach.

For an option buyer, time is a resource that’s constantly draining away. You pay a premium for the right (but not the obligation) to buy or sell a stock, betting that it will make a big move in your favor—and do it fast enough to outrun theta's daily decay.

Think of it like buying a ticket to a championship game. The ticket has value because of the potential for an amazing outcome. But as the game clock ticks down with no big plays, the value of that potential fades. By the final whistle, it's just a worthless stub.

The Buyer Mindset: Betting on a Big Move

The buyer's goal is simple but tough: profit from a large, directional move in the stock price. Success means being right about both the direction and the timing.

- Primary Goal: Make a profit that covers the premium you paid plus the value lost to time decay.

- Greatest Risk: The stock goes nowhere or doesn't move enough, letting theta bleed your option's value down to zero.

- Advantage: Your risk is capped at the premium you paid, but your potential gains are theoretically unlimited.

Buyers are paying for leverage and a shot at a home run. They accept the daily cost of time decay in exchange for the chance at an explosive profit if they nail the forecast.

For an option buyer, every tick of the clock is a cost. The trade isn't just about being right on direction; it's a race to be right before your time value runs out.

The Seller Mindset: Profiting from Patience

On the other side of the trade, an option seller (or writer) sees time as their primary source of income. By selling an option, you collect a premium upfront and take on the obligation to fulfill the contract if it's exercised. The core strategy here is to profit from the high probability that the option will simply expire worthless.

Sellers act a lot like an insurance company. They collect premiums for insuring against a specific event—in this case, a large price swing—and they profit as long as that event doesn't happen. The steady, predictable drip of time decay works directly in their favor, reducing their potential obligation day by day.

The seller’s perfect scenario is a stock that stays flat or moves in a way that keeps the option out-of-the-money. As expiration gets closer, the accelerated decay of time value dramatically increases their odds of keeping the entire premium. This is what makes selling options such a powerful way to generate consistent income.

How Time Decay Impacts Option Buyers and Sellers

To really understand the two sides of the coin, it helps to see their perspectives side-by-side. The fundamental difference lies in how they view the passage of time—as either a cost or a source of profit.

| Perspective | Option Buyer (Long Position) | Option Seller (Short Position) |

|---|---|---|

| Role of Time | An enemy; every passing day erodes the option's value. | An ally; every passing day increases the probability of profit. |

| Primary Goal | Profit from a significant, fast price move in the underlying stock. | Profit from the option expiring worthless or decreasing in value. |

| Theta's Impact | Negative Theta: The option loses value daily, creating a headwind. | Positive Theta: The position profits from time decay daily. |

| Ideal Scenario | The stock makes a large, favorable move well before expiration. | The stock price remains stable, moves sideways, or moves against the option. |

| Risk Profile | Defined Risk: Maximum loss is limited to the premium paid. | Undefined Risk: Potential losses can be substantial if the stock moves sharply. |

| Probability | Lower probability of success, but with the potential for high returns. | Higher probability of success, but with limited, defined profit (the premium). |

Ultimately, choosing your side comes down to your strategy and risk tolerance. Are you swinging for the fences and willing to pay for the opportunity, or are you looking to collect consistent income by letting the clock do the work for you?

Using Historical Data to Predict Theta's Behavior

Theory is great, but real money is made (and lost) in the messy reality of the market. This is where historical data becomes one of your most powerful allies, closing the gap between knowing a concept and knowing how to trade it. By looking back at how markets actually behaved, you can see how time decay on options plays out under pressure.

It’s one thing to know that theta accelerates as expiration gets closer. It's another thing entirely to see exactly how fast at-the-money options bled value during a chaotic earnings week versus a quiet, sideways market. This context turns theta from just a number on a screen into a tangible, strategic force you can learn to anticipate.

Fortunately, this kind of analysis no longer requires a PhD in quantitative finance. High-quality historical options data is more accessible than ever before. Providers now offer detailed datasets including bid/offer quotes, volumes, and of course, the Greeks. By digging into this info, you can spot recurring patterns in how different options decay. You can explore historical options data archives to get a feel for how this information is organized and what you can learn from it.

Backtesting Your Assumptions

The best way to put this data to work is through backtesting. Think of it as a trading simulator that uses real market history. You can run your strategy through past market conditions to see how it would have held up, all without putting a single dollar on the line.

For example, you could take a covered call strategy and run it through a period of extreme volatility. Did the accelerated theta decay generate enough premium to make the extra stock price risk worth it? Backtesting gives you the hard evidence you need to answer that question.

Backtesting transforms hindsight into foresight. It allows you to learn from the market's past to build a more resilient and data-driven approach for the future.

Running these simulations gives you a practical feel for how theta truly impacts your bottom line. It helps you dial in your entry and exit points, fine-tune your strike selection, and build a trading plan that's based on evidence, not just a hunch. If you're just getting started with this, our guide on how to backtest a trading strategy is a fantastic resource. This is what separates strategic trading from simple guesswork.

Proven Strategies to Profit from Theta Decay

Knowing what theta is is one thing. Actually putting it to work is where the real trading begins. When you decide to harness the power of time decay options, you're using strategies designed to make that daily erosion of an option's value your main source of profit. It's a mindset shift—moving away from predicting huge price swings and toward profiting from something far more reliable: the steady passage of time.

Instead of fighting the clock, you start making it an ally. Let's dig into some of the most effective ways to turn theta into a consistent tailwind for your portfolio.

