What Is Bid Ask Spread in Trading

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

A Trader's Guide to the Poor Man Covered Call

Discover the poor man covered call, a capital-efficient options strategy for generating income. Learn how to set it up, manage it, and avoid common mistakes.

A Trader's Guide to Shorting a Put Option

Discover the strategy of shorting a put option. Our guide explains the mechanics, risks, and rewards of cash-secured vs. naked puts with clear examples.

What Is Risk Adjusted Return? A Practical Guide

What is risk adjusted return? This guide explains how to measure it with the Sharpe Ratio, how to interpret the numbers, and why it's key to smarter investing.

Ever notice how a stock seems to have two prices at the same time? No, it's not a glitch in the matrix. You're looking at the market in real-time, and that little gap between the two prices is known as the bid-ask spread.

The spread is simply the difference between what buyers are willing to pay for something (the bid) and what sellers are willing to sell it for (the ask). It's the built-in cost of making a trade and it's how brokers and market makers keep the lights on.

Demystifying the Bid and Ask Prices

Think about the last time you were at an airport currency exchange. They have a "buy" price for your dollars and a slightly higher "sell" price to give them back to you. That difference is their profit for making the transaction possible. The financial markets work on the very same principle.

The bid price is the highest price a buyer is ready to pay right now. On the flip side, the ask price is the lowest price a seller will accept. The spread is the space between them.

The Spread in Simple Terms

This concept is huge because it’s the immediate, unavoidable cost of any trade you place. For options traders, getting a handle on this is non-negotiable, and you'll see these prices laid out clearly when you learn how to read an option chain.

At its core, the bid-ask spread is the fee traders pay to market makers for providing liquidity. A buyer always pays the higher ask price, while a seller receives the lower bid price. The market maker pockets the difference.

Let's break this down with a quick look at a hypothetical stock to make it crystal clear.

Bid Ask Spread At a Glance

The table below gives you a simple snapshot of how these components fit together using "Stock XYZ" as our example.

| Component | Definition | Example Price (Stock XYZ) |

|---|---|---|

| Bid Price | The highest price a buyer is willing to pay. | $100.00 |

| Ask Price | The lowest price a seller is willing to accept. | $100.05 |

| Spread | The difference between the ask and the bid price. | $0.05 |

As you can see, the spread is just a nickel, but it's the fundamental cost of doing business in the market.

This same principle holds true whether you're trading stocks, options, or anything else. For a deeper dive into how this works in other markets, check out this excellent guide on how to define spread in forex.

Why the Spread Directly Impacts Your Profits

Understanding the bid-ask spread isn’t just theory; it’s a real cost that hits your bottom line on every single trade you make. Think of it as an unavoidable entry fee.

The moment you open a position, you’re already slightly in the red. Why? Because you always buy at the higher ask price and have to sell at the lower bid price. Your trade doesn’t start at zero—it starts from a small deficit.

Before you can even think about making a profit, the asset's price has to move enough just to close that gap.

The Spread as a Trading Hurdle

Let's make this real. Imagine you buy an option contract with a bid of $1.95 and an ask of $2.00. You pay $2.00 to get into the trade.

If you changed your mind and wanted to sell it one second later, the best price you could get is the $1.95 bid. That's an instant loss of $0.05 per share, just for playing the game.

Your position has to gain at least $0.05 in value just to get you back to breakeven. That initial gap is the cost of the bid-ask spread—a hurdle every trader has to clear.

A wider spread is like a higher hurdle. It demands a bigger price move in your favor just to break even, and that can seriously eat into your profits, especially if you trade frequently.

This built-in cost is a huge deal for certain trading styles. For instance:

- Short-Term Trading: Day traders and scalpers live and die by small gains. A wide spread can wipe out their entire profit on a trade before it even gets started.

- Low Liquidity Assets: Options or stocks that don't trade very often usually have much wider spreads, making them more expensive to get in and out of.

At the end of the day, acknowledging the cost of the what is bid ask spread is the first step toward smarter trading. It forces you to be pickier with your entry points and set more realistic profit targets, ensuring you account for this built-in fee. Getting this right is fundamental to your success.

What Makes the Bid Ask Spread Widen or Narrow

The size of the bid-ask spread isn't set in stone. In fact, it’s constantly changing, expanding and contracting based on what the market is doing at any given moment.

Think of it like the supply and demand for anything else. When an asset is popular and trades heavily, the market is buzzing with activity. That intense competition forces the spread to get razor-thin. When an asset is less popular or the market gets choppy, the spread widens to account for the extra risk.

