Finding the Best Options Trading Platform for Consistent Income

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

For serious income investors, the best options trading platform isn't your traditional brokerage. It's a specialized analytical tool—something like Strike Price—that shifts your trading from guesswork to a data-driven process. It gives you the probability analytics, risk monitoring, and smart alerts that standard platforms just don't have.

Why Your Broker Is Not Enough for Options Income

The world of options trading has changed. A new wave of retail investors is ditching high-risk, speculative gambles for a much smarter approach: generating consistent, repeatable income by selling covered calls and secured puts. This methodical style demands a different class of tools than what your brokerage app offers.

Most brokers are built to do one thing well: execute trades. They give you basic option chains, sure, but they often leave out the critical data needed for strategic income selling. An income-focused trader needs answers to some tough questions before ever hitting the "buy" or "sell" button.

- What’s the actual statistical probability of this strike price expiring worthless?

- Which option gives me the best premium for an acceptable level of risk?

- How can I get an early warning if one of my positions is in danger of being assigned?

These are the questions that define a sustainable income strategy, yet standard platforms leave you to figure it out on your own. This gap forces too many traders to rely on gut feelings—a recipe for inconsistent, frustrating results. The demand for better tools is clear, with the global options trading platform market valued at USD 1.5 billion in 2023 and projected to hit USD 3.0 billion by 2032.

The Move to Data-Driven Decisions

A modern options seller needs more than an "order" button; they need an analytical partner. The best options platforms act as an intelligent layer on top of your existing brokerage account, designed specifically to find, manage, and optimize your income-generating trades.

The core difference is moving from asking, "Can I make this trade?" to asking, "Should I make this trade?" A specialized platform gives you the data to answer that second question with confidence.

Of course, beyond the numbers, there's always a human element. A truly modern investor also benefits from understanding market psychology to trade smarter.

This guide will zero in on the essential features that empower this smarter way of trading. We’ll break down what really matters when you’re evaluating platforms from the perspective of an income seller.

Core Criteria for Evaluating Platforms

| Feature | Importance for Income Sellers | Why Standard Brokers Fall Short |

|---|---|---|

| Probability Analytics | Essential. It shows you the statistical chance of success so you can balance risk and reward. | Lacks real-time probability data, forcing you to guess or use clunky external calculators. |

| Risk & Opportunity Alerts | Critical for identifying high-premium strikes and warning you when a position's safety erodes. | Offers generic price alerts, not strategic, opportunity-based notifications that actually help. |

| Seamless Broker Integration | Automates position tracking, which eliminates manual entry and ensures your portfolio analysis is accurate. | Requires you to manually enter data into spreadsheets or other tools, which is slow and prone to error. |

| Intuitive Mobile Experience | Lets you manage positions, get alerts, and scan for opportunities on the go. | Mobile apps are often stripped-down versions focused only on basic trade execution, not analysis. |

These are the building blocks of a system that replaces speculative bets with calculated, repeatable strategies—paving the way for consistent income.

Essential Features for Data-Driven Options Sellers

If you're serious about generating steady income from selling options, a basic "buy/sell" button isn't going to cut it. You need tools that shift your strategy from guesswork to a calculated, data-backed business.

The right platform acts like an analytical partner, constantly scanning the market for trades that fit your rules and flagging risks before they become real problems. Let's dig into the features that separate a top-tier platform from a standard brokerage app.

Probability Analytics

For an options seller, the most important number on the screen is the statistical chance of a trade succeeding. Probability analytics give you exactly that—the real-time likelihood that a strike price will expire out-of-the-money (OTM).

Without this, you're flying blind. You have no real way to know if the premium you're collecting is worth the risk you're taking. A platform that crunches these numbers for you instantly turns a confusing option chain into a clear map of risk and reward.

Knowing a trade has an 85% probability of success allows you to build a systematic, repeatable strategy. You stop chasing high premiums on risky bets and start selecting trades that align with your long-term income goals and risk tolerance.

This is the bedrock of a professional approach. It lets you make decisions based on statistical facts, not gut feelings or market noise. It's the difference between gambling and investing.

Real-Time Alerts for Risk and Opportunity

Generic price alerts are pretty much useless for a strategic options seller. What you need are smart, context-aware notifications built specifically for income strategies.