Covered Calls: A Conservative Income Approach

The covered call is a classic for a reason. It's a foundational strategy for investors looking to generate a little extra income from stocks they already own. Think of it as renting out your shares. It's a great entry point into selling options because your risk is "covered" by the stock you hold.

The mechanics are pretty simple: for every 100 shares of a stock you own, you sell one call option against it. In return, you get paid a premium right away. The trade-off? You agree to sell your shares at the option's strike price if the stock climbs above it before the contract expires.

The goal of a covered call isn't to hit a home run. It's about consistently collecting income, which effectively lowers your cost basis on a stock you're happy to hold for the long haul.

Time decay is the engine that drives this strategy. Theta's impact on a covered call is huge because it steadily chips away at the value of the call option you sold. This makes it cheaper to buy back if you ever want to close the position early.

For example, if you sell a call with a $3.00 premium and a theta of -0.05, its value is set to drop by $5 per day (per contract). That decay increases your odds of keeping the entire premium you were paid upfront. You can find more practical insights on how theta drives premium decay on thebluecollarinvestor.com.

Short Puts: A Bullish Way to Get Paid

What if you're bullish on a stock and want to buy it, but at a better price than where it's trading today? The short put is a powerful tool for exactly that. Instead of just setting a limit order and waiting, you can actually get paid for your patience.

When you sell a put option, you collect a premium and agree to buy 100 shares of the stock at the strike price, but only if the stock drops below that level by expiration.

Here’s how it works in your favor:

- If the stock stays above the strike: The option expires worthless. You just keep the entire premium as pure profit. No strings attached.

- If the stock falls below the strike: You get to buy the stock you wanted all along, but your effective purchase price is even lower than the strike because of the premium you collected.

This strategy makes time decay your best friend while you wait for the perfect entry point on a stock you believe in.

How to Manage and Mitigate Time Decay Risk

We've talked a lot about how option sellers can profit from time decay, but knowing how to defend against it is just as vital for option buyers. If you're buying calls or puts, theta is a constant headwind, a steady drip pulling value from your position every single day.

But you don't have to be a passive victim. With the right approach, you can build a shield against theta's relentless drag. It's about shifting from just buying a single option and hoping for the best to using smarter structures that actively manage your exposure. These methods won't stop decay completely, but they can slow it to a crawl, giving your trade the breathing room it needs to work out.

Use Spreads to Reduce Net Theta

One of the most effective ways to fight back against time decay is by using a debit spread—think a bull call spread or a bear put spread. The setup is straightforward: you buy one option, but at the same time, you sell a cheaper one further out-of-the-money.

By selling an option as part of your trade, you are collecting premium and its associated positive theta. This incoming theta helps offset the negative theta from the option you bought, slashing your total daily decay.

This structure immediately lowers the net cost of your trade and cuts down the daily "rent" you pay just to hold the position. Sure, you cap your maximum profit, but in exchange, you take a ton of pressure off the timing of your entry.

Go Further Out in Time

Another simple but powerful tactic is to just buy more time. Theta decay isn't a straight line; it accelerates like a rock falling off a cliff in the final 30-45 days before expiration. An option with six months left on the clock will lose value far more slowly than one with only three weeks to go.

Buying longer-dated options, often called LEAPS (Long-Term Equity Anticipation Securities), gives your investment thesis plenty of runway to play out without the constant stress of accelerating decay. The upfront cost is higher, but the daily bleed from theta is significantly lower.

Finally, have a disciplined exit plan. Unless you have a truly compelling reason, avoid holding a long option into its final month. That’s when the decay curve is at its steepest and your position is most vulnerable. Getting out before you enter that "danger zone" is a simple way to preserve your capital.

Time Decay FAQs

Even when you have the basics down, a few practical questions always pop up. Let's tackle the most common ones traders ask about time decay options to clear up any lingering confusion.

Does Time Decay Stop Over the Weekend?

Nope. Time decay is relentless—it works seven days a week, including weekends and holidays. Even when the market is closed, the clock is still ticking.

This is a huge edge for option sellers. An option's time value continues to drain away on Saturday and Sunday. Come Monday morning, sellers often find the options they've sold are worth a little less, even if the stock price hasn't moved an inch.

Which Options Suffer the Most from Time Decay?

At-the-money (ATM) options get hit the hardest by time decay, at least in pure dollar terms. The reason is simple: they have the most extrinsic value packed into their premium, and that's exactly what theta eats away at.

While an out-of-the-money (OTM) option might decay faster as a percentage of its value, the actual daily dollar loss is almost always biggest for ATM options—especially when you get inside that final 45-day window.

This makes at-the-money contracts a favorite target for sellers looking to make the most from theta's daily grind.

Can Option Buyers Avoid Time Decay?

You can't stop time decay, but you can definitely manage it. As a buyer, theta is a constant headwind, but smart traders know how to minimize its drag on their positions.

A few solid tactics include:

- Buying more time. Longer-dated options have a much slower rate of daily decay.

- Using debit spreads. A strategy like a bull call spread helps offset some of your theta exposure, lowering your net cost.

- Getting out early. Don't hold on until the bitter end. Close your position before the last 30 days, when decay really kicks into high gear.

Using these techniques gives your trade a much better fighting chance.

Ready to turn time decay from a risk into a reliable income stream? Strike Price gives you the data-driven tools to sell options with confidence. Our platform provides real-time probability metrics, smart alerts, and a clear dashboard to help you find the safest, highest-yield opportunities. Stop guessing and start making informed decisions.

Discover how Strike Price can transform your trading strategy today!