Finding the Best Options Trading Platform for Beginners

If a stock moves past your strike, the option can be assigned — meaning you'll have to sell (in a call) or buy (in a put). Knowing the assignment probability ahead of time is key to managing risk.

Posted by

Related reading

Out of Money Call Options A Guide to Consistent Income

Learn how to use out of money call options to generate consistent income. This guide covers key strategies, risk management, and real-world examples.

How Options Are Priced A Practical Guide for Investors

Understand how options are priced with this clear guide. Learn about intrinsic value, implied volatility, and pricing models to improve your investing strategy.

Greek Options Explained for Income Traders

Unlock your options trading potential. This guide on greek options explained shows you how to use Delta, Gamma, and Theta to generate consistent income.

For anyone just getting into selling options for income, the best options trading platform isn't the one with the most bells and whistles. It's the one that zeroes in on probability, risk management, and a clean interface you can actually understand. While big brokerages like E*TRADE have solid tools, specialized platforms like Strike Price are built from the ground up to help new sellers spot high-probability trades without getting overwhelmed.

Choosing Your First Options Trading Platform

Picking your first platform is a huge decision. It sets the tone for your entire learning experience. The goal for a beginner isn't to find the platform with the most features, but the one with the right ones—the tools that actually build confidence and support a disciplined, income-first strategy. A cluttered screen or confusing risk metrics can lead to expensive mistakes, fast.

The best platforms act as a guide, turning complicated data into something you can act on. They shouldn't bury you in endless charts. Instead, they should highlight what truly matters for selling simple strategies like covered calls and cash-secured puts.

This means you should be looking for a platform that delivers on four key things:

- Clear Probability Metrics: You need to see the chance of a contract expiring worthless instantly, letting you weigh the risk against the reward.

- Intuitive Design: A clean, simple layout for both web and mobile is non-negotiable. It just reduces the odds of making a costly error.

- Actionable Alerts: Get notified about high-probability trades and, just as importantly, get warnings when your open positions are getting risky.

- Educational Support: The tools are only half the battle. You need resources that teach you how to use them to make smarter decisions.

While our focus is options, the core ideas behind choosing the right platform for your business hold true here—it's all about clarity, function, and whether it aligns with your goals.

Comparing Key Platform Philosophies

Every platform is built with a certain type of trader in mind. Figuring out their core philosophy helps you find the right home for your strategy. Many beginners have found success starting with a simple, clear game plan. For example, back on February 9, 2021, a trader sold a cash-secured put on UAVS at a $10 strike. They collected a $0.65 premium, netting a 6.5% return in just 10 days. This conservative trade gave them a 20% buffer on the downside—perfect for a newcomer.

| Platform Type | Primary Focus | Best For Beginners Who... | Example |

|---|---|---|---|

| All-in-One Brokerage | Comprehensive market access | Want everything in one place and are comfortable with a steeper learning curve. | E*TRADE, Tastytrade |

| Specialized Analytics Tool | Data-driven decision support | Want to identify high-probability trades and manage risk effectively. | Strike Price |

| Commission-Free Starter | Low-cost and mobile-first | Are highly budget-conscious and prioritize ease of access over advanced tools. | Robinhood |

Ultimately, the choice comes down to your personal learning style and what you want to achieve. If you're just dipping your toes in, you might find our complete guide to getting started with beginner options trading helpful for nailing down the core concepts you'll need.

Your Platform Evaluation Checklist for Selling Options

When you’re starting out selling options, it’s easy to get distracted by flashy marketing. The key is to cut through the noise and zero in on the tools that actually help you generate income from strategies like covered calls and cash-secured puts.

Think of this as a no-nonsense inspection list. Don't just ask if a platform has a feature; ask how it helps you make a smarter, less emotional decision. This is how you find a platform built for consistent, probability-based trading.

Core Decision-Making Tools

The best platforms turn complex data into simple, actionable signals. Without these core tools, you’re basically just guessing.