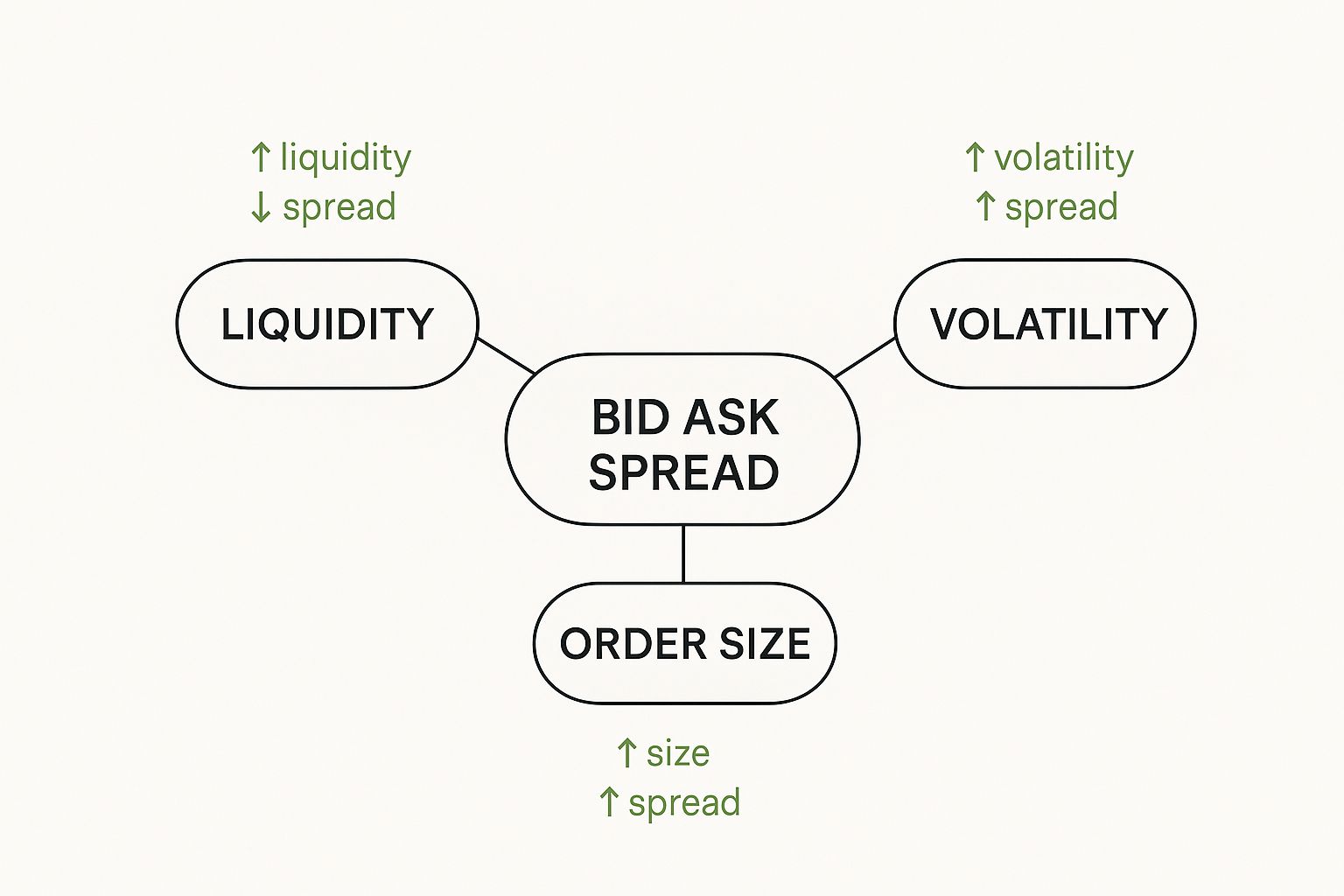

Three big factors are always at play: liquidity, volatility, and competition.

The Role of Liquidity and Volatility

Liquidity is probably the single biggest driver. In simple terms, it's a measure of how easily you can buy or sell something without moving its price. A stock with massive trading volume is highly liquid because there are tons of buyers and sellers competing for orders. This competition is great for traders—it squeezes the spread down to almost nothing.

On the flip side, less liquid assets like penny stocks or options on a little-known company have far fewer people trading them. With less action, market makers take on more risk, and they bake that risk into a much wider spread.

Volatility is the other key piece of the puzzle. When a stock's price is swinging all over the place because of an earnings report or some big news, uncertainty skyrockets. Market makers widen the spread to protect themselves from the risk of holding a stock that could drop in value in the blink of an eye.

This map breaks down how these forces work together.

As you can see, more liquidity means a tighter spread. But add in more volatility or a massive order, and the spread is likely to get wider.

How Competition Narrows the Spread

Finally, good old-fashioned competition has a huge impact. When multiple exchanges are all vying to execute trades for the same stock or option, they have to fight for your business. How do they do that? By offering tighter, more attractive spreads.

The more competition there is for an asset, the narrower the spread becomes. This principle ensures that investors get better prices in a healthy, active market.

Research on the U.S. options market shows this in black and white. When an option is only listed on a single exchange, the average spread is about 25 cents. But when three different exchanges compete for that same option, the average spread drops to just 15 cents.

That's a 40% cut in trading costs for investors, all thanks to competition. Understanding these forces helps you see why the what is bid ask spread is so much more than just a gap between two numbers—it’s a direct reflection of the market’s health and your own trading costs.

How Technology Shrank Spreads for Everyday Investors

It wasn't that long ago that trading floors were pure chaos. Picture traders yelling over each other, scribbling on paper tickets, and a general sense of organized frenzy. In that world, the bid-ask spread was a huge profit center for market specialists, and it made every single trade more expensive for the average person.