A great platform will give you two key types of alerts:

- Opportunity Alerts: These ping you when a stock on your watchlist has an option that meets your criteria—say, a fat premium at a safe probability level. It automates the hunt, saving you from hours of manual searching.

- Risk Alerts: Think of these as your early-warning system. If a stock moves against you and your chance of being assigned jumps, a risk alert gives you the heads-up you need to manage the trade—by rolling or closing it—before it gets out of hand.

These alerts mean you're always on top of your portfolio, ready to jump on good trades and sidestep bad ones, even when you're not glued to your screen.

Seamless Broker Integration

Let’s be honest: tracking your positions in a spreadsheet is a recipe for disaster. It’s not just a pain; it's dangerously easy to make a mistake. One forgotten trade or a simple typo can throw off your entire risk analysis.

Seamless broker integration is the fix. By linking directly to your brokerage account, the platform automatically pulls in all your open and closed positions, creating a single source of truth.

This connection ensures every piece of analysis, from performance tracking to risk monitoring, is based on live, accurate data. No manual entry, no costly errors, and a complete picture of your trading without the extra work.

Comprehensive Risk Monitoring

As your portfolio gets bigger, it becomes nearly impossible to track the risk of every single position in your head. A consolidated risk dashboard is an absolute game-changer.

This feature gives you a bird's-eye view of your entire options portfolio. You can see key metrics at a glance, like total premium collected, overall delta exposure, and which positions are getting dangerously close to their strike price. Understanding these option trading greeks is fundamental to managing portfolio-level risk.

This holistic view shows you how all your trades interact and helps you spot concentrated risks you’d otherwise miss. For anyone managing a handful of covered calls or secured puts, it's an indispensable tool.

When you can do all of this from your phone, you have true control. A great mobile experience brings these features together, letting you get alerts, check probabilities, and manage trades from anywhere. You're always in command of your income strategy.

Comparing the Top Platforms for Income Generation

Choosing the right options trading platform isn’t about finding the one with the most bells and whistles. It’s about asking which one has the right features for an income-focused seller. The differences really pop when you compare them based on the day-to-day tasks of running a covered call or secured put strategy.

We’ll look at four distinct types of platforms head-to-head: Strike Price (a specialized analytical tool), Interactive Brokers (the pro’s choice), tastyworks (built for high-frequency traders), and a traditional broker like E*TRADE or Schwab. Instead of a simple feature list, we’ll compare them based on how they handle the critical jobs of an income trader.

Analytics and Strategy Tools

The heart of any income strategy is finding the right trade—one that perfectly balances a juicy premium with a high probability of success. This is where you’ll see the biggest gap between platforms.

A traditional broker, for instance, just gives you a static option chain. It’s a wall of numbers with bids, asks, and volume, but it offers zero strategic guidance. Want to find a decent covered call on NVDA? You’re left scrolling through dozens of strikes, basically guessing which one offers a fair return for the risk you’re taking.

Interactive Brokers (IBKR) is a step up with advanced tools like its Probability Lab, but it’s really built for quants who are comfortable modeling complex outcomes. It's incredibly powerful, but overkill for traders who just want to find a solid, reliable trade and move on. Tastyworks is in a similar boat, designed for speed and assuming the trader already knows exactly what they’re looking for.

This is where a specialized tool like Strike Price completely changes the game.

Real-World Scenario: Let's say you want to sell a covered call on NVDA. Your goal is specific: generate at least a 1.5% return in the next 30 days with an 85% or higher probability of expiring worthless. On a traditional platform, this is a painful, manual process of trial and error. In Strike Price, you just use "Target Mode," plug in those exact criteria, and it instantly filters the entire option chain to show you only the strikes that meet your personal income and safety goals.

This simple shift turns a frustrating hunt into a clear, data-driven decision. It moves beyond just showing you data to actively helping you find the trade that fits your strategy.

Alerts and Automation for Opportunity and Risk

Good alerts aren't about noise; they're about delivering the right information at the right time. For an income seller, that means getting proactive notifications for both new opportunities and brewing risks.

Traditional brokers usually offer basic price alerts. You might get a text if a stock hits a certain price, but that’s a lagging indicator. It doesn't help you find new trades or warn you when the risk profile of your open position has shifted.

IBKR and tastyworks offer more sophisticated alerts, but they often require a complex setup. You can build custom alerts based on the Greeks or volatility, but it’s a manual process that requires deep technical know-how. You have to know exactly what to look for and how to build the trigger yourself.