You need to prioritize platforms that offer:

- Real-Time Probability Metrics: Does the platform clearly show you the probability of profit (POP) or the chance of an option expiring worthless? Seeing a 75% chance of success transforms a speculative bet into a calculated risk. It’s the most important number for an options seller.

- Intuitive Risk Visualization: Can you instantly see your max profit and loss? Look for simple P/L graphs that show you the outcomes at different stock prices. This visual clarity keeps you from accidentally taking on risks you don't understand.

If a platform buries its probability metrics behind confusing menus—or doesn’t offer them at all—that’s a huge red flag. Your main goal is to sell options that are likely to expire worthless, and you can't do that without clear, easy-to-find data.

Functionality and User Experience

A powerful tool is useless if it’s a pain to use. A clean, fast user experience is non-negotiable, especially when you need to manage trades on the go. Your mobile app should be just as powerful as the desktop version, not a watered-down afterthought.

As you compare platforms, look for these practical features:

- Customizable Alerts: Can you get notified when a strike price is hit, or when implied volatility spikes? An alert telling you an option's assignment risk just jumped from 15% to 30% is incredibly valuable. It lets you manage the trade proactively instead of getting caught by surprise.

- Streamlined Mobile Interface: Can you analyze and place a trade on the mobile app with the same confidence as you can on your computer? A cluttered or slow app is a recipe for mistakes and missed opportunities.

- Brokerage Integration: How smoothly does the platform connect to your brokerage account? A clunky integration that requires manual data entry is a time-waster and invites errors. You want something seamless that lets you act fast.

Beginner's Platform Evaluation Checklist

To put it all together, here’s a checklist to guide your evaluation. Use this to compare platforms and ensure you’re choosing one that truly supports a beginner options seller’s workflow.

| Essential Feature | Why It's Critical for Beginners | Look For (Example) |

|---|---|---|

| Clear Probability Data | Turns guessing into a data-driven decision. | A simple percentage showing the chance a contract will expire worthless. |

| Visual Profit/Loss Graphs | Helps you understand risk at a glance, preventing costly surprises. | A chart showing your breakeven point, max profit, and max loss. |

| Customizable Alerts | Allows for proactive risk management instead of reactive panic. | Notifications for changes in assignment risk or price movements. |

| Full-Featured Mobile App | Enables you to manage trades confidently from anywhere. | An intuitive interface that mirrors the desktop experience without lag. |

| Seamless Broker Sync | Saves time and reduces errors when placing and tracking trades. | Direct, one-click integration with major brokerages. |

By using a structured checklist, you can look past the marketing hype and focus on what matters. For anyone focused on selling cash-secured puts, a dedicated cash-secured put calculator is another tool that can help you dial in your strategy, making sure your strike price aligns with your income goals and risk tolerance. This disciplined approach is the first step to building a consistent, data-driven income stream.

Comparing Top Options Platforms for New Traders

Picking the right platform is like choosing a co-pilot for your trading journey. The best options trading platform for beginners isn't just about placing trades; it’s about making smarter, data-driven decisions. Here, we'll skip the generic feature lists and compare the top platforms through the eyes of a new options seller looking to generate consistent income.

Instead of a one-size-fits-all answer, we’ll look at how platforms like Strike Price, Tastytrade, and E*TRADE serve different types of beginners. The goal is to help you find the perfect match for your specific goals and trading style.

Situational Showdown: Strike Price vs. Traditional Brokerages

The biggest difference between a specialized tool like Strike Price and an all-in-one brokerage like Tastytrade or E*TRADE boils down to their core philosophy. Brokerages are built to let you trade almost anything. Specialized platforms are built to help you find the right trades within a specific strategy.

Scenario 1: The Focused Income Seeker

Your goal is simple: generate consistent income from stocks you already own (or want to own). You want to quickly answer the question, "What's the best covered call I can sell on my AAPL shares this week?"

Strike Price: This is where it shines. Its "Target Mode" lets you define an income goal (like “$100 per week”) and a safety threshold (like “85% probability of success”). The platform then scans the market and hands you tailored trade suggestions that meet your exact criteria. It completely removes the manual research and emotional guesswork.