Then, electronic trading changed everything. The loud, crowded trading pits were replaced by powerful algorithms and lightning-fast data networks. This kicked off an era of intense competition and efficiency that nobody had ever seen before.

This tech revolution brought in automated market makers and high-frequency trading firms. These new players compete with each other in milliseconds, all trying to offer the tightest, most attractive prices. This constant digital battle directly benefits regular investors like us by squeezing the bid-ask spread down to a tiny fraction of what it used to be.

The Digital Impact on Your Trading Costs

The difference this has made is staggering. Back in the 1990s, before automation really took hold, the average bid-ask spread was around 60 basis points. Today, it has practically vanished.

By 2021, the average spread had cratered to just 1–2 basis points—a drop of over 95%. This massive decrease in trading costs is a direct win from all that technological advancement.

What this really means is that the built-in cost of placing a trade has almost disappeared for highly liquid assets. Investors now get to keep much more of their returns because the initial hurdle to turn a profit is so much lower. You can learn more about how today's tools give you a critical edge by reading our guide on using real-time options data.

The move from manual to automated markets has been one of the biggest wins for retail investors, period. It has made accessing the markets cheaper and fairer for everyone. For a deeper dive, check out the findings from Modern Markets Initiative.

How Spreads Work in Different Financial Markets

https://www.youtube.com/embed/1WO1GmrIlS0 The bid-ask spread is a universal concept in trading, but it definitely wears different hats depending on the market you’re in. The core idea is always the same—it’s the cost of making a trade. What changes, sometimes dramatically, are the factors that make the spread wider or tighter.

Take the wild world of foreign exchange (forex), for example. Spreads there are famously tight. The forex market is the biggest and most liquid on the planet, with trillions of dollars flying around every single day. Because of that insane volume, major pairs like EUR/USD often have razor-thin spreads, sometimes just a fraction of a pip. It’s why high-frequency traders love it.

Spreads in Options and Bonds

Options contracts, on the other hand, bring a few more variables into the mix. An option’s spread is heavily influenced by its liquidity, how much time is left until it expires, and its implied volatility. An option on a super popular, heavily traded stock is going to have a much tighter spread than some obscure, far-out-of-the-money contract that nobody is touching.

Getting a handle on these nuances is key. You can dive deeper into how all these factors play into the final price by checking out how to calculate option premium.

The bond market has its own rhythm, too. Here, spreads are all about credit risk and trading volume. Research from the New York Fed on U.S. fixed-income markets found a clear pattern: higher trading volumes consistently lead to lower bid-ask spreads, whether you're looking at corporate, municipal, or government bonds.

That same study also pointed out that municipal bond spreads average about 9 cents per $100 higher than government bonds. This makes sense, as it reflects their different risk profiles. You can explore more findings on bond market liquidity from the New York Fed if you want to dig in.

The core principle of the bid-ask spread applies everywhere, but its behavior adapts to the specific risks and liquidity of each market—from the high-speed forex market to the risk-sensitive world of bonds.

Looking at these markets side-by-side teaches a crucial lesson for any trader. While the what is bid ask spread question has a single answer, its real-world impact is anything but constant. Learning how it behaves in your specific trading niche is a critical step toward mastering it.

Common Questions About the Bid-Ask Spread

Let's pull everything together by tackling some of the most common questions traders have about the bid-ask spread. This should help lock in the concepts we've covered.

Is the Spread a Direct Fee?

Not exactly. The spread isn't a direct fee or commission your broker itemizes on a statement. Think of it more as an implicit cost baked right into the market's pricing structure.

You pay it by default whenever you trade — buying at the slightly higher ask price and selling at the slightly lower bid price. While it's not a line item, this cost is very real and directly impacts how quickly your trade can become profitable.

How Do I Find the Current Spread?

Finding the spread is simple on any trading platform. When you pull up a quote for a stock or option, you'll always see two prices listed in real-time: the bid and the ask.

To find the spread, just subtract the bid from the ask. For instance, if the bid is $50.10 and the ask is $50.15, the spread is just $0.05.

The bid-ask spread is the gap between what buyers are willing to pay (bid) and what sellers are willing to accept (ask). It’s a natural part of the market that reflects liquidity and acts as a built-in cost of trading.

Which Trading Styles Are Most Affected by the Spread?

The traders who feel the sting of the spread the most are those moving in and out of the market quickly.

- Scalpers: These traders are hunting for tiny, lightning-fast profits. A wide spread can completely wipe out their potential gain before the trade even has a chance.

- Day Traders: Because they enter and exit positions multiple times a day, the cost of crossing the spread adds up, eating into their daily profits.

On the other hand, long-term investors aren't nearly as concerned. For them, the spread is a small, one-time cost that becomes almost insignificant when compared to the much larger price movements they're aiming for over months or years.

Ready to turn trading theory into real-world income? Strike Price uses real-time data to show you the probability of success for every options trade, helping you make smarter, more confident decisions. Start generating consistent income today.