Specialized platforms, on the other hand, build the intelligence right into the alerts.

- Opportunity Alerts: Strike Price can ping you when a stock on your watchlist suddenly offers unusually high premiums at safe probability levels, essentially automating the hunt for good trades.

- Risk Alerts: Even better, it watches your open positions for you. If a stock moves against your short call and the probability of assignment jumps from 15% to 30%, you get an immediate alert. This is your early warning to consider rolling or closing the position before it becomes a real problem.

These intelligent alerts are a massive differentiator. You can learn more about how they work in our deep dive on finding the best options trading alert service.

Feature Comparison for Options Income Sellers

To make sense of it all, let's break down how each platform type stacks up for the specific needs of covered call and secured put sellers. A quick glance shows where the strengths and weaknesses lie for an income-focused approach.

| Feature | Strike Price | Interactive Brokers (TWS) | tastyworks | Traditional Broker (e.g., E*TRADE) |

|---|---|---|---|---|

| Probability Analytics | Excellent - Core feature, easy to understand. | Good - Powerful but complex (Probability Lab). | Fair - Built-in but geared for fast trading. | Poor - Manual calculation required. |

| Strategy Filters | Excellent - "Target Mode" finds trades for you. | Fair - Requires manual screening and setup. | Fair - Fast scanners but less goal-oriented. | None - Just a basic option chain. |

| Intelligent Alerts | Excellent - Automated risk & opportunity alerts. | Good - Highly customizable, but complex setup. | Good - Customizable, focused on active trading. | Poor - Only basic price alerts. |

| Broker Integration | Excellent - Direct sync for a unified view. | N/A - It is the broker. | N/A - It is the broker. | N/A - It is the broker. |

| Portfolio Risk Dashboard | Excellent - Consolidated view of all positions. | Good - Robust risk tools but steep learning curve. | Good - Visual P/L and risk graphs. | Fair - Basic portfolio view, no deep analytics. |

| Mobile Experience | Excellent - Clean, intuitive, mobile-first design. | Fair - Powerful but cluttered and complex. | Good - Designed for speed and on-the-go execution. | Poor - Stripped-down, execution-only focus. |

As you can see, while professional platforms are powerful, they aren't necessarily optimized for the simple, repeatable workflow of an income seller. Specialized tools fill that gap by focusing only on the features that matter most for this strategy.

Broker Integration and Portfolio View

An accurate, real-time snapshot of your portfolio is non-negotiable for serious risk management. How platforms deliver this has a huge impact on your workflow and, more importantly, your accuracy.

Trying to use a standalone tool without any broker integration means you’re trapped in "spreadsheet hell." You have to manually log every single trade, remember to update it when you roll or close it, and just pray you don’t make a typo. One small mistake can throw off your entire portfolio analysis.

This is why seamless broker integration is a must-have. A platform like Strike Price connects directly to your brokerage account (like Robinhood or E*TRADE) and automatically syncs all your open and closed positions. This creates a single source of truth—a reliable dashboard where you can see your real performance and risk exposure at a glance, with zero manual data entry.

Dominant platforms have reshaped how retail investors sell options for income. In 2024, the top global players—including giants like Interactive Brokers, TD Ameritrade, Charles Schwab, tastyworks, Webull, and E*TRADE—captured nearly the entire revenue pie. This moderately-concentrated market is projected to hit $10 billion globally by 2025. You can find more insights on the options platform market size on Infinity Market Research.

Ultimately, this integration ensures that all the advanced analytics and alerts are running on live, accurate data from your actual positions.

Mobile Experience and On-the-Go Management

In today's market, you absolutely need the ability to manage your portfolio from anywhere. But let's be clear: not all mobile apps are created equal.

The mobile apps from traditional brokers are usually just stripped-down versions of their desktop platforms, focusing almost entirely on placing trades. Sure, you can execute an order, but you can forget about doing any deep analysis. The IBKR and tastyworks apps are more feature-rich but can feel cluttered and overwhelming, trying to cram a desktop’s worth of functionality onto a tiny screen.

A truly mobile-first platform like Strike Price is different because it was designed from the ground up for use on the go. The interface is clean and intuitive, focusing on the key actions an income seller actually needs:

- Quickly check the probability of success for a potential trade.

- Receive and act on critical risk and opportunity alerts.