Tastytrade/E*TRADE: These platforms give you all the raw data you need, but you have to do the work yourself. You'll pull up the option chain, scan through dozens of strike prices and expiration dates, and mentally calculate which one best fits your risk-reward profile. It's doable, but it’s a manual process.

Scenario 2: The All-In-One Power User

Maybe you're a beginner who wants to eventually grow into a multi-strategy trader. You value having everything under one roof—from charting and stock research to execution. In that case, a full-service brokerage makes a lot of sense.

Tastytrade: Built for active options traders, it offers a powerful platform with deep analytical tools, complex order types, and tons of educational content. The learning curve is steep, but it provides a comprehensive sandbox for traders who want to explore more than just selling puts and calls.

Strike Price: This isn't a brokerage. It’s a powerful analytical layer that integrates with your existing brokerage account. This "unbundled" approach lets you use its best-in-class probability tools and alerts right alongside the execution platform you already know and trust.

For a trader who wants automated opportunity alerts on their existing stock portfolio, Strike Price's Target Mode is a clear winner. For those who value an all-in-one brokerage experience with deep charting capabilities, Tastytrade offers a steeper learning curve but greater depth.

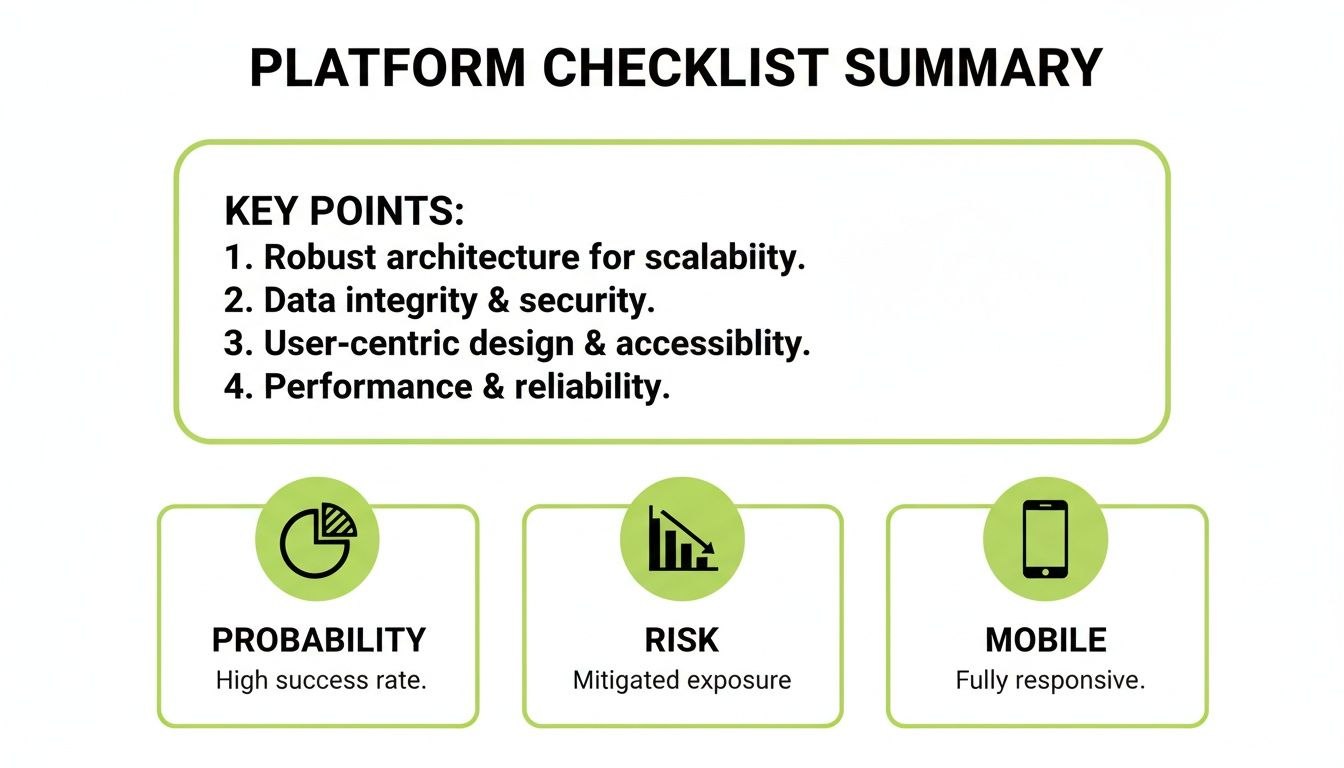

This checklist sums up the essential features—probability, risk management, and mobile usability—that should be at the top of every beginner's list.

As the graphic shows, a great platform simplifies complex data into actionable insights, whether you're at your desk or checking in on the go.

Comparing Core Philosophies on Risk

How a platform helps you see and manage risk is arguably its most important job. For options sellers, this often comes down to the strategic link between covered calls and cash-secured puts.

Professionals often see these two strategies as two sides of the same coin because their profit-and-loss profiles are nearly identical. For a stock trading at $20, selling a cash-secured put at the $20 strike for $0.70 in premium produces the same outcome as owning 100 shares and selling a covered call at the $20 strike for that same premium. This equivalence is a huge advantage for beginners, allowing them to tap into deeper liquidity and reduce costs.

Strike Price: The platform is built around this very concept. It seamlessly helps you find high-probability opportunities for both strategies, empowering you to pick the one that fits your current situation—whether you own the shares or just have the cash.

E*TRADE: While E*TRADE’s Power platform has excellent risk graphs that can show this equivalence, it requires you to build and compare the strategies manually. It gives you the tools for analysis but doesn't proactively guide you toward understanding this powerful relationship.

Feature Showdown for Beginner Options Sellers

Let’s get granular. When you're just starting with covered calls and cash-secured puts, a few key features make all the difference. Here's how the top contenders stack up.

| Feature | Strike Price | Tastytrade | E*TRADE (Pro) | Robinhood |

|---|---|---|---|---|

| Probability of Profit | A core feature, displayed clearly on every strike. | Available, but often bundled into a complex "tastytrade" metric. | Present, but requires navigating to specific analysis tabs. | Not readily available; requires external tools. |

| Trade Opportunity Alerts | Automated and customizable based on user-set income goals. | Manual scanners and watchlists; requires user initiative. | Offers basic price alerts, not specific option trade ideas. | Basic price movement alerts only. |

| Mobile User Experience | Clean and focused on managing positions and finding trades. | Full-featured but can feel cluttered and intimidating for a beginner. | Powerful and comprehensive, but potentially overwhelming. | Extremely simple, but lacks deep analytical tools. |

| Learning Curve | Very low; designed for beginners from the ground up. | High; built for active, experienced traders. | Moderate to High; a robust platform with many features. | Very low, but at the cost of advanced functionality. |

| Brokerage Integration | Seamlessly connects to major brokerages. | All-in-one brokerage and platform. | All-in-one brokerage and platform. | All-in-one brokerage and platform. |

This table makes it clear: the "best" platform really depends on what you need it to do. Are you looking for an easy-to-use analytical tool that plugs into your current setup, or a do-it-all brokerage that you can grow into over time?

For a deeper dive, check out our guide on the best options trading software available today. The right choice will align with your learning style, time commitment, and trading goals, giving you the support you need to build a consistent, data-driven income strategy.

A Practical Workflow for Probability-First Trading

Checklists and theory are one thing, but seeing a strategy in action is what makes it all click. Let's walk through a real-world, probability-first workflow designed for one simple goal: generating income.

We'll use a common scenario—turning a stock you already own into a consistent source of cash. This example shows how the right tools can take options selling from a complex guessing game to a repeatable, data-driven system. It’s a perfect illustration of how the best platforms don't just throw data at you; they guide you to the right decision.

Step 1: Start with Your Portfolio

Let's say you own 100 shares of Apple (AAPL). It's a solid long-term hold, but you want it to do more than just sit there. The goal is to generate extra income by selling covered calls against those shares, but safely—with a high probability of keeping both the stock and the cash.