- View a clear, consolidated dashboard of your portfolio’s health.

This mobile-centric design means you always have full control over your income strategy, whether you're at your desk or waiting in line for coffee. It prioritizes clarity and action over just throwing a wall of data at you.

How to Choose a Platform Based on Your Trader Profile

There’s no such thing as the single "best" options trading platform. That's a myth.

The right platform for a day trader juggling complex spreads is absolutely the wrong choice for someone focused on generating steady income from covered calls. The trick is to match a platform’s strengths to your personal trading style, experience level, and what you’re trying to accomplish.

Instead of a one-size-fits-all approach, let's break down the ideal tools for three common types of traders. This way, you can find a platform that actually supports your strategy, so you aren't paying for features you'll never use or wrestling with a tool that wasn't built for you.

The Beginner Income Seeker

Just getting your feet wet with covered calls or secured puts? Your main priorities are guidance, safety, and simplicity. You need a platform that doesn’t just throw data at you—it needs to help you make sense of it, turning confusing option chains into clear, actionable choices. Your biggest risk right now isn’t the market; it's making simple mistakes because you're overwhelmed.

For this profile, you need tools that build confidence. Think clear probability analytics showing the statistical risk of any trade, educational content explaining the "why" behind the numbers, and a user interface that makes sense from day one. Fancy charting tools and multi-leg strategy builders are just noise at this stage. You can explore some of the foundational concepts in our guide to beginner options trading.

Recommendation: A specialized platform like Strike Price is the perfect fit here. Its "Target Mode" cuts through the complexity. You define your income goals and safety thresholds, and it shows you only the trades that match. It takes the guesswork out of the equation and helps you build a disciplined, repeatable strategy from the ground up.