First, you'd link your brokerage account to a platform like Strike Price. A seamless sync is critical. It pulls in your live portfolio, so you're not fumbling with manual entry, and ensures any trade ideas are based on what you actually own.

Step 2: Define Your Income and Safety Goals

This is where a probability-first platform changes everything. Forget scanning endless option chains. Instead, you tell the tool what you want. Using a feature like Target Mode, you set your goals in plain English.

For our AAPL example, you might set two rules:

- Income Target: Earn at least $100 in premium this week.

- Safety Threshold: Only show me trades with an 85% or higher probability of expiring worthless.

Just by setting these goals, you're telling the platform exactly what a "good" trade looks like for you. It instantly filters out thousands of irrelevant, high-risk options, leaving only the ones that fit your personal risk tolerance.

A platform that lets you set clear income and probability targets transforms your approach. You're no longer reacting to market noise; you're proactively telling your tools what a "good" trade looks like to you, creating a disciplined and repeatable strategy.

Step 3: Review Tailored Trade Suggestions

With your goals locked in, the platform’s engine gets to work. It scans every available strike and expiration for your AAPL shares, checking them against your $100 income target and 85% safety rule.

In seconds, you get a curated list of suggestions. Instead of a confusing wall of numbers, you see a clean summary for each potential trade:

- The exact strike price to sell.

- The premium you’ll collect.

- The probability of success (expiring worthless).

- The annualized return on your investment.

This workflow turns hours of research into a simple decision. You can quickly compare a handful of high-quality options and pick the one with the best balance of cash and safety. For instance, you might see a trade offering $115 in premium with an 88% chance of success—a perfect match for your criteria.

Step 4: Execute and Monitor with Alerts

Once you've picked your trade, a deep brokerage integration lets you place the order in a few clicks. The platform prefills the trade ticket, which cuts down on the risk of costly execution errors—a common trap for new traders.

But the platform's job isn't over once the trade is live. It keeps monitoring your position in real-time. If the market gets choppy and the risk on your position changes—say, the probability of assignment jumps from 12% to 25%—you get an alert.

This proactive monitoring keeps you in the driver’s seat. You get the heads-up you need to decide whether to close the trade early or let it ride. This kind of guided workflow is what truly sets the best platforms apart for beginners.

Understanding Risk When Selling Cash-Secured Puts

Selling cash-secured puts can feel like a big leap for new traders, but it’s one of the most powerful and straightforward ways to generate income. Think of it this way: you’re getting paid to wait to buy a stock you already want, but at a lower price. It's a strategy that turns market uncertainty into an advantage.

The hesitation usually boils down to one word: risk. What happens if the stock price tanks? That’s where the “cash-secured” part comes in as a critical safety net. You only sell a put if you have enough cash set aside to buy 100 shares of the underlying stock at the strike price. This isn't a wild guess; it's a planned purchase with a premium paid to you upfront.

Puts vs. the Familiar Covered Call

The best way to get comfortable with the risk-reward of a cash-secured put is to compare it to its mirror image: the covered call. Many beginners are surprised to learn their profit and loss outcomes are almost identical. Both are conservative income strategies designed to generate cash flow from a stock.

Here’s how they stack up:

- Covered Call: You sell a call option on 100 shares you already own, agreeing to sell them at a certain price if the stock rises.

- Cash-Secured Put: You sell a put option, agreeing to buy 100 shares at a certain price if the stock falls, using cash you've already set aside.

In both cases, your max profit is limited to the premium you collect. The risk is symmetrical, too. With a covered call, your risk is the stock price dropping. With a cash-secured put, your risk is also the stock price dropping after you're assigned the shares. The difference is, with a put, you get into the stock at a price you were happy with from the start.

The Real Risk of Selling Puts

The risk isn't in the option contract itself, but in owning the underlying stock—something you were prepared to do anyway. A good platform with clear probability tools helps you manage this intelligently. By picking a strike price with an 80% or 90% chance of expiring worthless, you're stacking the odds heavily in your favor.

This data-first approach takes the emotion out of the trade. Instead of worrying about every market dip, you focus on a simple question: "Am I willing to buy this great company at this discounted price?" If the answer is yes, selling the put is a logical next step.

Selling a cash-secured put isn't about avoiding risk; it's about defining it on your own terms. You set the price you're willing to pay for a stock and get paid a premium while you wait for the market to come to you.

How Modern Platforms Build Guardrails

Finding the best options trading platform for beginners means looking for one that gives you guardrails. Modern tools like Strike Price help you see the probability of success for every single strike price, turning what feels like a complex decision into a simple one. A key part of evaluating these risks is understanding how markets move, which you can learn more about in this essential guide to market volatility.

These platforms give you the confidence to use puts effectively by:

- Showing Clear Probabilities: Instantly see the likelihood of an option expiring worthless.

- Setting Proactive Alerts: Get notified if the risk profile of your position changes.

- Calculating Breakeven Points: Understand the exact price the stock needs to stay above for you to profit.

By demystifying the process and giving you clear data, these tools empower beginners to use cash-secured puts as they were meant to be used: as a smart, disciplined way to generate income and build a portfolio of quality stocks at great prices.

Got Questions? Let's Get Them Answered.

Jumping into options can feel like learning a new language. Even after you nail down the basics, the practical, real-world questions start popping up. This is where we clear the air.

Think of this as a quick chat about the stuff that's probably on your mind. We’ll skip the jargon and give you straight answers so you can move forward with confidence.

How Much Money Do I Really Need to Start Selling Options?

There's no single "magic number," but the capital you need is actually very straightforward and directly tied to the strategy you're using.

- For covered calls: It's simple. You have to own at least 100 shares of the stock for every single contract you want to sell. The cost is just the price of buying those shares.

- For cash-secured puts: You need to have enough cash on hand to buy 100 shares at the strike price if the trade goes against you. So, if you sell one put contract with a $50 strike, you’ll need $5,000 sitting in your account as collateral.

The smartest way to start is with high-quality stocks you can actually afford and wouldn't mind holding for the long run. This turns the capital requirement into a strategic part of building your portfolio, not just a trading fee.

Isn't Options Trading Way Too Risky for a Total Beginner?

Let's be clear: some options strategies are pure speculation. But selling covered calls and cash-secured puts? They're widely considered to be on the conservative end of the spectrum. The risk is manageable because it's defined from the very beginning.

Before you ever click "sell," you know your maximum possible profit (the premium) and the exact scenario where you take on risk (owning the stock). It removes the guesswork.

Using one of the best options trading platforms for beginners is a massive help here.

When a tool shows you the real probability behind a trade, you stop gambling and start making calculated decisions. Choosing a trade with an 85% probability of success isn't a gut feeling—it's a smart, data-driven move.

Can I Actually Make Consistent Monthly Income Selling Options?

Yes, absolutely. In fact, that's the whole point for most options sellers. It's an achievable goal if you're disciplined. By repeatedly selling covered calls on stocks you own or cash-secured puts on stocks you want to buy, you can collect premiums week after week, month after month.

Success really boils down to three things:

- A repeatable, disciplined strategy.

- Smart risk management.

- Using the right tools to find high-probability trades.

Consistency doesn't come from hitting home runs. It’s built by hitting singles and doubles, over and over again.

What Happens If My Option Gets Assigned?

First off, assignment isn't a failure—it's a normal, expected part of the process. It just means the person who bought your contract decided to exercise their right.

Here's how it plays out:

- Covered Call Assignment: You sell your 100 shares at the strike price you already agreed to. You keep the premium you collected upfront plus the cash from the sale. You locked in your planned profit.

- Cash-Secured Put Assignment: You use the cash you set aside to buy 100 shares at the strike price. Because you also kept the premium, your actual cost to acquire the stock is lower than what you paid.

In either case, you're now free to restart the income cycle by selling a new option on a different stock or even the one you just bought.

Ready to turn these insights into action? Strike Price provides the probability tools and alerts you need to start selling options with confidence. Find your first high-probability trade today at strikeprice.app.