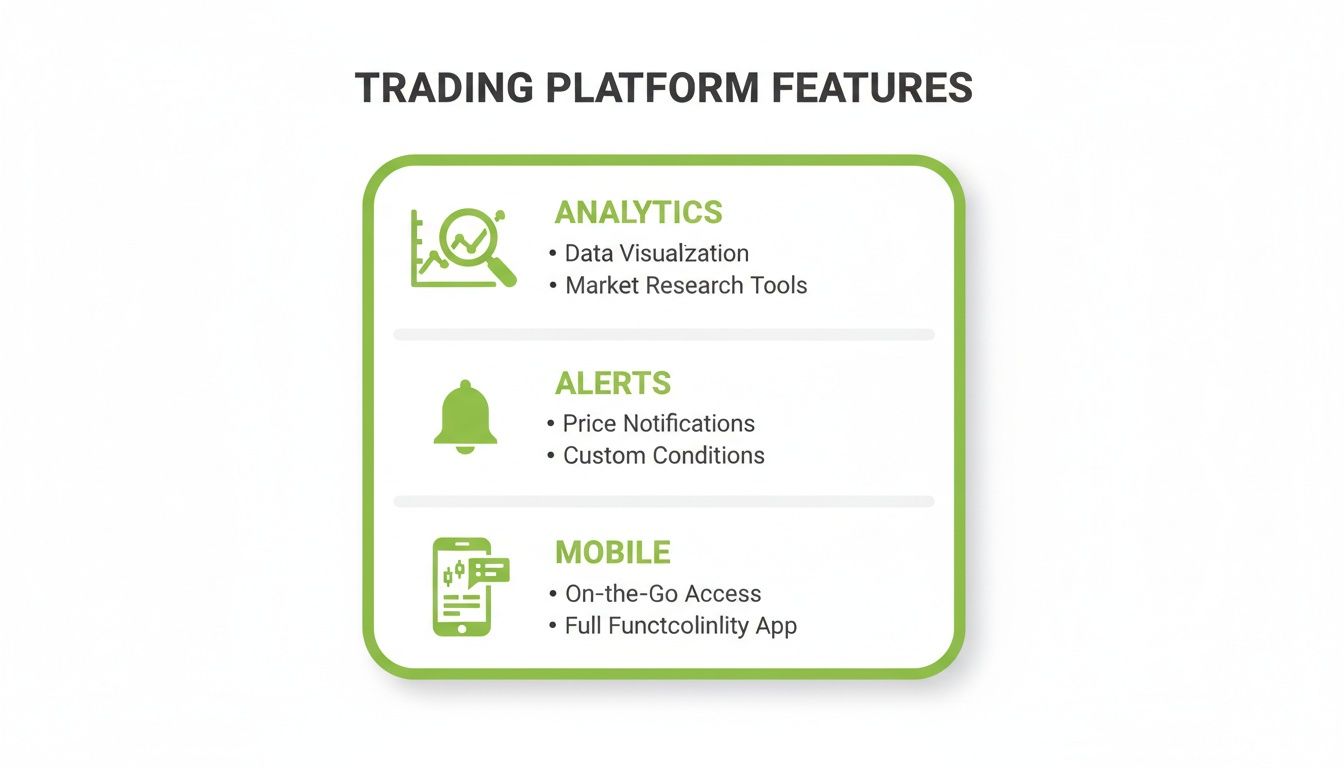

This image sums up the key features every options income trader should be looking for.

These three pillars—analytics, alerts, and mobile access—are the foundation of any solid platform built for a data-driven income strategy.

The Active Portfolio Manager

Once you're juggling multiple positions across different stocks, your needs shift from finding single trades to managing a complete portfolio. You're no longer just looking for one good trade; you're conducting an orchestra where every position affects your overall risk and return. At this point, tracking everything in a spreadsheet just isn't going to cut it.

Your must-have tools become a consolidated risk dashboard, seamless broker integration, and smart alerts. You need to see, at a glance, how your portfolio's delta is balanced, which positions are getting dangerously close to their strike prices, and where your risk is concentrated. Automation is your best friend here, helping you stay on top of it all without spending hours on manual checks. As you define your trader profile, it's also worth understanding the difference between TFSA and RRSP accounts, as this can influence where you hold your positions.

- Recommendation: While a platform like Interactive Brokers offers powerful risk tools, its complexity can be a major hurdle. Strike Price offers a more focused solution with its automated broker sync and consolidated dashboard, giving you that crucial high-level view without the steep learning curve.

The Mobile-First Trader

Let's be real—for many of us, trading happens in the spare moments between meetings or during a commute. If you manage your portfolio primarily from your phone, the mobile experience isn’t just a feature; it’s everything. A clunky, stripped-down mobile app that feels like an afterthought just won't work.

You need a platform designed with a mobile-first philosophy. That means a clean, intuitive interface, quick access to probability data, and actionable alerts pushed right to your device. The goal is to monitor risk, spot opportunities, and manage positions with the same confidence you’d have sitting at your desk.

This mobile-first retail audience is a huge driver of the recent surge in options trading. By Q3 2025, U.S. options average daily volume hit new peaks, with index options up 17% year-over-year to 4.9 million daily contracts and single stocks rising 25%.

- Recommendation: This is another area where Strike Price shines. Its mobile app isn’t a condensed version of a desktop platform—it's a full-featured command center designed for on-the-go management. It ensures you never miss a critical risk alert or a high-premium opportunity, no matter where you are.

Your Platform Evaluation Checklist

Choosing the right options trading platform isn't about chasing flashy features. It's about finding the tools that actually fit your income strategy, making your workflow smoother and, hopefully, more profitable. This checklist is designed to help you cut through the marketing fluff and do your own hands-on analysis.

Think of these questions as a practical framework for testing any platform. By asking them, you can figure out if a tool is truly built for a data-driven options seller or just another generic trading app.

Analytics and Finding Trades

The whole game for an income trader starts with finding the right opportunities. A platform should do more than just spit out a static list of strike prices; it needs to give you real strategic guidance.

Here's what to ask:

- Does it clearly show the probability of a strike expiring worthless? This is the single most important number for an options seller, yet you'd be surprised how many platforms bury it or don't show it at all. You need this metric front and center.

- Can I screen for trades based on my goals? For instance, can you ask it to find all covered calls that offer at least a 2% return with an 85% or higher probability of success? Hunting for these manually is slow and you're bound to miss things.

- How does it help me weigh risk versus reward? It should be dead simple to see which strike prices offer the most premium for an acceptable amount of risk. This stops you from getting greedy and chasing yield on trades that are way too dangerous.

Risk Management and Automation

Once you've sold your contracts, your job shifts to monitoring them. Your platform should act like a second set of eyes, alerting you when things change and giving you a clear picture of your entire portfolio.

The goal is to be proactive, not reactive. A great platform gives you the heads-up you need to deal with potential problems long before they blow up.

Dig into the platform's risk tools by asking:

- Can I set up custom alerts that actually matter? You need notifications that are specific to your strategy, like an alert when an option's probability of being assigned jumps from 15% to 30%. Generic price alerts just don't cut it.

- Is there a consolidated dashboard for my entire options portfolio? Trying to manage positions across different stocks without a high-level view is a headache. You need to see your total premium collected, overall risk exposure, and performance in one place.

Workflow and Usability

Finally, even the most powerful analytics are worthless if the platform is a pain to use. It has to fit into your routine, whether you're at your desk or checking trades on your phone.

Ask yourself these last few questions:

- How well does it connect with my brokerage account? Automated position syncing is a must-have. Manually entering every single trade is a surefire way to make mistakes that throw off your entire analysis.

- Is the mobile app just as powerful as the desktop version? A mobile app needs to be more than just a place to hit "buy" or "sell." You should be able to analyze probabilities, manage your alerts, and monitor your portfolio with the same clarity you get on a bigger screen.

Frequently Asked Questions

When you start looking for the best options trading platform, a few key questions always come up. Moving from simply buying stocks to selling options for income is a big shift, and it raises practical concerns about the right tools, costs, and what you can realistically expect. Let's tackle those questions head-on.

Why Can't I Just Use My Regular Broker's Free Tools?

Your standard brokerage account is fantastic for buying and selling stocks, but its tools just aren't designed for the specifics of selling options for income. A typical broker will show you an option chain, sure, but it hides the single most important number for an income seller: the real-time probability of a strike expiring safely out-of-the-money.

Without that number, you’re basically flying blind. You're left guessing which trades offer a fair premium for the risk you're taking. A specialized platform like Strike Price acts as a smart layer on top of your broker, turning your process from reactive to proactive. These tools are built from the ground up to find high-probability trades, manage your risk, and match opportunities to your income goals—giving you a critical edge.

The whole point of a specialized platform is to turn a confusing wall of numbers into a clear, actionable decision. It answers the question, "Is this a smart trade for my strategy?"—something most broker tools simply can't do.

How Important Is Broker Integration for an Options Platform?

It's absolutely essential. Seamless broker integration is a must-have for both efficiency and accuracy. Without a direct link to your brokerage account, you’re stuck manually typing in every single trade you make.

That manual work isn't just tedious; it's a recipe for disaster. A forgotten position or a simple typo can throw off your entire portfolio's risk analysis, leading you to make some really poor decisions.

Direct integration automates the whole thing.

- It makes sure your dashboard is a true, real-time reflection of all your open and closed positions.

- This gives you accurate risk monitoring based on live, correct data.

- It powers timely alerts that are triggered by what's actually happening in your portfolio.

This creates a reliable, streamlined system that’s vital for any serious options seller who values their time and their money.

What Is a Realistic Income Expectation When Using These Tools?

While a specialized platform gives you the tools to trade smarter, it can't guarantee returns. Your income potential is still driven by market conditions, how much capital you have, and your personal comfort with risk.

The real advantage of these platforms is that they help you build consistency and manage risk like a pro. By using probability analytics, you can systematically find trades that meet your safety criteria while still generating good premium income. This data-driven approach helps you sidestep bad trades and consistently jump on opportunities that fit a sustainable, long-term strategy.

For example, a trader might consistently aim for a 1-2% weekly return on their collateral by only selling options that have an 85% or higher statistical probability of success. The platform's job is to make finding and managing those specific trades a simple, repeatable process.

Are These Platforms Suitable for Beginners?

Absolutely. In fact, a good analytical platform can be even more valuable for a beginner than for an expert. New traders often get bogged down by the sheer complexity of option chains and risk management.

A platform built for income sellers cuts through the noise and focuses on what actually matters.

- Guided Decisions: Tools like "Target Mode" let you set your income and safety goals, then the platform shows you only the trades that fit.

- Built-in Education: They translate complex data into things you can actually understand, like the probability of success, so you learn by doing.

- Automated Warnings: Smart alerts act as a safety net, letting you know when a position's risk profile changes. This helps stop small mistakes from becoming big losses.

For someone new to selling options, the right platform provides the guardrails needed to build disciplined, data-driven habits right from the start.

Ready to transform your options trading from guesswork to a data-driven strategy? Strike Price provides the probability analytics, smart alerts, and seamless broker integration you need to generate consistent income. Join thousands of successful income traders today.